One of the conditions for using maternal capital funds is to improve living conditions.

Thus, it is possible to buy a new apartment or individual house using government money. However, not all so simple. There are several restrictions, as well as a standard document verification procedure. Without meeting all the requirements and without a complete package of documents, you will not be able to use federal money.

In this article you will learn what exactly needs to be done to obtain maternity capital for the purchase of housing, as well as when exactly you need to start collecting the required documents and conditions for purchasing housing.

Maternity capital: what is it?

The only body in the Russian Federation that issues MK certificates is the Pension Fund, to which you need to apply with a corresponding application. Regulates the right to receive funds. This document, among other issues, contains explanations of how maternity capital can be used after a child is 3 years old.

Financial assistance is issued in the form of a certificate, which can be used at the discretion of the parents to improve the child’s quality of life. There is no possibility to cash out funds for your own needs.

It is also useful to know that:

- money is issued only once, regardless of the number of children in the family;

- Parents gain access to funds after the child reaches three years of age;

- financial assistance is provided for both natural and adopted children;

- the program is continued until 2026, although the possibility of receiving money later is provided if the certificate is received before the end of the established period.

Find out more about what maternity capital is and when it is paid.

Conditions for purchasing housing

According to Federal Law No. 256 of December 29, 2006, maternity capital can be spent on improving housing conditions .

According to this law, children must be allocated shares in the purchased housing; we will consider the terms of purchase below.

Terms of use: there is a limit on the age of the youngest child. The money can only be used when the child reaches the age of three. However, this restriction can be circumvented absolutely legally. The same law allows you to use maternity capital to pay off your mortgage without a three-year wait.

Thus, you can contact the bank to apply for a mortgage , purchase real estate and begin the procedure for early repayment of maternity capital. This process usually takes about three months if you submit all the necessary documents the first time.

Legislation on maternity capital

In addition to the main law of 2006, there are other documents that regulate the intended use of funds under the program:

- . This document regulates the allocation of funds for the repair, purchase or construction of housing. The resolution provides for one of the cases when you can receive money before the child is three years old - repaying a mortgage loan. The sale of real estate purchased using MK requires the collection of a large number of additional documents, including from the guardianship authorities and the Pension Fund.

- . This describes the possibility of paying for an educational institution for a child or several children using certificate funds. Tuition can be paid for for all children, not just the one who received financial assistance.

- .

- . This document explains how to get maternity capital in cash. According to the law, parents can receive from the body of the MK a monthly payment in the amount of the regional subsistence minimum for children (about 10 thousand rubles). This is the second case when you can receive money before the child is three years old. In addition, this law provides the only opportunity to cash out part of the funds and spend them on the needs of the child.

- In addition, before 04/15/20, changes in legislation must be prepared and adopted to bring into force “retrospectively” changes in the issuance of maternity capital from 01/01/20, which were mentioned by the President of the Russian Federation in the Address to the Federal Assembly on 01/15/20 (issuance of capital for the first child , increasing its amount by 150 thousand rubles for the second or subsequent).

Any use of financial assistance for a child will require writing an application to the Pension Fund and providing an impressive list of certificates and documents.

What is needed to obtain maternity capital

In 2020, the following are eligible for financial assistance:

- Women and men with Russian citizenship who gave birth to or adopted a second child after January 1, 2007. From 01/01/20, parents whose first child was born will have this right. The certificate is issued to only one parent.

- The father or adoptive parent of the child in cases where the right to financial assistance is lost by the mother or adoptive parent. A man is not required to have Russian citizenship.

- Children under the age of majority, in cases where parents lose their rights to receive financial assistance.

Now about how you can get maternity capital after 3 years. To do this, you need to submit the following documents to the Pension Fund: application, passport, pension insurance policy, birth certificates of children (all) or court decisions on adoption. A certificate granting Russian citizenship to the child may be required if one of the parents does not have a Russian passport.

Receipt and registration process

Before you start collecting documents, you need to understand exactly how you will use the maternity capital.

If we are talking about early repayment of the mortgage, then the scheme of your actions will be the same, but if you plan to buy a home with this money without using the bank’s money, then the scheme will be completely different.

Here is the procedure for using maternity capital to purchase housing. So, if you buy a home using bank money, then you will need to apply for a mortgage on standard terms and contact the Pension Fund. To do this you will need to make an appointment.

Usually, registration is made 2-3 weeks in advance due to the large number of people who want to manage public money. During this time you will need to collect a package of documents . This includes:

- statement;

- the applicant’s passport and his SNILS;

- children's birth certificates and marriage certificates;

- certificate;

- obligation;

- purchase and sale agreement and other documents for the apartment;

- mortgage agreement;

- a certificate from the bank about the balance of the debt.

Watch the video for the process of obtaining maternity capital for housing.

It is worth noting that when using maternity capital to purchase housing, the purchase conditions are as follows: an obligation to allocate children a share in residential real estate and a certificate of the balance of debt must fully meet the requirements of the Pension Fund.

Since each branch has its own nuances and requirements, it is better to take samples of these documents in advance from the branch of the Pension Fund where you plan to submit documents.

The obligation is indefinite and is drawn up by a notary. The cost of this document is from 1000 to 12000 rubles. As for the bank certificate, it is valid for 1 month and somewhere they require 100-500 rubles for issuing it, but in most banks it is issued free of charge.

Having collected the entire package of documents, you will have to go to the Pension Fund. There you hand over all the documents and receive a receipt for their teaching by a specialist. The check takes 30 days.

If during the check no issues are discovered that may interfere with your disposal of the maternity capital funds, then the payment will be made within the next 30 days.

If the mortgage is closed, then get a certificate of closure from the bank, your mortgage note and remove the encumbrance. After this, you will need to allocate shares to the children within 6 months, according to the obligation.

To do this, an agreement is drawn up in free form and also certified by a notary. Then all the necessary documents are submitted to Rosreestr.

If you use maternity capital without attracting bank funds, then the procedure changes. Initially, you find a seller who transfers the apartment or house to you, according to the purchase and sale agreement.

The contract states that an encumbrance will be placed on the property until full settlement with the seller is made. In case of failure to fulfill obligations, the property is alienated in favor of the seller.

Then you must submit documents to the Pension Fund. You will need the following :

- statement;

- the applicant’s passport and his SNILS;

- children's birth certificates and marriage certificates;

- certificate;

- obligation;

- purchase and sale agreement and other documents for the apartment;

- an extract from the Unified State Register confirming the transfer of ownership.

The extract is valid for only 10 days and takes 3-5 days to complete, so order it immediately before your visit to the Pension Fund.

Its cost does not exceed 500 rubles. Verification takes 30 days and transfer of funds another 30 days.

You can also use a mortgage and capital at the same time for a down payment. Then you will need the same documents as when buying a home using government funds, but finding a seller will be very difficult, since the transaction will take about three months. The fulfillment of the obligation occurs after the repayment of the mortgage loan.

For information on documents for registration and use of mat capital, watch the video.

What is maternity capital provided for?

There are only four directions for using funds:

- housing: construction and reconstruction of houses, purchase of apartments, payment of mortgage payments;

- education: payment for accommodation in other cities (only in dormitories) and education in kindergartens, schools, universities;

- pension upon reaching a certain age - formation of a pension contribution for the mother;

- rehabilitation and adaptation of children with disabilities: purchase of technical equipment from strollers to cars, and payment for the services of various institutions or specialists.

Using maternity capital: when and how

The main question of interest to most families is how to buy an apartment with funds from the state. Speaking about how to use maternity capital after 3 years to buy an apartment in 2020, it should be noted that this is the easiest way to purchase real estate.

The rules of action after receiving the certificate and the child’s third birthday are as follows:

- find a residential property or repair contractor and agree on the cost;

- sign a purchase agreement, indicating deferred payment as one of the clauses;

- write a statement about the need for a transfer from the buyer’s account (according to MK) to the seller or contractor and submit it to the Pension Fund.

The request is processed within 60 days. After checking the PF transfer, the money is credited to the seller's account. If the amount exceeds the capabilities of the certificate, for example, when purchasing a home, the owner of the apartment complex is obliged to transfer the remaining money himself.

Also, assistance from the state is used to pay for tuition. By the way, you can pay for the education of all children in the family, for example, for kindergarten. Or spend funds on any child to pay for university, provided that the student has not reached the age of 25.

You can also spend money on the rehabilitation or socialization of a disabled child. This means the acquisition of equipment that makes life easier, and various services such as examination by specialists, courses of medication and treatment in specialized institutions.

Terms of use

Federal Law No. 256 allows the purchase of housing with the following condition: you can buy any residential property if it is larger in area than the existing one.

So, according to the rules, you can buy the following :

- an apartment in a new building or in a building under construction (read about purchasing an apartment in a building under construction here);

- individual house or apartment on the secondary market;

- land for building an individual house.

Interestingly, it is still possible to use maternity capital for repairs, despite the fact that the law denies this. The fact is that the Federal Law says about the possibility of reconstructing a residential building.

If its area becomes larger after reconstruction, then you can use federal money for reconstruction and repairs.

But you will have to report that the money was spent specifically on expanding and improving living conditions.

You will learn about the use of maternity capital for housing from the video material.

conclusions

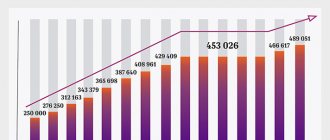

The assistance program for large families is a good opportunity to improve the well-being of parents and children. Almost 90% of families eligible to receive funds use this money to purchase or renovate their home. Receiving and selling funds is quite simple.

Money will also come in handy in other cases: education, treatment, children staying in preschool institutions.

To issue a certificate, you should contact the nearest branch of the Pension Fund of Russia, not necessarily at your place of registration, with an application.