Types of pension payments for residents of Crimea and Sevastopol

Russian citizens are paid several types of pensions. Residents of Crimea and Sevastopol are also entitled to these payments:

- Insurance. Regulated by Federal Law No. 400-FZ of December 28, 2003. Subject to annual indexation by the state. Paid from the funds of employers who pay the unified social tax and insurance contributions. These pension accruals are addressed to different categories of citizens. Due to old age. The standard and most common type of payment. Cash support is paid to residents of Crimea and Sevastopol who have reached retirement age. It is 55 years for women and 60 years for men (based on the pension reform, it will soon be increased by five years). The pensioner must have the required insurance (work) experience and the amount of insurance contributions.

- Due to disability. Assigned to disabled people of all 3 groups, subject to existing insurance coverage.

- On the occasion of the loss of a breadwinner. Payments are received by persons recognized as disabled and dependent on the deceased breadwinner, if he had insurance coverage.

- Due to old age. The funds are addressed to victims of radiation and man-made disasters, such as what happened at the Chernobyl nuclear power plant. Accrued subject to an insurance period of at least 5 years.

- Due to old age. Men over 65 and women over 60 who do not have sufficient work experience to receive an insurance pension.

Some categories of persons are entitled to additional support:

- Monthly cash payment (MCV). Refers to disabled people, veterans, and family members of the deceased.

- A set of social services (NSS) - as part of the EDS. This includes travel on suburban transport, dispensing medications, and treatment in health resorts.

- Additional monthly financial support (DEMO). Paid to citizens of Crimea and Sevastopol who have served the country - heroes of the USSR and Russia, order bearers, etc.

Regulatory framework

On July 21, 2014, after a referendum, Federal Law No. 208-FZ was adopted. According to this law, it became possible to receive a pension in Sevastopol or Crimea on a general basis. At the end of the transition period, the document finally introduced the Crimean peninsula into the regulatory space of Russian pension provision.

Residents of this region were recalculated payments using a new formula. Where the new amount was lower than the previous one, pensioners were left with the same monthly allowance. In 2015, they could influence the amount of pension payments by providing additional documents.

Pension calculation

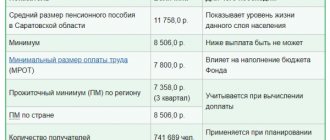

Let us remind you that in Russia the concept of a minimum pension does not exist. Minimum pension payments are set depending on the cost of living in the region. Based on this, it can be noted that the minimum pension in Crimea in 2020 is 8,530 rubles .

Today, many people are wondering whether the minimum wage (minimum wage) affects the amount of the pension? The answer is clear - no. Even if the minimum wage increases, this will not affect pension payments in any way. Therefore, you should not expect indexation of pensions.

The pension is calculated according to the following formula: the amount of accumulated pension points is multiplied by the cost of one point and the fixed payment is subtracted. This formula is actually extremely complex, because it is the Russian Pension Fund that sets the value of pension points, so calculating the pension yourself is extremely difficult.

Employees of the Pension Fund of the Russian Federation in Crimea will help you sort out all the questions that arise.

Return to contents

Conditions for granting an old-age pension

Residents of Crimea and Sevastopol can receive old-age insurance payments under the following conditions:

- Reaching retirement age. Until recently, it was 60 years for men, 55 years for women. From 2020, the age will increase - to 65 years for men (by 2028), 60 years for women (by 2034).

- The insurance period for 2020 is from 9 years (by 2024 it will gradually increase to 15 years). Annual increase – for 1 year.

- The total number of pension points is from 13.8 (by 2025 it will gradually increase to 30). The annual increase is +2.4 points.

- For some categories of citizens, financial support is assigned ahead of schedule (disabled people after a military injury, workers in the Far North, etc. - see No. 173-FZ of December 17, 2001, Art. 25).

Social old-age pension is assigned under the following conditions:

- Permanent residence in Russia. It must be confirmed by a note in the passport or a certificate of registration at the place of residence.

- Reaching the age of 65 years for men, 60 years for women.

- Lack of the required length of service, as well as income from which insurance payments would be paid to the Pension Fund of the Russian Federation. This applies incl. disabled citizens.

- Favorable Beeline tariffs for pensioners - how to choose and connect

- How to find out if a mobile phone is tapped

- Which working pensioners can have their pension indexation returned?

Registration in the OPS system and obtaining SNILS

The procedure for assigning a pension begins with the registration of a citizen in the compulsory pension insurance system (OPS). To do this, you need to register with the Pension Fund of Russia by logging into the personalized accounting system.

The person is assigned an insurance number for an individual personal account and is given a special plastic green card (SNILS). This procedure is the main condition for assigning pension payments.

Residents of the Crimean Peninsula, who have retained their SNILS from the time they were part of Ukraine, do not need to re-issue a “green card”. An exception is the case if the actual data (full name, gender, date, place of birth) differ from those indicated in the Russian passport.

The employer is responsible for registering employees in the OPS system. He also issues SNILS to his employees. Entrepreneurs and self-employed persons apply to the Pension Fund or MFC branch for this purpose. The registration process is a sequence of actions:

- Come to the branch of the Pension Fund or the Multifunctional Center.

- Fill out the insured person's application form ADV-1.

- Submit your Russian passport and application form (aka application).

- Receive a receipt from a specialist with a number by which you can check the readiness of SNILS.

- On the required day, come and pick up a plastic card with an insurance number.

Features of calculating insurance experience

The insurance period for residents of Crimea and Sevastopol, who were previously citizens of Ukraine, is calculated on the basis of average monthly earnings in 2000–2001. This may be another period of work activity before 2002. These documents must be provided by employers or government agencies. The income, which is listed there in Ukrainian hryvnias, is translated into Russian rubles at the exchange rate as of January 1, 2002 (10 UAH = 56.6723 rubles).

Calculation of pensions in 2020 - IPC

Since 2002, individual personal accounts (IPA) have become fully operational, into which deductions from citizens' wages are received. The coefficient for these years is calculated based on accumulated contributions to the individual insurance policy. Experience and any other parameters do not affect the calculation.

Who hasn’t tried to determine the amount of future benefits from the state using the calculator posted on the official website of the Pension Fund of Russia? The result, if not upsetting, was puzzling. How is all this calculated? What formulas? When contacting Pension Fund employees with questions on this topic, there is usually no answer or it consists of standard phrases. No wonder - it is impossible to describe the algorithm in a nutshell.

How to apply

It is better to apply for an old-age pension 6 months before retirement. Procedure:

- Receive a certificate of average earnings for 60 months without interruption until January 1, 2002. After this date, work experience is not counted when determining pension payments.

- If a resident of Crimea or Sevastopol cannot confirm work experience before 2002, he can indicate the period of work activity until January 1, 2015. In this case, the average earnings are still indicated before January 1, 2002 at the named place of work. This applies only to citizens living in Crimea or Sevastopol as of March 18, 2014.

- Issue an extract from your individual personal account. Check whether the data corresponds to what the employer submitted to the Pension Fund.

- Come to the Pension Fund office at your place of residence and submit all the necessary documents. If necessary, consult a specialist.

List of required documents

To receive an insurance pension, residents of Crimea and Sevastopol need to submit a list of documents to the Pension Fund:

- application for social benefits;

- passport of a citizen of the Russian Federation (residence permit if there is no citizenship);

- certificates of: birth of a child;

- registration or divorce;

- change of name;

- registration at the place of residence (if the data is not in the passport);

- average monthly salary from the employer;

- family ties with disabled persons under care;

- Transfer money from phone to phone using ussd command, SMS message, mobile application online

- Sovcombank loan for pensioners - types and conditions of provision, documents, interest rates

- 7 ways to make your winter shoes non-slip in icy conditions

Pension calculator Online

Important!

Before you start calculating your future pension, please read the following information carefully: The results of pension calculations are purely indicative and are intended only to provide an indication of the value of your future pension.

For a more accurate calculation, we recommend contacting the pension fund. All calculation data: coefficients, point value, fixed payment amount, which are used in the calculator, are given as of January 1, 2020. This means that for the entire period of work experience that you indicate in the calculations, the values of the coefficients, fixed payments, your salary, etc. will apply.

taking into account 2020 indexation.

We recommend reading: How to submit a 3rd personal income tax declaration if there is no apartment rental agreement

The calculator will be more useful to those users who are just starting their work experience.

When calculating, it is conditionally assumed that in 2020 you have the right to receive a pension with the data you entered.

Amount of payments in Crimea and Sevastopol in 2020

From January 1, 2020, the pensioner’s subsistence level (PMP) or minimum pension in Crimea (which is the same thing) is 8,530 rubles, in Sevastopol – 8,722 rubles. The average amount of pension payments is about 12,000 rubles. In 2020, the insurance period must be at least 9 years, and the sum of points must be 13.8.

Formula for calculating insurance pensions in Russia (including Crimea and Sevastopol):

SP = IPK * SIPC + FV, where:

- SP – insurance pension;

- IPC – individual pension coefficient (sum of points accrued by the date of assignment of cash support);

- SIPC – the cost of the individual pension coefficient (the cost of a point by the date of accrual of payments);

- FV – fixed payment.

The percentage of state pensions is integrally linked to the amount of social security:

- For old age – from 200 to 250% of social benefits.

- For disability – from 100 to 300%.

- In case of loss of a breadwinner – from 125 to 250%.

- For length of service - appointed personally.

Additional payment to federal primary care

Subjects of Russia determine their subsistence level. If citizens receive security below this amount, they are paid additionally from federal and regional budgets. PMP of Crimea at the beginning of 2020 - 8530 rubles, Sevastopol - 8722 rubles. This is lower than in Russia - 8,726 rubles, therefore a federal surcharge is charged to the level of the all-Russian PMP.

Annual indexation

Pension accruals in Crimea and Sevastopol, as well as other regions of Russia, are constantly indexed. The minimum consumer basket is taken as a basis, and price increases are taken into account. In 2019, various types of support were increased:

- insurance – by 3.7%;

- for government provision – by 4.1%;

- EDV – by 2.5%;

- DEMO – remains from 500 to 1000 rubles, since it is not indexed.

A table has been published with the timing of pension indexation in 2020: who will receive an increase and how much

How many times will pensions be indexed in 2020? Will EDV and social benefits be indexed? Will state and social pensions be increased? We talk about the coefficients and present a single table with indexation dates. You can also familiarize yourself with the new amounts of pension payments after indexation.

The maximum increase, which is made in August, is limited to only 3 points (pension coefficients), converted into cash equivalent. As of August 1, 2020, the cost of 1 coefficient will be 87 rubles 24 kopecks. Therefore, pensioners will not receive an increase of more than 261 rubles 72 kopecks (87.24 rubles x 3) from August 1, 2020.

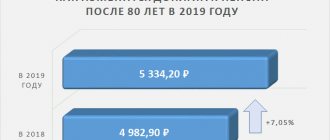

Increasing pensions for Crimean residents from January 1, 2020

From 2020, as part of the pension reform, it is planned to index insurance coverage by 7.05%. This will only affect non-working pensioners. On average in Russia, payments will increase by 1000 rubles. annually, i.e. at a faster pace (about twice), outpacing inflation. This will remain the case until 2024.

For example, if a pensioner from Crimea or Sevastopol received 10,000 rubles. per month, from 2020 he will be paid 11,000 rubles. An increase in the amount of payments, ahead of inflation, became possible as a result of the pension reform and raising the retirement age.