The cost of living for a pensioner for 2020 is set at

9 311 ₽↑465 ₽

on the basis of Federal Law N 380-FZ “On the federal budget for 2020 and for the planning period of 2021 and 2022” dated December 2, 2019

Data on the cost of living is always at hand in Viber. For free!

MORE DETAILS

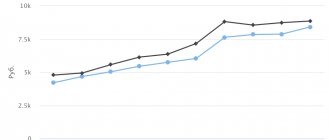

Living wage of a pensioner for previous years

| Year | Size, rub./month |

| 2019 | 8 846 ₽ |

| 2018 | 8 726 ₽ |

| 2017 | 8 540 ₽ |

| 2016 | 8 803 ₽ |

| 2015 | 7 161 ₽ |

| 2014 | 6 354 ₽ |

| 2013 | 6 131 ₽ |

| 2012 | 5 564 ₽ |

| 2011 | 4 938 ₽ |

| 2010 | 4 780 ₽ |

Green color - the size has increased relative to the previous period, Red color - the size has decreased relative to the previous period, Yellow color - the size has not changed relative to the previous period

This living wage for a pensioner is established ANNUALLY and is used to calculate the social supplement to the pension.

The living wage, taken into account when providing benefits and calculating social payments in the Russian Federation, is established QUARTERLY.

Social supplement to pension

According to Article 12_1 of Federal Law No. 178-FZ “On State Social Assistance” (04/24/2020)

, the total amount of material support for a non-working pensioner cannot be less than the subsistence level of a pensioner in a constituent entity of the Russian Federation.

If the amount is less, then a social supplement is assigned from the regional or federal budget. The additional payment is established in such an amount that the total amount of material support for the pensioner, taking into account this additional payment, reaches the minimum subsistence level for the pensioner established in the constituent entity of the Russian Federation.

What does the total amount of material support consist of?

When calculating the total amount of financial support for a pensioner, the amounts of the following monetary payments established in accordance with the legislation of the Russian Federation and the legislation of the constituent entities of the Russian Federation are taken into account:

- pensions, including the amount of the due old-age insurance pension, taking into account the fixed payment to the insurance pension, increases in the fixed payment to the insurance pension established in accordance with Federal Law N 400-FZ “On Insurance Pensions” (04/22/2020), and funded pension , established in accordance with Federal Law N 424-FZ “On funded pensions” (October 3, 2018), in the event of a pensioner’s refusal to receive these pensions;

- urgent pension payment;

- additional material (social) support;

- monthly cash payment (including the cost of a set of social services);

- other measures of social support (assistance) established by the legislation of the constituent entities of the Russian Federation in monetary terms (with the exception of measures of social support provided at a time).

The calculation does not take into account social support measures provided in kind, with the exception of cash equivalents of social support measures for paying for telephone use, for paying for residential premises and utilities, for paying for travel on all types of passenger transport (urban, suburban and intercity), and as well as monetary compensation for the costs of paying for these services.

Who receives the minimum pension and what does this minimum depend on?

In Russia, at the federal level, there is a provision that states that the old-age pension in the country cannot be lower than the cost of living of a pensioner for the region in which he lives.

The cost of living for a pensioner is not statistical data that is published once a quarter. Its value is set in the fall of each year for the entire next year, and, as a rule, regional authorities set a value higher than statistical data. Since the pensioner’s cost of living is established in advance, it also takes into account future price increases.

This material was stolen from the site. It happens. Most likely, the stolen version is missing a lot of the information you need. For example, useful links in the article. Visit www.newsment.ru to read the original article and find lots of other useful information!

The pensioner’s minimum pension amount, established by the regional authorities, will be the minimum pension for this region.

If a person who is retiring has a monthly payment that is less than the pensioner’s monthly minimum wage in the region, the budget will pay him extra towards his pension as much as necessary to make these values equal.

Of course, if the regional budget can afford additional social payments, the central government will not prohibit them. That is why in Moscow, for some pensioners, the minimum pension is approximately one and a half times higher than the subsistence level.

Self-study documents

Decree of the Government of the Russian Federation N 975 “On approval of the Rules for determining the cost of living of a pensioner in the constituent entities of the Russian Federation in order to establish a social supplement to pensions” (07/30/2019)

Federal Law N 178-FZ “On State Social Assistance” (04/24/2020)

Federal Law N 134-FZ “On the subsistence minimum in the Russian Federation” (04/01/2019)

Did you find this information useful?

0 0

How is the minimum pension determined in Moscow?

As in any other Russian region, the monthly income of a pensioner in Moscow cannot be less than the cost of living for older people in the city. This procedure exists everywhere, and the amount of the minimum payment to pensioners depends only on how expensive life is in a particular subject of the Russian Federation.

In some cases, the pension itself may be below the subsistence level. This happens when a pensioner has some other income. For example, if it works. In this case, he is paid the amount of pension that was calculated for him in the Pension Fund. Even if it is lower than the cost of living, the pensioner has other sources of income.

But if there is no additional income, the state pays in addition to the pension of any elderly Russian exactly as much as is necessary so that his pension does not fall below the subsistence level.

This procedure applies in Moscow, but it only affects those elderly residents who have lived in the city for less than 10 years. For others, the minimum pension is higher.

The budget of the city of Moscow is so large that the city can afford to incur additional social expenses and guarantee local residents something more than the federal government guarantees them. Therefore, for example, Muscovites of retirement age who have lived in the city for more than ten years can qualify for a higher minimum pension.

Photo: minsvyaz.ru

Rating of regions according to the cost of living of a pensioner in 2020

| Region | Size, rub./month |

| Chukotka Autonomous Okrug | 19000 |

| Nenets Autonomous Okrug | 17956 |

| Kamchatka Krai | 16756 |

| Magadan Region | 15943 |

| Murmansk region | 14354 |

| The Republic of Sakha (Yakutia) | 14076 |

| Yamalo-Nenets Autonomous Okrug | 13510 |

| Khanty-Mansiysk Autonomous Okrug - Ugra | 12730 |

| Moscow | 12578 |

| Sakhalin region | 12333 |

| Republic of Karelia | 11836 |

| Khabarovsk region | 11799 |

| Jewish Autonomous Region | 11709 |

| Komi Republic | 11534 |

| Arhangelsk region | 10955 |

| Primorsky Krai | 10775 |

| Krasnoyarsk region | 10039 |

| Amur region | 10021 |

| Moscow region | 9908 |

| Transbaikal region | 9829 |

| Kaliningrad region | 9658 |

| Kabardino-Balkarian Republic | 9598 |

| Sevastopol | 9597 |

| Vologda Region | 9572 |

| Tomsk region | 9546 |

| Pskov region | 9529 |

| Saint Petersburg | 9514 |

| Irkutsk region | 9497 |

| Novosibirsk region | 9487 |

| Smolensk region | 9460 |

| Novgorod region | 9423 |

| Sverdlovsk region | 9311 |

| RF | 9311 |

| Tula region | 9310 |

| Kaluga region | 9303 |

| Tver region | 9302 |

| Krasnodar region | 9258 |

| Tyumen region | 9250 |

| Leningrad region | 9247 |

| The Republic of Buryatia | 9207 |

| Bryansk region | 9120 |

| Vladimir region | 9077 |

| Ivanovo region | 8978 |

| The Republic of Khakassia | 8975 |

| Astrakhan region | 8969 |

| Kostroma region | 8967 |

| Republic of Crimea | 8912 |

| Altai region | 8894 |

| The Republic of Ingushetia | 8846 |

| Tyva Republic | 8846 |

| Karachay-Cherkess Republic | 8846 |

| Perm region | 8777 |

| Altai Republic | 8753 |

| Voronezh region | 8750 |

| Kurgan region | 8750 |

| Oryol Region | 8744 |

| Rostov region | 8736 |

| Ryazan Oblast | 8694 |

| Chelyabinsk region | 8691 |

| Samara Region | 8690 |

| Nizhny Novgorod Region | 8689 |

| The Republic of Dagestan | 8680 |

| Yaroslavl region | 8646 |

| Republic of Bashkortostan | 8645 |

| Lipetsk region | 8620 |

| Kursk region | 8600 |

| Ulyanovsk region | 8574 |

| Volgograd region | 8569 |

| The Republic of Mordovia | 8522 |

| Kirov region | 8511 |

| Udmurt republic | 8502 |

| Omsk region | 8480 |

| Republic of North Ossetia-Alania | 8455 |

| Penza region | 8404 |

| Kemerovo region | 8387 |

| Mari El Republic | 8380 |

| Stavropol region | 8297 |

| Saratov region | 8278 |

| Orenburg region | 8252 |

| Republic of Kalmykia | 8242 |

| Tambov Region | 8241 |

| Republic of Tatarstan | 8232 |

| Republic of Adygea | 8138 |

| Belgorod region | 8016 |

| Chuvash Republic | 7953 |

The size of the minimum pension in Moscow in 2020

Thus, in Moscow in 2020 there are two minimum pension amounts for city pensioners:

- 11,816 rubles - this minimum is guaranteed to pensioners with less than ten years of living experience in the city (this is the cost of living for a Moscow pensioner for 2020),

- 17,500 rubles - pensioners with more than ten years of living experience in the capital receive no less than this amount.

Over the past ten years (namely, six years ago, in 2012), Moscow has noticeably grown in territory. A large part of the Moscow region was annexed to the city. This is the territory of the so-called New Moscow.

Of course, the question may arise whether its residents can qualify for the Moscow minimum of 17,500 rubles.

Yes, of course, this rule also applies to them. Despite the fact that such people formally became Muscovites only six years ago, in the case when a person was registered in the territories annexed to the capital ten years ago, he is also considered a Muscovite “with experience.”

Pension size for working and non-working pensioners in Moscow in 2020

In 2020, the rules for calculating pensions for working pensioners in the Moscow region will be subject to the same standards as for all Russians. Therefore, they receive an insurance pension and all required payments without indexation.

But this applies only to recipients of insurance payments. If the pension is calculated according to the state pension provision, then they are subject to indexation. These individuals can expect an increase of 4.1%.

If such a citizen stops working, the pension will be indexed at the time of work. If after this such person gets a job again, then the pension remains at the same level and no deductions will be made from it.

Exceptions are provided only for the following groups:

- the pensioner got a job after indexation on January 1;

- The pensioner got a job after indexation on April 1.

No recalculation will be made for them. All pensioners who stopped working can count on indexation of their pensions in 2020. The insurance payment will be increased to 4982 rubles. Its coefficient will also be raised to 81 rubles.

Amounts of payments to certain categories of citizens in Moscow in 2020

Amounts for certain categories of citizens will be paid every month, the recipients’ cash accruals look like this

- Persons of the Moscow defense - 8 thousand rubles.

- Veterans of labor and military service - 1 thousand rubles, home front workers - 1 thousand 500 rubles, rehabilitated people - 2 thousand rubles.

- Participants of the Patriotic War (1941-1945), disabled people of the Second World War 1941-1945. – partial compensation for food products from the basic necessary list – up to 2 thousand rubles.

- Persons who suffered from political repression and are rehabilitated will increase by double or more times the amount of compensation provided now.

- Heroic figures of the Russian Federation, USSR, Labor of the Russian Federation, Socialist Labor, full gentlemen with the Order of Glory and Labor Glory - 25 thousand rubles.

- Widows (widowers) of heroes of the USSR, Russia, Labor of the Russian Federation, Socialist Labor, full gentlemen with the Order of Glory and the Order of Labor Glory - who have not entered into a subsequent marriage - 15 thousand rubles.

- Additional lifetime financial remuneration for persons of retirement age with the title “Honorary Citizen of Moscow” - 50 thousand rubles monthly.

- Persons of retirement age with the titles “People’s Artist of the Soviet Union”; “Honored Artist of the Russian Federation”; “Artist of the People of the RSFSR”; "People's Artist of the Russian Federation"; “Honored Artist of the RSFSR” – 30 thousand rubles.

Financial compensation is provided for long-livers of the Russian capital. Additional cash rewards await Moscow residents who are 101 years old or older. They will immediately receive from the state, on the occasion of their own birthday, a one-time gift income that will amount to 15 thousand rubles.

Comment

Tell me, what do you think about this?

The survivor's pension in Moscow increased in 2018

The survivor's pension directly depends on the cost of living in the region. It will be indexed in 2020:

- from February 1, an increase is expected for those who receive insurance payments;

- From April 1, state and social payments will be indexed.

The additional payment will also be increased. Now it will be 2 thousand 498 rubles. If a child is raised by a single mother, then the amount of compensation will be 7 thousand 386 rubles. If both parents died, the pension will rise to 10 thousand 472 rubles.