When is insurance and social?

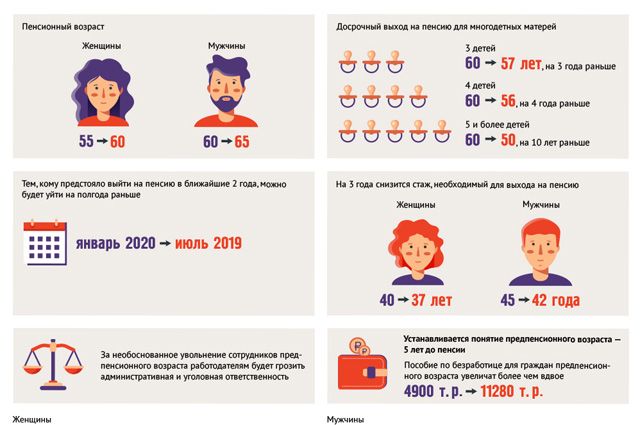

According to the new law, the retirement age in Russia has increased by 5 years. From now on, women will retire at the age of 60, and men at 65. But the “full” new age will begin to apply to women born in 1968 and younger. For men - born in 1963 and younger. Everyone who is older falls under the so-called transition period - over the next 10 years, their retirement age will increase gradually (see infographic).

However, all this applies only to those who earn an insurance pension - now for this you need to accumulate at least 30 pension points and have at least 15 years of insurance experience. If there are not enough points or experience, if a person worked illegally or did not work at all, he will have to rely only on a social pension. For her, the age also increases by 5 years. Women will be able to receive a social pension at 65 years old, men at 70 years old. And this “social” retirement age will also increase gradually over 10 years.

Basic provisions of the federal law

Providing monetary allowances to citizens at the expense of the budget of the Russian Federation is provided for by the legislation of the Russian Federation. Main provisions of the law:

- In some cases provided for by Federal Law No. 166, pension provision for certain civil categories is carried out in accordance with the approved procedure of the Government of the Russian Federation.

- A pension is a payment made every month. Citizens who meet the conditions stipulated by the Federal Law have the right to receive payments.

- Financing of cash allowances is carried out from the budget of the Russian Federation.

Persons who have worked in government positions for more than 15 years have the right to receive compensation for their length of service, but only after dismissal on the basis of:

- Liquidation of state power organizations and other government agencies. Staff reduction.

- Dismissal from public office due to termination of powers.

- Reaching a certain age specified in the Federal Law to work in the position held.

- Health problems that interfere with the performance of duties.

- Dismissal due to reaching retirement age.

What is the basic income tax rate in 2020? Read more.

Expert opinion

Kostenko Tamara Pavlovna

Lawyer with 10 years of experience. Author of numerous articles, teacher of Law

Those dismissed from the civil service on the above grounds can count on compensation for their length of service. But only if a position in the civil service is filled for a full 1 year.

During the period of work in the civil service, a pension is not paid, even in the case of more than 15 years of service.

Military personnel and their families may be assigned the following allowance:

- for work experience;

- as a result of disability;

- by loss of a breadwinner.

This is important to know: Standards for one-time tax, how calculations are made, what increases costs

A long-service pension is assigned after reaching 15 years of service and dismissal on the basis of Art. 8 FZ-166 . Monetary allowances for disabled people are provided to military personnel who were injured during their service.

Conscripts (sailors, foremen, soldiers, sergeants) are also entitled to benefits due to disability, but no later than 3 months from the date of dismissal from the military service. Or, if disability occurred later than 3 months due to combat injuries.

If a serviceman dies during service or as a result of an injury after 3 months, then their closest relatives who are disabled are assigned a survivor's allowance. The following are considered disabled:

- Minor children, sisters, brothers and grandchildren of the deceased in the absence of able-bodied parents. When studying full-time at a university, the salary is extended up to 23 years.

- A close relative of the deceased who cares for the deceased’s sisters, brothers or children under 14 years of age. In this case, the age or working capacity of the relative does not matter.

- Parents of military personnel who died during military service or after dismissal due to injury, when they did not reach retirement age.

- Grandparents of the deceased in case of under 60 and 55 years of age. Or are disabled people who do not have relatives to support them.

Monetary allowance is assigned only if the citizen applying for receipt was dependent on the deceased.

Participants of the Great Patriotic War have the right to receive a “Pension for participants of the Great Patriotic War” if they are recognized as disabled people of the 3rd, 2nd and 1st degrees, regardless of the reasons. If the applicant for security has become disabled due to illegal actions or on purpose, then a social pension is assigned.

What awaits teachers, doctors and northerners?

Retirement for teachers, doctors, artists and other creative workers has also been postponed by 5 years. According to the new rules, they must develop their special length of service (from 15 to 30 years, depending on the category of the beneficiary), but they will be able to retire only after five years. An exception, as for everyone else, is made for a 10-year transition period - from 2020 to 2028, the period for applying for a pension for them will be postponed for a period of 1 to 5 years (see infographic). For example, if a school teacher completes the required 25 years of teaching experience in 2021, he will be granted a pension after 3 years, that is, in 2024.

For residents of the Far North and equivalent areas, the retirement age is also increased by 5 years. Northern women will be able to retire at age 55, and men at age 60. But provided that by this age they have managed to complete the necessary northern experience. The changes will not affect only the small indigenous peoples of the Far North. For them, the retirement age was left unchanged: 50 years for women and 55 for men.

Text of the current version of the law

Federal Law No. 166 regulates and controls the rights of citizens of the Russian Federation to receive different categories of pensions. If a person falls under one of the categories listed in the law, it is recommended to study the described law and contact the administrative authorities to receive assistance and funds.

Citizens must have with them documents proving their rights to receive assistance, in the form of a passport, death certificate, medical certificate, etc.

You can download the Federal Law of December 15, 2001 N 166-FZ (as amended on July 1, 2017) “On State Pension Provision in the Russian Federation” by following the link.

Law 166-FZ on state pension provision in the Russian Federation: what awaits Russians, main points, nuances of providing cash benefits.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Who needs it early?

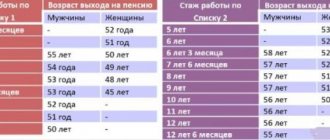

Nothing changes for workers in hazardous and hazardous industries - miners, chemists, etc., as well as police officers, military and other law enforcement officers who receive pensions other than through the Pension Fund.

The conditions for mothers of large families with 5 or more children also remain unchanged - if they have the required insurance period of 15 years, they will still be able to retire at 50 years old. But now the right to early exit has appeared for mothers with 4 children - for them it will be 4 years earlier, that is, at 56 years old. If a woman has three children, she will be able to retire 3 years earlier than the new retirement age, that is, at 57 years old.

Those who by this time have already completed a long period of insurance (official, for which contributions to the Pension Fund were deducted) will be able to retire early 2 years earlier. For women to start resting at 58, they need to work for 37 years. For men to retire at 63, they will need 42 years of insurance coverage.

When is an early retirement pension granted?

Some citizens have the right to early receipt of a labor pension. To do this, it is necessary to have special grounds that are established at the legislative level. In this case, not only modern legislative acts can work, but also laws that were in force earlier, for example, in the USSR. You can receive early deduction only after filing a statement of claim in court.

Articles 30, 31 and 34 of the Insurance Pension Law indicate the persons who are entitled to receive early payment.

This includes the following groups of citizens:

- Those employed in professions with dangerous or difficult working conditions.

- Pilots.

- Railway transport workers.

- Involved in field work.

- Women with many children.

- Teachers.

Important! You can view the full list of categories of persons who can take advantage of the benefit in the RF Government Decree No. 665 dated July 16, 2014.

In 2020, an addition was made to the law, according to which the right to early retirement is granted to persons with extensive insurance experience. Requirements for citizens will depend on the category in which they are allowed to receive early payment. The criteria include age, special and insurance experience.

When will the savings portion be given back?

Unlike the insurance pension, the funded pension will be paid at old age - from 55 years old for women and from 60 years old for men. We are talking about people born in 1967 and younger, whose employers for 12 years - from 2002 to 2013 - paid insurance contributions to a funded pension - first 3% of earnings, then 6% (the state then “signed” everyone to save). At NPFs the average bill per person is now 71 thousand rubles. Legislators have not yet decided how people aged 55 and 60 will receive their savings - one-time or in parts.

How will Russians' pensions change? Infographics Read more

Federal Law of October 11, 2018 No. 356-FZ

RUSSIAN FEDERATION

THE FEDERAL LAW

On the execution of the budget of the Pension Fund of the Russian Federation for 2017

Adopted by the State Duma on September 25, 2020

Approved by the Federation Council on October 3, 2020

1. Approve the report on the execution of the budget of the Pension Fund of the Russian Federation (hereinafter referred to as the Fund) for 2020:

1) the total revenue of the Fund’s budget in the amount of 8,260,075,956.1 thousand rubles, of which 8,170,045,610.8 thousand rubles in the part not related to the formation of funds for financing funded pensions, including through interbudgetary transfers received from the federal budget in the amount of 3,677,132,775.2 thousand rubles and the budgets of the constituent entities of the Russian Federation in the amount of 3,259,524.3 thousand rubles;

2) the total volume of expenses of the Fund’s budget in the amount of 8,319,454,695.8 thousand rubles, of which 8,061,021,337.8 thousand rubles in the part not related to the formation of funds for financing the funded pension;

3) the volume of the Fund’s budget deficit in the amount of 59,378,739.7 thousand rubles, formed on the basis of the Fund’s budget surplus in the part not related to the formation of funds for financing the funded pension, in the amount of 109,024,273.0 thousand rubles and the Fund’s budget deficit in the part related to the formation of funds to finance funded pensions, in the amount of 168,403,012.7 thousand rubles.

2. Approve the following indicators for the execution of the Fund’s budget:

1) the Fund’s budget revenues according to budget revenue classification codes for 2020 in accordance with Appendix 1 to this Federal Law;

2) the structure of the Fund’s budget expenditures for 2020 in accordance with Appendix 2 to this Federal Law;

3) sources of internal financing of the Fund’s budget deficit according to the classification codes of sources of financing budget deficits for 2020 in accordance with Appendix 3 to this Federal Law.

President of the Russian Federation V. Putin

Moscow Kremlin

October 11, 2020

No. 356-FZ

Annex 1

to the Federal Law

“On the execution of the budget of the Pension Fund of the Russian Federation for 2017”

Budget revenues of the Pension Fund of the Russian Federation according to budget revenue classification codes for 2020

| (thousand rubles) | |||

Indicator name | Budget classification code of the Russian Federation | Cash execution | |

chief revenue administrator | budget revenues of the Pension Fund of the Russian Federation | ||

| Income, total | 8 260 075 956,1 | ||

| Tax and non-tax revenues | 000 | 1 0000 000 | 4 575 129 838,2 |

| Insurance contributions for compulsory social insurance | 000 | 1 0200 000 | 4 495 251 841,0 |

| Insurance premiums | 000 | 1 0200 160 | 4 495 251 841,0 |

| Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of an insurance pension | 182 | 1 0200 160 | 4 305 732 377,5 |

| Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of a funded pension | 182 | 1 0200 160 | 495 595,1 |

| Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation (for billing periods from 2002 to 2009 inclusive) | 182 | 1 0200 160 | 245 552,6 |

| Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of insurance pensions (for billing periods from 2002 to 2009 inclusive) | 182 | 1 0200 160 | 200 457,3 |

| Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods from 2002 to 2009 inclusive) | 182 | 1 0200 160 | 45 095,3 |

| Contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund of the Russian Federation for the payment of additional payments to pensions | 182 | 1 0200 160 | 6 222 477,0 |

| Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of insurance pensions (for billing periods expired before January 1, 2013) | 182 | 1 0200 160 | 956 219,1 |

| Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods expired before January 1, 2013) | 182 | 1 0200 160 | 149 104,2 |

| Contributions paid by coal industry organizations to the budget of the Pension Fund of the Russian Federation for the payment of additional payments to pensions | 182 | 1 0200 160 | 1 909 634,1 |

| Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 1 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for payment of insurance pension | 182 | 1 0200 160 | 72 503 390,3 |

| Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraph 1 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions | 182 | 1 0200 160 | 20 777 551,3 |

| Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for payment of insurance pension | 182 | 1 0200 160 | 51 725 839,0 |

| Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension | 182 | 1 0200 160 | 101 345 890,4 |

| Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of a funded pension | 182 | 1 0200 160 | 261 438,0 |

| Additional insurance contributions for a funded pension and employer contributions in favor of insured persons paying additional insurance contributions for a funded pension credited to the Pension Fund of the Russian Federation | 392 | 1 0200 160 | 5 385 128,4 |

| Insurance premiums paid by persons who voluntarily entered into legal relations under compulsory pension insurance, credited to the Pension Fund of the Russian Federation for the payment of an insurance pension | 392 | 1 0200 160 | 45 034,3 |

| Taxes on gross income | 000 | 1 0500 000 | 5 246,2 |

| Tax levied in connection with the application of the simplified taxation system | 000 | 1 0500 110 | 5 246,2 |

| Minimum tax credited to the budgets of state extra-budgetary funds (paid (collected) for tax periods expired before January 1, 2011) | 182 | 1 0500 110 | 5 246,2 |

| Debt and recalculations for canceled taxes, fees and other obligatory payments | 000 | 1 0900 000 | 677 711,0 |

| Arrears, penalties and fines on insurance premiums | 000 | 1 0900 140 | 463 297,6 |

| Arrears, penalties and fines on contributions to the Pension Fund of the Russian Federation | 182 | 1 0900 140 | 463 297,6 |

| Insurance premiums in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation (for billing periods expired before January 1, 2010) | 182 | 1 0900 160 | 214 413,4 |

| Insurance contributions in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (for billing periods expired before January 1, 2010) | 182 | 1 0900 160 | 159 620,4 |

| Insurance contributions in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods expired before January 1, 2010) | 182 | 1 0900 160 | 54 793,0 |

| Income from the use of state and municipal property | 000 | 1 1100 000 | 73 825 665,5 |

| Income from the placement of budget funds | 000 | 1 1100 120 | 73 817 045,0 |

| Income from the placement of funds of the Pension Fund of the Russian Federation, generated from the amounts of insurance contributions for a funded pension | 392 | 1 1100 120 | 68 872 756,2 |

| Income from investing pension savings transferred by management companies to the Pension Fund of the Russian Federation in accordance with the legislation of the Russian Federation | 392 | 1 1100 120 | 68 675 836,1 |

| Income from the temporary placement by the Pension Fund of the Russian Federation of funds generated from the amounts of insurance contributions for a funded pension, as well as income from the sale (redemption) of assets acquired from pension savings funds | 392 | 1 1100 120 | 33 286,9 |

| Income from the temporary placement by the Pension Fund of the Russian Federation of funds generated from the amounts of additional insurance contributions for a funded pension and employer contributions in favor of insured persons paying additional insurance contributions for a funded pension | 392 | 1 1100 120 | 163 633,2 |

| Income of the Pension Fund of the Russian Federation from investing reserve funds for compulsory pension insurance | 392 | 1 1100 120 | 4 944 288,8 |

| Income from investing funds from the reserve of the Pension Fund of the Russian Federation for compulsory pension insurance | 392 | 1 1100 120 | 4 944 288,8 |

| Income received in the form of rent or other payment for the transfer for paid use of state and municipal property (except for the property of budgetary and autonomous institutions, as well as the property of state and municipal unitary enterprises, including state-owned ones) | 000 | 1 1100 120 | 8 330,3 |

| Income from the rental of property under the operational management of state authorities, local governments, state extra-budgetary funds and institutions created by them (except for the property of budgetary and autonomous institutions) | 000 | 1 1100 120 | 8 330,3 |

| Income from the rental of property under the operational management of the Pension Fund of the Russian Federation | 392 | 1 1100 120 | 8 330,3 |

| Other income from the use of property and rights that are in state and municipal ownership (except for the property of budgetary and autonomous institutions, as well as the property of state and municipal unitary enterprises, including state-owned ones) | 000 | 1 1100 120 | 290,2 |

| Other income from the use of property in state and municipal ownership (except for the property of budgetary and autonomous institutions, as well as the property of state and municipal unitary enterprises, including state-owned ones) | 000 | 1 1100 120 | 290,2 |

| Other income from the use of property under the operational management of the Pension Fund of the Russian Federation | 392 | 1 1100 120 | 290,2 |

| Income from the provision of paid services (work) and compensation of state costs | 000 | 1 1300 000 | 3 551 404,7 |

| Income from compensation of state expenses | 000 | 1 1300 130 | 3 551 404,7 |

| Income received by way of reimbursement of expenses incurred in connection with the operation of property | 000 | 1 1300 130 | 10 341,5 |

| Income received by way of reimbursement of expenses incurred in connection with the operation of federal property assigned to the Pension Fund of the Russian Federation with the right of operational management | 392 | 1 1300 130 | 10 341,5 |

| Other income from compensation of state expenses | 000 | 1 1300 130 | 3 541 063,2 |

| Other income from compensation of expenses of the budget of the Pension Fund of the Russian Federation | 392 | 1 1300 130 | 3 541 063,2 |

| Income from the sale of tangible and intangible assets | 000 | 1 1400 000 | 1 511,8 |

| Income from the sale of property in state and municipal ownership (with the exception of movable property of budgetary and autonomous institutions, as well as property of state and municipal unitary enterprises, including state-owned ones) | 000 | 1 1400 000 | 1 511,8 |

| Income from the sale of property under the operational management of the Pension Fund of the Russian Federation (in terms of the sale of fixed assets for the specified property) | 392 | 1 1400 410 | 379,6 |

| Income from the sale of property under the operational management of the Pension Fund of the Russian Federation (in terms of the sale of material reserves for the specified property) | 392 | 1 1400 440 | 1 132,2 |

| Fines, sanctions, damages | 000 | 1 1600 000 | 1 937 855,9 |

| Monetary penalties (fines) for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budgets of state extra-budgetary funds) | 000 | 1 1600 140 | 1 891 077,2 |

| Monetary penalties (fines) for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Pension Fund of the Russian Federation) | 100 | 1 1600 140 | 0,0 |

| Monetary penalties (fines) for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Pension Fund of the Russian Federation) | 392 | 1 1600 140 | 1 888 098,9 |

| Monetary penalties (fines) imposed by the Pension Fund of the Russian Federation and its territorial bodies in accordance with Articles 48 - 51 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal compulsory health insurance fund" | 392 | 1 1600 140 | 2 978,3 |

| Monetary penalties (fines) and other amounts collected from persons guilty of crimes and compensation for damage to property | 000 | 1 1600 140 | 3 217,1 |

| Monetary penalties (fines) and other amounts collected from persons guilty of committing crimes and for compensation for damage to property, credited to the budget of the Pension Fund of the Russian Federation | 392 | 1 1600 140 | 3 217,1 |

| Income from compensation for damage in the event of insured events | 000 | 1 1600 140 | 1 801,5 |

| Income from compensation for damage in the event of insured events, when the beneficiaries are recipients of budget funds of the Pension Fund of the Russian Federation | 392 | 1 1600 140 | 1 801,5 |

| Income from compensation for damage in the event of insured events under compulsory civil liability insurance, when the beneficiaries are recipients of budget funds of the Pension Fund of the Russian Federation | 392 | 1 1600 140 | 1 799,8 |

| Income from compensation for damage in the event of other insured events, when the beneficiaries are recipients of budget funds of the Pension Fund of the Russian Federation |

Who are pre-retirees?

A new concept has appeared in domestic legislation - “citizens of pre-retirement age”. This age begins at 55 years for women and 60 years for men. Along with the pension law, a package of documents protecting the interests of pre-retirees was adopted. Firstly, administrative and criminal liability was introduced for the dismissal of such workers and refusal to hire them. Secondly, employers have an obligation to annually provide pre-retirees with 2 days of free medical examination while maintaining their salary. Thirdly, for people over 55 and 60 years old, an unemployment benefit of 11,280 rubles was established. But they will pay it for no more than one year. Fourthly, pre-retirees will be able to undergo retraining and advanced training courses - 5 billion rubles have been allocated in the budget for special employment programs.

Fifthly, all the benefits that are currently provided to pensioners will be preserved for pre-retirement people. We are talking about both regional benefits (each subject makes changes to its legislation) and federal ones - tax exemption for an apartment, house, dacha, garage and 6 acres of land. Pre-retirees will not have to pay property taxes. But! This right will only be retained for a transitional period of 10 years. It will end in 2028. This means that women born in 1973 and younger and men born in 1968 and younger will no longer be able to take advantage of the benefits.

Whip for employers. How will they punish for dismissal at 50-60 years old? Read more

Latest amendments

The latest amendments to the law on pension provision for citizens of the Russian Federation were made on July 1, 2020, with the adoption of Federal Law No. 148. According to these changes in article two, in the seventh paragraph the phrase “federal state security authorities” was changed to the words “state security authorities (federal authorities state protection)".

This is important to know: Petition to the court: how to draw it up correctly, form and sample 2020

You may be interested: Federal Law 143 in the new 2020 edition is here:

According to the third article of the described law, in addition to ordinary citizens of the Russian Federation, pensions can be received by:

- Persons injured during military service. They are entitled to a disability pension and an old-age insurance pension;

- Members of families whose cosmonaut relative died. Such persons are entitled to a survivor's pension;

- Participants in the Great Patriotic War have the right to receive a disability and old-age pension;

- The pension is accrued in the same way as for participants of the Second World War, citizens who received the badge “Resident of besieged Leningrad”;

- Mothers and fathers of persons who served in military service and were injured or died are entitled to receive funds. Parents are entitled to survivor benefits;

- Wives whose spouses were injured or died during hostilities or conflicts are entitled to receive a survivor's pension;

- Any families that have lost their breadwinner also have the right to receive money upon presentation of evidence of relationship to the relevant authorities.

The processes for receiving funds by persons with several categories of pension coverage are also described. One citizen has the right to receive a pension for the loss of a breadwinner, for old age and for long service, etc.

The seventh article describes the conditions and requirements for receiving a pension by federal government employees. The amount of funds and length of service for employees are determined in the appendix of this Federal Law on the State.

pensions. Civil servants have the right to receive a long service pension along with disability and old age benefits.

Pensions are not paid to such persons during the period of work in:

- State Service of the Russian Federation;

- Interstate or intergovernmental body;

- State service of the Russian Federation when replacing another person;

- A municipal body or when replacing another person in a municipal body;

- State body of a constituent entity of the Russian Federation.

Article 7.2 describes the system for accruing and receiving funds by citizens who participated in testing flight equipment. Persons who participated in the research and testing of serial aviation equipment, parachute and aerospace equipment, and aeronautical equipment receive a long-service pension only if they have a work experience of 25 years for men and 20 years for women.

Expert opinion

Kostenko Tamara Pavlovna

Lawyer with 10 years of experience. Author of numerous articles, teacher of Law

In situations where a citizen left his place of work for health reasons, the length of service is reduced to 20 years for men and 15 years for women. Positions, amount of funds and calculation of the period of work are regulated by the Government of the Russian Federation.

Article number 11 of the law on social pensions describes the conditions and requirements for calculating funds to disabled citizens. In accordance with this article, the following are entitled to receive a pension:

- Disabled since childhood or persons who received 1, 2 or 3 disability groups;

- Citizens of the Russian Federation who have reached the age of 65 years for men and 60 years for women. Foreign persons residing in Russia and meeting the conditions described above;

- Parents with disabled children in the family;

- Citizens belonging to the categories of small peoples of the North and living in the territories of the peoples of the North, who have reached the age of 55 years for men and 50 years for women;

- Citizens under 18 years of age, minors who have lost one or both parents, and full-time students in educational institutions.

This is important to know: Refund of 13 percent from the purchase of an apartment: necessary documents

The listed citizens may also be provided with a pension for the loss of a breadwinner, old age or disability.

What else do they want to change?

The pension law will be considered in the Federation Council and then sent to the president for signature. But, apparently, these are not the last changes in pension legislation. Tatyana Golikova has more than once voiced the idea of abandoning the point-based pension formula in force in Russia since 2020. “This is a very difficult decision, but we will have to make it,” the Deputy Prime Minister said the other day, explaining her position as follows: “The point formula has not worked in full. The calculation is carried out in a slightly confusing way, and then the result is indexed to the inflation rate. This raises many questions. The pension should depend on the length of service and the earnings that the employee received during his working activity.”

Question answer

How will the funded pension system work in the IPC?

Another innovation that may appear in the coming years is individual pension capital (IPC). The Ministry of Finance plans for it to start operating in January 2020. What is it? The IPC will replace the mandatory pension savings frozen since 2013. But, unlike the previous system, contributions will be made not by the employer, but by the employee himself in the amount of 1 to 6% of earnings. Moreover, connection to the IPC is supposed to be made compulsory and voluntary, when silence means consent. If an employee does not want to pay part of his salary for a future pension, he must write a statement of refusal to his employer (and repeat it after 5 years). If you don’t do this, contributions to the NPF will go automatically. This story will affect all officially working citizens of the country without exception. However, as the Central Bank reported, the final version of the bill on individual pension capital is not yet ready.

166-FZ: latest changes 2020

The law was adopted on December 15, 2001. It regulates the monetary provision of citizens who have reached a certain age or in other cases provided for by regulations.

Several times amendments were made to Law 166-FZ on state pension provision in the Russian Federation:

Name of the normative act

Suspension of the 4th paragraph of Article 25 (on indexation of pensions) until January 1, 2017.

Pensions, according to Art. 18 and art. 17.1, are subject to indexation from April 1, 2016 by a coefficient of 1.04.

Article 2 paragraph 7 has been amended to the wording.