All about checking your pension savings for 2020

The reform carried out in 2020 makes it possible to independently form your own pension with certain savings. The insurance pension, in turn, is divided into the following groups:

- in case of loss of a breadwinner;

- establishing the fact of disability (disability group);

- reaching the age limit for old age pension.

Also, pension savings are divided into 3 categories:

- target;

- urgent;

- one-time

This right is granted as a result of the formation of the required number of points or IC (individual coefficient).

Elena Smirnova Pension lawyer, ready to answer your questions. Ask me a question Every year, during your working life, points are awarded. In the case of the formation of an exclusively insurance benefit, a person adds 10 points .

What pensions are considered social?

0 3469 The law establishes the possibility for citizens to receive various types of social benefits.

One of these types of payments are social pensions assigned to certain categories of citizens when... — Read more —

Options for checking old age pension accruals

To check the correctness of the calculation of the old-age pension, you can use different methods, but for reliability it is necessary to carefully study all the entries made in the work book and obtain reference information from the employer about the salary received in the period from 2000 to 2001.

For your information: It was at this time that the calculation procedure changed, since the Government of the Russian Federation introduced the concept of “insurance pension experience”.

So, to check your accrued old-age pension you can:

- Submit a petition to the Pension Fund division at the place of permanent registration with a request to verify pension accruals. It is also necessary to indicate that you should check with the allowances, indexation and other calculations established by the Law;

- Write a petition addressed to the head of the Main Directorate of the Pension Fund for your region with a similar request to conduct a thorough audit of pension payments.

- You can apply in person when visiting a local PF branch, send a registered letter, or make a request on the government services website. But only authorized users who have already confirmed their personal data in an official way, for example, through Russian Post, will be able to do this.

Required documents

The future recipient of the pension must approach the preparation of documents responsibly. It is their package that determines the size of future payments, as well as the speed of processing the request and assigning a pension.

Before you start applying for a pension online, you will need to prepare the following documents:

- passport ;

- documents confirming the place of actual residence (if different from registration);

- work book and other documents that can confirm the conduct of official labor activity (work);

- salary certificate (for the last 5 years);

- documents confirming the presence or absence of family members declared incompetent;

- documents confirming the applicant’s disability (if available);

- certificates of change of surname, name, and other personal data (if there were such facts).

When an applicant fills out an application for a pension in electronic form, he must provide data from these documents. The originals will need to be presented in the future when contacting the Pension Fund department.

Important. It is not yet possible to apply for a pension online. You can only submit an application online, schedule a visit to the Pension Fund, etc. You will still have to visit the territorial division of the fund with documents in person.

Information for future retirees

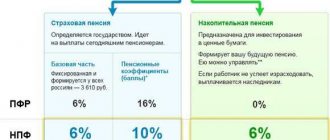

Recently, the pension system has undergone significant changes. Now each citizen’s pension is divided into an insurance and funded part. The funded part of the pension can be left to be managed by the Pension Fund or transferred to any non-state pension fund at your discretion.

You should know! The size of the funded part of a pension located in a non-state fund cannot be found out through the State Services portal or the official website of the Pension Fund. To obtain information, you must contact the NPF directly.

Maternity capital for 2 children

0 5521 Maternity capital is one of the most common social security schemes for citizens.

The procedure and main features of its issuance are regulated by the norms currently in force in the country... — Read more —

How to find out the size of your future pension through the personal account of the Pension Fund

At this time, there are several options available to everyone:

- through the personal account of the Pension Fund;

- using a pension calculator;

- on the State Services website.

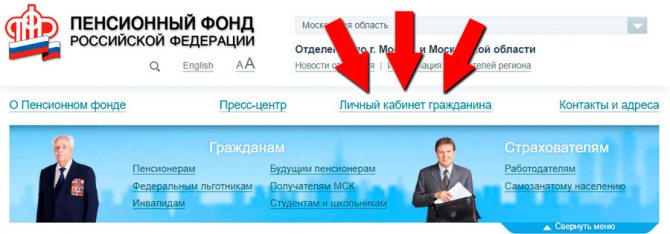

All future pensioners can find out the size of their pension in their personal account of the Pension Fund. All new users who do not have access to their “Personal Account” must complete a simple and standard registration. It can be completed either on the State Services website or on the Pension Fund website.

At the first stage of registration, you will need to enter data such as:

- FULL NAME;

- phone number;

- E-mail address;

After that, a message will be sent to your mobile phone with an individual code necessary to activate your account.

In the second step, you will need to enter more detailed information:

- passport data (date and place of birth, series and number, when and by whom the passport was issued);

- SNILS number.

When all entered data has been verified (the verification takes some time), a letter with the results will be sent to the user’s email. After completing this procedure, the user can log into his “Personal Account”.

How to find out the amount of the assigned pension? All information is available in the “Individual Personal Account” tab when you go to the “About generated pension rights” page. The user will see a page with information about his work experience and accumulated points, taking into account which pension savings are calculated.

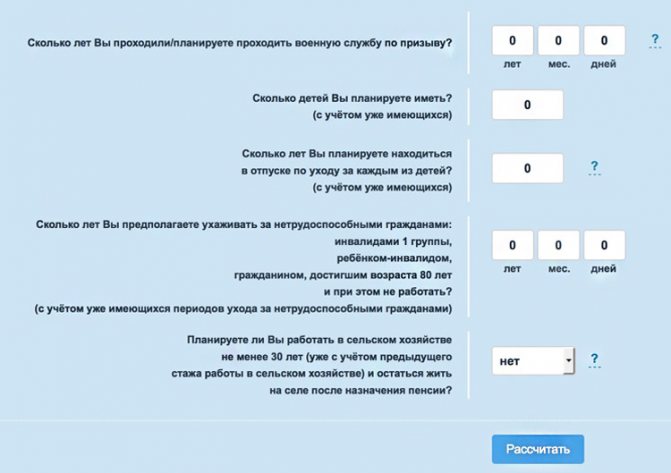

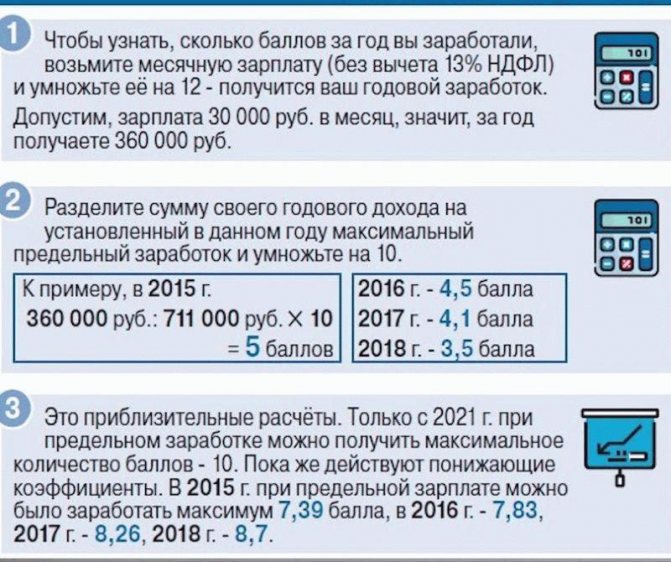

Rules for using the pension calculator on the Pension Fund website when checking pension savings

The pension calculator is very easy to use, and everyone can understand how it works. This service has been successfully operating since 2020. The new pension system is based on a system that operates on the principle: the more you work, the more you will receive later. The work of the pension calculator is based on it.

It also takes into account the time spent on military service and maternity leave, that is, payments will also be accrued on them. The service includes the principle that the longer a person does not receive a pension and accumulates work experience, the larger the amount of future pension payments he can count on.

To predict the size of your future pension, you will need to go to the website of the “Pension Fund of the Russian Federation”: https://www.pfrf.ru. On the main page of the site you will be asked to familiarize yourself with the latest news and changes in laws relating to pensioners, and at the end of the page you can see a clickable button: “Pension calculator”.

The service visitor does not need to register, confirm his identity or waste time on other formalities. Anyone can calculate their pension savings.

The procedure itself takes no more than five minutes. On the downloaded page, you must enter your year of birth, gender, the number of years spent serving in the army or maternity leave, as well as indicate how many more years you plan to work and the amount of your monthly salary.

Elena Smirnova Pension lawyer, ready to answer your questions. Ask me a question In addition, if the user plans to retire later than the legal age, this also needs to be recorded in the calculator. There is a special column for this.

You will also need to provide additional information such as:

- How many years do you plan to care for disabled relatives (disabled people or elderly people over 80 years old) without working?

- In what form do you carry out your labor activity (self-employed or hired worker; combination of hired labor and independent work).

After entering all the data, the user will see the size of his future pension, the number of individual pension coefficients and total work experience. It will also be possible to obtain detailed information regarding all the nuances and algorithm for forming pension savings.

State services pension fund personal account, find out the size of your pension

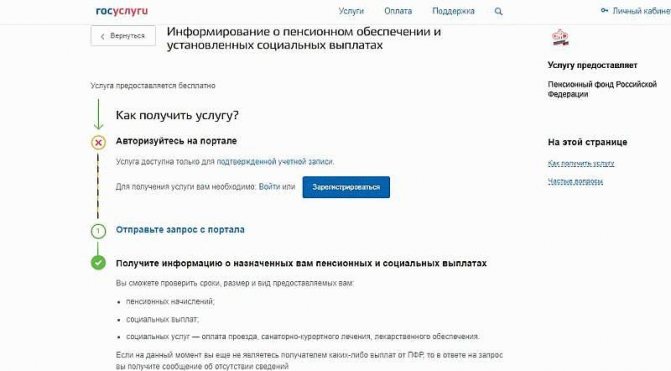

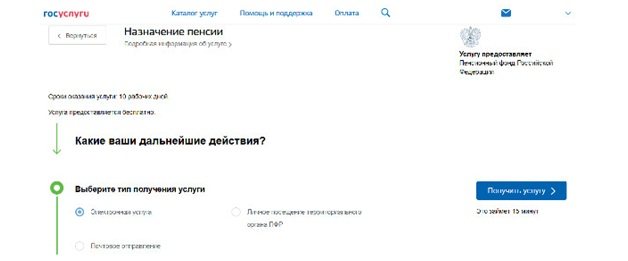

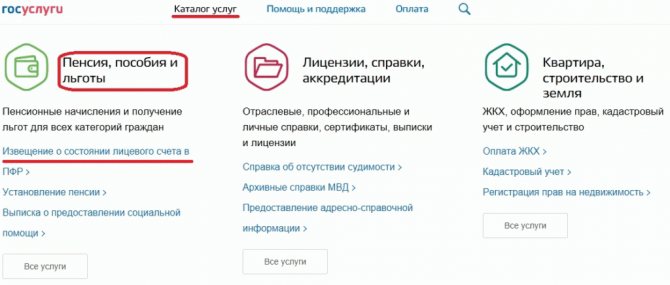

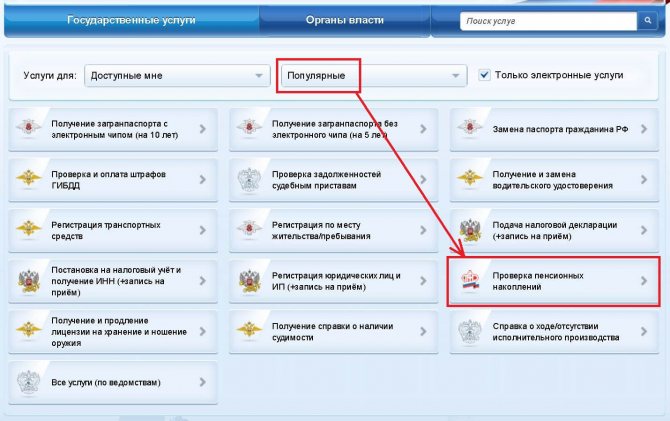

In order to find out the size of the pension through the State Services service, the user also needs to have a registered account on it. If it is not there, then you need to go through the registration procedure as described in paragraph 1. After this, the entire range of services provided by this service will become available.

How can I find out the size of my pension in my Personal Account? You need to open the section: “Service Catalog”, subsequently indicating that you need to view the “Entire Catalog” by clicking on the appropriate link. In the section “Pension, benefits and benefits” you need to look at everything. Then click on the clickable link: “Get a service.”

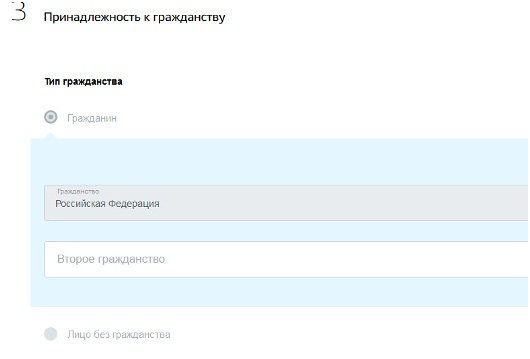

On the next page the user will need to provide the following personal information:

- FULL NAME;

- date of birth;

- SNILS number.

Now you just need to send a request and wait for a response notification to your email. You can monitor the status of your request in your “Personal Account”. If necessary, you can save the application or send it to yourself by email.

Where to see the storage part

Until recently, once a year the Pension Fund of the Russian Federation sent out letters with information about the status of the savings account. Russian Post delivered such correspondence to all citizens of working age who paid contributions to the Pension Fund. Now such letters are not sent out, but all information is available on the state portal. There you will receive information about:

- places of work;

- periods of work;

- the amount of contributions from your employer.

At the same time, not all citizens now have a funded component. It is available by individual choice to persons younger than 1967. They indicate whether to direct all deductions only to the insurance part or to separate the share to the funded one.

To find out the funded part of your pension through State Services, go to the website gosuslugi.ru with your login (this is your phone number, SNILS or email address) and password. Go to the Service Catalog, scroll the page to the “Pension, benefits and benefits” category, select “Notice on the status of your personal account.”

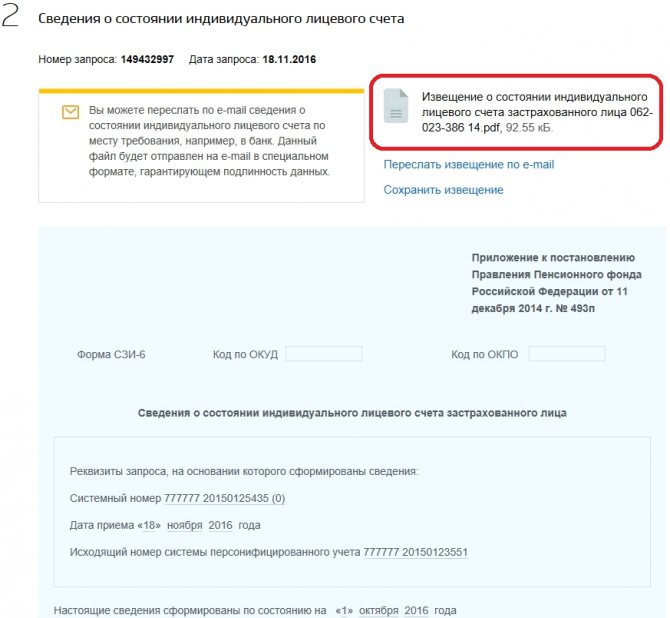

Service details will appear. The request to the Pension Fund is sent electronically, the waiting time for a response is no more than 2 minutes. Once your application has been processed, you will be provided with an extract from your pension contribution history. The document is generated in *.pdf format, which can be viewed in any modern browser, saved to a computer or printed. The legislation does not provide grounds for refusal to perform a function; as a result of consideration of the application, a reporting extract must be generated.

If you agree with the information provided and want to find out the funded part of your pension through State Services, click the blue button on the right “Get a service”. After a short processing of the request, information about the status of your personal account will appear.

You can view the PFR notice in *.pdf format - this file has no legal force and is for reference only. If you need to provide an official statement to a bank or other organization, select the “Forward notification by e-mail” option. The State Portal guarantees that in this case the data will be sent in a special format that guarantees its authenticity.

The statement contains detailed information on the basis of which the personal coefficient is calculated: pension option, length of work experience, amount of annual contributions to the insurance part. If you work in several places at once, you will find deductions for each employer in the file.

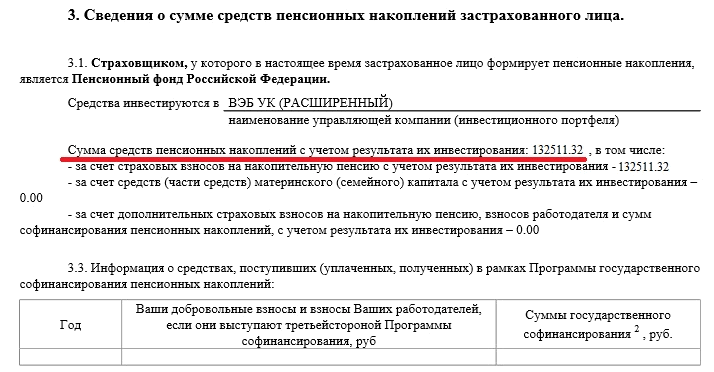

Paragraph 3 of the statement provides data on the amount of the funded part of the social payment. You'll see which fund is managing your retirement money. The total amount of savings includes both insurance premiums directly and maternity capital funds, and additional voluntary payments, if any.

When participating in the state program for co-financing the funded part, the amounts of voluntary contributions and additional payments made for them will be listed here by year.

Freezing maternity capital

0 604 Maternity capital can be issued to citizens for specific needs.

To receive it, a citizen must provide documentary evidence of belonging to a specific category of persons who, by law, receive... — Read more —

View your pension in the Pension Fund account - step-by-step instructions

View your pension in your personal account of the Pension Fund of the Russian Federation, simple, in a few clicks.

The pensioner must act according to the following algorithm:

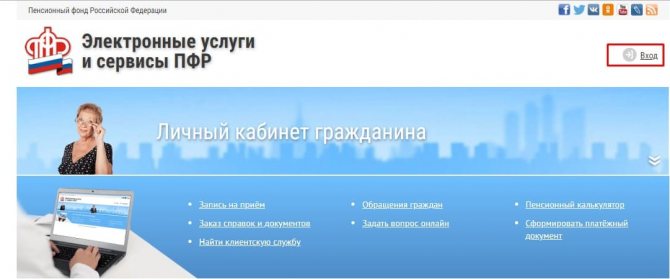

Step 1: Log in to your account on the Pension Fund service at: es.pfrf.ru.

Step 2: On the page “Electronic services and services of the Pension Fund of Russia” , click “Login”.

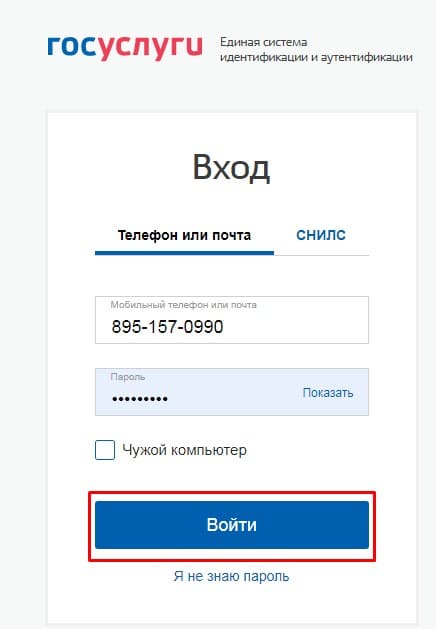

Step 3: On the page of the unified system “Gosulug”, enter the phone number and password specified when registering on the “Gosulug” portal.

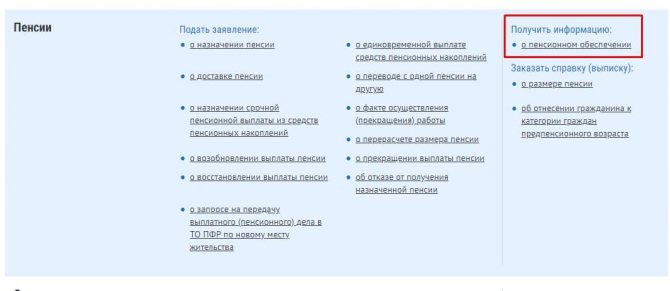

Step 4:

In the

“Pensions” section, click on the link “Get information about pensions” .

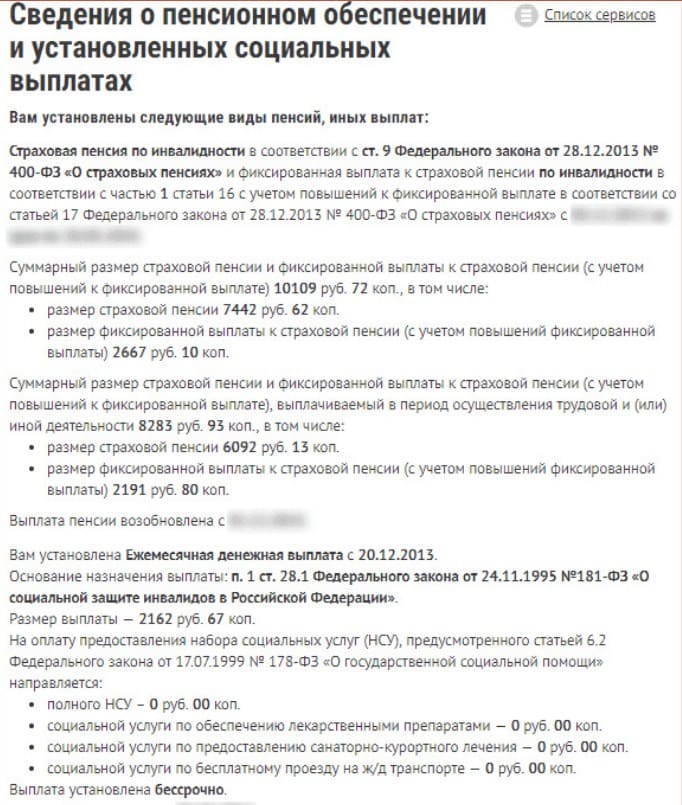

Step 4: A window will open in which a detailed statement of pension payments made . In this electronic document the user can see:

- the amount of the accrued insurance share of the pension and the related fixed payment in rubles;

- the amount of payment for a working pensioner when indexation is not taken into account;

- the amount of monthly cash payment, the set of social services established by the state.

Receiving an extract is available to any pensioner registered on the Pension Fund service. Indexations and other adjustments to social charges carried out by the fund are also reflected in your personal account.

Pension for foreign citizens in Russia

0 673 According to the rules and regulations for calculating pensions in the country's pension fund, it is possible in a number of cases for citizens of other states to receive pensions.

Under similar provisions, foreigners have... — Read more —

Advantages of the Gosuslug portal

Knowing how to apply for a pension through State Services is also useful for other options for setting payments. Only the application submission mechanism changes. In a paper or electronic application, the points will be the same as on the state portal:

- The paper form can be brought to the Pension Fund office at your place of residence or MFC. Take your passport with you.

- The remote service is available on the official website of the Pension Fund.

The State Services portal contains a large array of reference information and sample documents. It indicates in what sequence the user should perform actions remotely, organizes a search by the desired department, real-life situation, or topic. An extremely simple interface helps the average user who is not familiar with programming to perform all operations.

The list of services provided by the site is constantly increasing. Sitting at home at your computer, you can make an appointment with a doctor, register with a clinic or call a doctor at home, or order a foreign passport. The service also allows you to manage your pension savings and carry out various actions that previously required a mandatory visit to the office.

Finding the right service is not difficult. In the catalog they are divided into categories. It is also convenient to search through the “Search” button or department pages.

You can view your pension in government services only after official registration, which takes place in three stages: pre-registration, activation and authorization.

To pre-register, you need to fill out the required fields and submit a request. A message with a code will be sent to the contact you specified (this can be an email or phone number). The received code is entered in the activation section. If your account is successfully activated, great opportunities will open up for using the site.

Anyone can control the amount of already accrued pension savings, as well as monthly contributions to the Rosgosstrakh pension fund in the “Personal Account”. In addition, the service provides the opportunity to use the following services:

- viewing data filtered over a certain period of time;

- downloading samples of required documents;

- familiarization with the terms of the contract;

- tracking any information relating to the client’s personal account.

List of required documents

What is the required package of documents?

Before submitting an application to the LC, you must prepare a set of documents, which includes the following items:

- applicant's personal passport;

- his work record;

- a certificate of salary for 5 years of work (for a randomly selected period);

- medical insurance;

- certificate of insurance experience.

In the case when a set of documents is prepared in advance, visiting the Pension Fund is not at all necessary.

They are submitted together with the application through the same government services portal after you have completely completed the registration and user identification procedure.

You can send them to the portal address if you use an interactive form specially designed for this purpose, into which all electronic copies of documents are uploaded one by one.

In conclusion, we note that the advantages of using the Personal Account include the ability to quickly respond to all changes in the work of PF services, as well as contact their representative if necessary.

Expert opinion

Smirnov Vladislav Vyacheslavovich

Legal consultant with 10 years of experience. Specialization: family law. Law teacher.

By now, a significant portion of pensioners have already taken advantage of the opportunity to apply for a pension through government services and take direct part in the work of the relevant services.

In the following video you will learn how to work with the Pension Fund’s personal account:

How to apply for a pension through State Services? This is exactly the question that faces those who are entering a well-deserved retirement, but do not want to waste extra time in queues when applying for payments required by law. The single portal of State Services has significantly simplified the interaction of Russian residents with various government agencies, including the Pension Fund.

Using this service, you can significantly save time on applying for a pension and significantly simplify the procedure itself.

What affects the amount of pension benefits?

Employers are required to make contributions for each employee to the Pension Fund, based on the percentage of total earnings established by the Government of the Russian Federation. But if the salary is paid in envelopes, then no transfers are made from it, and as a result, the employee is paid the salary in full. But there is a certain risk here - you can no longer count on a decent pension, because there will be no accrual of points, no increase in insurance and work experience, which affect the amount of old-age security.

If the future pensioner has a short insurance and work experience (less than 10 years), then he will only be paid social benefits in old age, and 5 years later than provided for persons who have reached the legal age.

What types exist according to the legislation of the Russian Federation?

To understand how the types of pensions existing in Russia differ, you should understand their features:

- Insurance. A person who has issued this type of pension will receive monthly payments from the state, the amount of which is calculated based on the amount of wages that he received during his work activity. Every year the state indexes such pensions.

- State. This type of pension is assigned to individuals in the form of compensation for earnings that they lost due to termination of work for certain reasons.

- Cumulative. Such a pension can only be formed for persons born in 1967 or earlier, provided that they submitted a corresponding application to the Pension Fund by the end of 2015. Since 2005, funded pensions have been formed only through voluntary contributions made by citizens to the Pension Fund. One important point is worth noting. If a person works, all insurance contributions transferred from his earnings will form an insurance pension. If a person refuses to further form a funded pension, all collected funds will be saved and paid upon retirement. Such savings can be managed not only by the pensioner, but also by his authorized representatives.

Types of charges

Pension payments can be insurance and funded; both of these options are formed from deductions from wages during official employment.

But some pensioners receive only an insurance pension, while others receive from both sources. Moreover, the state regularly indexes the amount of old-age insurance payments, but funds from the funded part go to private funds for investment in economic projects. And the activities of these funds do not always bring profit; there are investments with negative results, so waiting for an increase in this case is pointless.

But since January 2014, contributions to savings funds have been canceled, and the amounts go directly to insurance pension payments.

One-time payment from maternity capital

0 651 The law establishes the opportunity for citizens of the country to receive one-time payments from the total volume of maternity capital.

The rules for accruing funds and their subsequent distribution to citizens are established... — Read more —

Alternative ways to obtain a certificate of pension savings

All information is confidential, so access to it is possible only with proof of identity. A passport and SNILS are required.

You can get information in printed form:

- By contacting the Pension Fund at your place of registration

- by sending a request to the MFC;

- requesting data through partner banks (Sberbank, VTB, UralSib, etc.).

Submit data via the Internet:

- on State Services;

- on the Pension Fund portal;

- through the Internet banking service.

If pension savings are accrued through a non-governmental organization, then you must submit an application to the NPF or register on their website. You can log in to most organizations using your State Services account.

Through the website of the Russian Pension Fund

The second way to calculate the amount of a funded pension is to use a special online calculator (https://www.pfrf.ru/eservices/calc/): - Select “Pension calculator”. — Enter the necessary data. - Click “Calculate”. The data will be processed and as a result a report will be displayed on the monitor, which you can download to your computer or send by email.

Personal visit to the Pension Fund of Russia

You can receive a paper copy of the statement by visiting the Pension Fund branch. Thus, you can find out about the status of your savings account without personally visiting the territorial office of the Pension Fund. In addition, information via the Internet on the State Services portal will be received many times faster.

What is required to submit an electronic application?

If an account has not been created previously, you can register it.

To do this, you need to have your SNILS and passport at hand and follow these steps:

- Go to the portal and click “Register”.

- Provide contact details (phone, email) and confirm them.

- Enter your full name, passport details, INN and SNILS number.

- Wait for the specified data to be automatically verified.

Initially, a simple profile is created on the portal. Before creating an application to the Pension Fund, it must be confirmed in any of the following ways:

- through the online banking of Sberbank, Tinkoff, Post Bank;

- through a code received in a regular registered letter;

- through the multifunctional center (personal visit required).

Through your personal account in the pension fund

While on the Pension Fund website, you are also required to register, indicating a valid (working) email for confirmation.

- After the above steps, you need to fill out a form in which you should indicate your passport details and SNILS number.

- Next, to get information about savings, you need to go to the “Pension Fund” section and select the appropriate link there.

If any problems arise, you can contact the Pension Fund staff at the phone number indicated at the top of the page. The hotline operates 24 hours a day and calls are free.

Formation of the insurance and funded parts of the labor pension

0 1272 Every citizen by law has the right to the formation of funded pensions in accordance with the provisions of the current agreement with the pension fund.

The formation of the considered parts of pensions occurs in strict... — Read more —

I need to check the correctness of pension calculations.

2. I need to check the correctness of pension calculation.

2.1. You can order a calculation.

3. I am a disabled person of the 1st group, I receive a disability pension, I have work experience until 2002, I want to check the correctness of the calculation of my pension. How can I do it?

3.1. Checking the accrual of old-age pensions is possible in the following organizations: Territorial branch of the Pension Fund of the Russian Federation. You need to come to the customer service and write a corresponding statement. Among the documents you need to have with you, you must have a passport and SNILS. Multifunctional center (MFC). Here you will be asked to fill out an application, to which you will need to attach your passport and SNILS.

3.2. Contact the Pension Fund client service at your place of residence and demand a pension calculation; if the calculation is violated, you can contact the prosecutor’s office.

Social pension for disabled people

0 536 Disabled people have the right to receive social benefits from the state in accordance with the provisions of the current legislation of the country.

According to the norms of current laws, one of the types of such accruals is the possibility... — Read more —