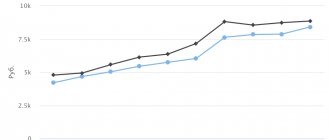

Average size of insurance pension in Volgograd and the Volgograd region

Pensioners living in Volgograd and the region receive insurance contributions that amount to 12,920 rubles. Today, this allowance is paid to 762,150 officially registered persons in the region. The increase in indexation contributed to the overall increase in the interest rate received in the region. Its increase was influenced by the economic situation in Volgograd. In total, at the beginning of the year, indexation amounted to 1.5 percent. Such planned measures to increase payments to citizens of retirement age can take place in several stages per year. The final dimensions are formed directly in the Volgograd region itself. To obtain the average value of payments, all monthly contributions to citizens are taken. Based on them, the overall level of payments for each specific person is calculated.

Volgograd region: minimum pension amount from January 1, 2020

It is worth noting the excellent transport links, some of them are quite famous in Europe.

For example, the E40 route is more than 8 thousand kilometers connecting the most important countries such as France, Belgium and Germany with Ukraine, Kazakhstan, Russia, Turkmenistan and Kyrgyzstan. Contrary to rumors, forecasts that the age limits for retirement will be changed upward are unjustified. Although the government considered several options for resolving this issue, namely:

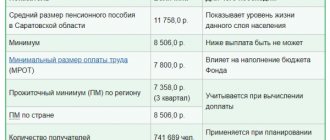

Minimum pension amount

Volgograd has a minimum established threshold for pension contributions of 8,350 rubles. An important criterion for assessing these indicators is the overall economic value throughout the region.

Depending on labor payments and subsistence minimums for certain individuals, the final value of the amounts is formed. The minimum indicators refer to general rates by region, since they all depend on the basic subsistence standards.

The region itself assigns specific funds for additional payments. The lower threshold values include additional charges and coefficients that are applied in Volgograd. Such amounts of monthly contributions are guaranteed by the country to support certain categories of citizens.

Minimum pension in Volgograd from May 1, 2019

— In our region, in connection with the entry into force of the new Federal Law, 110.1 thousand citizens will have the right to establish a social supplement

, i.e.

More than 20 thousand pensioners with low incomes

will additionally acquire the right to a corresponding increase .

Minimum pension 15,000 from May 1, 2020 in the Moscow region

In addition to the pension itself, the so-called financial support for a pensioner In order for the total material support of non-working pensioners to be no less than the minimum subsistence level indicated in the table, the Pension Fund of Russia or through Social Security makes a special social supplement to pension (SDP), established as the difference between the value of the SMP and the total income of the pensioner:

How the region's economy is formed affects the size and increase of old-age or disability pensions. In Volgograd, most industries are in good condition. According to statistics, 11 destinations occupy leading positions among other regions of Russia.

The minimum wage in Volgograd and the Volgograd region

In 2020, in the Volgograd region there is a minimum wage rate of 9,000 rubles per month. This size changes every year. This is due to the fact that the final amount of salary deductions is influenced by the general economic situation in the region and country. It is legally established that this amount of payments should be indexed at the state level. Every year in the summer this amount increases or remains at the same level. Today its size is about 7,500 rubles. Later it is planned to increase this size by 300 rubles. Such growth will contribute to an overall increase in wages throughout the country. The minimum established at the state level is the initial one for calculating all wages by organizations. According to this indicator, enterprises cannot accrue income to citizens below this threshold. The final amount is determined by the region itself, depending on its economic situation for the current period.

Features of the region and the size of pensions

Number of pensioners in the Volgograd region: 761,000 . The amount of payments assigned to pensioners of the Volgograd region who receive such a right based on age category, insurance experience, disability group or other basis depends on the characteristics of the region’s economy.

Many industrial sectors of Volgograd are leaders in the country. This is due to the influence of the following factors:

- the presence of favorable river infrastructure, which allows optimizing transport links and cargo transportation, importing and exporting goods abroad;

- natural resources that attract visitors from other countries to visit national parks and reserves located in the Volgograd region;

- innovative agricultural production.

The mentioned advantages make it possible to establish a high level of minimum earnings, while simultaneously increasing the level of contributions to the least socially protected group of citizens.

Minimum, average and maximum pensions

The size of the pension assigned in the Volgograd region is set in such a way that the amount of accruals is not less than the cost of living established for the region.

If the recipient of the benefit is less than the specified limit, the citizen is entitled to an additional payment that equalizes the accruals to the stipulated minimum.

As of the end of 2020, the minimum pension amount is set at 8,569 rubles . This amount is determined by a resolution of local authorities and takes into account the level of expenses for the purchase of basic necessary goods and products.

According to experts who examine statistical data, the average level of pensions in the Volgograd region for 2020 amounted to 13,405 rubles . This number was obtained based on the results of a study of the amount of benefits among pensioners in the region, the number of whom in the region exceeds 761 thousand people.

Living wage for a pensioner in the Volgograd region:

| Year | Amount, rub. | Law of the Volgograd region | Federal cost of living |

| 2020 | 8569 | dated 10/09/2019 No. 81-OD | |

| 2019 | 8569 | dated October 23, 2018 No. 115-OD | 8846 |

| 2018 | 8535 | dated October 31, 2017 No. 93-OD | 8726 |

| 2017 | 8535 | dated October 28, 2016 No. 102-OD | 8540 |

| 2016 | 8510 | dated October 30, 2015 No. 186-OD | 8803 |

| 2015 | 6769 | dated October 24, 2014 No. 133-OD | 7161 |

| 2014 | 6350 | dated October 25, 2013 No. 131-OD | 6354 |

| 2013 | 6108 | dated 08.10.2012 No. 98-OD | 6131 |

| 2012 | 5340 | dated October 27, 2011 No. 2235-OD | 5564 |

| 2011 | 4788 | dated 01.11.2010 No. 2104-OD | 4938 |

| 2010 | 4284 | dated 03.11.2009 No. 1946-OD | 4780 |

View other regions →

Maximum accruals are assigned to persons noted for outstanding services to the Fatherland. The amount of such benefit is 17,444 rubles .

Social and insurance payments

Insurance pension payments by age category in the Volgograd region, as well as in the country as a whole, are due in the presence of the following circumstances:

- reaching the age of sixty for women and sixty-five for the male half of the population;

- fifteen years or more of work experience;

- number of pension points – from thirty and above.

The specified characteristics are given taking into account the changes programmed by the pension reform carried out in the period from 2018 to 2024, when the increase in indicators reaches the maximum envisaged value. Benefits are calculated in accordance with Law No. 400-FZ, adopted in December 2013, taking into account the amendments made by Law No. 350-FZ in October 2020.

Disability and loss of a breadwinner

In addition to the above, insurance premiums may be assigned under the following circumstances:

- in connection with disability - if the disabled pensioner has insurance experience;

- due to the loss of a breadwinner - to the relatives of the deceased, on whose support they were, in the absence of the ability to work.

Provides for the appointment of social pensions of a similar nature, entitled to persons who have not earned social service in the presence of appropriate circumstances.

In addition to citizens of the Russian Federation, a social pension can be assigned to foreigners and stateless persons living in the country, provided they have been within the Russian Federation for at least fifteen years.

Additional payments (allowances) to pensions in Volgograd and the Volgograd region

Additional payments are calculated individually for each resident of the region. The program is aimed at supporting such a group of citizens in Volgograd, with the goal of improving their conditions so that they can receive the minimum amount of benefits to live in this region. The regional government can index certain parts of pensions to increase the level to the minimum established by legal acts. Material benefits are paid based on these values. The amount of such allowances is determined based on the financial situation of each individual citizen, whose total payment amount is actually less than the established minimum subsistence level. In the Volgograd region, additional payments and bonuses are formed on the basis of general indicators for payments made.

Minimum pension in Russia in 2020 - table by region

From January 1, 2020, in Russia as a whole and in its individual regions, new values of the living wage for a pensioner begin to apply.

This indicator, albeit indirectly, determines the amount of the minimum old-age insurance pension for residents of specific regions, republics and territories of our country.

Let's find out what the minimum old-age pension will be in Russia from January 1, 2020 - a table of specific amounts for all regions of the country.

What kind of living wage are we talking about?

The expression “living wage” in relation to pensioners can have two meanings in Russia. And older Russians sometimes confuse them, so it’s worth recalling some nuances.

There is a statistical living wage. It is calculated every quarter of the calendar year. Rosstat monitors the cost of goods included in the consumer basket.

Then, using a certain methodology, the cost of living is determined in a specific region and in the country as a whole.

Moreover, four different figures are obtained: the cost of living for people of working age, pensioners, children, as well as the average value “per capita”.

At the same time, for pensioners, another value is determined - the pensioner’s subsistence level (PMP) for calculating the amount of social supplement.

The amount of PMP is no longer determined by Rosstat, but by the authorities of each Russian region and the government of the country (it sets a certain average figure for Russia). PMP is installed once a year - in the fall or even at the beginning of winter.

This value is calculated in advance and is valid from January 1 of the next calendar year.

Until recently, PMP may not have been correlated with the statistical subsistence level at all. There was simply no single method for calculating such a value. Now this technique has appeared, and the PMP more adequately reflects reality.

The meaning of the PMP is that a pensioner in any Russian region cannot have an income less than this value. If his pension accrued to the Pension Fund is lower than the PMP, and there is no other income, the person is paid a social supplement. It equalizes the pension to the pensioner’s living wage.

At least that's how it worked until 2020. Now the scheme for calculating minimum pensions has become a little more complex, but more profitable for older Russians.

Minimum pension and PMP are no longer synonymous

There are not so few people in Russia who receive a minimum pension. And in most cases, people are not at all to blame for what happened to them in old age. They worked honestly for decades and received good salaries. But the Pension Fund awarded them a pension less than the subsistence level.

In many cases, this happened due to the fact that at one time the archives, which contained the information necessary for calculating pensions, disappeared. Often the destruction of archives was beneficial to certain people. And the interests of hundreds and thousands of honest workers, of course, were of no interest to anyone.

In addition to the fact that people now receive pensions that are much less than the level they deserve, they have been haunted by another injustice for many years.

The point is the methodology by which minimum pensions were indexed at the beginning of each year. The amount that was calculated by the Pension Fund and which was less than the subsistence level was subject to recalculation.

The accrued pension increased, but this did not guarantee that a person would receive more in the new year. If the PMP in the region did not increase or increased slightly (and there are areas in Russia where the PMP did not grow for years or increased by mocking amounts of 2-3 rubles), the pension remained the same.

It’s just that the social supplement decreased as much as the accrued pension increased.

In the spring of 2020, the law was changed, and now it has become fairer. The Pension Fund first determines the new amount of social supplement relative to the old amount of the accrued pension. The amount of the surcharge is fixed. Then the pension is indexed to a common percentage for everyone, and to this the results are added to the previously fixed amount of social security payment.

As a result, a particular person’s pension, although not by much, exceeds the amount of the PMP. The final result is different for different pensioners. So it is no longer possible to say that the minimum pension and PMP are always synonymous.

Only those who have just retired will receive a monthly payment at the subsistence level of pensioners in 2020. Provided that they receive a pension less than this level. And that they will officially leave work - working pensioners are not entitled to social security payments.

Living wage for a pensioner in 2020 – table by region

At the moment, the authorities of all Russian regions have decided on the size of the PMP on their territory.

For this, a new methodology is now used, which is also a little fairer - regional officials can no longer come up with the amount of PMP arbitrarily.

They are required to take the cost of living statistics and multiply them by a certain coefficient, which takes into account the inflation forecast for the new year.

The following table contains the cost of living for a pensioner in the regions of Russia from January 1, 2020, as well as a comparison with 2020 - this way you can find out how much the minimum pension will increase in a particular region.

Conditions for obtaining a pension in Volgograd and the Volgograd region

Persons can apply for subsidies when they have already reached the retirement age prescribed by law. This indicator has different meanings depending on the situation and category of citizens. Future pensioners need to contact the branch of the pension institution in order to receive the payments due each month. Another condition for receiving insurance contributions is that the person has work experience. To confirm it, you need to contact the fund with documents that would confirm it. To do this, you need to find a branch at your place of registration or residence and draw up a corresponding written request. After completing and submitting all papers, the institution will make a decision on payments. The first deductions will be received by the person no earlier than the next month after submitting the application to the organization.

Where to contact

Branches of the Russian Pension Fund in the Volgograd region.

| Service region | Address | Telephone | Reception schedule for citizens on weekdays |

| Volgograd region | st. Raboche-Krestyanskaya, 16 | +7 | 8:30 - 17:30; on Friday until 16:30; lunch: 12:30 - 13:18 |

| Voroshilovsky district | st. Kozlovskaya, 33/1 | +7 | 8:00 - 17:00; on Friday until 16:00; lunch: 12:30 – 12:48 |

| Dzerzhinsky district | st. Republican, 17 | +7 | |

| Kirovsky district | st. named after General Shumilov, 19A | +7 | |

| Krasnoarmeysky district | st. Rossiyskaya, 2 | +7 | |

| Krasnooktyabrsky district | st. named after V.I. Lenina, 67A | +7 | |

| Sovetsky district | Ave. Universitetskiy, 70B | +7 | |

| Traktorozavodsky district | st. named after Degtyareva, 37 | +7 | |

| central District | st. Sovetskaya, 34A | +7 |

Pension 2020

Secondly, while a pensioner continues to work, he does not have the right to receive a social supplement up to the subsistence level. That is, the approval of new PMP values will not affect their pension provision in any way.

Subscribe to news

Firstly, when calculating their pension, the fixed payment and point price are used in the values that were established on the date of registration of the pension. That is, annual indexations do not apply to workers, and therefore there will be no increase of 6.6% in January for them.

Citizens who have never worked receive very little financial benefits in old age. The minimum pension is equal to the pensioner's subsistence level (PMP). The state sets the national average every year. Regional authorities determine the local indicator based on the economic situation. For this purpose, the Ministry of Labor approved a calculation methodology. In 2020, the amount will be indexed taking into account inflation. Senior citizens are paid a social supplement up to the minimum wage in the region.

Pension provision in Volgograd

Attention! If you have any questions, you can consult with a lawyer on social issues for free by phone: +7 in Moscow, St. Petersburg, +7 throughout Russia. Calls are accepted 24 hours a day. Call and solve your problem right now. It's fast and convenient!

- Discount on major repairs – 50% for people over 70 years old, 100% for people over 80.

- Targeted assistance to the poor.

- Providing free medicines in state pharmacies with a doctor’s prescription.

- Exemption from property tax.

The concept and meaning of the minimum wage

The minimum wage (SMW) is also used to assign various social benefits. Thus, it affects the amount of benefits for child care up to 1.5 years, for pregnancy and childbirth (for working mothers), and is necessary for calculating benefits for temporary disability, unemployment, and social pensions.

The minimum wage on the territory of the Russian Federation is established by federal law. Today, the minimum wage directly depends on the size of the monthly minimum wage. Finally, the provision of Article 133 of the Labor Code of the Russian Federation, which states that the minimum wage cannot be less than the minimum wage, has been implemented in practice.

According to Article 1 of the Federal Law of the Russian Federation “On the minimum wage” dated October 19, 2000 No. 82-FZ, the lower minimum wage level is set in the amount of the monthly minimum wage of the working population in Russia as a whole for the 2nd quarter of the previous year.

Thus, from January 1, 2020, the minimum wage will be equal to 12,130 rubles (Order of the Ministry of Labor of Russia dated 08/09/2019 No. 561n). Regions can set their own minimum wages for workers who do not receive salaries from the federal budget, in an amount not lower than the all-Russian one (Article 133.1 of the Labor Code of the Russian Federation).

Let us further consider changes in the indicators of monthly wages and minimum wages in the Volgograd region from January 1, 2020.