Civil servants have the right to receive a pension if one of the following conditions is met:

- having a minimum work experience;

- reaching retirement age.

The payment is assigned to both federal and municipal employees. The size and conditions are determined by current legislation. Let's consider what the pension of civil servants will be in 2020 in Russia.

Retirement age

A gradual increase in the retirement age allows the state, at the expense of freed-up funds from the Pension Fund, to increase the size of the pension of the oldest age categories. Simultaneously with the increase in actual payments, the requirements for pensioners also increase. In 2020, older people were able to receive the calculated part of the old-age insurance pension, from whose official salary contributions were made to the Pension Fund of the Russian Federation for more than 11 years and whose pension score was at least 18.6. have worked for 15 years and have accumulated at least 30 points by the time of retirement will be able to apply for an insurance pension in 2025

Gradual increase in retirement age

The age at which a Russian citizen can count on accrual of an old-age insurance pension will change by 5 years from 2020 to 2028. For those elderly people who are the first to fall under the pension reform, that is, in accordance with the previous legislation, must apply for a pension in 2020 and 2020, a preferential opportunity is provided to become a pensioner six months earlier than indicated in the current standards.

Benefits for men

| Age | Man's year of birth | Year of pension registration |

| 60,5 | II half of 1959 | I half of 2020 |

| 61,5 | I half of 1960 | II half of 2021 |

| 61,5 | II half of 1960 | I half of 2022 |

Benefits for women

| Age | Woman's year of birth | Year of pension registration |

| 55,5 | II half of 1964 | I half of 2020 |

| 56,5 | I half of 1965 | II half of 2021 |

| 56,5 | II half of 1965 | I half of 2022 |

Who can retire early?

According to Russian laws, the right to early retirement depends on the worker’s age, pension points earned by him, profession, and length of service. Even the number of children can affect this date.

You can retire early:

- Citizens whose work history includes a long period of dangerous or hard work.

- In accordance with Art. 30 of Law No. 400-FZ, geologists, tractor drivers living in villages, and bus drivers for transporting passengers are allowed to retire before the period established by law.

- The right to retire based on length of service is granted to doctors, teachers and people in creative professions.

- Employees who have been laid off can retire early if they have enough length of service and pension points, and there are no more than two years left before the age threshold.

Retirement age for residents of the Far North

Elderly people living in the Far North and equivalent areas have the right to retire 5 years earlier than the age established by the state for the majority of the population. But since the general pension threshold for residents of the Far North, as well as for all Russians, is increasing in connection with the pension reform by 5 years, the preferential difference will be deducted from the age determined taking into account the requirements and benefits of the transition period of the pension reform.

Long service retirement

For teachers, doctors, opera singers, and ballet dancers, pensions are assigned based on length of service without taking into account age. The required work experience of people in such professions, as before, is 25–30 years. The transition period for raising the retirement age postpones the period for registering a pension by the same number of years by which the retirement period of an ordinary Russian has changed since the beginning of the pension reform.

That is, if by the time a doctor has completed his seniority in Russia, the general retirement age has risen by 4 years, then the doctor who has completed his seniority will have to wait 4 years after that before he can retire.

Retirement age for civil servants

The period for changing the pension threshold for civil servants is longer than for ordinary citizens, since their retirement age until 2021 increases per year by only 6 months. After this period, the pension threshold for civil servants will, like that of employees of commercial enterprises, be increased annually by 12 months. By the end of the pension reform, the retirement age for male civil servants will be 65 years.

Women civil servants will only be able to retire at the age of 63, so the adaptation period will last for them until 2034. At the same time, the length of service required to receive a long-service pension will increase by 6 months until it reaches 20 years by 2026. In 2020, female civil servants are granted pension benefits at the age of 56.5 years , and for men at 61.5 years . at least 17 years this year

Pensions for civil servants in 2020: latest news

In 2020, the rules for issuing pensions will change slightly. It is planned to increase the retirement age. This measure is aimed at retaining valuable personnel and regulating the country's budget. Innovations include:

- gradual increase in retirement age: will increase by 6 months annually;

- the algorithm for calculating work experience to determine the funded part of a pension will change;

- The maximum length of work experience will increase: it will be 65 years.

The changes will also affect deputies: they will have the right to receive an additional payment to the insurance part of the pension when the duration of their duties is 5 years (previously 1 year). This will help reduce budget pension costs by 620 million rubles per year. The change will also help retain qualified personnel in the labor market, which will ultimately increase the efficiency of civil servants in managerial positions.

During the course of the changes, adjustments will be made: if necessary, amendments will be made to the legislation.

Why will the required length of service to pay pensions to civil servants be increased in 2020? The latest news says: this is necessary not so much to save the state budget, but to retain personnel.

Related news:

- What will the pension be in 2020?

- What will the old age pension be in 2020?

- Prospects for life in Russia in 2020

- Labor and social pensions in 2020 in Russia

- What awaits pensioners of the Ministry of Internal Affairs in 2020?

- How to calculate maternity payments in 2020 in Russia?

Pension reforms: what awaits civil servants?

Let us list the main nuances of pension reforms that will affect civil servants.

- Increasing the length of work experience. From January 1, it will gradually begin to grow and as a result it will no longer be 5 years: 15 instead of 20.

- The method of calculating payments will change: the pension amount will be 45-75% of wages. The percentage depends on the length of service of the employee.

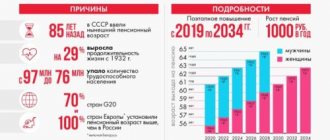

Why will the law on pensions for civil servants in Russia change in 2020? The reasons were the following factors:

- economic crisis: the Pension Fund suffers from a lack of funding, which forces us to look for ways to solve the problem;

- increasing life expectancy of taxpayers;

- increase in the number of non-working pensioners: there are more of them in relation to those working.

All these reasons upset the budget balance and force action to be taken. It is expected that pension reforms will help solve problems and provide civil servants with a normal pension in the future.

New rules for early retirement

Changes in pension legislation have introduced additional grounds for early retirement:

- Mothers with many children received the right to receive pension payments before reaching the age required by law if they have 15 years of work experience. A woman with three children will be able to retire 3 years ahead of schedule. Mother of four children - 4 years early. A woman with 5 or more children can still retire at age 50.

- Women (minimum 55 years old) whose work experience exceeds 37 years, and men who have officially worked for more than 42 years (not before turning 60 years old) can retire 2 years earlier.

- Unemployed people who are unable to find a job can apply for a pension benefit 2 years earlier than the officially established period, taking into account the transition period.

Retirement table by year

For men

| Year of pension registration | Man's year of birth | Age at which pension can be calculated | How many additional years will you have to work? |

| 2020 | 1959 | 61 | 1 (you can apply for a pension six months earlier) |

| 2022 | 1960 | 62 | 2 (you can apply for a pension six months earlier) |

| 2024 | 1961 | 63 | 3 |

| 2026 | 1962 | 64 | 4 |

| 2028 | 1965 and those younger. | 65 | 5 |

Women

| Year of pension registration | Woman's year of birth | Age at which pension can be calculated | How many additional years will you have to work? |

| 2020 | 1964 | 56 | 1 (you can apply for a pension six months earlier) |

| 2022 | 1965 | 57 | 2 (you can apply for a pension six months earlier) |

| 2024 | 1966 | 58 | 3 |

| 2026 | 1967 | 59 | 4 |

| 2028 | 1968 and those younger | 60 | 5 |

Minimum work experience for retirement

To retire in 2020, you must work at least 11 years, which includes:

- That period of official employment when a citizen or his employer paid insurance contributions to the Pension Fund.

- 1.5 years of maternity leave (no more than 6 years in total for several children), if the mother has work experience before the start of such a period or after its end.

- Time to care for a disabled person of group I, a disabled child or an elderly person over 80 years old.

- Time of military or equivalent service.

- In accordance with Article 12 of Law No. 400-FZ, work experience also includes the period of receiving benefits for temporary disability, unemployment, and time spent moving for employment in the direction of the employment service.

- 5 years from the period of residence in an area where it is impossible for spouses of military personnel and diplomats to find employment will be counted towards the pension experience.

Note! All this data is converted into pension points. To retire in 2020, you need to earn 18.6 retirement points. The number of years required to obtain official work experience and, accordingly, pension points will increase according to changes in the age threshold.

| Year of pension registration | Required work experience | A sufficient number of points to obtain an insurance pension |

| 2020 | 11 years | 18,6 |

| 2021 | 12 years | 21 |

| 2022 | 13 years | 23,4 |

| 2023 | 14 years | 25,8 |

| 2024 | 15 years | 28,2 |

| 2025 | 15 years | 30 |

Retirement age in other countries

Raising the retirement age today is a global trend. Reforms similar to Russian ones are already underway or planned in countries such as Japan, Spain, Ukraine, the Czech Republic, and China. In England, for example, by 2046 it is planned to raise the pension threshold to 68 years. Belgium plans to raise the retirement age to 67 by 2030. From 2024 to 2033, Austrians will equalize the pension rights of men and women, raising the pension threshold for the latter to 65 years.

In Germany

The average life expectancy of a German is 81 years, of which only in the last 14 years does the average person become so frail that he is no longer able to ensure his existence. The reform, which began in 2012, should increase the retirement age to 67 by 2031.

Residents of Germany born in 1965 and later will only be able to apply for a pension benefit upon reaching the age of 67, that is, 2 years later than those born, for example, in 1950, and 1 year later than those born in 1960. The pension payment per month is on average 1,100 euros. The minimum benefit is 374 euros.

In China

In China, with an average life expectancy of 67 years, only government employees can receive a pension. On average it is 2350 yuan (almost $367). At the moment, the country is also undergoing a reform, as a result of which the age of transition to state support for the Chinese will increase from 60 to 65 years.

Women whose specific profession is physical labor will begin to retire at 55 instead of the current 50, and workers in the intellectual sphere will be able to apply for a pension benefit upon reaching 60 instead of the usual 55 for the previous generation.

IN THE USA

The average life expectancy of an American is 78.5 years. At the same time, American residents, regardless of gender, apply for a pension benefit, the average amount of which is $1,200, at the age of 66. Changes in the country's pension legislation, recently approved by the US Senate, are designed to annually increase the pension threshold for those born after 1954 by 2 months.

In France

The French, whose life expectancy is on average 83 years, retire at least at 62 years. But only disabled people will receive payments from the state at this age. The real retirement threshold in this country is 67 years. The average payment to an elderly Frenchman who has crossed the age limit set by the state is equivalent to 700 US dollars.

In Japan

Residents of this country, with an average life expectancy of 84 years, become pensioners between the ages of 62 and 71 (last year the upper limit was 70 years). The later a Japanese person retires, the greater the amount of benefits accrued to him. So, when applying for a pension at the age of 62, the amount of monthly payments will be equivalent to $1,050. For those who supported themselves until age 65, the benefit is paid in an amount equivalent to $1,500, and those who were able to survive until age 70 will receive the equivalent of $2,100.

In Ukraine

Ukraine, whose retirement age, with an average life expectancy of 72.5 years, as in Russia, was 60 years for men and 55 for women, and the average pension in hryvnia corresponds to an amount equal to 140 US dollars, is currently carrying out a reform, aimed at gradually increasing the pension threshold for women up to 60 years of age.

In Belarus

The reform to increase the retirement threshold in Belarus, with an average life expectancy of 74 years, has been going on for the third year, increasing the pension threshold by 6 months annually. In 2020, men aged 62 and women aged 57 can apply for pension benefits in this country. The average pension of a resident of Belarus is equivalent to 175 US dollars.

In Kazakhstan

The pension reform of this country, whose average life expectancy is 68.5 years, has increased the retirement age of Kazakhstanis to 63 years. And if for men the increase in the threshold was only 3 years, then for women the size of the adjustment was 8 years.

In order to adapt the female part of the population to the new rules, the transition to them is carried out in stages. The pension threshold will be increased annually by 6 months until 2027. The average pension benefit for a Kazakh citizen for 2020 is 90,000 tenge, which is equivalent to 216 US dollars.

Delayed holidays

Now officials receive an insurance pension and a long-service pension upon reaching 60 years of age (men) and 55 years of age (women) - like other citizens of the Russian Federation. Let us remind you: when there was talk in the government about raising the retirement age for all Russians, Prime Minister Dmitry Medvedev recommended his colleagues to “start with themselves.”

In the original version, the pension “bar” was the same for both sexes - 65 years old, and they were going to “start with yourself” from July 1 of this year. The final version of the amendments is as follows: the retirement age will increase gradually from January 1, 2020 - every six months. And eventually it will grow to 65 years for men and 63 years for women.

According to the Ministry of Labor, the amendments will affect about 70 thousand people. We are talking about persons who held positions in the state civil and municipal service of the Russian Federation, as well as held government positions at the federal, regional and municipal levels. Thus, changes will occur both for officials working in government agencies and for those holding “political” positions.

The document also provides for a gradual increase in the minimum length of service in the civil service, which gives the right to a long-service pension, from 15 to 20 years (six months annually). In addition, the period of work as a State Duma deputy and senator is increasing, which is the minimum to obtain the right to an additional payment to the old-age insurance pension in the amount of 55 percent. This period will increase from one year to five years. And to receive an increased payment (75 percent), you will need to work in the State Duma or the Federation Council for ten years instead of three.

The A Just Russia faction did not support the bill. “The point is not that we really care about officials, we are fundamentally against raising the retirement age,” explained the first deputy leader of the faction, Mikhail Yemelyanov. He emphasized that SR views this bill “as the beginning of a creeping process of raising the retirement age in Russia.”

For male officials, the retirement age will gradually increase by five

Representatives of different factions have repeatedly said that they are ready to tighten pension rules for officials, as well as for themselves, but it is premature to do this for all Russians. As follows from a Levada Center survey conducted in October last year, only 8 percent of respondents agree with raising the retirement age for the entire population.

Meanwhile, the State Duma began to tighten itself in the area of discipline. At the same meeting, a bill on depriving deputies of their powers for absenteeism and loss of connections with voters was adopted in the second and immediately in the third reading. It was added to the document for the second reading that the period of non-fulfillment of duties should be 30 days. Another addition is that a deputy can lose his mandate not only on the initiative of his faction, but also on the proposal of the committee of which he is a member. It is interesting that the amendments increased discipline in parliament even before their final adoption - the turnout at the plenary sessions increased noticeably.

What can people of pre-retirement age expect?

The older a person gets, the more difficult it is for him to find a job. And if earlier men, starting from the age of 60, and women from 55 years old, could no longer think about tomorrow, now, due to the increase in the retirement age, this age group has turned out to be the most vulnerable in social terms. To smooth out the period of adaptation to the pension reform measures, Russian legislation has provided a number of benefits for “pre-retirees”.

Who are pre-retirees?

The concept of “pre-retirement age” was introduced by Art. 5 Federal Law No. 1032-1 “On employment in the Russian Federation” dated April 19, 1991. Art. 1 Federal Law No. 350 dated October 3, 2018 changed the number of pre-retirement years from 2 to 5. The moment of pre-retirement age is counted by subtracting 5 years from the retirement age that has increased due to the pension reform. The beginning of the pre-retirement period is also calculated for employees who have the right to receive early retirement benefits.

How to apply for pre-retirement status?

Pension Fund employees automatically assign pre-retirement status to an elderly person based on information received by the Pension Fund. You can clarify the status of a pre-retirement person using a certificate that he can receive from the Pension Fund, through the “Personal Account” of the pre-retirement fund on the Pension Fund website, or through a special service of the Pension Fund through a request made by an organization that needs confirmation of the status of a pre-retirement person, based on his application submitted to this organization.

Attention! Pre-retirement status can only be assigned to a citizen whose work experience and pension points entitle him to receive an old-age insurance pension. The titles “Veteran of Military Service” and “Veteran of Labor” give this right.

Benefits for people of pre-retirement age

For pre-retirement people, municipalities provide a number of benefits:

- Free travel on public transport, metro and intercity transport to the place of sanatorium-resort treatment if such treatment is required for medical reasons.

- Free trips to the sanatorium.

- Free dental prosthetics.

- Benefits in real estate taxation.

The titles “Veteran of Military Service” and “Veteran of Labor” in combination with pre-retirement age give the right to a discount in payment for utilities, telephone communications and cash payments, both one-time and permanent (for example, a monthly cash payment for veterans living in Moscow).

Advanced training program

For people of pre-retirement age, in case of problems with employment, the legislation provides for a program of professional retraining in employment centers with a scholarship equal to the minimum wage (Government Order No. 3025-r dated December 30, 2018).

Exemption from work to undergo medical examination

Free medical examination for people over 50 years of age is provided regardless of pre-retirement status. But the state allocates 2 paid working days for this event to pre-retirement people (Part 2 of Article 185.1 of the Labor Code).

Responsibility for the dismissal of pre-retirees

For the unjustified dismissal of a pre-retirement employee, the state punishes the employer with a fine of 200,000 rubles. or in the amount of 18 months' salary, 360 hours of forced labor. Denial of employment due to pre-retirement age entails criminal liability under Art. 144.1 CC.

Increased unemployment benefits

In accordance with Art. 34.2 of Federal Law No. 1032-1, in case of registration with the Employment Center as an unemployed person, for the first 3 months the pre-retirement worker will receive 75% of the lost salary, then 4 months - 60% and 45% before the end of 2 years, if the man’s experience is 25 years, and for women - 20. The maximum amount of unemployment benefits paid cannot exceed 11,280 rubles.

What remains the same?

The retirement age for Russians who have the right to receive early retirement benefits will not change:

- Before the established deadline, pensions will be assigned primarily to those citizens for whose work in difficult or dangerous conditions the employer made additional insurance contributions at special rates. As before, workers in hot shops, railway transport, the mining industry, rescuers, and bus drivers will be able to retire earlier.

- Mothers of many children, people with disabilities and trade workers living in the Far North and equivalent regions will be able to retire early.

- Women and men whose pensions are granted before they reach retirement age due to man-made and radiation disasters.

- Test pilots and other citizens, the full list of which is determined by Art. 30 of the Law of December 28, 2018 No. 400-FZ “On Insurance Pensions”.

Assignment of social pension

If the required number of pension points has not been accumulated and there is no 11 years of service (as of 2020), upon reaching the age of 65 for men and 60 for women, a social pension will be assigned. The pension reform involves a gradual increase in this age to 68 years for women and 70 years for men.

Payment of pension savings

The age limit for receiving urgent and one-time payments and using the funded part of pension deposits remains for women 55 years old and 60 years old for men.

Important! The assignment of savings in accordance with the conditions of reforming the Russian pension system is possible only if there is a minimum length of service and pension points required for the current year.

Increasing the pension qualification

The authorities have been talking for several years about the need to raise the age limit for working citizens.

The reform began with the public sector. In particular, from January 1, 2020, the Federal Law of July 27, 2004 No. 79-FZ “On the State Civil Service of the Russian Federation” changed. The new edition, among other things, clarifies what the age limit for being in the civil service is. For ordinary officials it increased from 60 to 65 years. If a person holds the position of adviser or assistant, he can work longer - until the end of the term of authority assigned to him. To do this, you will need a written decision from the employer’s representative, as well as the written consent of the employee himself.

Special conditions are provided for managers. With the consent of the employee and by decision of the government agency (the relevant official), the contract with such a civil servant can be extended until he turns 70 years old.

It is important to understand that the age limit for civil service does not increase immediately: the qualification will increase annually by 6 months. According to amendments to Federal Law No. 400-FZ of December 28, 2013 “On Insurance Pensions,” male officials will have to work a full 65 years by 2026. For women, a benefit is provided - leaving work at 63 years old. Those who leave their positions in 2032 will have to work until this age.

Let us note that 65 and 70 years are, in principle, not the limit. At the request of the employee and with the consent of the employer, cooperation can be continued on the basis of a fixed-term employment contract. The only thing is that the employee will no longer be able to hold a position related to the civil service.

Increased indexation of insurance pensions

The indexation coefficient of the fixed part of insurance pensions, which began in Russia in 2020, from January 1, 2020 is 6.6%, which exceeds the forecast inflation rate for 2019 by 3.6%. The size of the fixed payment today is 5,686 rubles 25 kopecks.

To calculate the amount of the additional payment, you need to multiply the amount corresponding to the fixed share of the pension by 0.066. The cost of a pension point, on the basis of which the size of the future pension of a person who has reached retirement age is determined, is 93 rubles for 2020.

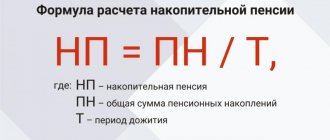

How to calculate your pension?

There is a formula: P = (45% NW-SP) + 3% NW * St,

where P is the amount of the future pension, SZ is the amount of monthly earnings, SP is the insurance part of the pension, St is the “extra” length of service (calculated as the total length of service minus 15).

For example. Ivanova Larisa worked for 30 years. She received the right to an old-age pension in the amount of 6,000 rubles. The monthly salary was 50,000 rubles. Thus, the size of her pension will be: 22500 - 6000 + 1500*15 = 39000 rubles.

The Government claims that money from the budget saved as a result of the upcoming reforms will be spent on increasing the pensions of absolutely all Russians. It is still difficult to predict how such changes will turn out for citizens. But, given that adjustments will be made to the legislation every year based on the results of the analysis of the results of the reforms, we can only expect positive consequences.

Increasing pensions for rural pensioners

Since 2020, elderly village residents with 30 years of work experience in agriculture have received the right, in case of living in rural areas after retirement and from that moment on they have no official employment, to a 25% bonus to its fixed part upon reaching the established state retirement age.

Significant changes due to the pension reform that have taken place over the past 16 years in Russia and have affected all older people require careful monitoring of annual changes in Russian legislation. Timely acquaintance with the conditions for receiving an old-age insurance pension can not only bring your retirement date closer and increase the amount of monthly payments, but also help you obtain additional benefits before this moment arrives.

Retirement procedure for civil servants

Back in October last year, the legislative government commission decided to approve the draft Federal Law “On Amendments to Certain Legislative Acts of the Russian Federation Regarding Increasing the Retirement Age for Individuals.” This can be called the only law in a series of heated debates that relates to the pensions of Russians in 2017 that was presented to the public.

It also regulates the pensions of officials. And you don’t even have any doubt that the document will come into force. Government officials will begin to receive the following innovations from 2020:

- raising the limit for holding bureaucratic positions from 60 to 65 years;

- increasing the civil service length of service for retirement, from 15 to 20 years;

- for a 55 percent increase, deputies will have to work for another five years, and for a 77 percent increase - 10 years, compared to three years in our time.