In the system of compulsory pension insurance, Sberbank NPF has become one of the leaders. This is a subsidiary organization associated with PJSC Sberbank. Not only those who have already collaborated with the company before, but also new clients who prefer reliable insurers can apply for services.

Every year the client receives a message at least once about the status of his account. To do this, notifications in writing are sent to the registration address. But there are other options for obtaining information.

Profitability of Sberbank NPF

An indicator such as the fund's profitability tells how much the organization earned on investments, which means how much profit clients received. Yield by year is reflected on the official portal of Sberban NPF in the form of convenient charts. According to the data, the interest rate is rising.

A constant analysis of the fund's profitability over 8 years shows that in 2014-2017 there was an increase in the number of people insured under compulsory pension insurance programs with non-state financing. It was then that the accumulated profitability began to grow from 62 to 115%.

| Year | Accumulated profitability, % |

| 2014 | 66.2 |

| 2015 | 82 |

| 2016 | 99.2 |

| 2017 | 115.7 |

The most profitable Sberbank online deposits for pensioners

Today, in order to make a deposit at a high interest rate, a pensioner needs to have a computer with an Internet connection or run to the nearest Sberbank ATM. This is because now the most profitable and profitable for pensioners are deposits of individuals “Save online” and “Replenish online”, issued remotely.

Today, deposit rates when opened via the Internet are higher than when made at a bank branch.

There is only one nuance to consider. All persons receiving a pension, regardless of age, can open a deposit in the office. And in the Internet bank, deposits on preferential terms are available only to old-age pensioners and so-called pre-retirees: women over 55 years old and men over 60 years old.

Let’s look at the current special conditions for older people and pensioners for online deposits.

2.1. Sberbank deposit “Replenish online” for pensioners

This is a replenishable Sberbank deposit for those pensioners who prefer to save and regularly set aside their funds.

Interest is calculated monthly and can be withdrawn, but if you are saving, it is better to leave it in the account. This money will increase the deposit amount, increasing income next month.

The “Replenish Online” deposit is made via the Internet or at an ATM.

Conditions

- Duration: 3 months. - 3 years

- Amount: from 1,000 rubles

- Replenishment: provided

- Minimum contribution amount: • in cash - from 1,000 rubles. • non-cash - unlimited

- Partial withdrawal: not provided

- Capitalization: provided. The accrued interest is added to the deposit amount, increasing income in subsequent periods.

- Interest accrual: monthly. The accrued interest can be withdrawn or transferred to the card account.

Interest rate for pensioners (% per annum)

without capitalization / with capitalization

In rubles

| Term | Interest rate |

| 3-6 months | 2,60 / 2,61 |

| 6-12 months | 3,00 / 3,02 |

| 1-2 years | 3,05 / 3,09 |

| 2-3 years | 2,80 / 2,88 |

| 3 years | 2,55 / 2,65 |

Pros and cons of the “Replenish Online” deposit

Increased rate, it is possible to top up your account.

There is no possibility of partial withdrawal of money without losing interest.

See what the interest rate on deposits at VTB Bank is today - more details →

2.2. Sberbank deposit “Save online” for pensioners

We can consider that in 2020 this is the most profitable deposit in Sberbank for pensioners, since it has the maximum rate. Interest is calculated monthly. And the client himself can decide what to do with them: withdraw or leave on the account (capitalize).

“Save Online” deposit is made via the Internet or at an ATM.

Conditions

- Duration: 1 month. - 3 years

- Amount: from 1,000 rubles / 100 dollars

- Replenishment: not provided

- Partial withdrawal: not provided

- Capitalization: provided. The accrued interest is added to the deposit amount, increasing income in subsequent periods.

- Interest accrual: monthly. The accrued interest can be withdrawn or transferred to the card account.

Interest rate for pensioners (% per annum)

without capitalization / with capitalization

In rubles

| Term | Interest rate |

| 1-2 months | 2,05 / 2,05 |

| 2-3 months | 2,35 / 2,35 |

| 3-6 months | 2,85 / 2,86 |

| 6-12 months | 3,35 / 3,37 |

| 1-2 years | 3,50 / 3,56 |

| 2-3 years | 3,35 / 3,46 |

| 3 years | 3,20 / 3,35 |

In US dollars

| Term | Interest rate |

| 6-12 months | 0,05 / 0,05 |

| 1-2 years | 0,35 / 0,35 |

| 2-3 years | 0,35 / 0,35 |

| 3 years | 0,35 / 0,35 |

Pros and cons of the “Save Online” deposit

Maximum interest rate.

It is not possible to replenish your account or partially withdraw money without losing interest.

See the most profitable deposits for pensioners in the top 10 banks →

How to register in your personal account of Sberbank NPF

All clients of the Sberbank non-state pension fund can log into their personal account. However, it is worth noting that all the features of the online account can be used by those who:

- entered into an agreement;

- opened a pension savings account;

- consented to the processing of personal information.

Registration of a remote account is available on the official page of the fund.

Registration

How to submit an application

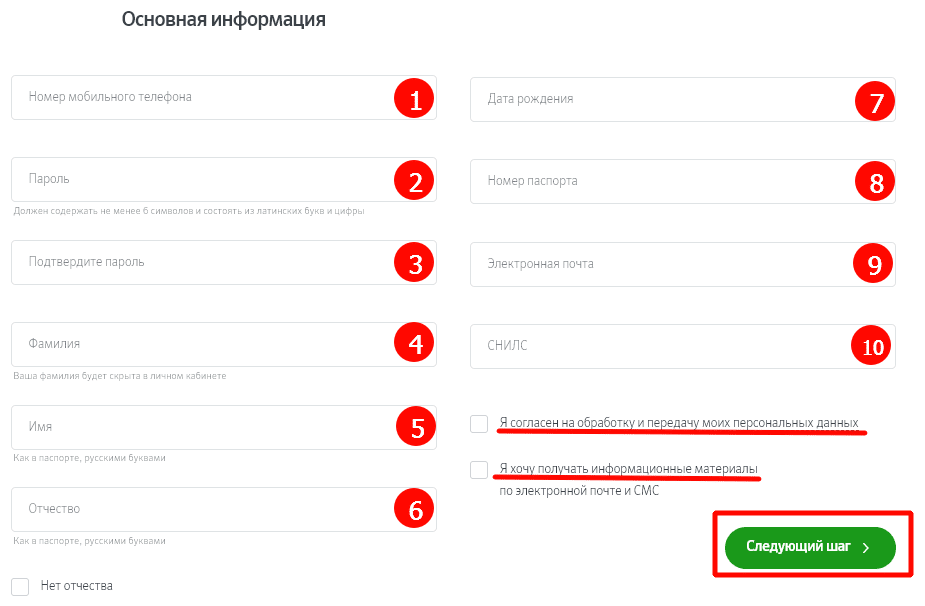

To register a personal account, you must fill out an online application using the form provided on the page.

- Phone number to which the system can send messages with an authorization code in the personal account.

- Create a password to access your account and repeat it. If the passwords do not match, the user will see a warning. Check the combinations are correct.

Important! The security system requires you to create a password consisting of 6 or more characters, including Latin characters and numbers.

- Indicate personal information in the appropriate lines: information from your passport, as well as the insurance number of your individual personal account.

- Enter your email - it will be needed to confirm registration actions on the site.

- Consent with the processing of personal data is expressed by checking the appropriate box.

- Additionally, you can express your desire to receive informational messages.

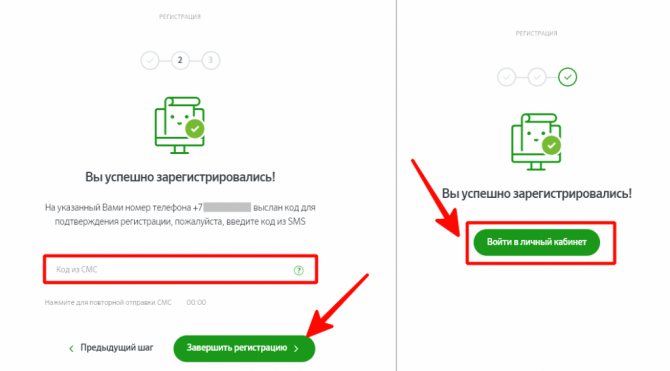

Confirmation of registration is carried out by entering a combination of characters, which is automatically generated and sent to the phone number specified in the application form.

Receiving information through Sberbank

You can check your savings through the bank’s services, or in person at its branches.

Generating statements through online services

- Electronic.

To use this service, you must first register in the mutual exchange service with the pension fund. For this:

- contact Sberbank with a written application;

- gain access to a remote Internet service;

- open the electronic application form through the “Other” – “Pension programs” tab by clicking on receiving an extract;

- fill out the application indicating your passport information and submit it;

- confirm the above information;

- monitor the execution of the request;

- When you receive the “completed” status, open the document.

- Receive on paper.

For this:

- to fill out and submit in the “Application” section;

- fill in the details of your identity document, date and number of the NPF agreement, address for delivery of the document;

- receive an extract to the above address.

There are no commissions charged for these transactions.

Login to your personal account of Sberbank NPF on lk.npfsb.ru

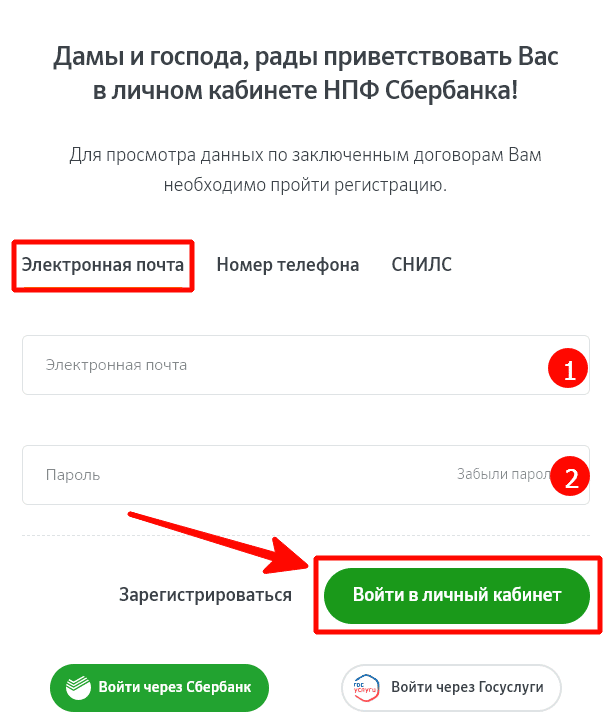

Authorization in the online account of Sberbank NPF can be done on the page. It is possible to authorize in different ways, which we will discuss below. Select the appropriate method, provide authorization information and log into your personal account.

Login to your personal account

Please note that any method of logging into your personal account requires entering the password set at the time of registration.

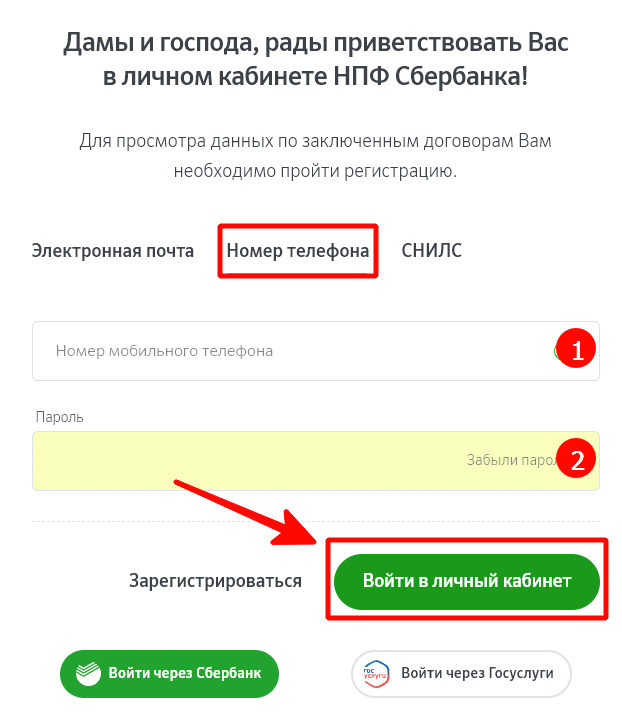

Login for individuals by phone number

- Enter the phone number you provided in the registration form.

- Enter your password.

You can also choose the option of authorization using your email address.

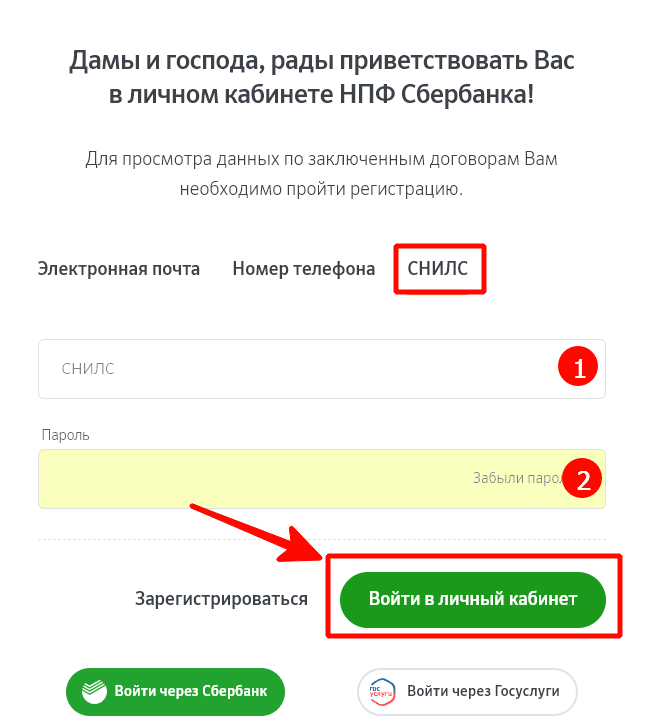

Login using SNILS

The insurance certificate number is entered in the first line, and the password is entered in the next line.

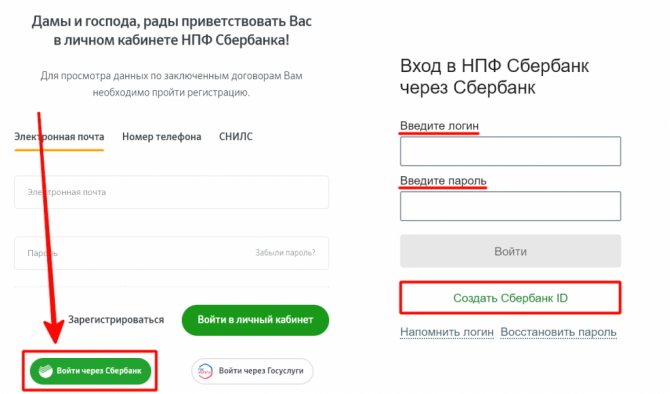

How to log in through Sberbank Online

The founder of Sberbank NPF is the bank of the same name, therefore, for the convenience of clients, authorization has been implemented through Sberbank’s remote banking service system. Login to the personal account of Sberbank NPF through Sberbank Online is carried out after specifying authorization data.

Login through Sberbank Online

If the policyholder does not have a Sberbank personal account connected, then you can create a Sberbank ID:

- indicate the numbers from the Sberbank card to which the Mobile Bank service is connected;

- confirm ID registration;

- the system will send personal login information.

Now you can log into your personal account of Sberbank NPF.

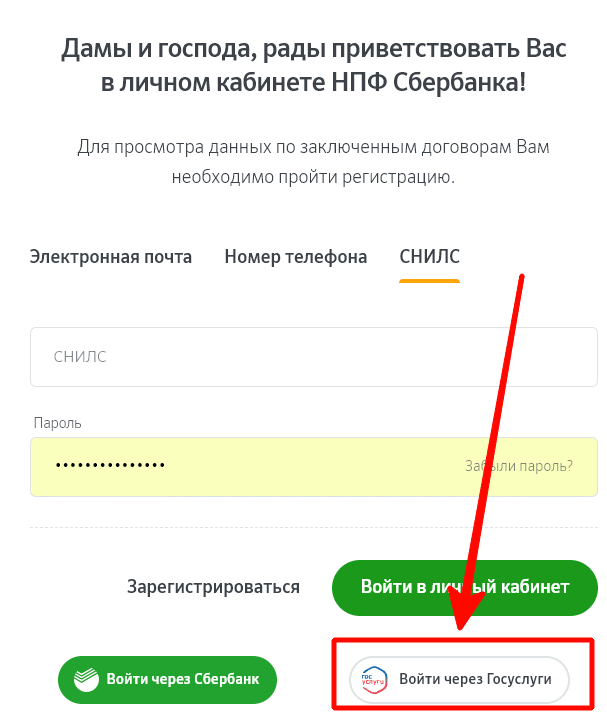

Login through State Services

The State Services portal interacts with an increasing number of companies every year and allows you to log in with a single login and password in different systems. Select the authorization method through State Services and use the password of this portal.

Login through State Services

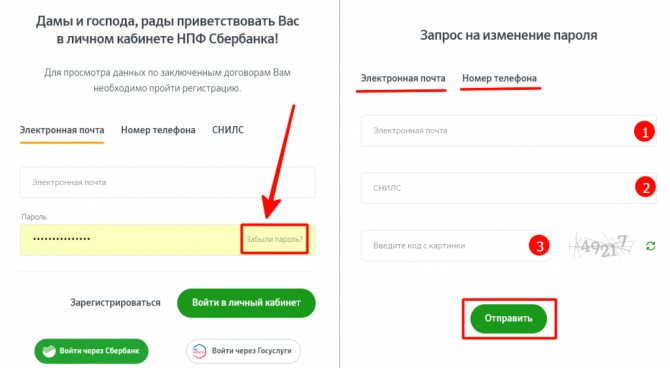

Recovering lost login and password

Lost authorization data can be restored without visiting offices. Click the “Forgot password” button and enter any data of your choice to identify the user: email, phone number, SNILS. Confirmation of the operation consists of the verification code from the picture.

Password recovery

What does Sberbank offer today?

3.5% interest

on balance

before 30%

cashback

₽0

per month

Online application

Today, Sberbank offers a number of deposits that depend on your financial management strategy:

- Old savings deposits “Online Plus”, “Save” and “Give Life” with a favorable interest rate;

- “Top up” deposit with the option to top up your account;

- “Manage” consumer deposit with the option of partial withdrawal and replenishment without damage to the invested funds.

Any of the offers is intended for both individuals and pensioners. You can make a deposit at the nearest Sberbank branch or through Internet banking.

In addition to them, Sberbank can offer pensioners special favorable conditions. For example:

- “Pension Plus” for receiving pensions, benefits and other social benefits;

- “Replenish” and “Save” on favorable terms for people of retirement and pre-retirement age.

The whole essence of the benefits of deposits for individuals of retirement age lies in the established interest rate, regardless of the established terms and amount.

Autopay settings

Persons insured by Sberbank NPF have the opportunity not to miss contributions to their pension account using the automatic payment service. It is available for connection after the contract is loaded into the database. The user independently sets the transfer amount and frequency. The operation is not subject to commission if carried out from a Sberbank account or card. When auto-replenishing an NPF account from a card of another bank, you should clarify the amount of the commission.

Important! Autopay is available to those who have already made the initial funds transfer.

Transfer of pension savings

If there is a need to transfer funds to a new non-state PF, the following steps are taken:

- The most suitable investment option is selected. It is advisable to obtain as much information as possible about each possible option.

- The transfer application form is filled out. There are 2 types of transfer: early and urgent.

- Applying to a new NPF with an application.

- Waiting for the application to be reviewed.

The same sequence of actions applies to all pension funds.

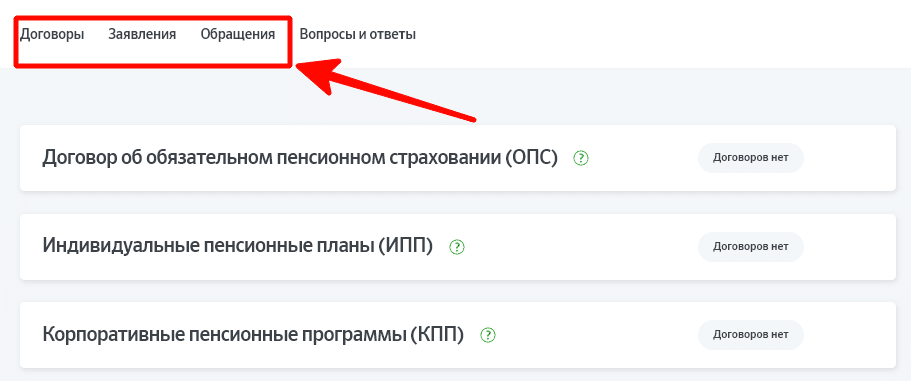

Section of contracts and statements

In the corresponding section of the online account of NPF Sberbank, you can view all the documentation. If the client does not see the documents in the personal account, this is most likely due to the fact that the contract was not concluded or the client’s personal data has been changed since its conclusion. Sometimes the absence of a contract is due to the fact that personal information was entered incorrectly during registration. If there are no reasons for the absence of documents, then they are available online - they can be viewed and printed.

Conditions for early termination of deposits in Sberbank

In any unforeseen situation, if you need money before the end of the deposit, you can always get it. But you may not see the percentages. For “Replenish” and “Save” deposits, issued both in a bank branch and online, the following conditions for early termination apply today:

✓ For deposits for a period of up to 6 months (inclusive) - at an interest rate of 0.01% per annum.

✓ For deposits for a period exceeding 6 months:

- during the first 6 months after opening a deposit - based on an interest rate of 0.01% per annum;

- after 6 months after registration of the deposit - based on 2/3 of the interest rate established by Sberbank for this type of deposit on the date of opening (extension) of the deposit.

In case of early termination of the deposit, interest is recalculated without taking into account monthly capitalization.

Conditions for prolongation of deposits

If the money is not withdrawn at the end of the deposit period, the deposit will be automatically extended. Moreover, it will be extended on the terms and at the interest rate that will be in effect for this deposit on the date of extension.

The number of automatic contract renewals is unlimited

For deposits, you can issue a power of attorney and draw up a testamentary disposition.

See: 50 of the most profitable deposits today. Read more →

How to terminate an agreement with NPF Sberbank

The law establishes a restriction that allows you to terminate cooperation with a non-state pension fund only once a year. It is worth noting that you cannot refuse service within the framework of state pension insurance, but the funded part can be transferred to another fund. Termination of the contract is stated in the document itself and consists of a written notification of such a desire.

Attention! Do not forget to indicate in the application for termination of the agreement with Sberbank NPF the details by which funds should be transferred from the account.

How to obtain information about the savings of the deceased?

If a person saving money for retirement dies, the right to the collected funds passes to the legal successors of the deceased.

You can find out how much money the deceased left and receive the amount due only after submitting an application in the appropriate form to the fund, as well as the necessary additional documents.

The legislation of the Russian Federation states that only the official successors of the deceased who have opened proceedings on the issue have the right to apply to the NPF. Also, the transfer of funds can be carried out as part of the progress of the probate process.

The savings are paid to the heir or heirs no earlier than six months after the death of the holder. In most cases, the process is completed no earlier than after 7 months. This time is necessary for the administration of NPF Sberbank to study the issue. If a positive decision is made, the applicant is notified that he can receive the amount due to him. The applicant is also notified if the result is negative.

If you need to get information about how much has been accumulated in the PF account of the deceased, there are several options for contacting:

- according to the SNILS of the deceased online;

- by contacting one of the offices mentioned above in person;

- through the State Services portal;

- through a banking institution.

How to find out the checksum of a Sberbank bank card?

Customer reviews about the personal account of Sberbank NPF

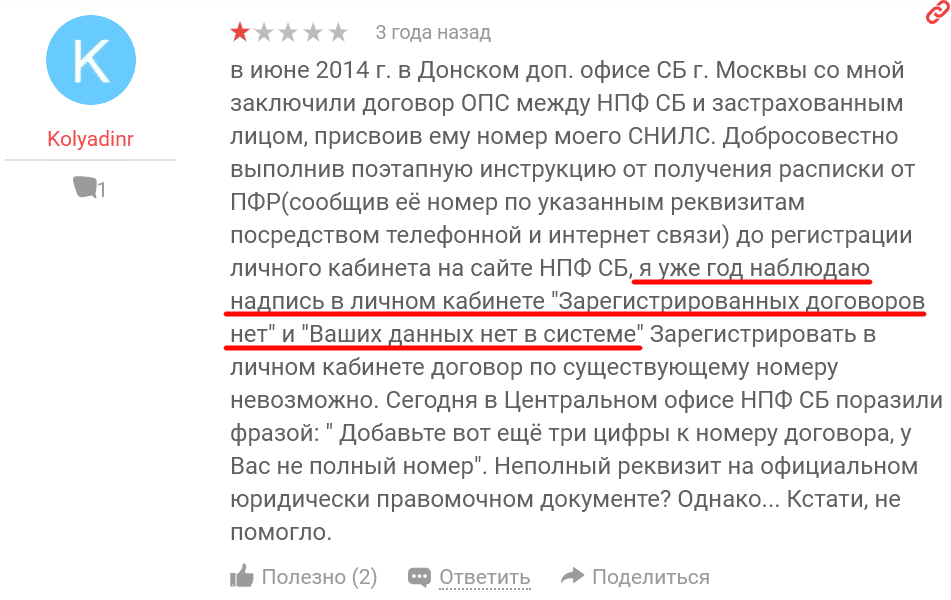

Clients of Sberbank NPF on various forums and websites note that their personal account does not always provide data on contracts. Very often you can see a message indicating that there is no concluded contract and no data in the system. Users of the review service under the nicknames Larisa Gavrikova and Koliyadinr and many others encountered this problem.

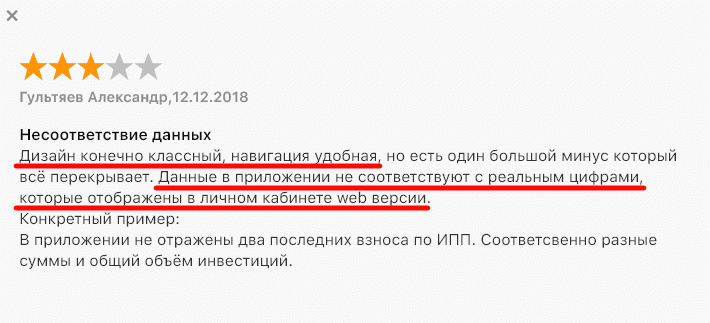

Those clients who have installed the mobile application, for example, Alexander Gultyaev, note the attractive design, easy navigation, but pay attention to the fact that the account balance in the personal account on the mobile device does not always coincide with the balance displayed on the site.

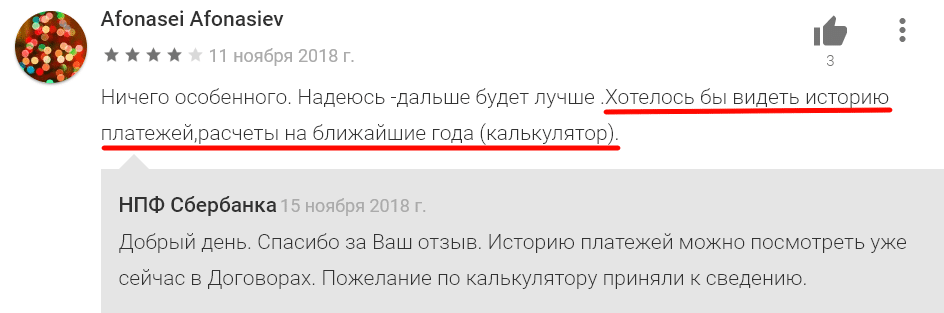

A user with the nickname Afonasei Afonasiev proposes to introduce a display of payment history and a functional calculator for calculating savings into the Sberbank NPF mobile application.

Are you a client of Sberbank NPF? Do you like your personal account and its functionality? Share your experience of interacting with a non-state pension fund with our readers.

Personal account of Sberbank NPF: login on the official website

3.2 (63.64%) 11 votes

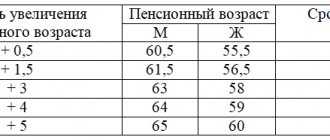

What is the funded part of a pension?

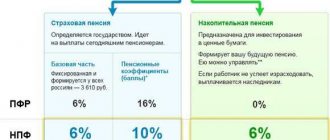

Until the end of 2013, part of the insurance premiums withheld from salaries was directed to the funded part of citizens' pensions. Its value was 6%. Since 2014, this program has been frozen, and now all pension deductions go to the insurance part.

Insurance part

It is formed through mandatory insurance transfers from employees and goes towards cash payments to current pensioners. This indicator affects the amount of future pension benefits for the employee himself, based on the amount and duration of contributions. Accounting for deductions is carried out in points, representing a complex calculation system. Insurance savings are managed exclusively by the Pension Fund.

Where to see your points

- In a proven way in the branches of the Pension Fund of the Russian Federation. They will provide free information about all accruals for your future pension. You must apply with your passport and SNILS.

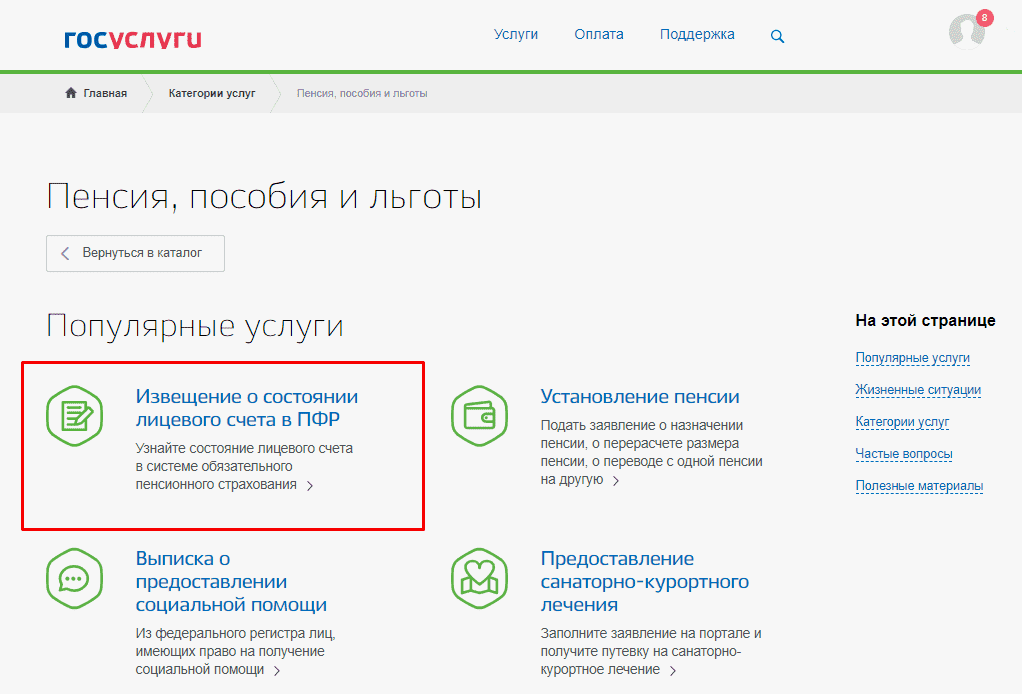

- You can also obtain such data on the government services portal. If you do not yet have registration on this site, go through the procedure for verifying documents (passport, SNILS and TIN) yourself by clicking on the “registration” button, or contact the MFC or any government agency. In the latter case, you will have immediate access to the services. If you choose the first option, you will have to wait to receive the password on paper by Russian Post. Interaction with the Pension Fund takes place in the section of the portal of the same name.

Cumulative part

You can manage these savings by transferring them to various non-state funds. Their size increases due to investment income, subject to successful placement. The state has given the insured the right to choose: leave their savings in the State Pension Fund of the Russian Federation or transfer them to a non-state pension fund.

Advantages of storing the savings portion in a non-state pension fund

Firstly, it is a higher return on investment.

This is due to the wider capabilities available to NPFs. If the fund invests your savings wisely, you can not only beat inflation, but also get a significant increase.

Secondly, the cumulative part is inherited. It can be received both by legal heirs and by third parties by written order of the insured. This happens if a person does not live to see his pension (has never received it).

Risks of NPF

If the fund you choose performs poorly, you may not receive income or go into the red. Although the state is now closely monitoring the work of such funds, imposing certain requirements on them. In the process of sifting out of several hundred, a few dozen remained. The state guarantees the safety of your savings portion in the event of the revocation of the NPF’s license. The list of accredited funds can be viewed on the Pension Fund website.

Also, to choose a non-state pension fund wisely, it is recommended to evaluate such an indicator as stability of work. To do this, look at their performance indicators over the past 5 years. If a fund has an average investment percentage, but it is stable every year, this is a good indicator. If the percentage of income jumps from high to negative income, the fund is engaged in risky operations and you can expect anything from it.

It is better to choose a non-state pension fund with representative offices in your region, because you will have to interact with this fund in resolving various issues (receiving savings, inheriting them). And transferring originals of important documents by post can take some time and be risky in terms of possible loss.

What fund does the citizen belong to?

Before viewing your savings in the Savings Bank, you need to check whether they are there. You can find the necessary information on the Government Services website. At the initial stage, they register and go to their personal account. From the list - “Notice about the status of a personal account.” It contains the following information:

- Personal data of the insured citizen.

- Size of the coefficient.

- The amount of money generated from insurance premiums.

- Insurer.

- Data on the savings part.

The service works free of charge in real time.

Which to choose?

To answer the question: which Sberbank deposit is the most profitable for pensioners, you need to understand for yourself the purpose for which money is deposited at bank interest.

- In order to obtain maximum benefits, the most profitable is “Online Plus”. The main caveat: you should only invest money into the account for a period of 6–12 months. For other terms, the “Save” deposit will show greater profitability. However, this also has its drawbacks - it cannot be replenished.

- In order to accumulate funds, the most profitable deposit for pensioners in Sberbank will be “Replenish” with an increased interest rate and the possibility of replenishment. You cannot withdraw money (you can, but this will affect the rate) without losing interest.

- In order to generate income with the ability to manage your funds, it is worth taking a closer look at the “Pension Plus” and “Manage” deposits. Using them, you can withdraw part of the funds from your bank account at any time, if desired.