In 2008, sensing the growing dissatisfaction of military pensioners, the government approved the possibility of them receiving a second pension payment. You can find out the amount of future additional support in any Russian pension fund, or independently calculate the second pension for military pensioners using a calculator.

Frequent changes in pension legislation force future and current pensioners to personally oversee issues related to additional payments, retirement age, and raising the minimum of certain conditions. To study the news, people resort to newspapers, television or, as in this case, the Internet.

What is a mixed pension

As a general rule, in order to receive a military pension, a citizen must serve in the army or other security forces equivalent to them for at least 20 years. This is the so-called length of service. Its calculation has a number of features, which will be discussed below.

However, if a citizen does not have such length of service, that is, his period of service is less than 20 years and at the same time he worked in civilian positions, then he cannot count on full military pension coverage. He is assigned a mixed pension, taking into account both military service and civilian experience.

The grounds for its calculation are specifically stated in the law and are:

- Total work experience – at least 25 years.

- The period of service in the military is at least 12 years and 6 months.

At the same time, it is important to take into account the circumstances on the basis of which the serviceman was transferred to the reserve. They may be as follows:

- health status;

- reduction and reorganization of military units (other structures);

- reaching a certain age threshold (for example, for contract servicemen from the rank and file and non-commissioned officers, the age limit for serving in the army is 35 years).

Civil pension for military pensioners

The assignment of payments for length of service for most former military personnel occurs during the period when they are fully capable of working. Therefore, many of them, upon completion of service in the military or other structures equivalent to them, find employment in civilian life or engage in business, registering as individual entrepreneurs.

Accordingly, former military personnel are subject to the provisions of Federal Law No. 200 “On Insurance Pensions” and they are required to register with the pension insurance system. However, the civil pension for military pensioners is calculated in a different manner from other categories of citizens.

Indexation of pensions for working pensioners in 2019

Not so long ago, old-age insurance payments were indexed to all pensioners, regardless of their work activity, but since 2016, Article 26.1 of Federal Law No. 400 came into force in the Russian Federation. According to its provisions, from January 1, 2020, the insurance pension is indexed only for non-working pensioners . Those who work receive cash support in the same amount without taking into account planned indexations.

- At the same time, the February indexation in 2020 affected only those pensioners who, as of September 30, 2020, did not officially work anywhere.

- If a citizen left work in the period from October 1, 2020 to March 31, 2020, then he had the right until May 31, 2016 to submit a corresponding application and the necessary documents to the territorial body of the Pension Fund of the Russian Federation or a multifunctional center (MFC). In this case, the pensioner was assigned an increased insurance pension, taking into account the indexation.

It is worth noting that at the moment, if a pensioner has stopped working, an application to the Pension Fund is not necessary!

From now on, the periods of work of citizens will be determined automatically by the Pension Fund on the basis of reports that the employer will transmit to the Pension Fund.

Indexation of pensions for working citizens will be suspended (as already specified in the federal budget law) until 2020.

Indexation of pensions for military pensioners

Unlike insurance payments, state pension benefits are indexed for both working and non-working pensioners, including military personnel. Indexation is carried out by the state in accordance with Article 25 of Federal Law No. 166 every year on the first of April.

However, according to the same article, the increase in monetary support for military personnel and members of their families is regulated by Law of the Russian Federation No. 4468-1, due to changes in the size of the reduction factor or indexation of the military personnel's monetary allowance.

In January 2020, military pensions were increased by 4% as a result of the indexation of monetary allowances. The reduction factor remained unchanged - 72.23%.

Increase in insurance pension

Since the old-age insurance pension for former military personnel is assigned without taking into account the fixed payment , for those citizens who do not work but receive both pensions, the insurance cash provision is annually indexed in accordance with the legislation of the Russian Federation.

The size of the insurance pension depends on the amount of contributions accrued for it under the compulsory health insurance system, converted into pension points, multiplied by SIPC - the cost of one point (see the formula above). On January 1, 2018, insurance pensions were indexed by 3.7%, while the SIPC also increased, after which it amounted to 81 rubles 49 kopecks .

But, if a military pensioner officially gets a job again, his pension provision, namely the insurance pension, is subject to annual recalculation on August 1.

Calculation of military pension

The calculation of its sum consists of many terms and is made according to the following formula:

Using this formula, you can calculate a military personnel’s pension using the following algorithm:

- The values of payments by position (OVD), payments by rank (OVZ), and bonuses for length of service (NVL) are added up

- The resulting amount is multiplied by a fixed reduction factor. At the moment it is 72.23.

- Then , subject to full service (20 years), years of work in excess of service (N) are multiplied by 50%, with another 3% added for each subsequent year. If the calculation takes place for a mixed pension, not 3% will be added, but 1% for each year of overtime.

- Both obtained values are multiplied by each other.

- The presidential allowance (PD) is added to the resulting value

- The total value is multiplied by the regional coefficient (RC), which is determined based on the area of service.

How and when can a military pensioner apply for a civil pension?

Subject to receiving appropriate payments for length of service, a working military pensioner has the right to receive a civil pension.

To do this, the following conditions must be met:

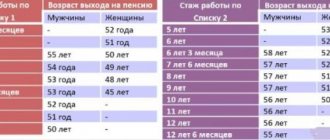

- has reached the generally accepted retirement age (before the start of the pension reform, it was 60 years for men and 55 for women, but a gradual increase is envisaged).

- You must have a minimum insurance experience in a civilian specialty. Before 2020, it was 6 years, but it is expected to increase by 1 year annually. Thus, in 2019 it is already 10 years old.

How is a civil pension calculated for a military man?

It is calculated from three components:

- insurance payment;

- storage part;

- fixed payment.

The amount of the fixed payment does not depend at all on how long the citizen has worked. The assignment of an insurance component to a military pensioner differs in its specific features. It is calculated using the following formula:

Where SPB is the sum of pension points. One pension point in 2019 is 74.27 rubles.

IPC is the pension coefficient for the entire length of service.

It is difficult to calculate these amounts yourself, since to do this you need to know your IPC, which is a variable value.

Is it possible to receive a military and civil pension at the same time?

Many former military personnel are wondering: is it necessary to switch from a military pension to a civilian one or is there a double payment? The legislation provides that a military pensioner who receives the appropriate funds has the right to receive a second, civilian pension if the conditions mentioned earlier in this article are met.

In what cases is it allowed?

The labor pension for persons born in 1967 consists of two parts: funded and insurance.

A funded pension is material assets of compulsory savings that are accounted for in a special part of the personal account of the insured citizen. This part is formed on the basis of receipt of insurance contributions for mandatory pension financing and income from their investment.

You can find out more about what the funded part of a pension is, to whom and how it is paid, here.

According to current legislation, military personnel who have reached a fixed retirement age and have at least 5 years of insurance experience have been established to receive a one-time service pension or disability payments. The exception is those citizens who served in conscription as sergeants, sailors or soldiers.

For this category of pensioners, it is possible to form accumulative pension funds in the insurance system in the following cases:

- If they were born after 1967 inclusive, in case of payment of insurance contributions for low-income pensions while working in non-military positions.

- If they refer to people for whom LF insurance premiums were sent during the period from 2002 to 2004 while working in non-military positions.

- If persons are members of the Pension Co-financing Program.

- If pensioners have the right to maternity capital and transfer this money to a further pension account.

You can find out more details about who has access to the funded part of the pension and how to receive it in this material.

If a citizen has switched to an early old-age pension, but he has not yet received the funded part, this person has the right to apply to the territorial state body of the pension fund at his place of residence or to a non-state fund (NPF) if his pension savings are located there. You must submit an application to establish the accrual of a funded pension, having with you a passport and a document on pension insurance (more details on how to apply for payment of the funded part of a pension can be found in this material.

In the case when a person who has an accumulated amount of funds applies for the first time for a labor pension, he can simultaneously be approved for the insurance part of labor pension payments and determine the right to the method of issuing the funded part. Federal Law No. 360-FZ of November 2011 describes the types of accruals of savings funds for pensioners.

Useful video

We suggest watching the video for more information on the issue:

Military personnel, based on the type of their activity associated with an increased danger to life, have a number of benefits and preferences on issues related to pension provision. They have the right to count on payments from the Ministry of Defense upon reaching their seniority.

Additionally, like all citizens of the Russian Federation, they can receive a second, civilian one, if after finishing their service they worked in civilian positions. For military personnel who have not served 20 years for good reasons, mixed payments are provided.

Former military personnel, a long-service pension is granted at a fairly young age. Many are employed after completing their service in civilian jobs and are engaged in entrepreneurship. Legal registration of this activity gives the right to receive a second pension. But the design of its insurance part is somewhat specific.

The legislative framework

The issuance of civil pensions to former employees of the Ministry of Internal Affairs is regulated by the following acts:

- Federal Law No. 400 of December 28, 2013;

- Federal Law No. 166 of December 15, 2001;

- Federal Law No. 156 of July 22, 2008;

- Decree of the Government of the Russian Federation No. 162 of February 25, 2000.

The general principle of the right to social security in old age is set out in the Constitution of the Russian Federation (Article 39). The rules for assigning military pensions are regulated by Law No. 4468-1 of February 12, 1993.

In controversial situations (for example, with mixed experience in difficult conditions), the basis for court decisions is not only regulations, but also legal practice in similar cases.

By law, insurance benefits are assigned to those who have accumulated enough length of service and individual coefficient points (IPC) at the time of reaching retirement age. The amount of the IPC depends on the amount of income and contributions to the Pension Fund.

The length of service does not include periods of service in the Ministry of Internal Affairs and other activities that have already been taken into account when calculating long-service benefits. If a former military man is already receiving departmental payments and does not have sufficient grounds for insurance charges, then he is not entitled to old-age social benefits.

To receive a second pension, you must have civil service.

Mixed pension calculation

The calculation of the amount of civil pension for military pensioners is carried out based on the following algorithm:

- SP – insurance pensions;

- SPK – the price of one pension point for the year the pension provision was established;

- IPC is the sum of collected pension points.

In 2019, one point is valued by the state at 87.2 rubles. In the future, its value will increase taking into account inflation and other economic factors. Thus, the civilian part of pension payments depends on two factors: the amount of official wages and the length of work experience.

How to apply for a civil pension

You need to do the registration about a month before the retirement age. It is mandatory to submit a written application - through the State Services Internet portal, or by registered mail to the Pension Fund. You can fill out the form during a personal visit to the local branch of the Pension Fund or the MFC office at registration or place of residence.

A military pensioner must attach the following documents to the application:

- Passport.

- SNILS.

- Work record book and other documents confirming work experience.

- Papers for calculating military pensions.

- Confirmation from employers about the presence of work experience that was not recorded before the transition to a personalized accounting system.

- Certificate of consecutive salary for five working years before 2002 (if relevant).

Additionally, you may need documents confirming disability and the presence of dependents, certificates certifying the availability of preferential service, and the performance of special work. If the registration is carried out by a legal representative, his passport and notarized power of attorney.

Requirements for obtaining mixed experience

Expert opinion

Vasiliev Pyotr Severinovich

Lawyer with 10 years of experience. Specializes in criminal law. More than 3 years of experience in drafting contracts.

Mixed length of service is the sum of all work for hire, some of which is contract service in the army. To qualify for a mixed experience calculation, you need to meet a number of requirements :

- Dismissal from the armed forces occurred for one of three reasons:

- deterioration of health;

- reduction;

- reaching the retirement age of the law enforcement agency.

- The service period was at least 13 years, and the total work experience was more than 25.

- The contract service took place in one of 7 departments:

- Internal affairs bodies (OVD).

- Ministry of Defense of the Russian Federation.

- Armed forces of the Russian Federation.

- Drug department

- Criminal-executive service.

- Fire Department.

- Federal Security Service.

to contents

Conditions for additional payment to pensioners for civil service

A serviceman who continues to work after dismissal in a civilian occupation has legal rights to pensions from both the law enforcement agencies and the Pension Fund of the Russian Federation. This right is enshrined in Federal Law No. 136. According to this law, to receive the second additional payment for civil service, a pensioner needs :

- Reaching retirement age: men - 60, women - 55. In the case of work in the far north and in areas equivalent to it, Federal Law No. 400 is applied, which describes special working conditions. According to it, retirement age may come earlier.

- The insurance period (the period of full payment of contributions to the Pension Fund from wages) outside the law enforcement department must be at least 8 years.

How is the payment amount calculated?

In 2020, the general system for calculating pension payments changed, which also affected former military personnel. It became possible to calculate the insurance payment for pensioners using the formula:

IPK X SB=P,

in it:

IPC - the number of points for the entire period of official insurance experience,

SB - the price of the current point,

P - pension amount.

You can find out your IPC by calling or personally contacting the Pension Fund , or try to calculate it yourself. To do this, find out the total number of insurance transfers. And stick to the calculation algorithm.

- The totality of your insurance payments / all-Russian payments of pension insurance contributions * 10 = Civil Procedure Code. In 2020, the annual coefficient should not exceed 8.7.

- Then, GPC * number of years of experience = IPK

- And finally, IPC * current point price = insurance coverage.

Payment calculation procedure

The main parameters by which a mixed pension is formed are length of service and total length of service . Using them, specialists from the Russian Pension Fund calculate the basic amount of social benefits.

Afterwards, various increasing and decreasing coefficients are applied to it (why and who needs the length of service coefficient when calculating a pension?). Their use depends on the length of military service and the length of work in a civilian specialty after retirement.

Even with incomplete service, but not less than 12 years and 6 months, a citizen has the right to count on 50% of the military pension payment, which is indexed annually by 1%. This happens on August 1st.

Comments (12)

Showing 12 of 12

- Eduard 05/02/2016 at 19:41

I am a former military man, currently retired, receiving disability benefits, which is why I had to leave my job. He worked in one place in a certain law enforcement agency for almost 25 years. Why don't I get paid anything for my length of service?answer

- Alina 05/09/2016 at 13:33

A pension for long service is provided to military personnel who have reached the age of 45. You are currently receiving cash benefits for disability. Both of these monetary provisions are government payments. In accordance with Russian Federation Law No. 4468-1, if a military pensioner has the right to two types of state pension payments, then he can choose only one. In your case, it is not known whether you are entitled to a monthly allowance for long service. But even if you have such a right, you will need to choose one pension out of two. In this case, two payments are not provided for by the legislation of the Russian Federation.

answer

My mother is a former military man. She retired from the law enforcement department at the age of 45 back in 2006. In 2013, she got a job in a clothing store as a storekeeper, where she currently works. Since 2005, she has received a military pension for long service. She turned 55 in February 2020 and is legally entitled to work benefits. But the Pension Fund of Russia said that she had little work experience and needed to come back later. Why was she denied this payment, since she had already reached the required age?

answer

Alina 05/14/2016 at 14:44

The actions of the Russian Pension Fund are absolutely legal, since in order to receive an insurance (labor) pension for former military personnel, several conditions must simultaneously coincide, and specifically for your mother this is:

- reaching the age of 55 years;

having a minimum insurance period, which in 2020 is 7 years;

We do not know the amount of your mother’s individual pension coefficients, but the insurance period in civilian life is less than the required 7 years (about 3 years). Since to assign this type of pension, only years of work in civilian life are taken into account.

answer

I have been receiving a military pension since 2010 and continue to work in civilian organizations. This year I turn 55 years old. When applying for a labor pension, they took certificates from places of work before 2001. Why is length of service after military retirement not taken into account?

answer

- Eduard 10.28.2016 at 15:28

The fact is that since 2002, the law “On Compulsory Pension Insurance in the Russian Federation” came into force, in connection with which insurance contributions to the Pension Fund of the Russian Federation began to be deducted for you and periods of work were registered by transmitting information about the length of service by your employer. Therefore, this period of work is automatically taken into account in the Pension Fund, and certificates of experience are needed to confirm your work activity until 2001.

answer

Hello, I am a pensioner of the Ministry of Internal Affairs since 2010, and an individual entrepreneur since 2014. Starting this year, they stopped indexing pensions. In June I submitted documents for insurance payments to the pension fund; in June I will turn 55 years old. Civilian experience of 9 years 5 months, if I close my individual entrepreneur, will the military pension be indexed and approximately how much will the civil pension be added? Thank you!

answer

My dad, a WWII participant and a special risk group, died in 2020. Is my mother entitled to compensation for the loss of a breadwinner? The pension fund said no, but the military registration and enlistment office said yes. Dad was injured in military service, mom was declared incompetent, disabled group 1. We live in Ufa.

answer

Does my husband receive a military pension? after retirement, he registered as an individual entrepreneur and pays fixed contributions to the Pension Fund for himself (without hiring employees). Will he be entitled to an additional insurance pension?

answer

For 20 years of flight work I receive a decent pension, taking into account the reduction factor of 72.23%.

For 22 years of work experience in 3 jobs, I received as much as 3.5 thousand rubles.

The thieves! Look what buildings the Pension Fund of Russia has erected in all cities, and now they are also increasing the retirement age!

answer

He received a military pension after working in the law enforcement department for 20 years. Now I am 73 years old, I worked in civilian life for 20 years. Am I also entitled to an insurance pension? Did I pay taxes? What should I do and where should I go?

answer

Hello! I worked in the Ministry of Internal Affairs for 26 years. After retiring, he continued to work as a civilian for 5 years, that is, he worked until May 15, 2020. Four months have passed since my dismissal, but I still have not received an indexation of my military pension.

answer