Apply for a pension through government services

Access to government services is now available on all electronic gadgets

Any person who has reached retirement age and is familiar with the procedure for working with network portals can apply for a pension through government services.

In addition, to achieve the required result, it is necessary that your application comply with the strictly established form of its completion.

Please note: All other types of pensions (for disability, for receiving a funded component and for the loss of a breadwinner) can be issued in the same way.

Electronic application

Through a personal account on the Internet, a citizen can submit an application for any type of pension. The legal representative of a minor or incompetent person can do the same. To enter the account via the Internet, the registration data of the State Services website is used. When filling out the application, you must correctly select the territorial office of the Pension Fund of the Russian Federation to which the application will be automatically sent.

The completed stage is marked with a green tick.

Personal data

An application written in accordance with all the rules is the key to quick and accurate calculation of pension payments. It is necessary to accurately indicate passport data, date of birth, personal identification number, and citizenship. In addition to this information, you need your residential address, email, and telephone.

- How to donate blood correctly

- How to distinguish a heart attack from a panic attack

- Compensation for kindergarten - procedure for registration and receipt for failure to provide a place or food

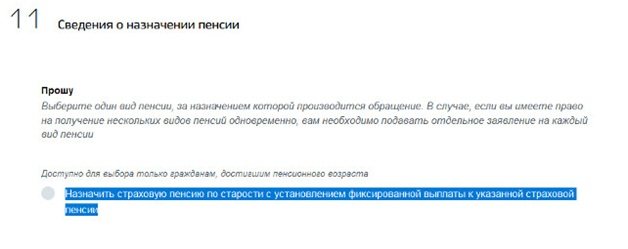

Type of pension

The third stage requires indicating the type of pension (insurance, preferential, survivor), the presence of other accruals, whether the applicant is employed at the time of filing the application, whether there is a dependent. In your personal account, you can check the amount of insurance coverage, the number of deducted contributions, and view your pension points.

This will determine the type of pension the applicant can claim.

Delivery method

At the final stage, you are asked to choose a method of receiving pension benefits. Transfer to a bank account requires information about the financial institution, account number and card. When choosing delivery of a pension by Russian Post, the address of the future pensioner is indicated. If you prefer another organization responsible for delivering pension benefits, then information about it is needed. The recipient's address is also entered.

The procedure for applying for a pension via the Internet

In order to apply for a pension through government services, you will need to complete several steps.

Preparing for registration

With two steps you will find yourself in a unified electronic system of government services

Before proceeding with the application procedure, the interested person will need to register on one of the following services:

- An Internet resource specializing in the design of relevant government services;

- ESIA system.

It should be noted that from a purely practical point of view, each of the offered services is quite simple, very convenient and quite informative. In order to register on it, the user will need, in addition to access to the Internet, the following documents and means of communication:

- personal passport;

- valid SNILS card;

- working email;

- registered telephone number.

Procedure for obtaining an account

To enter your personal account you need to register in the ESIA system

The sequence of operations performed during registration is as follows:

- First, in the column called “Single Account”, you must enter all your personal data (full name, working phone number and email address) and after familiarizing yourself with the procedure for working on the service, click “Register”.

- After a certain period of time (usually it does not exceed 15 minutes), a message is sent to the phone number specified when filling out or to the postal address, which contains a confirmation code for the operation being performed. The received code should be entered into the form provided by the program, and then click “Confirm”.

The next step will be to do the following:

- After confirming the code, the program will prompt us to come up with a secure password consisting of at least 8 different characters, which is entered into a window specially designated for this and remembered.

- Upon completion of registration, you will be able to log into your Personal Account by logging in to the website (to do this, you must provide your phone number and enter a password). After logging into your account, you should go to the “Filling out and checking personal data” tab.

All your personal data is entered into the proposed form in accordance with the points specified in it, after which the procedure for verifying this information is launched, which can last from minutes to several days.

- After a certain time has passed, a message is sent to your phone or email about the completion of the verification or the impossibility of completing it.

This happens when the data you provide is insufficient or incorrect. You can view the results of the check and the cause of the failure here on the portal.

Based on the results of their study, it is necessary to add missing information or correct previously entered information.

And only after completing the registration procedure you will be able to access your Personal Account on the PF service.

Thus, the specified application form allows you to undergo this important procedure without leaving your home.

In addition, with this method of registering a pension, users have the opportunity to independently manage its maintenance (choose a delivery method, for example).

Registration through ESIA and State Services

Applying for a pension online is much easier than visiting a Pension Fund branch. To do this, you need to obtain an account in the Unified Identification and Authentication System. You can register online on the website of the State Services portal:

- Go to the main page of the site.

- Click on the Register button.

- Fill out the form that opens.

- Wait for the code that will arrive at the specified phone number and enter it in the provided window.

- Create a password, enter it again and click Finish.

- This concludes the simplified registration procedure.

- Enter the remaining data and snils.

- After the system checks all the information provided, you will receive a notification on your phone that the standard registration has been completed.

- To confirm your identity, the system will prompt you to choose a method of completing the procedure.

- Get an activation code, enter.

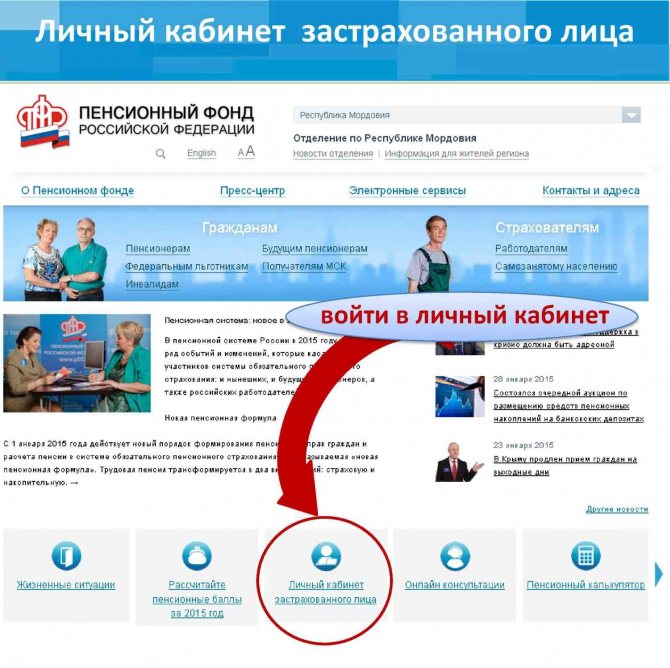

After completing full registration, a citizen can use all the functionality of State Services. In the personal account on the Pension Fund website, the future pensioner is given the opportunity to familiarize himself with all the information of interest via the Internet.

The length of service, IPC (individual pension coefficient), and work record data are indicated here.

Personal account service for pensioners

In your personal account you can order different types of services

The previously described procedure for obtaining a password and registration allows you not only to create an account, but also to create your own Personal Account. Thanks to this, future retirees can realize the following opportunities:

- receive complete information about the current state of your pension savings (number of points, insurance period, as well as the amount of contributions);

- request information about the current status of your personal account (personal account).

In addition, they can independently calculate the amount of the components of their future pension using a software personal calculator.

Using LC services, a pensioner can also manage his funds, namely:

- formalize a refusal to form a funded component in favor of its insurance part;

- submit an application to change the insurer;

- receive notifications from the Pension Fund about replacing the previous insurer.

By using the services of this service, each owner of a personal account gets the opportunity to:

- apply for pension benefits;

- choose one or another delivery method;

- place an order for a certificate about the current status of various accounts and the amount of payments.

Important! For working pensioners, the LC indicates the amount of insurance payments, taking into account indexation corresponding to the amount of pension benefits that a citizen is entitled to upon completion of work.

Benefits for pensioners

In the Russian Federation, social and pension legislation provides certain benefits for pensioners, but many pensioners do not use them because they simply do not know about their existence.

In this section of the School of Life “Social support for pensioners: Benefits for pensioners” you will find complete information about what benefits various categories of pensioners can claim.

Benefits for pensioners are provided at the federal and regional levels.

The list of federal benefits for pensioners is regulated by Federal Laws of the Russian Federation and Resolutions of the Government of the Russian Federation.

The list of regional benefits for pensioners is enshrined in the legislative acts of the constituent entities of the Russian Federation. Regional benefits, as a rule, are provided to pensioners whose income is considered insufficient.

As a consequence of the trend that has emerged in recent years of shifting measures of social support for the population from the federal level to the regional level, there are not many benefits left at the federal level that pensioners can take advantage of.

But it is also useful for pensioners to know about them because almost all federal benefits for pensioners from the state can only be received if they apply for them. The so-called declarative principle applies, that is, if you do not demand a legally established benefit, you will not receive it.

This applies to:

- some tax benefits,

- reimbursement of expenses for travel to the place of rest of pensioners-northerners, as well as

- additional leaves for pensioners who continue to work.

Benefits for pensioners at the regional level are usually more numerous.

Here is an incomplete list of benefits provided to pensioners in accordance with the legislation currently in force:

- the right to improve living conditions if necessary;

- the right to pay for housing and communal services in the amount of half their cost;

- reimbursement of expenses for major repairs after 70 years in the amount of 50%, after 80 years - 100%;

- a set of certain social services or payment of monetary compensation for them;

- free and discounted medical care;

- provision of sanatorium and resort vouchers;

- exemption from certain taxes and the use of tax deductions when calculating the amount of income tax (NDFL);

- additional unpaid leave if the pensioner continues to work;

- preferential dispensing of medicines in a wholesale and retail pharmacy network upon presentation of a pension certificate and a prescription from the attending physician, etc.

To avoid any illusions, I want to warn you right away that a simple pensioner will not receive large amounts of benefits from our state. In addition, I repeat, benefits can only be used by application.

Let's look at all these benefits for pensioners in order in the materials in this section.

If you have any questions about the violation of your rights, or you find yourself in a difficult life situation, then an online duty lawyer is ready to advise you on this issue for free.

SOCIAL SUPPORT FOR PENSIONERS: BENEFITS FOR PENSIONERS

List of required documents

What is the required package of documents?

Before submitting an application to the LC, you must prepare a set of documents, which includes the following items:

- applicant's personal passport;

- his work record;

- a certificate of salary for 5 years of work (for a randomly selected period);

- medical insurance;

- certificate of insurance experience.

In the case when a set of documents is prepared in advance, visiting the Pension Fund is not at all necessary.

They are submitted together with the application through the same government services portal after you have completely completed the registration and user identification procedure.

You can send them to the portal address if you use an interactive form specially designed for this purpose, into which all electronic copies of documents are uploaded one by one.

In conclusion, we note that the advantages of using the Personal Account include the ability to quickly respond to all changes in the work of PF services, as well as contact their representative if necessary.

Expert opinion

Smirnov Vladislav Vyacheslavovich

Legal consultant with 10 years of experience. Specialization: family law. Law teacher.

By now, a significant portion of pensioners have already taken advantage of the opportunity to apply for a pension through government services and take direct part in the work of the relevant services.

In the following video you will learn how to work with the Pension Fund’s personal account:

How to apply for a pension through State Services? This is exactly the question that faces those who are entering a well-deserved retirement, but do not want to waste extra time in queues when applying for payments required by law. The single portal of State Services has significantly simplified the interaction of Russian residents with various government agencies, including the Pension Fund.

Using this service, you can significantly save time on applying for a pension and significantly simplify the procedure itself.

General provisions

All persons included in the pension insurance system of the Russian Federation have the right to receive an old-age insurance pension. But compared to 2018 and earlier in 2020, the requirements for a future pensioner have changed. First of all, we need to take into account the increase in the retirement age. In 2020, a man must turn 61 and a woman must turn 56 to retire. But since the authorities have provided certain benefits for 2020, the age should be 60.5 and 55.5 years for men and women, respectively. The benefit extends to 2020, when the retirement age will rise to 62 and 57 years. In the future, the retirement age will be:

- 2021 – 63/58 years for men/women;

- 2022 – 64/59 years for men/women;

- 2023 – 65/60 years for men/women.

At this “mark” the increase in the retirement age stops.

In addition to the retirement age, length of service requirements are changing. If in 2014 only 5 years of experience were required, in 2020 - 9 years, then in 2019 the minimum experience that allows you to apply for a pension through the State Services, MFC or Pension Fund must be at least 10 years. The systematic increase in the requirements for minimum experience is +1 year to the previous value. In 2024, the increase stops at 15 years of insurance experience.

The requirements for the minimum number of accumulated pension points – IPC – are also changing. Back in 2020, at least 6.6 pension points were required, in 2020 - already 13.8 IPC. In 2020, you need at least 16.2 pension points. For 2020-2025, the requirements will be as follows:

- 18,6

- 21

- 23,4

- 25,8

- 28,2

- 30

There are no plans to increase requirements from 2025. Therefore, you will need to have time to earn at least 30 points for your Pension Fund account. Points are awarded for salary throughout the year. To receive 1 IPC you need to work for 1 year at the minimum wage.

If a “candidate” for pensioner meets the minimum requirements for assigning a pension, he can submit an application for a pension - State Services in this case will be one of the convenient options.

Required documents

The future recipient of the pension must approach the preparation of documents responsibly. It is their package that determines the size of future payments, as well as the speed of processing the request and assigning a pension.

Before you start applying for a pension online, you will need to prepare the following documents:

- passport ;

- documents confirming the place of actual residence (if different from registration);

- work book and other documents that can confirm the conduct of official labor activity (work);

- salary certificate (for the last 5 years);

- documents confirming the presence or absence of family members declared incompetent;

- documents confirming the applicant’s disability (if available);

- certificates of change of surname, name, and other personal data (if there were such facts).

When an applicant fills out an application for a pension in electronic form, he must provide data from these documents. The originals will need to be presented in the future when contacting the Pension Fund department.

Important. It is not yet possible to apply for a pension online. You can only submit an application online, schedule a visit to the Pension Fund, etc. You will still have to visit the territorial division of the fund with documents in person.

Registration of a pension through the State Services website: advantages and disadvantages

At first glance, the procedure for applying for a pension through the State Services website consists of the following advantages:

- a citizen does not need to waste time visiting the Pension Fund;

- The State portal provides a convenient form for monitoring the process of considering an application (acceptance of an application, processing of documents, assignment of a pension);

- filling out an application electronically eliminates the possibility of using an incorrect form;

- If some of the required information in the application is not filled out, the resource will not allow the user to save the form, thus eliminating the possibility of filling out the form incorrectly.

At the same time, the process of electronic registration of a pension has one significant drawback - one way or another, the applicant will still have to personally visit the Pension Fund to present the original passport, work book, and other necessary documents. However, this disadvantage is more than compensated for by the existing advantages, so every year more and more citizens choose the electronic method of applying to the Pension Fund for a pension.

Rate the quality of the article. Your opinion is important to us:

- About

- Latest Posts

Belova Alina Sergeevna

Chief expert. Main Directorate of the Pension Fund No. 7 for Moscow and the Moscow region

What is required to submit an electronic application?

If an account has not been created previously, you can register it.

To do this, you need to have your SNILS and passport at hand and follow these steps:

- Go to the portal and click “Register”.

- Provide contact details (phone, email) and confirm them.

- Enter your full name, passport details, INN and SNILS number.

- Wait for the specified data to be automatically verified.

Initially, a simple profile is created on the portal. Before creating an application to the Pension Fund, it must be confirmed in any of the following ways:

- through the online banking of Sberbank, Tinkoff, Post Bank;

- through a code received in a regular registered letter;

- through the multifunctional center (personal visit required).

How to apply online?

Everything is as automated and simplified as possible for the convenience of users.

Instructions on how to write a pension application online include 4 steps:

- Find and select that you want to receive it electronically. To search, you can use the catalog (it is located in the “Pension” section) or the search bar.

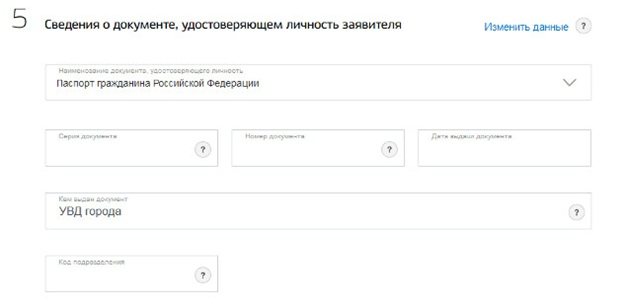

- Entering personal, passport data, address. Most of the information will be filled in based on the profile information automatically. If necessary, you can make adjustments to the information, for example, if it has recently changed.

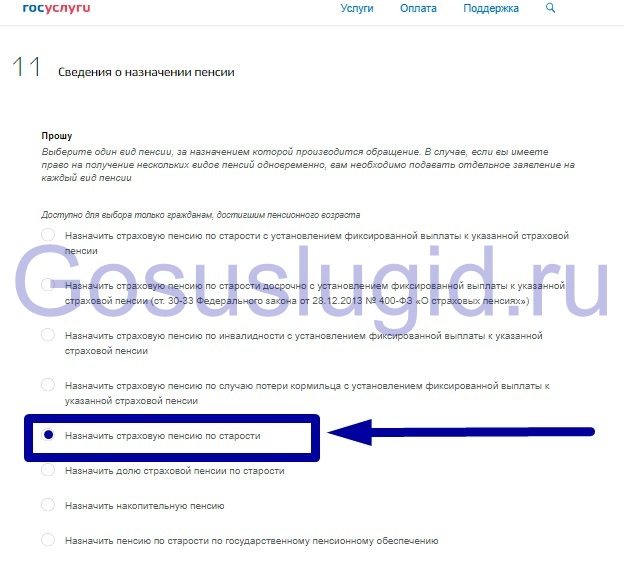

- Selecting the type of pension to be assigned. If the applicant is entitled to different types of pensions, then a separate application must be submitted for each of them. Additionally, you must provide information about whether the applicant is currently receiving any other pension (for example, as a military pension) or not.

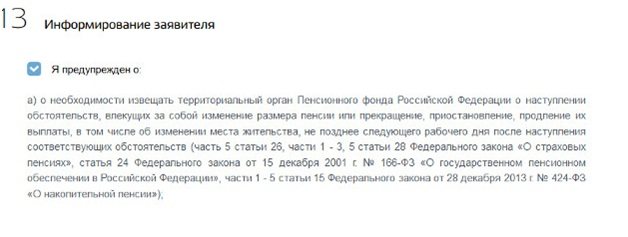

- Read the warning and confirm sending the application. The message contains information about the need to report to the Pension Fund about any changes in data that may affect the amount of the pension and any issues related to its payment.

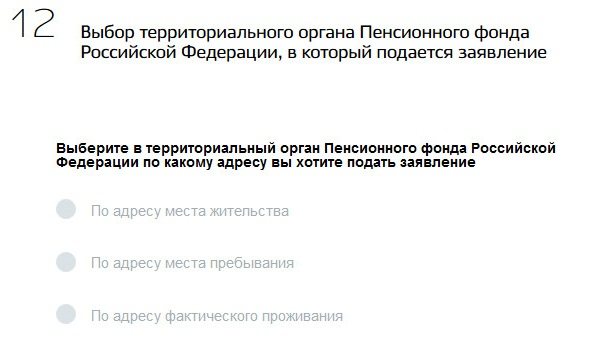

The application is sent for processing to the territorial department of the Pension Fund. It will be determined automatically by registration address or residence. If necessary, the user can independently select the desired department. Information about the submitted application will appear in your profile notifications.

When the application is processed, the user will receive an invitation to visit the Pension Fund department in person in their personal account on the portal. You must show up at the appointed time.

A list of documents that you need to bring with you will be given in the invitation. They must be in original form. It is also advisable to take copies.

If a person is entitled to payments from the Pension Fund of the Russian Federation, then he needs to formalize them correctly. It’s not difficult to figure out how to apply for a pension through State Services. To do this, just follow the prompts on the screen and enter the information from the documents correctly. It will take much more time to prepare a package of necessary documents.

“Pension delivery” on the State Services Portal and on the Pension Fund website

With the advent of the state portal on the Internet, it became possible to apply for a pension through a personal account on the State Services. This saves the time of future pensioners - there is no need to stand in queues at the Pension Fund to submit the relevant papers, this is very easy to do via the Internet at any suitable period of time.

We present step-by-step instructions that will help you understand the smallest nuances.

How to apply for a pension on another card without leaving home

Among pensioners, such a service as pension delivery is very popular. Let's figure out how to get this service through the State Services portal, as well as through the website of the Russian Pension Fund.

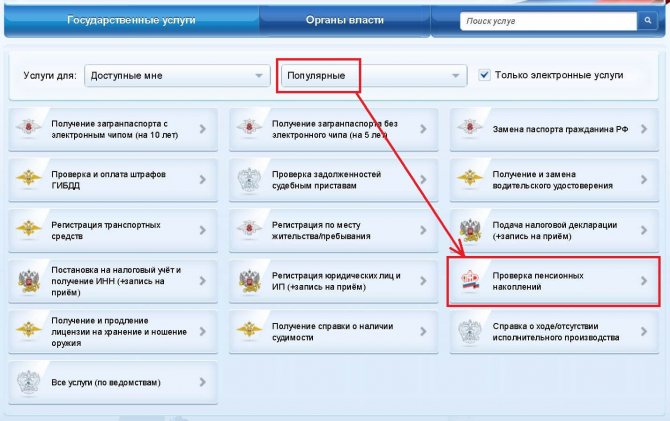

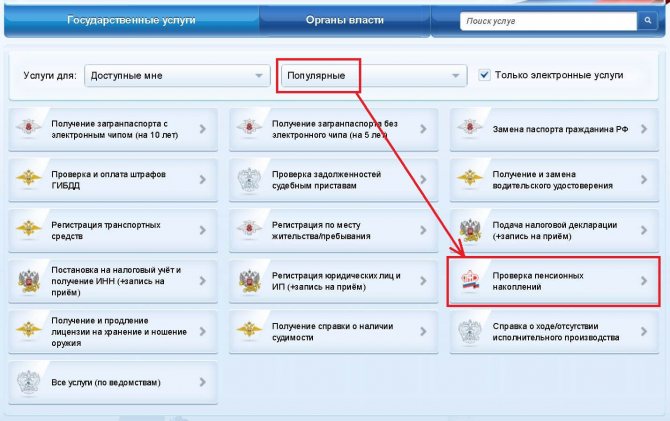

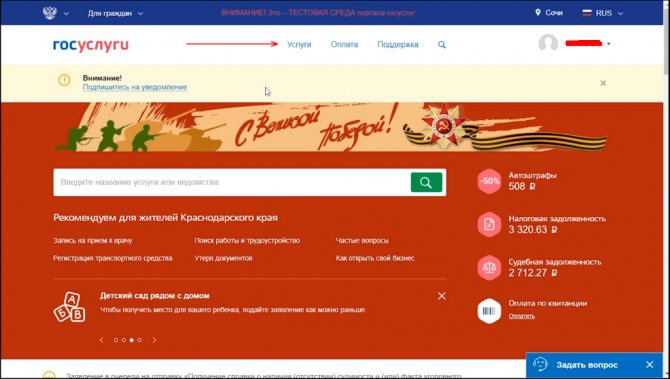

So, first you need to log in to the State Services portal, then go to the “Services” catalog

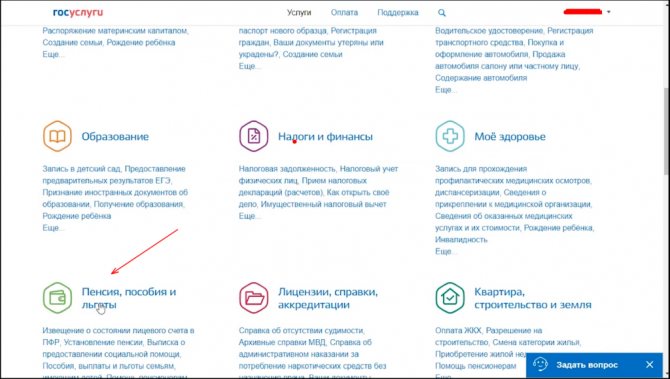

Next, go to the section “Pension, benefits and benefits”

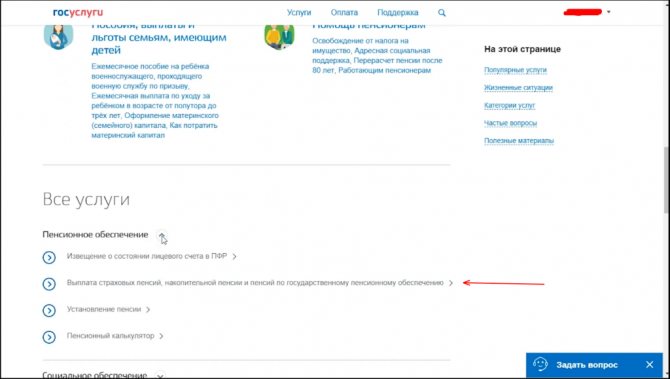

In the “Pension, benefits and benefits” section below, under popular services, you need to open the “Pension provision” tab and select “Payment of insurance pensions, funded pensions and state pensions”.

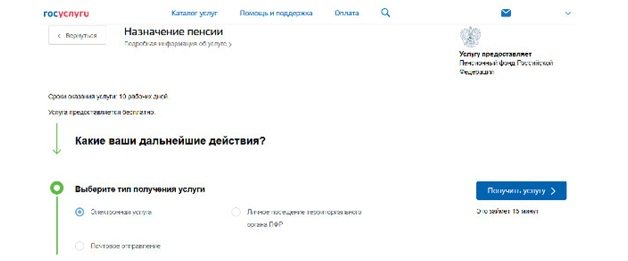

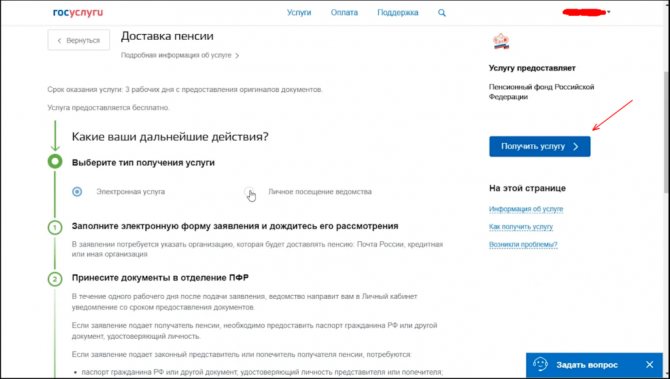

After opening we will see electronic

You can make an appointment with the Pension Fund, but in our case we will receive an electronic service. On the side, click the “Get Personally” button; the applicant’s data is downloaded from the user’s personal account. In information about the place of birth, it is necessary to indicate the country and region; it is not necessary to indicate the city and region.

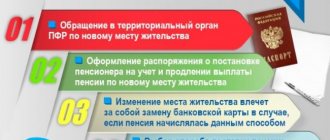

Next, we indicate the address of permanent registration at your place of residence, if you will receive the service at this address. It is also possible to receive the service at the address of the place of residence - this is temporary registration, or at the address of actual residence.

There is no need to fill in contact information, as well as passport information; the program fills them out automatically from your personal account.

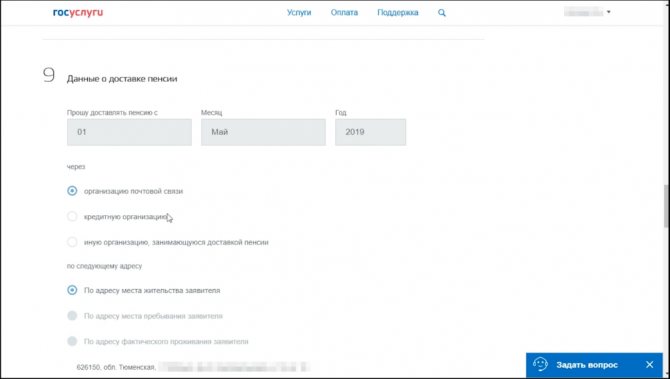

In paragraph 9 we write down the date, month and year from which it is necessary to transfer the pension to the new details and through which organization. This can be done through the mail, credit, or other organization.

The address is indicated automatically, depending on the fields filled in above.

In paragraph 10 we write down the name of the organization and account number. Specify the savings book account number or bank card account number.

This is where you need to choose the pension delivery method that is acceptable to you.

In paragraph 12, the program itself selected the territorial body of the Pension Fund based on the address entered above.

In paragraph 13, we tick the information that you have been warned about the need to inform the Pension Fund that you got a job, changed your place of residence, or went abroad. Click the “Submit Application” button.

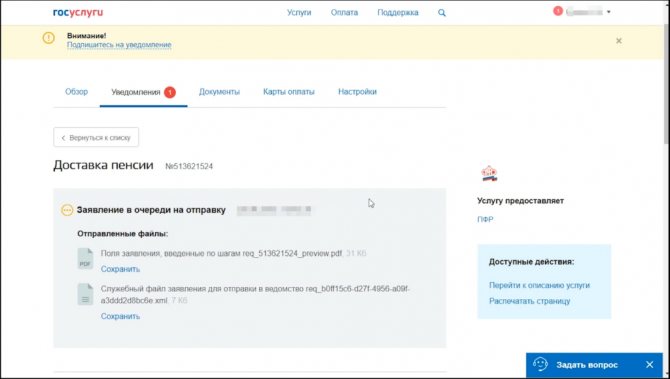

So, in the user’s personal account on the State Services portal, information is displayed that the application is in the queue for sending, and the application service file is also saved.

Within 3 working days, information about the result of the service will be sent to your personal account and email.

This pension delivery service can be obtained on the official website of the Pension Fund of the Russian Federation by logging into it using the login and password from the State Services portal.

To do this, go to the “Authorities” section, find the “Russian Pension Fund” and in the “information and contacts” tab look for the website address, go to the Pension Fund website and go to the citizen’s personal account.

There are quite a lot of electronic services in your personal account, including a pension delivery service. It is necessary to indicate the territorial body of the Pension Fund, also enter the applicant’s data, information about the delivery of the pension and click the button to generate an application.

Documents for assigning a pension via the Internet

Before submitting an application, the future pensioner must collect the following package of documentation for registration:

- a document confirming the absence or presence of family members with disabilities;

- general civil passport of the Russian Federation;

- a certificate from the place of residence or actual stay, if the citizen does not live according to registration;

- employment history. If there is none, the Pension Fund can accept from the citizen a certificate issued by the employer, which indicates the length of service;

- a document indicating the average monthly income;

- if your surname has changed during your life, then a document confirming this fact is required;

- certificate of disability or lack thereof.

After receiving a response from the State Services on an electronic application, the originals of all documents are sent to the Pension Fund for consideration.

Preparation of documents

How soon the applicant will receive the first payment depends on the deadline for submitting documentation and the reliability of the data provided. Pension Fund employees recommend starting to collect documentation 2.5 months before your expected retirement.

You can submit documents for an old-age pension one month in advance.

Then the first payment is assigned from the date of retirement. If you are late, payments will begin on the day the documents are submitted. To easily apply for a pension, you need to provide the Pension Fund with the following:

- passport;

- work book;

- certificate from place of residence;

- snils;

- income document for the five-year period from 1997 to 2002.

- The most useful product on the planet

- Kalanchoe for a runny nose

- Indexation for working pensioners - abolition under the new law and the possibility of return

Instructions on how to write and submit a pension application through State Services

Before using the service and providing an application form for calculating a pension by year, a citizen must register on the State Services resource with confirmation:

- go to the State Services website, click on the registration button located next to the login form;

- Following the prompts, enter all the required data, including phone and email. After that, click on the “Register” button;

- a confirmation code will be sent to your phone number, which should be entered in the appropriate field;

- Next comes filling out the profile, you should indicate the SNILS number, series and number of the passport, and so on;

- at the last stage you will have to confirm your identity, otherwise many of the portal’s functions will not be available.

There are three ways to do this: go to a specialized center, receive a code in a letter, or use an electronic signature; there are also other ways. You can find out more about identity verification by clicking on the link.

On a note! You won’t need to use any documents during registration - just fill out the required fields, but to confirm your registration at the MFC, employees will require a passport from you.

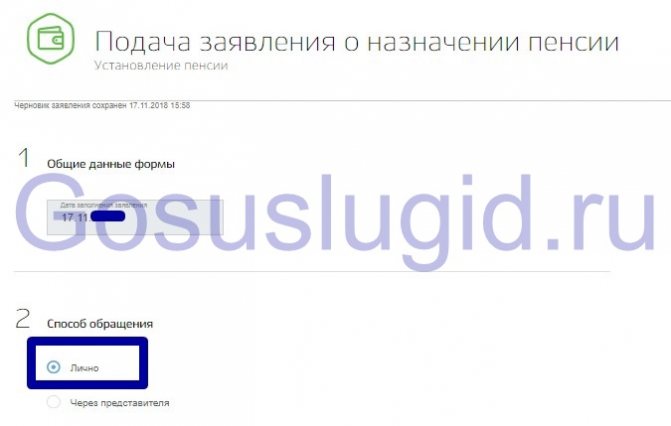

So, registration and confirmation have been successful, you can start applying for a pension:

- go to the Personal Account at State Services;

- find the link “Pension, benefits and benefits”;

- Click on the “All” button and “Pension assignment”. To avoid such a long path, just follow the link and you will find yourself on the desired State page class=”aligncenter” width=”775″ height=”390″[/img]

- in the “Electronic service” section, check the box;

- click on the link “Get a service”;

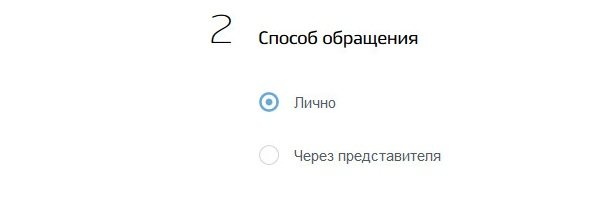

- To fill out an application for a pension, you must provide reliable information about yourself. Filling out begins with indicating the method of circulation. We put “personally”.

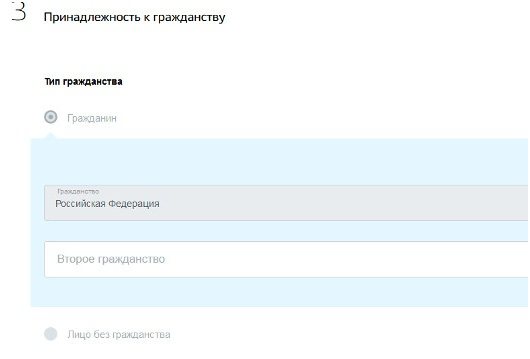

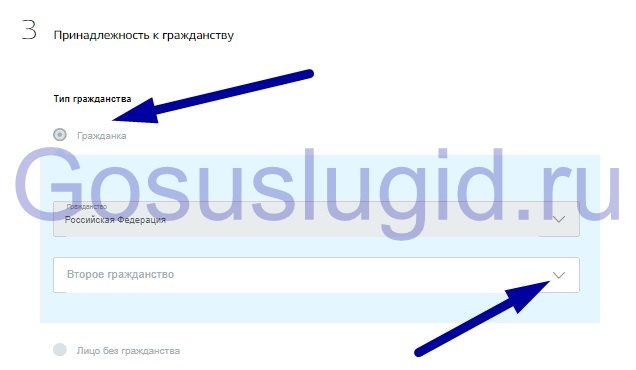

- We indicate citizenship; if the pensioner has a second citizenship, this must be indicated in the field below.

- The applicant’s details will be supplied without your participation, they will be pulled from the State account class=”aligncenter” width=”634″ height=”309″[/img]

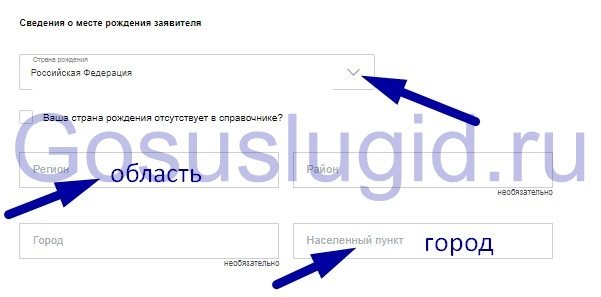

- Next, you should indicate your place of birth. Nothing complicated, everything is exactly as indicated in the passport. It is enough to write the region and locality in the application

- Data about the country and address will also be automatically inserted into the fields; you just need to indicate below that it matches or does not match the actual

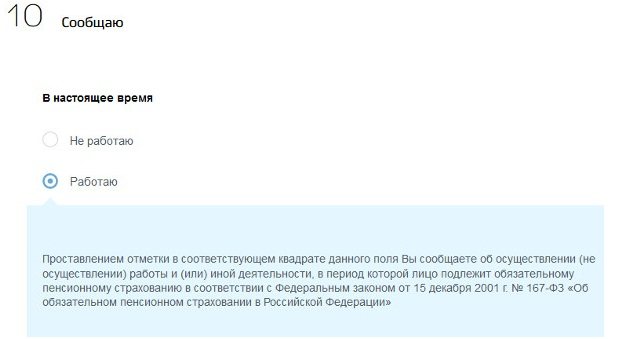

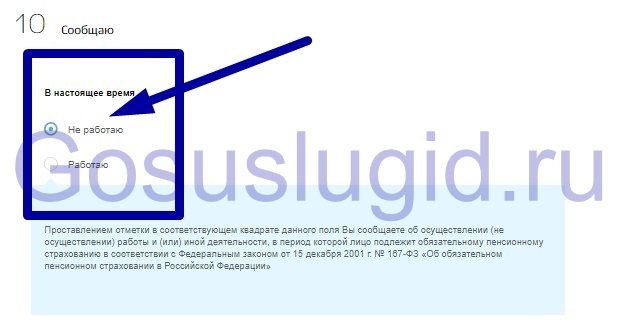

- Then we indicate whether you are working or not. The size of the pension depends on this answer. If the pensioner is not working, pension payments will be higher. But it makes no sense to give false information on the State Services portal, since when checking documents at the department, you will be denied old-age benefits. The application will have to be resubmitted.

- When choosing information about the assignment of a pension on the State Services, many users are puzzled by which item to choose to correctly submit the application. If a citizen has reached retirement age, the types should indicate “Assign an old-age insurance pension.”

- After selecting the type and branch of the pension fund in which you want to enroll, click on the “Submit” button and wait for the result.

At this point, submitting the form to receive a pension registration service can be considered complete. You will receive a confirmation email and an invitation to visit the Pension Fund at the appointed time.

Types of pensions

to citizens of retirement age in connection with loss of ability to work and, accordingly, loss of income. Benefits may vary:

- insurance pension;

- state pension;

- accumulative payment.

Each payment is assigned within a certain period, expressed in an amount established by law and paid to specific groups of citizens. An insurance pension can be issued for the female part of the population aged 60 years and over , for the male half - from 65 years . Also, to assign such a benefit, you must have at least 15 years and the number of accumulated points is at least 30 .

A state security pension is awarded to citizens who retired early, are unemployed and belong to the categories specified in the Federal Law “On Insurance Pensions” . In particular, municipal employees, mothers of many children, disabled people, people with northern experience and some other groups of people can apply for such benefits.

The funded payment is available to people born in 1967 and later. Since 2020, such citizens have had the opportunity to choose tariffs for their deductions:

- insurance part 16%;

- insurance – 10% , savings – 6% .

Cumulative payments are transferred to the management of the Pension Fund or Non-State Pension Fund, which multiply these funds and then pay them to the insured persons. The issuance of money can be done in various ways.

Insurance pension

The concept of insurance pension refers to a payment that is provided to citizens upon reaching a certain age and completing a designated period of service.

There are several types of insurance benefits:

- Old-age benefits are assigned to citizens aged 60 and 55 years (women and men) with at least 15 years 30 points .

- A disability pension is awarded to those citizens who have health limitations, regardless of age and length of service. The person must prove the disability with an official medical report. If the group is cancelled, the citizen switches to another type of payment.

- Survivor benefits are provided to dependents, as well as family members of employees who die while performing their duties or as a result of injuries received.

Working pensioners are also entitled to benefits, however, it will not be subject to indexation until 2020, like the same payment to unemployed citizens. If a person stops working, he will again have the right to indexation of benefits.

The IPC or individual pension coefficient is an important indicator for calculating the total benefit amount. The minimum amount of points for assigning an old-age payment is 30 points . The cost of one point is set annually by the government and in 2020 is 93 rubles . In 2020, a person can earn 9.57 points .

To assign benefits, it is important that the citizen:

- confirmed your rights to receive benefits using an official document;

- was of the appropriate age and had the specified length of service.

To receive payments, a person should contact the Pension Fund at the place of his registration and submit an application for a benefit. If all documents are in order and the citizen meets the requirements, benefits begin to accrue from the first day of the next month.

State pension

For those citizens who retired earlier, due to length of service or due to other circumstances, they are entitled to a state security benefit . The following types of payments exist:

- For length of service - assigned to citizens who went on vacation due to the fact that they have developed the necessary work experience.

- For old age - prescribed to people who have been exposed to radiation and who took part in the elimination of man-made disasters.

- In connection with the loss of a breadwinner - provided to family members of a military serviceman or law enforcement officer who died in the line of duty or was injured.

- If there is a disability group , it is paid to those citizens who received disability as a result of man-made disasters, as well as in other situations.

- Social benefits are assigned to citizens who have reached retirement age, but have not completed the required length of service and have not accumulated the required number of points. The benefit is assigned to people aged 65 and 70 years (for women and men).

- A military pension is awarded to employees who are on vacation due to compulsory service.

- The northern payment is awarded to people who have work experience in the specified regions.

- Payment for hazardous working conditions is awarded to people who retired due to loss of qualifications and physical ability to work, which occurred due to work in conditions harmful to human health.

The mandatory conditions for the appointment of such benefits are:

- citizens should not be employed;

- applicants for benefits are required to confirm their existing work experience using a work book or contract;

- To receive a disability benefit, you will need a medical certificate confirming the presence of a group, and in the event of the loss of a breadwinner, an act of death of a citizen.

The payment is processed at the pension fund branch at the citizen’s place of registration. To assign a benefit, you will need to submit an application in a standard form (you can view and download it here: [Sample application for a state pension]) and provide a mandatory package of documentation that will confirm work experience, the presence of a group and lack of employment. Benefits begin to accrue on the first day of the next month.

Funded pension

People born in 1967 and younger are given the opportunity to form a funded part of their pension . However, from 2015 to 2020 it is not formed, and all contributions go to the insurance part of the security.

A funded pension should be understood as part of the funds received from employers as contributions and remaining at the disposal of the Pension Fund of the Russian Federation or transferred to non-state pension funds. The savings part is formed from credited funds and savings resulting from successful investment of funds.

As such, registration of a funded payment is not required. The only thing a citizen must do is submit an application indicating the tariff and to whom the funds will be transferred for further investment. If such a document is missing, then the distribution will occur only to the insurance part .

The payment is calculated by dividing the amount of savings by 20 years or 240 months . The later a person retires, the higher his savings benefit will be.

Additional payments to pension

The state provides social support for pensioners in the form of additional payments to benefits, various benefits and discounts. All support measures are divided into several groups:

- Social benefits are available to disabled people, single citizens, and other categories of pensioners and are expressed in the form of subsidizing the cost of maintaining living space, discounts on the purchase of medicines, and receiving free services in healthcare institutions and transport.

- Tax deductions are provided to pensioners when purchasing living space, and benefits are provided when paying transport, land, and property taxes.

- A social supplement up to the subsistence level is provided in each region and is assigned in accordance with the amount established by the executive body. Paid by the pension fund automatically when calculating benefits.

- Upon retirement, a citizen is entitled to all the same payments that are provided for by law in the case of leaving work of his own free will: compensation for unused vacation, severance pay, and other additional payments specified in the collective agreement.

Changes and indexation of pensions from January 1, 2020

Another indexation of the amount of payments is expected in 2020. The date has been moved to January 1, since the increase factor is not tied to the inflation rate. Pensions will increase by 6.6% only for non-working recipients; a moratorium will continue to apply for working pensioners.

Indexation of pensions from January 1, 2020 will increase the size of the main indicators to the following values:

- IPC - 93 rubles ;

- Fixed payment - 5686.25 rubles ;

- The average pension is 16,389.62 rubles .

In 2020, the minimum requirements for old age pension will also increase:

- you must score a minimum of 18.6 IPC;

- work experience must be 11 years;

- The retirement age will be gradually increased - 56.5 and 61.5 years for women and men.

The cost of living is also planned to increase in 2020. The new value will be 9,311 rubles.

Conclusion

As a result, several conclusions can be drawn:

- The state provides citizens of the Russian Federation with compensation payments designed to compensate for loss of income due to incapacity and reaching old age..

- Pension benefits can be of different types and are assigned only to certain groups of people in specific situations.

- The old-age payment is due to people who have reached the age of 56.5 and 61.5 for women and men with 11 years of service and 18.6 pension points in 2020.

- State security benefits are available to citizens who retire early due to length of service or due to individual circumstances.

- The funded part is available only to those persons born in 1967 and later . Its formation is frozen.

- Retirement gives citizens the right to various types of additional payments and social support measures.

- Benefit indexing in 2020 will take place on January 1 by 6.6% .

List of laws

- Federal Law “On Insurance Pensions”

Samples of applications and forms

You will need the following sample documents:

- Sample application for state pension

Alternative design methods

There are other ways to apply for your pension that are worth knowing about. After all, not everyone can correctly submit an application online. You should be aware of alternative methods, including the classic personal appeal of a convenient department.

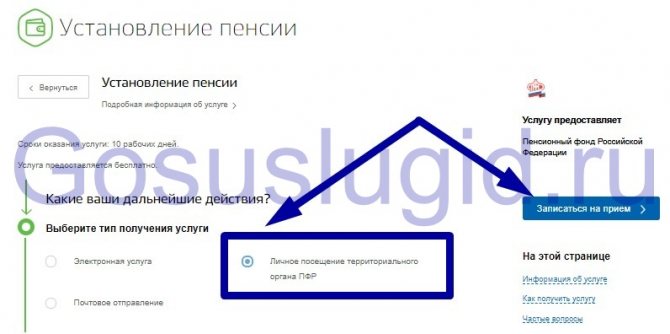

Making an appointment with the pension fund for a personal visit

When going to the pension fund to apply for a pension, it is better to make an appointment in advance at the State Services, so you do not have to sit in line. To do this, you need to select “Personal visit” at the initial stage and you will not have to write an application on the portal. In this case, you must submit it by filling it out yourself.

The application form itself can be asked from a fund employee or printed on the portal. You are allowed to visit the pension fund to calculate and accrue your old-age pension no earlier than 30 days before the retirement age.

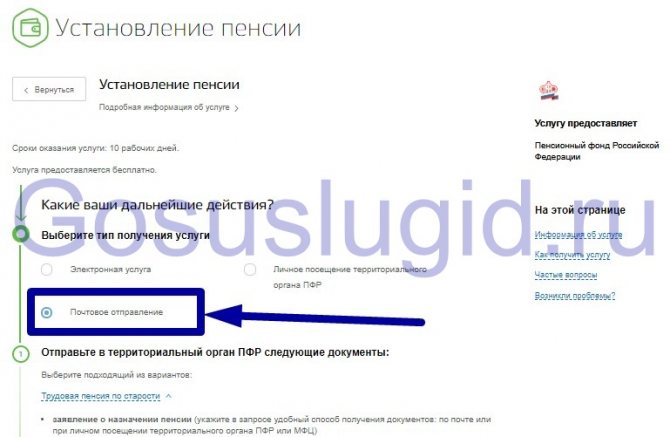

By mail

You can forward your application for an old-age pension and seniority pension. To do this, you need to make copies of all documents, write a statement, put the relevant papers in the envelope and a second envelope to send back. The date of application for pension is considered to be the date indicated on the postal item.

Expert opinion

Smirnov Vladislav Vyacheslavovich

Legal consultant with 10 years of experience. Specialization: family law. Law teacher.

After consideration, the applicant receives a response and an invitation to the Pension Fund to provide original documentation. It is better to use the service through the MFC or the State Services Internet portal

Through MFC

You can also visit the MFC and submit an application there

- Collect a complete package of documentation;

- Make an appointment by phone or online;

- Submit an application for a pension. If it is difficult for you to do this on your own, an employee will be happy to assist;

- all documents will be sent to the Pension Fund for review, where they will determine the amount of payments taking into account the funded part of the pension.

The answer will come to the multifunctional center, where the applicant receives an answer regarding the service.

Thus, you can use a variety of ways to receive your pension. But the best option for obtaining an old-age pension would be to use State Services.

Firstly, you will not have to waste time standing in line, and secondly, you will be spared the long process of filling out a form when contacting the department. But the choice is always yours.

There are always heated conversations and fierce debates around pensions. And while many people are concerned about retirement age issues, not everyone knows the legal basis for pension payments.

However, the main thing is the nature of the receipt. In Russia it is declarative.

That is, the citizen himself takes care of his well-deserved rest. By the time you contact the Pension Fund and draw up an application, the necessary documents are prepared.

And today, applying for a pension through State Services is much more profitable than visiting the Pension Fund or MFC.

Who can use the service

Anyone who has earned the right to an insurance, funded or social pension under the laws of the Russian Federation and has a confirmed account on the portal can submit an application to the Pension Fund through Gosuslugi.

The pension system in Russia is quite complex. There are many reasons for receiving payments from the Pension Fund. They will not be considered within the scope of the article. Let us dwell only on the procedure for registering pension provision.

To gain access to the service, you must register on the State Services portal. The process consists of several stages:

- Fill out the registration form on the website gosuslugi.ru

- Enter personal information.

- Pass a background check with the Pension Fund and the Ministry of Internal Affairs.

- Confirm your identity using one of the available methods.

Advice. The procedure may take several days. It is better to register in advance. However, you should not be discouraged from applying online because you do not have a verified account. By registering once, the user gets access to all services provided by state and municipal authorities on the e-government website.

The procedure for establishing a pension through State Services

The original documentation indicated below is verified with the information of the electronic application filled out on the State Services portal after it has been sent and reviewed. Therefore, there is no need to visit the Pension Fund initially.

You need to familiarize yourself with the background information on the State Services website in the appropriate section on pensions. There you are asked to recalculate payments, select savings for insurance, and review your savings.

Next, a citizen counting on security orders a government service.

Pre-registration on the portal is required. This information is publicly available.

Expert opinion

Smirnov Vladislav Vyacheslavovich

Legal consultant with 10 years of experience. Specialization: family law. Law teacher.

In addition, step-by-step navigation on the site, which is intuitive, allows an inexperienced user to register and order a government service. Depending on whether you have an account or not, the duration of the service is determined.

So, priority registration will take time. But the fact that the state service for calculating pensions is free and saves time through the State Services portal pleases even citizens unfamiliar with Internet platforms.

Who is eligible for benefits

Despite the fact that all residents of Russia are entitled to pensions, upon reaching a certain age, the amount of payments for certain categories of citizens may differ markedly.

The size of the pension is affected by:

- insurance and work experience;

- special working conditions;

- the living wage established in the region.

People who receive a minimum pension receive social supplements, targeted assistance, and other types of support.

The retirement age in Russia is conventionally divided into 2 categories.

- Citizens who apply for an insurance pension retire to a well-deserved retirement at the age of 55-60. To do this, you must have at least 10 years of work experience and a certain number of pension points.

- People who do not have work experience receive a social pension, assigned from the age of 60-65.

In both cases, pensioners can claim a number of intangible privileges designed to create comfortable living conditions. Social benefit packages may be provided by default or require writing an application at the Pension Fund office at your place of residence.

In addition, the list of support measures, which is often established at the regional level, also differs. Let's look at the main social benefits that are relevant for all regions of the country.

Benefits for utility bills

This type of social support was introduced so that after paying off receipts for payment of housing and communal services tariffs, pensioners have funds left for a decent living.

Therefore, in all regions of the country such subsidies are intended to support low-income pensioners. In addition, beneficiaries include:

- persons with disabilities of groups 1 and 2;

- citizens with dependent 2 or more minor children:

- liquidators of the consequences of the Chernobyl accident, including victims of the disaster, internally displaced persons and victims of radioactive radiation;

- participants of the Great Patriotic War and those equated to them: residents of besieged Leningrad;

- concentration camp prisoners;

- home front workers,

- participants in local armed conflicts;

The subsidy amount does not exceed 50% of the total amount of utility bills for all categories of beneficiaries. In addition, elderly people receive compensation for major repairs.

The following values apply here:

- disabled people, veterans and low-income pensioners - 50%;

- all pensioners over 70 years old - 50%;

- over 80 years old - 100%.

Subsidies are provided on the basis of an application, which is supported by the following documents:

- pensioner's ID;

- certificate of family composition;

- certificate of financial situation;

- written confirmation of arrears in payment of utilities.

Important! Subsidies must be reissued every 6 months. If the pensioner’s financial situation improves, the benefit ceases to apply.

Benefits for undergoing spa treatment

This type of social support is regulated at the federal level, so preferential vouchers are paid for from the state budget. As part of this program, pensioners are provided with:

- paid travel to and from the place of sanatorium-resort treatment, provided that there is a medical order and the vacationer does not leave the region;

- free accommodation and medical and health procedures;

- 50% discount on the purchase of prescription medications at retail locations.

It should be clarified that in the latter case the prescription is valid for 10 days.

To take advantage of the privilege, you must contact the territorial office of the Pension Fund of the Russian Federation, write an application and submit the following documents to the employee for consideration:

- photocopy of passport;

- conclusion of a medical commission;

- referral for sanatorium-resort treatment.

Important! In some regions, financial compensation is provided if a pensioner refuses to apply for a free voucher.

Benefits for medical care

All elderly citizens retain the right to receive free medical care in clinics, hospitals and when calling a doctor at home. In addition, the social support program provides the following benefits for certain categories of citizens:

- disabled people - free medications according to the established list (360 items);

- war veterans and disabled people receive free trips to sanatoriums and health resorts;

- persons over 60 years of age receive free flu vaccination;

- citizens over 60 years of age receive free medical examination every 3 years, war invalids and blockade survivors annually, regardless of age;

- for pensioners in the Far North and territories with similar conditions - reimbursement of travel expenses for a trip to any Russian resorts and sanatoriums.

All pensioners without exception are entitled to free of charge:

- medical examination every 3 years - for persons over 60 years of age;

- influenza vaccination.

Important! Low-income pensioners can receive partial reimbursement of expenses for the purchase of essential medicines. To do this, you will need a certificate of financial status, prescriptions for medications (form 107/y) and receipts confirming the fact of purchase.

Benefits on transport

Pensioners in the regions receive preferential or free travel on all types of municipal transport in urban and suburban directions. The procedure for providing this measure of social support is regulated by local governments, and therefore may differ depending on the region of residence.

It is permissible to refuse to provide benefits in favor of increasing pension benefits. In this case, a monthly increase will be accrued commensurate with the amount of the non-material benefit.

In addition to public transport, the program covers:

- travel on commuter trains,

- purchasing tickets for long-distance trains;

- purchase of air tickets (the amount of the discount is determined by the transport company).

Discounts are provided by default at the time of purchase of travel documents. To do this, you simply need to present your pension certificate.

Important! Some Moscow pensioners have lost their right to preferential use of the metro. Now free travel is provided depending on age, length of service and social status.

Tax benefits

Property benefits for pensioners completely exempt elderly citizens from paying taxes on the real estate they own. This right can be used by working and non-working pensioners who own an apartment, country house, dacha or garage. The benefit applies only to one piece of real estate at the citizen’s choice. In addition, the program covers:

- tax on a vehicle with a capacity of no more than 100 hp. With. (not for all regions);

- the right to a tax deduction when purchasing real estate;

- partial exemption from land tax;

- exemption from paying state fees when filing lawsuits regarding pension disputes;

- exemption from personal income tax in relation to state pension provision and insurance and funded pensions paid through the Pension Fund and government agencies, social supplements to pensions.

To take advantage of the benefits, you must contact the tax office at your place of residence, write an application and present your passport and pension certificate.

Important! When purchasing a plot of land, only plots intended for individual development are subject to the tax deduction. This does not include country and garden plots.

Documents required for granting a pension

The list of documentation presented below is considered the same for all subjects of the Russian Federation:

- Identification. Most often this is a passport. If a question arises about a representative, then his identity card and document on the right of authority are attached.

- A certificate from the last workplace confirming the length of work (this is the last five years in a row and until 01/01/2002 for the entire period of work) and the average monthly salary. This point contains the most nuances, considered individually.

- Employment history.

Other documentation includes:

- Certificate of change of surname.

- About the disability group.

- About the death of the breadwinner.

- Certificate of disabled family members.

- About registration and place of actual residence.

Pension rights are also confirmed by SNILS. The PRF considers only originals.

Duration of the service and its cost

The cost of the government service is zero rubles, and the execution time is ten working days. However, due to additional documentation, the processing time will increase.

After all, employers have been providing information to the fund only since 2002. Until this moment, there are no entries in the Pension Fund register.

The future pensioner provides such information during a personal visit to the pension. Non-insurance periods of life without work are also taken into account:

- Army.

- Childcare for children up to one and a half years old.

- Caring for the elderly or disabled people over 80 years of age.

- This also includes the overseas life of a consular officer and the spouse of a military personnel.

Changes in the regulations for the provision of services are announced by notice in your personal account and via e-mail. Non-insurance periods may not appear in the consideration of the application. But the applicant has a greater interest in them.

Step-by-step instructions for registration on the State Services website

- A service called “Pension Setting” is available after logging into the site. It is in demand and can be easily found on the page in your personal account.

- But it is foreshadowed by the category “Pension, benefits, benefits”.

- After clicking on the “Pension assignment” link, the citizen is directed to a page containing instructions and a “Get service” button.

- The application form is a basic form to fill out. It is discussed in the article below.

- After filling out the fields and sending the electronic document, wait for the notification.

- An invitation to the Pension Fund branch with original documentation for verification will be sent to your email and personal account on the portal.