What is the difference between federal and regional surcharges?

What is the difference between these two pension grant options?

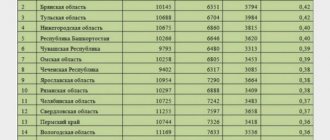

The method of additional payment directly depends on the PMP established in the citizen’s place of permanent residence, and the same indicator, but for the country as a whole. If the PMS is less than one, then the low-income part of the population of the older age group that lives in this region may qualify for a federal social supplement. It is issued by the Pension Fund.

If the PMP is higher than the national average, a regional subsidy is determined. It is financed by the Social Security Service.

Unified PMP – 9311 rubles . To understand what type of additional payment a particular pensioner is entitled to, you should compare this indicator with the same in the region of his residence.

Regional benefits

For some groups of beneficiaries, preferences are provided, paid from the local treasury. They are:

- Labor veterans are provided with:

- 90% discount on tickets for suburban railway transport during the “dacha” period (from April 27 to October 31);

- monthly monetary compensation for part of the cost of housing and utilities;

- free production and repair of dentures;

- preferential travel on road transport on adjacent interregional, intermunicipal and municipal regular transport routes;

- free provision of medicines.

- All pensioners without exception are entitled to:

- exemption from transport tax and property tax on one property;

- preferential use of public transport;

- monthly monetary compensation for the cost of paying a contribution for major repairs;

- a one-time social payment for partial reimbursement of expenses for gasification of residential premises;

- social taxi services;

In addition, the Social Code of the Leningrad Region stipulates the right of married couples of pensioners to a lump sum payment on the occasion of the anniversary of their marriage. It is provided to citizens of the Russian Federation who permanently reside in the Leningrad Region and have been married for 50, 60, 70 and 75 years.

Additional payments (allowances) to pensions in the Leningrad region and St. Petersburg

A number of legislative acts have been adopted in the Leningrad region where pensioners can receive social support. The city leadership provides pensioners with different types of benefits, namely:

- Medical institutions provide free services to pensioners who were employed during their work, and also purchase medicines and technical equipment for rehabilitation at a discount;

- Discounts are available for travel on public transport;

- Dental prosthetics;

- Free treatment in a sanatorium as prescribed by a doctor;

- Single pensioners are provided with sanitary and hygienic care.

In addition, pensioners are provided with a set of required products and things.

If a pensioner is a resident of besieged Leningrad, then he is provided with a subsidy and a 50% discount on utilities.

What is included in the minimum value

The composition of the consumer basket is approved by the Institute of Social and Economic Problems of the Population.

It includes products, non-food products and services that allow a person to maintain a certain standard of living.

The food basket affects the calculation of the cost of living

The main influencing factor is the food basket, since the cost of the non-food part is defined as 50% of the price of food.

The cost of medical and educational services is practically not taken into account, since they are provided by the state in the minimum required quantities.

The consumer basket includes:

- products;

- industrial essential goods;

- communal payments;

- medicines;

- transportation costs;

- additional expenses.

The 2020 food basket includes cereals, eggs, meat, vegetables, potatoes, fruits, fish, dairy products, sunflower and butter, bakery and confectionery products, spices, coffee and tea.

On average, per person per year is 37.2 kg of meat, 16 kg of fish, 97 kg of vegetables, 23 kg of fruits, 107.6 kg of potatoes, 238.2 kg of dairy products and 200 eggs.

Non-food essential goods include clothing, shoes, household chemicals and hygiene items. Additional expenses include payment for events, hairdressing services, etc.

If the recipient is dependent on minors, then they are entitled not only to additional payments, but also to partial compensation for additional expenses: discounts on entertainment events, free tickets to museums, etc.

When calculating, attention is paid to the average standard of living in the region, mentality, climate and regional characteristics of consumption of non-food products. The level of living wage for a pensioner in St. Petersburg and Moscow is higher than in other regions of Russia.

What does the minimum old-age pension consist of?

It happens that a person was assigned an old-age pension, but its amount turned out to be lower than the pensioner’s subsistence level. In this case, he is entitled to an additional payment up to the “minimum wage”. It is correctly called “social supplement to pension” up to the pensioner’s subsistence level. The right to it arises when 2 conditions are simultaneously met:

absence of work or other activity during which the person is subject to compulsory pension insurance;

failure to achieve the total amount of material support for a pensioner equal to the minimum subsistence level of a pensioner in the region of his residence.

Keep in mind that in order to calculate the “total amount of material support”, almost everything is taken into account - all cash payments, including pensions and cash equivalents of social support measures to pay for telephones, housing, utilities and travel on all types of passenger transport (urban, suburban and intercity) , as well as monetary compensation for the costs of paying for these services.

The amount of PMP for determining the size of federal and regional social supplements to pensions is established in the whole of the Russian Federation and in each subject of the Russian Federation. So, for 2020 in the Russian Federation it is 8,726 rubles, in Moscow – 11,816 rubles. (clauses 3, 4, article 4 of the Law of October 24, 1997 N 134-FZ; part 5 of article 8 of the Law of December 5, 2017 N 362-FZ; article 1 of the Moscow Law of October 25, 2017 N 37 ).

Minimum and average pension rates in St. Petersburg and the Leningrad region

The amount of accruals for pensioners depends on the type of pension, as well as the applicant’s length of service and the number of pension points.

In addition, the amount is affected by the preferential grounds on which additional support is provided. Federal legislation establishes the following types of pensions:

- insurance;

- social;

- state;

- cumulative (additional).

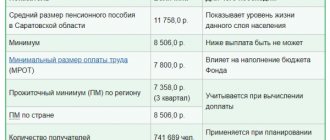

In 2020, the following indicators were recorded in the Leningrad region:

- the minimum pension for non-working pensioners is 9,160.0 rubles;

- average - 15,616.0 rub.

It should be understood that statistical data does not reflect the situation of a particular pensioner. After all, the law provides for a serious increase in the maintenance of people who fall under preferential criteria. For example, disabled children of group I are allocated a social allowance in the amount of 15,434 rubles, single disabled children of group II - 6,849 rubles, and participants of the Great Patriotic War are increased to 32,500.0 rubles.

According to federal law, a non-working pensioner cannot receive less than the minimum subsistence level (ML) for the corresponding group of the population.

By old age

The minimum threshold for the amount of pension payments for residents of St. Petersburg and the Leningrad region has not been established. Nevertheless, it exists. The fact is that pensioners whose income is less than the subsistence level established in the region of their residence are paid the remaining difference at the expense of public funds in order to equalize their pension and the subsistence level.

The cost of living for them is:

- 9,514 rubles in St. Petersburg;

- 9,247 rubles in the Leningrad region.

Thus, thanks to the corresponding additional payment, the pensioner simply will not receive less than this amount.

In addition, additional pension supplements are provided for residents of the northern capital. These include the following types of financial assistance.

- Regional pension supplement for citizens whose income is less than the subsistence level. In addition to the federal surcharge in St. Petersburg, pensioners also receive assistance from the city budget. True, its size is small - it is only about 600 rubles. However, for low-income citizens of retirement age who receive small payments from the state, even this increase is often very significant and represents real help.

- Additional payment for labor veterans. An additional payment to the pension of citizens with the status of “labor veteran” is made from the city budget. It does not reach 1000 rubles. To receive funds, you need to meet a number of conditions - veteran rank alone is not enough. Firstly, the insurance period established by city legislation is required. For men it is forty-five years, and for women – forty. Secondly, the veteran must have lived in St. Petersburg for at least twenty years. In this case, the citizen must have permanent registration at the place of residence in the city. Temporary registration at the place of stay is not taken into account in this case.

- Siege survivors, repressed persons, as well as veterans of the Great Patriotic War are also entitled to a bonus. Its size is similar to the size of the supplement for labor veterans and is about 1,000 rubles. Unlike the previous category of pensioners, blockade survivors, repressed persons and veterans are not subject to any additional requirements - they are entitled to an increase in any case.

- Pensioners are entitled to an additional payment to their pension for children born before 1990 in St. Petersburg. Citizens who retired before 2020 and gave birth to children before 1990 are entitled to a special regional St. Petersburg bonus.

It should be remembered that the listed measures of financial assistance for pensioners do not apply in the Leningrad region.

For the loss of a breadwinner

There are no additional payments for citizens who receive a survivor's pension in the northern capital. However, as in the case of an old-age pension, such persons are entitled to an additional payment if their income does not exceed the subsistence level established for them in the subject of the federation where they live. Since citizens of different social groups can receive a survivor's pension, it is not possible to name a single minimum amount of such payments for them, since the cost of living is different for everyone.

However, in practice, most often minor children receive a survivor's pension. For them, the subsistence minimum (and therefore the minimum survivor’s pension) will be as follows:

- 10,783.60 rubles in St. Petersburg;

- 9,877 rubles in the Leningrad region.

By disability

For disabled people, the pension consists of two components:

- minimum fixed part;

- the insurance part, consisting of contributions that were transferred for the employee during his work activity.

The fixed part depends on the disability group and has the following dimensions:

- 11,372.5 rubles for disabled people of the first group;

- 5686.25 rubles for disabled people of the second group;

- 2,843.13 rubles for disabled people of the third group.

As is the case with other recipients of pension payments, disabled people have the right to receive additional payment if their income is less than the subsistence level. Also, disabled people have the right to a unified social payment, which is carried out at the expense of the city budget of St. Petersburg. It represents the difference between the cost of living for disabled residents of the northern capital, multiplied by 1.15 and the citizen’s pension.

By simple calculations we obtain a figure equal to 10,328.15 rubles. It is until this goal is achieved that the city makes additional payments to disabled people. It should be noted that in the Leningrad region there is no unified social payment for persons with disabilities.

The minimum wage in the Leningrad region and St. Petersburg

Every year, the minimum wage increases or decreases based on the general financial situation, both in St. Petersburg and throughout the country. The established indicator is formed annually at the legislative level. This year it is about 7,500 rubles per month. After the administration adopted a new planned strategic project, it was decided to increase its size by 300 rubles per month.

Such an increase will affect all salaries that apply throughout the country.

The initial size of pensions established by current legislation determines the level of payments to working citizens. Below this threshold, wages cannot be paid. This makes it possible to regulate the relationship between employee and employer at the economic level.

In the Russian Federation, all persons who work in budgetary organizations and who are financed from the regional budget, the minimum wage is 7,500 rubles, from 2020 this rate will increase by 4.9 percent The minimum wage in the Leningrad region and St. Petersburg will increase significantly, and will in 2020 will be approximately 16,500 rubles.

Additional measures to support pensioners

Local authorities have adopted a social program that provides for additional payments to various groups of beneficiaries. The indicators are shown in the table:

| Recipient category | Amount of additional payment (RUB) |

| Disabled children of group 1 | 15 434,0 |

| Single disabled people of group 2 | 6 849,0 |

| Home front workers | 1 304,0 |

| Veterans of Labor | 911,0 |

| Repressed and rehabilitated | 2,152.0 – 4,301.0 depending on category |

| Former military personnel who became disabled during military service | 18,706.0 - 3,741.19 depending on the category of disability |

| Pensioners | 600,0 |

| Pensioners born between 06/22/1928 and 09/03/1945 | 1 935,0 |

Conditions for assigning pension benefits

Budget funds are provided to citizens according to the criteria laid down in the legislation.

They are: 1. For old age:

a. insurance is assigned if the criteria for length of service and points are met:

- after 60 years for women;

- after 65 years for men;

- at a different age in the presence of preferential grounds;

- work experience of at least 15 years (this indicator will be relevant by 2024, in 2020 the minimum experience is 10 years, within 5 years it will increase by 1 year annually);

- 30 individual pension coefficients (in 2020, the minimum amount of pension points was 16.2, the required number will increase annually and will reach 30 by 2024)

b. social :

- women who have celebrated their 65th birthday;

- men over 70 years of age;

- foreign citizens and stateless persons permanently residing in the territory of the Russian Federation for at least 15 years and who have reached the specified age;

- state : assigned to citizens affected by radiation or man-made disasters;

- The state pension for long service is assigned to federal civil servants, military personnel, astronauts and flight test personnel.

2. For disability:

- insurance in the presence of disability and at least one day of insurance experience;

- social in the presence of disability and lack of insurance coverage;

- state is assigned to military personnel, citizens who suffered as a result of radiation or man-made disasters, participants in the Great Patriotic War, citizens awarded the “Resident of Siege Leningrad” badge, and cosmonauts;

3. In the event of the loss of a breadwinner, a pension is entitled to:

- insurance is assigned upon the death of the breadwinner, who was dependent on the applicant for pension provision. The main condition is that the deceased breadwinner has an insurance period (at least one day);

- social is assigned to children under the age of 18, as well as over this age, studying full-time in educational organizations, until they complete such training, but no longer than until they reach the age of 23, who have lost one or both parents, and children of a deceased single person mothers;

4. State pension is assigned to disabled family members of fallen (deceased) military personnel; citizens injured as a result of radiation or man-made disasters, astronauts.

For information: people born after 1966 have the right to redistribute part of their savings contributions. This is done by concluding an agreement with the Non-State Pension Fund.

List of documents

To assign pension benefits, you need to contact the territorial Pension Fund office. In this case, the right must be proven documented. The Pension Fund will require the following basic documents:

- passport and SNILS;

- work record book and contracts with employers for periods not included in the main document;

- A certificate of earnings for 60 consecutive months may be required;

- additionally, to increase accruals: information about the presence of dependents and their identity documents;

- children's birth certificates (add points);

- certificate of service in the armed forces or other paramilitary forces;

- preferential certificate;

- certificate of disability assignment;

Hint: documents can be brought to the department a month before eligibility. They will be accepted for consideration, but pension benefits will be assigned from the date the grounds arise.

Conditions for obtaining a pension in the Leningrad region and St. Petersburg

Any person who has reached retirement age can apply for a pension. The type of pension paid is issued to each individual individually, taking into account this or that situation.

Types of pensions:

- on state support;

- insurance;

- cumulative.

For each type of pension, an appointment procedure and certain conditions are established. Also, each category has its own fixed amount, which is issued without fail. The increase in the amount of payments depends on the length of service of the person applying for a pension, as well as the number of pension points collected.

Persons who have Russian citizenship can apply for a pension. The application is reviewed within ten working days. If the Pension Fund employees refuse to accrue a pension, the reasons and further actions must be indicated.

The documents are returned along with the notification. If a citizen does not agree with the refusal, he can challenge the decision in court.

If a citizen sends an application for a pension via mail, then the date of application will be considered the date on the postmark of the letter, and if through a multifunctional center, then the date of receipt of documents.

If a person has the opportunity to send documents via the Internet, then first he needs to register in his personal account on the official website of the Pension Fund, then send scanned documentation along with the application.

What kind of increase awaits pensioners in April 2020?

In April, state pensions, including social ones, are traditionally increased in Russia.

• State pensions are given to veterans, cosmonauts, victims of man-made disasters and other small categories of citizens.

• Social pensions are paid to disabled people and other disabled citizens of Russia. Including the right to receive a social pension are persons who have reached the ages of 70 and 65 years (men and women, respectively).

The social pension will increase by as much as 7 percent from April 1, 2020.

The easiest way to calculate your pension based on the results of the April indexation of 2020 is to multiply its current value by 1.07.

We also took a calculator and did the math. Here's what happened:

- 1. Group 1 disabled since childhood and disabled children: 12,681.09 x 1.07 = 13,568 rubles.

- 2. Group 2 disabled people since childhood, Group 1 disabled people: 10,567 x 1.07 = 11,306 rubles.

- 3. Disabled people of the 3rd group: 4491 rub. x 1.07 = 4,805 rub.

- 4. Citizens who have reached the age of 70 and 65 years (men and women, respectively), Group 2 disabled people (except for those disabled since childhood): 5283 x 1.07 = 5,652 rubles.

These numbers are not official. If we made a mistake in the calculations, please correct us, we will be grateful!

Indexation of social supplements for pensioners in St. Petersburg in 2020

Measures to support residents of the Northern capital are defined in the Social Code of St. Petersburg. There are quite a lot of them. Here are just a few.

✓Monthly cash payment to pensioners

Residents of St. Petersburg who have reached the age of 60 and 55 years (for men and women, respectively) can apply for it.

Its size in 2020 will increase from 600 to 624 rubles.

But pensioners born between June 22, 1928 and September 3, 1945, who fall under the preferential category of Children of War, in 2020 will receive an additional payment of not 1,935 rubles, as before, but 2,012 rubles.

✓Monthly cash payments to labor veterans and pensioners who have worked in St. Petersburg (Leningrad) for at least 20 years

These payments are received by veterans of labor or military service upon reaching the ages of 60 and 55 years (for men and women, respectively). In St. Petersburg, they also equate pensioners who have worked in St. Petersburg (Leningrad) for at least 20 years and have a work experience of at least 45 years for men and 40 years for women.

The payment amount in 2020 will increase from 911 rubles. up to 947 rubles.

By the way, labor veterans and citizens equivalent to them in St. Petersburg also have the right to 50 percent benefits for utility bills and a number of other support measures.

✓Monthly cash payments to home front workers

These payments are received by pensioners living in St. Petersburg who belong to this category of beneficiaries.

The amount of payments in 2020 increases from 1304 rubles. up to 1,356 rubles.

Let us note that this is not a complete list of social support measures for pensioners in the Northern capital.

Please check with the social security authorities of St. Petersburg for the size of payments after indexation in 2020 and the exact categories of recipients!

Providing minimum insurance pensions in St. Petersburg

When taking into account individual coefficients, attention should be paid to the rules reflected in Federal Law No. 400 of 2013.

They are reflected in Article 15 of this act. To obtain information about the status of your personal account, just go to your personal account on the State Services portal. The cost of one point changes every year . This happens as a result of indexing. The prices set in the previous period, which is considered the reporting period, are subject to accounting.

Social benefits are fixed. The amount may increase in some situations. Factors influencing the increase are reflected in legal acts adopted at the regional level. To receive allowances, you will need to have the specified right.

Increase in monthly payments for Leningrad residents in 2020

The calculation of these additional payments is carried out by the pension authority in the country. From year to year this amount is indexed.

A person can apply for such payments if he belongs to a certain category.

These groups include:

- citizens in the age category of 60 years;

- women who do not work and are aged 55-60 years;

- persons who have lost their ability to work, classified into groups 1 and 2.

Pensioners themselves or their representatives can apply for payments.

Additional payments up to the cost of living in St. Petersburg

If the pension benefit is less than the subsistence minimum, then a Leningrader can count on bonuses.

Upon reaching 80 years of age, a citizen begins to receive an increased pension. This occurs as a result of an increase in the size of the fixed insurance payment . Recalculations are made automatically. Therefore, elderly citizens will not need to come to the Pension Fund.

In this case, the average pension in St. Petersburg in 2020 will increase by approximately 5,000 rubles.

An allowance of 1,000 rubles is given to persons with the status of “child of war.” Payment is made using budget funds.

How to get it?

Based on how the PMP indicator in a particular federal subject of the country compares with the federal PMP standard established in 2020, a social subsidy can be determined for an elderly person. It may be local, regional or federal in nature. Let us remind you that in 2020 the level of PMP, regulated by regulatory documents, will be 9,311 rubles .

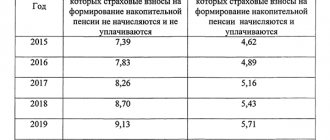

The difference between the federal and regional allowance can be clearly seen from the table below.

| Type of payment | Federal | Regional |

| Where should I go to apply? | To the territorial branch of the Pension Fund | To the social service at your place of residence. The decision to assign a subsidy is made by the local executive authority of the subject of the federation |

| Fund providing financing | Federal budget of the country | Local budget of the region |

| Subsidy amount | In the amount of PMP where this indicator is lower than that established for the country | In the amount of PMP there, it is higher than the federal |

The social supplement to the insurance type of old-age accruals is due from the 1st day of the next reporting period after submitting the application. The subsidy for those who have disabled status or receive survivor benefits will be assigned automatically from the moment they determine the corresponding current payments. There is no need to personally contact the pension department and submit an application for this category of recipients.

A pensioner’s right to receive a subsidy will be lost if he becomes officially employed or moves outside the state on a permanent basis. A person is obliged to notify the pension department and the social security service about these factors in order to recalculate or completely cancel the surcharge.

Terms and methods of receiving payment

After submitting the application, the pension is assigned within ten days. This also applies to city surcharges. They are paid along with the pension at the number determined by the Pension Fund of the Russian Federation, taking into account the order in which the funds are received.

There are two main ways to receive money:

- by mail;

- to a bank account (including card).

You can learn more about the additional payment to pension payments, bringing them to the level of the subsistence level, from this video:

Thus, pensioners of St. Petersburg are entitled to a number of bonuses. The main one is a social supplement to pensions, bringing it to the level of the subsistence level. Certain categories of pensioners have the right to count on additional assistance.

Minimum social payments in St. Petersburg

The size of the social pension in 2020 in St. Petersburg is 6,200 rubles.

Federal Law No. 400 of 2013 “On Insurance Pensions” reflects that a citizen will need to have 9 years of experience in order to retire. There is a minimum number of points that must be accumulated before retirement. This value is 30.

One of the mandatory conditions is that the citizen must register in the pension system. Old age payments can be received by certain categories of persons.

The list includes:

- citizens affected by accidents or man-made disasters;

- government officials;

- astronauts;

- other.

If an elderly person has temporary registration in the region in question, then he has the right to receive payments from the budget. In this situation, it does not matter whether the pension previously included other additional payments established before moving to St. Petersburg.

Where to go for pension assignment and consultations

For advice on the assignment and size of pensions, please contact your local branch of the Russian Pension Fund:

PFR branch for St. Petersburg and Leningrad region

Address: 194214, St. Petersburg, Engels Ave., building 73 (Udelnaya metro station)

Hotline for the population, (812) 292-85-56

Website: www.pfrf.ru

Reception of citizens:

Mon-Thu: 9.30 – 17.00, lunch: 13.00 – 13.45;

Fri: 9.30-13.00;

Sat-Sun: closed.

For advice on the purpose and size of regional social support measures, please contact the relevant social protection authorities of the population of St. Petersburg and the Leningrad region.

Saint Petersburg

Information and reference service of the social protection system of St. Petersburg

Telephone

Hotline operating mode:

Mon-Thu: 8:30 – 17:20,

Fri: 8:30 – 16:20,

Sat-Sun: closed.

Website: iss.ktsz.spb.ru

Leningrad region

Information and reference service of the Center for Social Protection of the Population of the Leningrad Region

Telephone; (81370) 3-88-33.

Operating mode:

Mon-Thu: 09:00-18:00, break 12:00-12:48;

Fri: 09:00-17:00, break 12:00-12:48;

Sat-Sun: closed.

Website: evc.47social.ru

For individual consultations on issues of social support for the population, please contact relevant specialists.