Let's be honest: now in our country no one understands exactly how much pension he will receive. Complex systems of calculations, allowances, benefits - formulas, formulas, formulas. And also a new special regime for the self-employed. The confusion only increased because they do not pay insurance premiums. So, what is next? I whitewashed myself, started paying NAP and “Hello, poor old age?”

In today’s post I decided to look at how the professional income tax will affect the future pension of the self-employed.

Tax without contributions

Self-employed people pay a tax rate of 4% when receiving income from individuals and 6% when receiving income from legal entities and individual entrepreneurs.

According to Article 146 of the Budget Code of the Russian Federation, part of the tax paid is credited to the health insurance fund (37%), and part (63%) to the regional budget.

Let me add that this is how the tax itself is divided; you don’t have to pay anything on top of it.

Thus, self-employed people, unlike individual entrepreneurs, do not pay fixed contributions.

For many, this is the decisive factor when choosing a status.

However, in this case the formula works:

No contributions = no experience for pension and points

Registration of a pension: new rules

To count on a pension, a modern able-bodied citizen who has no special privileges must fulfill three conditions:

- Reach retirement age (in 2020 it is 56.5 years for women and 61.5 years for men, by 2025 the age will be 60 and 65 years, respectively);

- Collect the required number of pension points (IPC for 2020 – 18.6, by 2025 it will grow and stop at around 30);

- Accumulate work experience (currently – 11 years, and by the end of the transition to the new rules – 15 years for men and women).

It is impossible to fulfill these conditions while working as a freelancer: the work experience is not recorded anywhere, and the IPC (Individual Pension Ratio) does not increase. But young people are following the modern path and stubbornly do not want to get an official job. Opening an individual entrepreneur or other form of business management is also not feasible or necessary for many. Not every freelancer can successfully call himself a businessman with an annual income of more than 300 thousand. And the pension will be calculated based on the accumulated length of service, as well as from pension contributions. There is no place for a freelancer to get all this.

The “self-employed” form of employment partially solves pension and other issues. To legally and easily start saving for retirement, a freelancer must register as self-employed. What benefits does this status provide in terms of pensions? Unlike employees, the self-employed can independently determine the size of their future pension.

Pension without experience

As you know, the size of the pension directly depends on the amount of insurance premiums paid. But for now, let’s skip this size issue and talk about the right to a pension as such.

The fact is that the right to an insurance pension does not automatically occur upon reaching retirement age. It depends on two more criteria - length of service and points. To qualify for an insurance pension, you will need to have at least 15 years of experience and at least 30 accumulated points, the number of which, in turn, depends on the amount of contributions paid.

Let’s say a man has been self-employed all his life or has worked under an employment contract for a short time, but by the age of 65 years of experience or points he has less than the norm. What kind of pension can he expect? Only for social.

At the same time, you can apply for a social pension only 5 years after reaching the generally established retirement age. That is, for men, the right to such a pension will begin at 70 years old, for women - at 65 years old.

The size of the social pension is set by the state. Now it is 5283.84 rubles per month.

Who is considered self-employed by law?

This population group includes people who have organized a workplace for themselves.

That is, those carrying out independent activities (working exclusively for themselves). These include:

- Officially registered individual entrepreneurs (IP);

- Persons conducting private legal practice (notaries or lawyers, for example);

- Other citizens receiving personal income for:

- provision of services;

- execution of work;

- Farm managers.

Important: by Law No. 212-FZ of July 24, 2009, these people are required to independently make insurance contributions:

- pension;

- medical.

Attention: only the periods for which mandatory payments were made to the Pension Fund are taken into account when calculating the length of service.

Download for viewing and printing: Federal Law “On Insurance Contributions to the Pension Fund, Social Insurance Fund, Federal Compulsory Medical Insurance Fund” dated July 24, 2009 N 212-FZ

What types of pensions are available to the self-employed?

The type of old-age maintenance for individual entrepreneurs depends entirely on how much participation they have managed to take in filling the Pension Fund budget. These people can qualify for the following types of pensions:

- insurance, subject to the presence of a certain number of: points on a personal account (16.2 points in 2020);

- years of work experience (10 in 2019);

Insurance situations in which entrepreneurs can apply for benefits are as follows:

- Upon reaching the age limit, it is mandatory to participate in labor activities:

- for insurance payment this is: 60th birthday for women;

- 65th birthday for men;

- preferential, established by regulatory documents;

- for social:

- 65th birthday for women;

- 70th birthday for men;

- there is a preferential benefit established by law for certain categories of citizens;

- when registering a disability;

- in case of loss of a breadwinner.

For information: all self-employed people, without exception, are guaranteed social benefits in old age. But its size is small.

How to earn the right to a pension

If a self-employed person simultaneously works somewhere under an employment contract, the issue of a future pension is less pressing for him, because contributions for him are paid by the employer, the self-employed person has work experience and no points whatsoever.

If the self-employed person is already a pensioner, then the issue of lack of experience and points under NAP is also irrelevant for him.

But the rest of the self-employed, if desired, can voluntarily form their pension rights.

To replenish their individual pension insurance with experience and points, self-employed people need to enter into voluntary legal relations for compulsory pension insurance and pay a contribution.

How many fees should I pay?

Federal Law No. 167-FZ specifies the minimum and maximum amounts of voluntary pension contributions. For ordinary individuals and for NAP payers, they are slightly different.

For the self-employed, the voluntary contribution is accepted as equal to the fixed contributions of the individual entrepreneur.

In 2020, the minimum contribution is 32,448 rubles .

You can pay a smaller amount, but then a period proportional to the payment will be included in the insurance period.

The maximum amount of insurance premiums is calculated based on 8 minimum wages and the contribution rate.

In 2020, the maximum contribution is 256,185.60 rubles .

Contributions can be paid in one lump sum or in installments throughout the year. Payment must be made by December 31st.

KBK - 39210202042061000160 - Insurance premiums paid by persons who voluntarily entered into legal relations for compulsory pension insurance, credited to the Pension Fund for the payment of an insurance pension.

Is it profitable for the self-employed to pay contributions to their pension?

From the point of view of tax law, the concept of “self-employment” means that a person pays tax on professional income. Both an ordinary individual and an individual entrepreneur can become an NPT payer. To do this, you need to register on the Federal Tax Service website or in the “My Tax” application.

The NAP regime is very similar to the simplified tax system Income - the tax rate in both cases does not exceed 6%. Individual entrepreneurs under the simplified system are required to pay insurance premiums for themselves, and if they switch to NAP, they do so voluntarily.

At the same time, the tax calculated on the simplified tax system for income is reduced by the insurance premiums paid, but there is no such possibility on the NAP. Let's show it with an example.

Let’s assume that a self-employed person on NAP and an individual entrepreneur on the simplified tax system without employees earn 1 million rubles a year each. Both clients are legal entities, so the tax rate on income is the same - 6%.

An individual entrepreneur is obliged to pay insurance premiums for himself based on:

- for medical insurance – 8,426 rubles;

- for pension insurance - 32,448 rubles + 1% on income over 300,000 = 39,448 rubles.

In total, the individual entrepreneur transferred 47,874 rubles for his insurance, but they are completely deducted from the calculated tax. Therefore, the tax will be only (60,000 - 47,874) 12,126 rubles. In total, the individual entrepreneur will transfer 60,000 rubles to the budget: tax in the amount of 12,126 rubles and contributions in the amount of 47,874 rubles.

A self-employed person will transfer the same amount to the NAP - 60,000 rubles - but this will only be the tax on professional income. It turns out that their tax burden is the same, but the first will have a pension insurance period, and the second will not.

According to our calculations, a self-employed person wins if his income is lower than 800,000 rubles per year. Then he will pay less to the budget than an individual entrepreneur on the simplified tax system. But if a self-employed person decides to pay contributions for himself voluntarily, he will find himself in a less advantageous position than an individual entrepreneur, because contributions cannot be deducted from professional income tax. This means that, despite the advantages of the NAP, it is more profitable for a self-employed person with an income of 800,000 rubles to register as an individual entrepreneur on the simplified tax system Income.

To receive individual clarification on this issue, we recommend that you contact us for a free consultation.

Free tax consultation

How to become a self-employed volunteer

If you decide to pay contributions towards a future pension, you must first register with the Pension Fund of the Russian Federation - voluntarily enter into legal relations under compulsory pension insurance.

To do this, you need to submit to the Pension Fund at your place of residence:

- registration application;

- information confirming the fact of registration with the tax authority as an NPA taxpayer (obtained through the “My Tax” mobile application).

After submitting the application, the Pension Fund will register the self-employed person and issue him a registration notice.

How to apply for a pension for self-employed citizens

The procedure for applying for a pension benefit is practically no different from a similar procedure for other citizens. The PF must provide:

- passport;

- SNILS;

- two statements: about the purpose of the benefit and about the method of delivering the money.

You should also attach a certificate of professional activity.

The easiest way to complete the registration is through the government services portal. Sending by Russian Post is available, or you can personally go to the Pension Fund branch.

How is experience calculated?

The insurance period for self-employed volunteers will begin to count from the date they submit the application.

Moreover, the length of service also depends on the amount of contributions paid.

Even if the application was submitted at the beginning of the year (or even the previous year), but before December 31 the self-employed person paid contributions in an amount less than the established minimum, not the entire year will be counted toward his length of service. The Pension Fund will calculate the length of service in proportion to the contributions paid.

Thus, for 1 year of pensionable service in 2020, a self-employed person must pay 32,448 rubles .

How are points calculated?

Let's calculate how many pension points a self-employed person will receive if they pay voluntary contributions.

The number of points is affected by three parameters:

- the amount of contributions paid;

- the maximum base for calculating contributions, which is different for each year and is established by the Government;

- the contribution rate, which is now 22%.

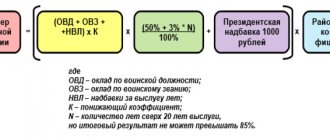

The formula for calculating points is as follows:

IPC = (DZ/22*16)/206 720 * 10,

Where

- DV - voluntary contributions;

- 22% - general contribution rate;

- 16% - individual part of the tariff;

- RUB 206,720 — contributions at an individual rate from the maximum base (1,292,000 * 16%)

Thus, having paid the minimum amount of contributions (RUB 32,448), a self-employed person will receive 1,142 points.

Having paid the maximum amount of contributions (RUB 256,185.60), a self-employed person will receive 9.013 points.

What will the pension be?

So, we counted the points. How much is this in rubles?

The cost of a point is different every year. From year to year it grows by the indexation coefficient. By law it is established for the period until 2024.

But we will not get ahead of ourselves, predict future inflation, etc.

Let's calculate the increase in pensions in this year's prices. In 2020, the cost of a point is set at 93 rubles.

Accordingly, by voluntarily paying the minimum contributions, a self-employed person will earn 106 rubles. 21 kopecks (1,142*93) future pension.

By voluntarily paying the maximum contributions, a self-employed person will earn 838 rubles. 21 kopecks (9.013*93) future pension.

When calculating the insurance pension, a fixed payment is added to the part calculated based on points, which, for example, in 2020 is 5,686.25 rubles.

As mentioned above, to acquire the right to a pension, a citizen must have at least 15 years of experience and 30 points.

Thus, if a self-employed person decides to pay only the minimum contributions each year, he will have to pay them for an average of 26 years (30/1.142). Then, at age 60/65, she/he will become entitled to an insurance pension.

If a self-employed person decides to pay the maximum contributions each year, they only have to pay them for an average of 3 years (30/9,013). Then, at the age of 60/65, she/he will acquire the right to an insurance pension (of course, provided that 15 years of service have also been accumulated).

If a self-employed person does not want to voluntarily pay contributions to the Pension Fund and the length of service and points from his other work activities are not enough, then, as was said, he will be able to retire 5 years later than his peers. And the pension will not be insurance, but social.

What goes into work experience?

The length of service includes the period of work of a citizen during which his employer made transfers to the Russian Pension Fund. For those who were not employees during their working career, the length of service includes the time when the citizen voluntarily paid contributions to the Pension Fund of the Russian Federation, thereby entering the sphere of pension insurance. Additionally, during the period of employment the following may be counted:

- time of service in the ranks of the Armed Forces of the Russian Federation;

- period of care for a child up to one and a half years old or for a disabled person or an elderly person;

- remaining in the status of registered unemployed;

- other circumstances in accordance with the law.

Important! The concept of continuity of service is currently excluded from the legislation of the Russian Federation.

Types of experience

The above circumstances refer to the total length of service. Pension legislation also provides for such concepts as:

- Special experience. This concept applies to the time of work in certain conditions: in regions of the Far North, in other areas with a regional coefficient, etc., in special (harmful) production conditions, in professions and positions in which length of service is counted.

- Insurance experience. This is the time during which contributions for the citizen were transferred to the Pension Fund. It differs from the general length of service in that contributions could also be paid during periods when the citizen did not work (due to disability, care, etc.).

Important! “Non-working” periods are counted in this type of length of service if the citizen carried out labor activities before or after them.

In what cases do the self-employed have length of service?

When answering the question whether self-employment is included in the length of service, you should know that for such citizens the length of service is counted during the periods when they voluntarily transferred insurance contributions to the pension fund. If no transfers were made for a certain year, then the length of service for that time is not accrued.

Important! The transfer of insurance premiums in this case does not reduce the accrued income tax.