Has a new form been introduced? When and what changed in her for the last time? For which reporting period should the new calculation form be used? Where can I download a free RSV form in an easy-to-fill out format? How to fill out the DAM for the 3rd quarter of 2020: a sample form, as well as links for downloading, are in this material.

In October 2020, it is necessary to submit to the Federal Tax Service “Calculation of insurance premiums” for 9 months. This year a new form is being used. At the same time, since April 2020, new rules for calculating contributions have been introduced for a number of companies and individual entrepreneurs - small and medium-sized businesses can take advantage of the right to reduced tariffs, and for companies affected by coronavirus, a tariff with a zero rate is provided. Let's consider how to compile the DAM for 9 months of 2020 for the affected industries, taking into account the new requirements.

How to use the calculator

Instructions for using the individual entrepreneur insurance premium calculator

- By default, calculations are made for the selected whole year. If you registered an individual entrepreneur this year, or you closed it, then select a more specific start and end date for the period.

- If your income for the selected period was no more than 300,000 rubles, then you can leave the “Income for this period” field empty. The entered amount will not affect the final result.

- Click "CALCULATE". You can save the result with all the calculation details to a doc file.

About the individual entrepreneur insurance premium calculator

As soon as an individual entrepreneur has received registration in this capacity, he has obligations to the state for taxes and fees. Regardless of the taxation system he adheres to and the financial success of his business, individual entrepreneurs must annually pay contributions to insurance funds.

To calculate the amount of amounts required to be paid, you can use an online calculator, which will make this process quick and transparent.

When do you need to pay?

Insurance premiums are calculated to be paid once a year. They must be transferred by the end of the current year, that is, by December 31. Otherwise, the entrepreneur is free to choose the terms for payment: you can make one payment at any time of the year, or you can make payments in installments, again at intervals convenient for the entrepreneur. Usually, a quarterly mode of making equal shares of insurance premiums is chosen - this way the tax burden will be distributed more evenly.

If an additional contribution to the Pension Fund is provided for an individual entrepreneur (in case of income over 300,000 rubles), then it must be paid before April 1 of the next year. At the same time, the obligatory part must be paid by December 31, and until April you can “delay” with contributions calculated from the amount that exceeded the limit of 300 thousand rubles.

Employee rehired

Situation: how to calculate insurance premiums at general rates if during the year an employee was fired and rehired by the same organization? The amount of payments accrued from the beginning of the year until dismissal exceeded the maximum base.

Calculate contributions based on income accrued before dismissal.

The calculation period for contributions to compulsory pension (social, medical) insurance is a calendar year (Part 1 of Article 10 of the Law of July 24, 2009 No. 212-FZ).

The employer determines the basis for calculating insurance premiums independently for each employee on an accrual basis from the beginning of the year. In 2020, organizations paying insurance premiums at general rates will charge premiums in the following order.

1. To the Pension Fund of the Russian Federation:

- at a rate of 22 percent - from payments not exceeding 796,000 rubles;

- at a rate of 10 percent - from payments exceeding RUB 796,000.

2. In the FSS of Russia:

- at a tariff of 2.9 percent - from payments not exceeding 718,000 rubles;

- at a 0 percent rate – for payments exceeding RUB 718,000.

3. In FFOMS: at a rate of 5.1 percent, regardless of the amount of payments.

This procedure is provided for by parts 1, 3, 4 and 5 of Article 8, part 1 of Article 58.2 of the Law of July 24, 2009 No. 212-FZ and Decree of the Government of the Russian Federation of December 4, 2014 No. 1316.

The legislation does not establish a relationship between the maximum amount of payments subject to insurance contributions and the number of contracts (labor or civil law) on the basis of which during the billing period the same employer (customer) accrued these payments to the employee. Thus, a break in work associated with the dismissal of an employee, as well as the number of employment or civil law contracts concluded with him during the year, do not affect the procedure for calculating insurance premiums.

Therefore, if before dismissal the amount of payments accrued to the employee exceeded:

- 718,000 rub. – in the Federal Social Insurance Fund of Russia there is no need to pay insurance premiums (zero tariff is applied); in the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund, contributions must be calculated at regular rates (22 and 5.1 percent, respectively);

- 796,000 rub. – in the Federal Social Insurance Fund of Russia there is no need to pay insurance premiums (zero tariff is applied), in the Pension Fund of the Russian Federation contributions must be accrued at a rate of 10 percent, in the Federal Compulsory Medical Insurance Fund - at a rate of 5.1 percent.

The validity of this conclusion is confirmed by letter of the Ministry of Labor of Russia dated March 5, 2014 No. 17-3/B-96.

How to pay insurance premiums?

The payment method is chosen by the individual entrepreneur. The easiest way, and this method is the most common, is a transfer from the entrepreneur’s current account by bank transfer. You can deposit these funds from any personal account, not necessarily registered as a settlement account and linked to the activities of an individual entrepreneur. Payment in cash is also possible, just remember to keep the bank receipt to confirm payment of insurance premiums.

IMPORTANT INFORMATION! The budget classification code (BCC) for the transfer of insurance premiums has changed since 2020 - now these payments are subject to the jurisdiction of the Federal Tax Service. Both mandatory fixed payments and a contribution from increased income of more than 300 thousand must be paid to the same BCC.

Amount of insurance premiums: calculate using a calculator

Although contributions are fixed, the amount payable changes annually. Until 2020, it depended entirely on the minimum wage set by the state. The object and basis for calculations do not matter.

To calculate the amount of fixed contributions using the calculator, you need to know the following basic initial indicators:

- the minimum wage value established for the reporting year at the legislative level (necessary for calculation only until 2018);

- tariffs for contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund (constant values, required for calculation only until 2020);

- fixed amounts in the Pension Fund and the Federal Compulsory Medical Insurance Fund (for 2018-2020);

- the number of billing months for which it is planned to transfer the contribution (12 in the case of annual payment);

- income for the selected period (in rubles).

The first three indicators do not need to be entered; they are fixed in the calculator. You need to enter the start date of the reporting period and its end, the calculator will take into account the estimated time independently.

Calculation of monthly payments

Calculate the amount of insurance premiums payable monthly throughout the year:

- to the Pension Fund of Russia (PFR);

- to the Social Insurance Fund of Russia (FSS of Russia) (for compulsory social insurance for temporary disability and in connection with maternity);

- to the Federal Compulsory Medical Insurance Fund (FFOMS).

Before calculating the total amount of monthly payments to each extra-budgetary fund for the organization as a whole, determine the amount of insurance contributions for each employee (parts 3, 4, 5 of article 8, part 6 of article 15 of the Law of July 24, 2009 No. 212 -FZ). Determine contribution rates in accordance with Articles 12, 58 and 58.1 of the Law of July 24, 2009 No. 212-FZ and Articles 22 and 33.1 of the Law of December 15, 2001 No. 167-FZ (regarding the payment of pension contributions).

To calculate the monthly payment amounts for each employee, use the formulas:

| Amount of monthly payments for pension contributions | = | Payments accrued to an employee from the beginning of the year to the end of the current month | × | Contribution rate for financing labor pensions |

| The amount of monthly payments for compulsory social insurance in the Federal Social Insurance Fund of Russia | = | Payments accrued to an employee from the beginning of the year to the end of the current month | × | Tariff of contributions to the Social Insurance Fund of Russia |

| Amount of monthly payments for compulsory health insurance to the Federal Compulsory Medical Insurance Fund | = | Payments accrued to an employee from the beginning of the year to the end of the current month | × | Tariff of contributions to the FFOMS |

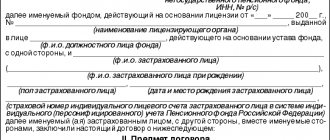

Non-budgetary funds recommend keeping records of payments and accrued insurance premiums for each employee on individual cards. The recommended form of the card is given in the letter dated December 9, 2014 of the Pension Fund of the Russian Federation No. AD-30-26/16030 and the Federal Social Insurance Fund of Russia No. 17-03-10/08/47380.

An example of reflecting payments and accrued insurance premiums in an individual card

Alpha LLC applies a simplified taxation system and pays contributions at the general rate. With A.V. Lvov entered into an employment contract No. 34 dated August 23, 2013. His insurance number is 150-223-66719, and TIN is 501012141523. Lvov’s monthly salary is 30,000 rubles.

The Alpha accountant reflected the amounts of payments and accrued insurance premiums from payments to Lvov in an individual card.

The payment amounts for each employee (by extra-budgetary funds) must be added up. The result will be the total amount of insurance premiums accrued from the beginning of the year to the end of the current month for the organization as a whole.

Calculate your insurance premium payment for the current month as follows:

| Payment of insurance premiums for the current month | = | Payment of insurance premiums accrued from the beginning of the year to the current month inclusive | – | Payment of insurance premiums accrued from the beginning of the year to the previous month inclusive |

Such rules for determining the amount of the monthly payment for insurance premiums follow from Part 3 of Article 15 of the Law of July 24, 2009 No. 212-FZ and paragraph 4 of the Procedure approved by Order of the Ministry of Health and Social Development of Russia of November 18, 2009 No. 908n.

How to correctly determine the amount of income from which contributions are paid?

In order to correctly enter into the appropriate window of the calculator the key indicator on which the amount of mandatory insurance payments will depend, you need to know exactly what financial results fall under the concept of “income of an individual entrepreneur” and are the basis for this calculation.

If the size of the contribution itself does not depend on the tax system, then this is decisive for determining income.

- Entrepreneurs under the general taxation system must pay contributions on the same income on which they pay personal income tax (not to be confused with the tax base; unlike the amount of income, it is reduced by tax deductions).

- Under the simplified tax system (USN), for calculating contributions, income is taken that is not reduced by the amount of expenses, even if the tax is paid according to the “income minus expenses” scheme.

- When using UTII, income for calculating insurance premiums is considered imputed, which must be calculated according to a specially provided formula, including basic profitability (it is determined by the Tax Code depending on the indicators of the object), multiplied by corrective indicators.

- The patent system takes into account potentially real income established by regional laws, and it is taken as an insurance base.

- When combining several tax systems at the same time, the amounts of income to take into account the amount of insurance premiums are added up.

What changes should be taken into account when calculating contributions?

According to Law No. 102-FZ, all small and medium-sized businesses that pay income to individuals will apply reduced insurance premium rates in 2020:

- 10% – for pension contributions (PPS) (both within the contribution base of RUB 1,292,000 and above it);

- 0% - for compulsory social insurance (OSI) for temporary disability, maternity, pregnancy and childbirth (VNIM and B&R) (regardless of excess of the contribution base - in the amount of 912,000 rubles);

- 5% – for compulsory medical insurance (without using the base).

At the same time, the reduced tariff begins to apply if the payment exceeds 1 minimum wage (according to legislators, this fact should encourage employers to increase small salaries).

For more details, see our material “For whom and what insurance premiums have been reduced since 04/01/2020”.

IMPORTANT!

The new rules for calculating insurance premiums are effective starting with payments for April 2020 .

The monthly division of amounts into taxable contributions at the previous rates and at reduced rates, in which it is also necessary to take into account the excess of the maximum base for compulsory pension insurance and compulsory social insurance, raised a lot of questions among accountants. The Federal Tax Service undertook to answer these questions: letter No. BS-4-11/11315 dated July 13, 2020 contains, among other things, practical examples of calculations that you need to familiarize yourself with and take them into account in your work.

How the calculator works

Since 2020, the calculator for calculations is based on Article 430 of the Tax Code of the Russian Federation and in fact the calculation formula can be written as follows:

Svzn = Rfix / 12 x Nmonth, where:

- Svzn – amount of insurance premium payable;

- Rfix – a fixed amount of a specific insurance contribution (to the Pension Fund of the Russian Federation or to the Federal Compulsory Compulsory Medical Insurance Fund);

- Nmonth – the number of months for which the contribution is paid (after all, the business may not have been started from the beginning of the year or only part of the payment needs to be calculated).

Until 2020, the calculator uses the formula established by Article 14 of Federal Law No. 212-FZ to calculate insurance premiums:

Свзн = minimum wage x Рtar x Nmonth, where:

- Svzn – amount of insurance premium payable;

- Minimum wage – the minimum wage value adopted by the state for the reporting year;

- Rtar – the rate of a specific insurance premium (in the Pension Fund of the Russian Federation - 26% or in the Federal Compulsory Medical Insurance Fund - 5.1%);

- Nmonth – the number of months for which the contribution is paid.

If you need to calculate an additional contribution amount for an individual entrepreneur with more than 300 thousand annual income, then the Pension Fund should receive an additional 1% on the amount exceeding the limit.

Limit amounts

Now let's dwell on the fact that for each employee it is necessary to keep analytical records of all amounts paid to him. This is important not only in order to successfully pass personalized accounting, but also in order to accurately calculate all types of insurance premiums. The fact is that the above rates for calculating contributions to the funds apply only to certain limits of the employee’s salary. So, in 2020, in the absence of a preferential tariff, we calculate 22% to the Pension Fund until the employee’s total taxable income does not exceed 796,000 rubles. After this, a reduced tariff is provided, which is 10%. For calculating contributions to the Social Insurance Fund, a different level is set - 718,000 rubles. After this, contributions are not charged at all. Significant changes in 2020 affected the calculation of contributions to the Compulsory Health Insurance Fund. If in 2020 these contributions were not accrued upon reaching the limit, then in 2020 they are accrued at a rate of 5.1% regardless of employee income. The same applies to contributions to the Social Insurance Fund for injuries. For simplified beneficiaries with a reduced tariff, upon reaching the maximum amount, contributions to the Pension Fund are not accrued at all (as we remember, they do not have accruals to the social insurance fund and the compulsory health insurance fund).