The legal topic is very complex, but in this article we will try to answer the question “Additional payment to pensions after 80 years for disabled people of group 2 in 2020.” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

Military pensioners receive their pensions earlier. It takes into account the policy of the structure where they worked, as well as the accumulated length of service. In practice, they end their careers much earlier than civilians. Therefore, after retiring from military service, they can continue to work like ordinary people.

In addition to this increase, citizens will receive an additional payment for caring for a pensioner. The accrual applies to able-bodied people providing constant supervision. It doesn’t matter if he’s a relative or if he lives nearby. Each year, the caregiver will receive 1.8 points, and the payment is made monthly as a pension. This is 1200 rubles. Some regions use a multiplying factor.

What benefits and allowances are available to pensioners after 80 years of age?

- the death of the disabled ward or the assistant himself will occur;

- care has been stopped according to the application submitted by the elderly person;

- the caregiver got a job and started earning money;

- the ward was transferred to a nursing home, hospital (treatment), sanatorium or other place of social service.

But pensioners should pay attention to an important nuance: an additional payment to a pension after 80 years of age is assigned only if it is an insurance pension, and for old age. The preference does not apply to recipients of insurance pensions for the loss of a breadwinner or disability, as well as state and social pensions.

Payment of land rent by pensioners 80 years of age or older

Conditions for calculating rent for land in 2020 - 2020 and the procedure for its payment According to Article 65 of the Land Code of the Russian Federation, payment for land use is one of the fundamental principles of leasing land plots in the country. To pay for the use of land, the employer can perform the following actions: According to the Land Code of the Russian Federation, some categories of the population have benefits when paying for the lease of land plots: Methods for calculating payments for land of private and legal entities Calculation of the rent rate for land directly depends on who is owner of the site: private person or organization; municipality, subject of the Russian Federation, state property.

What pension is paid to disabled people of group 2 in 2020, additional payments and indexation amount

Exactly how a disability group is assigned is established by Government Decree No. 95, as well as by Decrees of the Ministry of Health and the Ministry of Labor. These standards define what a medical and social examination is and how it is carried out.

Legislative norms regarding payments to disabled people of group 2:

Assigning a disability group to a person means that due to health reasons he cannot work either fully or partially, or communicate at the proper level with other people. Because of this, his ability to provide for himself is significantly reduced.

The amount of payments in case of disability of the second group depends on several factors. The choice of the type of state support, as well as the category of the disease, that is, whether it is congenital or acquired, matters. In 2020 social pension

, assigned on a general basis is

5283.84 rubles

.

per month, disabled children of group 2

receive

10567.73 rubles

.

Assigning a disability group to a person means that due to health reasons he cannot work either fully or partially, or communicate at the proper level with other people. Because of this, his ability to provide for himself is significantly reduced.

What pension is paid to disabled people of group 2 in 2020, additional payments and indexation amount

Thus, in addition to benefits, a disabled person has the right to count on a pension (social or insurance). The first is determined by federal law and does not depend on length of service, IPC, or maximum points. The second is calculated according to the formula. Disabled people of group 2 who have worked at least one day have the right to receive either one or another pension of their choice.

This is interesting: How to register a citizen of Uzbekistan in Moscow in 2020

But the degree of relationship between the pensioner and the person who will care for him does not play a role in processing the additional payment. This can be any relative or stranger, including those not living with the pensioner.

- If everything is simplified to the utmost, we can state the following: upon reaching 80 years of age, the pension will increase by the amount of the fixed payment. For example, a pensioner receives a pension of 14,000 rubles in 2020. He celebrated his 80th birthday in October. After this, his pension will be recalculated and will be 14,000 + 4,982.90 = 18,982.90 rubles.

- Next year the fixed part will increase.

Additional payment to pension after 80 years in 2020 for a disabled person of group 2

Such indexation coefficients were approved with the aim of annually increasing the pension provision of Russians above the inflation rate (according to Government forecasts, price increases will be no more than 4% annually). Thus, the size of the age allowance by 2024 will increase by more than 2,000 rubles. (relative to size in 2020).

This payment by the state includes a special set of social services, the benefits of which have their own cost - 1121

ruble. By default, these benefits are issued in kind, as a result of which the cost of the NSO is deducted from the surcharge.

Benefits for pensioners after 80 years of age

- They do not pay income tax.

- Exempt from property tax for apartments or other types of real estate owned by a pensioner.

- A number of regions provide persons over 80 years of age with an exemption from paying transport tax for a car whose power does not exceed 100 hp .

- When paying the land tax, the amount on which the tax is calculated is reduced by 10 thousand rubles .

- When filing a claim in court regarding property worth no more than 1 million rubles, persons are exempt from paying state duty.

- When purchasing real estate, a pensioner retains the right to a tax deduction.

Group 1 disability pension in 2020, latest news

If the status of a disabled person is obtained with work experience, an insurance pension will be issued; if a person belonging to a preferential category does not have a single working day, then he is entitled to a social pension.

Pension for disabled people of group 3

The closer a person’s retirement is, the more interested he becomes in the principles of calculating cash benefits for pensioners. At the moment, the state is constantly making changes to the pension system, improving legislation, and perhaps pensions for disabled people of group 1 will also be affected.

A monthly cash payment (MCP) is provided to beneficiaries who receive financial assistance from the state: veterans, disabled people, people affected by radiation, orphans, Heroes of the Soviet Union and other socially vulnerable categories of citizens.

Letter from the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia dated April 15, 2020

At the same time, in accordance with paragraph 5 of Article 391 of the Code for the categories of taxpayers specified in this paragraph, the tax base when calculating land tax is reduced by a tax-free amount of 10,000 rubles per taxpayer in the territory of one municipality in relation to a land plot owned, permanent (perpetual) use or lifetime inheritable possession.

We recommend reading: Sample to write a statement to a district police officer against neighbors

Supplement to pension for disability in 2020

Pensioners who are recipients of a disability insurance pension and who have dependents can also count on certain additions to their pension from the state. The amount depends on the disability group and the number of dependents.

Nuances

The procedure for applying for a monthly cash payment is regulated by the Procedure for making monthly cash payments to certain categories of citizens of the Russian Federation, approved by Order of the Ministry of Health and Social Development of September 30, 2004 No. 294.

An appeal to the fund will be required if the pensioner decides to refuse one type of payment in favor of this supplement (for example, switch from a survivor's pension to an old-age pension). In this case, he needs to submit an application to the regional branch of the Pension Fund.

- Two statements (from the elderly person and the person who will take care of him).

- Passports.

- Work record book of the caregiver.

- Document confirming the absence of government payments and unemployment benefits.

- Confirmation from the tax office about the absence of an individual entrepreneur.

- Conclusion of the medical institution on the need to provide care.

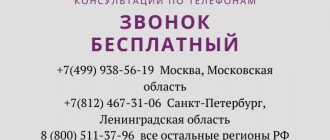

Free legal consultation: ON TAX ISSUES

Example: I took out loans from a microfinance organization to renovate an apartment and treat an illness.

What should I do? Moscow St. Petersburg By clicking the SEND button, you accept the terms and conditions Send Send

Moscow Government

Ministry of Justice of the Russian Federation

Rospotrebnadzor Latest questions Full comprehensive service From the moment you contact us until the issue is completely resolved, we are ready to accompany our clients, providing them with the necessary services and advice.

I realized late that these were unaffordable loans for me. They call and threaten with various methods of influence.

Free detailed analysis of the situation Our specialists will study your situation in detail, review all available documents, and draw up a clear picture of the problem. Working for results We are interested in the success of your business! Your victories are our victories. We are exclusively results-oriented. Drawing up documents If necessary, the lawyers of our company will take upon themselves the preparation of all the necessary documents for a positive resolution of the case.

Free study of options Only after a detailed analysis of the available documents and immersion in the current situation will we be able to work out solutions and the feasibility of their use.

Submitting documents We take care of everything. Compilation. Collection of the necessary package of documents.

Submission to the authorities. Tracking. Control of every movement of the case. There is always a possibility that the client does not need to go to court or draw up a claim and other documents, since there is no prospect of winning and the client will waste time and money, or worse, worsen his situation.

This is why our company’s lawyers first do a free analysis of the situation, study the available documents, and only after that offer solutions, if any. Why

Land tax for pensioners 2020: whether they pay or not

Welcome to helpguru.ru.

In this article we will talk about land tax for people of retirement age. At the end of 2020, new changes to the tax code came into force; they also affected the land tax for pensioners. Pensioners need to learn about this innovation in detail, as well as find out what rights they now have when paying this tax.

CONTENTS On December 21, 2020, another law was adopted in the third reading, which amends some articles in the tax code, and also exempts people of retirement age from paying tax for 6 acres.

That is, another amended land tax was introduced for pensioners in 2020.

This instruction was made by the president of the country during a press conference held with journalists. He argued that if a pensioner owns six acres of land, then this plot should not be taxed at all. And if the area of the plot is larger, then a smaller area of the plot will be taxed, with the deduction of the non-taxable 6 acres.

According to the explanations of the head of the State Duma Budget Committee, it became clear that this was done to reduce the amount of tax, since the value of land increased significantly when recalculating the cadastral value, and along with the increase in value, the amount of taxes also increased.

We recommend reading: How much benefits were increased in the Leninsky district 2020 Orda district

This benefit applies to all pensioners. The new law began its work on January 1, 2020 and is retroactive.

That is, it applies to taxes for 2020. The question of whether pensioners pay land tax or not has been resolved. Now pensioners do not pay land taxes in full.

In other words, the tax will be calculated minus 6 acres of land.

It is necessary to familiarize yourself with the rules of the tax code that relate to benefits when paying land tax. In accordance with Article 391 of this code, when changes had not yet been made, tax payers could take advantage of the right to deduct in the amount of 10,000 rubles in one municipal

Laws of the Russian Federation 2018-2019

The upcoming pension reform in 2020 has caused unrest among society and a lot of questions not only about the methods of calculating pension benefits, but also about the size of the payments themselves. The minimum pension in Moscow was usually one of the highest in the country. It is calculated based on the amount established by law throughout the entire state, plus regional surcharges, which differ depending on the cost of living in a given territory. The basic accrual procedure in 2020 remains the same, however, several innovations will come into force from the new year. Changes in 2020 From January 1, 2020, the pension reform, which was proposed and developed by the Cabinet of Ministers, comes into effect.

The minimum pension in 2020 in the Moscow region is based on the cost of living and cannot be lower than it. In 2020, the cost of living in the Moscow region was 9,527 rubles. Accordingly, age pensioners cannot receive payments less than this amount. A revision of the minimum wage will be carried out by local authorities at the end of autumn 2020, after which it will be possible to talk about the amount of benefits for old-age pensioners. Social benefits The amount of financial support for various categories of citizens who, for whatever reason, require state assistance, is calculated individually.

We recommend reading: How to Register a Computer in 2019

Conditions

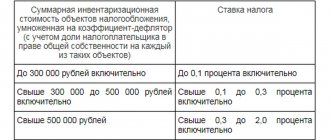

According to the regulations of the legislation in force today in the country, the following conditions for paying land tax are established:

- the tax is accepted in the amount of 0.5% of the total cost of the land plot;

- Lands that have an agricultural purpose and are used for farming are subject to taxes;

- plots of land included in the area of responsibility of the housing and communal services complex are subject to taxes;

- land taxes are imposed on plots of land that were purchased and used as summer cottages, used for raising livestock, planting gardens, etc.;

- To receive benefits, you must submit a completed application to the relevant authority;

- when applying, a citizen should collect and submit all the documents required in this case;

- the amount of land tax is calculated taking into account the tax rate established in each specific case and the value of the site according to land cadastre estimates;

- the procedure for tax benefits applied to pensioners differs in each individual case;

- to resolve the issue of obtaining benefits for calculating the tax on a piece of land, it is necessary for the pensioner to provide the pension certificate at his disposal;

- the procedure for payment by a pensioner of the established land tax is established in accordance with the procedure adopted in each individual case;

- pensioners who have state awards are relieved of the need to pay land tax;

- To consider the possibility of establishing the volume of tax charges, the citizen must provide data regarding his length of service.