NPF Uralsib is a non-state pension fund that provides services to clients under corporate and private pension programs, which has joined NPF Future since the end of 2020. Uralsib clients were also automatically transferred to the new Pension Fund.

Those of them who have opened a personal account of NPF Uralsib can, like new clients, enter a similar web service on the website of the Pension Fund “Future”, which fully retains the functionality of the Uralsib web service.

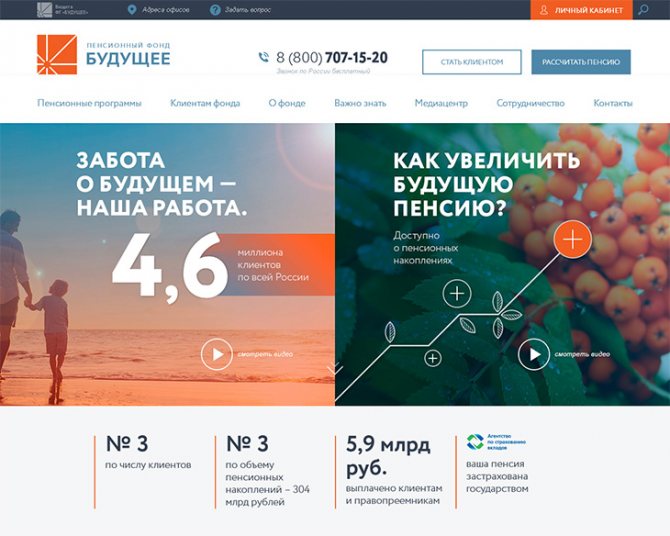

Briefly about the fund

NPF Uralsib began operating in 2000; for a long time it was a closed structure. The fund served exclusively corporate clients, that is, retired bank employees. Ordinary citizens have gained access to pension programs only since 2007.

futurenpf.ru - official website of NPF Uralsib

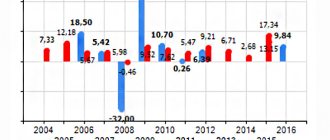

NPF Uralsib has always shown itself to be a reliable fund, which was confirmed by expert ratings. In them, the organization was assigned exclusively level A ratings. This indicated the stability of the structure and high trust of experts. However, since 2020, NPF Uralsib has been reorganized, joining the non-state fund Future. Automatically, all citizens switched to services in this NPF. At the same time, neither the pension programs nor the terms of service have changed, so renewing the contract will not be required either.

UralSib Bank hotline phone number

The financial institution cares about its clients and offers a hotline to solve problems, operating around the clock, without days off or breaks.

| Telephone | Geography of the call | Purpose of service | Call costs |

| 8-800-200-55-20 | inside the country | any questions | for free |

| +7-495-723-77-77 | roaming | any questions | network operator tariffs |

| 8-800-700-77-16 | all regions of Russia | Internet banking | For free |

By calling, users can:

- resolve security issues (blocking/unblocking cards, personal accounts);

- get help with web banking;

- troubleshoot transfers and payments;

- find out information about banking products;

- make calls from abroad;

- set transaction limits;

- perform a number of other operations.

Personal account features

If a personal account in NPF Uralsib already exists, then the user can take advantage of all the benefits of the personal account at any time. The following functions are available here:

- Request for account statements and certificates.

- Tracking the history of accruals and the status of the agreement with the NPF.

- You can view how much pension savings you currently have.

- Use of official application templates.

- Informing about innovations in legislation, as well as about new profitable programs.

- Receiving advice from fund employees via the Internet.

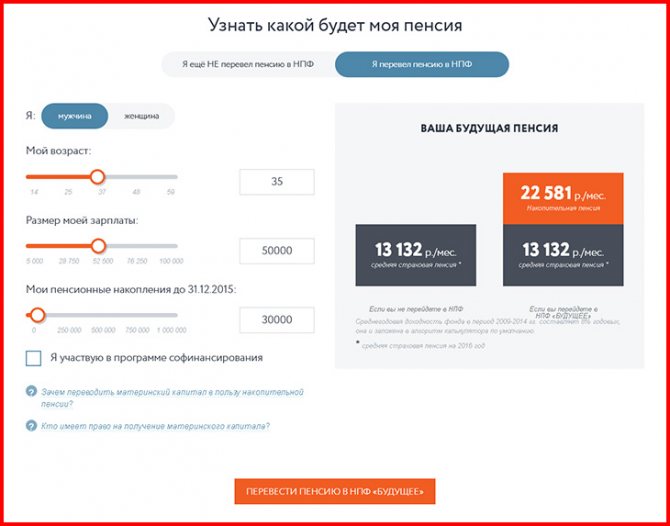

The website also has a convenient pension calculator . Using it you can calculate the approximate size of your pension. The current salary level, the amount of savings, and the client’s age are taken into account. Here, after calculations, you can see how the funded pension will differ from the regular one.

Pension calculator Uralsib

You can also familiarize yourself with additional programs and apply for participation. At the moment, two of them are available - co-financing of a pension and transfer of maternity capital to a non-state pension fund to a savings account.

Transfer of funds from the personal account of UralSib Bank

To transfer funds in the top menu of your account, in the “Services and transfers” item, you need to select the “Transfers” item and the type of transaction:

- to your own account in UralSib;

- to a third-party client at your bank;

- to a third party in another bank;

- Legal Entity/Individual Entrepreneur;

- repaying a loan from a third-party bank;

- transfer in the currency of another state;

- currency exchange.

By clicking on the desired icon, the system will open a form for entering details. When making a transfer to a third-party bank, in the appropriate column you need to click on the bank directory. The system will display a search window. The client indicates the required organization in it, and the details will be entered in the required columns.

In the next step, a window will open with the entered details for verification before sending to the bank. Below the forms, mark the date of the transfer, enter the password from SMS (or the generated key) and confirm the payment with the “Transfer” button.

Important! A fee may be charged for the transaction, the amount of which is displayed when filling out the form with the details after making the transfer amount.

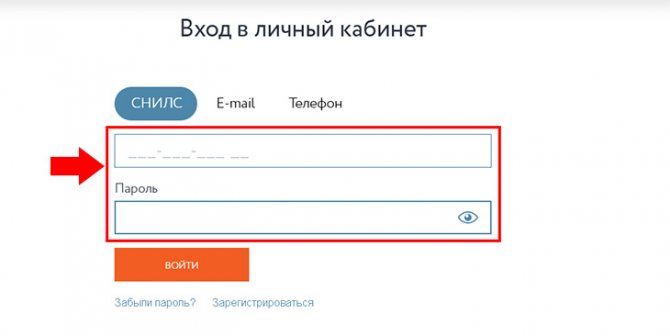

Registration and login to your personal account

New users can register an account and gain access to service management on the Future Foundation website.

The link to enter your personal account of NPF Uralsib is highlighted in orange. The registration function is available on the same page. To register on the website of NPF "Future", to which Uralsib was merged, you need to click the "Registration" button under the login form and fill out the fields:

- SNILS;

- data from the passport (number, series);

- FULL NAME;

- phone number;

- e-mail.

Next, you just need to agree to the transfer of data for processing and complete registration.

futurenpf.ru/personal/ - personal account of NPF Uralsib

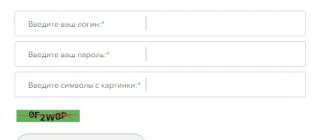

You can log into your Uralsib personal account using your password and login. It is either a phone number, or an e-mail, or SNILS. If the access code is lost, you can restore it by indicating the SNILS number in the “Forgot your password?” section. After this, you will need to enter the verification code and wait for the password reset email.

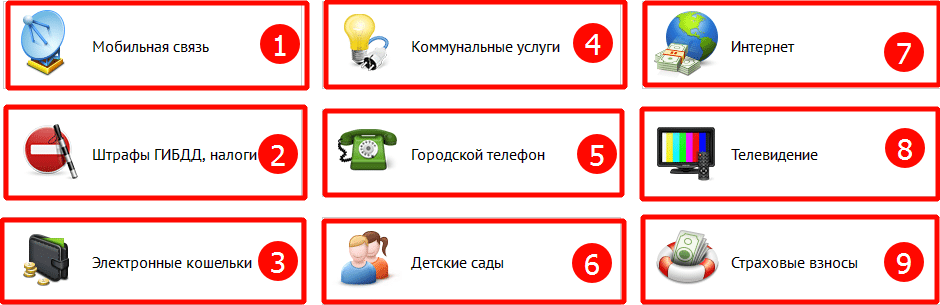

Payment with UralSib cards via the Internet

Cardholders can make any payments on the bank’s website without logging into their account. To do this, on the main page of the site in the top menu, select the “Payment by card” section.

The system will automatically redirect the visitor to a page to select the desired service. The following can be topped up online from the card:

- Mobile connection.

- Taxes, traffic police fines.

- Electronic wallets.

- Com. Services.

- City connection.

- Children's preschool institutions.

- Internet services.

- Telecommunications.

- Insurance premiums.

A simple click on the corresponding icon takes you to a page where the service providers displayed in icons are displayed on the screen. The client just has to select the desired organization, fill in the empty fields in the form that opens and confirm the operation.

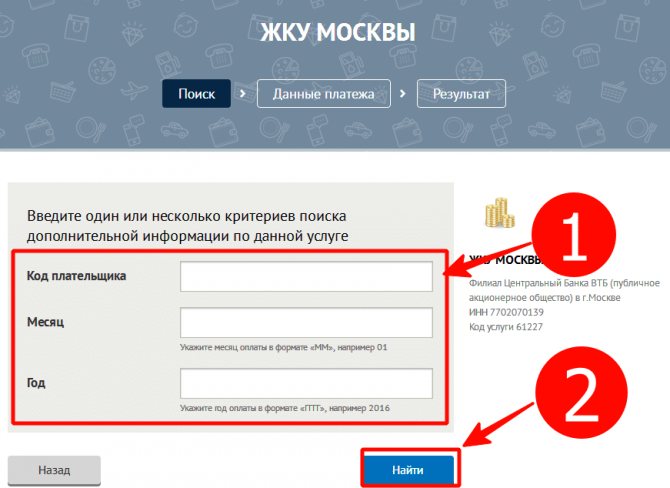

Payment for services with UralSib-online cards

To pay online using a utility card, click on the section of the same name. In the section heading you must indicate the city in which payment will be made. The list of cities for selection opens after clicking on the name of the locality. After clicking on the desired organization, a form for entering details is displayed on the screen. After filling out the fields (1), you need to click “Find”.

The system will find the user and display all payment data on the screen. After checking the data, entering payment details, the amount and date of payment, identifiers are entered to confirm the payment.

Note!

- Payment by card can be made from your personal account.

- To make a payment, you will need to indicate the card number, expiration date and the code located on the back.

How to check savings

To check your pension savings, you need to go to the appropriate tab after logging into your personal account. In addition, you can find out this information both through your account on the Pension Fund website and through the State Services portal. In this case, you need to send a request to receive notification of the account status. A letter with the necessary data arrives on the same day, usually almost instantly.

If there is no personal account on the website of NPF Uralsib, then to obtain this information you should contact the MFC or personally come to any branch of the Pension Fund.

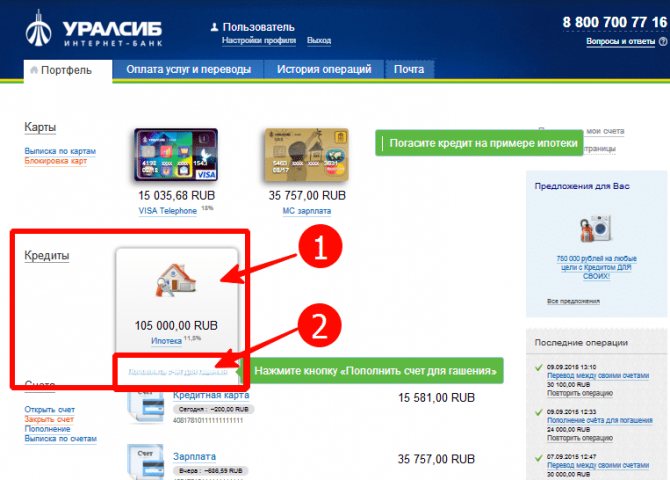

Loan repayment in UralSib Internet bank

Account owners have the opportunity to pay current loan payments remotely. To make a payment you must:

- on the main page select the desired banking product;

- Click on the account replenishment button.

To transfer funds between your accounts, in the right menu you must select the action “replenishment of account for redemption”. The amount of the current payment is displayed in the window at the bottom of the form. The payment amount in the window can be changed. The action is confirmed by clicking on the “Next” button.

The system will open a window in which the client can set a payment date. To confirm, enter your online banking password and complete the transaction. In this section, you can make payments regular by checking the box in the required box.

Note! In this section you can submit an application for partial/full early repayment of the loan.

When paying for a loan by card, the client can choose a payment plan. To do this, on the main page, click on “Make payment” and check the appropriate option:

- Grace period;

- minimum payment;

- full repayment;

- payment of an arbitrary amount.

After entering the amount and clicking “Next”, the system will redirect the user to the payment page. Having noted the payment date, the client must confirm the action. To do this, in the appropriate window, the code used to log into the Internet bank. Complete the operation by clicking the “Transfer” button. The payment can be saved as a template. To do this, give the template a name and select an identification icon. The template is saved and it is automatically transferred to the appropriate section.

Reviews about UralSib Bank

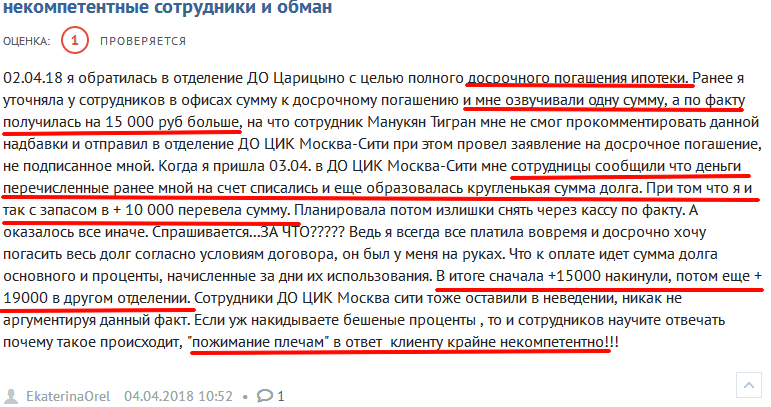

Users of banking services write reviews on a variety of resources about the activities of the bank and the service it provides. There are different opinions among them. Some clients are quite satisfied with the work of the online bank and personal account, while others leave complaints. For example, Ekaterina from Orel speaks out about the unfair calculation of interest on early repaid mortgages. At the same time, the woman is outraged that the employees cannot explain how they were counted.

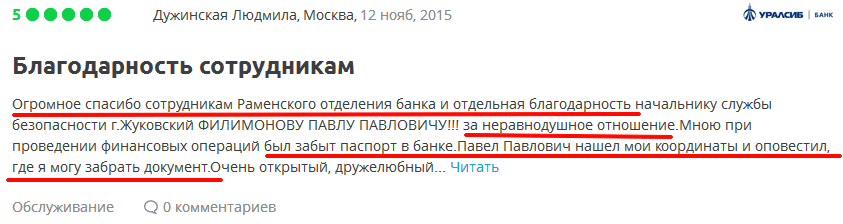

Lyudmila Duzhinskaya from Moscow, on the contrary, is pleased with the responsiveness and participation of the employees of the Ramensky branch and expresses gratitude to them for returning the forgotten documents.

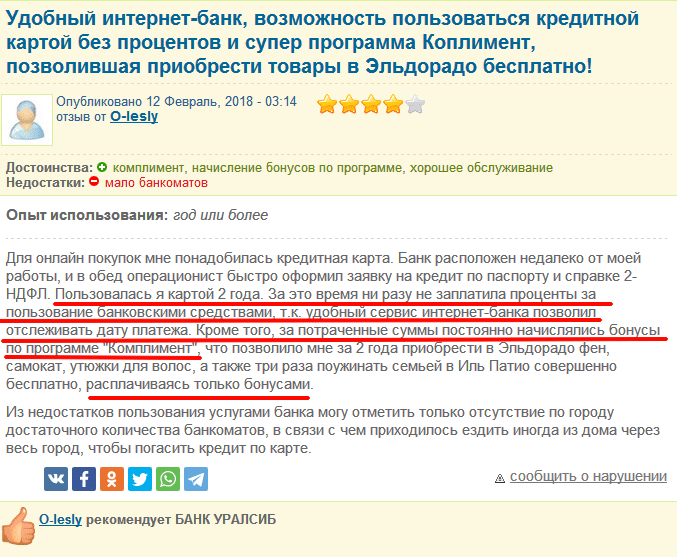

Another positive review about the possibilities of using the card without paying interest and accruing bonuses for purchases was left by O-Lesly. The woman claims that with proper use of the product, you can not only not pay interest, but also receive good bonuses that you can spend at your discretion.

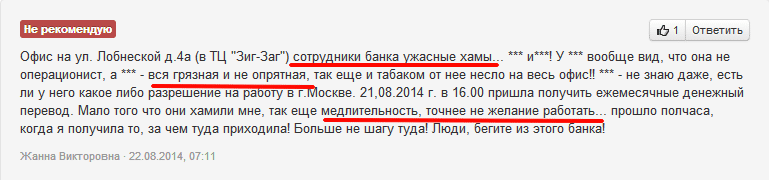

But Zhanna Viktorovna is outraged by the rudeness, incompetence, slowness and unkempt appearance of the employees of the department on the street. Lobneskaya. The woman does not recommend the bank to anyone and claims that she will never cross the threshold of this institution again.

To find out the true state of affairs, potential clients study various resources, determining for themselves from the stories of other people the positive and negative aspects of banking products, the service offered and the bank’s attitude towards its clients. Write reviews, describe real situations and your attitude towards them. Your stories about UrasSib Bank and its personal account will help those who have doubts weigh the pros and cons.