About NPF

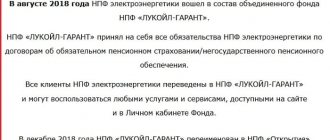

Founded in 1994, NPF GAZFOND is subordinate to OJSC Gazprombank and its subsidiaries located throughout the country. Clients can use the services of compulsory insurance, as well as pension provision.

The Fund is a member of the international NPF association Russell 2020 and is a co-founder of NPF organizations. At first, only Gazprom employees and their close relatives could use the fund’s services.

Over time, it has turned into an open organization that allows every Russian to invest their funds to replenish their funds. According to statistics from the official website, more than 400 enterprises cooperate with the Gas Fund in 2020.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

According to economists, this year the fund's profitability is minimal, but stable. Analysts believe that the Gas Fund is capable of providing citizens with pensions for many decades.

NPF engages in long-term investments and does not offer high returns over a couple of years. When transferring to this fund, citizens must expect 5 or more years of savings to receive a significant pension supplement.

As the Gasfond grew, other organizations joined it:

- NPF Heritage;

- KITFinance NPF;

- NPF Promagrofond.

In 2020, more than 6 million people entrusted their savings to the fund; the amount of pension savings amounts to 425 billion rubles. At the moment, about 16 billion rubles are being paid.

Gazfond hotline

Any questions will be answered by calling the Gazprombank NPF hotline. The following numbers are available to clients:

- 8 800 700 8383 - for free calls from the regions;

- 8 495 721 8383 - for clients in Moscow;

- 8 812 449 8383 - hotline for residents of St. Petersburg.

Official website of the non-state fund https://gazfond.ru/

Save important information with the contacts of the hotline of the non-state pension fund of Gazprombank

Conditions of registration

To use the fund's services, it is enough to conclude an agreement. You can sign the papers at any branch, as well as online on the website if the applicant has an electronic signature. Before signing, you can clarify the information by phone or in person.

When concluding a contract, a minimum package of documents is required. Fund staff advise potential clients about available pension schemes.

Then you just need to make a down payment and the account is open. The fund operates only by bank transfer.

The client has several options to make transactions:

- through the online system of any bank;

- Bank transaction;

- at the Gazprombank terminal;

- withhold part of your salary every month.

The Foundation also offers the following services:

- Receive a tax deduction annually from contributions paid (13%, up to 120,000 rubles).

- Inherit the funds of another client if the person is his close relative.

- Register in your personal account and receive information about your savings without leaving your home.

What percentage

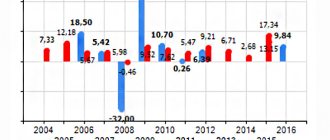

On average, the fund's return is 8%. It varies depending on the economic situation in the country and, taking into account inflation in 2020, is 4%. Customer savings grow by this amount every year.

What is the most profitable Gazprombank deposit for pensioners?

This question is answered by 10bankov.net expert on savings programs Olga Karpova.

The “ Pension Income ” deposit is advantageous in that you can always withdraw money from it, and interest will continue to accrue on the remaining amount. This is a kind of electronic wallet or savings account.

But if you plan to save money, then it is not suitable. Pension Savings deposit has the highest percentage . It will be the most profitable today among Gazprombank’s pension deposits,” says Olga Karpova.

But pensioners can arrange not only special deposits for elderly people at Gazprombank. Any other deposit is available to them. Moreover, some of them may be even more profitable than pension ones.

What documents are needed

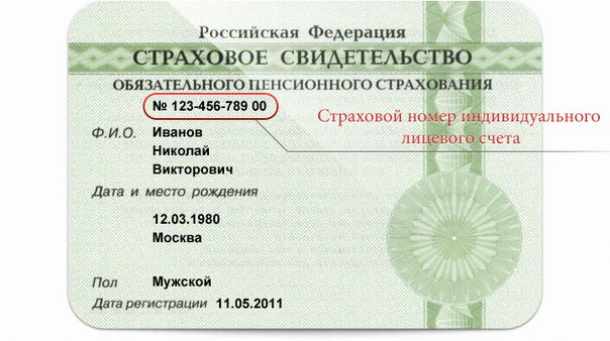

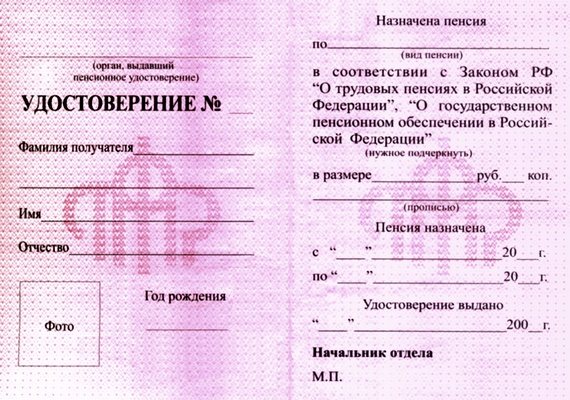

To become a client of NPF Gazfond, a citizen must provide:

- passport;

- SNILS;

- pensioner's ID.

Employees have the right to request additional documents, for example, registration information and the right to reside in Russia (if the applicant is a foreigner).

About the bank

Gazprombank is one of the most reliable banks in Russia.

Its head office is located in Moscow. The bank was created to finance infrastructure projects in the oil and gas industry. Today it is one of the three largest banks in Russia in terms of all main indicators and ranks third in the list of banks in Central and Eastern Europe in terms of equity capital. Gazprombank's clients include about 4 million individuals and about 45 thousand legal entities. In Russia, the regional network of Gazprombank is represented by 20 branches located from Kaliningrad to Yuzhno-Sakhalinsk. The total number of offices providing high-quality banking services exceeds 350.

General license of the Bank of Russia No. 354. The information is not a public offer.

How to find out the amount

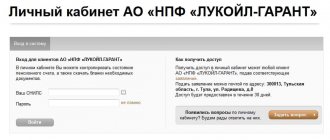

To find out the amount of savings and other data, the client must register in the Client Account on the NPF website.

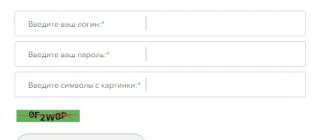

To gain access to personal data, a citizen must fill out:

- information about the signed contract;

- email;

- basic data specified in the contract;

- phone number.

Registration consists of 3 simple steps:

- email registration, confirmation;

- basic data entry, verification;

- phone number confirmation, you will receive a code that you will need to enter on the website.

The user then creates a password to log into the site and gains access to personal account data.

Types of Gazprombank pension cards

In 2020, among more than a dozen offers from Gazprombank, there are two for pensioners - they are serviced according to attractive tariff plans, which allows us to consider the programs economically beneficial for that category of users whose budget often consists only of payments from pension funds. Cards can be personal - indicating the name of the owner, and immediate receipt - without including personal data. Let's consider these proposals in more detail.

Gazprombank offers to issue a credit card on favorable terms:

Amount: up to 600 thousand rubles. Grace period: 60 days Interest rate: 25.9% Age: up to 64 years Cashback: up to 10%

Standard pension cards

This program is specially designed for those people who do not expect advanced functionality from a banking product. The project supports a standard package of opportunities, the main purpose of the plastic is to receive pension payments coming from the regional and federal funds.

The card should be used in the same way as any card issued by this organization. It can pay for purchases in the retail network, withdraw cash through the company’s ATMs and partner cash dispensers, make card-to-card transfers, and also make other financial transactions within the current tariff plan.

Issued free of charge, no money is charged for opening a current account. The validity period of plastic is 36 months. After this period it will be replaced with a new one. The cost of the service is zero rubles.

Pension card GAZFOND

The bank’s special offer, “Gazfond,” is also aimed at senior citizens and provides its owners with a number of additional opportunities and benefits. Unfortunately, to receive such a card there is a condition - you must be an active member of the NPF Gazfond or sign a pension agreement with it.

The product category is classified as the most functional - it supports almost all the capabilities of the bank’s previously existing offers and allows:

- receive pension accruals;

- transfer pension fees from this account to a personal account that is opened by an individual on the basis of an agreement concluded with the institution;

- transfer money from a standard pensioner card to a special one - “Gazfond”;

- receiving through ATMs of the network a statement showing the current balance of a personal account opened in the specific name of a client who is a member of the NPF Gazfond.

The product can be manufactured free of charge and has a shelf life of 12 months.

How to receive the funded part of a pension from NPF Gazfond

Pension savings are paid to citizens receiving old-age contributions. In NFP, it does not matter how exactly a person became a pensioner:

- ahead of schedule;

- within generally established periods (60 years for men and 55 years for women).

To receive the funded part of the pension, a person must meet 2 conditions:

- the onset of a citizen’s right to receive a pension;

- have a sufficient amount of accumulated funds.

Persons whose insurance part of their pension is no more than 95% of the funded part can count on lifetime payments of the funded part.

In 2020, it is calculated taking into account monthly payments for 18 years. That is, a citizen can determine the monthly payment by dividing the total amount of savings by 2020 months.

One time

Citizens whose savings amount is less than 5% of their pension can count on a one-time payment.

As a rule, citizens born in 1953–1966 and 1957–1966 fall into this category, since it took them only 3 years to accumulate a pension (from 2002 to 2004).

In addition to the above persons, citizens who:

- have reached the established retirement age;

- receive any type of disability pension;

- receive survivor benefits;

- have not accumulated the required amount of work experience to receive an old-age pension.

The main condition is participation in the savings scheme for any period of time.

Conclusions: what is the most profitable Gazprombank deposit for pensioners today?

As this review has shown, interest rates on Gazprombank pension deposits are currently not very profitable. Therefore, it makes no sense for pensioners to focus only on them. In some cases, it will be much more profitable to issue a regular deposit for individuals.

Is it profitable to open investment deposits?

Gazprombank offers clients quite a lot of investment deposits, which imply the execution of ILI, NSZh, etc. agreements. They have increased profitability. But they are also distinguished by a number of features that should not be forgotten.

The bank guarantees profitability only for those funds deposited in a regular deposit. The return on the money you invest is not strictly defined. It may be significantly lower than customers expect. In addition, these funds are not insured by the state.

Recently, interest rates on deposits in Russian banks have fallen sharply, and against this background, complex investment deposits are becoming increasingly popular. However, they should be recommended only to experienced investors who know what they are doing and are ready for risky investments for the sake of an increased interest rate on the deposit.

For those who are looking for not only profitability in a bank, but also stability, it makes sense to pay attention to ordinary deposits, which Gazprombank also has quite enough of.

Survey

Comparison of deposit returns

Let's compare the profitability of basic and pension deposits excluding investment deposits. Let's assume that you want to invest 1 million rubles for 1 year. How much income will you receive?

Comparative table of profitability of Gazprombank deposits

| Contribution | Bid | Income from 1 million rubles in 1 year |

| For savings | 4,1% | 41 224 |

| For life | 3,8% | 38 880 |

| Business | 3,1% | 31 616 |

| Champion | 4,2% | 42 000 |

| Pension savings | 3,3% | 33 687 |

| Pension income | 2,6% | 26 456 |

As you can see, with this combination of amount and term, the most profitable deposit in Gazprombank, excluding investment ones, turned out to be the “For Savings” deposit . It has a maximum bet.

But with a period of 6 months (181 days), the “Success” deposit may also be of interest today - 5.2% per annum in rubles.

However, there is no need to cut off other deposits, for example, “Champion”, as well as those that have the function of replenishment (“Living”) or partial withdrawal of money without loss of interest (“Business”).

Experts advise opening several different deposits at once. You should store a large amount on one of them (with the maximum rate) in order to receive a decent income. You should put a very small amount on the second (replenishable) one in order to be able to save money. And on the third (with partial withdrawal) keep a 2-month supply of funds so that the money can be withdrawn if you suddenly need it, and the interest “drips,” says 10bankov.net expert on savings programs Olga Karpova.

Is it worth translating: pros and cons

Before signing an agreement with the fund, it is recommended to consider all the advantages and disadvantages. The advantages include:

- The ability to replenish your account in any possible way, including by deducting part of your salary, through another bank, any bank terminal, online on the website or in person at a branch.

- Make a tax deduction from contributions every year.

- Choose any pension scheme, change it at any time.

- Transfer funds to heirs or close relatives.

- Terminate the agreement unilaterally at the discretion of the applicant, receiving the accumulated interest on the account and all contributions.

- Use your personal account, receive any information about your personal account within a few minutes, keep track of receipts of funds.

Judging by customer reviews, the main disadvantage is the fund's profitability. In 2020 it is about 4%, no increase is expected in 2020. However, it is worth considering that in the state pension fund the profitability is zero.

The Fund has the right to stop indexing pensions at its own request, for example, to cover losses or survive a difficult economic period.

Citizens who transferred the funded part of their pension to a non-state pension fund have the opportunity to increase future payments. If you take care of your savings in advance, the Gazfond has all the conditions to provide for your old age.

Advantages and disadvantages

Any fund necessarily has pros and cons.

| + | — |

| Funds are distributed among several managers | Low profitability of NPF Gazfond Pension Savings OJSC |

| Member of the National Association of Non-State Pension Funds | Purchased ratings and awards speak more about PR to attract clients than about real results |

| Common structure of branches and representative offices | It is very difficult to make changes to the contract, even according to an individual plan |

| Remote “communication” with the fund via the website | Chat - support on the site - works every time |

| Reports are posted regularly | The information is so cleverly hidden that it seems to be there, but you still have to find it |

How to use the card?

Regardless of the fact that the tariff plan does not provide for the accrual of an additional amount to the remaining balance, preferential service principles apply within the framework of the programs. There is no possibility of producing additional cards, cashback is not awarded.

General rules:

- issued free of charge;

- withdrawal of cash through devices of the bank and its partners – zero rubles;

- At ATMs of other financial institutions, a commission fee of 0.5% of the withdrawn amount is charged. The commission cannot be less than 150 rubles;

- for non-cash transactions there are no additional fees;

- any transfers to the card – zero rubles.

Reviews from cardholders

As practice shows, the most favorable reviews can be heard from those company clients who have already transferred their pension funds to the Gazprombank fund. This category of customers notes not only the free use of the product, but also a number of additional features that this card gives them.

At the same time, some users speak negatively about the restrictions on the design of Gazfond plastic. Among the disadvantages, many note the lack of interest bonuses on the balance.

Pension plastic cards from this organization are a modern banking instrument that successfully competes with analogue offers from other financial institutions. Their target audience is citizens who have reached retirement age. Those who are insured by a non-state fund can purchase a product with special offers and expanded functionality.

Terms of service and interest

Standard pensioner cards, which can be obtained from Gazprombank:

- Mastercard payment system;

- Visa;

- World.

They operate under the following conditions:

- relevance – three years;

- limit restrictions – 50,000 rubles per day, 250 thousand – per month;

- information about the balance - in ATMs of the company and partners - zero rubles, in third-party devices - 10 rubles 1 statement.

As part of the tariff plan, no additional interest accrual is provided.

For Gazfond plastic, the service conditions are similar to those described above, with the only difference being that the card is valid for only 12 months. There is also no interest surcharge on the remaining amount.

Reference! If a technical overdraft occurs, an additional payment of 0.1% is added to the balance daily.