Home » Categories of citizens » Pensioners » Benefits for pensioners after 70 years of age

Persons of retirement age are considered one of the vulnerable categories of the population, therefore the state provides them with various privileges that allow them to improve their lives. Most pensioners have small pensions, so benefits allow them to reduce spending on various needs. Detailed information about what types of benefits exist for pensioners after 70 years of age is in the video below:

Citizens who have crossed the threshold of 70 years of age are entitled to special privileges. Of course, pensions and other payments for older people do not increase, but they can receive compensation for paying utility bills and utility repairs in the apartment, free medical care and discounts on medicines.

Benefits for pensioners after 70 years of age

- If an elderly person is in a difficult financial situation, the state provides him with food, clothing, hygiene products and basic necessities. Disabled people are also entitled to fuel, a vehicle for transportation, medical equipment and rehabilitation equipment. To receive the necessary things, a citizen must provide a certificate of disability and other necessary documents

- Reimbursement for utility costs

On June 10, 2011, a decree came into force according to which non-working pensioners who want to gasify their homes can apply for partial compensation of costs from the state.

What are the benefits?

When a citizen reaches the specified age, he must familiarize himself with local legislation and find out about the support measures introduced. There are standard conditions:

- issuing urgently needed supplies, including food, clothing, and hygiene products;

- providing a significant discount in the process of paying for utilities, because part of the payment comes later as compensation; similar benefits are possible if there is no official work, also when the pensioner has only one home;

- the use of medical services is free, free medicines, but for this you must be registered at the clinic at your place of residence and have a prescription;

- if a person does not stop working at the age of 70, he can take advantage of the offer of free advanced training courses that give the opportunity to use modern technologies;

- provision of paid leave - fourteen days a year, as an addition.

The listed benefits are offered at the federal level, however, the administration of a particular region is given the right to various additions, for example, the adoption of certain regulations, according to which the category of citizens 70 years old can use other types of support.

Those who want to have the latest information regarding payments and benefits can always contact employees of social protection institutions.

Are pension supplements available after age 70?

Social supplement to pension up to the subsistence level in the capital. If a non-working resident of the capital provides local social security authorities with information that the amount of the pension he receives is below the subsistence level (ML) in Moscow, then he is entitled to monthly cash compensation payments up to the minimum amount established by federal legislation.

In Moscow in 2020, the size of the PM was 11,560 rubles, in the Moscow region - 9,160 rubles. When paying out funds, the targeted assistance received by the pensioner and all types of subsidies are taken into account.

Paying for utilities places an enormous burden on the shoulders of an elderly person. The federal authorities are providing benefits to pensioners in 2020 on housing and communal services payments.

Tax benefits

It is worth mentioning that persons over seventy years of age are entitled to special social support measures, but often pensioners do not even know about their existence. Ignorance of this information means that pensioners can enjoy all the benefits and privileges that are due to them for their labor efforts.

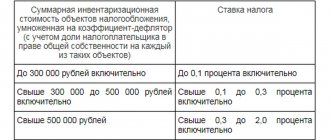

Benefits for retirees over 70 include tax privileges. In particular, this category of pensioners has the right to receive the following tax benefits:

- Exemption from payment of transport tax. According to the law, pensioners, as well as other beneficiaries, are exempt from paying tax on a vehicle they own, however, only citizens whose vehicles have a capacity of no more than 100 horsepower can exercise this right

- Discount on land tax. Of course, it will not be possible to completely exempt a person from paying taxes on the land plot he owns. However, government authorities provide the opportunity to receive a discount of 10 thousand rubles for the amount specified in the tax notice, which can significantly save the payer’s budget

- Exemption from property tax. This right can be exercised only in relation to one property owned by a pensioner over 70 years of age

- A person has the right to independently choose the property in respect of which such a benefit will be applied;

- Exemption from income tax

Providing any tax benefits is possible only after a citizen’s personal appeal to the Tax Inspectorate office of his city. Such privileges are not automatically granted.

Rules for tax exemption for pensioners

Chernobyl Nuclear Power Plant, cosmonauts, etc. Legal framework Federal Law of the Tax Code of the Russian Federation No. 117, Article 395 indicates possible benefits for citizens that are provided when paying land tax. Tax Code of the Russian Federation, Article 361.1. The following citizens are entitled to tax benefits for paying transport tax:

- individuals who have a vehicle weighing less than 12 tons are in the vehicle register and the amount paid for compensation for damage in this period is equal to or exceeds the amount of calculations in this period;

- if the amount paid in this period for a vehicle over 12 tons is higher than necessary;

- An individual entitled to a benefit must submit documents to grant such a right upon application.

What taxes are pensioners exempt from paying? The state security category has many benefits for payment, but you won’t have to completely forget about it.

Subsidies for utilities

The privileges that pensioners are entitled to after 70 years of age include receiving a significant discount on utility bills in the housing and communal services sector. For this category of citizens, the amount of compensation payment ranges from 30 to 40 percent, depending on the region.

People can enjoy such privileges only after submitting an appropriate application to the social security authority. In this case, from the amount indicated in the receipt, the pensioner will be paid monthly subsidies in the percentage prescribed by law.

"Utility" benefits

For citizens whose age has exceeded the threshold of 70 years, subsidies are provided to pay for the utility burden. A pensioner can take advantage of the preference if his monthly costs for housing and communal services amount to 22% of his total income.

Compensation is provided based on the actual costs of services; if an excess of the subsidy is detected, the difference in the overpayment will be offset against future payments.

As a rule, the subsidy is valid for a six-month period, after which the pensioner will need to again contact the authorized body (MFC or social protection) with the same package of documents, which include:

- Passport;

- Statement;

- Documents on the ownership of the living space;

- Receipts indicating the amount of payments for the utility burden;

- Pensioner ID;

- Extract from the house accounting book;

- Certificate of pension amount.

For ease of application, a pensioner can use the electronic application submission service - the State Services website.

If the applicant is unable to provide the required amount of paperwork to receive a subsidy (loss, loss), the competent authority in this matter can organize a request for the necessary data independently through interdepartmental interaction.

Discounts on contributions for major repairs

In 2012, all owners of apartments in apartment buildings were required to pay fees for major repairs. Of course, this necessity did not please the majority of Russians, and in particular, it had a negative impact on pensioners.

Due to the fact that citizens over 70 years of age need additional measures of state support, in 2020 another Federal Law was adopted at the federal level, according to which this category of beneficiaries can count on receiving benefits when paying for major repairs of an apartment building.

In particular, at the legislative level the following privileges are provided for such citizens:

- A discount of 50 percent from the total amount of the invoice issued for major repairs. Providing such a benefit is possible only in cases where employed citizens are not registered in the apartment

- Disabled citizens who live together can also count on similar privileges. In this case, a discount on capital repairs is provided only if there is a person in the family who has already reached 70 years of age

Important! Pensioners over the age of 80 are completely exempt from making contributions for major repairs of an apartment building.

Targeted material support

Social security services for pensioners also include the possibility of providing targeted financial assistance measures for needy pensioners over 70 years of age.

In particular, pensioners over 70 years of age may be entitled to additional benefits and subsidies to improve their living conditions if their income is below the subsistence level or they need to improve their standard of living.

The amount of payment is determined individually, after studying documents about the person’s condition, living conditions, and income received.

Travel by public transport

At the legislative level, it is possible for a citizen over 70 years of age to enjoy transport benefits. In particular, pensioners over this age can use this right to travel to a place of rest. Citizens over 70 years of age are given the opportunity to travel free of charge to the place of sanatorium treatment, but only once a year.

At the regional level, it may be possible to use public transport for free or at a discount.

For the purchase of housing

Some 70-year-olds continue to lead not only an active lifestyle, but also a feasible work activity. If such an employee is employed on a completely official basis, then after purchasing housing (an apartment or a share in it, a house, a land plot for individual housing construction), he has the right to a refund of income tax previously paid to the state treasury in the amount of 13% of the cost of the purchased real estate .

Important! The tax base for property deduction is the same - no more than 2 million rubles, that is, the amount of the deduction is no more than 260 thousand rubles (13%).

Example: new housing was purchased for 2.5 million rubles. The maximum amount for a tax deduction in this case is 2 million rubles, that is, no more than 260 thousand rubles. If the cost of the purchased housing is less than 2 million rubles (for example, 1.5 million), then the tax base will be the actual cost of housing, and the deduction amount will be 13% of 1.5 million - 195,000.

It can be extended over the entire working period after purchasing a home, or the three previous years preceding the purchase are taken into account. Only the employee whose employer made monthly income tax deductions from his official (white) salary can claim such a deduction.

All expenses aimed at improving housing (purchase of building materials, services of hired workers) can also be included in the tax base. It is necessary to attach all available receipts and contracts for the performance of one-time work by one or another employee.

This can also include all credit loans and interest payments on them aimed at the construction and improvement of housing. Taking into account such additions, the tax base may increase to 3 million rubles, no more. Accordingly, the tax deduction in this case will amount to 390 thousand rubles (13% of 3 million rubles).

Example: pensioner Nikolai Petrovich is 75 years old. He quit his official job in August 2020, and purchased an apartment in August 2020. Immediately I declared the apartment to the Federal Tax Service Inspectorate (Inspectorate of the Federal Tax Service).

He is entitled to a tax deduction for two working years, from August 2015 to August 2020, in an amount corresponding to contributions to the Federal Tax Service (13%) for the entire period under review. As you can see, the size of the official salary also matters here.

It may be beneficial for the employer to reduce the amount (pay less taxes); he is interested in paying the money in an envelope.

For an employee who wants to purchase housing, on the contrary, it is much more profitable to work according to the white, official scheme. The higher the salary, the greater the income tax deductions, which are refundable when purchasing or improving housing.

The authorized representative is the Federal Tax Service Inspectorate, a non-working pensioner should contact them, and a working pensioner should contact their employer. A purchase and sale agreement, a registration statement for housing, a pension certificate and a passport are presented.

What taxes are pensioners exempt from in Russia in 2020?

It represents a certain amount by which the tax base (salary or other income before personal income tax) is reduced. There are restrictions on the maximum refund amount:

- 260 thousand rubles - the size of the maximum tax base for a standard deduction and 65 rubles. – the maximum amount of monthly tax deduction;

- 120 thousand rubles – for training a pensioner and 50 thousand rubles. – for the education of his children (grandchildren);

- 120 thousand rubles – for treatment;

- property – up to 3 million rubles.

Refund of personal income tax when purchasing real estate Since 2014, both working and non-working pensioners have the right to receive a tax deduction when purchasing real estate. To receive this benefit, the latter are required to apply to the INS no later than next year from the date of completion of their labor activity.

Otherwise, you won’t be able to take full advantage of it, because...

Regional benefits

If we consider all of the above, we can conclude that the Legislative Bodies of the constituent entities of the Russian Federation offer some discounts to pensioners who have reached old age in the following systems:

- Taxation

- Transportation

- Housing and communal services

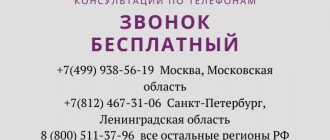

Contacting the local branch of the Tax Service, Social Security authorities, MFC and the Pension Fund will help clarify the situation related to the current provisions on benefits and whether recalculation is allowed in your region.

Social support for pensioners

We are talking about pension accruals and social benefits. If the state compensates an elderly person for the cost of a trip to a health care facility, travel to it, or medical services, then no tax is deducted from these amounts. But provided that the amount of charges does not exceed 4,000 rubles.

Attention! In some regions, other tax benefits may be guaranteed. Their list and features of provision can be found in local services.

Vacation without security. The right of a working citizen over the age of 70 to receive vacation without mandatory payment.

This means that the employer, in addition to the main vacation days, provides the pensioner with additional ones. For example, in the standard case, an employee receives 14 days of rest, and for the Second World War category a 35-day break is provided.

Understanding the situation and trying to improve the situation, the state is introducing a number of measures aimed at supporting a normal standard of living for the elderly. All options for privileges due are divided into two types - provided at the federal level and sponsored by the local budget.

Preferences are divided into several types:

- Tax benefits for pensioners

- Discounts on utility bills

- Social targeted assistance provided to citizens in need

- Benefits for purchasing medicines, traveling on intercity and city transport, providing treatment, purchasing travel tickets

At the federal level, for an elderly person receiving old-age benefits, regardless of their place of residence, the state guarantees different types of preferences that can be used if necessary.

Types of benefits provided to pensioners whose age has exceeded 70 years

So, the status of a pensioner, as well as the age of 70 years or more, gives the pensioner the right to use benefits of various types. So, their list includes the following possibilities:

- receive free treatment and stay in sanatoriums;

- exemption from transferring certain tax payments to the state treasury;

- free distribution of a number of medications in pharmacies;

- discounts provided for payment for housing and communal services;

- tickets for public transport at a reduced price.

Pensioners must fulfill certain conditions in order for the government to deign to provide them with all possible assistance, which is largely necessary simply in order to survive

Of course, each type of these privileges also implies the need to fulfill certain features and additional conditions. We discuss them later in this article.

Benefits for pensioners over 70 years old in Moscow

- Targeted social and material assistance

- Benefits for payment of transport tax, contributions for land plots

- Compensation for using a landline telephone

- Possibility of not paying for garbage removal

- Free medical care at home if your health does not allow you to visit the clinic

- Receiving dental care under a social program

- A trip once a year to a place of sanatorium-resort holiday according to appropriate medical indications

What taxes do pensioners not have to pay?

This also applies to the concept of tax regime. The tax regime gives the right to some regions, cities or the entire territory of Russia to exempt certain categories of citizens from paying one or another tax. Who can apply? A special tax regime allows you to separate certain categories of the population and exempt or provide benefits from paying certain taxes.

The main reason for the release is the low income of such citizens and rationality. Pensioners make up the majority of the total mass, which includes many categories that receive social benefits from the state:

- old age pensioners;

- citizens in the civil service who retired early;

- disabled people,

- persons who have lost their family breadwinner.

The state has federal beneficiaries on a special account, which include those awarded federal awards, titles, medals, etc.

- Tax deduction for the purchase of real estate, use of land.

- Exemption from paying state fees when applying to judicial authorities.

Local preferences The size and conditions for providing tax benefits at the federal level can be adjusted by the authorities of the constituent entities of Russia. The most common at the regional level is the adjustment of benefits for paying transport tax. You can get acquainted with the complete list of categories of citizens who are entitled to benefits for a specific region of Russia at the Federal Tax Service branches at your place of residence or on the corresponding page of the official website of the Federal Tax Service nalog.ru by selecting the desired type of tax, subject of the Federation and clicking the “Find” button.

Legal regulation

Pensioners in Moscow, like other subjects of the federation, enjoy benefits based on articles of various regulatory documents.

Such rules allow working pensioners who still transfer personal income tax from their salaries to take advantage of the deduction, and return previously paid income tax to those who purchased property in the year they ended their working career. The benefit is issued by sending the following business papers to the inspectorate:

- Title documents for property

- Sales and purchase agreements and payment documents confirming the transaction amount and the fact of payment

- Declaration 3-NDFL

- Income certificates

Employed pensioners additionally submit an application to send a notice to the employer, who, after receiving it, will begin to apply the deduction when calculating wages.

Instead of applying, those who are not working leave the details of their current account, to which compensation will be transferred directly from the Federal Tax Service.

Targeted assistance is provided in difficult life situations (death of loved ones, flood, fire, natural disaster). Help is not always presented in monetary terms; it can also be food, clothing, sanitary and hygiene items.

If a 70-year-old pensioner is given the status of a disabled person, he can count on paying for fuel, a vehicle, or purchasing necessary devices that improve the quality of life. To receive them, you need to contact the territorial social protection body with an application and attach supporting documents - help will inevitably come.

Benefits for paying land and transport taxes - there are some territorial discrepancies on all these issues, so it is better to clarify the information locally by contacting the regional municipality.

In the Altai Territory, if they have a car with a power of up to 100 hp, pensioners over 70 years of age are exempt from transport tax.

In the Leningrad region, an 80% discount on transport tax is provided, and taxpayers who own up to 25 acres of land are completely exempt from land tax.

This also includes benefits for gasification of housing (the amount is set at the regional level). These benefits are also relevant for 70-year-old non-working pensioners if the gasified facility is their only home.

All documents confirming the right to benefits are submitted to the OSZN.

Free training at the employment service - any pensioner who has reached the age of 70 has the right to undergo training at the territorial employment service.

It is possible to improve your qualifications in your specialty, you can master a new profession, undergo training in an area of interest (computer literacy, landscape design, floriculture, macrame and much more). Training is free. It is enough to contact the SZN employment service with a passport and pension certificate.

Compensation payment EDV (one-time cash payment) - to receive it, not only the age threshold is important, but also confirmation of the status of a disabled person or veteran. Accrued to those exposed to radiation at the Chernobyl NPP; subjects who have state awards or other beneficiaries on the basis of regulatory legal acts. For all these categories, the EDV is relevant only if the NSO (set of social services) is abandoned.

The authorized representative is the territorial body of the Pension Fund.

Important! It is impossible to receive EDV and NSU at the same time. You will have to make a choice: either the EDV or the NSU. To refuse or accept the social package, you must write an application before October 1 of the current year, while the new conditions will come into force only from the beginning of next year.

The absence of property tax, as for all pensioners, remains. Pensioners do not have any property taxes.

If the tax office mistakenly sent receipts for payment of property tax, and you, as a law-abiding citizen, paid it immediately and have done so for several years, then you have the right to contact the tax office for a recalculation. Do not despair, the Federal Tax Service will certainly return all funds paid.

Zero property tax also applies to part of the housing, the share in the common ownership of housing.

Often there is no need to additionally visit government agencies and present supporting documents. The Pension Fund of the Russian Federation, the Federal Tax Service, and the OSZN work according to a coherent centralized scheme of access to a single computer database.

In conclusion, I would like to say that no matter what difficult situation happens to you, do not despair. There will always be someone who will lend a helping hand. Everyone will get what they deserve.

Follow changes in regional legislation, and you will always learn about federal innovations: notifications will be broadcast repeatedly in all media. I would like to warn against word of mouth; you should only trust trusted sources.

If you want to know what benefits pensioners have after the age of 70, check out the resource provided. The information has been verified for compliance with regulations.

Pension after 70 years in 2020

Pensioners who have reached the age of 70 can receive the 13th payment (or the so-called bonus)

The more exact amount of the “second” pension is still unknown.

However, it is expected that the implementation of this law will require about 500 billion rubles.

There is an opinion that the amount of old-age benefits will be equal to the size of the labor pension of each citizen.

Given the existing restrictions in the country's budget and the Pension Fund of the Russian Federation, the 13th payment will not exceed 6,000 rubles

An increased pension rate is not provided.

Will everyone get it?

Not everyone is entitled to the thirteenth pension.

Citizens who officially work will not receive the new payment (there are about 14 million of them in the country).

You can receive benefits without additional documents. It is expected that this will improve the lives of many citizens of the country.

Latest news

The bill is currently being finalized.

There is debate over the proposal for people of retirement age to abandon the 13th payment in favor of increasing monthly benefits.

The amount of the second pension is also established and the provisions on the basis of which it is formed are developed. It is planned that the latter will be approximately equal to the single payment of 2020.

The main problem is the allocation of funds from the country’s budget, which in 2020 does not allow the launch of this project.

It is also planned to recalculate the military pension.

Pensions after 70 years of age can be increased due to benefits provided to citizens who have reached this age.

Some privileges can be obtained both in the form of a certain benefit and monetary compensation for its refusal.

Military pensioners for Russia and its armed forces

Initial concepts When paying taxes, money goes into the state budget of the country, and constitutes the main amount that can be spent on the significantly important needs of the state and its entire population. The amount of tax is set depending on the earnings of each citizen.

Types of taxes: Federal taxes and fees The totality of these types applies to all citizens of the Russian Federation, and their payment is made in accordance with the Tax Code Regional taxes These taxes are also paid on the basis of the Tax Code, but do not apply to the entire country, but to individual regions Local taxes and fees This type is the most highly specialized, and is distributed on the basis of the Tax Code of the Russian Federation in accordance with other legal acts that were issued by local authorities and are paid in a specific city. Absolutely all taxes must be established by the Tax Code.