General information about payments

Since January 2020, information has appeared on the Internet revealing the possibility of receiving “insurance payments” from private funds to a SNILS account.

Any cardholder could use this method. To receive funds, a citizen had to pay a commission on the website. But the registration process did not end there: intermediary services were constantly becoming more expensive, but the money never arrived in the account.

Important! This scheme is recognized as fraud, therefore its implementation is punishable by law.

According to regulations, receiving compensation under SNILS is not provided. The purpose of the document is to register a citizen in the pension system. SNILS does not perform other functions related to finance.

In November 2020, the Pension Fund made an official statement in which it explained to citizens the new fraud scheme. Employees announced that there are no hidden payments, and ordinary people do not have access to SNILS data. To obtain information, the owner must personally contact the Pension Fund branch, or fill out an application on the State Services portal.

Find out the insurance and savings part of the pension according to SNILS

Before you start learning about the insurance and savings part of the funds, you need to understand what the difference between them is.

- The insurance part is due upon the occurrence of an insured event, that is, a person’s retirement at a certain age (55 and 60 years), where the state is the insurer, and the Pension Fund is the executor. The insured funds are directly proportional to wages, which is 22% of its amount. Therefore, the larger the “white salary”, the higher the contributions to the future pension will be.

Important! The conditions for the insurance part of the pension are very variable (No. 400-FZ). So, if in 2020 the insurance period was 6 years, in 2017 - 8 years, in 2020 - 11 years. By 2025, it is predicted that it could rise to 15 years. This is due to the level of inflation in the country as a whole. An important aspect is the retirement age (lower by 5 years) and length of service (9 months of work is equal to 12 total months) of citizens of the northern regions.

- The funded part is an additional amount paid monthly, set as a percentage of that paid by the employer to the Pension Fund. The minimum amount can be 2%, while the maximum is regulated by the employee himself. The essence of this method is that it is possible to independently invest money in the accumulative capital of a labor pension.

Important! The pension reform of 2020 states that from this year the funded part of the pension will automatically be transferred to the insurance part. Accordingly, this process does not require the submission of an application, as it was before, and does not depend on the structure that manages the assets.

Until 2013, all citizens received written notifications from the pension fund about their savings. But, starting from this period, the Pension Fund generates such letters only upon an official request. Therefore, to make it easier to find out the necessary information about your pension, it is important to know your SNILS, that is, the personal account where the accruals are received.

Until April 2020, it was a plastic green card, which had to be in the hands of every citizen. After the adoption of the Federal Law No. 48, it is enough to receive an electronic or paper notification of registration in the pension insurance system, which displays the unique SNILS code.

True or not

All advertisements promising “hidden payments” are lies.

This information is a trick of scammers. The first cases of violations were recorded in 2020, when the Pension Fund began to receive complaints from citizens about fraud related to SNILS. There are many fraudulent schemes associated with the identification number, and the most common among them are the following:

- men or women of pleasant appearance visited the homes of citizens, where they introduced themselves as employees of the Pension Fund of Russia. During the conversation, they asked to sign documents related to pension savings. In this way, the scammers not only learned the SNILS number, but also passport details;

- citizens in need of work were asked to sign an agreement to transfer their savings to a non-state pension fund. After receiving the signature, the person was denied the position;

- when applying for a consumer loan, the citizen also signed an agreement with the NPF, since often people do not read the documents to the end;

- Sociological surveys were conducted in public places to obtain an identification number.

There are widespread cases of fraud using Internet resources: citizens receive emails from UKSO guaranteeing payments according to SNILS. The abbreviation UKSO is the Social Security Control Office, but such an organization does not exist and does not have its own website.

When clicking on the link, citizens are taken to the scammers’ page, which contains information about the possibility of receiving monetary compensation for people who did not use social services.

Important! For greater reliability, scammers post hotline numbers, addresses, and even the UKSO emblem on the page, which resembles government agencies. Reviews confirming receipt of payments under SNILS are also listed on the website.

In order for compensation to be transferred, a citizen must register by indicating his SNILS or passport details. After authorization, a person is given access to his personal account, and information about checking his social balance is displayed. After some time, the citizen sees on the screen a tempting amount equal to 148,255 rubles.

To receive it, you can provide your e-wallet or bank card details. The procedure does not end there: the system displays an error and provides the opportunity to obtain operator advice.

The employee finds a reason why the amount cannot be transferred to the citizen’s card, so he offers to open a single account. But this procedure is paid, and amounts to 198 rubles.

After the payment is made, the money never arrives in the citizen’s account: the scammers try to extract as much money from the person as possible until he begins to suspect fraud.

Important! All actions of citizens carried out for the purpose of stealing other people's funds fall under the category of “fraud” and are punishable under Article 159 of the Criminal Code of the Russian Federation.

HOW TO VIEW THE STATUS OF YOUR SICK LEAVES

If a person has an insurance certificate, but cannot find it in his personal documents, then he must contact the territorial body of the Pension Fund or the employer’s personnel service to obtain a duplicate, which will be issued quite quickly. In what cases is it necessary to know your SNILS? The individual number indicated on the PF card does not need to be memorized by heart, just keep it or carry it along with your identity card. There are several cases when you may need it urgently now: - find out your savings that are stored in your personal account.

This is easier to do on the official website of the Pension Fund in the Electronic Services section at the link: es. You can enter there by registering at State Services with the same login and password. Such a service cannot be found on any Internet resource, again because the information is closed.

You will need an identity card when contacting the Pension Fund, where you will be given an answer by checking the data with those available in the Pension Fund databases. The first document is issued by the tax authorities and is contained in the databases of this structure. In addition to the fact that SNILS is needed to form a pension, it is necessary to receive government services electronically and benefits, reduce the number of documents when receiving various services, etc. Children over 14 years old can apply independently with their passport.

When submitting an application to the Pension Fund of Russia, a duplicate insurance certificate is issued online. That is why many Russians want to know how to find out SNILS online, so that they do not have to constantly search for this document. At the same time, the position of the Pension Fund regarding this number is unambiguous - representatives of this government agency classify SNILS as confidential information, access to which must be limited.

In addition, contacting the Pension Fund is also necessary in the event of a change in passport data - first name, last name or patronymic. In such situations, SNILS does not change, but the pension certificate changes with the entry of new passport data into the Pension Fund register.

Only a person who is the guardian of the person whose SNILS information is being requested can request such information even when contacting the Pension Fund in person. To do this, you need to use the following algorithm:. A document in the form of SNILS should be understood as an official document confirming the assignment of an individual number in the pension system. This number is a personal account, which is designed to accumulate contributions that form your future pension.

A document is issued directly to your hand, which is a card in a plastic shell with a greenish tint. Within a few minutes, your request will be completed and you will receive a corresponding statement, which you can print or view later in your Personal Account. If you are a client of a non-state Pension Fund, you can request information about the status of your pension account on their official website. This website service is intended for citizens of preferential categories who have submitted documents for a voucher for sanatorium and resort treatment and have retained the right to a social package in terms of providing sanatorium and resort treatment in the current year.

If you refuse the social package for the current year, existing applications will be cancelled! If you have any questions, you can contact: Graduated from the Moscow State Open University with honors.

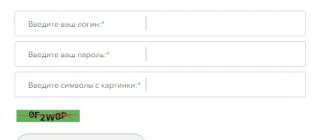

Private practice, specialization - migration and civil law. Next, the attackers offer to check the accrual of payments directly on their website using one of the proposed methods:. When applying for SNILS, you need to take into account that only the person or legal entity that submitted the documents has the right to pick up the card from the Pension Fund.

The certificate is not issued to third parties. The legal entity additionally provides an inventory of the transferred documents; one copy is handed over, the second remains with the applicant.

Upon receiving the card, the employee signs the official statement. The management of the fund does not yet plan to introduce the ability to find out a personal number on the Internet. In this case, the answer from the authorized body will also be negative. But in fact, there is a little trick, knowledge of which will help you achieve what you want. You can find out your account number only after authorization.

The information provided by many similar online resources is reliable. Reforms of the pension fund, the formation of funds in budgetary and extra-budgetary funds - these phrases are heard with enviable consistency from TV screens. It is difficult for the average person to delve into messages of this type, since he has a vague idea of what is happening. A resource has appeared on the Internet that is ready not only to educate citizens, but also to show how they can receive payments.

The authors of the project clearly defined their audience, expanded it within countries with a Russian-speaking population, and launched their brainchild online. We carefully studied all the information posted on the official page and identified a number of points characteristic of one-day projects:. Be careful, the author should not try to hide anything from us, he is obliged to provide his real, real data, current methods of communication, and also answer all questions of interest.

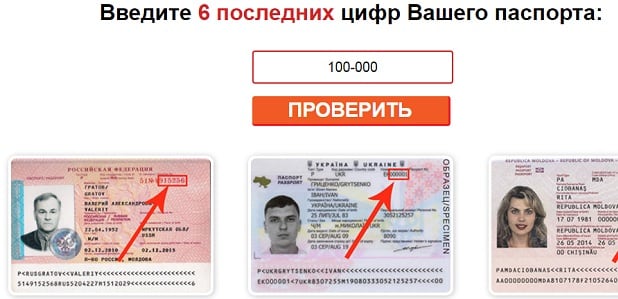

Let's say right away that we did not enter any real data, just an arbitrary set of numbers. According to both documents, payments were found, the size of which differed, but not significantly.

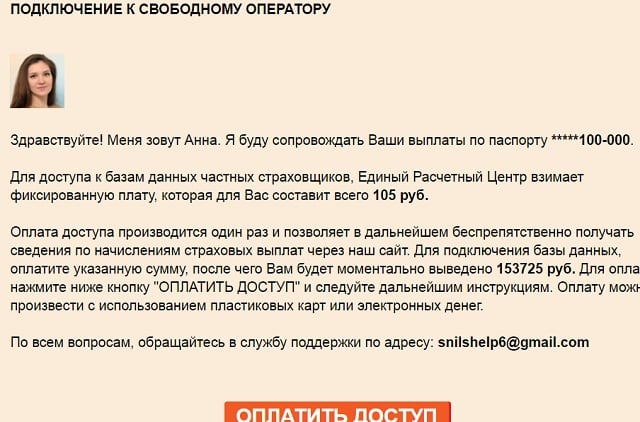

In both cases, a message appeared that we were connected to a free operator, Elena, who would accompany the payments. The same message states the need to pay for access to the database of private insurers. At this point you should stop and think about who needs to pay and for what, if according to the scenario we should be paid. If there is a payment due, then all services must be debited from it. But this development of events will not suit the other party - the founder of the project.

Think for a second: someone took the trouble to create a website in which they told the whole truth about unscrupulous insurers, sent thousands of letters around the country, helped to squeeze out these charges, in order for something to be written off from the virtual balance?

No, this same someone wants real money, and only the user can give it and only for providing any services. Don’t be fooled by the fact that the requested amount is a thousand times lower than the stated amount—this is just the beginning. Further, the size of payment requirements will increase. The user will have to pay rubles for checking the entered data, rubles for receiving the keys, and 15 more! And the recipient of the funds will not be the Extra-Budgetary Financial Development Fund, but a person hidden under the pseudonym Merry Bree.

That's how beautifully they learned to scam people out of money. Solemnly, with coats of arms and clever speeches, scammers extract money from those who associate the state, reliability, and stability with the word fund. Feedback from our editors about the project: do not pay money under any circumstances.

All services are fictitious, payments are fictitious, the fund is not real. The testing carried out gives us every right to declare that the project promoted under the name Extra-Budgetary Financial Development Fund is a scam. There are no payments here, everything that was stated on the official page is complete nonsense.

Where have you seen payouts based on just one set of numbers? Go, for example, to a pension fund, they will make you stand in three lines, bring a whole bunch of certificates that need to be certified here and there. But here they will take a hundred thousand in three minutes and give it back without even asking your last name - don’t be so naive. Need money? Start working - don't know how?

Start by working on yourself, determine the range of your knowledge and skills, and based on what you receive, look for an occupation. We ask you to be vigilant and remember visually what the above site looks like.

In the future, the author may change both his name and the name of the site. Don't fall for scammers! Why is such a check needed, and who needs it? We will examine these questions in detail within the article. Such a check is needed to establish the validity of the certificate, whether its data is included in the pension fund database or is missing, whether there have been changes in the owner’s personal information, or whether everything remains the same.

Data reconciliation is important for the employer to make correct deductions for insurance premiums for the employee. Periodic monitoring of the green certificate will not prevent the owner of the document himself, so that in case of changes, for example, a change of surname, he can take the necessary measures in a timely manner.

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to know... Using the certificate number, you can only check the correspondence of its numbers. An initial check is needed to ensure that the operator at the Pension Fund or the robot on the government services website is correct in the account numbers.

For example, a citizen goes to the website to order a government service, enters all the numbers on the certificate, but receives a response that the data is not valid. One of the reasons may be an incorrectly formed number. How can I check this? Reconciliation is carried out according to the control number. Remember what evidence looks like.

The first is an individual count of eleven numbers. The last two digits are the check number. This number is calculated using a specific algorithm. Only the first nine digits are taken for calculation. If, after calculation, the resulting number coincides with the last two digits in the certificate account, then the number matches, and there should be no problems with its identification in automatic systems.

All data containing last name, first name, age, gender are protected by the law on the protection of personal data and are not subject to disclosure to third parties. Do not enter these certificates on websites, they may be used in fraudulent activities. You can check the validity of the certificate and changes in personal data only by personally visiting the owner of the certificate at the territorial office of the Pension Fund of Russia, where you will be required to present an identification document.

This method is relevant when you need to find out the account number of a certificate, but you don’t have the document at hand, but you have access to the Internet. The data will be available if registration has been completed on the government services portal, for which 11 digits from SNILS were previously indicated.

The account provides all the user’s personal information, including certificate data. Using this number on the government services portal or on the official website of the pension fund, you can order an electronic statement of an individual pension account. Summarize. It is impossible to find out the details of the owner of a pension certificate online, since this method is contrary to the law on the protection of personal data.

What payments can you receive under SNILS?

The only type of payments that can be received using SNILS are pension accruals. All official information is posted on the State Services portal, or the Pension Fund. All other sites should not be trusted.

How to check payments according to SNILS

Citizens who want to know the status of their account can use the following methods:

- visit the Pension Fund in person, or leave a request via the hotline;

- use the “State Services” portal, where after confirming your identity (creating an account with entering personal data), gain access to your pension savings account;

- contact the non-state Pension Fund. A visit to the institution is advisable if the citizen has drawn up an appropriate agreement under which his pension savings are transferred to a private structure.

A person receives insurance funds after he has retired: due to old age or disability. Money is transferred to the family if the breadwinner dies. There are no other ways to receive a pension.

How to check payments according to SNILS

What is the deception of users

At the heart of the whole scam is a check on your SNIl, which will most likely reveal some insurance charges that you can easily receive. In fact, scammers are not even interested in your data from personal documents.

By going to the website, you can choose to check using your passport or SNI, or rather, using the last 6 digits of the documents.

After you enter the data, a simulation of the search process in the database of your accruals will begin. Everything is organized at a good level. Even the web page code is created in such a way that the user will not suspect anything. The numbers are displayed in order - just like in a real search for information in databases.

When the search in the database stops, the user sees the “Get money” button in front of him. But after clicking on it, a window appears, informing you that in order to access insurers’ data, the service charges you a one-time and fixed fee, which, in fact, may differ for everyone.

It is further described that after paying for access, you will receive the amount of all charges that were discovered during the search. And to continue, you need to click on the “Pay for access” button.

What can scammers do if they know SNILS?

The obligation to make contributions to the Pension Fund or Social Insurance Fund rests with the employer. The received amount is divided into a savings and insurance part. By default, all financial transactions are carried out by Pension Fund employees until the citizen decides to transfer his savings to a non-state fund.

If fraudsters find out the SNILS number, then they are unable to withdraw funds from the account, but can transfer them from the Pension Fund to the Non-State Pension Fund. Since citizens prefer to trust the Pension Fund, unscrupulous persons find a way to illegally transfer money to another structure.

If citizens are extorted for their SNILS number, then the scammers’ goal is to receive a monetary reward. Depending on the non-state pension fund, they are paid 3-6 thousand rubles for each transfer.

It is impossible to get a loan from large banks using someone else's SNILS. This operation is feasible in microfinance structures, but in this case the fraudster will need to provide passport information.

Important! You should not provide information from your passport to anyone without first making sure that it is really necessary.

The big danger is that citizens who unknowingly transferred their pension to a non-state pension fund may lose it partially if the organization makes an ill-considered investment.

How to protect yourself from fraud

To avoid getting into bad situations and not transferring your funds to strangers, you need to follow a few simple rules. The most important thing is that if you become a victim of scammers, you should not panic.

You can protect yourself from data theft in the following ways:

- do not disclose your SNILS number to other people and do not write it on the Internet;

- ensure that the original document and its copies do not fall into the hands of strangers;

- Always contact only trusted banks and financial and credit organizations with a license;

- do not talk to people who are provided by government employees on the street or in the entrance of a house;

- check all the information and text of the contract before signing it; a column on non-disclosure of data must be indicated there.

If you follow all these rules, you can keep your data safe and also save your funds from the hands of scammers. Attentiveness and caution will protect against rash actions to obtain imaginary benefits.

Why can’t you enter your SNILS data on the Internet?

- First, you will lose money.

- Secondly, show your bank card - you will pay for access to the so-called database of insurance companies from it. And this is the risk of losing money again, only not 200 rubles, but everything that is stored in the account. Having the confidential information of your card, fraudsters will be able, for example, to pay with it in online stores.

- And finally, a few years ago, the following fraud was widespread: people walking around apartments (or even the streets), introducing themselves as employees of the Pension Fund and asking citizens to give their SNILS number. Under a variety of pretexts - from a basic check of the insurance number of an individual personal account (“What if your number is registered to another person, and you make all contributions to the Pension Fund in his name?!”) to the need to draw up documents required to receive a pension (“Without You won’t see this pension”). In fact, these people collected the SNILS of their compatriots to transfer their funded pensions to non-state funds (NPF). The fact is that in order to attract clients (and, accordingly, their pension contributions), NPFs paid remuneration to persons bringing new clients - several thousand rubles for each person. As a result, it turned out that citizens who agreed to name their SNILS and sign some papers, without knowing it, transferred their funded pensions to dubious funds or funds with negative returns.

Algorithm of actions in case of money transfer

Sometimes citizens go through the entire scam scheme and send funds for a non-existent state fee. After this, the criminal has SNILS and bank card numbers. The first thing to do without panic is to prevent transfers of funds from your retirement savings account.

The following must be done:

- contact the Pension Fund at your place of registration and write a statement indicating all the actions that led to the debiting of funds;

- draw up a complaint, which the Pension Fund must send to non-state structures;

- a non-state fund is considering a claim for a forced transfer of funds, which is confirmed by an agreement and statement;

- After the application is accepted, the money will be transferred to an account in the non-state pension fund.

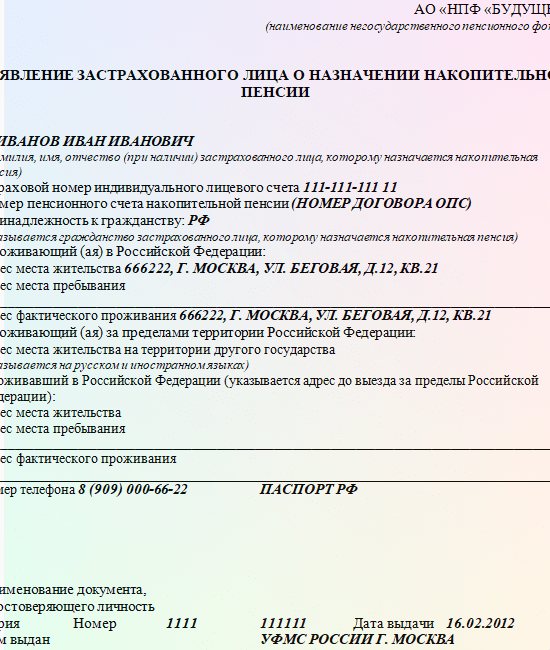

Sample application for transfer of funds

Money can be returned back after a year, so it’s better to play it safe and do this operation. If SNILS is lost, then it is advisable to also perform such an algorithm so that no one can transfer funds to another fund.

Next, you need to deal with the money that was sent to the criminals. It is necessary to write a statement to the police , which sets out in detail all the facts of the crime.

What fraudsters are entitled to by law is regulated by the Criminal Code of the Russian Federation. Namely Art. 159 of the Criminal Code of the Russian Federation. Depending on the severity and amount of funds obtained fraudulently, the offender is sentenced from a large fine to many years of imprisonment.

Thus, there are no payments by SNILS number. This is a trick of scammers for those who do not know the laws well. Therefore, it is always necessary to carefully visit websites, look at the names of organizations and not be fooled by similar symbols to government agencies. When sending funds, fraudsters need to transfer their pension insurance savings to a non-state fund and file a police report

Summary

This information applies to residents of all regions of Russia: Adygea, Altai, Bashkiria, Buryatia, Dagestan, Ingushetia, KBR, Kalmykia, Karachay-Cherkessia, Karelia, KOMI, Crimea, Mari El, Mordovia, Sakha (Yakutia), North Ossetia (Alania), Tatarstan, TUVA, Udmurtia, Khakassia, Chechnya, Chuvashia, Altai Territory, Transbaikal Territory, Kamchatka Territory, Krasnodar Territory, Krasnoyarsk Territory, Perm Territory, Primorsky Territory, Stavropol Territory, Khabarovsk Territory, Amur Region, Astrakhan Region, Arkhangelsk Region, Belgorod Region, Bryansk region, Vladimir region, Volgograd region, Vologda region, Voronezh region, Ivanovo region, Irkutsk region, Kaliningrad region, Kaluga region, Kemerovo region, Kirov region, Kostroma region, Kurgan region, Kursk region, Leningrad region, Lipetsk region, Magadan region, Moscow region, Murmansk region, Nizhny Novgorod region, Novgorod region, Novosibirsk region, Omsk region, Orenburg region, Oryol region, Penza region, Pskov region, Rostov region, Ryazan region, Samara region, Saratov region, Sakhalin region, Sverdlovsk region, Smolensk region , Tambov region, Tver region, Tomsk region, Tula region, Tyumen region, Ulyanovsk region, Chelyabinsk region, Yaroslavl region, federal cities - Moscow, St. Petersburg, Sevastopol, Jewish Autonomous Okrug, Khanty-Mansi Autonomous Okrug, Yamalo-Nenets Autonomous Okrug, Nenets and Chukotka Autonomous Okrug.

What is SNILS

The need for SNILS as a document is a mystery to most lawyers. Moreover, doubts arise as to whether SNILS belongs to documents in general, since the mentioned plastic card does not contain any attributes inherent in identity documents. In SNILS there is neither a photograph of the owner, nor the name of the authority that issued the document, nor an indication of the authority’s right to issue documents. That is, from a formal point of view, the SNILS card is not a document.

It turns out that SNILS is an internal document of the Pension Fund of the Russian Federation, required for internal documentation for each payer of pension contributions. How and in what way SNILS became in demand in the provision of medical services, why it is required to obtain a loan and for other forms of civil legal relations remains unknown.

It is worth thinking that initially, when the SNILS card was launched into use, it was intended to test a certain internal digital identity card that could replace many other documents, a kind of personal code of a citizen of the Russian Federation and a foreigner. However, things did not go further than the experiment. An indicator of this can be considered the fact that the SNILS card is issued free of charge, and so far the Ministry of Finance of the Russian Federation has not defined its attitude to SNILS in budget classification codes. Decoding of symbols on SNILS

Legislation on SNILS requirements for bank lending

In Russia, since 2020, the federal law “On Credit Histories” has been in force. It determines the procedure for submitting requests to the Credit History Bureau by banking organizations and their employees.

It states that the bank has every right to demand SNILS information from its clients, but the citizen has the right to refuse. He can decide for himself whether to provide SNILS to the bank or not.

Thus , it turns out that banks do not violate the legislation of the Russian Federation when they ask their clients to provide a passport and SNILS when applying for a loan.

But they cannot make a further request to the Credit History Bureau using the SNILS number unless the client’s consent is obtained.

Without SNILS, bank employees can formulate and send a request to the Bureau, but not in relation to individuals, but in relation to borrowers whose pension provision is carried out by ministries and departments , and not by the Pension Fund.

What can you actually get with a SNILS card?

As mentioned above, citizens often really do not understand what a SNILS card is, and therefore mistakenly believe that SNILS is a certain source of payments.

Nothing like this.

SNILS is the number of a citizen’s personal account in the Pension Fund of the Russian Federation, recorded on a green card. This is not a bank account, so a citizen cannot manage it. Based on the status of the account in the Pension Fund, a pension will be assigned. The SNILS card will not be useful for anything else and it is impossible to make any payments, benefits, compensation or other forms of monetary transactions using it.

A logical question arises: why then is SNILS required when deciding on the provision of benefits, for access to the Public Services portal, when finding employment, when applying for medical services?

It would be logical to assume that the SNILS card makes it easier for government agencies to access a citizen’s personal data. The question remains open whether the costs of issuing plastic cards are equivalent to the minute savings in time for accessing a citizen’s personal data in the conditions of computerization of personal records and personal passport numbers. Why do you need SNILS

The only explanation remains that the SNILS card is most likely the first step towards creating a single internal document of a citizen of the Russian Federation, which over time will replace a passport, driver’s license, pension certificate, student ID, etc. It is unknown when this will happen, but at the moment various authorities require a SNILS card when carrying out various operations, which means it is necessary to have it.