Information about the fund

- Full name of the organization (name of NPF): Joint Stock Company “Non-state pension fund “Defense-Industrial Fund named after. V.V. Livanov"

- Status in 2020: Active - Valid license

- License number: 347/2

NPF Defense-Industrial Fund named after.

V.V. Livanova was founded in 2000 and provides social security to citizens of the Russian Federation under OPS and NGO programs. The value of the fund’s own assets exceeds 5.3 billion rubles of savings, and the number of clients reaches the 100 thousand mark. The fund is part of the DIA system, i.e. pension funds are insured by the state. Interesting fact from the official website: Just 2 years after its opening, the fund paid pensions to more than 5 thousand people. Now more than 10 thousand people receive an additional non-state pension.

Affiliated funds

No affiliated funds

Requisites

View details

INN of the non-state pension fund 7718003106 KPP of the non-state pension fund 771801001 Name of the payee (abbreviated) JSC NPF OPF Bank account number of the payee 40701810700030000098 Bank of the payee VTB Bank (PJSC) Location of the payee's bank Moscow Cash account of the payee's bank 30101810700000000187 BIC of the payee's bank 044525187 INN/KPP of the payee's bank 7702070139/783501001

NPF "Defense-Industrial Fund": pension savings will not be lost

Pension reform in Russia continues. Its component is non-state (additional) pension provision.

The non-state pension fund "Defense Industrial Fund" (NPF "OPF") has long-term experience in working on corporate pension provision with a number of largest industrial enterprises and companies.

The Defense Industrial Fund was created in 2000. Its main task is the social security of citizens on the basis of additional pension agreements in the form of payment of non-state pensions and improving the standard of living of citizens of retirement age.

Since 2002, Russia has been reforming the pension system. The pension reform is aimed at increasing the level of pension provision for Russian citizens and developing insurance and funded principles for calculating pensions.

An integral part of the pension reform is non-state (additional) pension provision. DPO

— as a mechanism for interaction between non-state pension funds, employers and employees.

The need to develop additional vocational education in society is due to a number of factors:

Firstly

, from January 1, 2020, a new pension formula will come into effect, which assumes that rights to an insurance pension will be taken into account not in absolute numbers, but in pension coefficients, in other words, in points (based on the level of wages, length of service and retirement age ). How much one pension point will cost will be decided by the Pension Fund. The value of the point will be established annually depending on the ratio of income and liabilities of the Pension Fund. Considering the shortage of Pension Fund funds already now, there is no hope for a high cost of a point.

Secondly,

low replacement rate (the ratio of the average pension to wages), which does not ensure the payment of a decent pension depending on the labor contribution of each employee. In the country, this figure does not exceed 37%, given that the average salary in the country is 27,000 rubles. (according to the Federal State Statistics Service). To live comfortably in retirement, the replacement rate should be (referring to the experience of other countries) not lower than 60-75% of the last salary.

Third,

the unfavorable demographic situation and the aging population in the country, as well as a significant reduction in officially employed citizens, compulsory insurance contributions for which are not made and, accordingly, do not go to the pension budget, thereby leading to an even more serious deficit in the state pension system.

In a modern market economy, the state is not able to bear the burden of all social obligations to citizens and is objectively forced to encourage citizens to save for their old age on their own and at the expense of employers through the construction of corporate or individual pension programs.

With appropriate government policies that maximally stimulate the formation of voluntary pension savings by legal entities and individuals, the non-state pension provision (NPO) system should become one of the key areas for the development of a stable pension system in the Russian Federation. The additional pension program allows not only to ensure social security for citizens, but also to solve personnel problems at enterprises today, using additional pension provision as one of the effective ways to motivate employees, and also makes it possible for enterprises to receive significant tax benefits.

It is important for us to form a new pension culture for the citizens of our region, when people change their attitude towards the future, discover new opportunities for personal participation in ensuring a decent life and take an active part in the formation of a pension reserve, caring about a decent standard of living after finishing their working career.

NPF "OPF"

has long-term experience in corporate pension provision with a number of largest industrial enterprises and OJSC Komsomolsky-on-Amur Aviation, OJSC State Research Institute of Instrument Making, OJSC Ural Optical-Mechanical, etc.

One of the founders of the Foundation

- the largest enterprise in our region is the Komsomolsk-on-Amur Aviation Plant (KNAAZ).

NPF "OPF" -

one of the oldest foundations in Russia. 14 years in the pension market.

NPF "OPF"

is a member of the Union of Mechanical Engineers of Russia and the League for Assistance to Defense Enterprises.

NPF "OPF"

— one of the leaders in the NPF market, occupies third position in the ranking in terms of profitability among more than 100 NPFs in Russia.

—

We are proud of the results of our foundation's activities. Over 10,000 people are already receiving additional pensions. Most of them are our fellow countrymen, KNAAZ employees. They are our best recommenders! - noted in the fund’s branch in Khabarovsk.

A.I. Pekarsh, General Director of JSC KnAAZ:

— Since 2002, NPF “OPF” has been paying pensions to KnAAPO veterans. Over all the years of operation, the fund has never violated its obligations and has not suspended the payment of non-state pensions, which today more than 7,000 factory workers receive.

Additional information about the fund’s activities can be found on the official website of the NPF “OPF” - www.npfopf.ru.

Contacts

Official website of the NPF Defense-Industrial Fund named after. V.V. Livanova

https://www.npfopf.ru/

On the website you can find a pension calculator for calculating your future pension, documents with performance indicators, the latest news and contact information.

Email mail

Address

Legal address:

107076, Moscow, st. Stromynka, 18, room 5 B

Actual address:

125167, Moscow, Aviatsionny per., 5, k.4A Branches: 625000, Tyumen region, Tyumen, st. Dzerzhinsky, 15 (5th floor), office 512 tel., 8-963-061-04-41, e-mail: [email protected] 680014, Khabarovsk region, Khabarovsk, st. Dzerzhinskogo, 65, office No. 904. tel: (4212) 408664, 408665, 8(909) 825 8878 e-mail: [email protected] 681000, Khabarovsk region, Komsomolsk-on-Amur, st. Sovetskaya, 1, office No. 210, tel., e-mail: [email protected] Separate divisions: 681000, Khabarovsk Territory, Komsomolsk-on-Amur, Mira Avenue, building 29, office No. 22, tel. 4 217 549 250, e-mail: [email protected] 432072, Ulyanovsk region, Ulyanovsk, Antonova Ave., building 1, room 313, tel., e-mail

Hotline number

Unified information service: 8-800-505-87-53 (calls within Russia are free)

Tel: (499) 747-7435, (499) 747-7436 Fax: (499) 747-7436

Registration and login to your personal account

Only private and corporate clients have the opportunity to use the remote service. The personal account of NPF Bolshoi is created in such a way that special registration, remembering authorization data (login and password), and filling out a form to recover the password are not required.

All you need is to enter one of the client identifiers in the provided field on the main page for logging into your personal account:

- SNILS.

- Number of the pension card issued upon signing the agreement.

- Phone number associated with the contract.

Login to the personal account of the Large Pension Fund will be available after reconciliation with the fund’s database. This usually takes less than a minute. If you have any questions about the operation of your personal account, you can contact the online support service - the contact form is available in the upper right corner under the phone number.

- Official website: https://bigpension.ru

- Personal account: https://connect.bigpension.ru

- Hotline phone: +7 495 933-52-25

Statistics of NPF Defense-Industrial Fund named after. V.V. Livanova: rating of reliability and profitability

According to the Central Bank of the Russian Federation from the reporting “Main performance indicators of non-state pension funds” as of the date: 01/01/2020

Fund assets (thousand rubles): 8128541.39

Statistics on NPO (non-state pension provision) as of 01/01/2020

- Total volume of pension reserves (thousand rubles): 2341689.61

- Total number of participants (people): 12255

- Participants receiving a pension (persons): 9064

- Total amount of pensions paid under NPO (thousand rubles): 157690.24

Statistics on compulsory pension insurance (compulsory pension insurance) as of 01/01/2020

- Pension savings (thousand rubles, market value): 5453227.90

- Number of insured persons (people): 55794

- Participants receiving a pension under compulsory pension insurance (persons): 1052

- Amount of pension payments under compulsory pension insurance (thousand rubles): 27909.22

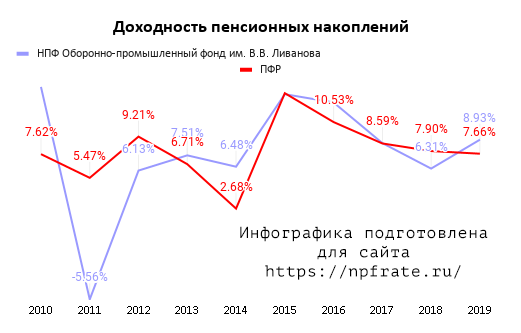

Profitability of pension savings

Current profitability

Minus remuneration for management companies, specialized depository and fund.

- Profitability of placing funds from pension reserves (NPO): 5.26%

- Return on investment of pension savings (OPS): 8.93%

Profitability chart

Data on the profitability of the NPF Military-Industrial Fund named after. V.V. Livanov in 2020 (as of 01/01/2020), including information for the previous 10 years in comparison with the profitability of the Pension Fund of Russia (VEB):

Yield comparison table

| Year | NPF Defense-Industrial Fund named after. V.V. Livanova | Pension Fund |

| 2010 | 13.72% | 7.62% |

| 2011 | -5.56% | 5.47% |

| 2012 | 6.13% | 9.21% |

| 2013 | 7.51% | 6.71% |

| 2014 | 6.5% | 2.68% |

| 2015 | 13.06% | 13.15% |

| 2016 | 12.31% | 10.53% |

| 2017 | 8.62% | 8.59% |

| 2018 | 6.31% | 7.90% |

| 2019 | 8.93% | 7.66% |

Promsvyazbank is thinking about creating a non-state pension fund

One of the few large state-owned banks that does not have connections with non-state pension funds (NPF), Promsvyazbank (PSB), is considering the possibility of creating such a business. For the universal bank that PSB strives to become, this seems logical: the pension product “should be on the shelf,” analysts say. In addition, NPF can begin to work with employees of enterprises of the military-industrial complex (DIC), the basis of the corporate base of PSB. But here the bank may face another strong player in the field of defense enterprises - Rostec.

Five people close to the bank and several private funds told Kommersant that PSB is considering the possibility of developing a pension business on the basis of its own non-state pension fund. The idea of a non-state pension fund appeared among the bank’s managers back in the first half of last year, but, according to Kommersant’s interlocutors, it did not receive conceptual completion then. Now the driver of the development of his own pension business is Kirill Altukhov, ex-chairman of the Western Ural Bank of Sberbank, says a source close to PSB. In particular, other Kommersant interlocutors add, the purchase of a private fund is being considered.

Mr. Altukhov refused to answer Kommersant’s questions. The PSB press service stated that “the bank is not negotiating the purchase with any of the NPFs.” The PSB did not specify whether the project of creating one’s own pension business is being considered in general.

PSB

at the end of 2020, according to the Interfax ranking, it took eighth place in terms of assets among Russian banks. As of January 1, 2020, its assets according to RAS reached 1.9 trillion rubles, capital amounted to 178 billion rubles, PSB itself reported. After the reorganization of PSB by the Central Bank, the bank was transferred to the Federal Property Management Agency. It received support status for supporting state defense orders and government contracts. But PSB’s management has spoken about the bank more than once (see, for example, “Kommersant” dated April 27, 2020).

Now almost all Russian state or quasi-state banks have a direct or indirect connection with the pension business. Sberbank, VTB or FC Otkritie have their own non-state pension funds; Gazprombank is a shareholder of several funds. NPF “Evolution” is close to the All-Russian Regional Development Bank. The only large state-owned bank without connections with pension funds is Rosselkhozbank, which, however, was not long a shareholder of the NPF Blagosostoyanie (see Kommersant of August 29, 2020). Until recently, PSB was also in this category.

Dmitry Medvedev, Prime Minister of Russia, about Promsvyazbank, January 22, 2020

The bank has its own history, it retains its universal legal capacity, giving it the opportunity to work with ordinary depositors and clients

A universal bank should have a pension product in its product line, said Mikhail Motorin, general director of NPF Otkrytie, in an interview with Kommersant. The desire to engage in the pension business seems logical; this is an additional source of income that can be obtained in the long term, points out ACRA analyst Irina Nosova. “These are new opportunities for growth and business development in the long term. In fact, this will lead to an increase and diversification of the banking group’s resource base,” she notes.

Kommersant’s interlocutors claim that the pension business development concept considered by PSB involves, in addition to the development of sales of pension products of NPFs through its own network, also the use of a corporate client base that has transferred to the bank as part of its activities as a support bank for the military-industrial complex. For PSB, managing pension funds may in the future become an additional source of income due to access to a large base of employees employed in the defense industry, agrees S&P analyst Ekaterina Marushkevich.

However, as several top managers of NPFs point out, here PSB may collide with the state corporation Rostec, which also plans to develop the pension business (two of its NPFs are in the process of merging, see Kommersant on November 26, 2020). “NPF Rostec is focused on attracting new clients through NPO for employees of enterprises,” explained a representative of the fund in December last year. “The development strategy of NPF Rostec is primarily related to the involvement of employees of Rostec organizations and members of their families in the NPO system,” said a representative of the state corporation itself in October 2020, noting that the fund should offer them a corporate program. According to one of Kommersant’s interlocutors, there have already been “consultations” with Rostec regarding the creation of the PSB pension business and the state corporation “did not recommend” developing this project. However, Rostec itself assured that it “does not have information about such consultations.”

Ilya Usov, Olga Sherunkova