I would like to clarify such a moment in a person’s life as retirement, reflect how this happens and what payments citizens are entitled to upon retirement.

Based on the current legislative system and the Labor Code of the Russian Federation, a citizen who has the right to retire has the right to continue working at an old or new enterprise. May also qualify for an extraordinary two-week vacation (not paid by the company).

If an employee decides to retire, he may not notify the employer in advance of his intentions. This condition does not apply in case of transfer to another enterprise for further accumulation of work experience.

Internal documents of the enterprise and organizations

Exactly how much salary will be paid upon retirement by age is very important to indicate in the collective agreement and in the additional provision on wage conditions. If such information is missing, the administration of the organization may not make any payments other than those established by the Labor Code.

Upon dismissal of an employee, according to labor law, the employee must be paid:

- Basic and additional salary. This payment is established by the official salary and tariff rate, as well as all bonuses and allowances established for the achievement of certain production indicators according to the time worked. Quarterly bonuses and certain additional payments can be paid to the employee at the end of the reporting period and the formation of the organization’s financial indicators.

- Compensation for unused vacation is paid regardless of the period when the employee did not use his right to vacation. Not a single day should be wasted, all days should be fully accounted for. The pensioner can alternatively go on leave immediately before his dismissal.

- Severance pay upon retirement during the process of staff reduction or liquidation of an enterprise is paid in accordance with the rules established by the collective agreement, current legislative norms or established written agreements between employees and the employer.

The final payment to the employee, according to Article 140 of the Labor Code, is made on the employee’s last working day. If the employee is absent from the workplace on the specified day for a valid reason, payment is made no later than the next day.

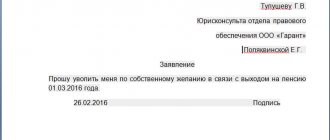

In case of voluntary dismissal, the phrase “due to retirement” indicated in the application completely exempts the employee from two weeks of work and imposes on the employer to accrue severance pay, which is documented.

If a pensioner or pre-retirement worker loses his job due to liquidation or staff reduction, he must be accrued specified cash payments based on the reduction. People of pre-retirement age also have the right to receive unemployment benefits, payments of which are made by the Employment Fund. These payments are paid in the amount of one subsistence minimum for 1 year.

Forcing a pensioner or pre-retirement person to write an application “of his own free will” is punishable. It can be appealed in court. In this case, the court may order payment by the employer for forced downtime of the employee, as well as moral damages.

Grounds for dismissal of a pensioner

If a pensioner resigns of his own free will without specifying a reason, then he must write a letter of resignation and undergo work within 14 days (this is done so that the organization can find a replacement for the employee). If a pensioner indicates the reason “retirement,” then he may be subject to dismissal without service.

Grounds for dismissal of a pensioner

Pension reform

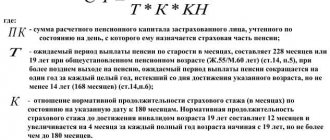

Increasing the pension amount by reducing the number of pensioners will take place in stages. This process is January 1, 2020. The required indexations will be calculated directly by the Pension Fund of the Russian Federation. According to Federal Law No. 350-FZ of October 3, 2018, when retiring in old age, certain conditions must be met:

- A gradual increase in the retirement age to 65 years for men and 60 years for women. This threshold must be reached in 2023;

- By 2024, the mandatory insurance period must be increased to 15 years;

- The individual pension capital must be increased to 30 units. This indicator should be achieved by 2025.

The increase in the retirement age by five will also affect teachers and medical workers, people applying for a long-service pension, as well as residents of the Far North and equivalent regions, as well as people living in regions with an unfavorable climate.

Applicants who are eligible to receive a social pension - persons who are not eligible to receive a pension due to insufficient required pension experience or number of points will receive a pension in accordance with the conditions for a gradual increase in the retirement age.

The new law that has entered into force does not bring changes in the area of mandatory additional payments in the event of old-age retirement, but only tightened the employer’s liability when dismissing employees of retirement and pre-retirement age.

Previously, the very fact of dismissing an employee at the initiative of the enterprise administration only upon reaching retirement age was considered discrimination. From January 1, 2020, this norm will also affect pre-retirement people - these persons will be registered for vacation in accordance with the new age qualification rules.

One-time payments established by law

The one-time payment provided in the event of retirement depends on the status of the pensioner himself, the type of social security, as well as the conditions contained in federal and regional legislation, as well as internal local orders and documents.

If regional legislation, in comparison with Federal acts, provides for improved conditions, it is an axiom. If the situation of persons retiring under a collective agreement improves, they have priority.

Retirement benefits for law enforcement officers

Employees of the Federal Penitentiary Service and other departments are assigned benefits in a different manner compared to persons who work in civilian professions. For such an employee, there is an obligation to register with the military commissariat at the place of service.

Pension contributions are assigned through the ministry where the citizen served.

A serviceman has the right to continue working in a civilian position after leaving the reserve. When he becomes eligible for old-age benefits, departmental payments do not stop.

How a pension is calculated for a working military man depends on his length of service and the amount of salary for the rank and position he held in the service.

Thus, upon retirement, a person has the right to count on the same payments as other citizens upon termination of their employment relationship. Pensioners are not included in the category of beneficiaries under the Labor Code of the Russian Federation.

Payments and benefits provided for civil servants

A number of civil servants have the right to preferential retirement. These categories of citizens perform their duties under conditions of increased responsibility and have worked for at least 16 years in federal and municipal structures; according to the planned indicators of the ongoing pension reform, this will increase to 20 years.

At the state level, certain benefits are established for civil servants:

- The pension must be accrued in the amount of 45-75% of those accrued for the last 12 calendar months, including all the establishment of bonuses for a given calendar year worked;

- Benefits for paying for housing and communal services;

- Priority when receiving free vacation packages. Failure to use this right may be compensated in monetary terms;

- The right to free travel in city public transport, as well as in public suburban transport;

- Undergoing examination and further treatment in departmental medical organizations;

- Compensation for funeral expenses to relatives if they provide all the necessary payment and cash documents.

The right to receive established and provided additional payments and benefits is retained even upon termination of employment in the public service and transition to the private (commercial) sector of the economy

Each additional year worked in a government agency provides an increase in pension in the amount of 3% of average earnings, but not more than 75% of it.

When an employee of a government agency reaches retirement age and has length of service, according to Federal Law No. 350-FZ, a one-time payment of 10 salaries is provided. This payment is made regardless of wages earned.

Answers to frequently asked questions

Question: How much salary is an employee of the Federal Penitentiary Service supposed to pay upon retirement?

Answer : The amount of payment depends on length of service. 5 salaries are paid if the output is less than 10 years. If you have 10-14 years of service, the person will receive 10 salaries. When the length of service is more than 15 years - 12 salaries.

Question: How much salary is paid upon dismissal of a military personnel?

Answer : If the length of service is less than 20 years, then the person will receive 2 salaries. When this figure exceeds 20 years – 5 salaries.

Pensions of military personnel and employees of the Ministry of Internal Affairs

All one-time compensation payments to these persons in the event of their retirement are established by special acts and decrees. By Decree of the Armed Forces No. 4202-1, as amended on November 28, 2015, as well as by Order of the Russian Ministry of Defense No. 2700 dated December 30, 2011, the lump sum benefit directly depends on length of service:

- Seven monthly salaries upon dismissal if the length of service exceeds 20 years;

- Two salaries if length of service is less than 20 years;

- There are established payments when an employee receives government awards from Russia and the USSR;

There is also provision for the payment of benefits of up to 2 million rubles in case of injury and the impossibility of further service due to medical indications. If a medical examination has established a disability, the funds allocated to pensioners are increased by a certain coefficient, depending on the degree of disability.

Calculation of compensation upon retirement to persons working in the conditions of the Constitutional Court

If a citizen worked in the northern or equivalent area, then if the staffing level is reduced, the payment of severance pay may be extended. The period is 6 months.

Compensation for working pensioners after dismissal from work is presented in the form of indexation for all periods while the person worked and received payments in a reduced amount. When calculating the amount, the northern coefficient is taken into account.

The value depends on the territory where the person worked. For example, in the Yamalo-Nenets Okrug the coefficient is 2.

Payments to employees working in commercial structures

Legal entities and (or) individuals who employ hired workers, with their internal documents, establish the amount of compensation payments when the employee goes on a well-deserved retirement.

These payments are financed from our own funds. Severance pay - three average monthly wages, including bonuses and allowances is not subject to personal income tax, and the employer is not charged insurance payments for this amount.

When retiring, an employee may have a number of reasons - being disabled or reaching retirement age. In this case, the principle of less is more applies. The large payment stipulated by the collective agreement is paid.

The increase in the retirement age has increased the liability for the employer to dismiss people of pre-retirement age.

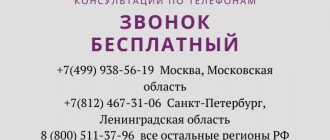

More detailed information about increasing the retirement age can be found through the Pension Fund of Russia personal account.