Brief description of NPF Trust

The fund has been operating since 1997.

Contents Hide

- Brief description of NPF Trust

- Functionality of the personal account of NPF Trust

- Registration in the account

- Authorization in your personal account

- Customer support through the account of NPF Trust

- How to disable your personal account?

- Security and privacy rules

At the end of 2020, NPF “Doverie” entered the RBC rating of “500 largest companies in Russia” according to the RBC Publishing House and took 235th place. During 2020, the fund's position rose by 129 points, which indicates the active development of the company.

The fund is also one of the ten largest non-state pension funds in the country. In this case, the rating was calculated based on the volume of pension savings and reserves in management.

In 2020, the fund’s pension assets doubled and reached 69.25 billion rubles. The assets include clients' pension savings.

The total number of insured persons in the fund reached 1.5 million people. The number of people insured under non-state pension provision is 5.5 thousand people.

In 2020, the return on investment of pension savings reached 7.39%. The rate of return distributed among the accounts of depositors and participants is 10.8%.

The reliability of the fund is confirmed by:

- participation in the system of guaranteeing the rights of insured persons;

- reliability rating "Expert RA" at level A+ ("Very high level of reliability").

Information about the fund

It is known that NPF “Doverie” was organized by several companies from Nizhny Novgorod in 1997. Over the 20 years of its existence, the fund acquired 800 thousand investors and created pension reserves worth about 11 billion rubles. The company provided services for co-financing pensions, managing the funded part of pensions, and creating additional pension savings.

For the convenience of clients, the organization created an official website where they could find out about the dynamics of their pension savings, submit an application to change their details, and get answers to other questions of interest. This resource is currently not working. We’ll tell you why below.

Due to a significant deterioration in the main financial indicators, NPF Doverie was forced to suspend its activities. Since the Bank of Russia did not see any real prospects for normalizing the financial position of the NPF, its management was recommended to recapitalize the company or carry out its restructuring. Therefore, on August 16, 2018, the procedure began for the merger of the Trust Fund with the NPF Samfar: Financial Investments, owned by Mikhail Gutseriev. At the moment, the transformation of the company is almost complete.

If you need additional information about the fate of funds placed in the non-state pension fund "Doverie", call the phone number of the successor fund - NPF "Samfar".

Functionality of the personal account of NPF Trust

Your personal account allows you to:

- View the status of the individual personal account of the funded part of the labor pension for any selected period.

- View the user's personal data.

- Change Password.

- Changing your email address information.

- Receive information about the time the client last used the Personal Account Service.

Fund return

For several years, the financial performance of NPF “Doverie” has been steadily deteriorating. If in 2013 the return on investment was 7.35%, then by 2020 the fund began to lose investors’ money. According to the Central Bank of the Russian Federation, it ended this period with a result of minus 10.38%. The negative profitability of NPF “Doverie” means that the savings of the organization’s depositors decreased by almost 11%.

Obviously, such a result of the investment activities of the fund managers had a negative impact on the company’s reputation. Today it is almost impossible to find positive reviews about the work of this NPF.

Registration in the account

Access to the “Personal Account” Service is provided after the funded part of the client’s labor pension is transferred under the management of the Fund and the pension savings funds have been credited to the personal account.

To register, on the official website of the fund you must fill out an application for access to your account indicating:

- SNILS numbers.

- Series and passport numbers.

- Phone. It is important to indicate the same phone number as in the agreement with the fund.

Within 30 minutes, an SMS will be sent to the specified mobile number - a message that may contain:

- Password to access the service. This is possible if the data verification was successful.

- Refusal of registration with explanation of the reason. This may be due to the fact that at the time of registration the funded part of the user’s labor pension was not transferred under the management of the fund. Or one of the verification parameters does not match the NPF database.

- A message indicating that the user is already registered in the system. In this case, you should use a password recovery service.

It is also possible to obtain an access password by sending a letter via Russian Post. But it will take much longer.

Foundation programs

Joint Stock Company NPF Trust offers individual programs aimed at creating a future pension. Moreover, we can talk about a completely non-state version of the pension and working only with the funded part of it.

Determining the size of monthly contributions, the nature of accruals upon reaching retirement age, the possibility of terminating the contract and transferring savings to successors are the main advantages of the fund’s activities in the pension sector.

The organization, together with the state, is implementing a pension co-financing program. Contributions made through the Pension Fund are doubled thanks to government support.

In addition to individual programs, the fund also implements corporate ones, allowing companies and legal entities to ensure the financial future of their employees.

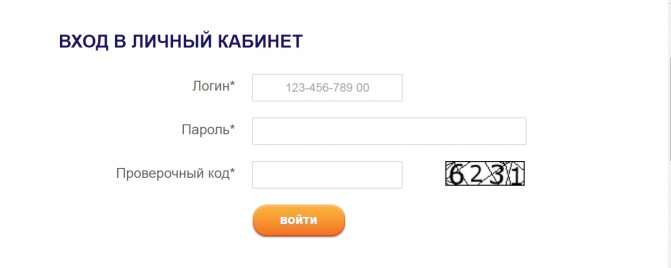

Authorization in your personal account

To log in, you need to go to the “Personal Account” section on the official website. The active button is located in the menu at the top. Then you are prompted to enter your login (SNILS number), password and verification code. The latter consists of 4 crossed out numbers and is indicated here.

On first access, for security reasons, you must change your password. The new password must contain at least 8 characters, including upper and lower case letters, numbers and special characters.

To be able to recover your password, you must provide a valid e-mail.

How to join

The issue of concluding an agreement for pension services with the non-state pension fund “Doverie” is now irrelevant, since the company has been merged with another non-state pension fund. For those who are already members of the fund, nothing fundamentally has changed. The funds of depositors of the NPF “Doverie” were transferred to the accounts of the “Samfar” fund. Now clients are served within the framework of the pension programs of this fund, and the fund will fulfill its obligations to them in full. The successor company guarantees an increase in the level of service and effective management of citizens' pension savings.

How to disable your personal account?

The User’s access to the “Personal Account” service is terminated upon submission of an application to NPF “Doverie” with a request to terminate access to the service or block it.

The Fund will stop providing access no later than 1 business day after the client’s request.

The Foundation may initiate temporary or permanent termination of access to the service in the following cases:

- If there are suspicions of unauthorized access to the service on behalf of the user.

- Upon termination of the OPS agreement.

- For technical reasons.

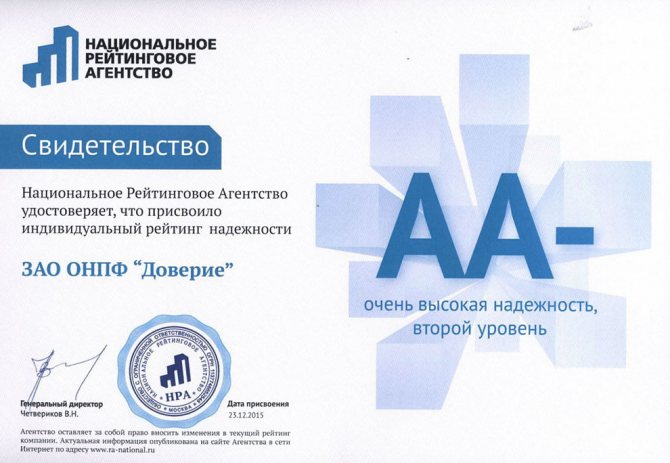

Reliability rating

The last rating actions regarding non-state pension funds took place in 2015. Then the company was assigned an A+ rating, meaning a stable financial position in the medium term. But subsequent events showed that the Expert RA specialists were mistaken. Just two years later, due to poor management, NPF Doverie JSC was faced with a significant reduction in the price of its assets and began to experience a liquidity shortage. Accordingly, in September 2017, the rating assigned by the agency was withdrawn.

Now we can talk about the reliability and profitability ratings of NPF “Doverie” only in relation to its legal successor – NPF “Samfar”.

Is there fraud in the Trust Fund?

Abuse is possible in any financial institution. Judging by reviews from clients of the pension fund, some of them encountered fraud on the part of agents of the NPF “Doverie”. However, these cases were isolated and were mainly associated with the imposition of services and the transfer of the funded part of the pension to the fund without the consent of the citizen. To prevent such actions from being carried out against you, do not give your passport or SNILS to strangers, do not sign consent to the processing of personal data if you do not understand why this is necessary. And regularly check the status of your pension account through the government services website or the personal account of the servicing NPF.

Is it possible to encounter fraud?

Employees of non-state pension funds have a goal to attract as many clients as possible. The procedure is performed using a large number of methods. At the same time, they say that some of them resemble fraudulent schemes. Because of this, customers write a large number of negative reviews.

It is important! Citizens may be lured into non-state pension funds under the pretext of quick employment. Having signed the agreement, a person may soon receive a notification that he has been transferred to the ranks of clients.

Another scheme involves intimidation. In this case, a person who does not have the necessary legal information is informed of the need to compulsorily conclude an agreement with the institution. At the same time, JSC employees report that soon only non-state institutions will be involved in the formation of pensions. An alternative way to attract investors is through promises of large profits and the provision of guarantees from the state. All of the above does not make the institution’s reputation positive. However, it cannot be said unequivocally that the fund is fraudulent. The institution's statistics suggest otherwise.

In Cherepovets, hundreds of voucher depositors of the Doverie fund demanded their money back

Today the management of Doverie Fund OJSC invited shareholders to a meeting in . Voluntary liquidation of the enterprise is on the agenda.

Security holders began arriving an hour before the event began. Those wishing to enter the building were required to register, so a huge queue formed at the entrance, mainly of elderly people. Seeing the cherinfo film crew, one of the pensioners shouted:

“Catch this disgrace on camera! They don't consider us people! It was scheduled for ten, we are an organized people, we arrived an hour in advance. There are five minutes left before the meeting starts, but we still can’t go into the building, we’re frozen!”

There is also crowding and confusion in the palace foyer. There is another queue at the reception desk. Without a mark that the procedure has been completed, you will not be allowed into the hall.

“Who’s that here with the camera?! Leave the building, this is a private event!” - several men demanded; they refused to introduce themselves.

“No way! They took our vouchers and are still giving orders! There’s no need to kick me out, let them film it, let them show the truth!” — several shareholders came to the defense of journalists. The security guards left the film crew alone.

OJSC Trust Fund was formed in 1996, the company is the legal successor of another organization - the Trust investment fund, where Cherepovsk residents carried their vouchers in the early 1990s.

“I donated vouchers worth 18 thousand rubles to the fund. She worked as a director and received 180 rubles a month. So think about whether this is a lot or a little - 18 thousand. What could I buy? Maybe a car... I have received dividends three times since 1994, only 61 rubles! Now I want the management of the fund to return my money, those 18 thousand rubles! They say that now the share costs a ruble, that is, I will only receive 18 rubles!” — shared pensioner Lydia Skokova.

“Now the cost of one share is five rubles 27 kopecks. Can you imagine this! If I have 40 shares, I will receive 200 rubles, and then I could buy an apartment!” - says shareholder Natalya Yakimova.

“I brought my four vouchers to the fund in 1992. Personally, the name captivated me - “Trust”, I believed it. We are simple people. At that time, one voucher could buy a house in the village or up to a thousand shares of Severstal. For 25 years, the fund’s management has been using our big money, now let them return it!” — says auctioneer Tatyana Alexandrova.

“This meeting is not to return our money! And in order to liquidate the fund. Those who will be involved in liquidation are asked to assign a salary of 340 thousand rubles. It’s impossible to solve all this without shareholders; they handed out ballots to us and asked us to vote in favor. But we are against it!” - Mikhail Matveev is worried; in the 90s, his mother invested 48 thousand rubles in vouchers into the fund.

Cherinfo journalists were not allowed into the hall where the meeting was held. None of the representatives of the foundation's management came out into the foyer.

According to cherinfo, today no decision was made to liquidate Trust Fund OJSC. An initiative group of shareholders intends to complain to the prosecutor's office.

Svetlana Marushchenko