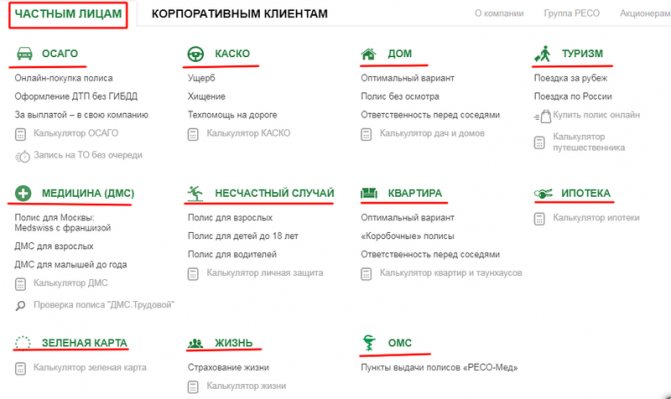

The insurance company was founded in Moscow in 1991. Today it has about a thousand branches and regional offices throughout the Russian Federation. There are also representative offices in Kazakhstan, Belarus, Armenia, and Ukraine. It provides insurance and reinsurance services in one hundred licensed areas. Main activities: OSAGO, CASCO, tourism, life, health, etc.

For convenience, the company offers its clients to register a personal account on the official Reso-Garantiya portal in order to issue insurance online and receive advice.

Personal account features

Users of the online services of Reso-Garantia Insurance Company receive information on existing insurance policies, renew them and issue new ones.

Personal account potential:

- Obtaining information on ongoing promotions and special offers that can significantly save the family budget.

- Monitor contract completion deadlines.

- Register new products from SK Reso and renew existing ones.

- Print documents.

- Calculate insurance premiums and amounts.

Registration in your personal account Reso

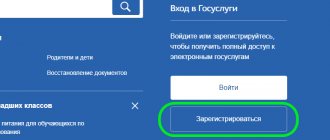

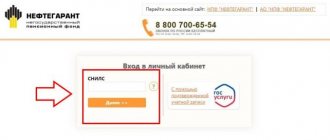

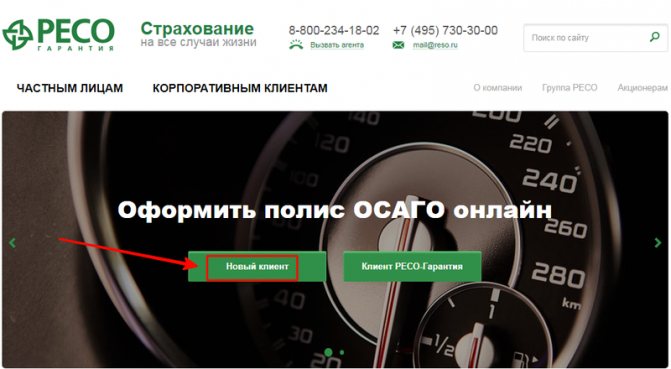

You can create your own account in Reso-Garantia through the official portal, where you need to click on the “New Client” button.

Registration

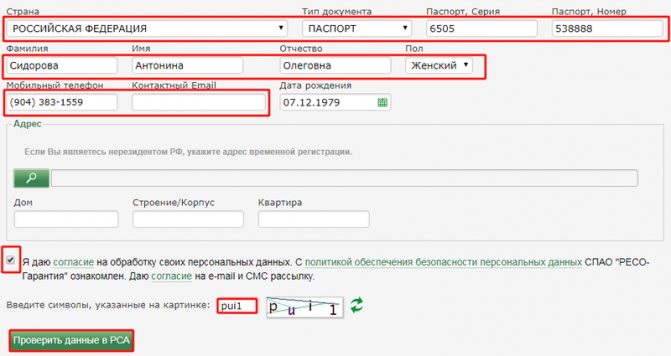

A page will open where you need to go down a little and fill out the policyholder’s form. Enter information correctly and reliably, so that in the future there will be no problems with paperwork and payments for insured events.

Fields to be filled in:

- Full Name.

- Series and passport number.

- Contact Information.

- Date of Birth.

Be sure to enter alphabetic characters in the correct box for confirmation. That you are a valid user.

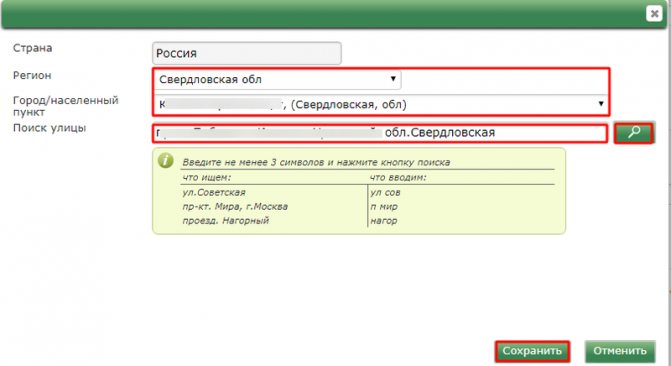

Enter your registration address in the appropriate line. The region and locality fields are selected from the list. You must enter the street into the line yourself and then press the search sign. After the save occurs, the client will be redirected to the personal account registration form.

After the user clicks on “Check data in RSA”, a page opens where you need to independently create a password for further login and confirm your phone number.

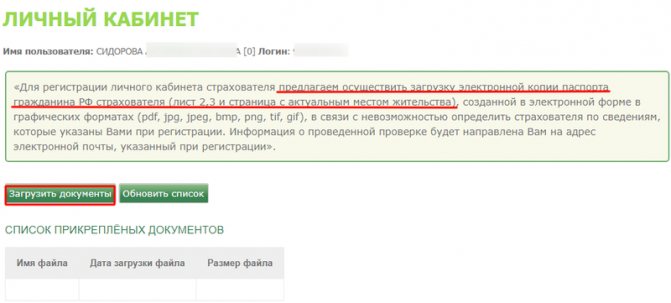

The next step is to support scanned pages 1 and 2 of your passport with your current registration.

After selecting the files, you need to click on “Attach to policy” to upload them to your personal account.

Attention! After checking the entered information, a letter about the results will be sent to the specified email.

The Central Bank canceled the licenses of five Motylev funds whose money was stuck in Russian credit

Previously, the Sun Foundation. Life. Pension admitted that he kept his savings in the Rossiysky Kredit bank. Thus, the savings are stuck in the bank, however, specific amounts are not named. “Indeed, the fund opened current accounts with OJSC Russian Credit Bank, in particular for settlements on transactions with its own funds (settlements for business activities) and for settlements on non-state pension provision (NPO). At the moment, funds in these accounts are blocked. However, the fund will promptly and in the very near future open new accounts in other reliable banks for the speedy resumption of all settlements with its counterparties,” the fund commented.

Interesting read: How to deregister a wrecked car

Sun Foundation Life. Pension" is one of the largest non-state pension funds in the country in terms of assets and number of insured persons. As of December 31, 2014, its clients are more than 800 thousand Russians, and the total amount of pension funds under management is more than 31 billion rubles. NPF Sberfond. Sunny Beach" at the end of 2014 accumulated 15.6 billion rubles, the number of insured persons forming the funded part of the labor pension in the fund is 256.8 thousand people.

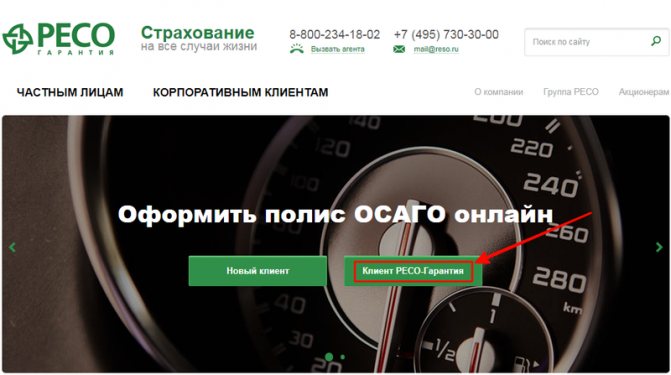

Login to your Reso personal account on reso.ru

Users visit the Reso-Garantia personal account through the main page of the portal.

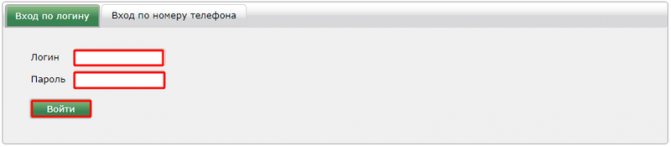

Online login to the agent's workplace

Reso-Garantia employees log into their personal account through a special page. The login is your name, and the password is issued upon registration.

Login to your personal account

Important! If the agent does not have access to the account, then he needs to contact his managers .

In the next step, a one-time code will be sent to the specified mobile phone, which must be verified by entering it in an additional cell.

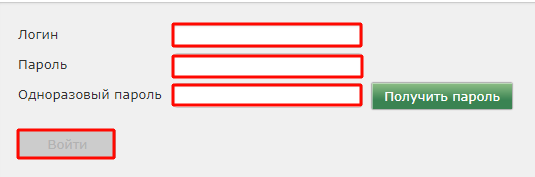

How to log into a client's personal account

Authorized users enter the Reso-Garantia account through a page where they enter a login (their cell phone number starting with the number “9”), a password (created during registration), and a one-time code (received via SMS).

Personal Area

I can’t log in: how to recover my login and password

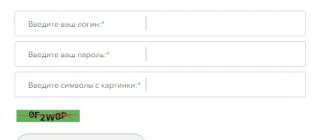

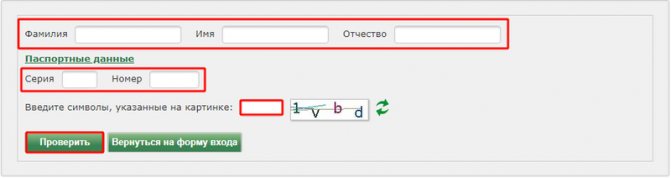

If the client has lost his input information, he can use the form to restore it. To do this, you need to go to the special Reso-Garantiya page.

Password recovery

Indicate in the appropriate cells:

- Personal information.

- Series and number of the passport of a citizen of the Russian Federation.

- Enter captcha symbols.

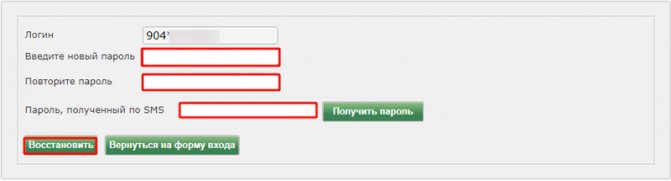

After verification, a form will open where you need to come up with a new password and confirm the code received in the message.

To restore your login, which is your cell phone number, you need to contact technical support in writing.

NPF "Renaissance Life and Pensions" lost its license: what next

NPF “Renaissance Life and Pensions” is a non-state pension fund, which since February 2020 has received the name “Sun.

Life. Pension". He was quite popular among the population of the Russian Federation, who, not trusting the state, entrusted their savings to this organization. However, unfortunately, the clients of this organization had to face a serious problem: the NPF “Renaissance Life and Pensions” had its license revoked and the institution was transferred under external management. Today we’ll talk about what this Pension Fund was, and what should investors who have entrusted their savings to this structure do now?

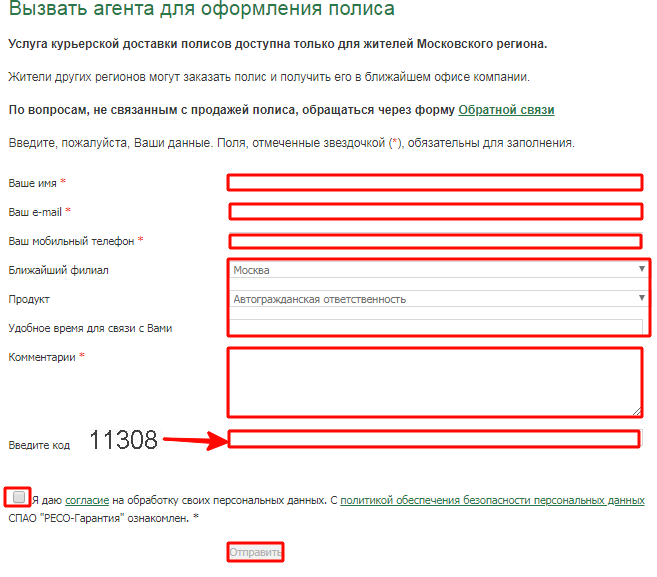

Calling an agent through your RESO personal account

If a client wants to call a company employee to his home, this can be done through his personal account. On the main page, go to the “Call an agent” form.

Fill out the application as completely as possible to select the right specialist. Indicate your name, email address, phone number, city, and the insurance product you are interested in. In the comments, you can write data on the previous contract, especially regarding car insurance (MTPL, CASCO). Be sure to check the box that allows the company to collect and store your personal information.

Purchasing an electronic OSAGO policy online

According to the Law on Motor Vehicle Liability, starting from January 1, 2020, you can draw up an agreement on the Internet. It is equivalent in strength to a document produced by printing. This innovation allows car owners to enter into car insurance contracts online. Payment is made cashless via the Internet.

For registration you will need scans:

- Driver's license.

- PTS.

- Certificates of registration.

- Passports of a citizen of the Russian Federation.

- A document confirming the completed technical inspection (diagnostic card).

- TIN.

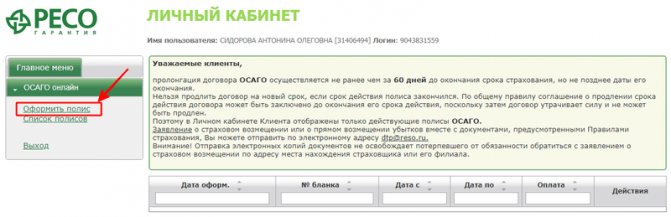

By logging into your personal account, select “Apply for a policy” in the side left menu.

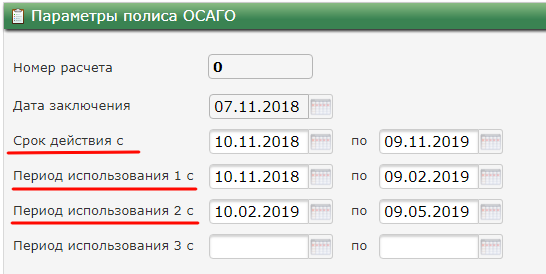

In the “Policy Parameters” section, fill in the start and end dates of the document and the period of use. In the case where the vehicle is used all the time, these dates coincide. If not, then the lines Period 1, Period 2 are filled in.

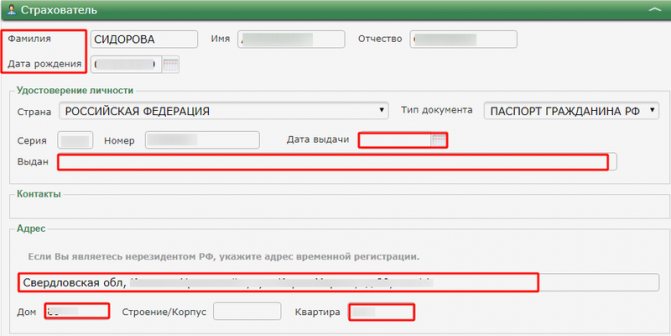

Section "Insured". By default, the data from the questionnaire is displayed. Some fields need to be completed: date of receipt of passport and department. If the address is not correct, it can be changed. It is necessary to check the accuracy of all the information provided so that there are no problems with payments and points accrual in the future.

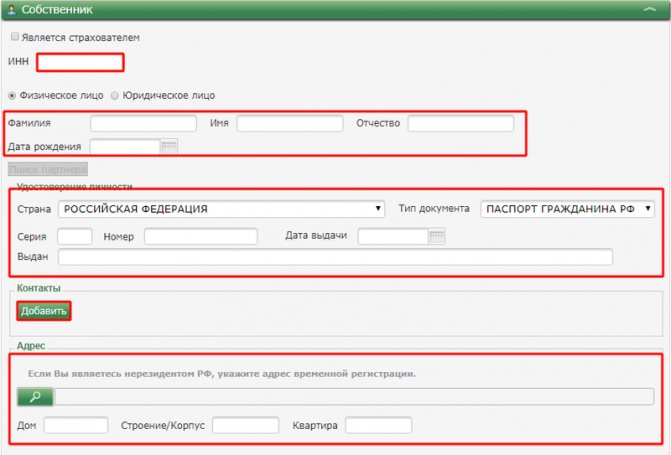

Section "Owner". By default, it is indicated that the policyholder and the owner are the same person. If in reality the owner of the vehicle is another person, then you need to uncheck the box and fill out all fields of the form.

Enter: personal information, identity card, registered address, contact information.

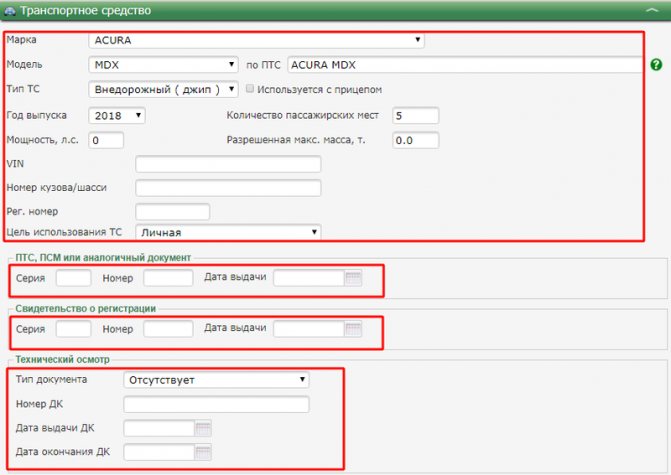

Section "Vehicle". Enter the data from the documents for the car, indicate the series and number of the PTS, the Registration Certificate, as well as information about the technical inspection.

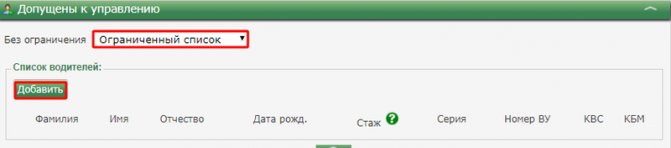

Section “Approved for management”. Here choose one of the options:

- No limit. All drivers are welcome. In this case, the KBM is calculated for the specified vehicle. When selling a car, the bonus-malus coefficient is lost and will be calculated again.

- Limited list. A certain number of persons admitted to management is entered.

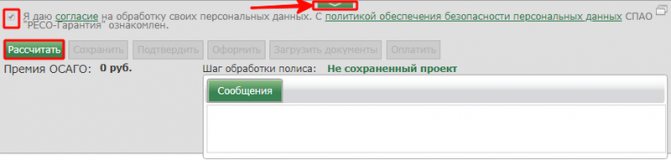

Click on the arrow in the middle of the bottom field. A calculation window will open, where you must first check the box to consent to the processing of the entered data.

The insurance premium amount will appear. After this, save the document.

Attention! If you have not passed the AIS RSA control, then you need to check all the entered data. A single digit error may indicate a discrepancy. It is also possible that the previous policy was filled out incorrectly by the agent. In this case, you will have to contact the insurance company with a statement. .

If all the data is entered accurately and the check in the PCA database is successful, then the payment must be made before 00:00 the next day. Otherwise, the application will be cancelled.

After funds are received into the company’s account, a PDF file with eOSAGO will appear in your personal account. It is equivalent in strength to the official auto insurance form.

OSAGO calculator

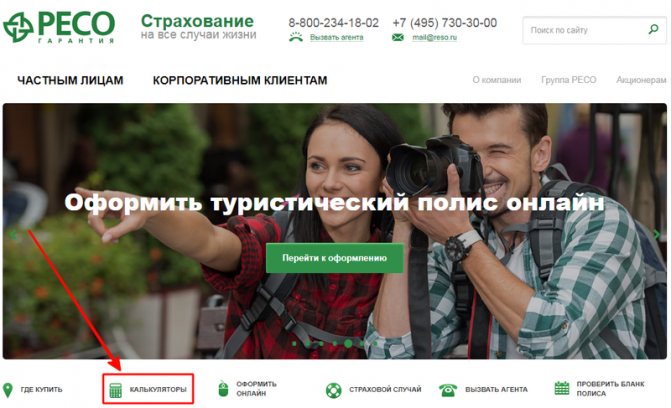

Before executing a vehicle insurance contract, you can make a preliminary calculation to clarify the amount of the accrued premium. The calculator is located at the bottom of the main page of Reso-Garantiya.

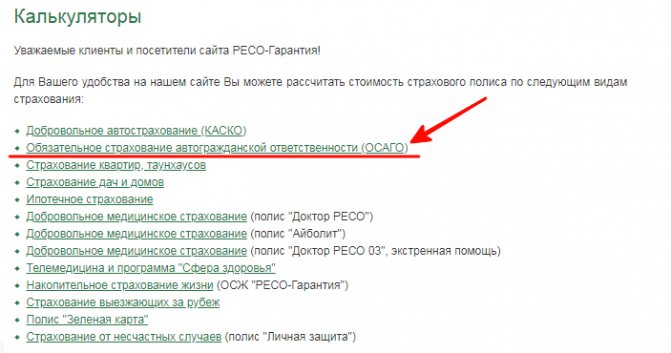

In the list that opens, select the MTPL calculator.

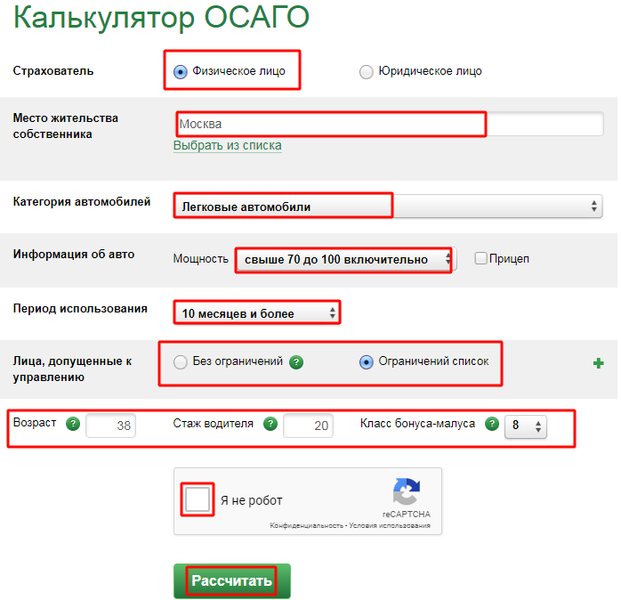

General information is entered into the form and an approximate calculation is made. The following fields must be filled in:

- Type of policyholder (individual or legal entity).

- Place of residence.

- Information about the vehicle.

- Operating period.

- List of persons admitted to management.

- Age, experience and KBM.

Be sure to check the box that you are not a robot and calculate the cost of the premium.

What to do if your NPF goes bankrupt?

A non-state pension fund (NPF) may go bankrupt, but there is no need to fear that pension savings may be lost.

“Non-state pension funds are institutions operating in the financial market. And they are characterized by all the events that occur in the economy.

Including bankruptcy. But due to the fact that the requirements for non-state pension funds from the regulator are quite strict, such cases are rare.

We remember the bankruptcy of pension funds owned by Anatoly Motylev and Evgeny Novitsky. All these cases occurred before the creation of a system for guaranteeing pension savings in Russia,” says Sergei Erlik, first vice-president of the National Association of Non-State Pension Funds (NAPF).

Online insurance in your personal account

IC Reso-Garantiya provides services to the population and organizations in the field of insurance in all types of areas: property (movable and immovable), life and health, travel, additional and compulsory health insurance, mortgage. Almost all policies can be issued online.

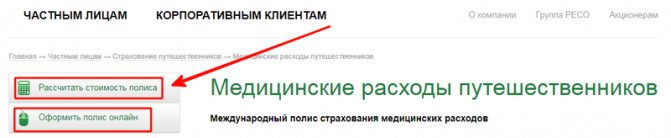

For example, we need insurance for traveling abroad. Then select “Tourism” and “Trip Abroad”. In the page that opens on the left, you can pre-calculate the cost of the premium, then draw up an agreement.

You will need to reliably fill out the form and transfer funds from a bank card. The electronic policy will be sent to the specified E-mail.

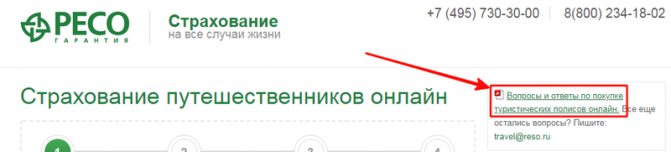

If you have questions about the design or use of a document, you can open the “Questions and Answers” form on the right.

RESO Mobile - personal account on your phone

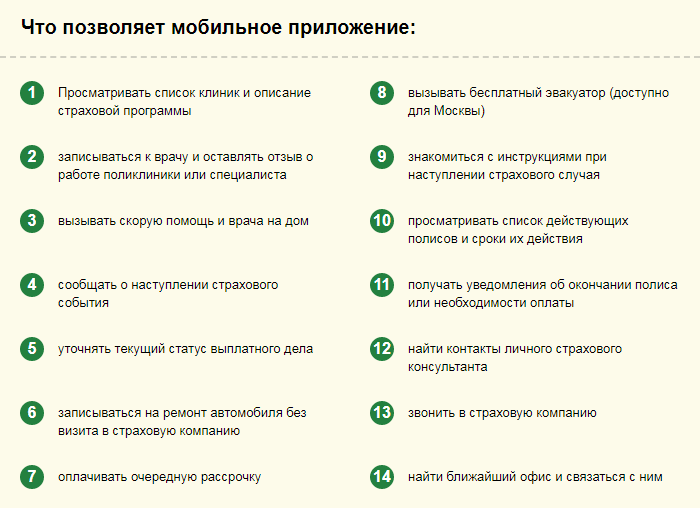

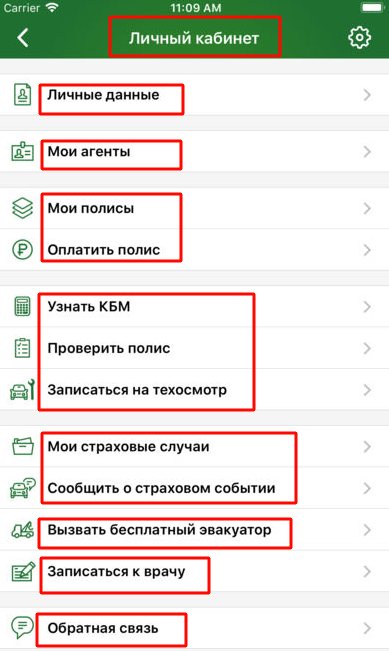

For those who constantly use gadgets, the company offers to download the convenient mobile application RESO Mobile. The version is available for iOS and Android operating systems, which can be installed through stores on your device.

Application potential:

Your personal account is quite simple and easy to navigate. In it you can:

- change or correct personal information;

- call the nearest agent;

- obtain all information about existing contracts;

- clarify information on compulsory motor liability insurance;

- report to the company when an insured event occurs;

- call a free tow truck;

- make an appointment at the clinic;

- Get advice from hotline specialists.

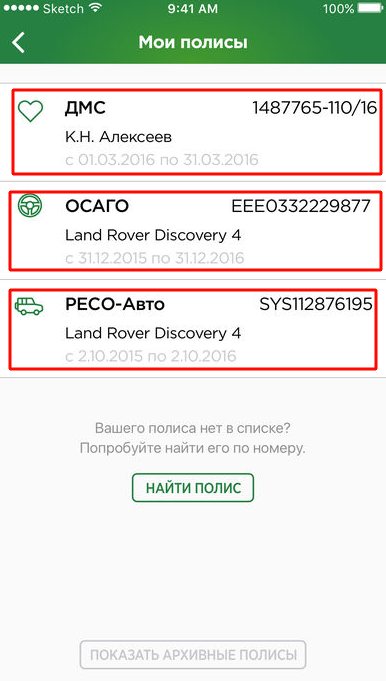

In the mobile version of IC Reso-Garantiya, all policies (current and archived) will always be at hand. They can be viewed in a special section and presented if necessary.

Download the Reso-Garantia application for your Android phone

You can install the program for RESO Mobile gadgets through Google Play:

Reso-Guarantee for iPhone, iPad and iPod Touch

The mobile version for Apple devices is available in the AppStore located on the device:

Reviews

It is no coincidence that RESO-Garantiya is one of the three leading insurers in the country. Clients trust the company and are not afraid to insure their own lives, property, and liability. Reviews about the company are mostly positive: users note fast service, reliable payments, a wide range of products and additional services.

Negative feedback about RESO-Garantiya is most often associated with the speed of service of some offices, as well as with the failure to provide due payments in cases where the basis is a controversial insurance event. It is worth noting that the last factor is typical of reliable companies, since verification is required before payment.

RESO-Garantiya is a reliable Russian insurer. Over the course of more than 25 years of history, the company has been constantly improving the level of reliability, service, and expanding the list of services provided. Clients use their personal account, as well as mobile applications, to manage policies and insurance without leaving home.

Reso-Garantiya hotline phone number

Reso-Garantia technical support operators work around the clock. They provide consulting services on all types of insurance. They also accept suggestions from clients to improve service and complaints about company employees.

Residents of Moscow and the region can contact the hotline by calling +7 495-730-30-00. Payment for calls is made according to the operator's tariffs.

Residents of Russian regions can call the multi-channel toll-free number 8 800-234-18-02.

What to do if a non-state pension fund is closed - liquidation of a non-state pension fund

One of the main problems that worries most citizens is the fear that a non-state pension fund may cease its activities; what to do if a non-state pension fund is closed.

Those who doubt the integrity of non-state pension funds, although they are controlled by the state, society, and independent institutions, are most worried that if the NPF ceases to operate, their pension savings will disappear without a trace.

What to do if my NPF is closed? Such concerns, naturally, cannot be ignored, since the overall amount of payments to citizens depends on the safety of pension savings. In addition, pension savings in their main amount are formed from hard-earned money, since it is from wages that a certain amount of at least six percent is deducted monthly.