Are citizens of Ukraine, Kazakhstan and Uzbekistan entitled to a Russian pension?

The question of whether residents of the CIS countries are entitled to a pension benefit by right of holding a residence permit in Russia can be answered unequivocally: in accordance with constitutional article No. 62 of Russian legislation, all migrants legally residing in the country have rights similar to local citizens.

And according to Article 39 of the Constitution of the Russian Federation, citizens of Ukraine, Kazakhstan, Uzbekistan, as well as all residents, without exception, who legally work in the territory of the Russian Federation, are guaranteed to be provided with all social benefits, which include:

- old age and disability pensions;

- compensation payments for the loss of a breadwinner;

- All accruals and payments are due to persons, regardless of their citizenship. If they live and work on the territory of Russia, which is documented in accordance with all norms and requirements, then they will receive the social benefits and compensation due to them.

Federal Law of Russia No. 115, which was adopted and approved back in July 2002 and is in force now, in 2020, states that a residence permit is a valid official confirmation of the legal presence and residence of stateless persons in the country.

This Law of the Russian Federation is valid for the appointment and issuance of all benefits and allowances, including the right to receive an old-age pension.

Return to contents

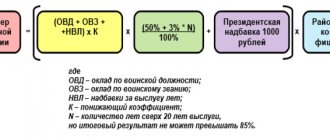

Procedure for calculating old-age benefits

If a foreign worker has received official employment in our country, this means that the employer pays contributions for compulsory pension insurance in the amount of 22% of monthly earnings. His future pension is formed from this money. And not only the insurance part, but also the accumulative part, if the person worked in those years until it was abolished. This means that the future pensioner has the right to dispose of it at his own discretion, that is, send it to a non-state pension fund to receive income from investments or receive a lump sum payment.

This procedure applies to all citizens and non-citizens of the country. The same applies to the conditions of retirement. In 2020, a person can receive an old-age pension if:

- appropriate age (including early retirement);

- insurance experience of at least 8 years;

- accumulated 11.4 points.

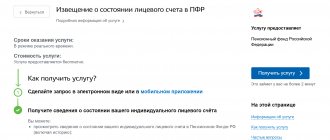

Each employee can find out his insurance length and the number of points depending on his salary without leaving home via the Internet. This can be done in your personal account on the official website of the Pension Fund or by requesting an extract on the status of your personal account on the government services website.

Is work experience in the CIS countries counted when calculating a pension?

This issue concerns all citizens who have worked at enterprises in their country and have now obtained a residence permit and are living in Russia. Both work and insurance experience, subject to the necessary deductions, are taken into account when calculating pensions for foreigners permanently residing in the Russian Federation . Here is a list of countries to which this applies:

- Armenia;

- Georgia;

- Kazakhstan;

- Belarus;

- Ukraine;

- Moldova;

- Tajikistan;

- Lithuania;

- Turkmenistan;

- Kyrgyzstan.

Here, any nuances matter: both harmful conditions and wages. All this is reflected not only in the mandatory assignment of benefits, but also in its size.

Return to contents

Receiving a Russian pension by foreign citizens

Foreign citizens, including citizens of the CIS, permanently residing in the Russian Federation, have the right to receive a Russian pension on an equal basis with Russian citizens (except for cases established by federal law or an international treaty).

To obtain the right to a Russian pension, foreign citizens, including citizens of the CIS, must have a residence permit. Otherwise, they do not have the right to a pension (Article 2 of the Federal Law of July 25, 2002 N 115-FZ “On the legal status of foreign citizens in the Russian Federation”). Otherwise, the conditions for receiving a Russian pension for foreign citizens do not differ from the conditions for citizens of the Russian Federation.

Foreign citizens or stateless persons can apply for an old-age insurance pension in the Russian Federation only if they permanently reside on the territory of the Russian Federation, that is, they have a residence permit.

Foreign citizens receive a Russian pension on the same basis as citizens of the Russian Federation, unless otherwise provided by law or international treaties of the Russian Federation (Part 3, Article 3 of the Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation "; Part 3, Article 4 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”).

If the validity of the residence permit has expired, the payment of the insurance pension is suspended for six months starting from the 1st day of the month following the month in which the validity of the specified document expired (clause 4, part 1, article 24 of the Law of December 28, 2013 N 400 - Federal Law “On Insurance Pensions”). If a foreign citizen pensioner has not presented a residence permit, payment of the insurance pension is terminated on the 1st day of the month in which the six-month period provided for in clause 4, part 1, art. 24 of the Law of December 28, 2013 N 400-FZ “On Insurance Pensions”).

The procedure for obtaining a pension in Russia, provided for foreign citizens

So, how are pensions calculated for citizens of the Russian Federation who have citizenship of another country, but also have a residence permit in Russia? The first step is for an individual under such circumstances to obtain qualified advice from the Russian pension fund located at the place of residence.

Fund employees responsible for calculating pensions must provide a sample application and a list of documents that need to be prepared. Here is a standard list of required papers:

- Residence permit (you can download the application here, sample form here);

- passport of the country of which the citizen is a national;

- pension insurance certificate;

- Russian-style work book;

- salary certificates for certain years;

- documentary evidence of work in hazardous production;

- certificates from other places of work, certified extracts from work books;

- papers on change of surname;

- documentary evidence of disability.

You must apply for a pension in advance, approximately 60 days in advance. A work book issued in Russia may not be required, especially in cases where you already have the right to confirm your pension in another country.

To be able to receive a pension benefit in Russia, it must be re-registered in accordance with all the rules provided for by law. It is clear that after this the pension will not be issued in the same place.

Regarding the myths that affect the timing of receiving a pension, that supposedly it takes 6 months to process the benefit after submitting the application, it is worth noting that they have nothing to do with the real state of affairs.

In this situation, things are somewhat simpler: payments to pensioners are freely assigned only if they obtain a residence permit in Russia .

Return to contents

Conditions for pensioners

Many fellow citizens are thinking about spending their old age in another, more economically developed country. Russians are also attracted to places on the planet with a comfortable climate and generous nature. Is it possible to move?

It is important to study the requirements for visitors in each specific country, since the grounds for granting a residence permit to pensioners in Europe in 2019 vary. In some states, older people are accepted if they have relatives among local residents. In other countries, it is necessary to prove that the migrant has sufficient means of subsistence.

In Russia, foreign pensioners also need to obtain a residence permit in order to live in the country legally and have broad rights. Depending on the circumstances, the reasons for moving may vary. It’s good if you have Russian relatives. Immigration is possible within the framework of the State Program for the Resettlement of Compatriots.

Procedure for obtaining a residence permit

In general, the algorithm of actions is practically no different from the procedure that other visitors undergo. First, you should make sure whether there are grounds for obtaining status under a simplified scheme. Next, the relevant documents are prepared. The package usually includes:

- application for a residence permit for pensioners;

- passport;

- photos;

- certificates of financial security and health status (meaning medical certificates of the absence of diseases dangerous to society);

- papers confirming that a person has housing.

Initially, a foreigner enters the Russian Federation legally, goes through the registration procedure, and then receives a temporary residence permit. Further, on the basis of such permission, he is engaged in obtaining a residence permit.

What awaits foreign citizens if work in Russia was temporary?

Contrary to all the fears of those citizens who, after living in Russia for a certain time, returned to their country, it is worth noting that all accruals made to pension accounts will be taken into account when calculating pensions. This is due to the fact that most CIS countries have concluded agreements with Russia on the offset of contributions.

Thus, a person is guaranteed by law to receive the right to maintenance, regardless of the country in which he worked.

Residence permit for pensioners in Russia

One of the most pressing issues for migrants who came to Russia from different CIS countries is and remains the issue of receiving a pension benefit. Today it is especially hotly discussed in connection with the huge number of migrants arriving in the Russian Federation for permanent residence.

One of the most pressing issues for migrants who came to Russia from different CIS countries is and remains the issue of receiving a pension benefit

Pensioners regularly turn to the Federal Migration Service with a request to explain to whom, how and when they are entitled to a pension in the Russian Federation, and whether they are entitled to it at all.

According to the laws of the Russian Federation, in particular, Article 62, Part 3 of the Constitution, all foreign citizens residing in the territory of the Russian Federation on permanent legal grounds have the same rights and obligations as local citizens.

All these guarantees and benefits apply to people of any citizenship. Thus, citizens of other countries and stateless persons legally residing in the territory of the Russian Federation, on an equal basis with Russian citizens, can receive all social compensations. The rights and obligations of foreign citizens, including pensioners, are regulated by Federal Law No. 115, adopted on July 25, 2002.

The document states that the only confirmation of permanent residence of foreigners and stateless people in Russia is a residence permit - a residence permit - only it has legal force when issuing benefits and social benefits.

This document can also be an identity document if issued to a stateless person. Accordingly, only those foreign citizens who have a residence permit confirming their permanent residence in Russia have the right to receive old-age payments. It follows from this that the fact of assigning guarantees depends only on the citizen’s permanent residence within our country.

As a result, all that is needed to receive social benefits is to obtain a residence permit in the Russian Federation

In connection with such statements, questions about the possibility of receiving a pension from the Russian Federation and living (possibly temporarily) in the territory of another state have become relevant. Let's consider this issue in more detail. According to the second article of Federal Law No. 21 of March 6, 2001, it is possible to receive the payment amount abroad.

Thus, citizens who leave or have left for permanent residence in the Russian Federation, but have the right to receive social payments from the state on the day of departure, can receive payments in the territory of another country in foreign currency according to the current exchange rate established by the Central Bank of the Russian Federation on the day of transfer.

To do this, you must provide a written application, and the pension will be transferred abroad starting next month. The state pension and its amount when transferred abroad are usually revised. Free legal support by phone: 8 (800) 775-65-04 (free call). As a result, all that is needed to receive social benefits is to obtain a residence permit in the Russian Federation.

Algorithm for foreign citizens applying for an old-age insurance pension

When applying for an old-age insurance pension, foreign citizens are recommended to adhere to the following algorithm.

Collect all the necessary documents to apply for a Russian insurance pension

You will need (clause 2 of article 24 of the Law dated December 15, 2001 N 166-FZ “On state pension provision in the Russian Federation”; List approved by Order of the Ministry of Labor of Russia dated November 28, 2014 N 958n):

- passport of a foreign citizen or other identification document;

- pension application;

- documents confirming the authority of the representative (if the application and documents are submitted through a representative);

- residence permit with a mark of registration at the place of residence;

- certificate of registration at the place of residence on the territory of the Russian Federation;

- statement of actual residence on the territory of the Russian Federation;

- Russian work book of the established form;

- contracts of a civil law nature, the subject of which is the performance of work or the provision of services;

- insurance certificate of state pension insurance of the Russian Federation;

- an extract from the individual personal account of the insured person in the compulsory pension insurance system.

- a certificate confirming that disabled family members are dependent;

- documents on changing full name (certificate of marriage, its dissolution, change of full name);

- medical and social examination certificate confirming disability.

An application for an insurance pension can be submitted no earlier than a month before the age that gives the right to receive an old-age insurance pension.

For citizens who arrived in Russia from the CIS countries in order to establish the right to a pension, including a pension on preferential terms and for long service, the length of service acquired in the territory of any of the countries party to the Agreement on Guarantees of the Rights of Citizens of the CIS Member States in area of pension provision dated March 13, 1992.

At the same time, documents necessary for pension provision, issued in the proper manner on the territory of these states and states that were part of the USSR, or before December 1, 1991, are accepted on the territory of the CIS member states without legalization.

Submit an application for a Russian insurance pension and relevant documents

An application for an insurance pension can be submitted no earlier than a month before the age that gives the right to receive an old-age insurance pension (clause 19 of Rules No. 884n). At the same time, you can apply for a pension at any time after the right to it arises, without being limited by any period. The pension is assigned by the Pension Fund branch at your place of residence.

In the absence of a place of residence confirmed by registration on the territory of the Russian Federation, an application for an insurance pension must be submitted to the branch of the Pension Fund at the place of residence in the Russian Federation.

If there is no place of residence on the territory of the Russian Federation, the application for a pension should be submitted at the place of actual residence (clauses 5, 6 of Rules No. 884n). Also, with your consent, the employer can submit an application for a pension at your place of residence, and if there is no place of residence, at the place of your stay or actual residence or at the location of the employer itself.

The Pension Fund body considers the application for an insurance pension within 10 working days from the date of receipt of the application

Receive a document confirming your right to receive an old-age insurance pension

The Pension Fund body considers the application for an insurance pension within 10 working days from the date of receipt of the application. The period for consideration of the application may be suspended until the verification is completed and additional requested documents are submitted, but for no more than three months (Parts 7, 8, Article 22 of the Law of December 28, 2013 N 400-FZ “On Insurance Pensions”).

The pension fund has the right to check the validity of the issuance of documents (information) necessary to establish an insurance pension, as well as the reliability of the information contained therein (clause 63 of Rules No. 884n). If the Pension Fund refuses to satisfy an application for an insurance pension, it is obliged to notify the applicant about this within five working days after the day the decision is made.

In this case, the Pension Fund must indicate the reasons for the refusal and the procedure for appealing it, as well as return all documents submitted by the applicant. Thus, this decision to refuse to grant an insurance pension can be appealed to a higher authority of the Pension Fund.