The size of the minimum pension in Russia is set every year depending on the cost of living of the pensioner.

Compare the minimum subsistence level for a pensioner, and, accordingly, the minimum pension, established in different regions of the country.

(continuation,

For data on the regions of the Central Federal District, see this page)

Northwestern Federal District

| Subject name | The cost of living for a pensioner in a constituent entity of the Russian Federation |

| Rep. Karelia | 11846 |

| Rep. Komi | 11534 |

| Arkhangelsk region | 10955 |

| Nenets Autonomous Okrug | 17956 |

| Vologda region | 9572 |

| Kaliningrad region | 9658 |

| Saint Petersburg | 9514 |

| Leningrad region. | 9311 |

| Murmansk region | 14354 |

| Novgorod region | 9423 |

| Pskov region | 9529 |

North Caucasus Federal District

| Subject name | The cost of living for a pensioner in a constituent entity of the Russian Federation |

| Rep. Dagestan | 8680 |

| Rep. Ingushetia | 8846 |

| Kabardino-Balkarian Republic | 9598 |

| Karachay-Cherkess Republic | 8846 |

| Rep. North Ossetia Alania | 8455 |

| Chechen Republic | 9035 |

| Stavropol region | 8297 |

Southern Federal District

| Subject name | The cost of living for a pensioner in a constituent entity of the Russian Federation |

| Rep. Adygea | 8138 |

| Rep. Kalmykia | 8242 |

| Krasnodar region | 9258 |

| Astrakhan region | 8969 |

| Volgograd region | 8569 |

| Rostov region | 8736 |

| Rep. Crimea | 8912 |

| Sevastopol | 9597 |

Volga Federal District

| Subject name | The cost of living for a pensioner in a constituent entity of the Russian Federation |

| Rep. Bashkortostan | 8645 |

| Rep. Mari El | 8380 |

| Rep. Mordovia | 8522 |

| Rep. Tatarstan | 8232 |

| Udmurt Republic | 8502 |

| Chuvash Republic | 7953 |

| Saratov region | 8278 |

| Kirov region | 8511 |

| Nizhny Novgorod region. | 8689 |

| Orenburg region | 8252 |

| Penza region | 8404 |

| Perm region | 8777 |

| Samara region | 8690 |

| Ulyanovsk region | 8574 |

Ural federal district

| Subject name | The cost of living for a pensioner in a constituent entity of the Russian Federation |

| Kurgan region | 8750 |

| Sverdlovsk region. | 9137 |

| Tyumen region | 9250 |

| Chelyabinsk region | 8691 |

| KHMAO-Yugra | 12730 |

| Yamalo-Nenets Autonomous Okrug | 13510 |

Siberian Federal District

| Subject name | The cost of living for a pensioner in a constituent entity of the Russian Federation |

| Rep. Altai | 8753 |

| Rep. Buryatia | 9207 |

| Rep. Tyva | 8846 |

| Rep. Khakassia | 8978 |

| Altai region | 8894 |

| Krasnoyarsk region | 10039 |

| Irkutsk region | 9497 |

| Kemerovo region. | 8387 |

| Novosibirsk region | 9487 |

| Omsk region | 8480 |

| Tomsk region | 9546 |

| Transbaikal region | 9829 |

Far Eastern Federal District

| Subject name | The cost of living for a pensioner in a constituent entity of the Russian Federation |

| The Republic of Sakha (Yakutia) | 14076 |

| Primorsky Krai | 10775 |

| Khabarovsk region | 10895 |

| Amur region | 10021 |

| Kamchatka Krai | 16756 |

| Magadan region | 15943 |

| Sakhalin region | 12333 |

| Jewish auto. region | 11709 |

| Chukotka Autonomous Okrug | 19000 |

Source: Pension Fund of Russia.

What is “minimum pension”

Let us say right away that there is no such definition as a “minimum pension” in the legislation. But it is also clear that we are talking about an amount less than which the old-age insurance pension cannot be. How is the minimum size determined?

To do this, let us pay attention to the concept of long-term socio-economic development of the Russian Federation for the period until 2020. It says that the minimum level of pension is set not lower than the subsistence level of a pensioner in the region of his residence (Part II of the Concept, approved by Order of the Government of the Russian Federation of November 17 .2008 No. 1662-r).

Thus, the cost of living of a pensioner in his region can be conventionally called the size of the minimum old-age pension.

Video: Minimum pension in Russia in 2020

That's why FREE expert consultants work for you around the clock!

- Moscow and the Region

lgotypro.ru

What does the minimum old-age pension consist of?

It happens that a person was assigned an old-age pension, but its amount turned out to be lower than the pensioner’s subsistence level. In this case, he is entitled to an additional payment up to the “minimum wage”. It is correctly called “social supplement to pension” up to the pensioner’s subsistence level. The right to it arises when 2 conditions are simultaneously met:

- absence of work or other activity during which the person is subject to compulsory pension insurance;

- failure to achieve the total amount of material support for a pensioner equal to the minimum subsistence level of a pensioner in the region of his residence.

Keep in mind that in order to calculate the “total amount of material support”, almost everything is taken into account - all cash payments, including pensions and cash equivalents of social support measures to pay for telephones, housing, utilities and travel on all types of passenger transport (urban, suburban and intercity) , as well as monetary compensation for the costs of paying for these services.

The amount of PMP for determining the size of federal and regional social supplements to pensions is established in the whole of the Russian Federation and in each subject of the Russian Federation. So, for 2020 in the Russian Federation it is 8,726 rubles, and, for example, in Moscow – 11,816 rubles.

The pensioner must receive a larger payment (when choosing between federal or regional). Also see “Where to apply for a social supplement to your pension: to the Pension Fund or Social Security?”

Who is entitled to

Residents of the Tambov region have rights to receive a pension in the following cases:

The number of points received directly depends on the citizen’s salary and the amount of insurance premiums paid. Payments are made by the employer without the participation of the citizen.

Every year, while a citizen is officially employed and regularly makes contributions, he accumulates pension points and develops pension rights. The amount of the pension ultimately depends on these contributions.

Are indexations taken into account when determining the minimum pension amount?

Insurance pensions of non-working pensioners were indexed from January 1, 2020 to 3.7. The cost of one pension coefficient after the increase was 81.49 rubles, and the size of the fixed payment was 4,982.9 rubles.

Social pensions have been indexed since April 1, 2020 by 2.9%, taking into account the growth rate of the cost of living of a pensioner in the Russian Federation over the past year.

As a result of indexation of insurance and social pensions in 2018, the average amounts of old-age pensions in Russia were:

- old age insurance – 14,151 rubles;

- social pension – 9,062 rubles;

These figures are provided by the Pension Fund on its official website.

The cost of living for a pensioner has not changed in any way due to the aforementioned indexations in 2020. Therefore, the minimum old-age pension remained at the same level. On many Internet sites you can find tables with strange amounts as minimum pension amounts, where the cost of living is indexed by an indexation factor. This is fundamentally wrong. The minimum cost of living for a pensioner remained at the same level. No need to index it!

From May 1, 2020, the minimum wage was equalized to the subsistence level. Now the federal minimum wage is 11,163 rubles. However, this increase also did not in any way affect the size of the minimum old-age pension, since the pensioner’s cost of living did not change). Its size for determining the amount of additional payment to the pension is established in accordance with the Federal Law of the Russian Federation of October 24, 1997 N 134-FZ “On the cost of living in the Russian Federation” for the country once every next year . In the constituent entities of the Russian Federation, the size of the subsistence minimum for determining the amount of social additional payments is also established once a year no later than November 1 of the current year.

Self-study documents

Decree of the Government of the Russian Federation N 975 “On approval of the Rules for determining the cost of living of a pensioner in the constituent entities of the Russian Federation in order to establish a social supplement to pensions” (07/30/2019)

Federal Law N 178-FZ “On State Social Assistance” (04/24/2020)

Federal Law N 134-FZ “On the subsistence minimum in the Russian Federation” (04/01/2019)

Law of the Tambov Region N 26-з “On the living wage in the Tambov Region” (07/05/2013)

Did you find this information useful?

1 9

Conditions for obtaining a pension in Tambov and the Tambov region

The pension is issued in accordance with the rules prescribed by the current acts. According to them, every citizen has the right to receive appropriate monthly contributions from the fund. The main condition for payments is that pensioners have work experience. To confirm it, when contacting fund branches, citizens need to provide written evidence in the form of certified documents from the employer. Also, in order to receive benefits, a person must have the appropriate age specified in legal acts. You must submit your application and papers at your place of residence or registration. When checking an application, employees also have the right to contact the citizen with a request to receive additional papers in order to confirm the information necessary for the calculation of funds. The total period for consideration of the submitted application is about 10 days. During this time, the submitted data is checked and pension payments are calculated for each subsequent month.

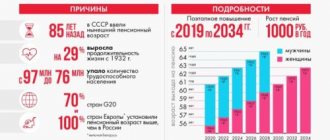

Paths for reform

Issues related to pension reform, as in other countries, tend to be sensitive. Not only are the fiscal stakes high, but retirees are an important voting bloc for the president.

Firstly, there is the issue of retirement age. The OECD average in 2019 was 64.6 years for men and 31.1 years for women. In Russia these figures are 65 and 60 respectively. Taken alone, the early retirement age represents an increased fiscal burden, but it also comes as Russia faces a demographic crisis, especially in the next decade. The problem is not so much that “Russia is dying,” a popular narrative that is not actually true, but that the ratio of workers to retirees is declining.

All this is the case, and barring fairly significant changes, pensions will become an increasingly large and likely unsustainable fiscal burden. The current plan for the retirement age is to gradually increase it to 65 years for both men and women (it should be increased from 6 months to a year per year after the reform). The government has already started implementing a higher retirement age for civil servants. But, I repeat earlier, this will be a delicate process that will require careful management.

Another important reform measure that has been discussed is the implementation, planned for 2020 or 2020, of the Private Pension Fund program to replace the funded portion. The new format will be a voluntary contribution to the wage fund of up to 6% on top of the 22% rate, which will be allocated entirely to the insurance pension. Perhaps most importantly, the Ministry of Finance and the Bank of Russia have assured that money contributed in excess of the 22% payroll tax will belong to citizens; is no longer an additional source of funds for the federal budget during a crisis. This would be an important step, as the continued freeze would not only reduce the incentive to save, but would also encourage participation in black/grey market employment.

When Russian authorities talk about structural reform, a term that has become something of a buzzword, pensions are a key issue. Given the percentage of the budget they make up, discussions on rejuvenating (or revitalizing) the Russian economy cannot be considered a major missing pension reform. The steps taken to address the problem so far are perhaps indicative of the authorities' approach to structural reform in general: "peripheral" measures that make the existing system marginally better, but do not address the fundamental problems that need to be overcome.

Average size of insurance pension in Tambov and Tambov region

The region and city of Tambov has an average value of insurance premiums for citizens in the amount of 11,700 rubles. As of spring 2020, throughout the Tambov region, 147,800 citizens were registered as receiving pension benefits. Every year, the government of the country carries out planned indexation of the funded parts of the pension savings of citizens living in the country. In one year, several promotions may occur over certain periods of time. In the spring, the level of payments was increased by 1.5%. This increase in interest subsidies applies to all categories of citizens of retirement age. All monetary savings in citizens' funds increase in payments annually. Their growth affects the economic situation in the country. A specific area may also provide certain increased levels of payments for its residents. It all depends on the regional coefficient and categories of working citizens in such regions.

Where to contact

PFR branches in Veliky Novgorod are located at the following addresses:

| Address | Telephone |

| St. Zelinskogo, 9b | 8(816)298-74-24 |

| St. Bolshaya Moskovskaya 60, | 8(816)263-57-50 |

| St. Tikhvinskaya, 11/16 | 8(816)277-21-12 |

For reference! Reception of citizens on general issues is carried out on weekdays from 08:00 to 17:00.

The minimum wage in Tula and the Tula region

The amount of monthly wages an employer pays to its employees is regulated at the legislative level. This measure is necessary so that workers for their work can receive money not lower than the level for living. The accepted amounts in the bills are regulators and make it possible to control the minimum earnings of citizens. Today this amount is equal to 7,500 rubles. Every year the government passes a bill to increase this level of payments. At the last session, it was decided to increase the size of payments to 300 rubles. Changes of this kind will affect all wages in the country. In the Tula region and the city of Tula, the minimum level of wages paid is within 11,000 rubles per month. The statutory amount may be higher. It depends on what the current economic situation is in the region and how much the minimum work of a worker is estimated for a certain time.

How to apply

To apply for pension benefits, you must contact the Pension Fund at your place of actual residence. To do this, the following package of documents is collected:

- passport;

- work book, documents on length of service not included in the work book;

- SNILS;

- military ID.

In addition, Pension Fund employees may additionally request certificates confirming the right to preferential retirement, information about state awards and other documents that could affect the size of a future pension.

Basic provisions

Pension benefits are assigned upon reaching a certain age and are due to all Russian citizens without exception. In addition, the established amounts are indexed annually.

The exception is employed pensioners, for whom pension indexation is not provided. However, this category of citizens can count on recalculation of their pension in full after they stop working. If the total income of a non-working pensioner does not reach the established minimum subsistence level, the pensioner may qualify for a social supplement to the pension.

1. By old age:

a. insurance is assigned if the criteria for length of service and points are met:

- after 60 years for women;

- after 65 years for men;

- at a different age in the presence of preferential grounds;

- work experience of at least 15 years (this indicator will be relevant by 2024, in 2020 the minimum experience is 11 years, within 4 years it will increase by 1 year annually);

- 30 individual pension coefficients (in 2020, the minimum amount of pension points is 18.6, annually their required number increases by 2.4 and will reach 30 by 2024)

b. social :

- women who have celebrated their 65th birthday;

- men over 70 years of age;

- foreign citizens and stateless persons permanently residing in the territory of the Russian Federation for at least 15 years and who have reached the specified age;

- state : assigned to citizens affected by radiation or man-made disasters;

- The state pension for long service is assigned to federal civil servants, military personnel, astronauts and flight test personnel.

2. For disability:

- insurance in the presence of disability and at least one day of insurance experience;

- social in the presence of disability and lack of insurance coverage;

- state is assigned to military personnel, citizens who suffered as a result of radiation or man-made disasters, participants in the Great Patriotic War, citizens awarded the “Resident of Siege Leningrad” badge, and cosmonauts;

3. In the event of the loss of a breadwinner, a pension is entitled to:

- insurance is assigned upon the death of the breadwinner, who was dependent on the applicant for pension provision. The main condition is that the deceased breadwinner has an insurance period (at least one day);

- social is assigned to children under the age of 18, as well as over this age, studying full-time in educational organizations, until they complete such training, but no longer than until they reach the age of 23, who have lost one or both parents, and children of a deceased single person mothers;

4. State pension is assigned to disabled family members of fallen (deceased) military personnel; citizens injured as a result of radiation or man-made disasters, astronauts.

5. The funded pension is paid together with the insurance if the applicant has entered into an appropriate agreement with the Non-State Pension Fund. Persons born after 1966 have the right to such rights.

For certain categories of citizens, a preferential retirement age is provided.

This includes:

- citizens employed in underground work, work with hazardous working conditions, hot shops, work with difficult working conditions;

- teachers and doctors with 25 and 25-30 (depending on the area) years of experience in their specialty, respectively;

- women who gave birth to three children and raised them until they reached the age of 8 years;

- one of the parents of disabled people since childhood, who raised them until they reached the age of 8 years;

- persons who have worked for at least 15 years in the Far North

- other.

Important! The minimum insurance period required to receive a retirement pension will gradually increase. Following this trend, retirees who will retire in 2025 will need to have at least 15 years of active service.