What is a non-state pension fund?

Non-state pension funds (NPFs) help save money for a dignified old age. You or your employer contributes to them, and the funds invest these funds so that they do not depreciate over time. When you retire, these savings begin to gradually pay you in the form of a pension.

NPF can help you increase your pension in two ways:

Increase the funded part of the state pension

From 2002 to 2013, part of employers’ mandatory pension contributions went not to the general account of the Pension Fund of Russia (PFR), but to the individual pension accounts of employees. These amounts can be left there, in the Pension Fund (they will still remain personal), or they can be transferred to one of the non-state pension funds. These individual accounts can be replenished independently - then the state pension will be larger. You can read more about this in the article about the role of non-state pension funds in compulsory pension insurance (OPI).

Create an additional pension

The second option is also possible: choose a non-state pension fund and enter into a non-state pension provision (NPO) agreement with it. This will allow you to organize a second, additional pension. This is the option Vasily chose.

Many funds simultaneously deal with state and supplementary pensions. If you transferred your pension savings to a non-state pension fund and are satisfied with the way it manages your funds, then you can start saving money there for an additional pension. But for this, the fund will enter into a separate agreement with you and open another account for you. If desired, you can enter into an agreement with another fund.

Formation of the PFR reserve for compulsory security

Measures to form the Pension Fund reserve are aimed at ensuring its financial stability, as well as maintaining the solvency of the entire pension fund system. The formation and expenditure of funds from the Pension Fund of Russia reserve for compulsory social security occurs in accordance with federal law through:

- investment income;

- contributions from pension savings;

- monetary amounts of pension savings that were not received by the legal successors of the deceased pensioner;

- amounts received from the application of financial sanctions, such as fines, penalties and others;

- amounts that were not accounted for in individual personal accounts six months after the end of the financial year.

At the expense of the PFR reserve, funds are paid to the legal successors of the pensioner who did not manage to receive pension payments; payment for the delivery of funded old-age pensions, urgent payments and one-time payments; guaranteed replenishment of funds in the citizen’s account.

How are these ways to boost your pension different?

You can decide for yourself what suits you best - choose just one way to increase your pension, or both: save for both the state pension and the supplementary pension. But it is worth considering that each option has pros and cons.

- NPF in OPS

- NPF in NGO

– Moderate returns Funds can invest only in the most reliable financial instruments.

+ Savings are insured Pension savings in the compulsory pension system are insured by the state. Whatever happens to the fund, the entire amount of contributions made will be returned to your individual pension account at the Pension Fund.

– Strict rules Standard rules for contributions and payments, assignments and indexation of pensions are established by law. For example, if you top up your account through your employer, you need to indicate in advance a specific amount or percentage of your salary in the application. If you want to receive the funded part of your pension not for life, but for some period of time, then it must be at least 10 years.

+ Profitability may be higher. Non-state pension funds may choose slightly riskier, but in the future, more profitable assets.

– Investments are not insured Voluntary contributions are not included in the deposit insurance system. If the fund fails, there is no guarantee that you will get your savings back.

+ Flexible conditions When you save for retirement on your own, you determine the convenient amount and frequency of contributions and payments, the rules for transferring savings by inheritance and other conditions.

Vasily wants to have more income in his old age and is not afraid to take risks, so he decided to save for an additional non-state pension.

Now the main thing for Vasily is to choose a reliable NPF that can profitably invest his money.

Federal Financing Law: Official Text

Federal Law 360 on payment financing was approved by the federal parliament in 2011. It came into force a few days after its adoption. The official text of the bill establishes the procedure for paying pension savings. Before the regulation came into effect, persons receiving a pension were required to submit a written application to the court in order to qualify for the transfer of the funded portion. The mechanism for issuing funds was not provided for by law. Today the legal document has 20 articles, each of which establishes certain rules:

- the concepts used in the current law are formulated;

- different types of pension payments are provided (there are 4 of them in the document);

- the insured person is guaranteed the opportunity to receive payment from pension contributions;

- It is allowed to receive a one-time transfer from pension savings;

- the concept and procedure for processing urgent payments has been established;

- sources of financing for payment of funded or fixed-term pensions have been identified;

- the procedure for forming a reserve of payments in the Pension Fund is regulated;

- a procedure for transferring savings from management organizations to the State Pension Fund has been formulated;

- a transfer from the Pension Fund to an accredited state company and the reverse procedure are provided;

- the features of accounting for funds entering the reserve and the procedure for their distribution in the accounts of the Pension Fund are determined;

- investment operations are allowed to increase the pension savings of citizens of the Russian Federation;

- a change in the amount of funded and fixed-term pension payments has been established;

- the formation and payment of pension savings held in a non-state fund is guaranteed;

- the procedure for creating a non-state pension fund reserve has been determined;

- investments are provided for NPFs to increase pension savings transferred to the fund’s management;

- changes are allowed in the formation of payments to non-state pension funds;

- state bodies responsible for monitoring pension payments have been established (the article has lost force);

- public control over the formation of pensions is regulated;

- final provisions formulated;

- The procedure for the entry into force of the presented bill is described.

Read also: Division of a car (vehicle) during a divorce

The latest changes to the current version of the document were made in 2015.

How to choose a non-state pension fund with high yield?

The Bank of Russia clearly regulates what non-state pension funds can invest their clients’ funds in (high-risk instruments are excluded), and strictly monitors compliance with these requirements. However, any investment carries risk. And the higher the probable return, the higher the risk usually is.

Before concluding an additional pension agreement with a fund, it makes sense to study its investment declaration to understand what exactly it plans to invest the money you entrust to it. NPFs are not required to disclose it, but may do so.

Much depends on the professionalism of the experts who manage NPF money. If for several years the return on investment of a particular non-state pension fund is above the market average, then most likely it has a strong team of investment specialists.

You can compare the return on investments of different funds in summary tables on the Bank of Russia website. If the fund operates in both the compulsory pension insurance system and the non-state pension system, then the profitability indicators for these two areas are published separately, and they may differ. Therefore, first, choose what type of fund investment you are interested in and check the profitability over several years.

On the regulator’s website, funds show their total investment income before deducting their own commissions and other payments. The net profitability that NPFs accrue to client accounts can now only be viewed on the websites of the NPFs themselves.

It is also worth remembering that past performance is not a guarantee of the same profitability in the future. Moreover, first of all, when choosing a non-state pension fund, you should still think about its reliability, and only then about profitability.

Sources of pension financing

State pensions today are financed from two sources:

- From the federal budget to provide each category of civil servants and social pensions.

- From the budget formed by the Pension Fund of the Russian Federation.

Components of a labor pension in the Russian Federation:

This part is fixed, set as a fixed amount, and the amount depends on the type of pension, the presence of dependents and the disability group.

Basic.- Insurance. This part depends on the citizen’s work activity.

- Cumulative. Depends on the amount of accumulated insurance premiums, which are also taken into account in the citizen’s personal account.

Pensions are paid by the Pension Fund of the Russian Federation, the funds of which are formed thanks to the following sources:

- Insurance contributions from employers and individual entrepreneurs for compulsory social insurance.

- Deductions from the unified social tax.

- Funds received from the placed amounts of insurance premiums paid for the funded part of the labor pension.

- Federal budget funds.

- Other sources.

As for the amount of contributions to the Pension Fund from enterprises/organizations, it is set every year by the board of the fund and further approved by the relevant authorities.

The insurance premiums themselves are charged on any type of remuneration, and the due date for payment of contributions is monthly, for employers and citizens.

How to understand which NPF is reliable?

It is important to understand that any investment is a risk. And therefore there are no completely risk-free funds. But several characteristics of NPFs can and should be studied.

- Check if the fund has a license. No scammers masquerading as NPFs have been spotted so far, but it’s better to be on the safe side.

- Pay attention to the life of the NPF (the longer the better), the number of clients and the amount of pension funds managed by the fund. All this data is publicly available on the Bank of Russia website. The logic is simple: the larger the fund, the more expensive and professional team of investment managers it can afford. The level of service in large funds is also usually higher: it will be more convenient and faster to clarify information on your account and receive advice on pension issues.

- Look who owns the fund. If it is owned by large and reliable structures, such as banks or corporations, this gives hope for the stability of the NPF. A good sign is if the fund is managed by people with extensive and successful experience in the financial market. Conversely, if the fund’s website does not contain information about managers, you should be wary.

Who can you trust to manage your pension savings?

Today, all citizens who have pension savings in their accounts have the right to independently choose an insurer who will manage the savings funds. By insurers, the legislator understands state and non-state pension funds. Direct management of the funds is carried out by the management company (MC). It is possible to independently choose a management company only if the insured person’s savings are placed in the Pension Fund of the Russian Federation. If the insurer is a non-state pension fund, then the latter independently determines who to entrust the management of savings.

How to start saving for an additional pension?

Start by calculating your personal pension plan.

Vasily reasoned that he would like to receive 30,000 rubles a month in retirement. He will retire in about 30 years and, according to cold-blooded statistics, will live about 20 more years after that (this is called survival time).

Let’s assume that the insurance part of Vasily’s state pension is 13,000, and he needs to add another 17,000 rubles monthly to this money, so that the total is 30,000 rubles. For 20 years, he needs to save at least 4,000,000 rubles (17,000 x 12 months x 20 years). And if we divide this amount by the number of months until retirement (4,000,000 rubles / 30 years of future work experience / 12 months), it turns out that Vasily needs to save about 11,000 rubles per month.

This rough calculation does not take inflation into account. In 30 years, Vasily will be able to afford 30,000 rubles less than he does today. That is why he should not just put money in an envelope, but try to make sure that it generates income that is ahead of inflation.

- Calculate, following Vasily’s example, what kind of pension you want to receive in the future and how much you need to save monthly for this. You can choose how often you will make contributions and decide on the payment amount (however, NPFs usually have a lower limit - for example, at least 500 rubles). After a few years, the plan may need to be adjusted to account for inflation or if your appetite increases.

- Select a non-state pension fund and find out all the conditions.

- Decide which pension option suits you best: lifelong or for a certain period, say 20 years. You can choose a combined option - with a one-time payment of a large amount immediately after retirement.

- As a rule, an agreement with a non-state pension fund is concluded for the entire period of accumulation and payment of a pension. Be sure to find out what will happen if you want to terminate it earlier. It is possible that the funds will be returned to you without taking into account investment income or even less than what you contributed.

- Find out if savings can be passed on by inheritance. And will the heirs receive anything if they already start paying you a pension?

- Inflation has slowed down significantly in recent years, but it should not be zero in any case. Therefore, it is worth finding out whether the fund will index your pension, when you start receiving it, and in what amount.

- Investments are always a risk. But some funds undertake to accrue income to you in any circumstances, even if the investment turned out to be completely unsuccessful and did not bring any profit. Find out if your fund will do this.

- Sign an agreement with the NPF if everything suits you. Some funds offer to conclude an agreement online - it’s convenient and fast. But in person, at the fund’s office, you will be able to ask questions that you could not find out on your own, and clarify unclear aspects of the contract with employees.

- Start making deductions . They can be done online, for example through a bank’s personal account, through ATMs, bank branches, you can even set up monthly deductions at your place of work - it all depends on the conditions of a particular non-state pension fund.

- After the required number of years, receive an additional pension . Like the state one, you can start receiving it when you reach retirement age. But the agreement with the fund may also stipulate other conditions for starting the payment of an additional pension.

To make investments in NPFs more profitable, file a tax deduction on contributions paid annually - this is another advantage of voluntary contributions to NPFs. True, you can return a maximum of 15,600 rubles per year, because the deduction is calculated from an amount not exceeding 120,000 rubles.

I am a legal successor and I want to receive funds

The following may apply for payment as legal successors:

- Legal successors under the agreement are persons whom the client himself has indicated as legal successors.

- Legal successors are relatives of the deceased. Spouses, children, parents are legal successors according to the law of the first stage. Brothers, sisters, grandfathers, grandmothers, grandchildren are legal successors according to the law of the second stage.

Important! If you have any doubts that the deceased was a client of NPF FUTURE, we recommend that you contact the Pension Fund of the Russian Federation to clarify this information.

Legal successors must apply to the Fund for payment before the expiration of 6 months from the date of death of the insured person.

If the deadline for filing a complaint is missed, it must be restored through the court. Contact the Fund's unified information and reference service at 8-800-707-15-20 and find out how to restore the application deadline.

The legal successor can apply for payment in one of the following ways:

- personally contact a branch of the Fund or partner bank URALSIB. Find out the address of the nearest branch in the Office Addresses section;

- send the documents to the Fund by Russian Post at the address: 162614, Cherepovets, Lunacharskogo Ave., 53A, JSC NPF FUTURE.

Below are sets of documents for those applying in person to branches and via Russian Post.

A set of documents for applying to a branch of the Fund or a branch of a partner bank of URALSIB:

If the legal successor is a minor, then he must contact a legal representative.

Documents for the successor:

- passport or birth certificate if the legal successor is under 14 years old;

- death certificate of the insured person (if available);

- SNILS of the deceased or a document issued by the territorial body of the Pension Fund of the Russian Federation, which contains the SNILS of the deceased insured person (if available);

- a document confirming the relationship of the legal successor with the deceased insured person (only for the legal successor);

- a certificate confirming the place of residence of the legal successor (for legal successors under 14 years of age);

- an extract with details of a bank account opened in the name of the legal successor.

Documents for legal representative:

- documents confirming the authority of the legal representative (for the parents of the legal successor this is the birth certificate of the legal successor, for the guardian this is the decision of the guardianship authorities);

- passport of the legal representative.

Attention to legal successors applying to fill out an application at the branches of the URALSIB partner bank! If you do not have a document containing the SNILS number of the deceased insured person, then the legal successor must take his SNILS number with him.

Sending documents by Russian Post

Important!

If a set of documents is sent to the Foundation by mail, they must be certified (certification requirements are described below).

Application forms for a legal successor to apply for payment:

Application of the legal successor for the payment of the pension savings of the deceased Sample Application of the legal successor for the payment of the pension savings of the deceased Consent to the processing of personal data Sample Consent to the processing of personal data

Set of documents for sending by mail

Certify by a notary (or in a manner equivalent to a notary):

- application by the successor for the payment of pension savings of the deceased;

- a copy of the successor's passport (3-4 pages and a spread with registration) or a copy of the birth certificate if the successor is under 14 years old;

- copies of documents confirming the relationship of the legal successor and the insured person (only for legal successors);

- if the successor’s personal data has changed, then certify copies of documents confirming such changes.

Additionally, if the legal successor is a minor:

- a document confirming the registration of the legal successor at the place of residence or a certificate confirming the address of his actual residence.

If the legal successor is a minor, then it is also necessary to certify copies of the documents of the legal representative.

- a copy of the legal representative’s passport (3-4 pages and pages with registration);

- a copy of the document confirming the authority of the legal representative (for the parents of the legal successor this is the birth certificate of the legal successor, for the guardian this is the decision of the guardianship and trusteeship authorities).

Attach without notarizing:

- a copy of the death certificate of the insured person (if available);

- a copy of the SNILS of the deceased or a document issued by the territorial body of the Pension Fund of the Russian Federation, which contains the SNILS of the deceased insured person (if available);

- an extract with details of a bank account opened in the name of the legal successor. The statement must have the bank’s seal; if there is no seal, then certify the statement yourself - sign “I confirm details”, surname, name, patronymic, sign and date;

- consent to the processing of personal data.

Send the set of documents to the address: 162614, Vologda region, Cherepovets, Lunacharsky Ave., 53A, JSC NPF “FUTURE”.

The Fund begins to consider sets of documents received from legal successors after the expiration of 6 months from the date of death of the insured person. After consideration, the Fund will send by Russian Post a copy of the decision on payment or refusal to pay.

What will happen to the money if I don’t live to see retirement?

The rules for inheriting voluntary contributions to an additional pension are determined by an agreement with a specific fund. Sometimes you can inherit savings only if the pension has not yet begun to be paid. In other cases, heirs may not receive the entire amount of the account, but a certain part of the savings. Please read the terms and conditions carefully in advance.

If the transfer of savings is possible, you can determine the list of heirs yourself when drawing up an agreement with the NPF - these can be any people, not necessarily relatives. If you do not specify anyone in the contract, then the pension savings will be inherited first by your closest relatives: children, spouses, parents (in equal shares), and secondly by brothers, sisters, grandparents, and grandchildren. To receive money, heirs must submit an application to your NPF.

Is it possible to change NPF?

An agreement with a non-state pension fund is not a lifetime contract. You can change the fund in search of more income or out of concern for the sustainability of your NPF. The rules for changing the fund for compulsory state pension insurance are uniform and determined by law. And for voluntary pensions, they are specified in the agreement with a specific fund. And these conditions for exiting a personal pension plan should be carefully studied in advance.

All over the world, non-state pension funds are the main source of “long-term money” for the economy. Since their contracts last for many years, funds can invest in long-term projects with increased returns.

But this also has a downside: if you want to withdraw money before the end of the contract, the fund may suffer losses. Therefore, all NPFs stipulate in advance the procedure for calculating the redemption amount, that is, the money that will be returned to you if you want to leave the pension plan ahead of time.

You may be left without investment income for several years or for the entire time. And sometimes you will receive even less than you contributed. Such details need to be clarified in advance.

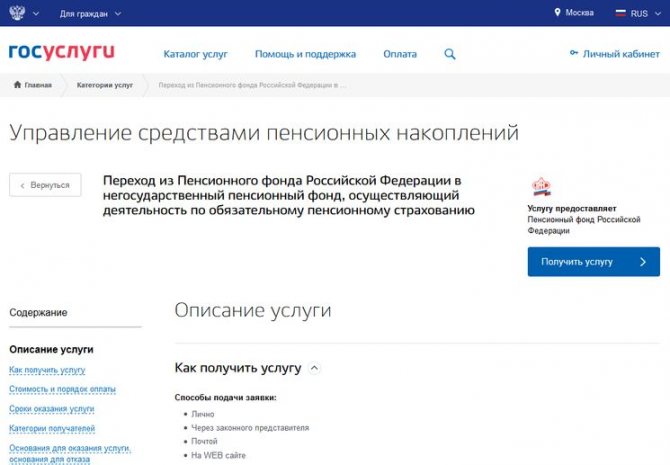

Application to the Pension Fund for transfer or early transfer to a non-state pension fund

When considering the procedure for transferring to a non-state pension fund, you need to know that according to Law No. 75-FZ (clause 4 of Article 36.7) and clauses 5, 5.1 of the Procedure approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 991p dated November 11, 2020, you You can submit an application for transfer (early transfer) directly to the territorial office of the Pension Fund at your place of residence, and also use the MFC, send an application by mail, or send an application via the Internet on the website of state and municipal services or on the website of the Pension Fund of the Russian Federation in the form of an electronic document.

The deadline for submitting an application to transfer to a non-state pension fund is December 31 of the current year.

If you submit an application electronically through a government services website, your signature is verified and your identity is verified using an electronic digital signature that you must have. If you submit an application through the MFC, the signature and your identity are verified by an MFC employee (see paragraphs 4, 5, paragraph 4, Article 36.7 of Law No. 75-FZ). When sending an application by mail, your signature must be certified by a notary, in accordance with paragraphs. 1 clause 4 art. 36.7 of Law No. 75-FZ.

When visiting a territorial branch of the Pension Fund in person, you must present a passport, a certificate of compulsory pension insurance and an agreement with the NPF.

You can change your decision to transfer to a non-state pension fund after submitting your application. If this happened before December 31 of the year preceding the year in which your application should be satisfied, you have the right to send a notice to the Pension Fund of Russia to replace the insurer you have chosen with another. The application can also be submitted electronically, in accordance with clause 3 of the Instructions, approved. Resolution of the Board of the Pension Fund No. 850p dated September 09, 2020 and art. 36.8-1 of Law No. 75-FZ.