A new category of citizens has emerged in Russia – pre-retirement people. The emergence of a new social group is associated with the adoption of a reform that delayed the retirement age. The program operates at the federal level, but Muscovites will receive additional social guarantees from the city budget.

Current: New benefits for pre-retirees in 2020 →

Until 2020, men received pensioner status and benefits from the age of 60, women from 55. Today, men begin to receive pensions at 65, women at 60, but the age allowing citizens to receive benefits has remained the same. It is called pre-retirement.

This definition follows from the legislative amendments introduced by the law of October 3, 2018 No. 350-FZ in paragraph 2 of Art. 5 of the Law “On Employment in the Russian Federation”.

A citizen will be issued a pre-retirement certificate if:

- there is Moscow registration at the place of residence;

- the citizen has reached pre-retirement age;

- have a certificate of “Labor Veteran” or “Veteran of Military Service”.

What benefits are available to pensioners in 2020 in Russia: list of benefits

At the level of federal legislation, in 2020, pensioners are provided with benefits related to exemption from certain mandatory payments, as well as the opportunity to receive a certain list of social and utility services for free or at special rates. So the list of benefits for pensioners includes:

- Cancellation of mandatory payments for transport, real estate, income and land taxes.

- Benefits for paying for housing and communal services, including utility bills, telephone payments, electricity, compensation for contributions for major housing repairs.

- The right to receive certain free medical services, the list of which is approved by the Ministry of Health in their pure and preferential sanatorium services.

- Preferential use of public transport and air travel.

- Tax deduction on income when purchasing or constructing housing.

- Compensation payments for persons of retirement age with income below the subsistence level.

- Other types of non-cash assistance to low-income pensioners, for example, provision of basic necessities, clothing, and food on a free basis.

A special feature of receiving benefits is that for most of them there is a special procedure for applying for them. That is, it is impossible to automatically receive social assistance; you must submit a corresponding application to the authorized body.

The latest news from the State Duma today allows us to conclude that the federal benefits provided for pensioners in 2020 will remain. In addition, according to Deputy Prime Minister Tatyana Golikova: “Benefits will be provided upon reaching the current retirement age, and not due to retirement.”

What types of pensions exist according to the legislation of the Russian Federation?

Our country provides several options for pension provision. These payments are intended to compensate the recipient for the income he had during his working life or to support socially vulnerable members of society (disabled people, orphans, etc.). The table shows the classification of this type of government subsidy according to Russian legislation:

| Types of pensions | |||

| For compulsory pension insurance | For state support | For non-state support (voluntary) | |

| Insurance | Cumulative | ||

Existing options:

| Not subdivided | The categories provided by law are:

| No categories |

Benefits for payment for housing and communal services

Legal regulation of benefits for housing and communal services is carried out according to the rules established by:

- Art. 159 Housing Code of the Russian Federation;

- Decree of the Government of the Russian Federation dated December 14, 2005 N 761 (as amended on July 26, 2018) “On the provision of subsidies for the payment of housing and utilities.”

- Order of the Ministry of Construction of Russia N 1037/pr, Ministry of Labor of Russia N 857 dated December 30, 2016 “On approval of the Methodological recommendations for the application of the Rules for the provision of subsidies for the payment of residential premises and utilities, approved by Decree of the Government of the Russian Federation of December 14, 2005 N 761.”

The calculation takes into account the maximum allowable share of utility costs from the income of the pensioner and the person living with him in the residential premises. Standards for the standard area of housing and the cost of housing and communal services are approved by regional legislation and are different in each region.

The list of benefits includes services for:

- Water supply (both hot and cold water), drainage and sewerage.

- Gas supply (in houses where gasification has been carried out)

- Electricity supply.

- Maintenance and maintenance of the building and surrounding area.

At the same time, benefits in the amount of 50% for housing and communal services are provided to participants of the Second World War, disabled people who became disabled as a result of the performance of official duties, close relatives of a deceased or disabled combatant, regardless of income level.

In addition, regardless of income level, pensioners living in residential premises under social rent are entitled to a 50% discount on housing and communal services payments.

Watch until the end! — REAL ESTATE TAX in 2020 in RUSSIA

Retirement from 2019 (table)

43.5 million pensioners registered with the Pension Fund of Russia (PFR) , of which 9.7 million were working (more than 22% of the total number). At the same time, the average old-age pension at the beginning of the year was 14,151.6 rubles (official data from Rosstat).

- the requirements for the minimum value are increasing annually from 2020 by 1 year , when the standard was set at 6 years ;

- the final value (15 years) will be fixed from 2024.

How to apply for benefits for utility bills, electricity and telephone payments

To apply for benefits for housing and communal services, you must submit an application to the MFC or through the Internet portal of State Services. The application must be accompanied by copies of documents confirming:

- the identity of the applicant;

- legal basis for living in a residential premises (document of ownership or lease agreement);

- payment for housing and communal services and lack of debt for the last month before submitting the application;

- a person’s right to receive benefits (for example, a copy of a pension certificate);

- income of a pensioner (certificate from the tax service and the Pension Fund) and family members living with the applicant.

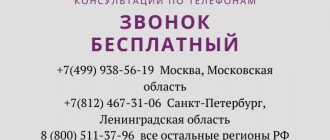

In addition, it is necessary to indicate information about the occupied space (certificate, according to the approved form) and information about the bank account of the pensioner to which the subsidies will be transferred. In some regions, in accordance with local legislation, the submission of additional documents may be required. More accurate information and advice can be obtained free of charge at the MFC at your place of residence. The deadline for obtaining the benefit is 10 days from the date of receipt of documents.

Insurance pension and its types

This type of government social payments, which partially compensates citizens for the lost income they had during their working years. The mandatory conditions for obtaining such security were discussed above. The amount of payments in this case depends on the number of individual pension coefficients (IPC) accumulated by the employee. These points are assigned for each year of work experience and socially significant activity (conscription service, caring for a disabled child, etc.).

The size of the individual coefficient varies depending on the selected type of pension (insurance/funded) and is indexed annually. In 2020 it is equal to 81.41 rubles. The number of points that an employee will receive for a year worked is calculated using the formula CIC = SSV/MSV x MPC, where:

- KIC – the number of individual pension coefficients (points) for a specific employee. This indicator is calculated for each year worked, summing it up with the readings of previous years.

- TIC – the amount of insurance premiums. They are accrued on wages before any necessary taxes are deducted from them. Their amount depends on the type of pension chosen by the citizen (for insurance it is 10%).

- MSV is the maximum amount of insurance premiums at a 16% rate. For 2020, the MSV indicator is 1,021,000 rubles.

- SPK is the maximum value of the pension coefficient. In 2019, this value is 8.7 (and will gradually increase to 10 by 2021).

Another value that influences the size of pension payments is the fixed part of the pension. Its size is determined by the state, and it is subject to annual indexation. The total amount that the pensioner will receive in hand is calculated using the formula RTP = CPC x SOK + FPP, where:

- RTP – the amount of the insurance pension.

- CPC – the number of individual pension coefficients (IPC).

- SOK – the cost of one IPC. For 2020, its value is 81.41 rubles.

- FPP is a fixed part of the pension. In 2020, its size is 4,982.90 rubles.

There are different types of labor pensions. They are divided depending on the situation that led to the occurrence of the insured event. The following options are legally defined:

- Due to old age. This is the most common way to go on vacation.

- Due to disability. Requires documentary evidence of disability.

- For the loss of a breadwinner. It has specific purpose related to specific causes of death of the insured person.

Old age pension

A prerequisite for receiving this payment is the attainment of the retirement age specified by law. Currently it is 55 years for women and 60 for men. For some categories of citizens, a different age limit is defined below the basic norm (for example, for rescuers or mothers of large families). The mandatory conditions for receiving this type of pension include:

- Availability of insurance experience (periodic contributions to the Pension Fund). In accordance with the results of the 2020 pension reform, this value increases annually until the established maximum is reached. It is 15 years and will happen in 2025. For those retiring in 2020, a 9-year coverage period is required.

- Availability of the required amount of individual pension coefficients. Similar to the previous indicator, this value also increases annually. The maximum value will be reached in 2025 and will be 30 points. Those going on vacation in 2020 need to have 13.7 IPC.

By disability

In accordance with the new legislation, when receiving this type of security, the cause of loss of ability to work does not matter (for example, it may be due to a work or domestic injury). Required conditions include:

- Determination of disability in a specific person. The supporting document is the conclusion of a medical and social examination. The designated group (I, II or III) regulates the amount of pension payments. In most cases, disability requires re-certification after a few years, but it can be established indefinitely.

- Availability of insurance experience. Supporting documents are SNILS and work book. The minimum length of service is 1 day (in the absence of an insurance period, the person will be assigned a social pension).

- New method of testing drivers for alcohol

- Curtains for the living room - how to choose ready-made sets in modern, classic or vintage style

- Sun blinds for cars

On the occasion of the loss of a breadwinner

Disabled dependent family members of a deceased citizen are entitled to this type of payment. This includes minor children, disabled spouses, close relatives caring for a disabled child, etc. (this list is presented in full in Article 10 of Federal Law No. 400-FZ “On Insurance Pensions” dated December 28, 2013). The mandatory conditions for assigning this type of maintenance to a dependent are:

- Whether the deceased person has an insurance record.

- Absence of criminal (illegal) actions on the part of the dependent that caused the death of the insured person.

Cancellation of transport, real estate and land taxes

The cancellation of certain types of tax fees for pensioners will remain in effect in 2020. Thus, persons of retirement age are exempt from paying the following types of mandatory payments:

- Property tax. The benefit applies to both working and non-working pensioners. Only one property of the same type owned by a pensioner with a total area of no more than 50 sq.m. is subject to tax exemption.

- Tax deduction. A pensioner has the right to a tax deduction in the amount of the cadastral value of six hundred square meters of land in his possession. For a tax deduction on income paid when purchasing or constructing housing, including expenses for paying mortgage interest. For a tax deduction on income if the funds were spent on treatment.

- Income tax. Personal income tax is not withheld from pensions and other social benefits of a pensioner. However, this rule does not apply to wages and other income.

- Transport tax. Pensioners who own a car intended for transporting disabled people, a vehicle received from social security authorities with a power of no more than 100 hp, and who have a motor boat with an engine of no more than 5 hp are exempt from paying transport tax. The benefit applies to only one vehicle.

In addition to federal benefits, pensioners are provided with additional regional benefits established by the legislation of the constituent entities of the federation.

Retirement age increase table

- For workers working in the Far North and areas equivalent to such areas. For this category of citizens, the retirement age will also increase by 5 years . After the transition period, Northern workers will retire not at 50 and 55 years old, but at 55 and 60 years old , respectively.

For citizens working in the teaching, medical and creative fields, the age for early retirement will be increased by 5 years . The new retirement age will be determined based on the date of completion of the required length of service:

Regional benefits for pensioners in Moscow and the Moscow region in 2020

The authorities of Moscow and the Moscow region, as measures of social support for people of retirement age living in the capital and region, have primarily provided for an increase in benefits and compensation payments, which are paid taking into account the living wages for pensioners and social standards established in the regions. The comparative table presents the main benefits and compensation payments for such persons:

| Type of benefit | Moscow | Moscow region | Conditions of receipt |

| Free travel on public transport | You can also take advantage of the benefit when traveling on commuter trains running from Moscow to the region and back. | With the exception of taxis, including minibuses | |

| Free dental prosthetics | The benefit is provided for non-working pensioners. The service includes a consultation with a doctor, treatment of simple enamel damage, repair of a prosthesis, and prosthetics with products of “budget” designs. | With the exception of products made of precious metals and metal ceramics. | |

| Free trips to sanatoriums. | The voucher is issued once a year, for a period of 18 days of sanatorium service, at the social security authorities at the place of registration of the pensioner. Also, travel to the sanatorium is paid for at the expense of the regional budget. | Availability of medical indications. | |

In Moscow, the city authorities pay for single pensioners telephone calls, as well as some utilities, such as garbage collection.

Owners of a Moskvich social card can count on discounts both in municipal institutions and private commercial enterprises, for example, pharmacies, shops, and catering establishments.

Who can apply

Until 2020, this title was used by people who had two years left before retirement. This age state did not imply any privileges. Since October 3, 2018, Law No. 350 Federal Law has established the status of a pre-retirement person 5 years before retirement age and provides a number of preferences. They can be used by citizens, regardless of registration.

Benefits in Moscow for pre-retirement age are additionally regulated by local act No. 19 of 2020. Only PAPs with a confirmed place of residence in the capital can apply for city benefits. Russians who are not registered in Moscow and are in the city passing through, visiting, for work, renting apartments without registration, cannot use capital subsidies.

Benefits announced for 2020 by local authorities for pensioners in the Rostov region

The authorities of the Rostov region promised to maintain existing benefits for pensioners for 2020. So the list of regional privileges includes:

- free dental care;

- 50% of payment from the regional fuel budget for pensioners living in houses without gas heating;

- free use of public transport, including trains;

- free vouchers to sanatoriums for medical reasons.

In addition, for pensioners who have worked in the public sector for at least 10 years in rural areas of the region, 100% compensation for utility bills and 50% payment for sanatorium and resort holidays are provided.