NPF Magnit is a full participant in the pension services market. The foundation began its work in 1995 in the format of the Virtue organization, changing its name to its current name in 2009.

At first, the fund specialized in non-state support. After the pension reform, the structure is also engaged in compulsory insurance in this area.

NPF Magnit website

Now Magnit is an excellent alternative for people who do not want to accumulate savings in a government structure. On the official website of NPF Magnit you can find all the information about the fund’s activities:

- Direction of work;

- Divisions and management structure;

- Investment policy;

- Basic indicators;

- Programs.

The goal of the Magnit organization is to effectively manage the target savings of the personnel of the company of the same name, as well as other citizens. The work is aimed at minimizing investment risks.

To accomplish these tasks, the fund invests money in securities, various programs, foreign exchange and other instruments that provide increased profitability. Savings continue to be invested even after citizens retire. Accordingly, their income increases.

Funded pension amount

Sexuality Never do this in church! If you are not sure whether you are behaving correctly in church or not, then you are probably not acting as you should. Here's a list of terrible... Christianity Unforgivable Movie Mistakes You've Probably Never Noticed There are probably very few people who don't enjoy watching movies. However, even in the best movies there are mistakes that can be noticed by the viewer... Movies If you have one of these 11 signs, then you are one of the rarest people on Earth What kind of people can be classified as rare? These are individuals who do not waste time on trifles.

Their view of the world is broad... New Age Top 10 Broke Stars It turns out that sometimes even the greatest fame ends in failure, as is the case with these celebrities...

NPF rating

Every future retiree is interested in choosing a structure with the most attractive conditions. As of last year, 69 non-state funds officially operated in the Russian Federation. However, more than 90% of all savings of the country's citizens are managed by the ten most successful organizations.

Ratings help you understand the situation in a given market and make the right choice.

One of the key indicators of fund performance are reliability ratings. Russians especially trust data from the well-known agency “Expert RA” and the National Rating Agency. In 2020, NPF Magnit did not participate in the formation of these ratings.

Services of NPF Magnit

JSC NPF Magnit provides services to citizens and employers who seek to increase the attractiveness of their organization for potential employees and attract valuable specialists. The fund's activities extend to additional pension provision, including early, as well as compulsory insurance.

In essence, NPF clients transfer the savings portion from the Pension Fund to the management of a non-state structure. At the same time, the citizen remains part of the state system and does not suffer any financial losses.

By voluntarily depositing funds into an individual account, the client can count on additional payments to his pension throughout his life or for a specified period.

Reliability of the Magnit pension fund

The reliability of the fund is ensured by the competent investment of pension savings and reserves. Three management companies are responsible for these issues.

Good to know! The Central Bank of the Russian Federation considers excessive returns on funds as evidence of investing in too risky assets. However, some excess of the indicator above the inflation rate is regarded as normal.

True, this does not apply to 2020, with inflation below 3%; the profits of all non-financial enterprises that operated without losses significantly exceeded this level.

Level of trust in NPFs, NAFI survey

Percentage of respondents who answered “I completely trust” and “rather trust” to the question “How much do you trust non-state pension funds?” The NAFI initiative all-Russian survey was conducted in July 2020. 1,600 people were surveyed in 140 localities in 42 regions of Russia. Age: 18 years and older. The statistical error does not exceed 3.4%.

| 2012 | 2013 | 2014 | 04.2015 | 11.2015 | 07.2016 | 07.2017 |

| 19% | 19% | 19% | 19% | 22% | 24% | 15% |

In general, in 2020, the majority of Russian non-state pension funds showed that they know how to manage pension deposits. Despite the devaluation of the ruble, the profitability of most of them is higher than the inflation rate. And which NPF is the best - reliable or profitable - is up to you to decide.

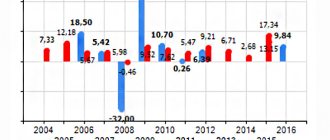

Profitability of the Magnit pension fund

As for the profitability of NPF Magnit, according to the Central Bank, it amounted to 9.37% at the beginning of this year. According to this indicator, the fund took 23rd position among all non-state structures.

At the same time, the fund demonstrates fairly high performance. During his work, profitability was close to 100% per annum. Data for the end of 2020 can be found in the public domain. For this period, the indicators were as follows:

- The volume of savings exceeded 7 billion rubles;

- The yield was 11.77% per annum;

- The level of accumulated profitability is 107.21%.

The organization's strategy is focused on exceeding the inflation level, as well as using the safest financial instruments. Important! Savings are under reliable state protection through cooperation with the DIA.

sovetnik36.ru

The latter can pay contributions in their own favor or on behalf of relatives. In the case of non-state pension provision, the amount of payments depends on the amount of funds in the private account.

The term of payments and their frequency are also taken into account. In the NGO system, the investor directly decides what will be the period for participants to receive a non-state pension. The minimum period is 5 years.

Reliability The total return of NPF "Magnit" remains within 11%. The reliability of investments is guaranteed by a strategy that is focused on exceeding inflation rates and is based on the use of the safest financial instruments.

Investments of the fund's funds are carried out by Premier League and Kapital. Opinion The activities of NPF “Magnit” are assessed very ambiguously. It is a solidarity payment system.

Contributions to it are paid by all employers for the people they hire.

Procedure for registration and termination of an agreement with the fund. List of documents

Drawing up an agreement with a non-state pension fund serves as a guarantor of an increased pension. The document indicates the size of payments, terms of contributions, their total quantity. NPF representatives draw up a pension accumulation plan based on these data. Investments go to a personal account, which is opened for each investor.

Helpful information! A citizen must write an application to the Pension Fund to transfer money to the NFP. For applications written before the end of the calendar year, changes are made to the register three months in advance. After this, the savings are transferred to a non-state fund.

To complete the contract, you must provide:

- Depositor's passports;

- SNILS;

- Statements;

- Client questionnaire;

- Consent to work with personal information.

In case of termination of the contract, you will have to submit an application to the new NPF, indicating the option for subsequent management of the funds.

Pros and cons of the fund

The decision to change the fund should not be made hastily. It is necessary to analyze all the pros and cons of the organization. For example, the advantages of NPF Magnit include access to information about the account status, programs in which funds are invested, and investment performance for a certain period.

After the client retires, his funds are still invested, and an annual recalculation is made to account for profits.

The downsides are the inability to predict the level of profitability and the theoretical possibility of losing the NPF license.

Reviews

I am pleased with the cooperation with Magnit, I am an employee of the network of the same name, I have income, the fund works stably

Igor Ivanovich, Krasnodar

The activities of the NPF do not cause dissatisfaction, unlike the work of the employees of this fund, they are rude everywhere, not even the hotline

More on the topic Russian Pension Fund hotline Tver phone 8-800

Oleg Petrovich, Tuapse

Thus, to join a non-state pension fund, you initially need to study all the positive and negative aspects and draw a conclusion. The activity of the magnet has not been assessed by experts for reliability, so you need to analyze the company’s work yourself.

Reviews from existing clients and investors of the organization are few and far between online. However, according to some responses, citizens experience difficulty in severing relations with the fund, since the termination system is not entirely clear. Moreover, there are complaints that people do not receive signed contracts, which complicates the procedure. How true this is is unclear.

Therefore, clients can leave reviews on our portal through a special form. Thanks to the expressed opinion, market participants will be able to draw their own conclusions when deciding to join NPF Magnit.

NPF Magnit is one of the first non-state pension funds in Russia. Already in 1995, this company began working with citizens of the Russian Federation. During the existence of the fund, considerable profits have been accumulated. Now this figure is as close as possible to 100% for the year.

Previously, this company was called NPF “Dobrodetel”. For a long time, she had only one offer for clients - non-state pension provision. However, already in 2006, the OPS program was added, and in 2009, the leaders of Tander CJSC decided to rename the fund to NPF Magnit. Since that time, active work began to increase the client base.

Magnit has become an excellent alternative for people who do not want to keep savings in the State Pension Fund (PFR). The purpose of creating this organization is long-term partnerships with insured citizens of Russia.

When evaluating the fund, we can highlight the following advantages:

- There is always an opportunity to find out about the state of the account, the programs in which pension savings are invested and the results of these programs for a certain time period.

- Investment of the insured client's funds continues even after the citizen reaches retirement age. Therefore, the calculation of the pension is carried out taking into account this profit. Recalculation is carried out every year.

Contact information of NPF Magnit, work schedule

NPF Magnit is located in Krasnodar at the address: st. Moskovskaya, 95, lit. Q. You can ask all your questions by calling +7 861 210-98-10. Opening hours: from 8.30 to 17.30. Customer reviews can be found on the website.

Free help from a Pension Lawyer Legal advice

on deprivation of rights, road accidents, insurance compensation, driving into the oncoming lane, and other automotive issues.

Daily from 9.00 to 21.00

Moscow and Moscow region +7 (499) 653-60-72 ext. 945 St. Petersburg and LO+7 ext. 644 Free call within Russia8-800-511-20-36 —>

Founded in 1995, the NPF fund “KhPF “Dobrodetel”” provided services to NGOs. In 2006, the programs were expanded: OPS was added to them. In 2010, the organization was given its current name. Read below about the Magnit pension fund: official website, personal account , reliability.

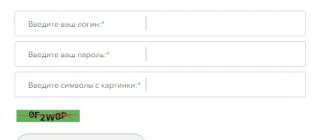

Personal account of NPF “Magnit”

Information about NPF “Magnit”:

- official website - https://www.npfmagnit.ru/about/;

- personal account - registration or login is not publicly available.

You cannot register your account yourself. To do this, you need to enter into an agreement with the Fund and become its full client.

The official website contains various sections that provide information about the NPF, its programs, and necessary documents. The pension calculator allows you to calculate the amount of your future pension. The “Question-Answer” section presents frequently encountered problems and methods for solving them. You can follow innovations and changes in “News”.

Services of NPF “Magnit”

The fund provides services only in two areas:

- non-state pension provision;

- compulsory pension insurance.

What actions are available to clients:

- lump sum payment of savings;

- urgent payment;

- the funded part of the old-age labor pension;

- payment of pension savings to the legal successors of the deceased insured person.

- The funded part is formed from contributions from employers. Unlike an insurance fund, a pension fund invests these funds in projects and increases their size if the instruments are selected successfully. Interest is calculated annually. The Pension Fund transfers the funds to Vnesheconombank (VEB), which is responsible for creating the investment portfolio.

- Insurance. The basic part of the pension, which is formed through regular contributions from employers.

Investfunds blogs

Who can tell me when Lukoil's next dividends will be? Sanctions are coming or What can Americans do with the ruble? Evgeny Voronchikhin / 11/29/2017 15:29 Evgeny Voronchikhin Alfa-quant, Asset Manager The Central Bank may independently begin purchasing government bonds of the Russian Federation if investments in OFZs are subject to American sanctions. Are there other options for anti-crisis measures and why might they be needed? It is possible that already in February 2018, US residents will be prohibited from investing in Russian Eurobonds and OFZs. At the end of this summer, Donald Trump signed a law that provides for the imposition of sanctions against “enemies of the United States.”

Contact information of NPF “Magnit” in case of questions

Branch: 350072 Krasnodar, st. Moskovskaya, 95, lit. In, of. 1.

Postal address: PO Box 394, Krasnodar, 350072.

Phones ext. 16110, 16112.

can be done in a special form on the page: https://www.npfmagnit.ru/contacts/. Attention! Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you for free - write a question in the form below: Share with friends: Consultation with a pension lawyer by phone In Moscow and the Moscow region +7 (499) 110-25 -80 St. Petersburg and region+7 (812) 407-18-13 NPF card

| Profitability: | 7,94 % |

| Assets: | 12647050.20346 thousand rubles. |

| Reliability: | |

| Official site: | www.npfmagnit.ru |

| Personal Area: | |

| Telephone: | 8 |

Information is current as of 04/19/2018.

The non-state pension fund "Magnit" as such began its work in 2010. It was founded in 1995 and previously bore the name “Virtue Christian Pension Fund”. Its owner all this time has been Tander CJSC.

Many companies that work in the field of pension financing give their clients access to a service for viewing available savings.

The Magnit pension fund does not have a “Personal Account” in the public domain on its official website. That is, it is not possible for clients to register and log into the personal account of NPF Magnit.

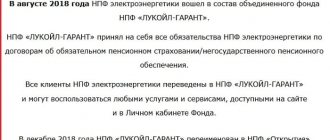

About the fund

NPF "Electroenergetics" was registered in 1994. The fund was created for the energy industry and energy workers. Nothing unusual. In those years, management (or people close to them) opened “pocket” funds as a source of inexhaustible personal resources. Investors were then promised: “if you save monthly for old age in 2020, you will receive more than a million in your account.”

Someone decided that energy workers cannot remain without work, and the non-state pension fund will always be full of money. Others looked at the fund's large clients (their names were associated with industrial giants).

There was enough money for NPF Elektroenergetiki to join in 2010:

- Wimm-Bill-Dann;

- "Loyalty";

- "Promregionsvyaz".

Then one of the oldest and largest funds in Russia “ate” NPF Lukoil Garant. Today, Otkrytie is considered the final legal successor of NPF Elektroenergetiki.

I wonder what role Irina Lisitsina played here:

- President of NPF "Electroenergetics" since 2012 and member of the board of directors since 2020;

- from 2004 to 2012, director of financial consulting, department director, managing director, head of the Otkritie investment group.

On the official website of NPF "Electroenergetics" the basic information was removed, leaving a message on the reorganization. But some data has been preserved on the network.

INFORMATION

STATISTICS

| Volume penny savings/reserves, thousand rubles* | 497999707,29586/ 66293673,99788 |

| Amount of pensions paid, thousand rubles* | 3207948,34707 |

| Number of clients* | 7131435 |

| Profitability* | 11.5 minus all remunerations (Central Bank data for Q2 2019) |

| Reliability rating | AAA until 2020 |

| Awards | Award winner: “Financial Elite of Russia”, nomination “Reliability” (2011); “Financial Elite of Russia”, nomination “Fund of the Year for NGOs” (2014); “Russian Financial Elite 2015”, nomination “Fund of the Year in the NGO Sector”. The Grand Prix: Best Five Year Fund (2005–2010); “Non-state pension fund of the year” (2013). Award “Financial Olympus 2010”, nomination “National Pension Fund Management Strategy. Dynamics and efficiency." |

TERMS AND SERVICE *

| Foundation programs | Funded pension Non-state pension Co-financing |

| Conditions of entry | There are no requirements |

| Types of payments | Lifetime, fixed-term, to legal successors |

| User's personal account on the official website | https://lk.open-npf.ru |

| Mobile app | No |

*NPF Otkritie

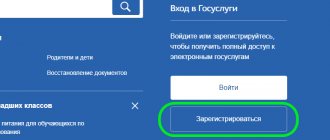

You can become a client of the legal successor of NPF Elektroenergetiki:

How to transfer pension

Proceed according to the scheme: “conclude an agreement with NPF Otkritie - terminate the agreement with another fund - notify the Pension Fund.” Moreover, all this is easier to do through the State Services website (if you have an electronic signature).

How to find out your savings

You can independently check your pension savings on the website of the successor NPF Elektroenergetiki (Otkritie) in your personal account. Or request written notification by calling the hotline.

I look at the situation: due to all the “marriage games” of funds, investors risk losing control over their money. Therefore, I advise you to register on the State Services website. Up-to-date information is provided there.

How to terminate an agreement with a non-state pension fund

Details of the procedure are specified in the contract. Taking into account changes in legislation, you need to:

- Write a statement to terminate the contract with NPF "Electroenergetics". There are different types of applications: early - with loss of investment income, unlimited - once every 5 years without loss.

- Conclude an agreement with a new fund.

- Notify the Pension Fund (submit a transfer application in person or through a notarized representative).

An important nuance: in order not to lose income (fixed once every 5 years), the application must be written in the year of recording before November 30.

On the website "State. But this will require an electronic digital signature.

Early retirement

...our native legislation is not considered a basis for starting payments. But if the agreement with NPF Elektroenergetiki stipulates that payments will begin from the moment of retirement (without specifying all the details), you can count on cash receipts.

Payment of fees

As NPF "Electroenergetics" paid, so you pay:

- through the accounting department where you work;

- through the Otkritie website in LC;

- make the transfers yourself.

The number of annual payments is specified in the contract.

Initially, activities that were associated only with non-state pension provision for citizens. Subsequently, the range of services provided by this organization expanded. Now he works within the framework of the compulsory pension insurance and security program.

Pension savings provide the following types of payments:

- a one-time payment of all funds accumulated in the fund and available on the client’s personal account (you can choose this tariff plan yourself);

- if the pension is needed in a short time, then it can be paid, but not at a time (the money will be transferred to the client within a certain period of time);

- savings in the fund concern not only the insurance part of the pension, but also the funded one (at the client’s request);

- in the event of the death of a person who has a personal account in this fund, his successor may receive a lump sum payment in his place (note that the trustee must also be a client of the Magnit NPF).

Please note that all these points must be taken into account in the agreement (when choosing a tariff) with the pension fund in order to avoid further misunderstanding of the terms of cooperation.

As mentioned earlier, there is no “Personal Account” on the official website of NPF Magnit, so you can clarify the terms of an already concluded agreement only by contacting the company’s employees by phone or by contacting the main office in person.

In addition, to increase the size of your future pension, NPF Magnit offers non-state pension services. This guarantees that the citizen, upon reaching retirement age, will receive not only a state pension, but also additional security from the NPF.

The amount of transferred funds can only be found out from the company’s employees, since NPF “Magnit” does not have a “depositor’s personal account” freely available. That is, the investor enters into an agreement under which he independently contributes part of his salary or other savings to the NPF.

A person controls the frequency and amount of payments individually. At any time, you can terminate the agreement with the fund and return all invested funds.

Different ways to find out your pension savings

This organization was created for long-term and mutually beneficial partnerships that arise between the fund itself and the insured citizens of our country. The arguments in favor of this organization also include the following advantages.

- The ability to find out about the status of your account, which programs your pension savings are invested in, and what their performance is for a specific period of time.

- Upon reaching the age of receiving a pension, the insured citizen’s funds continue to be invested, and profits are taken into account when transferring the pension, thanks to annual recalculation.

What are the performance results of the NPF to date? As you know, in recent years the number of Magnit stores throughout the country has increased significantly.

Reliability of the Magnit pension fund

NPF "Magnit" provides its investors with reliable investments. The safety of clients' funds is guaranteed by the use of the right financial instruments and policies aimed at exceeding inflation.

The disadvantage is the opacity of the work system, since clients do not have access to the “Personal Account” on the official website of NPF “Magnit”.

There are no statistics from rating agencies on the financial reliability of insurance companies. In the event of bankruptcy of a non-state pension fund, all pension savings are transferred to the Pension Fund of the Russian Federation, and the missing funds are paid in addition by the Bank of Russia or the Personnel Insurance Agency.

Additional information: since 2014, all non-state pension funds are required to enter the Guarantee System and successfully overcome the inspection from the Bank of Russia.

Contact information of NPF "Magnit" in case of questions

If you have any questions or for additional information on the tariffs of the Non-State Pension Fund "Magnit", you can contact the company's employees in one of the following ways:

- Contact the head office, which is located at: Krasnodar, st. Moskovskaya, 95B, office No. 1 (350072).

- Call the phone number (extensions 16110, 16112).

- Send an email

- Use the feedback form by following the link: https://www.npfmagnit.ru/contacts/.

Please note that the “Personal Account” of the Magnit pension fund is not publicly available, and this organization also does not have regional branches.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you for free - write a question in the form below: Sources used:

- https://ru-npf.ru/magnit/

- https://upfrf.ru/npf/magnit.html

- https://pfrf-kabinet.ru/lk/magnit.html

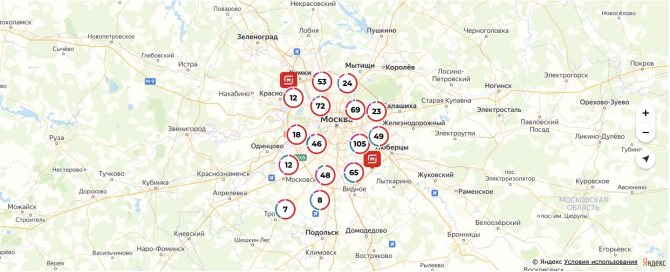

Magnit store addresses

This retail chain has many stores open. And purely physically, the buyer cannot know where the nearest store is located. But it's easy to find out. It's enough to do this.

The buyer needs:

- Follow the following link: https://magnit.ru/shops/ .

- Study the map, find the nearest store.

They are located in:

- Moscow.

- Krasnodar.

- Ufa.

- Chelyabinsk.

- Tyumen.

- Volgograd.

- Nizhny Novgorod.

- Omsk.

- Novosibirsk.

- Yekaterinburg.

- Kazan.

- Samara.

- Rostov-on-Don.

The stores of this outlet are known to almost all citizens.

What sets them apart from other stores is:

- a wide range of;

- low prices;

- nice atmosphere;

- convenient location.

In addition, customers also like this store because many products are sold here at very attractive prices, and some of them are sold at a promotion or with a very attractive discount.