There come times in the life of every person when, with the advent of old age or the onset of disability, he cannot work, and, therefore, receive wages to support himself and the disabled members of his family. Here social cash payments from state and non-state pension funds (PFR and NPF, respectively) come to the rescue. But such payments are the income of an individual. In accordance with Art. 207 of the Tax Code of the Russian Federation, all residents and non-residents who received income in Russia are required to pay personal income tax. Therefore, a logical question arises among older people: do pensioners pay tax on their pensions?

Brief answer to the question

To answer the question briefly, many experts narrow the topic and consider only income taxes. But there are other types of taxes: transport, property, land. Do pensioners pay them? After all, funds for these types of taxes do not fall from heaven in the form of “manna from heaven.” They have to be taken from the same pension.

We answer:

- income tax is not paid. Personal income tax is withheld only in rare cases, which we will discuss below;

- transport tax - paid by vehicle owners, regardless of age. It refers to regional types of taxation, so in some places there are benefits for pensioners, but in others there are not;

- property – paid, but there are benefits that people of retirement age can take advantage of;

- land - taken from all owners of land plots, regardless of what type they are classified as. There are benefits for individuals living on pensions.

“This will not bring much money to the budget: the existing rate of 13% is already low. Moreover, this will be illogical against the background of the principle of operation of individual investment accounts, which are exempt from taxes. Therefore, it will be more profitable for people to invest there rather than in SPP,” Anton Tabakh is sure.

But for the economy, in turn, as analysts warn, this approach will result in losses, since people will lose interest in investing, for example, in company shares. However, Russians have not experienced much “retirement optimism” before. As it turned out from a survey conducted by Sberbank Non-State Pension Fund in November-December 2020 in 30 Russian regions, the majority of citizens over 50 years of age (72.8%) believe that their own savings are not enough for a comfortable life in retirement.

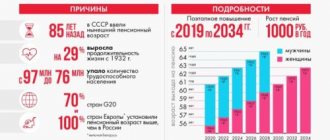

It should be noted that in the last 20 years alone, the state has carried out three or four pension reforms. In December 2020, a law was signed to extend the freeze on the funded part of the pension for another year - until 2023. Today, deductions in the amount of 6% of Russians’ wages are used to pay current pensioners.

Permanent news address: eadaily.com/ru/news/2020/01/24/v-rossii-gotovitsya-nalog-na-pensiyu Published on January 24, 2020 at 13:15

Add EAD to your sources: Yandex-News Google News

All news

- 19:54 “I hope this is a mistake”: Patrick Lancaster was not allowed on the flight

- 19:53 Belarusian opposition leaders nominated for Nobel Prize

- 19:20 Pompeo is authorized to warn: Arms sellers to Iran will be subject to sanctions

- 18:30 How to become a volunteer in Covid-19 vaccine trials and what awaits them?

- 18:05 Georgia is not responsible for the transit of civil flights - MFA

- 17:59 Social networks blew up a video with a new type of dance - “Covid waltz”

- 17:21 The head of the Yalta administration died from coronavirus

- 16:45 Media: Türkiye transferred more than 2,000 militants from Syria to Karabakh

- 16:25 Candidate for Prime Minister of Georgia drops out of race due to Covid-19

- 16:17 Former head of the SBU: The ideal of Ukraine is a nuclear power right up to Vladivostok

- 15:25 After the presidential elections, the United States will be on the brink of civil war - expert

- 14:38 “Attractive place”: 61% of Ukrainians plan to work in Poland

- 13:41 Opinion: Erdogan will make a strategic mistake by joining the anti-Crimean alliance

- 12:58 Minister of Education of Russia: There is no need to discuss the transfer of the OGE and the Unified State Exam

- 12:56 The head of the Ministry of Internal Affairs of Estonia is being “worked out” for his “intolerance” towards gays

- 12:43 Two children with a stroller fell from an escalator in a Moscow shopping center

- 12:25 Latvian nationalists were outraged by the call to give Russians equal rights

- 12:23 Ministry of Defense of Azerbaijan: Armenian troops carried out a counter-offensive

- 12:17 France sheltered teacher's killer after Poland refused asylum

- 11:57 Hardly a truce: Armenian Foreign Ministry pointed to the “treacherous essence” of Azerbaijan

- 11:56 In Tallinn, the United States will sign an agreement on the construction of a nuclear power plant in Poland

- 11:41 Annals of history: in Brazil, a bribe-taking senator was detained with banknotes in his butt

- 11:31 German airspace control center opened in Lithuania

- 11:28 The truce in Karabakh has been shaken: an offensive by Azerbaijan has been recorded

- 11:18 Over the past 24 hours, 15,099 new cases of coronavirus were detected in Russia

- 11:16 Lithuanians waited: Udaltsov leaves

- 09:57 A case has been filed against a Russian German who compared Merkel to Hitler

- 09:15 The Polish diaspora in the United States is disappointed with Biden’s phrase about “totalitarian Poland”

- 08:54 War in Karabakh: why is NATO Türkiye adding fuel to the fire?

- 08:44 The ex-speaker of the Seimas of Lithuania called for local Poles to be shot “once a year”

- 07:21 “I have never experienced such horror in any war”: Karabakh between the truces

- 06:05 The State Duma proposed paying extra for citizens who sort their waste

- 05:35 The pension delivery system is changing in Russia

- 04:45 The risk of coronavirus transmission through frozen food has been confirmed in China

- 04:16 Turkey may not be satisfied with the increase in oil production in Libya

Load more

Top news

- The ex-speaker of the Lithuanian Seimas called for local Poles to be shot “once a year”

- Ministry of Defense of Azerbaijan: Armenian troops carried out a counter-offensive

- Opinion: Erdogan will make a strategic mistake by joining the anti-Crimean alliance

- War in Karabakh: why is NATO Türkiye adding fuel to the fire?

Editor's Choice

- France shelters teacher's killer after Poland refuses asylum

Analytics

- London's ultimatum to the European Union: What is Brexit on “Australian terms”?

- The “war chest” is being emptied: Türkiye is paying for its aggressiveness – media

- Russia and the new Ottoman Empire: how not to repeat old mistakes - opinion

- “Monkey vaccine” as a symbol of the “antiviral arms” race

- War in Karabakh: Aliyev’s time trouble and Pashinyan’s American roulette

- Pause for Belarus: Lukashenko resisted the “cavalry attack” of the West

- Azerbaijani diaspora in Russia, the war in Nagorno-Karabakh and the influence of Turkey

Current stories

- Disintegration of Ukraine

January 2020

Information

- About the agency

- Authors

18+

© 2015-2020 EADaily

Media registration certificate: IA No. FS 77-63062 dated September 10, 2015, issued by the Federal Service for Supervision of Communications, Information Technologies and Mass Communications (Roskomnadzor).

When using materials, a hyperlink to the EADaily news agency is required

Using EADaily Information Agency information for commercial purposes without the agency's written permission may result in legal action.

Is income tax paid on pensions?

In accordance with Art. 217 of the Tax Code of the Russian Federation, income tax for pensioners is not taken from a pension if it is paid:

- employees of the state and municipal government apparatus;

- military, which includes personnel from the Ministry of Defense and astronauts;

- persons who participated in the liquidation of the Chernobyl accident;

- persons who have reached the established age (old age);

- people who have become disabled (due to disability);

- families who have lost their breadwinner.

Personal income tax is not charged from the insurance pension on:

- the estimated part of the labor pension;

- fixed payments added to insurance coverage;

- disability payments;

- survivor benefits.

From the above list it is clear that all main types of payments from the Pension Fund and the state or regional budget are not subject to income tax.

Things are different with non-state pension funds. According to paragraph 2 of Art. 213.1 of the Tax Code of the Russian Federation, payments of pension amounts from funds that are not state-owned are subject to taxation at a rate of 13%. However, not everything is so simple here either. There is no personal income tax when receiving a pension from a non-state pension fund if:

- accruals are made from the accumulative part;

- a non-state fund received a license;

- The agreement with the NPF was concluded by the employer, not the individual. Here the main requirement is not the presence of a license, but the registration of the fund in Rosreestr;

- The agreement with the fund was concluded by a close relative of the pensioner. In this case, the pensioner is considered a third party to the agreement and his pension payments are not subject to the requirement of the law to accrue 13% personal income tax.

Income tax

All earnings of citizens received from labor, authorship or other activities are subject to income tax in our country. In this sense, working pensioners are not much different from “ordinary” citizens who are not of retirement age. They also work, receive a salary and also pay income tax on it.

In addition to wages, personal income tax is levied in full on winnings, dividends, and pensions received under non-state pension insurance contracts. By paying income tax on time, working pensioners acquire the right to a refund of part of it from the amount of actual expenses:

- for education, treatment, medicines purchased by citizens for themselves or their family members,

- for the purchase of health resort cards and vouchers, VHI policies,

- to pay for contracts with non-state pension funds,

- incurred for the purchase and construction of residential real estate,

- for payment of interest on mortgage agreements,

- on the sale of previously acquired residential real estate,

within the following limits:

- 50 thousand rubles. for education;

- 120 thousand for medicines, medical services, voluntary insurance, non-state pension insurance;

- 2 million rubles when purchasing residential property;

- 3 million rubles on payment of interest;

- 1 million rub. on expenses for the sale of property.

You can apply for deductions no more than three years after the right to them arises. This rule applies to all types of deductions, except property. Pensioners can receive a property deduction at any time if they have income subject to personal income tax, or transfer it (deduction) to previous tax periods (but not more than three), if they had such income in the past. Thus, a pensioner who retired in 2013 and bought an apartment in 2020 can receive a deduction for 2012 and 2013.

To receive a deduction, you must submit a tax return to the Federal Tax Service, take a certificate of taxes paid at work and submit documents certifying your right to the deduction.

Do I need to pay taxes on pension supplements?

In addition to the main body of pension accruals, pensioners are paid various additional payments and allowances. Like the main types of pensions, all additional payments and allowances from the Pension Fund and the budgets of the country and regions are excluded from the tax base. This means that the following are not subject to personal income tax:

- additional payments up to the cost of living, paid from the federal and regional budgets. This rule of law also applies when the amount of additional payment is greater than the amount of the pension;

- supplements to pensions from the regional budget for WWII veterans, persons who survived the siege of Leningrad, and labor veterans;

- increased fixed payments for dependents;

- fixed premium (twice) for persons over 80 years of age;

- northern allowances;

- additional payments to pensions based on various coefficients: motivating, regional and for small peoples of the North.

Thus, indexation of pension provision, as well as bringing the pension amount to the level of the minimum wage, do not relate to additional income. Therefore, according to Russian laws, no income tax is withheld from them.

From the above, it logically follows that all additional payments from other sources, from the point of view of the Tax Code of the Russian Federation, relate to additional income. The Ministry of Finance has the same vision of the problem, which, in its letter No. 03-04-05/48965 dated July 13, 2018, classifies corporate pension supplements (paid by a former employer) as additional income, which is taxed at 13 percent. It makes no difference whether a pensioner is working or not.

The same attitude applies to additional payments to employees of municipal government bodies, if additional accruals are carried out on the basis of a decision of the Legislative Assembly.

When paying severance pay to pensioners, income tax is not charged on the amount of 3 average monthly salaries for the main part of Russia, and 6 monthly salaries for the northern and equivalent regions of the country. Everything above is taxable (letter of the Federal Tax Service No. AS-4-3/15293 dated September 13, 2012).

Which pension payments are subject to income tax?

According to the law, tax benefits do not apply to pensioners when receiving the following types of payments:

- pensions from savings in non-state pension funds (NPF);

- severance pay upon dismissal from work (partially);

- additional payment from the former employer for special merits;

- other payments not provided for in Art. 217 Tax Code of the Russian Federation.

Non-state pension

According to Russian legislation, every citizen upon reaching a certain age, becoming disabled or losing a breadwinner has the right to claim a monthly state benefit. In addition to this, individuals have the right to enter into an agreement with a non-state pension fund to form additional payments upon the onset of old age in addition to the assigned pension provision from the state.

Pension tax in a non-state fund is not calculated if the citizen independently formed savings. If the employer paid contributions for him, an income tax of 13% of the amount received will be withheld from the elderly person. An exception is contributions made to the NPF by the employer before 2005.

- How to get an early pension for January

- What dental services are provided under the compulsory medical insurance policy?

- Eyebrow spraying - what is it and a description of the tattoo technique, skin care after the procedure and the effect with photos

Additional payment to pension for long work experience

In order to support the standard of living of former employees or in accordance with the corporate social policy of the enterprise (organization), pensioners may receive additional cash payments. Their size is determined individually and is not regulated by law. The amount is determined in rubles.

This type of income is considered a source of additional income for citizens, regardless of whether they receive an old-age pension or a disability pension. The benefit does not apply to assistance, so payments are subject to taxation on a general basis - at a rate of 13%. Explanations on this issue can be found in the letter of the Ministry of Finance dated July 13, 2020 No. 03-04-05/48965.

Severance benefits

Upon dismissal from work, an employee is entitled to severance pay. Based on clause 8 of Art. 217 of the Tax Code of the Russian Federation, payment is not subject to income tax if its amount does not exceed:

- 6 times the average monthly salary - for workers working in the Far North and equivalent territories;

- 3 times the average monthly earnings for everyone else.

If the assistance exceeds the value, the resigning person must pay a tax of 13% on the difference. Changes regarding obligations to pay personal income tax on severance pay have been in effect since 2014. Detailed information on aspects of interest can be obtained in letters from the Ministry of Finance and the Federal Tax Service.

Personal income tax for pensioners – municipal employees

Many people are interested in whether pensions are included in the income of municipal employees, which is taxed. This is due to the fact that they receive pension benefits, calculated taking into account the allowance received. Since their pension payment is classified as state and paid from the federal budget, it is not subject to taxation.

Nuances of taxation of working pensioners

Employed persons of retirement age belong to a special group of Russian citizens. After all, in order to survive, they receive payments from two different sources:

- from the employer, for the work done;

- from the Pension Fund and the budget in the form of social payments (pensions and benefits).

Income tax is not calculated on the pension of working pensioners. But deductions are made from wages in the amount of 13%. After all, from the point of view of the law, as an employee, a pensioner is no different from the rest of the working population.

Attention: from any additional income that does not fall into the category of pension or social benefits, including income from deposits, investment activities, dividends from various shares, etc. personal income tax is withheld.

Is the pension subject to personal income tax?

Pensioners, as a privileged category of the population, have a number of tax breaks. They are fully or partially exempt from paying certain contributions:

- Property tax. They do not pay for one property of the same type.

- Land tax. Provides a tax deduction in the amount of the cadastral value of 6 acres of land.

- Transport tax. Upon payment, a discount is provided, the amount of which is determined by regional legislation. The benefit does not apply to every subject.

According to federal law, income tax is not charged on pensions in Russia if payments are accrued through the Pension Fund (PFR) or the law enforcement agency (Ministry of Defense, Ministry of Internal Affairs). There is no need to submit any documents to the Tax Inspectorate - the information comes there directly from the organization involved in calculating pension benefits.

Personal income tax is not withheld from the pensions of working pensioners. They pay income only from the salary they receive and other incentive payments from the employer. This provision also applies to military pensioners if they get a job after retirement. Do older people care whether pension payments are included in the income of a working pensioner? Yes, it is included, but only when calculating total income, not taxable income.

In addition, working pensioners are entitled to other benefits, unlike non-working elderly people. They can apply for a tax deduction from wages for treatment, purchase of real estate and education of children. You can return money previously paid through the Tax Office or your employer. There is no deduction from pension payments for working pensioners.

- Goat quilling

- How to disable roaming on Beeline

- How to spend Beeline bonuses

Article 217 of the Tax Code defines the list of payments that are not taxed:

- insurance, social and state pensions;

- funded pensions;

- social additional payments through the Pension Fund or social security authorities;

- fixed payments to the insurance pension.

Features of paying other taxes from pensions

Several other mandatory taxes are paid from pension payments: transport, property, land. Considering the small size of pensions for the bulk of the population, legislators have provided benefits and discounts for people of retirement age.

Transport. The tax refers to regional types of taxation. Therefore, the Legislative Assembly of each subject of the federation independently decides the amount of tax and benefits for pensioners. As a result, there are regions with benefits, and others where pensioners pay on an equal basis with the working population. This topic is covered in detail in the work “Transport Tax for Pensioners.”

Property. Based on Art. 407 of the Tax Code of the Russian Federation, pensioners do not pay tax for one object of each category of real estate:

- apartment;

- country house;

- garage;

- private house, etc.

There are two conditions for exemption from payment:

- the property must be owned by the pensioner;

- did not generate income (was not rented out or hired and was not used for business activities).

Land. Also applies to regional taxation. Can be reduced by 10.0 thousand rubles. for some pensioners, which include disabled people, WWII veterans, Chernobyl survivors, etc.

We especially note that the benefits are of a declarative nature. This means that if there is a benefit, but the pensioner did not submit a corresponding application to the tax and duties inspectorate in a timely manner, he will have to pay the tax in full.

To receive benefits, you must submit to the Federal Tax Service:

- passport;

- pensioner's ID;

- documents confirming ownership;

- application for preferential tax treatment.