Home > News > What awaits pensioners from August 1, 2020

20:39 July 31, 2017

1 726

From August 2020, working pensioners for whom policyholders (employers) paid insurance premiums in 2016 will receive an increased pension. This increase is due to the annual recalculation of the amount of pension provision, and it will affect only recipients of old-age and disability insurance pensions.

This recalculation is carried out without a declaration , i.e. To implement it, you do not need to contact the Pension Fund branches. The recalculated (increased) amount will be accrued from August.

It is worth noting that according to the Federal State Statistics Service, in 2020 the number of working pensioners decreased significantly compared to the previous year. If in 2020 there were 15,259 thousand people employed, i.e. 35.7% of the total number of pension recipients through the Pension Fund, however, already in 2020 their number decreased to 9,883 thousand people (22.9% of the total number of pensioners). This is largely due to the introduction of amendments to the legislation that limit working pensioners in the indexation of pension payments (Article 26.1 of Law No. 400-FZ dated December 28, 2013).

Cancel indexing

Federal Law No. 385-FZ of December 29, 2020, which abolishes the indexation of pension payments for pensioners who continue to work, has been in force since the beginning of 2016 to the present. This regulatory document provides for an increase in pensions only if the citizen receiving it resigns.

In comments to the State Duma’s refusal to index pension payments for working pensioners, the head of the Russian Ministry of Finance A. Siluanov said that this step was part of an anti-crisis plan, the objectives of which are:

- support for pensioners who have no other income;

- optimization of costs for pension indexation;

- maintaining the size of the state budget of the Russian Federation for 2017–2019 within the planned framework.

In April 2017, the Minister of Labor of the Russian Federation M. Topilin made a statement on the issue of indexation of pensions for citizens who continue to work. To compensate, the size of the country's budget will have to be increased by 170–200 billion rubles; in the absence of this amount, it is too early to talk about indexation of pensions.

Non-working pensioners

For the category of senior citizens, the amount of allowance is systematically increased, as stipulated by law. In particular, this concerns the revaluation of its value due to changes in the financial situation.

First indexation (April)

This year, as well as earlier, the indexation of pensions was supposed to be carried out twice a year. In April, there is a planned increase in proportion to inflation, while in October the calculation is based on the standard of living and contributions for financing. This year, the Government carried out a recount in April by 4%. This value did not cause enthusiasm, since the declared inflation rate was more than 2% higher.

Second indexation (October)

The October bonus is calculated taking into account several factors: standard of living, inflation rate, results of the first half of the year, budget size, contributions to the Pension Fund. It is determined mathematically and takes into account the situation as a whole. The Government’s task is to increase the level of well-being taking into account the economic situation.

For non-working pensioners, two pension indexations are provided in 2020

Since in April it was not possible to ensure an increase at the required level, the indexation of pensions in October will need to “reach out” to it at least, and also evaluate the results of six-month activities. Under favorable conditions, it is possible to increase payments by a certain amount exceeding inflation indicators.

Indexation for retiring pensioners

Law No. 385-FZ provides for the restoration of a pensioner’s rights to indexation after his dismissal from work. With this recalculation, all indexations missed by the employee and earned points will be taken into account. The recalculated pension amount will begin to be paid 3 months from the date of termination of the employment contract.

To receive an increased amount of pension payments, no action is required from a resigned employee - except in situations where the dismissal occurred before April 1, 2017. After this date, employers independently transfer information about the former employee to the Pension Fund, which performs a recalculation.

Important! After dismissal, the pensioner retains the right to return to work or get a new job. If he does this, he will be able to receive an already indexed pension and salary. While the pensioner is working, his payments will no longer be indexed. However, the size of the pension will not decrease again.

To increase payments, a pensioner should wait for the increase, which begins to be paid from the beginning of the fourth month after dismissal, and only then start working. So, if you quit on August 11, 2017, you can receive an indexed pension only from November 11. And a quit employee should get a new job no earlier than this date.

For three months after termination of employment, the payment amount remains at the usual level, and the difference between the old value and the indexed one is not compensated. Pensioners will receive compensation for the three months that elapsed from the date of dismissal until the pension is recalculated only from 01/01/2018.

Working pensioners

Indexation of pensions for working pensioners in 2017 occurs differently. It is known that payments in this category change individually, taking into account new revenues into the insurance system. Therefore, planned indexations do not apply to working elderly citizens.

Pension indexation on August 1 - applies only to working pensioners

It is believed that they have an additional source of funding, in addition to government contributions, from their employer, and therefore do not act as a social subgroup requiring priority support from the Government.

Pension recalculation

According to the law, the working category has the right to recalculate their pension. It is designed to take into account the new characteristics of a citizen in his payments. Since the employer sends contributions to the social insurance fund for a specific elderly employee, the Pension Fund has all the data about him. This allows a citizen to receive a modified pension annually without additional application to the Pension Fund.

Automation of pension indexation involves recalculation in the following stages:

- The employer pays contributions for the elderly employee.

- In August, points calculated taking into account the previous year until the end of December are added to the pension amount.

- Points are converted into monetary equivalent.

- The calculated cost is added to the base payment amount.

- Starting from August of each year, the pensioner begins to receive a pension calculated according to this principle.

What happens on August 1st

Regardless of the period of work, the pension is recalculated from August 1 of the current year for the previous one. Whether the pensioner worked for a few months or the whole year does not matter. If the employment was carried out in accordance with the principles of the law, all deductions were properly transferred, which allows the Pension Fund to have complete information about the length of service and salary of each person.

Contacting the Pension Fund

If a working pensioner quits his job, he also does not need to apply separately to the Pension Fund. If last year he did not work, no contributions were received in his name, this allows the Pension Fund to classify him as non-working and apply the appropriate norms. In this situation, recalculation does not occur, because the citizen’s situation has not changed compared to the previous period.

What can working pensioners expect in 2017?

A pensioner who continues to work in 2017 will not receive compensation until he resigns. However, the recalculation will still be performed on the basis of transfers paid by the employer. Immediately after the termination of the employment contract with the organization in which the pensioner worked, the missed coefficients for all indexations will be returned to him. Therefore, the size of the pension after dismissal does not decrease, and losses will only amount to the difference that was not paid to the employee from the moment he reached retirement age until leaving work.

In 2018, pensions of Russian pensioners will increase in accordance with the inflation rate - presumably by 3-4%. But this compensation will not affect working citizens. The same situation is expected in 2019. And, according to the Minister of Finance of the Russian Federation A. Siluanov, the issue of increasing payments to working pensioners can be resolved positively no earlier than 2020.

August recalculation of pensions in 2020

The August recalculation of pensions for working pensioners is carried out on the basis of Article 18 of the Federal Law-400: “Determination, recalculation of the size of insurance pensions, a fixed payment to an insurance pension, an increase in a fixed payment to an insurance pension and adjustment of the size of insurance pensions” and Article 26.1. Payment of an insurance pension during the period of work and (or) other activities (introduced by Federal Law of December 29, 2015 N 385-FZ).

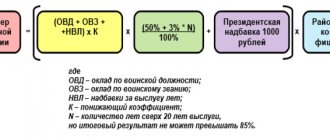

According to the rules, the increase in pension after the August recalculation is calculated using the formula

Increase = SPK x IPC 2016

Where

- SPK - the cost of one pension coefficient

As of August 1, 2020, SPK = 78 rubles 58 kopecks. This value will be applied to those who, on the date of recalculation, transferred to the status of a non-working pensioner, but worked in 2020. For working pensioners who worked in 2020 and did not change their status, a different figure will be used in the calculations, “frozen” due to the non-indexation of pensions for working pensioners - either SPK2015 = 71 rubles. 41 kop . , or SPK2016 = 74 rub. 27 kopecks Which one depends on when you retired. (Clarification on the size of the SPK was made by our user rzd )

- IPC2016 is an individual pension coefficient, “as of January 1 of the year in which the corresponding recalculation of the insurance pension is made based on the amount of insurance contributions not taken into account in the previous recalculation” (according to the wording of Federal Law-400). For the majority of working pensioners, for whom this recalculation is not being carried out for the first time, the phrase means that the IPC is determined based on the amount of insurance contributions transferred to the Pension Fund of the Russian Federation from January 1, 2020 to December 31, 2016.

The IPC limit remains the same - the value of the individual pension coefficient IPC2016 cannot exceed 3 points when recalculated (according to Federal Law-400).

Note that an IPC of 3 or more points was earned by those whose average monthly salary in 2020 was 20 thousand rubles or more. The PFRF will keep the rest (earned in excess of 3 points) for itself and will never return it to the pensioner.

The size of your IPK2016 can be found out either in your Personal Account on the Pension Fund of the Russian Federation website, or on the State website. By making a request, you can receive an official “Notice on the status of an individual personal account” (form SZI-6), which will also indicate your IPK2016.

The size of the insurance pension for working pensioners is recalculated due to an increase in their individual pension coefficient if the pensioner continues to work, and the insurance contributions that the employer pays for him to the Pension Fund of Russia after January 1, 2020 were not taken into account:

- when assigning an old-age insurance pension;

- when assigning an insurance pension in case of loss of a breadwinner;

- when assigning a disability insurance pension;

- when transferring from one type of insurance pension to an old-age insurance pension or a disability insurance pension;

- during the previous recalculation.

In these cases, the recalculation of the insurance pension is carried out by the Pension Fund of Russia without application from August 1.

The expected increase in pension after recalculation depending on the average monthly salary in 2020 is shown in the table

| Average monthly salary in 2020 (RUB) | Calculated IPC | IPK taking into account the annual limit of 7.83 points | IPC of a working pensioner (limited to 3 points) | An increase to the future pension of a working citizen, not pensioner (rub) | Increase in pension for a working pensioner (RUB) | Taken from a pensioner in favor of the Pension Fund of the Russian Federation (rub/month) | Annual “gift” from a working Pension Fund pensioner (rub/year) |

| 10 000 | 1,508 | 1,508 | 1,508 | 118,46 | 107,65 | 10,81 | 129,71 |

| 15 000 | 2,261 | 2,261 | 2,261 | 177,69 | 161,48 | 16,21 | 194,56 |

| 20 000 | 3,015 | 3,015 | 3,0 | 236,92 | 214,23 | 22,69 | 272,34 |

| 25 000 | 3,769 | 3,769 | 3,0 | 296,16 | 214,23 | 81,93 | 983,11 |

| 30 000 | 4,523 | 4,523 | 3,0 | 355,39 | 214,23 | 141,16 | 1 693,88 |

| 35 000 | 5,276 | 5,276 | 3,0 | 414,62 | 214,23 | 200,39 | 2 404,66 |

| 40 000 | 6,030 | 6,030 | 3,0 | 473,85 | 214,23 | 259,62 | 3 115,43 |

| 45 000 | 6,784 | 6,784 | 3,0 | 533,08 | 214,23 | 318,85 | 3 826,20 |

| 50 000 | 7,538 | 7,538 | 3,0 | 592,31 | 214,23 | 378,08 | 4 536,98 |

| 55 000 | 8,291 | 7,83 | 3,0 | 615,28 | 214,23 | 401,05 | 4 812,62 |

| 60 000 | 9,045 | 7,83 | 3,0 | 615,28 | 214,23 | 401,05 | 4 812,62 |

Pension recalculation

Citizens who continued to work received a small increase in their pension, although this was not indexation, but recalculation. From August 1, 2017, the amounts of pension payments were adjusted. The basis for the increase was the employee’s current salary and the number of points he earned for 2020. The maximum adjustment value is 3 pension points or about 235 rubles. According to information from the Institute of Social Analysis and Forecasting, the recalculation affected approximately 12 million working pensioners in Russia.

Despite the fact that many citizens do not distinguish between indexation and recalculation, there is a certain difference between these processes. Payments are indexed only for non-working pensioners. And the recalculation of the insurance pension in accordance with payments from the employer also applies to people who continue to work.

Recipients of disability or old-age pensions who worked officially have the right to recalculation. Payments for them will increase due to insurance premiums paid by employers. And the amount of the premium is calculated not as a percentage, as with indexation, but on an individual basis. Unofficially employed employees receive a pension, the amount of which is adjusted according to the rules regarding non-working pensioners.

From August 1, 2020, pensions of working pensioners will be recalculated

01 August 2020 08:02

The increase in pension as a result of the August recalculation is of a purely individual nature - the size of the increase depends on the amount of insurance contributions that the employer paid for the working pensioner to the Pension Fund in 2020.

To carry out the recalculation, no applications to the Pension Fund will be required - the recalculation is without application, except for persons who have the right to establish a share, but did not assign a share (civil servants, military personnel). In accordance with Federal Law No. 400-FZ dated December 28, 2013. “On insurance pensions”, during recalculation, a working pensioner can be additionally awarded no more than three points. Considering that the cost of a pension point from April 1, 2020 is 78 rubles 58 kopecks, the maximum increase in pension will be 235.74 rubles. In cases where the pensioner continues to work on the date of recalculation (that is, his pension was not indexed in 2020 and he did not interrupt his work), then when paying the amount of the increase, the cost of the 2020 pension point will be taken - 71.41 rubles. (non-indexed). Thus, for this category of citizens, the maximum increase in pension will be 214.23 rubles (71.41 x 3).

In order to earn 3 pension points per year, you need to receive a salary of about 22 thousand rubles per month or more. Thus, a working pensioner will be able to receive a maximum increase in pension, as a result of an adjustment, of 235.74 rubles (214.23 rubles for workers), receiving a salary in 2020 of about 22 thousand rubles or more. If a pensioner’s income is less than 22 thousand rubles per month, then the increase will be less.

As for individual entrepreneurs, if they pay a fixed payment for the year in the amount of 19,356.48 rubles, the increase will be 66.77 rubles.

“From February 1, 2020, pensions of working pensioners are paid without February indexation, and August recalculation will also be paid. After a working pensioner stops working, his pension amount will be recalculated and increased by the indexation coefficients that were missed during his working life. Indexed pension amounts will be paid in accordance with the above law from the month following the month in which the decision of the territorial body of the Pension Fund was made, the decision is made in the month following the month of receiving information from the employer,” explains Anastasia Kychkina, head of the department for organizing the assignment and recalculation of pensions Branches of the Pension Fund of the Russian Federation in the Republic of Sakha (Yakutia).

Comments (0)

Share your opinionCancel reply

Read other news on this topic

- 1 492 24.01.2020

Pensions in February 2020

All federal payments and benefits will increase by 3% from February 1, 2020.

- 7 131 114 15.10.2018

Retirement age in Russia from 2020

On October 3, 2020, the law on retirement age in Russia No. 350-FZ was signed by the President and officially published on the state legal information portal.

- 3 268 13.10.2017

Pensions in 2018

.

All news