The non-state pension fund Rosgosstrakh (RGS) is one of the largest in our country. He has been active in the pensions sector for many years.

At the end of the summer of this year, it is planned to complete the merger of three major market players - NPF RGS, NPF Lukoil-Garant and NPF Electric Power Industry. As a result, the largest non-state fund should appear.

Open mutual funds

A mutual investment fund (UIF) is a convenient tool for preserving and increasing capital.

In order to work with mutual funds, you do not need to be a financial expert, have an impressive starting capital and constantly monitor investments. All you need is to entrust the management of your funds to a team of professionals. Information on the estimated value of an investment unit, the value of net assets and their changes is available until the publication of new data or the publication of a message about the termination of a mutual investment fund.

Insurance and funded parts of the pension

The pension consists of two parts: insurance and funded. But what is the difference between them (and it is significant), many do not understand. Although this question should now be asked not only by older people, but also by young people who are striving to lay a reliable foundation for their future. By and large, this topic is relevant for any person. Therefore, it makes sense to understand how the insurance and savings parts are calculated and how the two options differ from each other.

Retirement savings option No. 1.

For most citizens, savings are formed exclusively in terms of an insurance pension - the Pension Fund of the Russian Federation offers this mechanism as the main and self-evident one. For those who followed this path, the unofficial name “silent” was assigned. These people never declared their intention to independently choose the option of compulsory insurance or transferred to a non-state fund, but later returned to the previous method of forming a pension.

Remember, have you ever signed an application or agreement to transfer savings to a non-state pension fund? If not, then your contributions in the amount of 16% from the individual part participate in the formation of only the insurance pension. This option for managing insurance funds involves transferring all contributions to individual coefficients - otherwise known as “pension points”. Each insured person has his own stock of accumulated points. You can check them using the citizen’s personal account.

Example: if your average monthly salary is 25 thousand rubles, then the number of pension points taken into account for 2020 is 2.938. This indicator was obtained by calculations:

(25000*12*16%/163360) *10, where 163360 is the standard amount of insurance premiums for 2020, and 10 is a constant value.

The number of points due cannot increase on its own, they will not be indexed either, but will remain in your individual retirement account to the extent that you earned them. And there will be as many coefficients as you accumulate over your entire working life. It is important that they do not depreciate over time. According to the new formula, which is used when calculating the insurance part of the pension, the total number of accumulated coefficients is multiplied by the cost of 1 point.

The cost of the point has increased every year since 2015 by the consumer price growth index. So, when the time comes to retire, the points you have accumulated will be converted into rubles, taking into account all indexations.

So, choosing the described pension savings option means:

- directing all insurance contributions paid in the amount of 16% to the formation of an insurance pension;

- transfer of contributions from rubles to individual coefficients;

- the personal number of points accumulated over the life of a particular person;

- annual indexation of the insurance pension with an increase in the value of the point;

- protection of points from depreciation over time.

Retirement savings option No. 2.

To choose a pension insurance option different from the previous one, that is, one that involves a funded part, you need to contact the Pension Fund with a corresponding application. This choice means that only 10% of contributions will be allocated to the insurance pension, and the remaining 6% will be transferred to the funded part of your future pension.

The money that you entrust to non-state funds or management companies is usually invested by them in some financial projects in order to obtain greater profits. These organizations retain a certain percentage for managing your pension savings. It should be borne in mind that investments can bring not only profits, but also losses, so choosing the option of compulsory pension insurance must take into account this circumstance.

The state guarantees the safety of your funds if they are transferred to non-state funds and management companies. What does it mean? If you transferred, for example, 12 thousand rubles to the management company to finance the funded part of your pension, then even if their investment turns out to be unprofitable, this money will still remain yours. But savings may “suffer” from inflation over the past year or depreciate without investment profits.

You can choose a non-state pension fund to manage insurance contributions only once every five years. If you transfer funds before this period, you will lose all interest on savings. The choice of a non-state fund or management company is a personal matter for everyone, but it should be done taking into account the reputation, age of the organization you like, as well as the overall profitability for the entire investment period.

There is nothing complicated in calculating a funded pension. The collected amounts are divided by the expected payment period (approved every year by federal law).

Example: in January 2020, a woman becomes entitled to an insurance pension. By this time, 158,767 rubles had been collected on her individual personal account. The expected period for 2020 approved by Federal Law No. 419-FZ is 246 months. The monthly amount of the savings portion will be 645.39 rubles (158,767/246).

So, choosing a funded pension option implies:

- formation of an insurance pension in the compulsory pension insurance system at the expense of 10% of insurance contributions from your salary and transferring it into pension points;

- transfer of 6% of contributions to your chosen non-state pension fund or management company to form the savings part;

- lack of guarantees of stable and constant profitability from managing your funds (it is different for different NPFs and management companies), the optimal profit option is higher than the annual inflation in the country;

- insurance of your funds against losses when investing;

- absence of linkage of savings to the value of the pension point, dependence of calculations on the approved period of savings payment;

- lack of indexation of funded pensions.

Advantages of open mutual funds

- Diversification

- Reliability and state control

- Liquidity

- Tax minimization

Date of relevance of changes: per day – 08/03/2018 , for other periods – 08/03/2018 Published: 08/06/2018 at 15:22

Get a complete data analysis of your investments

© RSHB Asset Management LLC, 2012-2018 All rights reserved. Legal license information.

Limited Liability Company "RSHB Asset Management". License to carry out activities for managing investment funds, mutual investment funds and non-state pension funds No. 21-000-1-00943 dated November 22, 2012, issued by the Federal Financial Markets Service of Russia, without limitation of validity. License of a professional participant in the securities market to carry out securities management activities No. 045-13714-001000 dated November 22, 2012, issued by the Federal Financial Markets Service of Russia, without limitation of validity.

The value of investment shares may increase and decrease, past investment results do not determine future income, and the state does not guarantee the return on investments in mutual funds. The rules of trust management of mutual investment funds provide for discounts to the estimated value of shares upon their redemption; the collection of these discounts reduces the profitability of investments in investment shares of mutual funds. Before purchasing an investment share, you should carefully read the rules of trust management of a mutual investment fund.

You can obtain information about the funds and familiarize yourself with the Rules for trust management of funds, as well as information about places for accepting applications for the acquisition, redemption or exchange of investment shares and other documents provided for by the Federal Law “On Investment Funds” No. 156-FZ and regulations of the Bank of Russia at the address of the Limited Liability Company "RSHB Asset Management": 125009, Moscow, Bolshoi Kislovsky Lane, building 9, tel.; Internet page address: www.rshb-am.ru, agents for the issuance, redemption and exchange of investment units of the fund (the list of agents can be found on the Internet website at: https://www.rshb-am.ru /offices/).

Open-end mutual investment fund of market financial instruments “RSHB - Balanced Fund” (Fund Rules registered by the Federal Financial Markets Service No. 2566 dated March 26, 2013); Open-end mutual investment fund of market financial instruments “RSHB – Bond Fund” (Fund Rules registered by the Federal Financial Markets Service No. 2567 dated March 26, 2013); Open-end mutual investment fund of market financial instruments “RSHB - Share Fund” (Fund Rules registered by the Federal Financial Markets Service No. 2568 dated March 26, 2013); Open-end mutual investment fund of market financial instruments “RSHB - Treasury” (Fund Rules registered by the Bank of Russia No. 2797 dated May 22, 2014); Open-end mutual investment fund of market financial instruments “RSHB - Currency Bonds” (Fund Rules registered by the Bank of Russia No. 2795 dated May 22, 2014); Open-end mutual investment fund of market financial instruments “RSHB - Gold, Silver, Platinum” (Fund Rules registered by the Bank of Russia No. 2796 dated May 22, 2014); Open-end mutual investment fund of market financial instruments “RSHB - Best Sectors” (Fund Rules registered by the Bank of Russia No. 2800 dated May 28, 2014).

RSHB Asset Management LLC notifies clients and other interested parties of the existence of a risk of a conflict of interest when carrying out securities management activities. In this case, a “conflict of interest” is understood as a contradiction between the property and other interests of RSHB Asset Management LLC and/or its employees and clients, or between the interests of several clients, as a result of which the actions (inactions) of RSHB Asset Management LLC and/or its employees cause losses to the client and/or entail other adverse consequences for the client. The rules for identifying and monitoring conflicts of interest and preventing its consequences when carrying out professional activities on the securities market of the Limited Liability Company “RSHB Asset Management” are posted in the “Information Disclosure” section of this website.

Source:

https://www.rshb-am.ru/trust/

How to join?

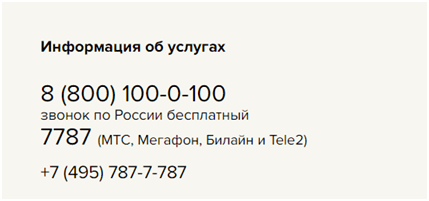

To join a pension fund, you need to familiarize yourself with the list of required documents that will be needed when concluding an agreement with the company. The absence of one of the documents will make it impossible to carry out this operation. For this reason, contact the department employees at the specified number, or check out the list on the official website.

Rosgosstrakh requires the following documents:

- Passport (original or copy).

- Insurance policy index number (SNILS).

Rosselkhozbank decided to create its own pension fund

Rosselkhozbank plans to create a non-state pension fund, follows from the bank’s development strategy until 2020, Kommersant reported on Wednesday. The NPF will specialize in serving the population of rural areas, small and medium-sized cities. “The creation of a non-state pension fund bank will contribute to the growth of social and financial security of residents” of these settlements, the strategy says.

Many large state and private banks have their own NPFs, such as Uralsib, Raiffeisenbank, Sberbank, Gazprombank, VTB, Russian Standard. A bank that has its own non-state pension fund has the opportunity to attract pension funds for deposits. “However, the fund itself will require quite serious investments from the bank,” says Galina Morozova, president of Sberbank Non-State Pension Fund.

However, pension market participants believe that the logical step for RSHB would be to acquire an existing non-state pension fund. If a fund wants to carry out activities in compulsory pension insurance (OPI), then by law it must first work for at least two years in the field of non-state pension provision, and by purchasing a fund “with a history”, the Russian Agricultural Bank could begin developing compulsory pension insurance on its basis immediately, explains Executive Director of NPF "National" Svetlana Kasina. According to the Federal Financial Markets Service, from January to September 2012, the volume of pension savings of non-state pension funds (raised within the framework of mandatory pension insurance) increased by 53%, while the volume of pension reserves (formed within the framework of voluntary programs) increased by only 6%. Over the past three years, only one new license has been issued in the pension market.

Source:

https://www.banki.ru/news/lenta/?id=4559709

Available features

The personal account of NPF RosGosStrakh allows clients to track the increase in the amount of pension savings. Control is carried out online. Users have access to a complete history of account transactions. Document forms are available for download. If the RGS client has forgotten the password, it is possible to recover it. If a user who has transferred to NPF RGS from the Pension Fund of the Russian Federation does not want to go through the registration procedure in the Personal Account, he will also have access to a number of opportunities. However, their list will be limited.

The following actions are available without registering in your account:

- find contact information for the offices of the RGS Foundation;

- calculate the amount of your funded pension using a calculator;

- order a call back;

- identification sheet required to inform NPF RGS about a change in personal information.

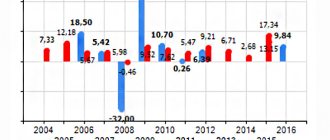

Investment activities

Find out about the investment strategy of Sberbank NPF and investment performance indicators

It is not an offer and does not guarantee future profitability. An actuarial yield of 7.5% is used in the calculations. The calculations take into account the growth of wages at the average inflation rate according to the Forecast of long-term socio-economic development of the Russian Federation for the period until 2030 of the Ministry of Economic Development of the Russian Federation (3.7%). The calculator shows the calculation of a non-state pension, taking into account an initial contribution of 1,500 rubles, with payment over 10 years, based on the “Universal” individual pension plan. The length of service for calculating the funded pension is calculated from 2002. The age for starting work is 18 years. In the calculations of the funded pension, a moratorium on deductions of 6% of employer contributions for 2014–2019 is taken into account.

Source:

https://npfsberbanka.ru/

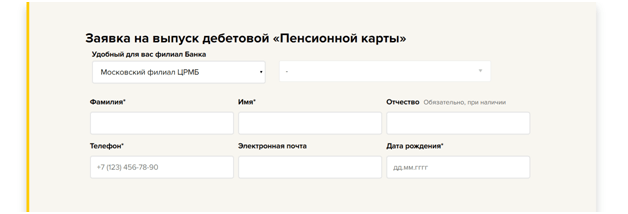

How and where to apply?

There are two options - through a bank branch or website.

In any of the cases you report:

- FULL NAME;

- address;

- contacts;

- date of birth.

If you want to do this through the website, call the hotline number.

The manager will process your request. Below are the fields that need to be filled out.

Get a card

If you ordered personalized plastic, or made an application through the website, the bank will notify you when it is ready. Within a couple of days, pick up your shipment and activate it by inserting it into the ATM.