According to the new law, the retirement age for civil servants was increased. A civil servant's pension is a benefit that he will receive for long work in one of the state federal positions.

A federal employee is a person who works in a federal service position and who receives a monetary benefit from the state budget for this.

Assignment of benefits

Every civil servant who fulfills all the conditions has the opportunity to receive a pension. According to the law, if the following conditions are met, a citizen can count on receiving a pension:

- at least 16 years of experience in the civil service;

- The retirement age for civil servants has been reached.

Upon dismissal, you can also apply for benefits if:

- There has been a reduction in staff or a government agency has been liquidated.

- Upon dismissal from a position.

- If the retirement age for civil servants has been reached.

- Due to poor health, which prevents further normal work activities.

Based on the functional and job characteristics of work, three types of civil servants are distinguished.

The first type is employees whose powers extend throughout the entire country.

The second type is employees whose work activity is limited to only one region.

The third type is military personnel and persons equivalent to them.

For each type there is a certain age, having reached which, you can safely retire to a well-deserved rest. On average it is defined as 60 years. At the request of the institution, the employee can work for a longer period, up to 70 years.

Required documents

Along with the application, a retired civil servant must provide:

- internal passport and copy;

- a bank statement showing the average earnings 12 months before the citizen retires;

- certificate of position held, it indicates the length of civil service;

- an extract from the Pension Fund on the amount of labor pension for old age or disability (if any) and their amounts;

- a copy of the work book;

- dismissal order and copy;

- any documents that can confirm length of service in the public service or serve as the basis for the accrual of benefits.

Right to pension

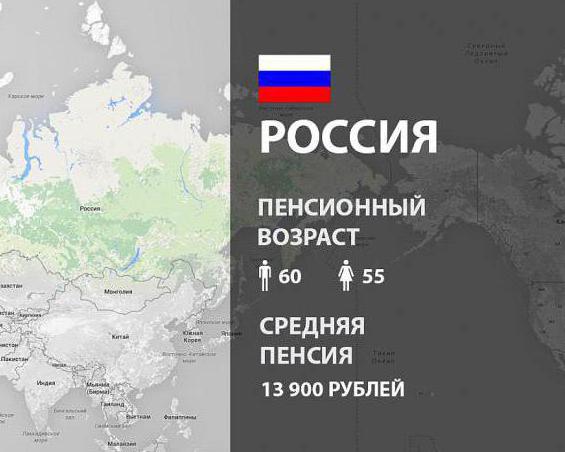

The bill on raising the retirement age for civil servants has a number of changes that came into force on January 1, 2020. According to the new project, the retirement age of citizens should be increased to 65 years for men and to 63 for women. At the same time, the length of service will also increase from fifteen to twenty years.

Initially, both men and women were supposed to retire at 65, but after the bill was revised, the age for women was changed. Now all ladies working in the civil service can retire at 63 years old. The bill also includes all changes that make it possible to accurately track the retirement age for civil servants and work experience:

- when retiring in 2020, you must have at least 16 years of experience;

- 2018 – 16.5 years of experience;

- 2019 – 17 years;

- 2023 – 19 years;

- when assigning a pension after 2025, you must have at least twenty years of work experience.

The proposed increase in the retirement age for civil servants and changes in length of service assume a gradual transition. In 2020, women can retire when they reach the age of 55.5 years, and men - 60.5. Next year, the retirement age for civil servants will increase by another 0.5 years, it will be 56 and 61 years for women and men. Gradually, the age should reach 63 and 65 years.

Requirements for work and insurance experience

The purpose of payments is related to the length of insurance and work experience:

- labor is the length of service until 01/01/2002;

- insurance is work experience after 01/01/2002, during which insurance premiums were paid, and some other periods (so-called non-insurance): for caring for a child under one and a half years old, a disabled child, a disabled person of group 1 and a person over 80, receiving benefits for unemployment and other cases.

The rules for their calculation do not change. The share of the insurance payment is calculated in the same way as for employees of non-state sectors - based on the amount of points earned, accrued annually depending on the insurance premiums paid and the duration of non-insurance periods. But in terms of length of service, pensions for federal civil servants depend solely on the duration of work in the civil service and average earnings.

In 2020, the conditions for assigning disability insurance payments are as follows:

- reaching age;

- minimum insurance experience - 11 years;

- The minimum sum of individual coefficients (points) is 18.6.

The requirements are growing every year until by 2025 the minimum experience is 15 years and the minimum number of coefficients is 30.

Experience and pension

To retire, it is not enough to meet the age specified in the bill. It is also necessary to have established experience. In 2020 it is 16 years. With this length of service, a pensioner can count on 45% of his salary. If this year the future pensioner has more than twenty years of experience, then he will be assigned more than fifty percent of his salary.

In 2020, the minimum length of service must be 17.5 years, at which 45 percent of pension payments calculated from salary will be assigned. And in 2025, the same percentage will be assigned for twenty years of service.

What is included in the internship

The increase in the retirement age for civil servants is calculated in parallel with the increase in length of service. This is a summary measure of length of government service that takes into account other types of activity when determining eligibility for benefits for federal workers.

To assign a pension for long service, periods of service in the position of a federal employee, state civil positions, and state federal positions are taken into account.

In accordance with the new bill, the length of service of a civil servant takes into account the following criteria:

- Retirement age for civil servants in Russia.

- The existing experience must meet the requirements of the Pension Fund of the Russian Federation when applying for benefits.

The new bill on raising the retirement age for civil servants provides for the opportunity to continue serving in the following specialties:

- Prosecutor's office employees.

- Investigative Committee employees.

- Military personnel serving under contract.

- Firefighters.

- Microcontrol authorities.

- Criminal executive bodies.

- Tax police.

- Customs officers.

- Deputies and persons working in local government bodies.

- Employees of intergovernmental organizations.

- Some positions in institutions where work is required by the state.

The size of the pension for persons in the above professions depends on their length of service and their average monthly salary for the last year of civil service.

Calculations

The payment is calculated in accordance with Law No. 166-FZ “On State Pension Security”. The amount of pension for state civil servants based on length of service is taken equal to 45% of average monthly earnings, but minus insurance and fixed payments to it.

After the amount of length of service has been assigned, the annual continuation of work in the civil service increases its amount by 3%, but not more than 75%.

For clarity, let's give an example.

Zhuchkov P.P. worked in the civil service for 19 years, over the last 12 months his average monthly earnings were 34,450 rubles, upon reaching retirement age he received the right to insurance in the amount of 10,356 rubles. Let's calculate his length of service payment in 2020:

34,450 (average monthly salary) × 45% = 15,502.5 rubles, then subtract insurance from this amount (15,502.5 – 10,356) = 5146.5 rubles. Then we take the average monthly salary and multiply it by the period worked beyond the required period and 3% (34,350 × 3% × (19 – 17)) = 2061 rubles. Add up the two resulting numbers (5146.5 + 2583.75) = 7207.5 rubles.

In total, we got the amount for length of service of 7207.5 rubles.

It grows every year due to the growth of its components.

Calculation of pension based on average monthly salary

Average monthly earnings are calculated based on the average monthly salary, including the following types of payments:

- monthly salary in accordance with the position;

- salary for title;

- long service bonus;

- any types of bonuses;

- lump sum payment of vacation pay and financial assistance.

Based on this, the full salary is taken into account, and not just its basic salary. The calculation does not include periods when there was no payment: vacations at your own expense, periods of incapacity for work. If there were accruals at this time, they are not taken into account when calculating the pension.

The total pension is calculated by dividing the salary for the year by twelve. If the calculation period included days when the citizen was without cash allowance, then the amount of the pension is calculated by dividing the amount received by the number of days worked and multiplying by the average number of working days in the month.

Long service pension

To qualify for a long-service pension, a citizen must meet the following conditions:

- the minimum age is for 2020 58 years for females, 63 for males;

- work experience in the state or civil service - from 17 years;

- continuous service in the last position - from 1 year without dismissal (the condition is relevant only for citizens in federal service);

- the reason for dismissal is reaching the age limit, changing the terms of the service agreement, laying off an employee or liquidating a government agency.

The conditions for early access to state pension provision (before reaching retirement age) are as follows:

- work experience in the civil service – from 25 years;

- continuous service in the last position - at least 7 years.

Calculation of the monthly payment amount

The monthly pension amount of a former civil servant is calculated using the formula:

(SD - SP) / 100 * 45,

Where:

- SD – average income received by a citizen;

- SP - the amount of the old-age or disability insurance pension received.

How is average income calculated?

To obtain the amount of the monthly pension payment, the average income of the employee is used, calculated based on his earnings for the last 12 months of work before his retirement.

The indicator is calculated using the formula:

The sum of all accountable income received during the year / 12 months

Days when the employee:

- took leave without pay (at his own expense);

- was on sick leave issued in connection with pregnancy and childbirth;

- was on parental leave for up to 1.5 years;

- was temporarily disabled.

If there are excluded periods in the accounting year, then the amount of average income is calculated using the formula:

SD / (D – ID) * 21, where

- SD – the amount of income taken into account for the year;

- D – number of days in a year (365 or 366);

- ID – number of days excluded from the billing period;

- 21 is an average indicator reflecting the number of working days in one month.

When calculating, we take into account funds received by a citizen as:

- basic salary;

- salary assigned on the basis of class rank;

- additional payment for length of service;

- an increase in income received due to the characteristics of the federal civil service;

- compensation paid for adding a citizen to the list of persons storing information classified as “Secret” or “State Secret”;

- permanent bonus payment;

- one-time bonus accrual, issued for special successes in the service (exceeding the tasks set according to the plan, successful completion of a special task, etc.);

- vacation pay;

- material assistance.

IMPORTANT:

If during one month included in the billing period a citizen received several bonuses, then only one, the larger one, will be taken into account in the calculations.

Recalculation of a civil servant's pension

Current legislation does not prohibit citizens from continuing to serve after they have begun receiving a state pension. If the employee’s immediate management does not mind, then he can remain in his position if he wishes.

In this case, Art. 14 Federal Law-166 dated December 15. 2001 (last revised October 1, 2020) provides for an increase in the amount of pension benefits. For each additional year of work, in addition to the minimum length of service required for retirement in the current year (17 years in 2020), a citizen will receive an additional 3% of average earnings toward retirement.

The amount by which the pension is increased is calculated using the formula:

Total income for the year / 12 / 100 * 3

Recalculation is performed for each year of service beyond the term. That is, the pension received by the employee will increase annually, and not once at the end of his service. The calculation and assignment of a new pension is carried out every year on August 1st.

IMPORTANT:

The maximum pension amount is limited to 75% of average earnings (45% upon entry into the basic pension and 3% per year of service in excess of the norm). That is, after receiving the right to a pension, you can serve for no more than 10 years (30 / 3 = 10). It follows from this that upon early retirement (to obtain this right you need to serve 25 years), the citizen is immediately assigned the maximum pension benefit.

Example of calculating state pension for service

Citizen A. S. Fedorov worked in the federal tax service. In 2020, when he turned 63, he had accumulated 17 years of service and received his pension. The total income of A.S. Fedorov for the year amounted to 500 thousand rubles. Of the last 12 months of work, 20 days Fedorov A.S. was on sick leave. He does not receive an insurance pension.

As a result, A.S. Fedorov will be assigned a state pension with a monthly payment equal to:

500,000 / (365 – 20) * 21 = 30 thousand 434 rubles. 78 kop.

Fedorov A.S. entered into an agreement with management, according to the provisions of which he will remain in service for another 3 years under the same conditions. If for 3 years Fedorov A.S. does not issue a certificate of incapacity for work and goes on vacation at his own expense, then each year the following will be added to his pension:

500,000 / 12 / 100 * 3 = 1 thousand 250 rubles.

The increase in pension is presented in the table:

| Year | Annual increase (according to the conditions in the example) | Payment amount after recalculation |

| 2021 | + 1 thousand 250 rub. | 31 thousand 684 rub. 78 kop. |

| 2022 | 32 thousand 934 rub. 78 kop. | |

| 2023 | 34 thousand 184 rub. 78 kop. |

IMPORTANT:

For the time that a citizen is in public service beyond the minimum length of service, he is not paid a pension. It begins to be transferred after dismissal, already in an increased amount according to the recalculation.

Increasing the retirement age

From 2020, the retirement age for civil servants has been increased. The bill was adopted in the spring of 2020. Now the retirement age of citizens working in state and federal institutions occurs upon reaching 63 and 65 years for women and men, respectively.

However, it was decided to reach such indicators gradually, annually increasing the retirement age by six months. In 2020, the ages should be 55.5 and 60.5 years. By 2026, the retirement age for male civil servants will be reached. Women will come to new data only by 2032. In addition to age, in order to be granted a pension, you must have twenty years of experience, previously this period was 15 years. Experience, as well as age, will increase gradually, over six months.

Termination of payment upon continuation of service

In most cases, long-service pensions and benefits are granted for life. However, there are 3 cases in which payments are suspended:

- return to public office. The employee must go to the Pension Fund within 5 days and fill out an application. After dismissal, the pension and benefits will resume when the citizen submits papers for accrual of payments. The amount will be recalculated taking into account the new service life;

- if a citizen receives a labor pension or any other material accrual to which an additional payment is due. Long service pay is inferior to most other deductions;

- if a citizen works in interstate bodies in a specialty for which he is entitled to receive a long-service pension. Different pensions cannot be combined.

The insurance pension will continue to be received without changes while continuing to serve.

Civil servants are entitled to receive a long-service pension along with benefits, discounts and allowances only upon reaching a certain age. The main criterion is work experience. The service life is gradually increasing, civil servants are becoming pensioners later and later.

The unstable system of receiving pensions and benefits often causes disputes between officials and bodies responsible for remuneration. Issues related to the right of regions to deprive pensioners of their benefits are still unresolved.

Year of retirement, age and length of service

In conclusion, it is worth noting that for the year of retirement you must have the required length of service and meet the legal age:

- 2017 – women 55.5, men 60.5 years, experience 16 years.

- 2018 – women 56, men 61, 16.5 years.

- 2019 – women 56.5, men 61.5, experience 17.

- 2020 – women 57, men 62, experience 17.5.

- 2021 – women 57.5, men 62.5, experience 18.

- 2022 – women 58, men 63, 18.5.

- 2023 – women 58.5, men 63.5, 19 years old.

- 2024 – women 59, men 64, 19.5.

- 2025 – 59.5 and 64.5 respectively, twenty years of experience.

From 2026, the length of service must be at least twenty years, and the age of men will reach 65. At the same time, the retirement age of women will continue to increase every year by six months to 63.