Today, all data on the official employment of citizens, the regularity and volume of mandatory insurance contributions are automatically calculated in the Pension Fund. In some cases, it is necessary to calculate the total length of service manually, for example, when calculating an approximate retirement date. To do this, you need a completed work book or copies of orders for enrollment and dismissal from work. The manual counting method is officially recognized and widely used by accountants and clerks. In this article we will look at how to independently calculate your length of service using your work book and how it affects your future pension.

How to use the calculator

There is a special program for calculating length of service using a work book - these are so-called online calculators. They serve to calculate the duration of activity, taking into account the time of incapacity for work according to the work book. You must enter data carefully to avoid calculation errors.

Let's look at step by step how to use our online work history calculator.

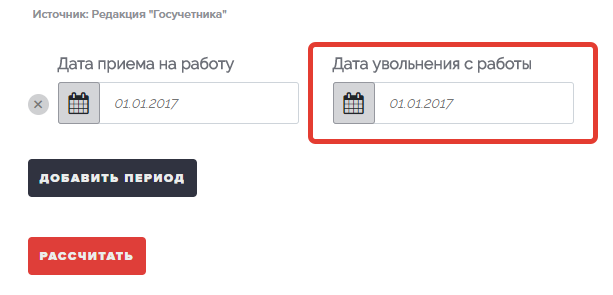

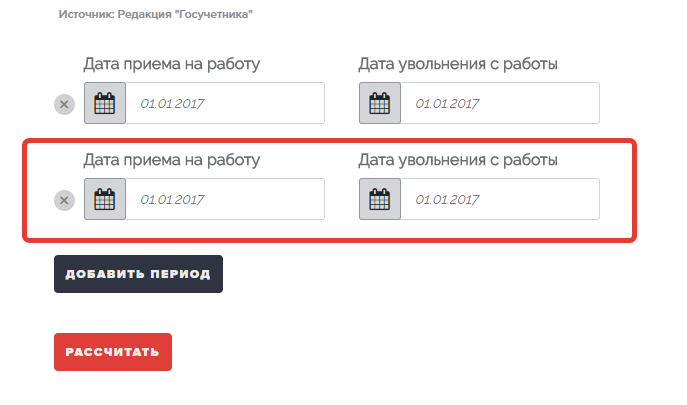

Step 1. In the “Date of hire” field, from the drop-down calendar, select (in accordance with the work book data) the required date, month, year.

Step 2. In the “Date of dismissal from work” field, select the required date, month, year from the drop-down calendar.

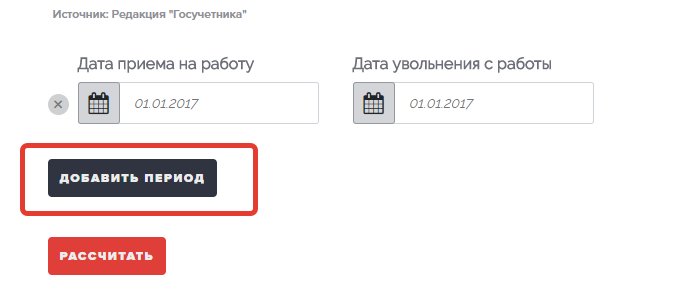

Step 3. If you work for more than one employer, or have other time to be included in the calculation, select the “Add period” field.

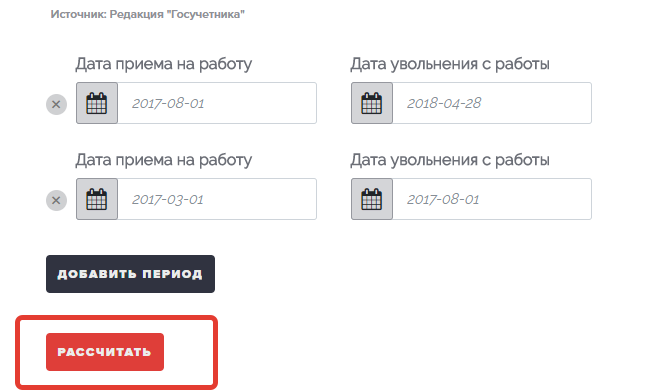

Step 4. From the drop-down calendar, again select the desired dates in the “Date of hiring” and “Date of leaving work” fields (which periods should be included in the calculation are listed below).

Step 5. Click the "Calculate" field.

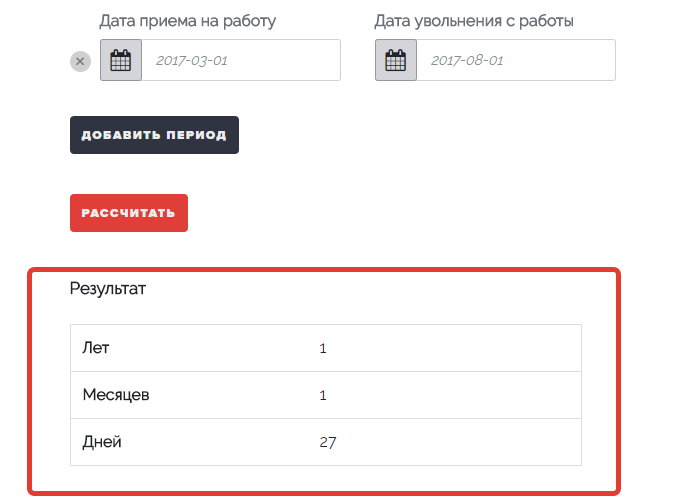

In the “Result” position you will see the total of the calculation in years, months and days. The values calculated by the work record calculator can be copied and saved.

Own wish

The first case of changing jobs is, of course, your own desire. Honestly, these things happen all the time. Few people want to be fired under the article. In such a situation, it is better to vacate the workplace yourself. In this case, the work book will not be tainted by any articles or indications of your carelessness.

If you leave your workplace of your own free will, without any reason, you risk interrupting your work experience. True, you will be given some period to find a new job. Now it is no more than a month. Practice shows that continuous work experience is maintained quite often. Few people would agree to give up work and then sit at home without money. People usually look for a new job, only then quit.

Legislative basis for calculations

The calculation is carried out in accordance with Federal Law No. 400-FZ dated December 28, 2013 “On insurance pensions”.

Previously, the concept of “work experience” was used, but since 2002 the clarified term “insurance period” has been used. It includes periods of deduction of funds from the employee’s salary to the Pension Fund of the Russian Federation, as well as others that the employee was able to justify. Thus, the insurance period represents the duration of working periods and other activities during which contributions for an employee are deducted to the Pension Fund of the Russian Federation.

Concept

This is employment, followed by work until retirement, without any interruptions. The break between jobs ranges from 1 to 3 months, depending on the conditions for losing the position.

There are also a number of situations when it is calculated according to certain conditions.

According to rules No. 252 of April 13, 1973, which were established by the Council of Ministers of the USSR, the following conditions fall under this concept:

- labor activity is carried out at one enterprise on a permanent basis;

- the break when changing jobs should not exceed one month (sometimes this period varies depending on the organization).

But at the moment these conditions have ceased to exist. The reason for this is the violation of the constitutional rights of a citizen by these rules. This aspect is regulated by the Determination of the Constitutional Court of the Russian Federation No. 16-0 dated March 2, 2006.

According to Law No. 255-FZ of December 29, 2006, the amount of material payments that an employee receives depends on the length of service along with the payment of all insurance contributions. Also, on the basis of this law, the amount of payments under the certificate of incapacity for work is approved.

It is calculated from percentages taken from the average salary:

- 60% for a period of up to five years;

- 80% for a period of up to eight years;

- 100% with more than eight years of experience.

According to Part 2 of Article 17 of the same law, if the permanent labor period worked before the adoption of this regulatory act is longer than the period for payment of insurance benefits, then the employee can demand to receive material payments on the basis of the former.

The amount of pension payments is currently not affected by the time of permanent employment.

However, despite the abolition of this concept, it is still applied and extended in the following cases:

- calculation of long service payments;

- calculation of wages;

- the amount of bonus received by the employee.

Thus, for example, employees employed in the healthcare sector receive a bonus, the amount of which depends on the time worked.

According to Law No. 76-FZ of May 27, 1998, this time period for military personnel is calculated according to the following algorithm:

- when serving under a contract, one day is equal to one day of work;

- during conscription service, one day is equal to two days of employment.

What is included in the insurance period

To independently calculate your work experience using a work book online, you need to know which periods can be included in it.

The current legislation gives a specific answer to this question: the duration of labor activity during which contributions to the Pension Fund of the Russian Federation were made (work under a contract, state civil or municipal service, activity in the form of individual entrepreneurs).

Not only periods of actual work activity, but also others are subject to inclusion in the length of service:

- military service (including activities that are equivalent to it);

- period of illness and receipt of social security benefits;

- a woman is on maternity leave;

- the time of being registered with the employment service as unemployed, including the period of paid public work, as well as moving to another place of residence for employment in the direction of the employment authorities;

- time spent in custody in case of unjustified prosecution or serving a sentence;

- time of care for each child up to one and a half years old (for one of the parents) - in total no more than 6 years;

- time spent caring for a person who is a disabled person of the first group, or an elderly person over 80 years of age;

- for wives of military personnel and diplomats - the time of accompanying spouses in the absence of employment opportunities (no more than 5 years).

In order to calculate not only the working time for pensions, but also for vacations, the following information is used:

- number of days actually worked;

- weekends, holidays;

- the length of time during which the employee retains his job (child care, vacation, sick leave);

- time of moving to get a job in another area in the direction of the state employment service;

- unjustified arrest and detention;

- forced absences;

- the duration of paid public work in the direction of the employment service, i.e. the need to work at an enterprise in the direction of government agencies.

Results

What is the end result? There is no continuous work experience as such in the modern world. More precisely, this concept exists, but it does not have any special practical application. And there is no point in chasing him.

Thus, if you do not plan to work for your own satisfaction or do not set yourself tasks from the series “continuous work for more than 5-10 years,” you should not torture yourself. Find a job and quit when necessary or possible. After all, in the future, only the total length of service that you have officially accumulated over your entire life will be taken into account.

Many people are now trying to conduct entrepreneurial activities, and also find unofficial employment in order to hide from taxes. Or they make a profit by some other methods (for example, from renting out an apartment). In general, whether to have continuous experience or not, everyone decides for himself. This is a private matter for the citizen. Military service in the army and the period of caring for children until they are one and a half years old are counted here.

Counting Features

When calculating (using an online calculator or manually, it doesn’t matter), the employer must adhere to the established requirements:

- Maintaining calendar order. The dates that are included in the work book (for individual entrepreneurs - in the tax return) are taken into account. If two or more periods coincide, the most profitable one is taken into account.

- Citizenship of the Russian Federation. If a person has the right to payment under the laws of a foreign state and there is no correlation with the norms of the Russian Federation, the period will not be taken into account in the calculation.

- Farming. Citizens working on private farms who are farmers will be able to include the time of such activity in their length of service, subject to contributions to the funds.

- Activities for an individual - subject to the implementation of activities under an agreement and payment of fees.

- Copyright agreement - subject to deduction of contributions to the funds.

- No retroactive effect. This means that if previously the period was included in the length of service, if the legislation changes, it may be included in the insurance period.

If there is no labor

An employer may be faced with a situation in which:

- no workbook;

- the work book is available, but there are no records in it for any periods of the person’s work;

- erroneous or incorrect information has been entered.

In the listed cases, in order to calculate the length of service correctly and confirm the period, you need a written work agreement. It must be drawn up in accordance with the laws in force at that time;

- collective farmer's workbook;

- certificate provided by the employer (or government agencies);

- extracts from orders;

- extracts from personal accounts;

- salary slip.

How to confirm other periods included in the length of service

A number of periods are taken into account for which contributions are not deducted, but the periods themselves are taken into account in the insurance period. How can I confirm them? Thanks to the legislator - answers to such questions exist:

- Military and other equivalent service - information from the military ID, certificates from the military registration and enlistment office, military unit, papers from the archive, work books. The offset occurs based on the actual duration of the period, without preferential calculations.

- Period of absence due to illness - documents from the employer or the Social Insurance Fund regarding the time of payment of sickness benefits.

- Time to care for a child up to 1.5 years old - birth documents, certificate of cohabitation, etc.

- Time registered with the employment service - a certificate from this organization.

- Time spent in custody - documents that need to be obtained at the FSIN institution.

- Caring for a disabled person of 1 year, a disabled child, a person over 80 years old - with the help of papers recording the fact and duration of disability - an ITU extract, and to confirm age - a passport, birth certificate.

- Spouses of diplomatic representatives during their stay outside the Russian Federation - with the help of certificates from the institutions that sent the employee to work.

- Spouses of military contractors who serve in places where there is no opportunity for employment confirm the period:

- until 01/01/2009 - certificates from military units, military registration and enlistment offices;

- after 01.01.2009 - certificates from the military unit, military registration and enlistment offices and certificates from the employment service.

- In case of service outside the state - only a certificate from the military unit or military registration and enlistment office.

Thus, the article provides an answer to the question: how to calculate length of service using a work book (the calculator and the rules for working with it are discussed above), and also provides a list of periods included in the calculation.