Summary

- NPF Prosperity I am a participant and contributor.

- When will payments to depositors of NPF Prosperity begin?

- When will the money be paid to the depositors of the NPF Blagodentstvo?

- I lost my contract with NPF Prosperity, what should I do?

- How to receive accumulated savings in NPF Prosperity.

- When payments are made under the NPF Blagodentstvo, it will soon be 2 years since the license was revoked.

- What to do next to get your money back from the NPF Prosperity.

- NPF Prosperity how to get money back

Questions

1. NPF Prosperity I am a participant and contributor.

1.1. Good afternoon. So we can congratulate you on this, ask your question and get an answer, and if you transfer the question to the VIP category, you will get several answers.

2. When will payments to depositors of the NPF Prosperity begin?

2.1. Hello, Ivan. Payments are being made. Information on the procedure and conditions for making payments can be obtained by calling the hotline: 8-800-200-08-05 and on the Agency’s official website on the Internet.

You need to be on the list of creditors. The liquidator, the Deposit Insurance Agency, has all the information.

3. When will the money be paid to the depositors of the NPF Blagodentstvo.

3.1. Hello, Ivan.

Payments are being made. Information on the procedure and conditions for making payments can be obtained by calling the hotline: 8-800-200-08-05 and on the Agency’s official website on the Internet.

You need to be on the list of creditors. The liquidator, the Deposit Insurance Agency, has all the information.

4. I lost my contract with NPF Prosperity, what should I do?

4.1. Contact the fund branch to resolve this issue.

5. How to receive accumulated savings in the NPF Blagodenstvo.

5.1. Hello! See the terms of the agreement; you must have a copy of the agreement with this NPF. The right to a funded pension arises from the moment the right to an old-age insurance pension becomes available.

6. When payments will be made under the NPF Blagodentstvo, it will soon be 2 years since the license was revoked.

6.1. — Hello, how will payments begin? Everyone will know about this, but in the meantime you should contact the Central Bank of the Russian Federation with this question. Good luck to you and all the best. :sm_ax:

7. How to proceed further to return money from the NPF Blagodenstvo.

7.1. Good day to you. If you want to transfer to a state PF, you need to write an application to the PF at the place of registration. Good luck and all the best.

7.2. You need to write an application to the Pension Fund, it should be written in two copies, and the receiving party must sign your copy.

8. Three years have passed since the arbitration court made a decision on the forced liquidation of NPF Blagodenstvie in connection with the revocation of its license. The Deposit Insurance Agency has not yet satisfied the demands of third-priority creditors. How to get my money back?

8.2. Wait. Because it is impossible to speed up this process. This is bankruptcy. Requirements are satisfied in order of priority. Federal Law of October 26, 2002 N 127-FZ (as amended on December 27, 2018) “On Insolvency (Bankruptcy)” (as amended and supplemented, entered into force on January 1, 2019), Article 16, 134

8.3. According to the Federal Law of October 26, 2002 N 127-FZ (as amended on December 27, 2018) “On Insolvency (Bankruptcy)” (as amended and supplemented, entered into force on January 1, 2019) - the procedure for satisfying creditors’ claims. Wait for your turn.

8.4. Good evening Inessa

You have the right to apply to the Agency with a request for payment of compensation for deposits from the day the insured event occurs until the day the bankruptcy proceedings are completed (see paragraph 2 of Article 50.16 of the Federal Law “On Insolvency (Bankruptcy), and if the Bank of Russia introduces a moratorium on satisfying creditors’ claims - until the end of the moratorium.

In order for individuals who invest their money to have guarantees in case the bank is declared insolvent, the law establishes the principle of mandatory participation of banks in the deposit insurance system (see Article 3 of the Federal Law “On Insurance of Individuals’ Deposits in Banks of the Russian Federation” dated December 23. 2003 No. 177-FZ) Compensation for deposits in a bank in respect of which an insured event occurred is paid to the depositor in the amount of 100 percent of the amount of deposits in the bank, but not more than 700,000 rubles. 5. The right to demand payment of insurance compensation on the deposit arises from the depositor in the presence of the circumstances specified in paragraph 1 of Art. 8 of Federal Law No. 177-FZ: revocation (cancellation) of a bank’s license from the Bank of Russia to carry out banking operations; introduction by the Bank of Russia, in accordance with the legislation of the Russian Federation, of a moratorium on satisfying the claims of bank creditors

8.5. Hello, payment to you must be made in accordance with Federal Law No. 127-FZ of October 26, 2002 “On Insolvency (Bankruptcy)” Article 16. Register of creditors’ claims 1. The register of creditors’ claims is maintained by an arbitration manager or registrar. The powers of the liquidator are exercised by the state corporation “Deposit Insurance Agency”, shake the money from them, the bankruptcy procedure and satisfying the claims of creditors is quite lengthy, you can file a complaint with the Central Bank of the Russian Federation, but this is unlikely to speed up the process, you just have to wait.

9. We have been depositors of the NPF Blagodentsiya with my wife since 2001. We received a letter from the DIA Group of Companies dated September 25, 2018, sent a letter to the liquidator on November 29, 2020, and no payments. We are currently pensioners. They are rude when they call the hotline. Buryatia VSZD PCh-12

Call the DIA and repeat the transmission of information by telegram.

10. NPF Prosperity has become bankrupt, how can I get my money back, which should be paid to me within 5 years, since I have been a pensioner since July 2020? I was told to write a letter to the Deposit Insurance Agency and find out if I am included in the register for payment. Is this really true?

10.1. In accordance with the decision of the Arbitration Court of the Irkutsk Region, the operative part of which was announced on January 16, 2020, in case No. A 19-27545/2018 Open Joint Stock Company Non-State Pension Fund Blagodenstvie (OAO NPF Blagodenstvie; hereinafter also referred to as the Fund ), OGRN 1143800000013, TIN 3808577700, registered at the address: 664011, Irkutsk, st. Rabochaya, 3, bldg. B has been declared insolvent (bankrupt), and bankruptcy proceedings have been opened against him. The powers of the bankruptcy trustee are exercised by the state corporation “Deposit Insurance Agency” (TIN 7708514824; address: 109240, Moscow, Vysotskogo St., 4) (hereinafter referred to as the Agency).

In order to participate in a bankruptcy case, creditors have the right to submit their claims to the Fund within two months from the date of publication of this message in the Kommersant newspaper. The bankruptcy trustee takes into account the received claims in the register of stated claims of creditors, which is subject to closure after the expiration of the above period.

Read more: Application for acceptance of a writ of execution by a bank

The claims of creditors included by the liquidator in the register of creditors' claims (hereinafter referred to as the Register) of NPF Blagodenstvie OJSC during forced liquidation are considered established in the amount, composition and priority of satisfaction, which are determined in accordance with Federal Law of October 26, 2002 No. 127- Federal Law “On Insolvency (Bankruptcy)”, and are included in the Register in the bankruptcy procedure.

In other cases, the claims of creditors are sent to the bankruptcy trustee with the attachment of judicial acts or other original documents that have entered into legal force or their duly certified copies confirming the validity of the claims, as well as to the Arbitration Court of the Irkutsk Region and the Fund.

Claims of creditors, as well as other postal correspondence are accepted by the bankruptcy trustee and the Fund at the address: 127055, Moscow, st. Lesnaya, 59, building 2.

When filing claims, the creditor provides information about himself, including last name, first name, patronymic, passport details (for an individual), name, location (for a legal entity), as well as bank details (if available). In addition, it is recommended to indicate the date of birth, postal address, insurance number of an individual personal account (for an individual), TIN (for a legal entity) and contact telephone number (if available).

Information on the progress of bankruptcy proceedings in relation to the Fund can be obtained on the Agency’s official website on the Internet information and telecommunication network (www.asv.org.ru, section “Liquidation of Non-State Pension Funds”) and by calling the hotline: 8-800-200-08 -05 (all calls within Russia are free).

11. NPF Prosperity has closed, the deposit insurance company has still not received funds from the personal deposit. Is it possible to return them without going to court?

11.1. Good afternoon

No, you need to be included in the list of creditors of NPF Blagodentstvo by submitting a corresponding application to the Arbitration Court.

12. I worked at Russian Railways and I had a deposit open, but more than 10 years passed, I accidentally found out about the bankruptcy of NPF Blagodenstvo. I even have a card with a login and password, but I couldn’t log into the site, how can I find out if I have any savings?

12.1. Hello, Natalya Sergeevna. I recommend that you contact the Pension Fund of the city of Irkutsk with your SNILS and passport and find out where your savings are currently located.

12.2. Good afternoon

Natalya Sergeevna, you need to clarify what agreement was concluded with NPF Blagodenstvo: - in Russian Railways on a non-state pension agreement, which was concluded by the employer of Russian Railways in favor of its employees for the formation of a non-state pension for Russian Railways employees; — in the Pension Fund of the Russian Federation about which insurer is taking into account the funds of pension savings for the formation of your funded pension; — and also to obtain information and enter the register of creditors, you should contact the state corporation “Deposit Insurance Agency”, which is the liquidator of NPF Blagodenstvo. Here is the link to the site: More >>>

13. My husband entered into a non-state pension agreement with the NPF Blagodentstvo, which was liquidated in 2020, the application was promptly submitted to the register of creditors’ claims, and in 2020 the husband died suddenly, my wife, at the moment, is being asked to file a claim. to the arbitration court, on the basis of which articles I must indicate in the application,

13.1. Good afternoon

NPF Blagodentstvo is currently not liquidated, but is in the stage of forced liquidation. The powers of the liquidator are exercised by the state corporation “Deposit Insurance Agency”

(TIN 7708514824) (hereinafter referred to as

DIA

) Since your husband is indicated in the register of creditors, and not you as an heir (legal successor),

you need to submit an application to the Arbitration Court in Irkutsk to replace the creditor

and attach a certificate of the right to inheritance according to the redemption amount of the pension agreement concluded between your husband and NPF Blagodenstva. If you do not have a certificate of inheritance of the redemption amount under the pension agreement, you must ask the notary to fill out a request with the DIA and send it to the address: 127055, Moscow, st. Lesnaya, 59, building 2. And only after receiving the above certificate, send an application to replace the creditor to the court.

Since the DIA is located in Moscow, I am ready to help you obtain information from the DIA, including about liquidation procedures and deadlines. Write a message if you need help.

The non-state Pension Fund "Blagosostoyanie" is a long-liver in the market of pension funds for insurance of individuals and legal entities. NPF Blagosostoyanie was established in 1996, and since 1999 it has acted as the single pension insurer for Russian Railways employees.

The fund's pension services have been available to employees in other industries since 2005. Individuals and legal entities are given the opportunity to choose an individual insurance program taking into account the needs of citizens wishing to enter into an agreement with a non-state pension fund.

Watch the report on the corporate pension program of Russian Railways:

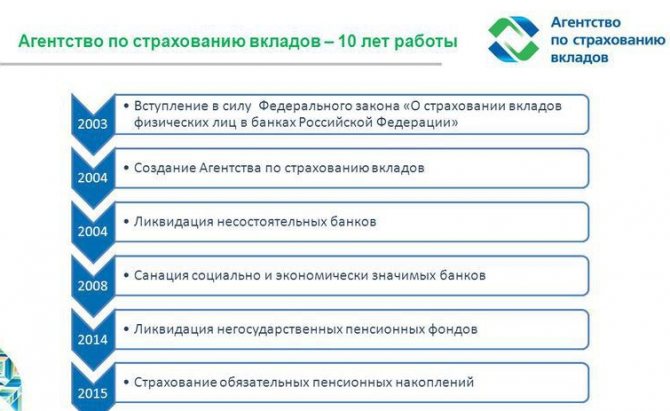

What systems provide state guarantees of payments for pension savings?

One of the important tasks of state regulation of the activities of funds managing pension contributions of Russian citizens is to guarantee the receipt of payments required by law.

In order to implement this principle, the legislator has provided various mechanisms, including:

- Creation of guarantee funds through the participation of several non-state pension funds, the activities of which are regulated by the internal rules of such funds based on the current pension legislation.

- Entry of a non-state pension fund into a mutual insurance company, which is a consumer cooperative whose purpose is mutual insurance of the property interests of participants.

- Concluding a voluntary insurance agreement by the fund, the purpose of which is to provide additional state guarantees to participants and depositors for the safety of their cash savings.

- Insurance of property liability of such organizations in the Deposit Insurance Agency, which acts (and through it the state directly) as the guarantor of citizens receiving the pension payments due to them under the law when appropriate conditions occur.

Important! The first three instruments, although provided for by law No. 75-FZ dated 05/07/1998 (Article 23), are used by funds at their own discretion. The indicated opportunities for non-state pension funds themselves are of a discretionary nature, i.e. are not mandatory, but only act as an additional means of attracting investors and protecting their property liability.

Reliability and profitability of the fund

Over the course of more than 20 years of its financial activity, NPF Blagosostoyanie has shown a high level of reliability. In 2005, the expert Agency assigned the fund an exceptionally high reliability rating. In addition to recognition of the company’s merits from the position of rating agencies, the activities of the NPF were awarded awards in the field of investment and improvement of pension programs. In 2007, the non-profit organization occupied a leading position among non-state pension funds, and in 2020 it tops the rating of 13 non-state pension funds in terms of asset value.

The rating and awards of the NPF are presented in the picture:

Since 2005, the company has been distinguished by a high level of profitability, which in its percentage ratio is close to the level of profitability of the Pension Fund of Russia.

| Profitability level of NPF “Blagosostoyanie” in comparison with the Pension Fund of Russia | ||

| NPF | Pension Fund | |

| 2012 | 7% | 9,2% |

| 2013 | 7% | 6,7% |

| 2014 | 6,3% | 2,6% |

| 2015 | 11,6% | 2,6% |

| 2016 | 10% | 10,5% |

Which is better - NPF or Pension Fund? Read our article on this topic HERE

Services for individuals

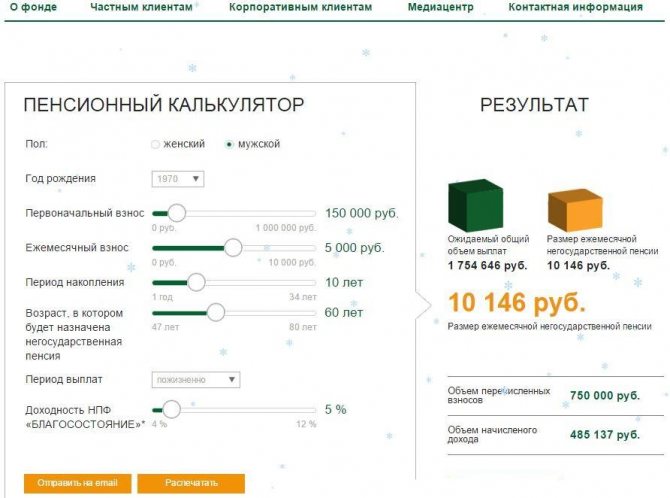

The level of profitability of the non-state fund is high due to the large-scale investment of funds from the company’s clients. The NPF offers its potential clients an individual pension program aimed at increasing the income of policyholders by investing deposits. The conditions provided to individuals are adapted to the wishes and capabilities of clients.

Read more: If the dismissal date falls on a holiday

When concluding an agreement with a company, policyholders are given the opportunity to independently control the amount of deposits and the period of their payment. The fund guarantees its clients annual accruals by increasing the company's profitability through investing deposits.

It should be taken into account that the initial payment when concluding an agreement with the company is 10,000. The size of subsequent contributions, as well as the periods for making them, is regulated by the client independently.

What guarantees does a non-state pension fund receive when joining the DIA?

There is no direct benefit for a non-state fund from participation in the insurance system. On the contrary, the obligation to pay contributions to the DIA creates an additional financial burden on the company and entails additional expenses.

At the same time, the law provides for the case when, at the expense of the fund formed by the DIA, the financial interests of the NPF will be protected. Thus, the DIA will bear expenses instead of the fund in the event that there are not enough funds in the citizen’s individual pension account to pay him the funds due upon the occurrence of an insured event specified by law.

An amount exceeding the funds available in the individual account must be drawn from the guarantee fund managed by the DIA.

In addition, with such a system, citizens can be sure that they will not lose their money in any case, but will receive all the payments due to them. Thus, NPFs receive additional funds for management from those citizens who, in the absence of an insurance system, would not dare to transfer funds for management into private hands.

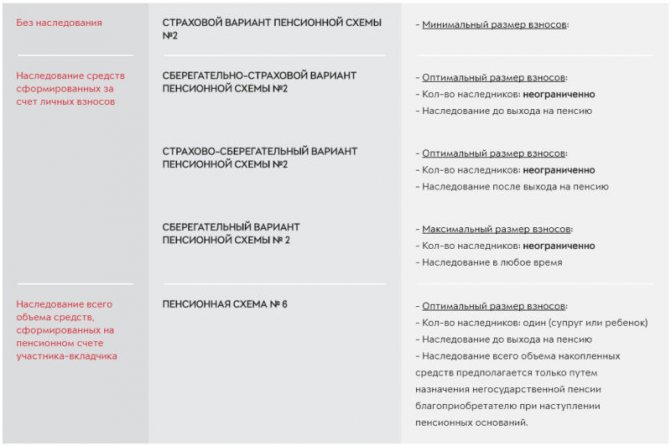

Services for legal entities

NPF “Blagosostoyanie” offers individual programs to legal entities, developed taking into account the characteristics of individual enterprises. The company assumes obligations to finance pension programs.

The agreement with the NPF guarantees preferential taxation for legal entities and exempts them from mandatory contributions to insurance funds.

The Russian Railways corporate system serves as a successful implementation of the mandatory pension program. The management of NPF “Blagosostoyanie” explains the stable payments of corporate pensions within the framework of compulsory pension insurance by the professional conduct of financial activities in the field of investing the deposits of their clients.

Pension programs of NPF "Blagosostoyaniye" are presented in the picture:

| Average size of corporate pensions of the Blagosostoyanie fund | |

| 2013 | 5 400 |

| 2014 | 6 000 |

| 2015 | 7 900 |

| 2016 | 8 700 |

| 2017 | 8 900 |

Personal Area

The company's clients are given the opportunity to check savings in the accounts of the Non-State Pension Fund "Blagosostoyanie" through remote access. In order to find out the size of your savings , you should register in your Personal Account on the NPF website at npfb.ru.

The right to use the services of the Personal Account is available to policyholders who have entered into an agreement with the company and filled out a form to agree to the terms of the online service. The application form can be downloaded from the company’s official website.

Please note that the client’s signature on the application form must be certified by a notary.

Next, you need to send the completed and certified application form to the NPF branch and wait for a response indicating the password to enter your account. For convenience and to save time, it is recommended to indicate an email address in the form, to which all the necessary information will be sent. The login to enter your personal account will be your pension insurance policy number (SNILS).

Employees of JSC Russian Railways can also find out the size of their savings through their personal account. In order to obtain a password to access online services, simply fill out a form in the HR department of your organization.

Watch a video about the capabilities of your personal account:

Access to remote access services is terminated upon termination of the agreement with NPF Blagosostoyanie.

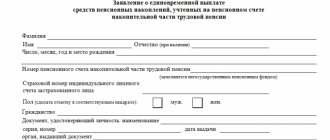

How to withdraw money?

If you want to terminate the contract with the Non-State Pension Fund “Blagosostoyanie” and withdraw your money, just write an application and indicate the bank account details for the transfer of insurance savings.

Even if the contract is valid for less than 1 year, the fund undertakes to pay out 100% of savings at a rate of 4% of investment income. With longer cooperation with the company, NPF clients can count on 100% of savings plus the actual rate of investment income. Payments of insurance savings are made within 2 months from the date of termination of the contract.

Subject to reaching retirement age, the payment of savings is made in accordance with the conditions specified in the contract.

A calculator for calculating pension payments is available on the fund’s website and looks like this:

Employees making contributions to the corporate pension program should contact the human resources department of their organization to obtain information on termination of the contract and early payment.

NPF bankruptcy is possible - what will be the citizens' money?

Over the past 4-5 years, 34 NPFs have ceased operations due to license revocation or bankruptcy. According to the law, when the license of a non-state pension fund is revoked, all savings of citizens and the register are transferred to the Pension Fund of Russia within 3 months.

What is bankruptcy for a non-state pension fund?

According to the law, a non-state pension fund cannot become bankrupt because it is a non-financial organization and is not engaged in commercial activities. However, NPFs may have their license revoked, which is what the Central Bank of the Russian Federation is doing. It is he who issues or revokes licenses from such Funds.

What will happen to citizens’ pension contributions if the NPF’s license is revoked?

Pension savings held in non-state pension funds are insured. They cannot be seized, and the NPF will not be able to spend them to solve financial problems.

As soon as a NPF’s license is revoked or another force majeure event occurs that leads to the liquidation of the organization, citizens’ pension savings are transferred to the Pension Fund of Russia within 3 months from the occurrence of such an event.

Next, the client determines which pension fund to enter into a new agreement with: state or non-state.

What will happen to the money from NPF investments?

If we talk about investment income, it will be returned to the insured investor only during bankruptcy proceedings. This will happen after the sale of the fund's property. Everything happens in the same way as the DIA returns money to bank depositors, when a special register is compiled with the full names of the depositors and the amounts they should receive.

After the sale of property and assets, the money received goes to pay investment income to insured investors. If the funds are not enough for a full refund, they are divided proportionally among all investors.

The first signs of possible bankruptcy

The NPF client needs to constantly monitor financial reports on the organization’s profitability. This information can be easily found on the Central Bank website, which publishes new data every quarter. The first alarm bell is a constant decline in profits and return on investment.

Of course, there is no need to immediately sound the alarm, because the economic situation in the country does not imply large-scale growth rates. It is clear that low returns over several quarters or a year do not indicate financial problems of the fund.

If a downward trend in profitability has been observed for several years in a row against the backdrop of an increase in profits in other funds, then this is something worth thinking about.

Similar quarterly reports can be viewed on the official website of non-state pension funds, which are required to publish them in the public domain. Some NPFs even open their investment portfolios so that investors can see exactly what assets a particular Fund invests in. This is a big plus, because here you can predict possible outcomes in advance.

In addition to financial reports, you need to closely monitor assigned ratings from rating agencies. All forecasts are reasonable and have a basis. If a rating agency sets a low level of reliability and predicts deterioration in the near future, this is a significant reason to think about changing NPFs.

What happens if you terminate the contract with the NPF?

If you suspect something is wrong and decide to terminate the contract with the NPF, foreshadowing the imminent bankruptcy, in this case part of the savings from investment income will be lost.

The NPF has no right to touch the funded part of the pension, but the investment income from placing the funded part of the pension will only be partially returned to the investor. In accordance with Russian legislation, a contributor can change his pension fund without penalties no more than once every 5 years.

If you do this more often, then everything will depend on the terms of the agreement with the non-state pension fund with which it was concluded. In most cases, investment income is lost for the last year preceding the year when the transition to another NPF took place. This once again proves how important it is to choose the right non-state pension fund to invest your pension.

Examples of bankrupt non-state pension funds

Today, 34 non-state pension funds are in the process of liquidation, the total amount of pension savings in which is over 100 billion rubles.

In 2020, the license of one of the largest non-state pension funds in Russia, Blagodenstvo, was revoked. According to the regulator, the revocation of the license was provoked by non-compliance with the law “On Non-State Pension Funds”. The license was revoked for repeated violations by the NPF in distributing, providing or disclosing information.

In the same year, a large NPF from Ulyanovsk-Povolzhsky launched the process of self-bankruptcy. The main reason was high competition and non-compliance with new legislation. NPFs had to completely change their work and increase their authorized capital in accordance with the law or close down.

Then CEO Pyotr Pyankov was accused of embezzlement of the pension fund, legalization of criminally obtained property, providing false information, etc.

In the process of forced liquidation of the NPF Strategy DIA revealed the insufficiency of the total property and assets to satisfy all the claims of creditors. The total number of depositors of this organization exceeded 130 thousand people.

A noteworthy case is that of Anatoly Motylev, who was the owner of 7 non-state pension funds whose licenses were revoked (“Sun. Life. Pension.”, “Protection of the Future,” “Sunny Time”), etc. For example, the largest Motylev Foundation is “Sun. Life.

Pension" was deprived of its license for frequent violations of the law on non-state pension funds.

In particular, he did not fulfill his obligations for the timely transfer of funds, did not comply with the instructions of the Central Bank of the Russian Federation to eliminate current violations, placed money in assets that did not meet the requirements of the Central Bank, etc.

What to choose: Pension Fund or Non-State Pension Fund?

If you immediately choose a reliable NPF, then this will be the best option. The risk of license revocation or bankruptcy of such a non-state pension fund will be minimal, and the profitability will be higher than when placing the funded part of the pension in the Pension Fund. Thus, the investor will receive more benefits from concluding an agreement with a non-state pension fund than with the Russian Pension Fund.

The most important nuance here is to choose a suitable non-state pension fund that will meet all reliability requirements:

- Term of the work. The older the NPF, the more reliable it is. The fact that the Fund survived the crisis of 2008 and subsequent ones speaks of its reliability and financial stability.

- and forecast from rating agencies. You should choose NPFs with a moderate or high reliability rating. The forecast should be at least stable. These indicators indicate whether the NPF can fulfill its obligations to depositors, whether it is resistant to external market factors, etc.

- Founding organization. If the Fund was created by a large and reliable company that is trusted by millions of Russian citizens, then it is worth paying attention to the created Fund.

- The fund's profitability and financial indicators. The higher the yield, the better for the investor.

- User-friendly interface, feedback, customer service. Clients often forget about the nuances of service. For example, a free hotline in Russia, service and a convenient personal account, but in vain. Such nuances play an important role when using any services frequently.

On the other hand, placing funds in non-state pension funds is very risky. Already 34 organizations are at the stage of liquidation, and most other non-state pension funds are bubbles consisting of several small funds that have been bankrupt for a long time, but not officially. It is clear that sooner or later they will also “burst.”

Against the background of Rosgosstrakh NPF, it becomes clear that it is becoming more difficult to trust large companies with big names. After all, they use money to support their own business, actually buying shares of their own companies.

Source: https://investor100.ru/vozmozhno-bankrotstvo-npf-chto-budet-dengami-grazhdan/