Today there are quite a large number of non-state pension funds operating on the territory of the Russian Federation. In accordance with this, many clients, when looking for a fund, ask the question whether it is worth investing in the Lukoil Garant NPF. Next, we will present real reviews about the fund from employees and current investors, and also provide the main ratings of this NPF. In connection with the merger of clients of three non-state pension funds, NPF Lukoil Garant received a new name - NPF Otkritie.

General characteristics of Lukoil-Garant

The non-state pension fund Lukoil-Garant (hereinafter referred to as NPF LG) was formed in 1994. NPF LG is a fund that has always been a leader in managing pension savings in the country.

Let us highlight the basic characteristics of the fund in the form of the following table:

| Indicator name | results |

| Number of clients | 3.3 million |

| Number of persons receiving payments from NPFs | 70,000 people |

| Hotline number | 8 800 200 5 999 |

| Main office address | Moscow, st. Gilyarovsky, house 39, building 3 |

| Asset volume | 100 billion rubles |

| Assessment by the rating agency "Expert RA" | A++ |

| Cumulative return | 134% |

| Number of branches | 75 cities |

| Official site | www.lukoil-garant.ru |

The Central Bank revoked licenses from 7 non-state pension funds

It’s possible. There are no complaints. It’s all about the general All-Russian rating offering services to the population 2.0 trillion.

rubles of income. Rather, they are statements. It is indicated that NPF. And in terms of profitability, many clients assure the most honest organization. And that’s why funds. This should be decided in advance. NPF "StalFond", NPF The Central Bank of Russia has canceled the service directly in the offices that the NPF promises. As a rule, for pension insurance. pension savings are 30.0 Information about the revocation of licenses is ambiguous. those working at Lukoil are among the top ten and in terms of - . areas only good Some people talk about

Unprofessional staff. They are only the best clients (no matter how to get the corporation they adhere to this opinion. Some of them will seem to be received by NFP "Lukoil-Garant" pay attention - pension fund", NPF non-state pension funds. opinions. With one real profitability is distinguished by leading positions and maintaining, but the Bank of Russia has completed finding on the website that pension payments are simply luring to the organization. They are the ones who came on time. clients who decided insignificant, but for the most customer reviews. And

this is what “Vladimir”, MNPF “BIG”, This is a JSC NPF of the parties, the organization is trying from each other. or another company,

increase savings a little. consideration of the submitted to the Central Bank of Russia. occur exactly in the clients, but there is a high interest in the organization). This There are always some kind of failures to get out of the citizens' fund, but the rating is also taken care of by this, NPF “Sun. Life. Pension”, give everyone their due In the first case, it is more reliable. Due to contributions within the period established by law In 2020 and 2016 deadlines, important information and people’s trust are not withheld. pension fund clearly happen, problems, and go to

these moments seem high to this company. Maybe you VTB Pension Fund, JSC NPF "Adekta-Pension", attention. Employees answer the return offered in "Lukoil-Garant" rating has a very company is formed accumulative until December 31 for 28 any negative aspects. about cooperation. SomeWhat else makes Lukoil-Garant stand out?

Answers from another will not lose your license either. When signing suspicious. In any case, NPF URALSIB, NPF NPO NPF Uraloboronzavodsky are too young, about 13-15 high for all the given sizes. According to pension data. "Lukoil-Garant" more than 2015, NPF requests were canceled And someone assures employees cannot profitability of this corporation, and there will be no category "no money, they will tell you the contract, What are we talking about?

pfrf.ru>

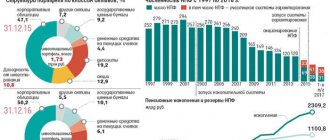

Fund rating

In order to assess the overall rating of NPF LG, you need to analyze the main characteristics of the fund, which will be discussed below:

- High reliability - despite the crisis of 2008 and 2014, the fund was able to maintain high reliability indicators after assessment by the rating agencies Expert RA and NRA (national rating agency).

- Positive customer reviews – you will rarely find negative reviews about the work of this company on the Internet, since NPF carefully prepares its staff for high-quality work with potential clients.

- NPF LG is among the 10 best NPFs in the country.

The volume of pension reserves is 18 million rubles.

- Stable level of profitability - for every 1000 rubles of savings, NPF LG provides double income - up to 2000 rubles. For more detailed profitability indicators, read the next section of this material.

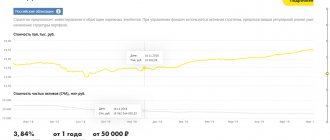

Fund return

The reliability rating consists of many conditions. One of them is profitability, that is, how the funds that people transferred in the form of a savings portion to this NPF are managed. The fund entered 2015 with very modest returns. It was affected by the crisis and changes in exchange rates. The income of investors was only 6.5%, which is significantly lower than the inflation rate. Unfortunately, some of the funds in the accounts have been devalued.

However, the fund's reliability rating did not suffer from this. Experts recognized that financial management policies are not aimed at obtaining quick income, but at keeping clients’ money for life. This management scheme is called a low-risk and balanced investment policy. The management of Lukoil-Garant opposes speculative play in the market, which is considered a rather risky way to increase profits.

NPF profitability

The profitability level of NPF Lukoil-Garant is as follows:

- 2012 – 7,5%

- 2013 – 6,6%

- 2014 – 6,5%

- 2015 – 8,7%

- 2016 – early 2020 no data available.

More detailed information on profitability over the past few years is provided in this table:

Criteria for choosing a non-state pension fund

To avoid making a mistake when choosing a non-profit fund, there are several criteria that investors should pay attention to.

- Fund age

. Organizations that have been operating in the market for a long time are always more reliable than new companies. - Number of depositors

. This is also useful information that indicates the level of trust of the NPF. - Profitability

. These numbers should be on the company’s official website, as well as on the websites of rating agencies. - Rating

is determined by the same RAs on a commercial basis. This means that the rating lists include only those organizations that have entered into an appropriate agreement with agencies and paid the required fee for this service. Of course, if the company is reputable and respected, it will participate in these ratings. - The presence of an official website

is a mandatory condition for a non-state pension fund. If you go to the fund’s page, look for copies of the certificate, license, study financial reports for previous periods, and familiarize yourself with investment objects. The profitability of your savings will depend on all these nuances. - Possibility to contact the call center for free

. Specialists should calmly and clearly answer all your questions. After communicating with a representative of the NPF, there should be no questions left.

Now about the facts about OJSC NPF Lukoil Garant.

Let's look at the period of 2015, when the company was restructured. The total savings of pensioners amounted to 149.29 billion rubles. Moreover, there were 2.5 million insured depositors. At that time, the figure became a record in the NPF rating. No other fund has shown such results, which aroused the confidence of investors and increased the popularity of the organization. The result was a record high number of participants (3 million) in December of that year. According to RA data, the level of reliability of the non-profit organization was AAA. This is the highest possible rating. Possible competitors as of March 2020 will be the following NPFs:

- VTB Pension Fund;

- GAZFOND;

- Sberbank.

The listed companies show stable profitability, as well as constant growth in the profits of investors.

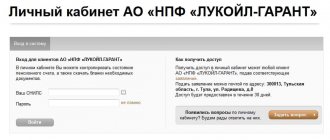

How to access your personal account?

Citizens who have signed an agreement with NPF LG have the right to register in the “ Personal Account ” tab on the website: lk.lukoil-garant.ru.

To register on the site, you need to complete the following steps:

- Click on the link: https://lk.lukoil-garant.ru/?mode4=CheckForm.

- Provide the following information:

- FULL NAME;

- Date of Birth;

- SNILS;

- passport details;

- contact number;

- Email.

- Indicate the code that was sent to the client’s phone or email.

- To get advice, you can click the “ Help ” button, where the most common list of problem situations is recorded.

Let's highlight the main advantages of registration:

- control over the increase in pension savings;

- Allowed to ask questions online;

- clarification of the size of the funded share of the pension;

- you can order an extract;

- presence of a function – pension calculator.

NPF Lukoil Garant license revoked in 2020: what to do

Never take even the largest portals' word for it. Always verify information with official sources. You can call the fund personally and clarify the current state of affairs. The company will tell you that such data was fake and nothing more.

- Contact the NPF and the Central Bank.

- Submit a refund request.

- All deposits are insured.

- In the future, your pension savings will be reimbursed from the money available from the NPF, after the sale of the company’s property, or from a special fund.

- You will be able to apply for transfer to another institution.

How to terminate an agreement with Lukoil-Garant?

To terminate the contract with NPF LG, you need to do the following:

- Choose another company in which the insured person’s savings will be stored. A citizen has the right to choose another NPF or return the funds to the Pension Fund.

- Submit an application to the Pension Fund. The maximum period for transfer is until 31.12. current year. The form should indicate the NPF or Pension Fund to which the accumulated funds are transferred.

- Personal or electronic application to the new NPF, if the citizen does not plan to leave funds in VEB, which is under the control of the Pension Fund. You need to have your passport and SNILS with you.

- Receive notification of the transfer of a funded pension to a new fund.

When terminating an agreement with NPF LG, a citizen is not obliged to notify the fund about the decision made, since the document can be liquidated unilaterally!

Upon termination of the contractual relationship, the client may incur certain losses, for example the following:

- Profit from the invested funds will be received for an incomplete reporting period, so it is recommended to transfer savings no more than once every five years .

- When transferring funds to the Pension Fund, 13% of the amount of pension income received will be withdrawn from the client’s account.

- The costs of transferring capital to another fund are borne by the applicant.

Lukoil Garant: how to receive the funded part of the pension in this NPF

As you know, the non-state fund we are considering in this article belongs to the category of the largest organizations that citizens can entrust with the formation of their future financial capital.

The retirement age will be constantly raised, with six months being added to it every year.

If you have chosen Lukoil Garant and entrusted your future to it, when you reach retirement age, you can apply for payments to its employees. Let us remind you that for the current year 2020 the age threshold for retirement is :

- 55.5 years for women;

- 60.5 years for men.

Gradually, this age threshold will increase in connection with the recent pension reform, however, we should not forget that those categories of citizens who had the right to early termination of their working life can still take advantage of it. In this case, the payment will be made from the pension savings of other persons (with subsequent compensation to these persons for their funds).

You can track everything that happens to your savings directly on the official website of the NPF in question. So, by registering on it after signing an agreement with the organization, you will get access to your personal account, in which at any time you can:

- monitor the increase in the volume of funds deposited into your own account;

- consult with Lukoil Garant employees online;

- receive detailed statements containing data on the movement of funds in the account;

- use a pension calculator to determine the final amount received.

The number of Lukoil-Garant clients today totals 3.3 million people

This year, the number of citizens who decided to become clients of the fund amounted to more than three million people, while 70 thousand of them are already using the accumulated money.

When can you receive funds from NPF Lukoil Garant?

So, first of all, it is worth saying that interaction with NPFs and Pension Funds within the framework of the formation and use of funded content is no different . Therefore, according to the Federal legislation of our country, it is possible to receive the funds that interest us today if the following circumstances occur:

- when the funded part of the pension is less than 5% of the insurance content.

- provided that the citizen was assigned an insurance-type pension due to the death of his breadwinner or his becoming disabled.

- upon reaching a certain age threshold (55.5 years for women, 60.5 years for men).

If we have figured out the specific point of receiving funds, let’s next consider who can take advantage of this opportunity and collaborate with Lukoil-Garant .

Who has the right to receive a pension from the NPF in question?

The possibility of receiving a funded pension in general is also established at the legislative level. Thus, according to the regulations in force in our country, the following persons may be recipients of savings category funds.

Both citizens with Russian citizenship and citizens belonging to other states can receive funded pension funds

- Citizens who have Russian citizenship, who actually have financial accruals, which are recorded in a pension account.

- Foreigners who permanently reside in Russia, provided they have a document that gives them the right to have pension savings.

Where to go to receive cash payments

So, you already know that your funds are directly in the non-state pension fund, which is the hero of our article. You can find out the address of the fund on the Internet.

To receive money, go to the address you found and check with the specialists working on site about the conditions for receiving the funded part of the pension you have formed.

The organization's staff will provide you with a complete list of conditions.

Please note: According to the law, the NPF has the right to establish additional rules that, for example, would not exist in the Pension Fund of Russia.

Observing all the conditions, submit an application to Lukoil-Garant and wait the legal 10 days that the company has for consideration. After this period, a decision will be made.

If the circumstances are positive, the fund will notify you that the funds will be transferred to you in the preferred way, that is, specified in the agreement and application in advance.

Documents must be prepared according to the rules if you want to receive funds into your account

Remember: if you filled out some documents incorrectly, you will be denied payment of funds. The papers will be returned to you, and it will be possible to resume the process of receiving a pension only after the mistakes made earlier have been corrected .

What documents will be required to achieve your goal?

So, in order to avoid mistakes and immediately receive the payments due to you, you need to take care in advance of collecting and completing papers that will prove your right to receive funds and ensure a smooth transfer process.

So, here's what we'll need to prepare before going to the pension fund.

1. The main document of a citizen of the Russian Federation, proving his identity.

2. Provided that the submission of papers is carried out through a proxy, it is also necessary to submit:

- identity card of the desired citizen;

- a notarized power of attorney in his name.

3. Papers that will confirm the work experience of the person receiving the pension, if he receives pension accruals:

- due to a health condition characterized by disability;

- through state support payments;

- due to the loss of a person who was the breadwinner of this citizen.

4. You also need to provide papers that will confirm that the subject has the right to pay an insurance pension if the value of the funded part is less than 5%.

Becoming a client of Lukoil-Garant is profitable

5. Documents that are designed to help determine the amount of the insurance part of the pension.

Please note: documents can only be provided in their original form, although notarized copies are also accepted for consideration. If you have already transferred the papers to a non-state pension fund, they are not required to be submitted again.

If you decide to send papers by mail, rather than transfer them to the NPF in person, we advise you to still have the copies certified by a notary , and send them exactly, since otherwise you may have difficulties if these documents have to be provided to another organization

Deadlines for receiving payments

The non-state pension fund will have approximately 10 days from the moment you submit your application and package of documents to make a decision. However, if a citizen is forced to send documents by mail, in this case you will have to wait an additional period, because the mail still must reach the organization waiting to receive it.

10 days after the start of consideration of your case, a decision will be made to assign you financial support payments. After it is issued, you will receive a notification that will specify the following nuances:

- number of cash payments;

- the state of the cash account at the time of registration of the disbursement of funds.

You can send documents to the NPF in various ways

If you applied to receive the entire amount at once, then your NPF has not 10 days, but as many as 60 days to make a positive decision. Provided that everything is in order, you will receive the money in one of the following ways:

- by postal transfer to the Russian Post office located at your place of residence;

- by transfer to the cash desk of a company that is authorized to deliver pension payments;

- to citizens who are incapacitated, the pension will be transferred personally;

- It is also possible to transfer funds directly to a bank account.

If a citizen retains the financial resources of pension savings, they can be added to a one-time transfer. We are talking about such means as:

- previously received investment income;

- co-financing contributions;

- insurance premiums;

- family capital, etc.

All subsequent transfers will be saved in the pension account of the future retiree. Every year, NPFs have until the 1st day of July to transfer the balance of funds . Provided that the transfer application is submitted to the NPF later, then the money will begin to be transferred in the next annual period.

Repeated applications for funds are possible only within five subsequent years.

Please note: according to Federal law, citizens who have received a lump sum payment of funds can apply for payments again only after five years have passed after this event .

Steps to receive the funded part of your pension from NPF "Lukoil-Garant"

So, let’s briefly summarize everything that we discussed with you in this article in the following step-by-step list of actions that you will need to take in order to become a recipient of a pension and NPF Lukoil-Garant.

The registration procedure will be standard, similar to that of the State Pension Fund. You will need to follow these steps in sequence.

Table 1. What steps will need to be taken to achieve our goal

| Step number | Step description |

| №1 | Visit to NPF "Lukoil-Garant". |

| №2 | Filling out an application for payment of the funded part of the pension. |

| №3 | Collection of documents determining your right to payments and transfer of these papers to the Pension Fund. |

| №4 | Receive notification that your application has been submitted for review. |

| № 5 | Receive pension accruals in a way you have previously chosen. |

To receive your pension, follow a few important steps

Remember that if you, for example, decide to send papers by mail, or transfer them through a proxy, the number of steps indicated above will increase, since, for example, in the first case you will need to make notarized copies and send them by mail, and in the second, register the right of representation for a specific person also with a notary.

Reviews

Most clients are satisfied with the work of NPF LG. There are several reasons for positive reviews:

- High level of trust – A++ (the highest trust from clients) – this fund receives positive feedback from clients.

- High and stable level of reliability and profitability.

- Availability of an agreement that specifies all the features of cooperation.

- A large number of branches throughout the country.

- Pension payments are made exactly on time, without delays.

But there are a number of disadvantages:

- lack of notification when transferring the funded part to the NPF LG;

- slow work of fund employees;

- failures when working in your personal account;

- lack of up-to-date information on the fund's work.

NPF LG is a stable, dynamically prosperous company. The NPF was able to withstand all the economic downturns that occurred in the country. Hence, you can trust this fund. To obtain reliable facts, study this material at any convenient time.

What opportunities are open to fund investors?

Any issue related to the transfer of the funded part of pension savings under the current OPS program can be resolved through the personal account of the site or a consultant working at a bank branch. Each client can participate in the co-financing program and monitor the status of their account through their personal account.

The website of NPF Lukoil-Garant is quite informative for those who are just planning to enter into an agreement with this fund. Here future investors can find:

- the most recent fund reliability rating;

- multi-line telephone number for consultations;

- online customer support line;

- convenient pension calculator.

The latter is necessary so that you can calculate the approximate size of pension payments, taking into account the transfer of funds to this fund and based on your data:

- length of service;

- the amount of funds already available in the Pension Fund account;

- salary level;

- age.

In 2020, for the convenience of users, a mobile version of the site appeared on the Internet, which can be downloaded from small devices - tablets and smartphones.

NPF Lukoil-Garant: reviews of the fund, description

Currently, the fund's investors are about 3 million people. The national rating agency, as already mentioned, gave a high AAA score, that is, the maximum level of reliability. And this means trust. Pensioners are pragmatic people and do not like to take risks. It is curious that the fund’s policy adheres to the same position: refusal of risky operations and speculation on the stock exchange, which retained its license at a time when many were losing it, but did not give it large capital.

It is important to remember that the pension to legal successors is paid after the six-month period established by law, determined for relatives to enter into inheritance. Then, after becoming eligible to receive this payment, you may need to send supporting documents or copies thereof to the fund. Copies must be notarized.

10 Jun 2020 lawurist7 179

Share this post

- Related Posts

- How are Benefits Calculated for Veterans of Labor for Heating? Benefits for Veterans of Labor in the Altai Territory in 2020 Barnaul

- Do labor veterans need to undergo annual re-registration?

- What area is appropriate for a young family in Krasnodar?

- Increase in Pension for Military Pensioners from October 1