The insurance number of an individual personal account, or SNILS, in some cases can come to the aid of a pensioner who wants to find out the amount of pension payments due to him. Thanks to the capabilities of modern means of communication, you can find out the data of interest via the Internet without leaving your home.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

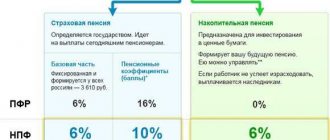

The main ways to find out your funded pension size

An important point is that information regarding the funds contained in the pensioner’s current account is classified as confidential. However, the citizen who is the owner of the account has every right to receive such data. It does not matter whether the funds are in an account opened with the Pension Fund or Non-State Pension Fund. This right is confirmed when using SNILS.

The number is reflected on the front side of the document in question. Using this number, you can check the information related to the funded part of the pension.

There are several options for checking:

- Personal visit to the branch of the pension authority. A citizen can contact us during business hours and ask any question regarding funds. He will need to have a certain package of documentation with him.

- Online application . This indicates that the use of modern technologies makes it possible to carry out verification activities in fairly simple ways. To do this, the citizen will need to register on the website through which he plans to obtain information.

In the latter case, a person has the right to use the official portal of the State Services or pension authority. In addition, a separate website is also being created for the non-state fund.

An important point in this case is that a citizen will not be able to obtain information when using the State Services portal if the funds are placed in an account with a non-governmental organization. This indicates that you will need to request information when using the official website of the selected company.

How to check pension contributions from a non-state pension fund

The funded part of the pension is transferred to the NPF upon the personal application of the citizen and the provision of identification documents. The easiest and fastest way to find out contributions to the pension fund is via the Internet.

For this purpose, there is a unified identification system, by registering in which you request the information of interest. NPF employees who fill out documents for transferring a citizen from a state pension fund to a non-state pension fund leave contact details that the client calls to clarify the necessary information and obtain account information.

How to find out about pension savings on the Pension Fund website using SNILS

For a citizen who prefers to receive information from the primary source, the best option is to use the official portal of the pension authority. Since the beginning of 2020, a section related to using the capabilities of your personal account began working on this resource. This resource makes it possible to find out how many coefficients a citizen has earned over a certain period of time.

In addition, information about the length of service of a particular citizen must be reflected.

Also, using the site allows you to:

- use an advanced calculator for calculations;

- the ability to print a notice about the status of the pension account;

- information about the time period while the citizen was working and the amount of contributions he made to the employee’s account.

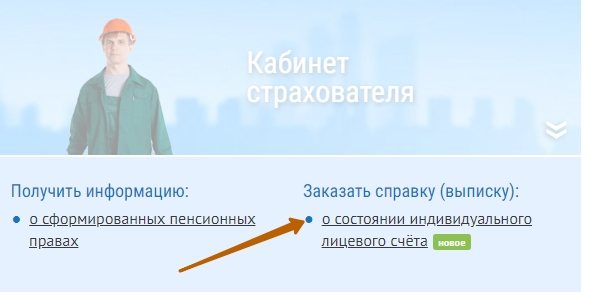

To obtain information from SNILS about the amount of a funded pension on the pension fund website, you need to use the following algorithm of actions:

- Log in to the official website and select the section related to using your personal account.

- Open a section that provides information about the formation of a pension and obtaining information about the rights of a citizen related to the pension;

- Go through the authorization process on the State Services portal. When a person previously registered, they simply need to enter their login information. Otherwise, initially register on the site by entering your last name and cell phone number.

- After opening a personal account, a person gains access to information about insurance production, and the information is provided by the Pension Fund of Russia. In addition, it is possible to make a request to obtain information about earnings contained in the personal account.

In this way, it will be possible to obtain information transmitted by the management of the organization where the person works. Based on the specified information, the person receives information about what period is used to calculate the pension and the place of employment. This data is used to make funded pension calculations.

To receive a statement in printed form, you need to click on the section on obtaining information about your account status . The system automatically generates a document, a person can print it at any time.

It is also possible to use the link to calculate the amount of future payment. If you click on it, the screen displays information about what data to enter to receive the amount.

How to calculate

To determine the amount of the insurance pension, the formula is used:

StP=SB*StB + RFV

Where:

- StP – the amount of the insurance pension;

- SB – the summed amount of all PB that a citizen has accumulated by the time the pension is calculated;

- StB is the annual state-indexed cost of industrial security, which in 2020 is equal to 81.49 rubles;

- RFV is the amount of a fixed payment, which is also set by the state at the beginning of the year, and in 2020 is 4982.9 rubles.

That is, you can find out your pension in 2020 using the formula:

StP=SB*81.49+4982.9

You can slightly increase the amount of insurance pension payments by applying for their accrual later than the due date. For each “overdue” year, in this case, payments will increase due to indexation using special coefficients.

Thus, if before 2013 it was possible to clarify the amount of pension savings through the mandatory distribution of notifications, today any citizen has the opportunity to independently find out the information he is interested in using the SNILS number.

Other ways to learn about savings via the Internet

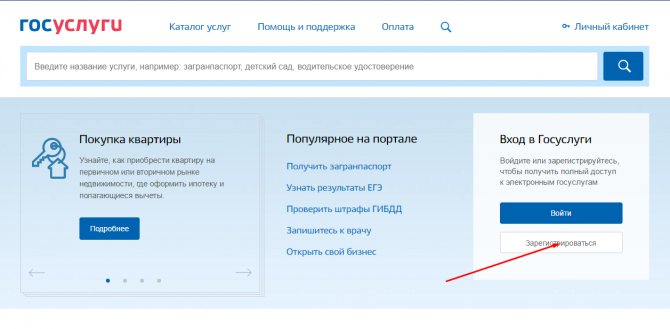

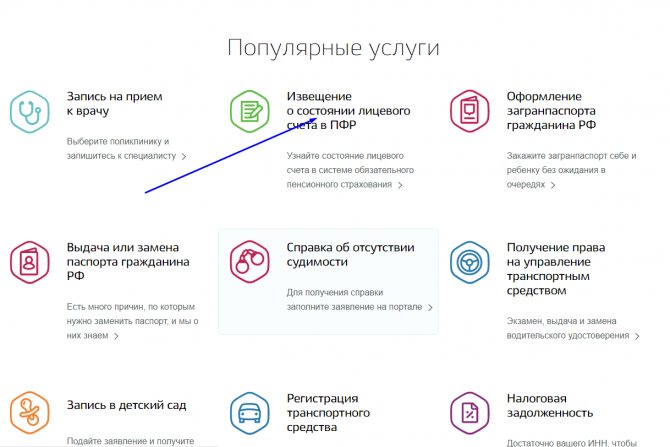

Using the State Services portal also has a certain sequence of actions:

- Registration on the portal . To do this, you need to open the official website and enter information about your last name, first name, patronymic, mobile phone number or email. Previously, it was possible to register on the site using information about SNILS. However, nowadays the process has become much easier. If a person was previously registered, then he needs to enter his phone data and specify a password.

- After entering the main page, you will need to go to the “Popular” block and select checking your personal account or catalog of services. Next, singing and benefits are used and you will need to select a notification regarding the status of the account.

- Next, a page opens where you need to click on receive the service and wait for the program to respond.

- A page will open where you need to find information about your account status that can be saved on your computer. You can also simply view the information.

Printing can also be done when using your personal account.

Checking savings for Russian Railways employees

I would like to emphasize that the Pension Fund “Welfare” belongs to and serves its employees.

In 2014, the fund was divided, with the formation of a subsidiary responsible for compulsory pension insurance activities. Further, it was bought by the investment fund 01 Group and changed its name to PPF “Future”. The main part of the fund continues to be called “Welfare” and implements the corporate pension system for Russian Railways employees. Due to the fact that in 2013, at the federal level, the official distribution of notifications about the status of individual accounts was canceled for citizens of the country, it is necessary to track savings independently. Apply the option you like best from those we discussed in the article.

Find information on SNILS if you are a member of a non-state pension fund

If we talk about the option of turning to non-governmental organizations, it is worth pointing out that this option can only be used if the citizen’s funds are accumulated in this company. information can be obtained by accessing the official portal.

There are also other ways:

- personal visit to the company office;

- telephone call.

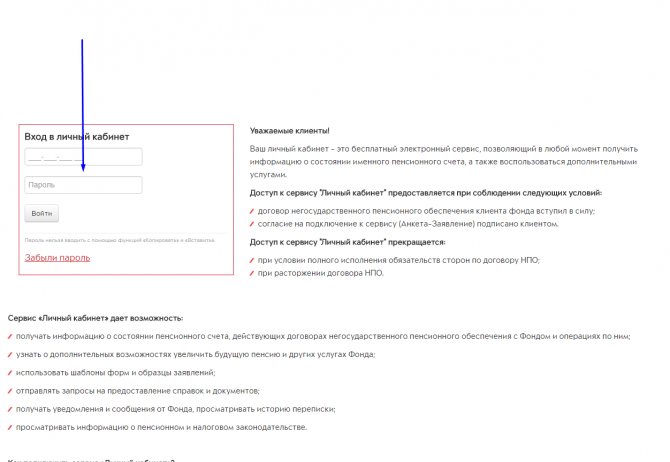

To enter your personal account, a citizen will need to keep his SNILS number and the details of the act by which his identity is verified. Email address information and password are also provided.

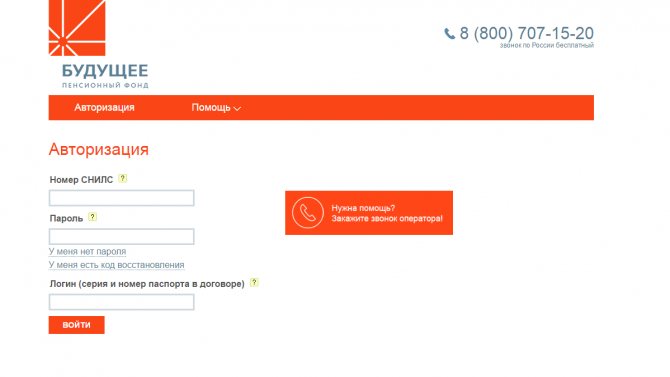

Sometimes non-state companies provide access subject to registration of an entry on the State Services portal. However, in this situation you need to use SNILS. Examples of such companies are Sberbank and Future.

It is possible to order a ready-made extract via email. It indicates the amount of accumulated funds. You can also request delivery using registered mail or hand delivery during a personal visit to the NPF.

Also, a personal account allows a citizen to dispose of accumulated funds. However, this can be done subject to the existence of such a right. It will be possible to generate and send an application to receive a lump sum payment.

Thus, there are several methods for obtaining information about savings. The citizen himself decides which method to use.

What's the catch?

In recent months, promises of payments under SNILS have been spreading on social networks, instant messengers, and also through contextual advertising. Allegedly, there are some sites that check their databases to see what social benefits you are entitled to based on your pension insurance account number. At the same time, the sites are designed in the style of official government institutions: the Pension Fund, State Services, Social Insurance Fund, etc. But, of course, they have nothing to do with them. An inexperienced person may not recognize the substitution at first glance.

The main psychological “hook” that naive citizens are caught on is the idea that the state is hiding some payments. But you are lucky to meet Robin Hood, ready to take it from the state and distribute it to those in need. Only for this you need very little: complete a survey and order payment processing on the appropriate website.

Instructions with pictures

State registration class=”aligncenter” width=”578″ height=”870″[/img] Registration form

Popular class=”aligncenter” width=”1236″ height=”738″[/img] Get class=”aligncenter” width=”830″ height=”341″[/img] View extract

PF addresses

PF authorization form

Website of the PF "Future"

Partner banks

For those who are not satisfied with any of the options above, there is another way. You can ask questions about your fund at banks that cooperate with the Pension Fund. It refers to:

- Sberbank;

- Gazprombank;

- VTB 24;

- UralSib;

- Bank of Moscow.

First of all, you need to personally visit one of the financial institutions and ask who deals with such issues. Then you must fill out and sign the application form, after which information about the NPF is provided.

Good to know! It is possible to obtain information about the location of pension savings in a particular fund in any division of these banks, even if you have never been one of their clients. After signing the application, the information is available in online banking and self-service terminals.