The non-state pension fund Safmar was founded in 2004. The headquarters of the organization is located in Moscow, and the fund itself belongs to one of the largest groups in the field of industry and finance in our country - the Safmar group. Details of the activities of NPFs in the field of pension insurance and provision will be discussed below.

Official website of NPF Safmar

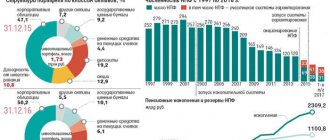

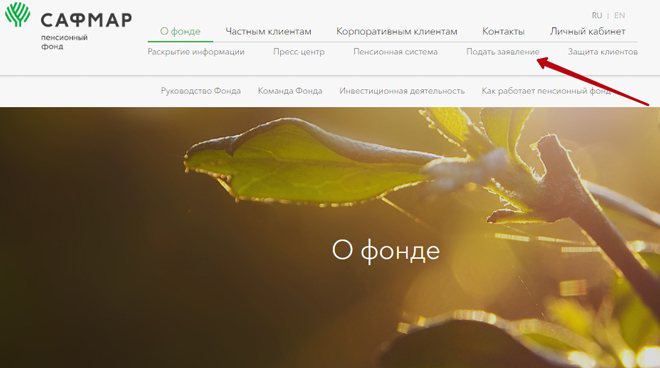

The organization has a well-developed website, which is located at www.npfsafmar.ru. The successful provision of services in the areas of compulsory pension insurance and non-state pension provision, as well as the merger of several funds, led to the formation of an impressive client base - more than 2.3 million people.

The fund manages over 200 billion rubles of pension assets. The fund's participation in the system of guaranteeing the rights of insured persons makes it attractive among potential clients.

The main page of the official website has a navigation menu with all the necessary sections - from the general information block to the personal account service. The latter allows you to get timely access to your pension account, monitor its growth, and control the flow of funds.

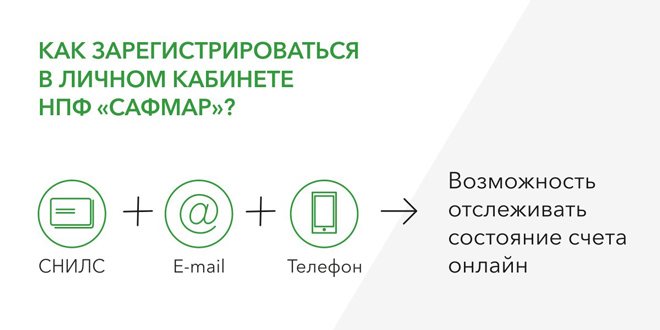

Only participants in the compulsory pension insurance program, SNILS, can register. You will also need to enter your email address and mobile phone number (if available).

After confirming your registration, you will have access to all important information regarding your future pension.

You can also find a convenient pension calculator on the website, which will allow you to calculate the amount of future non-state payments. The “Online Financier” program, presented on this same page, is a good financial product from NPF Safmar.

The advantages include the accrual of income from investment programs and the opportunity to receive a social tax deduction. In addition, the client can determine the size and frequency of deductions independently. Monthly contributions will allow you to accumulate significant financial wealth by the time you retire.

The fund also offers corporate programs, which will come in handy for many enterprises that want to centrally provide future pensions to their employees.

Profitability of NPF Raiffeisen

The Non-State Pension Fund pursues the main goal of not preserving funds for a long time and maintaining a minimum level of risks, but also ensuring high returns even in difficult conditions.

That is why investments, savings, and the use of reserve savings are constantly taking place; everything directly depends on the high professionalism of managers.

Reliability rating of NPF Safmar

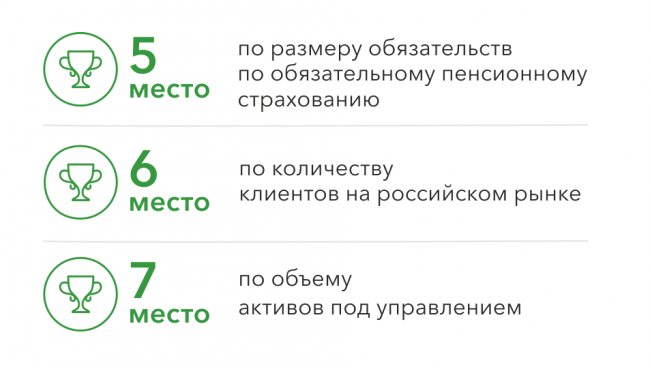

The Central Bank of the Russian Federation summed up the activities of the Safmar fund as of the second quarter of 2020. Among 66 participants, the fund took worthy places, which demonstrates the reliability of the financial organization:

- first place among the top non-state pension funds (criterion - the size of the average compulsory pension account);

- fifth place in total savings;

- sixth place in terms of number of clients served.

Thus, the fund shows serious results, which indicate confidence in it. According to expert assessment, the organization’s financial reliability rating is the highest – A++.

This fact suggests that the fund will not close overnight, and you can trust it with your pension savings. For potential clients, such information is important because it allows them to decide whether it is worth concluding a pension agreement.

Fund returns by year

The profitability of any non-state pension fund largely depends on the current situation in the financial market. And we are talking about both debt and stock markets. The debt market is subject to a reduction in the key rate of the Central Bank, which entails a decrease in the profitability of each non-state fund.

Negative dynamics have been observed this year in the stock market as well. There are many reasons for this, but, first of all, the rapidity of events taking place in the banking sector. Due to the outflow of part of the capital, constant sanctions and the slowdown in the country’s economic development, positive dynamics are being replaced by negative ones.

But this is a common occurrence - by such indicators one can judge the real state of the economic sector. So far there is no growth trend, but the picture may change.

NPF “Safmar” cannot be called high profitability. Although clients claim that pension savings are still increasing. At the end of last year, the profitability of NPFs was able to overtake the 2.5 percent inflation rate and amounted to 3.8%.

If we do not take into account the payment of remuneration to all management companies with which the fund cooperates, then the result reached 4.6%. The placement of pension reserves gave a yield of 4.3%, taking into account the remuneration paid.

Reliability and stability of increasing future pensions is exactly what pensioners are interested in. The period of financial recession this year may well give way to growth next year.

General information about the fund

This organization has distinctive features from other similar organizations. The reason for the differences is that the company is affiliated with a large financial holding company. Due to the fact that the funds contributed by citizens to the company are invested wisely, the organization in question is among the top five non-state pension funds. This applies to data on profitability and reliability.

In addition, Samfar is classified as a member of the ANPF, the Franco-Russian and Russian-British chambers. It is worth pointing out that the name was formed only in 2020. Until this point, this organization bore the name Raiffeisen. A reorganization procedure took place, in particular, the composition included:

- Confidence,

- European Foundation.

Currently, the combined finances of these organizations amount to about 300 billion rubles. The reserve consists of 8.5 billion. In 2020, the number of clients exceeded 4 million citizens.

Rules for submitting applications to NPF Safmar

All the features of submitting applications can be found on the official website of the fund in one of the menu sections - “Submit an application”.

Depending on what exactly the client needs (appointment of pension payments, notification of changes in personal data, etc.), a package of documents must first be prepared. What exactly should be included in it can be found in the corresponding lists (there are 14 of them).

Applications can be submitted in person or through a legal representative. There are several ways to submit:

- by mail (the authenticity of the documents must be confirmed by a notary);

- in the fund's offices;

- through partners, at Raiffeisenbank branches (pre-submission of an electronic application is required).

If we are talking about assigning payments, then after accepting and reviewing the documents, a written response is sent to the client by email. If the paperwork is completed correctly, no later than a month after the decision is made, it will be possible to receive the first amount of funds.

Offered pension programs

JSC NPF SAFMAR offers its clients programs for the formation of the funded part of pensions within the framework of compulsory pension insurance and individual solutions for non-state pension provision.

Fig.3. Getting advice about your accumulated pension amount

Features of the program for OPS:

- increase due to investment income received by the fund from their use, as well as when the insured person decides to add maternity capital to them;

- in the event of the client’s death during the accumulation period (before retirement), the funds are paid in the form of an inheritance to the legal successor;

- The decision to place a person in a non-state pension fund or Pension Fund, including changing the insurer, is made by the citizen independently.

Important! Funds accumulated within the framework of compulsory pension insurance can be paid only in accordance with the rules approved by law - for life, on a monthly basis. If a citizen does not fall under the co-financing program and is entitled to receive a state old-age pension, in these cases an immediate or lump sum payment may be received.

As part of the formation of NPOs, starting from 02/08/2018, the company’s clients are offered 3 types of programs for placing funds.

Table 7. Programs for the formation of pensions in NPF "SAFMAR". Source: npfsafmar.ru

| Characteristic | Financier PRO | Financier VIP | Financier online | ||

| Amount of contribution, minimum RUB. | First | 30 000 | 60 000 | 2 000 | |

| Subsequent | 5 000 | 5 000 | 2 000 | ||

| Frequency of replenishments | Not limited | Monthly | |||

| Fees collected from the deposited amount | Administrative | 0% | |||

| Insurance | |||||

| Coefficient applied to the redemption amount upon termination of the contract by the client | 0.95 for 3 years from the date of conclusion of the contract, 1 thereafter | 0.95 if the agreement is valid for less than 2 years, 1 over the specified period | 1 year – 0.7; 2-5 – 0,8; 6-10 – 0,9; 10 onwards – 0.95. | ||

| The percentage of the savings amount paid to the heir in the event of the death of a participant | 100% | ||||

Attention! The redemption amount includes collected savings and received investment income.

Fig.4. Pension calculations with NGOs

When the grounds for payment of a pension to a citizen arise, he has the right to independently determine the procedure for receiving non-state support formed on a personal account in the NPF “SAFMAR”. The company offers the following schemes:

- for life;

- with a certain period, not less than 5 years;

- until your personal account is reset.

For reference! The lifetime pension is calculated taking into account the average duration of receiving a pension by citizens of the Russian Federation, which is 19.5 years or 234 months.

How to draw up an agreement with NPF "SAFMAR"

To enter into a contract with a company for servicing the accumulative part of the compulsory pension system, the client must:

- Contact any branch of the fund in person with a passport of a citizen of the Russian Federation and an insurance certificate (SNILS).

- Report the transfer to the insurer to the Pension Fund by personally contacting the territorial department of the structure, MFC, through your personal account on the pages of the State Services portal or the Pension Fund. No later than December 31 of the year in which the contract was concluded.

- After receiving a notification about the transfer of funds, register in your Personal Account on the official website of the fund for the convenience of managing savings (optional).

.

.

.

Fig.5. Placing the first contribution to a non-state pension fund

The client can draw up an NPO agreement directly at the organization’s office or independently by filling out an online form on the company’s website. In case of personal application, the client must have a passport and SNILS with him; all other documents for signing will be generated and provided by a company employee.

After concluding the agreement, the participant is given a copy of the agreement and details for making the first payment, depending on the chosen program. The transaction is considered completed after the specified amount is transferred.

.

Online contract process:

- Go to the section of the site with individual savings programs.

- In the first window of the registration form, enter your full name, email and contact phone number.

- If the information is correct, the system will allow you to proceed to filling out your passport data.

- In the next window you will need to specify the parameters of monthly contributions.

- The last screen allows you to remotely top up your account using a plastic card.

Important! Online conclusion of an agreement is available only on the Financier Online savings program.

User's personal account

All fund clients who place funds under the OPS program can register in their Personal Account on the company’s website. The service allows you to view your savings, send applications to the company and ask questions to the support line in the form of a chat. The system also provides for changing contact information.

Fig.6. Registration in your personal account on the website of NPF "SAFMAR"

For clients under NGO programs, the use of the resource is provided only if they have previously received a login and password; new registration through the site pages is temporarily unavailable. To obtain information about your savings, you must personally contact the fund or send a written request.

How to find out your pension accrual

All necessary information about pension accruals and account status can be found by contacting the office directly, by calling the hotline or using the “Personal Account” service, which is located at client.npfsafmar.ru. The last method is very convenient, since it can be implemented without leaving home.

Access to your personal account is available to registered clients. Moreover, at the moment, the registration procedure is available only to participants in compulsory pension insurance. Clients in the field of non-state pension provision will be able to register a little later, as stated on the organization’s website.

Personal account features

Remote service through the personal account of NPF Safmar provides clients of the fund with maximum convenience and transparency of all transactions performed. Registered users can receive the following information and services around the clock and from any device with Internet access:

- Information about the current state of the pension account.

- Information about ongoing operations.

- Check your personal information and make changes.

- support service.

- Generate a pension account statement.

- Set up notifications.

How to receive the funded part of your pension

The packages of documents for assigning payments for the funded part are different if we are talking about submitting an application independently or through your legal representative. All necessary information on this issue is presented in Lists 1 and 2, respectively.

As soon as the necessary papers have been prepared, you can contact NPF Safmar - during a personal visit, by mail or through the fund’s partners.

If all documents are completed correctly, a notification that the application has been accepted for consideration should be sent to the post office within 5 business days.

For funded pensions, the decision must be made within 10 days, after which the NPF again sends a response by mail. One month is the deadline during which payments for the funded part of the pension must begin.

Important! The time for the fund to fulfill its obligations to the client is counted from the moment the corresponding decision is made.

Safmar Foundation office addresses

The location address of JSC NPF Safmar is Moscow, Serp i Molot Zavoda proezd, building No. 10. The organization's head office is located on the 11th floor in the Integral business center, located at this address.

After the final reorganization of several non-state foundations, the Education and Science Foundation became a branch of Safmar. This happened in September 2020. Now the client can also contact the address: Leninsky Prospekt, building No. 42, building 2. There is also a territorial branch in Saratov.

Fund hotline number

For all questions, you can contact the hotline: 8-800-700-80-20 and +7 (495) 777 9989. A call center specialist will promptly advise on pension issues. Calls are accepted every day from 8.00 to 20.00.

In general, NPF Safmar is one of those organizations that you can trust with your pension savings. The fund's profitability changes depending on the situation on the financial market, but this does not change the overall positive trend in its development.

If you want to invest in something other than the top non-state pension funds in our country, you should pay attention to the fund considered.

( 68 ratings, average: 2.66 out of 5)