Social assistance for those who cannot support themselves in old age, due to disability, or loss of a breadwinner, is an important issue for millions of people around the world. The Spanish authorities have managed to create a reliable pension system that helps the disabled to constantly feel the help and protection of the state. And although the pension in Spain in 2020 is inferior in size to payments in Germany, Spanish pensioners have the opportunity to live calmly and comfortably.

Types of pensions

In Spain, pensioners receive the following types of pension payments:

- Regular pension. It is calculated based on length of service and age. Paid from the state social insurance fund. The fund's budget is formed on the basis of contributions from the working population of the Kingdom of Spain. Every month, workers contribute 6.35% of their wages to social security tax.

- Disability pension. Children born with disabilities and people who received some type of disability in the process of being injured are entitled to receive these payments.

- Survivor's pension. This type of pension benefit is paid to the children or spouses of deceased men.

In addition, there is also a social and private pension. A private pension involves a Spanish resident making a monthly contribution to a fund of a certain amount.

Upon reaching retirement age, the money is returned to the person in the form of an increase to the basic pension.

Return to contents

Personal pension fund

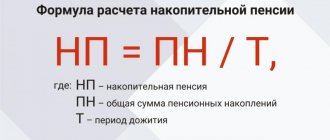

By old age, you can accumulate a substantial additional amount under an additional pension agreement - Plan de Pension.

Program participants make monthly fixed contributions of 50-100 euros to special funds managed by banks. Savings in different shares are invested in programs with fixed and variable income. The second option is more profitable, but riskier. Choosing a reliable fund is not easy - you need to compare profitability, commissions and other factors.

The accumulated money is inherited, it can be received ahead of schedule in case of a serious illness, work injury, or long-term unemployment.

This program is fully stimulated by the state - savings are co-financed from the treasury, benefits and tax breaks are provided. Thus, the deduction from the tax base for different age categories ranges from 30 to 50%.

Despite the obvious benefits, less than 20% of Spaniards participate in endowment insurance , while in Germany - more than 70%.

Spaniards start contributing to a supplementary pension at a young age. Photo: flickr.com/ansesgob

Conditions of retirement

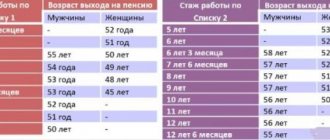

The payment of pensions in Spain is regulated by the legislation “On Social Security”. According to this law, residents over 67 years of age and with at least 15 years of work experience in Spain are entitled to receive an old-age pension.

Return to contents

Early exit

Early retirement is possible only if a person has at least 30 years of work experience in this kingdom. But if during this period a resident of Spain quit of his own free will or was on the labor exchange for more than 6 months in a row, then his pension is reduced by 7%.

Due to the large number of pensioners in relation to the working population, the Spanish government decided to raise the retirement age to 67 years

Citizens of this state who worked before January 1, 1967 have the right to retire early (at age 60) . You can retire before the age of 65 only if the person’s working experience is more than 38 years and 6 months, and he has been making contributions to the social insurance fund all this time.

Where you can find work in Spain, see here.

We have an informative video about the types of pensions in Spain

Return to contents

Who can retire early?

Other categories of people eligible for early retirement:

- People whose work involved hazardous substances and hazardous working conditions.

- Marine workers.

- Mining industry employees.

- Miners.

- Railway workers.

- Agricultural workers.

- Toreadors.

- Workers on gas and oil platforms.

Return to contents

What are the difficulties within the social system?

When we figured out what the average pension in Spain is for Russians and residents, it is worth remembering that difficulties may arise in calculation.

The main reason for the difficulties is that fewer people are born in the country than leave and die. That is, the number of able-bodied citizens is gradually decreasing. If life expectancy remains at the same level, then there will be no one to support pensioners. In addition, the unemployment rate is quite high, the main unemployed are young people. In search of earnings, they leave, work illegally, and do not make deductions.

Another category is adult children and grandchildren supported by their elderly parents. They do not strive to earn money, since the older generation provides everything for them. They don't need to look for a specialty. This is a side effect of the functioning of the pension system. In Spain there are a large number of people who, after 67 years, have not left work and continue to work. Now the state allows them to do this; before they did not have this opportunity; they had to retire or work unofficially. When he remains at work, a person receives only half of his well-deserved pension, but this suits the majority. True, it will no longer be possible to get a job in the public service, but in any private organizations you can continue to increase your experience.

Residents who are ready to retire must be 67 years old, or 65 if they have already worked 38.5 years. Social Security chiefs must regularly find money to cover persistent shortfalls in the elderly fund.

We examined many difficulties in the operation of the pension system of a European country, indicated the amount of the minimum old-age pension in Spain for Russians in the exact amount, taking into account all the nuances. We studied payments for citizens of Spanish cities, ways to increase the volume of subsidies and the problems faced by the government in promoting the reform. You can receive benefits in this state if you follow the rules. There is a wonderful climate and decent working conditions, but it’s worth weighing all the advantages and disadvantages of making a decisive move in advance.

Pension amount

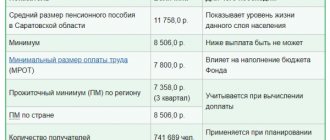

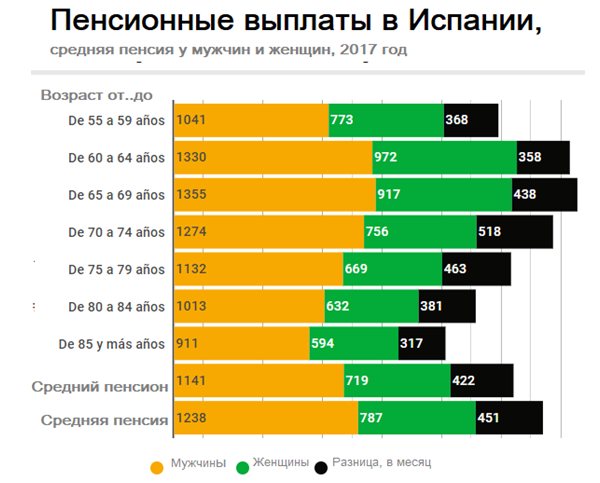

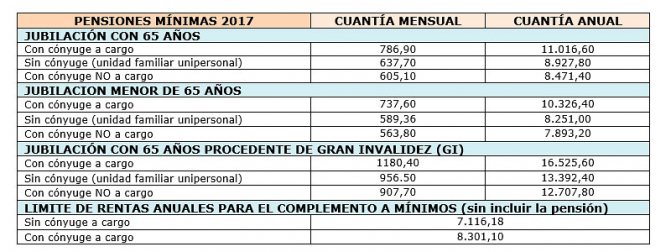

The minimum pension in the Kingdom of Spain is 636 euros, and the maximum is 2567 euros. The average pension in Spain in 2020 is 987 euros.

Pension rates in Spain

The size of the pension in Spain depends on the length of service, the salary received and working conditions. The more work experience a person has, the larger his pension will be. If a person has officially worked for more than 25 years, then his pension is automatically increased by 2% of the established amount. With a working experience of 25 to 37 years, a resident of the Kingdom of Spain can expect an increase of 2.75%. If the work experience is more than 37 years, the pension increases by 4%.

Return to contents

Pension supplements

In addition to the old age pension, a person can receive the following types of pension benefits:

- Due to disability. Disabled people and people who have received any disability group are given a pension of 948 euros. Disabled pensioners receive a supplement to their old-age pension of 316 euros per month.

- For the loss of a breadwinner. The pension in Spain is 648 euros.

Watch the video about pensions in Spain

Return to contents

How does the state support the unemployed?

To receive support from the state in case of unemployment, you must have a work history in Spain and pay contributions to the social insurance system. The amount of the benefit depends on how long a person has worked and is assigned to people from 15 to 66 years old.

By law, Spaniards are entitled to unemployment benefits if they have worked for at least a year in the previous 6 years and are registered with the employment service.

The usual benefit amount is approximately 70% of previous earnings. If a non-working person has children, the benefit can be up to 80% of earnings.

Spain has bilateral agreements on social assistance for unemployed people with Russia and Ukraine, therefore, for emigrants from the CIS who did not work in Spain, in problematic situations - in case of sudden disability or loss of a breadwinner - a minimum benefit is provided.

Autonomy pension

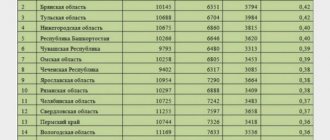

It is known that the size of the pension directly depends on the pensioner’s salary, which he received before retirement. And wages, in turn, depend not only on the specialty, but also on the region in which a person lives and works. Therefore, we can conclude that the size of pension payments is also influenced by the region .

Table: pension amounts for different autonomies of the Kingdom.

| Autonomy | Pension amount per month (expressed in euros) |

| Navarre | 1047.91 |

| Asturias | 1077.69 |

| Madrid | 1080.00 |

| Basque Country | 1133.00 |

| Extremadura | 761.00 |

| Galicia | 771.34 |

| Murcia | 803.52 |

| Andalusia | 821.40 |

| Valencia | 841.70 |

| Canary Islands | 842.71 |

| Castile-La Mancha | 843.43 |

| Balearic Islands | 844.04 |

| Rioja | 887.31 |

| Castile and Leon | 897.96 |

| Catalonia | 948.15 |

| Cantabria | 958.53 |

| Aragon | 958.92 |

Job offers in some cities in Spain:

- Madrid;

- Barcelona;

- Valencia.

Return to contents

Pension for the unemployed

Citizens of Spain who live in this country, but do not have work experience, also have the right to apply for a pension benefit. A social pension is provided for this category of the population in Spain.

The size of the social pension ranges from 458 to 1375 euros per month.

People who have lived in the Kingdom of Spain from 16 to 67 years of age for at least 10 years are eligible to receive it. Such people must have an income below the subsistence level (645 euros).

Return to contents

Tax system

Both residents and non-residents employed in Romania are required to pay income tax at a rate of 16%.

The amount of the contribution for the sale of real estate is presented in the table:

| Ownership period of the object, years | Sum | Bid |

| Until 3 | Up to 430 € | 3% |

| Over 430 € | 2% + 1285 € | |

| More than 3 | Up to 430 € | 2% |

| > 430 € | 1% + 860 € |

Land tax varies depending on location: in urban areas, the rate translates to approximately 0.28 rubles. up to 16.30 rub. for 1 sq. m., in the agricultural part - cheaper. If the location of the plot is an unfavorable zone, then the owner does not need to pay taxes at all.

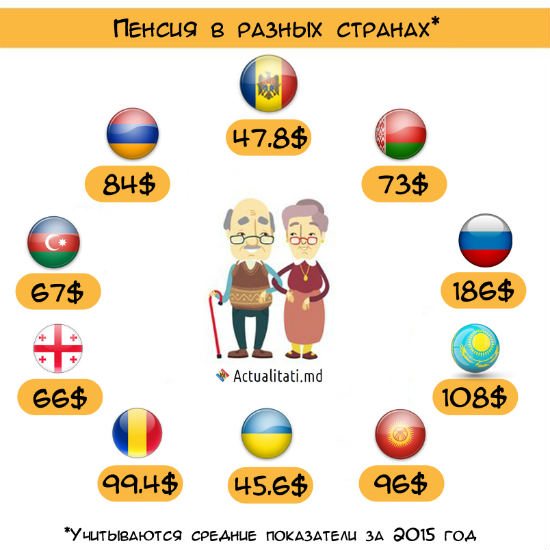

Pension for Russians

Since 1996, all immigrants from the Russian Federation who officially work in the territory of the Spanish Kingdom have the right to apply for a Spanish pension.

Requirements for Russians wishing to receive a pension in Spain:

- Total work experience of at least 15 years.

- Working experience in Spain for at least 1 year. Sometimes one year of work may not be enough to receive a pension, so you should find out this information from the pension fund.

Subject to these conditions, a resident of Spain has the right to claim a Spanish pension in the amount of 650 euros monthly. If the length of work directly in Spain is longer, the person will receive higher pension payments.

Return to contents

How to receive a pension in Spain as a citizen of the Russian Federation

Russian citizens can apply for a pension 2 times. The first time the pension is issued directly in the Russian Federation, and the second time in Spain when the person reaches 67 years of age.

Example: A Russian worked in Russia for 12 years and 4 years in Spain. He has the right to first apply for a pension in Russia at the age of 60 (for women at 55) and after 7 years a pension in Spain. When applying for a pension in the Kingdom of Spain, the Russian pension will no longer be paid to him. But there is one important nuance here. When a person begins to apply for a pension in Spain, the entire amount paid to him in Russia will be withheld.

To apply for pension payments in the Kingdom of Spain, a person will need to submit documents such as:

- Application in the prescribed form.

- Extract from the Pension Fund of the Russian Federation. The document must indicate the total length of service and the amount of pension.

- Employment history.

- Residence permit in Spain. Let us remind you that you cannot officially find employment for a long time in Spain without a residence permit.

Residence permit in Spain

All documents are translated into Spanish and certified by a notary. The registration process lasts up to 6 months.

Return to contents

Specifics of the educational system

Studying for Russians in Romania provides for the appointment of targeted scholarships. Some may even receive a grant.

Preschool education

You can start attending kindergarten at the age of 3. From 6 to 7 years of age, children prepare for secondary education.

Schools

Primary education lasts 8 years. Classes are held from 7 am to 8 pm in 3 shifts. Up to grade 4, a five-point system is used, then a ten-point system. Afterwards, children move to secondary school, where they receive compulsory knowledge for 2 years, and then expanded knowledge (grades 10-11).

Getting higher education

Studying at a university involves several options: regular form, short course and open correspondence course. Universities in Romania have requirements for documents, the exact list of which can be found on the website of the institution or embassy.

Problems in the country and reforms

Today, Spain is experiencing a demographic crisis, that is, the birth rate has sharply decreased, and the number of elderly people is only increasing. This situation indicates that in 15–25 years the working-age population will not be able to provide the required amount of cash flow to pay pensions to the elderly. This means that the country will experience a government budget deficit.

Today, the Kingdom of Spain is home to 7.8 million people over the age of 65 and only 7 million children under the age of 14. Therefore, the state government decided to increase the retirement age from 65 years to 67 years.

Return to contents

About the structure of the Romanian pension system

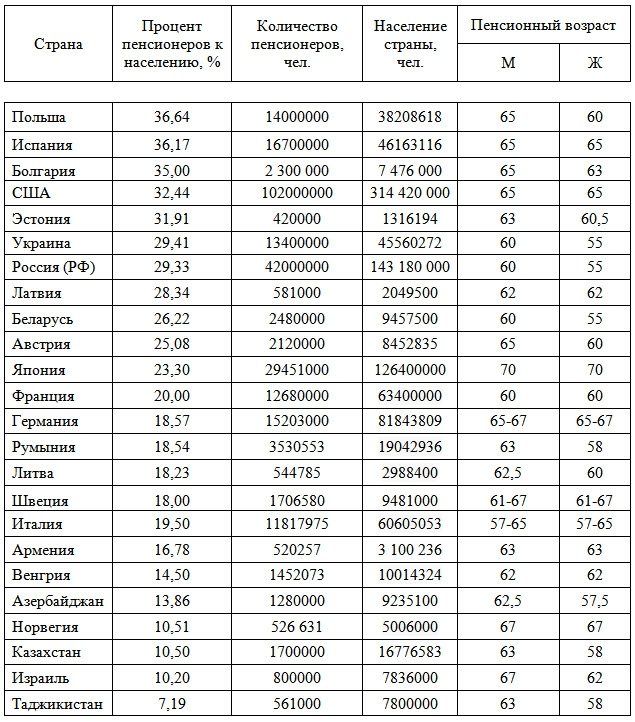

According to statistics in the European Union, Poland, Bulgaria, the Czech Republic, Yugoslavia, and Latvia are in the most critical situation. Of the named countries, Romania closes the list of countries. Romania is considered one of the poorest countries in Europe.

The minimum pension is 850 RON (13,900 rubles or 5,200 hryvnia), which is 10 times less than, for example, in Belgium.

Pension provision is still afloat, as the state is trying in every possible way to plug social gaps in the budget.

Among the countries represented in 2020, Romania took 4th place .

The structure of the Romanian pension system is based on a state pension fund, which concentrates the contributions of working citizens.

Today there are more than 5 million pensioners . If we compare the pension system of Romania with other EU countries, it is built on the principles of alternative savings opportunities, as in all other countries.

The crisis of the pension system is being led by the general economic crisis, which exposes the budget. States are forced to take preventive measures, which is reflected in the size of pensions.

For comparison: citizens who already reached retirement age several years ago, starting from 2020, receive a minimum pension of about $103 (6,695 rubles), the average is approximately $223 (14,495). Citizens with extensive work experience can receive up to $560 (36,499).

In Latvia, where the retirement age has long been 62 years and 9 months, the average pension level has increased from 139 euros (9,730 rubles) in 2015 to 250 euros (17,500) in 2020.

| 2015 | 2016 | |||

| Romania | Latvia | Romania | Latvia | |

| In Euro | 198 | 139 | 222 | 250 |

| In rubles | 12870 | 9730 | 14430 | 17500 |

Basic expenses

- Public utilities,

- Telephone.

- Electricity.

- Satellite television.

Benefits provided by the state

- Purchasing medications.

- Free travel on public transport.

- Discounts on travel around the country several times a year.

Utilities are very expensive in Romania, but food prices are affordable, so some pensioners, without particularly tightening their belts, but also without being luxurious, can afford to travel around the country, eat normally and buy the minimum necessary medicines.

Pensioners who want to get a job can do so, but only in private structures, otherwise they may lose their state pension.

Those who have a minimum pension receive a subsidy from the state - $100.

The pension crisis in the country began in 2008, so the government was forced in 2010 to issue a law raising the retirement age for men to 65 years, starting in 2011. Women will also face the same fate, but this will happen gradually until 2030.

As an alternative to the state pension fund, commercial investment funds have been created in the country, but their demand is very low, since the level of wages at enterprises is so low that people may be afraid to use the services of private structures.

Benefits in retirement

Pensioners in Spain rarely experience financial difficulties. Firstly, they have quite large pension benefits, which allow them not only to provide for themselves, but also to visit other countries. Secondly, a lot of benefits are provided for older people, such as:

- Free medical care. This applies not only to going to the doctor and getting tested. Many beneficiaries receive the medications they need at a 90% discount.

- Free or discounted travel on public transport. On many types of transport, pensioners have discounts from 50 to 90% of the total cost of a travel ticket.

- Discounts ranging from 10 to 50% on cinema visits.

- Free or reduced admission to museums. Often you can only visit public museums for free, such as the Reina Sofía in Madrid or the Museo Nacional de Arte de Cataluña.

How is the pension calculated in Spain? - Reduced cost of education. Surprisingly, Spanish pensioners show great interest in self-education even in old age. The most popular areas among retirees are foreign languages, art, philosophy and economics. Receiving additional education for retired people costs only 300 euros for the entire course of study.

- Discounts ranging from 25 to 75% on visiting sports sections.

- Discounts on purchases. Trading companies offer pensioners special cards that allow them to buy food and other goods without value added tax.

Return to contents

Features of provision

Everything is done to ensure that every person feels protected and does not worry about what his life will be like abroad in old age. The main requirements are as follows:

- reach 67 years for men and 65 for women to receive old-age benefits;

- have a total work experience with payment of social contributions of at least 15 years.

If both of these conditions are met, then you can count on a decent monthly amount. In addition, pensioners have access to a discount on the purchase of medications from 60 to 90% of their full cost and can receive free medical care.

Travel on public transport depends on the region - you can use it without paying or at reduced rates.

The state provides residents with interest clubs, the opportunity to attend excursions and go to the sea. Special discos are initiated especially for senior citizens.

Life of pensioners in Spain

Spain is among the top 10 countries most suitable for retirement. Pensioners in Spain lead an active lifestyle. Many of them quit their jobs, devoting their free time to travel, hobbies, or helping loved ones. Life in Spain is at a fairly high level.

The leisure time of Spanish elders is very varied. There are centers all over the country that offer older people a fun way to spend their time. At these centers, retirees study mathematics and computer science, do gymnastics or dance, embroider or sew, practice choral singing, or practice porcelain or pottery making skills.

Current prices for products in Spain - the next video is about this

Minimum pension in Romania

In order to prepare an assessment of the economic impact of the system of mandatory procurement components and subsidized electricity by August 1, a specialized working group met for the first meeting, the Ministry of Economy reports. April 27, 2020 In the last days of April and early May, warmer air masses will arrive and the thermometer can reach 23 degrees, but the warmth will be accompanied by showers and thunderstorms, reports the Center for Environment, Geology and Meteorology.

At a meeting of the EC Standing Committee on Plants, Animals, Food and Feed, 16 votes in favor banned the use of active substances - thiamethoxam, imidacloprid and clothianidin - plant protection products in open agricultural areas. Several countries, including Latvia, have strong objections to this ban, says the Peasant Diet society.

27 April 2020 In the second half of this year, 152 soldiers from the Slovak Armed Forces will join the NATO Enhanced Presence Battle Group in Latvia, the Ministry of Defense reports. April 27, 2020 Retail trade turnover in Latvia, according to calendar-adjusted data in constant prices, grew by 6.5% in annual terms in March, reports the Central Statistical Office.