Who are the combatants?

Combat veterans (VVD) include everyone who is listed in Article 3 of Federal Law No. 5-FZ “On Veterans”. These are four categories of persons:

- Military personnel and employees of government agencies who performed official duties in other countries during hostilities (the full list of countries is indicated in the annex to the law).

- Military personnel involved in demining the territories of the USSR and other countries in 1945-1951 and in trawling domestic and international waters in 1945-1957.

- Military personnel who took part in battles in Afghanistan, including pilots, drivers and government employees who worked in this country from December 1979 to December 1989.

- Military personnel sent to perform special tasks in Syria from September 30, 2015 (subject to completion of the period specified in the contract).

Who is included in the UBD?

Russians, foreigners and stateless persons residing in our country on a permanent basis can obtain this status.

The VBD certificate is issued for service in the territory of military operations, as well as in case of receipt of appropriate state awards.

Based on Article 3 of Federal Law No. 5 of January 12, 1995, this title can be received by:

- persons who have served in the Syrian Arab Republic since the fall of 2015;

- military personnel from government agencies of the former Soviet Union;

- employees who participated in the Afghan War;

- persons serving in the Ministry of Internal Affairs and other law enforcement agencies responsible for security in the country;

- and so on.

The rank is assigned only for service during military operations carried out in certain years. You can find out whether you can count on receiving a special status using the Appendix to Federal Law No. 5.

It is proposed to familiarize yourself with its text through the reference and legal system “GARANT”. Access to information is provided online free of charge.

This appendix contains a list of cities and territories in which military operations were carried out.

Participants in the actions listed in the text of the document have the right to apply for assignment of the corresponding UBD status. The list is regularly supplemented and updated at the federal level.

Useful article: military pensions in 2020.

Changes for 2020

Since February 2020, the amount of insurance pensions for combat veterans has been increased; more about this is below, in the section on the amount of payments.

In August 2020, changes were made to the list of participants in hostilities, which took effect from 01/01/2020. The VBD now includes military personnel and militias who took part in the counter-terrorist operation in Dagestan in August-September 1999. They will be entitled to all the benefits and payments that other persons mentioned in the law “On Veterans” have.

Procedure for appointment and payment

How to apply for a pension for veterans of the DB? The rules for providing a pension for old-timers are similar to the provision of a regular pension. The only difference is in the documents to be provided.

In general, to register, a pensioner should do the following:

- You need to go to the military registration and enlistment office, take a document guaranteeing that the citizen took part in hostilities, and get a certificate of an old-time military serviceman.

- Create a current account (how to do this should be clarified at the bank branch where you will open the account). They will explain and help you complete the process, and your pension will be credited there.

- Visit the Pension Fund at your place of residence.

- Provide confirmation of awards and merit badges.

- Wait for the application to be verified.

- Only after the above list can you have pension payments on standard terms.

Types of veterans' pensions

The legislation provides for three types of payments for UBI. And the size of the pension depends on what kind of pension is assigned to military veterans.

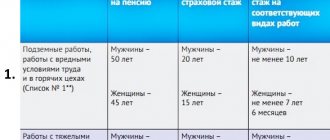

Long service pension

Veterans are entitled to one of three options for such payment:

- military - to receive it, a veteran must have at least 20 years of military service and be over 45 years old;

- military insurance - total experience over 25 years, of which at least half is military service. Age - from 45 years;

- insurance - assigned to people who have worked their entire career in civilian life, and received the status of a participant in combat operations when they performed regular official duties in a zone of military conflicts. The assignment of an insurance pension occurs at the same age as for civilians: in 2020 it is 60.5 years for men and 55.5 for women. In the future, the retirement age will increase annually by 6 months and by 2024 will reach 65 years for men and 60 years for women.

Monthly cash payment (MAP)

This is a government payment from the Pension Fund of Russia, it is established in accordance with Article 23.1 of Law No. 5-FZ. It applies to all combatants. Its size is specified in the law and is regularly indexed (in 2020 the amount was increased by 3%). Part of the due amount of the monthly cash payment is allowed to be used to finance a set of social services (travel to the place of treatment, sanatorium treatment, dental services, etc.). To do this, every year the veteran writes a statement, either agreeing or refusing a set of social services.

Military disability pension

Relies on military personnel who lost their health during the performance of official duties, or no later than 3 months after dismissal from service. If disability occurs due to a wound, concussion, injury or illness received during service, the pension is awarded later than the established 3 months.

The decision to assign a payment is made by the Russian Pension Fund on the basis of a document from the military medical commission that recognized the former serviceman as disabled. The period for payment of military pension is limited. It ends if the disability is removed at the next military medical commission or if the “regular” retirement age comes.

It is calculated based on the monthly allowance of the military personnel. Accordingly, the longer the service period, the higher the assigned disability pension.

What benefits are given to participants in military operations?

Social guarantees for Afghans are provided at the expense of federal and regional budgets.

War participants receive mandatory cash payments from the federal budget.

These payments include increased pension and disability payments.

Disability payments

This benefit is received by internationalist soldiers who have become disabled as a result of participating in the military conflict in Afghanistan.

The amount of payment depends on the disability group, the cause of its occurrence and the severity of the injury.

From 2020, Afghan war veterans will use

only one benefit : disability benefits or pension for participation in hostilities. The choice is given in favor of payment from a larger amount.

About privileges for Afghans who have state awards

The high status of state awards should guarantee decent pensions for Afghan veterans. The status is confirmed by the law of the Russian Federation, on the basis of which the need for government measures is recognized that will ensure the material and social well-being of the Heroes of the Soviet Union.

The legislation established the rights for them:

- Increasing the size of pensions for old age, disability, long service.

- Free travel to the place of treatment.

- Free treatment in hospitals and clinics.

- Providing free vouchers to medical sanatoriums.

- Free provision of necessary medications.

- Receiving free housing.

- Obtaining free land plots.

- Free priority major home repairs.

In addition to benefits, those awarded the highest awards of the USSR are entitled to a pension supplement of 400 rubles. Citizens who have 3 or more medals “For Courage” receive 1,000 rubles added to their pension benefits.

Each region has introduced its own benefits and allowances, except for the federal ones, which are provided to Afghan veterans.

Articles of the laws on veterans are designed to prevent instances of injustice towards veterans if, while performing an international duty, a citizen received wounds and injuries that limited his activities in the future.

Be sure to read it! Compensation for unused right to travel around the country: how much is due and how to get it

The law on social protection of Afghan soldiers establishes:

- Increased pension provision.

- Regular priority indexation of pensions and other additional payments.

- Benefits upon death of a veteran. Relatives receive monetary compensation for ritual services and transportation of the body to the burial site. Various benefits are provided to widows of Afghan veterans. If the veteran continued to serve in the RF Armed Forces, then his burial is accompanied by military honors.

Thus, the concept of veterans of military operations in Afghanistan was introduced into legislation in order to highlight the special status and services of citizens of this group to their country.

Pension benefits

For military personnel, one month of service in Afghanistan is counted towards length of service in three months . In particular, length of service includes the time of continuous stay in medical institutions as a result of injury, concussion, injury or illness during the period of service.

Note: The procedure for calculating length of service was approved by paragraph “a” of Part 1 of the Resolution of the CPSU Central Committee of January 17, 1983 No. 59-27, which is still in force today, although some of its provisions, for example, the right to free provision of a Zaporozhets car, today are not relevant and simply impossible to implement.

In addition, on the basis of paragraph “d” of Article 45 of the Law of February 12, 1993 No. 4468-1 “On pensions for persons who served in military service...” pensions assigned to veterans of combat operations in Afghanistan, both for length of service and for disability, have been increased by 32% of the estimated amount of social pension.

In addition to pension benefits, Article 23.1 of the Law “On Veterans” grants “Afghans” the right to a monthly cash payment (MCP), the basic amount of which – 1,699 rubles – is indexed annually.

Note: The UDV indexation percentage is calculated based on inflation for the previous year. The maximum amount of EDV (in case it completely replaces all benefits provided for by Law No. 178-FZ of July 17, 1999 “On State Social Assistance”) in 2020 was 2850.26 rubles.

Increased pension

Afghans receive 2 types of pensions - a long-service pension (basic) and a pension for participation in military operations (EPV).

The amount of the basic pension is influenced by : time spent in a hot spot, military rank, position held before retirement, etc.

A monthly cash payment is paid to all soldiers and family members of Afghan veterans who died in the line of duty.

The amount of monthly compensation is indexed every year . This amount includes a package of social services (medicines, special meals for disabled children, payment for sanatorium treatment, etc.).

You can refuse the social services package and receive a pension supplement.

Work and education

The employer is obliged:

- at your own expense, train “Afghan” veterans in a profession, including additional vocational education (Clause 17, Article 16 of the Law “On Veterans”;

- provide annual leave in the month chosen by the veteran;

- at the request of the veteran, give him additional leave at his own expense for up to 35 days a year (Clause 11, Article 16 of the Law).

Benefits related to obtaining an education are excluded from the Law “On Veterans”, but are still provided for by the Law “On Education in the Russian Federation”. "Afghans" can, using budget funds:

- study at the preparatory departments of universities under state jurisdiction (clause 11, part 7, article 71 of the Law of December 29, 2012 No. 273-FZ);

- be accepted within the established quota for training in bachelor's and specialist's programs - but upon successful passing of the exams required for admission (Part 5 of Article 71 of the Law of December 29, 2012 No. 273-FZ).

Attention: the provisions of Part 5 of Article 71 of the Law “On Education in the Russian Federation” are valid for combat veterans only until 01/01/2019 (in accordance with Part 14 of Article 108 of this Law), and during 2020 there are proposals to extend this period were not submitted to legislative bodies for consideration.

Housing benefits

All privileges in solving housing problems are listed in Article 16 of the Law “On Veterans”:

- Internationalist soldiers are provided with housing at the expense of the federal budget - but subject to their need for improved living conditions and being on the housing register;

- housing payment compensation is set at 50%;

- rent and (or) fees for maintaining residential premises;

- contributions for major repairs;

Note: Compensation is provided regardless of the type of housing stock and also applies to family members living with the veteran.

- in addition, priority installation of a residential telephone is required;

- Housing benefits also include an advantage when joining housing-construction cooperatives and gardening associations.

Housing programs

Law No. 5 defines standards for supporting combatants and veterans of Afghanistan in resolving the housing issue. In accordance with paragraph 1.3 of Article 16 of this law, benefits are provided in the form of subsidies for the purchase of housing. The amount of the subsidy is determined by the recipient’s family’s need to improve living conditions and depends on the number of family members. Also important are the size of existing housing and its current cost. State housing benefits are provided based on need criteria; the subsidy participant must meet one or more requirements from the following list:

- do not have registered housing;

- do not participate in programs involving the conclusion of a social rental agreement;

- be registered or live under a civil lease agreement in an apartment (house, dormitory) of insufficient space or that does not comply with SanPiN.

The state reserves the right to refuse to provide housing to a combat veteran if there are no corresponding needs. To participate in the program, persons who fought in Afghanistan must contact the administration of the locality (at their place of residence) with a corresponding application. Together with the application for housing benefits, a certain package of documents must be submitted for consideration, containing:

- personal passports of each family member of the “Afghan”;

- documents of children under the age of obtaining a passport (birth certificate);

- a certificate of a veteran or combat participant confirming the right to benefits;

- social insurance policy;

- passport for an apartment, if the family has its own housing that does not meet the standards;

- certificate from reg. fees confirming the absence of other real estate owned by family members.

To receive a subsidy, you must open an account in one of the Russian banks. Details are attached to the package of documents and submitted together. It is allowed to use the benefit recipient's card account to which pension or other payments are transferred. The period for consideration of the application does not exceed 60 days.

Tax benefits

1. According to personal income tax

This tax is not imposed on monthly cash payments (Clause 69, Article 217 of the Tax Code of the Russian Federation);

a standard tax deduction of 500 rubles is provided for income subject to personal income tax at a rate of 13% (clause 2, clause 1, article 218 of the Tax Code of the Russian Federation).

2. For personal property tax

A veteran may not pay tax on one of the objects of his property subject to taxation, provided that its value does not exceed 300 million rubles (clause 4, clause 1, clauses 2, 3, 5 of Article 407 of the Tax Code of the Russian Federation).

3. For land tax

The tax base for one land plot owned by a veteran is reduced by the amount of the cadastral value of 600 square meters of the area of this plot.

4. For transport tax

Transport tax benefits may be established by the laws of constituent entities of the Russian Federation. For example, in Moscow, veterans do not pay tax on one of their cars with an engine power of no more than 200 horsepower (Article 356 of the Tax Code of the Russian Federation; clause 5, part 1, part 5, article 4 of the Moscow Law of 07/09. 2008 No. 33).

5. By state duty

“Afghans” are exempt from state duty when going to court to protect veterans’ rights, if the cost of the claim does not exceed 1 million rubles. In case of a higher amount, the duty is paid in the amount calculated from the price of the claim and reduced by the amount of the state duty payable if the claim price is 1 million rubles (clause 3, clause 2, clause 3, Article 333.36 of the Tax Code of the Russian Federation).

Transport benefits

- extraordinary purchase of tickets for all types of transport (clause 16 of article 16 of the Law “On Veterans”);

- free travel on suburban railway transport, and in the case of traveling for treatment - on intercity transport to the place of treatment and back (Article 6.2 of the Law “On State Social Assistance”).

Other types of benefits

In addition to the above, veterans are also entitled to:

- preferential use of all types of services of communication institutions, cultural, educational and sports institutions (clause 16 of article 16 of the Law “On Veterans”);

- benefits for reimbursement of costs associated with the consideration of an administrative case, where veterans can be both plaintiffs and defendants (clause 3 of Article 107 of the Code of Administrative Proceedings of the Russian Federation). Costs mean payment for the services of experts, translators, representatives, travel and accommodation expenses of the parties, postage, etc. (Article 106 of the CAS of the Russian Federation).

Benefits for the CIVILIAN category compared to military personnel are limited.

For persons serving military units, the following is provided:

- admission out of turn at medical institutions and preservation of the right to treatment in clinics and hospitals where the veteran was served before retirement;

- preferential right to sanatorium treatment;

- emergency installation of a home telephone;

- vocational education at the expense of the employer, provision of annual leave during the desired period and additional leave without pay;

- provision of housing at the expense of budgetary funds (if needed and registered accordingly);

- priority right to join gardening associations.

For citizens sent to Afghanistan to work:

- annual provision of paid leave by the employer;

- extraordinary provision of vouchers to sanatorium and resort organizations;

- installing a telephone in the apartment out of turn;

- advantages for joining gardening partnerships.

Other benefits and payments

In addition to compensation and tax benefits, participants and veterans are entitled to regular cash payments. Once a month, citizens can receive the amount established by the federal government. In accordance with Federal Law No. 178, the condition for increasing the amount of EDV is possible by waiving certain benefits, including those provided in the form of:

- spa treatment;

- free medications;

- free train tickets.

The average increase will be 1082.53 rubles, which is insignificant compared to the costs of purchasing medicines, tickets and vouchers. If a participant in combat operations in Afghanistan dies, his family members retain the right to certain benefits. Close relatives of the deceased “Afghan” are entitled to:

- compensation for housing and communal services;

- treatment in departmental clinics;

- subsidies;

- help from a social worker.

Important! Relatives who retain rights to the benefits of an Afghan include: spouses, parents and children. Also, in the event of the death of a recipient of benefits, the family is paid an allowance to pay for funeral services.

Pension amounts

The amount of payment to a specific combatant is established based on his individual conditions and parameters.

How is the pension calculated?

According to the standards, there are several indicators on the basis of which a combat veteran’s pension is calculated: length of service, military rank, the amount of insurance contributions (if the VBD worked in civilian life), the number of dependents, the presence of disability. The average pension for combat veterans in Russia in 2020 in the Russian Federation is 25,000 rubles.

Amount of disability payment for former military personnel: from 40% to 85% of the salary for the corresponding rank, at least 150% of the social pension (for disability groups 1 and 2 - at least 300% and 200%, respectively).

Benefits and payments to combat veterans in 2020

For veterans who served military units of the USSR Armed Forces and the RF Armed Forces, who were located on the territory of other countries during the period of combat operations there, who were wounded, maimed, concussed, or awarded medals/orders of the USSR or the Russian Federation for participation in combat operations (this is category No. 5 from the approved list ), the list of benefits is much smaller . They are entitled to:

Housing for combat veterans in 2020

- Preferential pension provision in accordance with Law No. 4468-1 of February 12, 1993 (one day in “hot spots” is counted as 3 days of military service).

- Providing housing at the expense of the federal budget.

- Compensation in the amount 50% of living expenses:

- for the rental and/or maintenance of residential premises (including services and work for managing an apartment building, maintenance and ongoing repairs);

- contributions to the cap. repair.

- First-time phone installation.

- Priority right to purchase garden and vegetable plots of land.

- Advantage for joining a housing, housing-construction or garage cooperative.

- Medical assistance in medical organizations in which veterans were assigned during the period of work before retirement, extraordinary medical. help.

- Free provision of prosthetics (except dental ones) and prosthetic and orthopedic products, or reimbursement of expenses if the veteran purchased these products on his own.

- Providing additional leave of up to 35 days without pay, as well as the right to use annual leave at any convenient time.

- Preferential provision of services to sports, recreational, cultural and educational institutions, purchase of tickets for all types of transport out of turn.

- Additional professional education and prof. training at the expense of the employer.

The size of the pension for combatants and the right to receive it, as indicated earlier, depend on a number of factors.

Additional payments and allowances

The main additional payment that is due to each participant in hostilities is a monthly cash payment. From 02/01/2020, the EDV was increased by 3%, and it reached the following level:

- participants in combat operations - 3062 rubles;

- combat veterans - disabled - 5565 rubles 32 kopecks;

- veterans of the Great Patriotic War - 4173 rubles 97 kopecks.

1,100 rubles of this amount is the cost of a set of social services that are received in kind. Then the size of the cash payment will decrease.

Veterans receiving military pensions are entitled to the following allowances:

- if you have more than 20 years of service - a payment of 50% of the monthly amount paid + 3% for each year of service over 20 years;

- if you have mixed experience over 25 years - payment of 50% of the usual salary + 1% for each year of work (no matter military or civilian) over 25 years;

- an allowance of 100% of the calculated indicator for “military” disabled people who have reached the age of 80 years. This bonus affects the pension of veterans of the Great Patriotic War - its size is larger than that of others.

And there are a number of additional payments for this category of citizens:

- additional payment to military disabled people of group 1 (300% of the basic calculation indicator established in Law No. 5-FZ); 2 groups (200%); 3 groups (100%);

- additional payment for length of service (at age 45 and experience over 25 years);

- additional payment in the presence of disabled family members of a combatant: 32% - for one, 64% - for two, 100% - for three or more;

- additional payment if you have a military rank - 32% of the established pension amount.

Some constituent entities of the Russian Federation establish additional payments for participants in combat operations in certain regions. Pensions for Afghans, participants in the Chechen conflict and others are being increased. For this information, you should contact the regional branch of the Pension Fund.

Proposal to increase pensions from deputies

In 2020, a proposal was submitted to the State Duma to increase the level of payments for veterans. This proposal came from representatives of the LDPR party.

The bill reflects that it is necessary to double the amount of benefits. According to the document, veterans' benefits are equal to half the subsistence level established for the country's adult population. At present, the bill has not been finalized and no decision has been made on it.

The initiators indicate that the minimum is recalculated every quarter. If you tie payments for veterans to this value, this will allow you to constantly index pensions and increase their size. In the third quarter of 2020, the minimum was 10,400 rubles . It follows from this that the size of the pension for participants in combat operations in Chechnya and other areas would be 5,200 rubles if the reform were used.

The Legal Department reviewed the initiative and concluded that the application of such a law would significantly increase the costs of the pension system. Financing occurs using funds from the federal budget, which means that it will also suffer losses. It was recommended to obtain an opinion from the Government so that such costs become agreed upon.

Decision on the bill

To date, the Government has not yet made a decision on this issue. For this reason, the bill was sent to a group of initiators. No further actions were taken with respect to the submitted draft law. According to studies, to implement the measures outlined in the project, it will be necessary to spend about 37 billion rubles.

Every year the number of citizens who have received the status of combat veteran increases. Therefore, the costs for this expense item will gradually increase. Rosstat has published data on how many citizens receive payments in connection with the status in question. Now there are 1.37 million such people.

Read more: How to find out if there is an encumbrance on real estate

Benefits for combatants

In addition to cash payments, veterans are also entitled to in-kind benefits:

- tax (deduction for personal income tax of 500 rubles, exemption from property tax, and in some regions, from transport tax);

- provision of housing - if a combatant in need of improved housing conditions registered before 2005, then he is entitled to a cash certificate for the purchase of an apartment or a plot of land for individual housing construction;

- vouchers for sanatorium treatment, benefits for prosthetics, free medical care in military hospitals;

- the right to install a home telephone without waiting in line;

- provision of leave at any required time, an additional 35 days of annual leave (15 days are paid, the veteran has the right not to use the rest);

- free provision of funeral services in the event of a person’s death;

- discount on housing and communal services.

State social guarantees for Afghans

In addition to cash payments, internationalist soldiers are entitled to the following benefits : housing guarantees, tax, payment of housing and communal services, medical, and additional.

Be sure to read it! Investment of pension savings in 2020 and placement of pension reserves

Housing guarantees and benefits for utility bills:

- free housing out of turn if an Afghan veteran registered before December 31, 2004. This right is provided only for war invalids;

- obtaining and installing a landline phone first;

- reimbursement of 50% of rent;

Veterans undergo medical examinations at departmental institutions out of turn. In addition, Afghans receive free medical care in hospitals and trips to a sanatorium.

Afghan soldiers are also provided with benefits at the expense of regional budget funds . These include:

- free travel on public transport;

- exemption from payment of transport tax;

- reimbursement of 50% of costs for housing and communal services;

- obtaining prosthetic and orthopedic products.

The full list of benefits must be clarified at the Regional Social Security Office at your place of residence.

In addition to these basic guarantees, the state also provides additional rights .

Afghans can:

- choose your own vacation period;

- receive additional unpaid leave for up to 35 days;

- study at the expense of the employer;

- enter state universities without competition;

- receive a special scholarship while studying at a university;

- be served out of turn in all institutions.

After the death of an Afghan, his family members will receive benefits. Children enjoy all the privileges of a deceased participant in the Afghan war until they reach adulthood. In addition, the state compensates 50% of the cost of vouchers to camps and sanatoriums. Afghan widows are entitled to benefits until they remarry.

Pension payments to Afghanistan veterans

Participants in military operations in Afghanistan have the right to receive a military pension, and one length of service is equivalent to three years. In addition to the basic payment, an additional 32% of the minimum social pension will be provided as unified tax. Afghanistan veterans can receive additional payment in cash or in kind. The size of the first will be 3696.40 rubles. If the recipient of the funds refuses the money, he will be provided with medicines for this amount, and treatment in a sanatorium and medical institutions will be paid for. Among Afghan veterans, disabled people occupy a special place.

Read more: Compensation for a deceased relative in Sberbank

Pension payments for them are subject to increase:

- For disabled people of group 1 – three times.

- For disabled people of group 2 – twice.

If, after retiring from military service, an Afghan veteran decides to continue working in a civilian job and reaches retirement age, he will be able to obtain insurance benefits. Their national average is 9 thousand rubles, the total amount of pensions of former Afghans is 20 thousand rubles.

Is it planned to increase the retirement age for military pensioners?

Military pensioners retire with a minimum of 20 years of service. In recent years, there have been rumors about his promotion for five years. However, there is no official confirmation of this, so in 2020 the conditions for receiving a military pension remain unchanged. Now we can say with confidence that until the spring of 2020, there is no need to worry about raising the retirement age for the military.

In conclusion, we note that the pension for combatants, in terms of the terms of provision and the amount of payments, differs significantly from the civilian one. Only citizens with minimal military experience will be able to apply for funds. The size of the pension largely depends on the salary and the availability of overtime. Based on statistical data, the average amount of a military pension in the country is 16 thousand rubles. In addition to basic payments, every veteran can count on receiving a supplement in the form of EDV, as well as benefits for utility bills and taxes.

Citizens who have received the status of combat veterans are entitled by law to various pension supplements. Their amount depends on length of service, age and state of health. To receive additional payments, you must meet a number of criteria provided for by the Law of the Russian Federation No. 4468-I of February 12, 1993 and the Federal Law “On Veterans”.

Supplements to the basic pension for combat veterans begin to accrue from the moment the Pension Fund makes a positive decision on the assignment of pensions, and their amount is regulated by Law No. 4468-I.

Read more: How to sign a reconciliation report with discrepancies sample

If a veteran dies while on duty, his family members may receive additional payments. If they applied untimely, a recalculation is made, and contributions are transferred in any case without a time limit.

To apply for the bonus, you must have with you documents confirming participation in battles or business trips to hot spots: they will be needed when applying to the Pension Fund for the first time.