Service cost

The card is not completely free. Additional fees apply for some bank services:

- SMS banking – 50 rubles per month (starting from 3 months of use),

- 1% commission for withdrawals from third-party banks (minimum 100 rubles),

- transfers between cards at the rates of another bank (from 15 to 1000 rubles),

- 300 rubles for registration.

Other services are free:

- “linking” the card to the account,

- transfer of money to government accounts and funds,

- receiving a report on accruals and checking the balance on the balance sheet.

Possibility to terminate the contract early

When opening a deposit, it is recommended to carefully study the terms of the deposit program offered by the financial institution. Important factors determining the choice of investment method for Russian pensioners:

- profitability depending on the annual interest rate;

- the possibility of premature closure of a deposit caused by the need to withdraw savings when there is insufficient funds for current expenses, without loss of profit.

According to the current conditions of Post Bank deposit programs, unilateral termination of the agreement and withdrawal of money ahead of the period specified in the document, without reducing income, is allowed only for the “Accumulative” deposit. In other cases, the client is not paid any interest accrued during the storage of the investment.

Advantages of a pension card from Post Bank

The client receives advantageous offers, including:

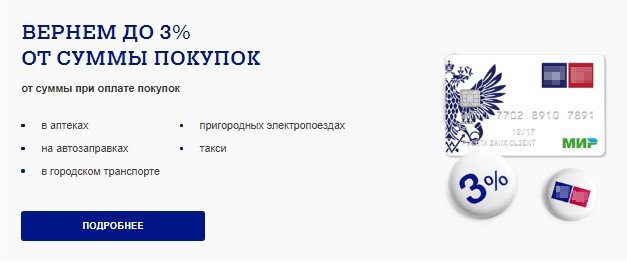

- 3% cashback when paying in stores,

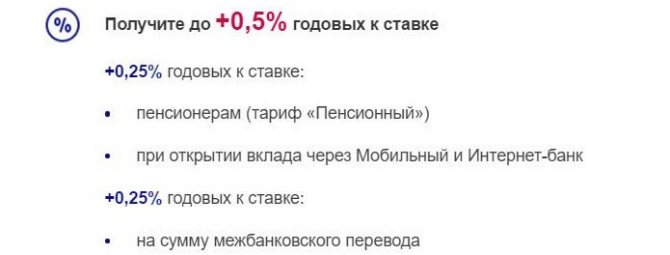

- + 0.25% to the base rate on deposits,

- 2,500 bonuses on the Pyaterochka card, which can be spent on paying for goods,

- partial or complete deferment of a pension to savings with an increase in interest on the balance.

In addition, the advantages of the card are:

- simplicity of design,

- the ability to pay for utilities, mobile communications and the Internet from a card,

- it is accepted in all retail outlets, pharmacies, cafes and so on, but only in Russia,

- free release and virtually free maintenance.

"Care Line"

Automatically activated. With her, by calling the number free of charge, you can get professional psychological, legal, and medical advice. There is no additional charge for the service.

“13th pension” program

This is a kind of affiliate program. The client can bring 5 people to the bank who will transfer their pension to Post Bank and receive a reward in the amount of 8,700 rubles. The amount is paid for every 5 people. There is no invitation limit. Depending on his activity, a person earns additional money.

Features of the “Pension” tariff

Elderly citizens of the Russian Federation who receive a monthly benefit from the Pension Fund of the Russian Federation at Pochta Bank open a savings account in a financial institution with the connection to the “Pension” tariff plan. The service package is provided under the following conditions:

- the deposit is issued and serviced free of charge;

- the credit institution does not charge a fee for re-issuing a plastic card after expiration or if the means of payment is lost;

- remuneration to a financial institution is not paid when receiving cash from ATMs accredited by the issuer and VTB Group;

- no commission is charged for transactions on intradepartmental transfers in Post Bank;

- annual income for storage up to 100 thousand rubles. determined at the rate of 4.5% of the balance;

- When placing an amount exceeding 100 thousand rubles, up to 7% is charged annually on funds remaining on the balance sheet at the end of the reporting period.

A savings account is opened at Post Bank.

In addition, pensioners have the opportunity to retain accrued interest upon early termination of the contract.

The terms of the tariff plan provide for free information to the client about the current account status, including:

- incoming and outgoing transactions on the card;

- the balance of money on the balance sheet.

During the first 2 months after opening a deposit, pensioners do not pay for SMS services. If you continue to use the function of transmitting information in SMS messages, a monthly fee of 49 rubles will be charged.

Advantages

Elderly investors note the following advantages of the “Pension” tariff:

- loyal attitude of bank employees towards elderly clients;

- receiving additional income by charging an increased interest rate on savings remaining on the card at the end of the reporting period;

- no commission when cashing out deposits at ATMs of the issuer and credit companies of the VTB Group;

- a wide range of free financial services;

- investment security ensured by special insurance programs within the framework of current legislation.

The bank, created on the initiative of Russian Post, belongs to the category of state-owned enterprises.

The safety and return of pensioners’ savings is ensured by the state, which inspires the trust of older users.

Registration of a pension card

To receive a debit card, the client must provide copies of his passport, TIN, pension certificate, SNILS, and also fill out an application. The card can only be issued in person at a bank branch.

Next comes the endorsement of the contract. Please read it carefully before signing!

After activating the card, it is “linked” to a phone number. This is necessary to receive secret codes, as well as information about deposits and withdrawals of money. The bank employee tells the client the PIN code for the card. If desired, the owner can independently change it at an ATM.

Terms of service at Pochta Bank

Every month, the pensioner receives the state old age payment through the postman, who brings the pension money home, at the post office, to a card linked to a savings account.

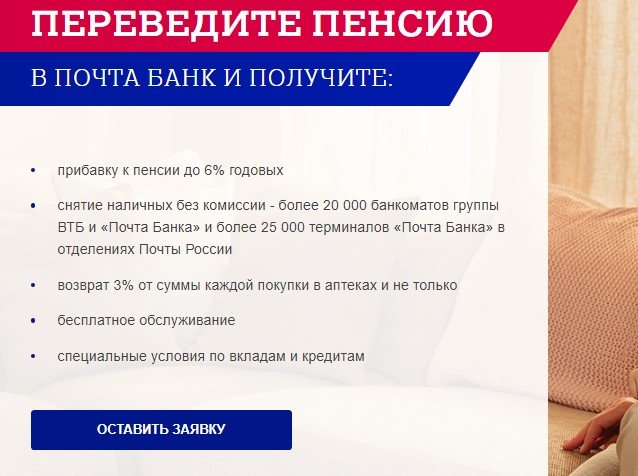

If you are looking for a financial institution through which you will receive payments, then take a closer look at Pochta Bank.

What are the terms of service?

- The pensioner receives an additional 6% per annum on the account balance.

- After each purchase at a pharmacy or gas station, the pensioner will receive 3% of each purchase back. This also applies to transport costs.

- If you wish, you can make a deposit or take out a loan on special terms .

Contribution

Credit

- The card on which the pension is stored is serviced free of charge. about the accrual of your pension.

Online services for pension cards

You can monitor your account status and the movement of funds in several ways.

Working with a map on the Internet:

- register on the bank's website,

- log in to your personal account using your login and password,

- enter your mobile number,

- send information to the operator,

- receive a secret code on your phone, enter it in the required field and send it for verification.

After this, the client can:

- control your account,

- learn about promotional offers,

- make transfers.

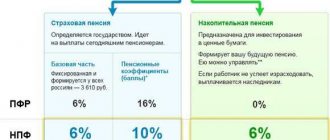

Formation of a pension in NPF Lukoil-Garant

For potential and current clients, NPF Lukoil-Garant has a number of proposals for pension formation.

These include:

- programs for private clients: funded pension, non-state pension provision and pension co-financing program;

- corporate pension programs.

Within each of them, Pochta Bank’s partner NPF Lukoil-Garant offers favorable conditions for the formation and payment of pensions, which makes it possible to choose the most profitable option.

Transfers from other accounts

When transferring money from another card, you must carefully enter all the data.

Expert opinion

Kochetov Vladimir Viktorovich

Leading specialist in finance. 23 years of experience in a large bank in Moscow. Specialization: loans, mortgages, refinancing.

Ask a Question

- If the funds are not withdrawn from the account and not transferred to another card, then there is not enough amount on the balance.

- If money was transferred via telephone or Internet, debited from the account, but there was no receipt, then an error was made in the recipient’s card number. In this case, you need to contact the bank, provide a receipt and return the money back.

- If it is impossible to either deposit or withdraw money from the card, then it is blocked. You need to go to a bank branch with your passport.

Rules for making deposits

The financial institution, part of the VTB Group, takes into account the limited capabilities of elderly clients.

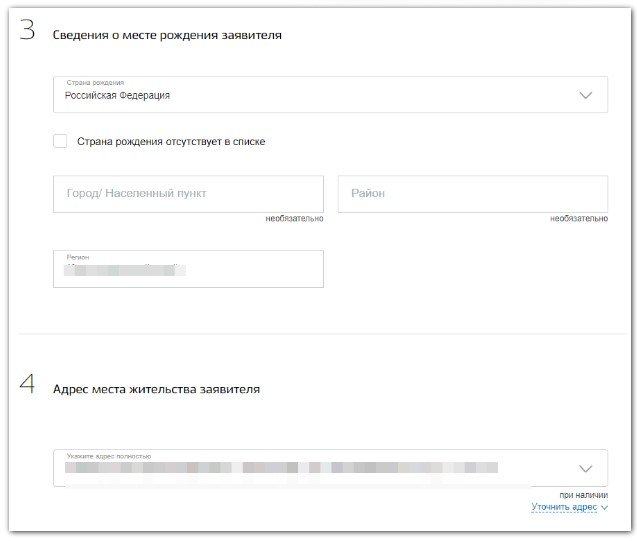

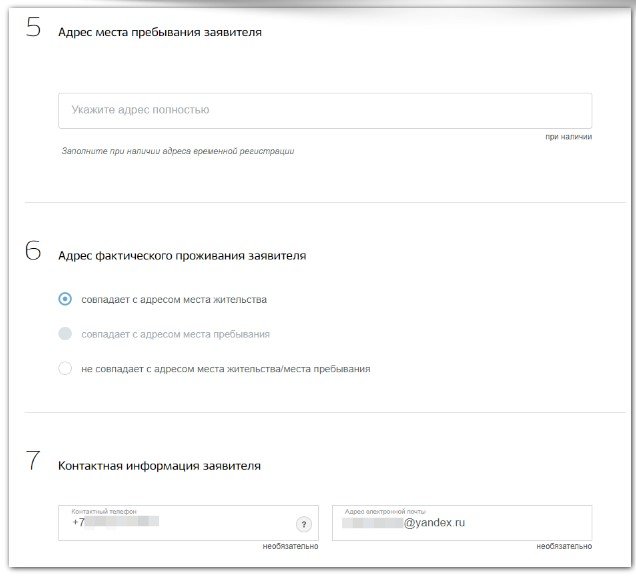

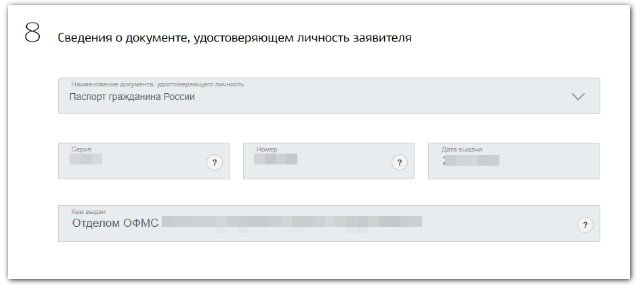

Filling out an application for a deposit.

Therefore, deposits are made according to a simplified scheme. To open an account and receive a plastic card, credit institution employees require a minimum package of documents, including:

- a civil passport with a registration stamp on the corresponding page confirming permanent residence on the territory of the Russian Federation;

- a correctly completed application form;

- pension certificate issued by the territorial division of the Pension Fund of Russia.

For the convenience of elderly depositors, there are consultation centers located at post offices that serve bank clients.

Employees help pensioners choose a deposit program that provides maximum income, explain the conditions and assist in the preparation of accompanying documentation.

At a bank branch

Most senior citizens rarely use online network services, preferring a personal visit to a credit institution to remote registration. In this case, the nearest branch is selected.

The priority of this method for clients of retirement age is explained by the possibility of receiving personal advice that helps resolve controversial issues. Bank employees help visually impaired depositors fill out an application form and provide comprehensive assistance in opening a deposit.

Online on the website

Owners of desktop computers or smartphones connected to the Internet open deposits online on the official website of the financial institution or in a special mobile application previously downloaded and installed on the phone. Remote processing is provided for all deposits, with the exception of Postal. Procedure:

- open the Post Bank portal;

- go to the page with a list of available deposits;

- carefully study the conditions, including the interest rate, the possibility of replenishing the account and the availability of the use of investments during the validity of the contract;

- select the most advantageous offer and click “Submit Application”;

- fill out the form, indicating reliable information corresponding to your passport data, email address and contact phone number.

At the final stage, the client center where the agreement is planned to be signed is indicated and the “Receive” button is pressed. A consultant from the deposit department of the financial structure contacts the pensioner to clarify the terms of the current program and agree on details.

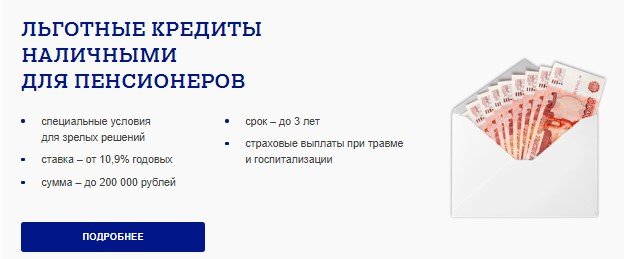

Conditions for lending to pensioners in 2020

People receiving a pension today cannot qualify for a separate lending program due to their age and financial limitations, but Post Bank offers them to take out a loan under one of the existing programs. As a bonus, citizens have the right to a 0.25% premium if they are served under the terms of the “Pension” tariff.

To enjoy all the benefits of Post Bank, you must register for a pension with it in advance. 2020 was no exception here. Depositors of Post Bank, serviced on “Pension” terms, have a number of advantages over clients of other domestic and foreign financial institutions:

- Reduced loan payments;

- Increased interest on the deposit balance;

- Favorable conditions for servicing deposits.

To connect to the “Pension” tariff in force today, an elderly person must do the following:

- Come in person to the Post Bank branch closest to your home to sign the agreement. You must take your SNILS and passport with you;

- Open a bank account in your name at a financial institution branch. At the same time, the employee will also give you a plastic product;

- Submit an official application to the pension fund. Specify Post Bank as the financial institution for receiving funds.

At the first stage, a new Post Bank client will be serviced at a basic rate. After the first transfer of funds from the Pension Fund is credited to the account, the account owner is automatically transferred to the “Pension” tariff.

Seasonal deposit

Elderly people receiving a pension can take advantage of the advantageous offer from Post Bank and become the owner of a seasonal deposit. The offer is only valid until June 30th. Before doing this, you should familiarize yourself with the terms of use of the deposit:

- The minimum amount of money to be kept in the bank for this deposit is 50 thousand rubles;

- The deposit is valid for 367 days;

- The owner receives a fixed amount of accrual on the balance - 8.25%;

- The entire amount of accruals is transferred by the bank on the last day of account servicing;

- The deposit amount can be increased within a period of up to 10 days from the date of signing the agreement;

- You cannot withdraw funds before the end of the term;

- The contract can be extended. The conditions correspond to the “Capital” deposit.

To complete the documents, you will have to personally visit a Post Bank branch. A mandatory requirement is to have a passport or similar identification document.

If a pensioner is already a client of Post Bank, then he has access to the system remotely. As an additional bonus for making a new deposit remotely, another 0.25% is added to the rate. The surcharge is a good incentive for bank clients. However, you should not forget that Post Bank provides only one bonus. If the client chooses a bonus for opening an account, he is deprived of the opportunity to receive a pension bonus.

Deposit replenishment is possible in various ways:

- Through an ATM;

- Remote transfer via Internet banking;

- Interbank transfer.

If the money was transferred to the account from another financial institution, then the owner will automatically be added another 0.25% to the rate. This will additionally increase the latter to 0.5% of the deposit amount. A similar bonus is available to bank clients when making different deposits.

Upon expiration of the agreement, the account owner can choose one option for using the funds: withdraw part or all of the money, leave it in the account to receive interest on the balance.

The proposed amount of bonuses for using the client’s money provides for freezing the deposit until the end of the contract. However, life can bring its own surprises, for example, a client may urgently need his money on deposit. Post Bank provides the option of issuing a deposit ahead of time. In this case, the client will have to write a standard application. The bonus amount is reduced to 0.1%. Similar conditions apply for account balances below 50 thousand, so you need to keep an eye on it.

Features of the “Capital” deposit

Capital lying “dead weight” does not bring benefits to its owner. In order for money to start “earning”, you need to place it on deposit in one of the financial institutions. Today Post Bank offers to join the Capital program. The method of concluding an agreement and other actions of the client are similar to the previous deposit.

The differences lie in the following points:

- If a client places up to 0.5 million rubles on deposit, he can count on 6.85% per annum;

- When placing more than 0.5 million to 1.5 million rubles, the bank pays 6.85% per annum;

- For deposits of more than 1.5 million rubles, the bank will pay 6.85% per annum.

You can get benefits from investing your own funds in six months. This option will provide retirees with additional income. The size of payments is reduced by 0.25%. The remaining service conditions are almost completely consistent with the Seasonal program.

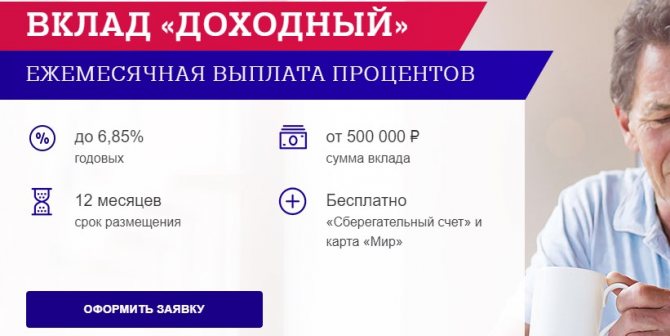

Deposit "Profitable"

This deposit is intended for people who want to earn money by investing capital, but do not want to limit themselves, for example, to deadlines. The owner of Dodhodny can independently determine the expiration time of the contract and not adhere to the 6-month multiple.

The following conditions await bank clients under this tariff:

- If a person places up to 0.5 million rubles on deposit, he can count on 6.75% per annum;

- When placing over 0.5 million to 1.5 million rubles, the bank pays 6.85% per annum.

Payment terms differ from the previous deposit:

- For a contract for a period of up to 180 days, the client will be paid 0.1%;

- For longer terms, the annual payment increases to 4.5%.

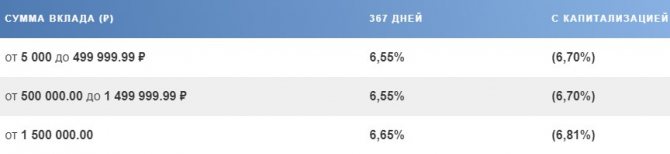

Saving pension deposit

Every domestic pensioner can become a Post Bank depositor and place his free assets on a savings deposit. Its peculiarity is the period for calculating interest. Today it is 92 days. The money received from the bank increases the investor's capital. They can be collected after the account is closed.

Main characteristics of the deposit:

- It is allowed to place on the account from 5 thousand rubles;

- The minimum period for placing funds is 1 year;

- Additional capitalization throughout the entire period;

- Quarterly interest accrual;

- The contract is extended on conditions similar to other programs.

A savings deposit allows you to store funds in a safe place and earn extra money from them. For the convenience of users, the deposit can be increased as the client has free money.

The bank offers people of retirement age very flexible and acceptable conditions for receiving additional money. At the same time, payments are slightly reduced compared to previous deposits:

- For deposits up to 0.5 million rubles, the bank pays 6.55% per annum;

- When placing from 0.5 million to 1.5 million rubles, the bank pays 6.55% per annum.

- For deposits of more than 1.5 million rubles, the bank will pay 6.65% per annum.

The quarterly payments received are added to the pensioner’s main account. Thus, the money remains in the bank and is then paid out along with the main amount of the deposit.

How to transfer a pension from Sberbank to Post Bank?

Is it worth transferring a pension from one institution to another? These financial structures are similar. Both have government support, and both have an extensive network of service points and customer centers.

The only thing that differentiates one from the other is the percentage. In Sberbank it is slightly lower. But the economic situation changes and the percentage can also either increase or decrease.

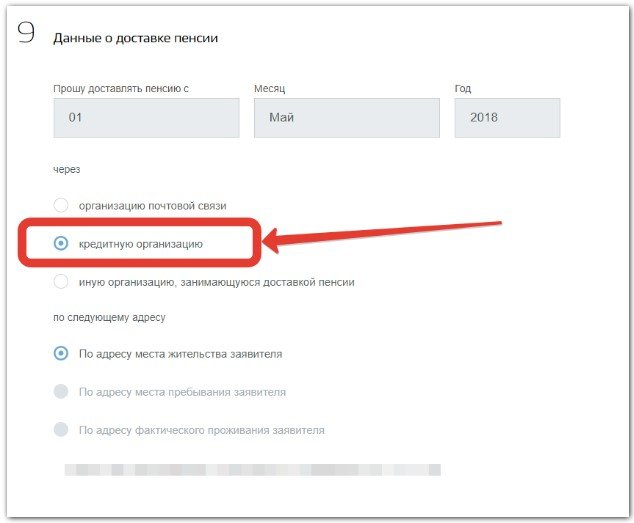

If you decide to transfer pension money to Post Bank, then you have two options :

- Come to the Pension Fund branch, taking your passport, SNILS with you, or fill out an application online on the Fund’s website. If you want to complete the process remotely, through the Pension Fund website, then you need to register on the State Services website. If in person, you will need to write an application for the transfer to the Pension Fund branch. The Foundation should provide you with a sample application. The procedure lasts up to three working days . If you choose this option, take care of the procedure in advance to ensure you receive payments on time.

- Contact Post Bank to open a savings account. After the account has been issued, you will fill out an application for the Pension Fund, and the employees of the banking institution themselves will send this application to the Pension Fund for re-registration.

Is it possible to transfer a military pension from Sberbank? No, this is impossible due to the statement that lists of retired military personnel are state secrets and must be stored only in a state bank.

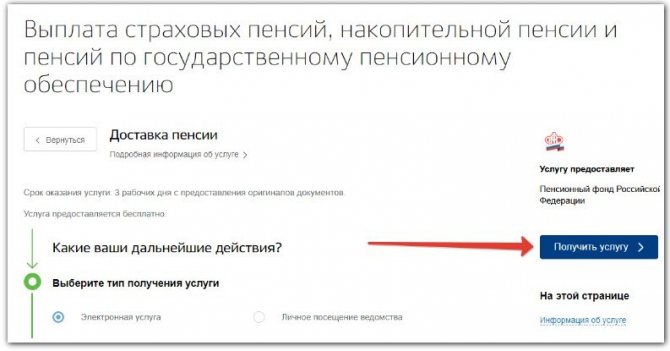

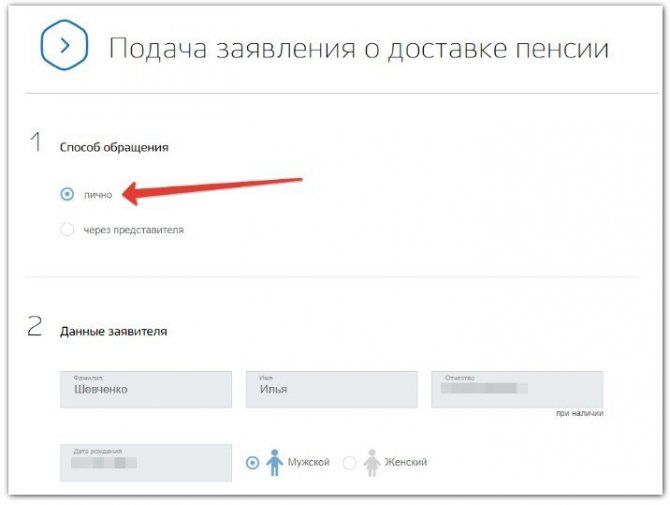

How to transfer a pension to Post Bank through State Services?

Let us immediately warn you that this method of transferring pension proceeds is for advanced users. If you are a retiree who is not afraid of difficult tasks, then you need to do the following:

- We open the State Services portal.

- Log in if you are registered. Otherwise, register first.

- Let's open.

- Select “Get a service”.

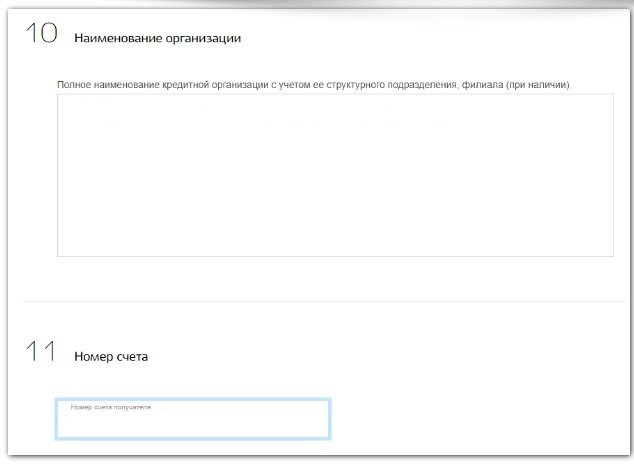

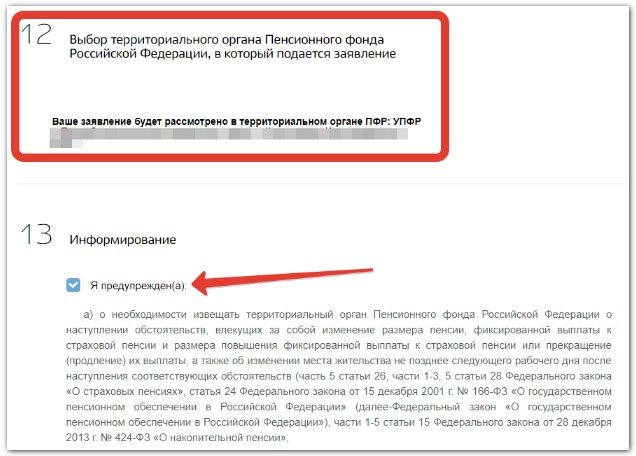

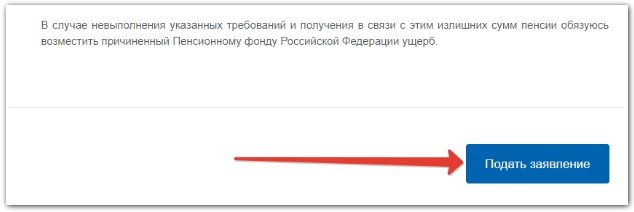

- Next, fill out the form. Please note that in the application you will need to fill out bank details (account number, full name of the credit institution).

Step-by-step photo instructions:

Step 1

Step 2

Step 3

Step 4

Step 5

Step 6

Step 7

Step 8

Step 9

After submitting the application through government services, it will be forwarded to the Pension Fund for consideration. Usually within one business day you receive a notification in your Personal Account that the documents are ready.

Then, if everything is in order or if any errors are identified in the application, you will have to visit the Pension Fund in person within five days after receiving the notification and present the original documents.

What is the benefit

If we analyze the above conditions and compare them with other banks, with the same Sberbank, then we can draw the following conclusion:

- There is no difference where to keep your pension - the offers are all very similar

- And if you have it in the range of 7,000 - 14,000 rubles and you live in a metropolis, then most likely you will not be able to save anything, and the announced 6% is meaningless for you

- As for PB, here we have only one serious benefit - cashback for purchases in pharmacies

- If we talk about stability and guarantees, then Post Bank belongs to the VTB holding, which in turn belongs to the state

Deadlines for receiving pensions on Pochta Bank cards

What date does the money arrive in the account?

The Pension Fund is responsible for accruing pension money, and any banking institution only issues the transferred funds. The fund transfers pension proceeds every month on certain dates, but before the 25th . Each pensioner is assigned a date individually.

The transferred money arrives in your bank account approximately one to two days after sending.

Since a card is linked to the pensioner’s savings account, you can find out about the receipt of funds on the card via SMS . This is a convenient service, but not free. If you want to save, then register in a mobile or online bank.

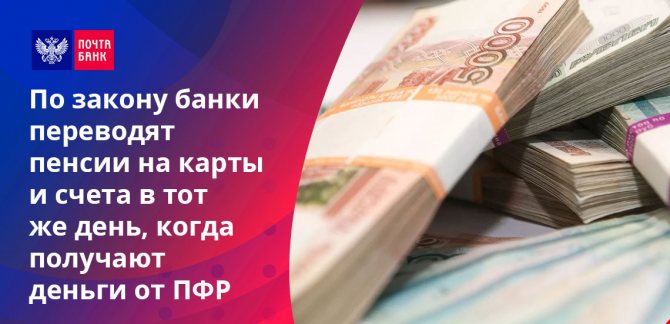

Does the bank process pension money?

A situation often arises when people think that a bank (no matter which one) is squandering pension funds and delaying their issuance. But this opinion is wrong. There are rules for the payment of pensions through credit organizations, enshrined at the legislative level.

By law, banks transfer pensions to cards and accounts on the same day they receive money from the Pension Fund. The deadline is the next day.

That is, if the Pension Fund suddenly transferred money in the evening, the bank does not have the technical ability to “scatter” everything across the accounts on the same day, so the payment is made the next day. But in fact, this rarely happens, and people get their due every day. So, there is no talk of any scrolling.

Design features

In its work, Post Bank adheres to high standards according to which the client orders and issues a card via the Internet. But the approach to pensioners is different - the person is required to appear in person. Apparently, bank employees, knowing that older people are poorly versed on the Internet, are simplifying the application conditions for them.

In addition, to transfer your pension to a new bank account, you need to submit an application to the Pension Fund. Therefore, it is impossible to do without the personal presence of the pensioner. Bank employees will tell you how to write an application correctly and help you do it. If the procedure is carried out at a post office, you can immediately send the document to the Pension Fund by mail.

After the plastic is issued to the owner, codes and passwords will be sent to his phone. The PIN code is assigned by the bank, but if the client finds it difficult to remember, it is possible to change the combination of numbers to a more convenient one. This can be done through an ATM or at a bank branch. The service is free.

A good assistant is a mobile application that allows you to control all financial transactions without leaving your home. When the money arrives in the account, the “Basic” tariff plan will change to “Savings”. After this, the card will have increased interest.

Current questions and answers to them

What is a Post Bank pension card?

Post Bank offers 2 types of pension cards - regular and for working pensioners. Payments from the Pension Fund and the enterprise where the pensioner receives his salary are transferred to them. At the end of each month, interest accrues on the balance. You can use the card to pay in stores and pay utility bills.

Which ATMs can you withdraw money from your pension card?

You can withdraw funds from the ATMs of Post Bank and VTB.

How much does card servicing cost?

Pensioners do not pay for card servicing. If the pensione orders a non-named card, it is issued free of charge. You will have to pay 300 rubles for a personalized card.

How to transfer your pension receipt to Post Bank?

Go to the nearest bank customer center, which can be located separately or located in a Russian post office. Contact a bank employee, open a savings account for free, and also fill out an application for the Pension Fund to transfer your pension to Post Bank. A bank employee will help you fill out an application, which will then be submitted to the Pension Fund of the Russian Federation.

A free Mir card is issued with your account. Why does a pensioner need a card? It's profitable. Payments will be transferred to the card and there is no need to go to the post office. It can be used as a settlement and cumulative account. If you want to have a personalized card, you will have to wait for it to be produced. This procedure is already paid.

will accrue on your savings account balance . What interest will be charged on the balance on the card?

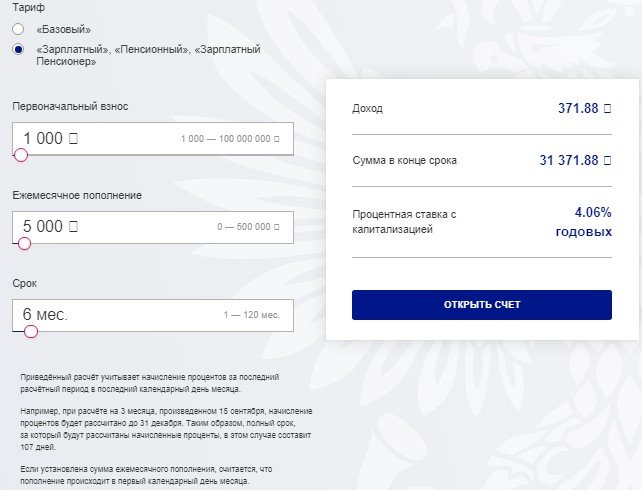

The bank's official website provides a calculator with which you can calculate your income

After receiving the first pension, the savings account tariff will be considered “Pension”, the conditions for it are as follows:

- 6% per annum on balances of 50 thousand rubles.

- 4% on balance from 1000 to 49,999.99 rubles.

- 0% per annum for balances less than 1000 rubles.

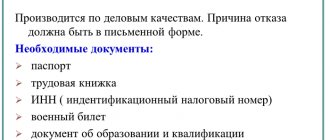

Required documents

In order to transfer a pension, you need to have a civil passport and SNILS with you . You will be given an application to fill out at the customer center.

Also, do not forget to take your mobile phone with you to connect to mobile and online banking if you wish.

Additionally you may need:

- Employment history.

- Pensioner's ID.

- Certificate of work experience.

- Certificate of salary for five years.

Video on the topic:

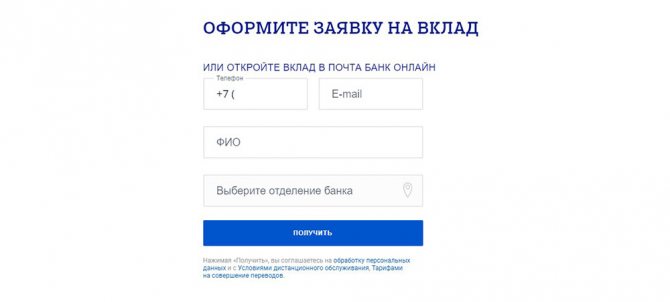

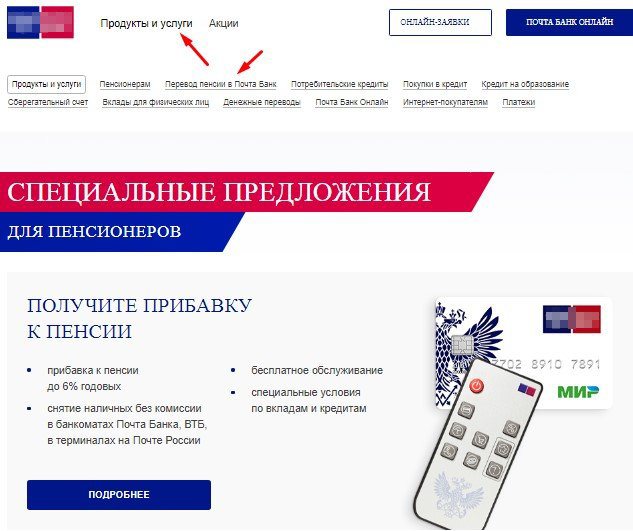

Online application for pension transfer

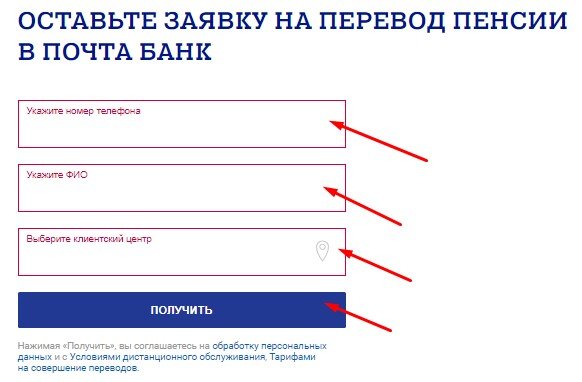

For convenience, take advantage of the opportunity to submit an application online. To do this, go to the website pochtabank.ru, go to the bank’s products and services for pensioners, select the appropriate service and fill out the application form for transfer and/or receipt of a pension.

In the application, enter your phone number, last name, first name, patronymic, select the client center convenient for you, click receive.

This is what an online application looks like

After sending the application, a bank employee will call you and tell you about the necessary documents and the further sequence of actions.

On this page you can also use the calculator and calculate how much money you will receive over the period you specify if you have a certain amount in your retirement account.

Post Bank delays payment of pension

If you study reviews on the Internet, you can see that sometimes citizens scold Post Bank for not sending money to the card on time, and sometimes there are delays of several weeks. But the bank has absolutely nothing to do with it. It’s just that after changing the method of receiving funds, the date also changed.

What's happening:

- For example, a citizen received a pension on the 5th through the Sberbank cash desk, that is, in cash.

- He decided that it was more convenient for him to receive payment through Post Bank. He issued a card there and wrote a corresponding application to the Pension Fund.

- The 5th of the next month has arrived. But still no pension. 6, 7, 8 have passed, no receipts have been observed. The person begins to blame Post Bank for this.

- The 20th day arrives and he receives a notification that funds have been credited. The person believes that his payment was delayed by 2 weeks and begins to speak angrily about the financial institution.

But what really happened? It’s just that in this locality, pension payments through credit organizations are made on the 20th. The fact that the person was not informed about the change of date when changing the method of receipt - here we must blame the employees of the Pension Fund, who accepted the application to transfer the pension to the card. If we consider when a pension arrives on a Sberbank card, then a similar principle applies.

When you change the method of receiving a pension, the date of its issue changes. Please check with the Pension Fund for information about the new number. The bank makes transfers according to the established schedule and agreement with the Pension Fund.

Formation of a payment schedule

It is important to understand right away that the pension payment date is set not by the bank, but by the Pension Fund. Only he draws up a specific schedule according to which people receive their due payments. It is simply impossible to pay everyone at once, so transactions are carried out gradually, which is why a schedule is created. Detailed information about the amount of old age pension.

What date you will receive your pension - this needs to be clarified with the Pension Fund. The exact timing depends on several factors:

- type of pension payment;

- the region where the Pension Fund of the Russian Federation is located, conducting the citizen’s case;

- place of registration or residence of the citizen;

- the method he has chosen to receive his pension.

Many citizens who are about to receive payment in a new way for the first time complain that the pension has not arrived on their Pochta Bank card. But it's not about the bank at all. He just transfers the money on the day he receives it from the Pension Fund. It’s just that when the method changed, the date also changed.