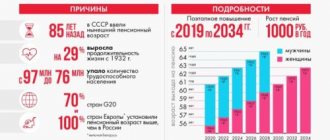

Pension indexation table until 2024

We have already talked about the increase in pensions from January 2020 in previous videos. Today we will look at the results of January indexation in Russia, as well as what amounts await us in the future.

So, in January, the Pension Fund paid new pension amounts for all non-working pensioners. The increase was 7.05%. For each, the increase was different depending on the previous size of payments.

For channel subscribers, we sent an indexation table depending on the size of the pension received. Let us recall that according to the latest data from the Pension Fund of Russia, the average amount of old-age payments in 2018 was 14,414 rubles. It was based on calculations of this amount that they promised an increase of a thousand rubles. In fact, only those who received amounts greater than the average received an increase of a thousand rubles.

In order to check the correctness of the indexation, you simply need to multiply the previous size by a factor of 1.0705. For example, a pension of 8215 rubles after indexation will increase to 8794 rubles.

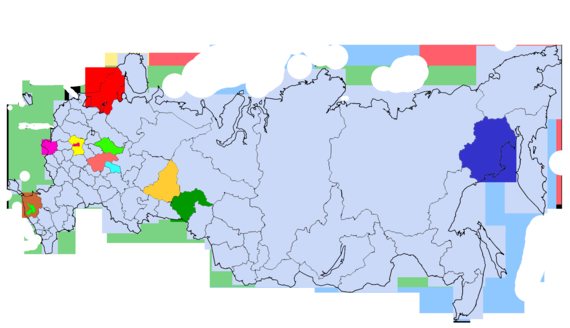

Let's look at the results of the January increase in our regions. If in Russia the average old-age pension has become 15,430 rubles since 2020, then in individual regions its size differs.

For example, according to the official website of the Pension Fund of Russia since 2020, the average old-age insurance pension since 2020 in the Kostroma region has been 14,298 rubles. In the Magadan region 22,480 rubles. Karelia reports an average old-age payment of 17,232 rubles. Bryansk region 14588. Krasnodar region 16257. Tyumen region 15490. Sverdlovsk region 15656 rub. In Mari El it is 12975. In the Nizhny Novgorod region it is 14437. In Adygea it is 12859. In Moscow, the average old-age pension has become 15329 rubles since 2020, and in the Moscow region it is 15323 rubles. Unfortunately, there are no complete statistics for all regions.

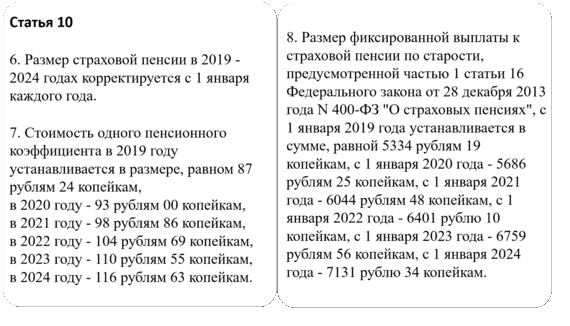

One more nuance regarding indexing. Never before have indexation percentages been set for years in advance. Now, with the adoption of Law No. 350-FZ, we know in advance the exact size of the increase in the insurance pension until 2024.

Let's supplement our first table with the approved indexation coefficients for 2020, 2021, 2022-23 and 2024.

Now every pensioner can find out in advance their size of future payments for the coming years. To do this, you need to multiply your pension amount by the specified coefficients one by one.

For example, the disability pension in 2020 is equal to 9,634 rubles. We multiply it by the indexation coefficient in 2020 of 1.066 and get the amount of 10,269 rubles. Next, we multiply this amount by the next year’s coefficient. And we get the amount of our payment in 2021 - 10 thousand 916 rubles. And so on. In 2024, the amount will already be 12,879 rubles. Try calculating your pension yourself to find out about future payments.

Let's also look at the three main reasons why you may not receive pension indexation from January:

- You receive a state pension. (Only insurance companies are indexed in January, while government ones are indexed in April of each year.)

- You are a working pensioner. (from 2020, no indexation is paid to pensioners who continue to work).

- You are the recipient of a social supplement up to the subsistence level of a pensioner. (If after indexation the total amount of income does not exceed the cost of living of a pensioner in the region, then you will not notice a real increase). The cost of living for 2019 by region was also sent to our channel subscribers.

That's all. Subscribe to the channel to know a little more about pensions than your neighbors.

How much will pension insurance be increased?

The main goal of pension reform is to bring the income of people of retirement age to a decent level. To accomplish this task, it is planned to index payments by an amount exceeding inflation. The Pension Fund has announced how pension benefits will be increased in the coming years.

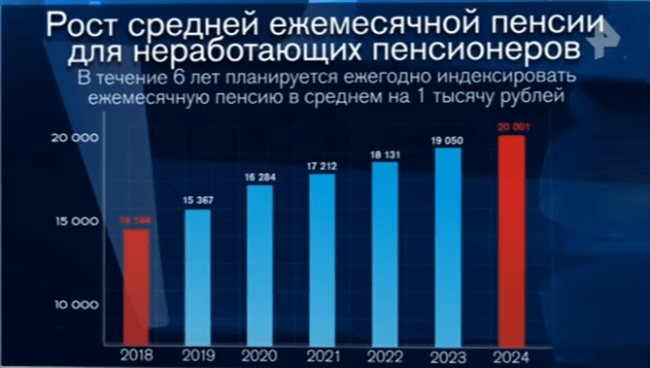

Rice. 1. Dynamics of increases in pensions and payments to non-working pensioners

Thus, in 2020 indexation will be 7.05%, in 2020 – 6.6%, in 2021 – 6.3%. How indexation will look in monetary terms is indicated in the table.

Table 1. Parameters of pension payments in 2018–2021:

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Average pension, rub. | 13 810 | 14 414 | 15 367 | 16 284 | 17 212 | 18 131 | 19 050 | 20 001 |

| Indexing | 3,7% | 7,05% | 6,6% | 6,3% | 5,3% | 5,1% | 5,0% | |

| Inflation rate | 3,1% | 4,3% | 3,8% | 4,0% | 4,0% | 4,0% | 4,0% | |

| Real amount of payments taking into account inflation, rub. | 13 890 | 14 794 | 15 781 | 16 644 | 17 427 | 18 323 | 19233 | |

| Promised increase, rub. | 604 | 953 | 917 | 966 | 919 | 919 | 951 | |

| Actual increase taking into account inflation, rub. | 80 | 380 | 414 | 360 | 215 | 192 | 183 | |

| Real growth | 0,6% | 2,63% | 2,69% | 2,21% | 1,25% | 1,01% | 1% |

As can be seen from the analysis, the growth of pension payments in the next 3 years will actually outpace inflation by 2.21–2.63%. And if this dynamic continues, by 2024 payments will reach the promised 20 thousand. However, real growth in payments will be reduced to 1%, provided that inflation does not exceed the forecast of 4%.

Rice. 2. Amount of real premium

But it should be taken into account that both the Government and the Pension Fund of the Russian Federation, when announcing an increase in pension provision to 20,000 rubles, relied on average readings, that is, they started from the size of pension provision in 2020 - 14,414 rubles. This means that pensioners receiving pensions different from this value will receive smaller or larger amounts added.

Table 2. Growth of payments in 2019-2024:

| Options | Payouts below average | Average pension | Above average payouts | |||

| 2018 | 7 000 | 10 000 | 14 414 | 25 000 | 60 000 | |

| 2019 | % growth | 7,05% | ||||

| Surcharge | 493,5 | 705 | 1 016 | 1 762,5 | 4 230 | |

| Amount of payments | 7 493,5 | 10 705 | 15 367 | 26 672,5 | 64 230 | |

| 2024 | % growth | 38,75% | ||||

| Surcharge | 2 712,5 | 3 875 | 5 587 | 96 875,5 | 23 250 | |

| Amount of payments | 9 712,5 | 13 875 | 20 001 | 34 687,5 | 83 250 | |

In fact, for pensioners who receive payments below the national average, even after 6 years the pension will not reach the average, not to mention the promised 20,000 rubles. And those who receive an old-age insurance pension below the PMP will not even feel the difference, since they will continue to receive a social supplement to the minimum.

Pensioners whose insurance coverage exceeds the average parameters will receive a significant increase. Moreover, the higher the pension, the greater the additional payment. Since the size of the maximum pension for Russians is not disclosed, it is impossible to say by how much the maximum payments will increase by 2024.

Reference! To independently calculate what your pension will be in 2024, you need to multiply the amount of payments as of the end of 2018 by a factor of 1.3875.

How to count

The future pension will depend on salary (the size of the white salary determines the amount of insurance contributions sent by the employer to the pension fund of the Russian Federation), work experience, which should not be less than 15 years, as well as retirement age - the state wants to encourage citizens to work an extra few years, to receive an increased pension, notes Mikhail Kuzmin, an analyst at Investcafe. For each year of later application for a pension, the insurance portion will increase by the corresponding premium coefficients. So, if a citizen applies for a pension 5 years after reaching retirement age, the fixed payment will increase by 36%, and the insurance pension - by 45%; and if after 10 years, then the fixed payment will increase by 2.11 times, the insurance part - by 2.32 times.

The length of service will now include such socially significant periods of a person’s life as military service, maternity leave, time spent caring for a disabled child, or a citizen over 80 years of age. For all these non-insurance periods, special annual coefficients are assigned. If we assume that an employee born in 1980 received 30 thousand rubles with 15 years of experience, then the approximate size of the pension according to the pension calculator on the Pension Fund website could be 7,698 rubles.

The need for a transition to the autonomy of the Pension Fund

Safonov pointed out that throughout the world the pension system is autonomous and does not depend on the budget and economic policy. “The essence of autonomy is this: it has clearly defined sources of replenishment of the pension fund and a clear, predictable spending policy. The pension fund, as a rule, performs one single function: to pay pensions. He never carries out social protection, for example, paying the same maternity capital, benefits, maintaining nursing homes, these are important things, but this has nothing to do with pensions,” the expert said.

In addition, according to Safonov, it does not include the state pension system. “This is a purely budgetary relationship, the state should pay directly to this category, social pensions should also be paid by the state. The state has money for social pensions - it pays them; if it doesn’t, then it doesn’t. And the Pension Fund should work only in relation to the contingent from whose wages contributions are collected, and pay exclusively to them,” the expert believes.

According to Safonov, nowhere in the world does a pension fund participate in economic policy from the point of view of stimulating and developing certain industries. “Our Ministry of Economy and the Ministry of Finance are starting to come up with various kinds of benefits, but the Ministry of Finance does not want to pay taxes for this and, accordingly, begins to play with contributions, thereby undermining the income of the pension system, and gives nothing in return. Naturally, this leads to the fact that after some time the Ministry of Finance is faced with the need to add some transfers,” Safonov said, clarifying that we are also talking about parliamentary pensions and military pensions.

“If a decision is made to increase pensions for civil servants and military personnel, then they need to be paid from the budget, then the number of innovations in the pension system will be reduced to a minimum. And we’ve already had six of them since 1991,” Safonov concluded.

On fixed parameters for increasing pensions in the Russian Federation from the President

For the second reading of the legislative draft on the new pension system in the State Duma, Putin introduced fixed parameters for increasing insurance pensions for the period from 2019 to 2024. He also proposed a new regulation for pension indexation from 2025.

In accordance with the amendments, one pension point will increase by 7.05% next year, which will amount to 87.24 rubles. And the amount of the fixed payment (part of the pension benefit) will be 5334 rubles. – will increase similarly.

In 2020, the value of the pension point (SPB) will increase again, but by 6.6%. In 2021, growth is expected by 6.3%, in 2022 by 5.9%, in 2023 by 5.6%, in 2024 by 5.5%. And in 2024, one pension point will be 116.63 rubles. When compared with the current value for 2020, the planned growth is 43%. And the fixed payment will also increase - by 43% and will be 7131 rubles.

The increase in the fixed payment and pension point will be carried out every year - 01.01.

Consequently, the old-age pension benefit in nominal terms in 2024 will be 43% higher. The fact is that the insurance benefit is calculated according to the formula - the number of pension points is multiplied by the cost of one point and a fixed payment is added.

These amendments fully comply with the Government’s promise that the average pension benefit will increase to 20,000 rubles by 2024 (from the current 14,000 rubles).

Putin's answer on indexation of pensions for working pensioners

Every year, pensions will increase faster than inflation, because the Ministry of Economic Development predicts inflation to be within 4% in 2024. However, the real growth of benefits will be called into question if the authorities fail to maintain inflation levels.