Pensions in European countries have long exceeded the level of payments in the CIS. The size of the pension in the European Union depends on state policies, retirement age, percentage of deductions from each salary and other factors. To earn a high pension, every European must fulfill a number of strict conditions. Only in this case can you count on a secure old age. Having worked the required number of years for the state, pensioners will receive a decent remuneration and will be able to afford to travel and live in abundance.

Pension system of Russia

If we talk about Russia, at present, according to age, women retire at 55 years old, men at 60. However, since 2020, as a result of the pension reform, the retirement age is now 60 and 65 years, respectively.

Certain categories of citizens may be assigned the following pension:

- Due to disability.

- Due to the loss of a breadwinner.

- Based on length of service.

- For special distinction before the state.

A pension in Russia may be as follows:

- insurance;

- social;

- cumulative.

An insurance pension is awarded, as a rule, for old age, in the presence of disability or in the event of the loss of a breadwinner for any reason. Those citizens who cannot confirm their work experience, as well as members of their families, can count on a social pension.

Citizens of the Russian Federation born no earlier than 1967 have the right to open a personal account for accumulating pension contributions during their work experience. Subsequently, the size of the so-called funded pension will depend on the amount of savings. In 2020, the following average pension amounts were established in Russia:

- Insurance - 15,495 rubles.

- For disability - 14,593 rubles.

- Social — 5,180 rubles.

- For disabled people and war veterans - 46,000 rubles.

Return to contents

What is the average pension to expect?

For any country, it is difficult to predict in advance the size of the average pension, since it depends on various factors. Another thing is the minimum pension; it often has a fixed amount set by the state. Usually it corresponds to the minimum subsistence level, but since it is also set by the state, the official subsistence level does not always correspond to the real one; therefore, pensioners with a pension far from the average level often experience financial difficulties.

A simple example - the average pension on the “Island of Freedom,” as Cuba is called, is only... 4 dollars! Do you think such an amount can correspond to the real cost of living, no matter how low the prices are?

Pension systems:

- State pension (solidarity pension system).

- From private pension funds (funded pension system).

- Hybrid – (state + funded).

The state pension, as a rule, has an amount corresponding to the current salary in the pensioner’s former profession. This can be 100% of the salary, but usually less - 80%, 70%, 60%...

With a funded system, the pension amount corresponds to contributions made during work. That is, as much as each employee has accumulated in his or her pension account at one time, that is what (according to the terms of the pension agreement) he will receive. Saved more - more pension, less - less.

But this way anyone can open an account, accumulate money on it, and then live on the interest. Yes maybe. Or you may not save up by spending on expensive real estate, a luxury car, a yacht, a casino and other entertainment. To avoid this, laws are passed on the mandatory deduction of a certain amount from each salary to the pension fund.

With a hybrid system, the employee contributes from his salary to both the state and private pension funds, respectively, after retirement he receives it from two sources at once.

Pension funds manage huge amounts of money, which they invest to generate profits. Those. All of them are, in fact, large investment funds operating in the stock, commodity and foreign exchange markets.

TOP 5 pension funds in the world by the size of attracted assets:

- Government Pension Investment Fund, Japan - $1.529 trillion. (2017).

- Government Pension Fund of Norway - $1.076 trillion. (2019).

- National Pension Service of Korea, South Korea - $580 billion (2017).

- Federal Retirement Thrift Investment Board, USA - $572.3 billion (2020).

- ABP, Netherlands - $456 billion (2019).

TOP-5 Russian NPFs (non-state pension fund) by asset size as of July 1, 2019 (RUB):

- Sberbank NPF – 537.5 billion.

- "GAZFOND pension savings" - 505.7 billion.

- Otkritie – 493 billion.

- “Future” – 262.2 billion.

- "VTB Pension Fund" - 191.8 billion.

Germany

The level of development of the state depends, among other things, on the attitude towards pensioners. As an example, consider the German pension system. A state with one of the most powerful economies in the world provides its citizens who have reached retirement age with all the conditions for a decent life.

The pension threshold established in the country is the same for men and women and is equal to 67 years. Despite this, citizens of the country can retire without waiting for this age: this is possible in the case when the pensioner pays from personal savings a certain amount necessary to compensate for the funds not received by the pension fund (about 0.3% of the existing savings for each unearned month).

It would be logical to assume that everything is in order with the size of the pension in Germany. On average, women in Germany receive 630 euros, and men - 1080. The average pension is 770 euros.

It should be said that, despite the reunification of the two Germanys, which occurred after the fall of the Berlin Wall, the difference in the development of the east and west of the country still exists to this day.

Working at one of the German enterprises, a citizen of the country contributes about 20% of his earnings to the Pension Fund during his work experience. In this case, half of the contribution amount is collected directly from the employee, the second half is paid by the employer.

Every German has the opportunity to resort to the services of one of the insurance companies in order to independently determine the amount of pension payments and accumulate a pension amount.

To count on an insurance pension, a German citizen must work at one of the country's enterprises for at least 5 years. If certain conditions are met, a pension in Germany can also be accrued to foreigners.

Return to contents

TOP countries by average pension size

Travelers from post-Soviet countries used to be (and still happen) very surprised by the abundance of elderly tourists from Japan, the USA, Germany and some other countries in Paris, Venice, Rome, and the resorts of Egypt, Turkey, Greece, and Mexico.

“Where does the money come from?” was a reasonable question.

And the box simply opens - in these countries there is very good pension provision, and even a recipient of an average pension can afford to travel to any country in the world, unless it is closed by the “Iron Curtain”, as in its time the USSR, as is now North Korea, or Syria, Somalia and a number of others are dangerous for tourists.

TOP 10 countries in the world with the highest average pension (in $):

- Luxembourg – 3350.

- Kuwait – 3000.

- UAE – 2776.

- Saudi Arabia - 2500.

- Switzerland – 2046.

- Sweden – 1865.

- Finland – 1780.

- Japan - 1700.

- Norway – 1584.

- Iceland – 1550.

With such a pension you can not only travel – you can live in many inexpensive resorts all year round. By the way, quite a few pensioners do just that - having accumulated a decent pension for their work, they move to live in “warm regions” - Thailand, Mexico, Ecuador, etc.

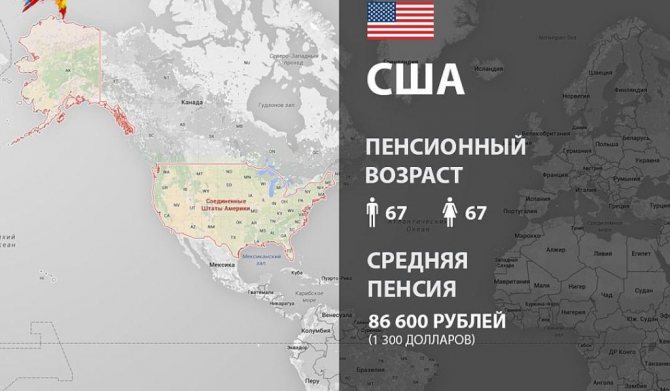

USA

In the US, men retire at 67, women at 65 and receive an average of $1,503 per month. One of the features of the American pension system is the opportunity to accumulate the necessary pension amount by working in one of the country’s companies for 10 years. Many citizens manage to collect savings for two or even three pensions during their working career.

If an American wishes to retire earlier than expected, for example, at 62 years old (early retirement age in the States), then he will have to submit a corresponding request indicating the reasons that prompted him to take such a step. At the same time, the early retiree must be prepared for the fact that the pension amount will be 70% of the amount that he would receive if he retired at 67 years old, and that it will not be possible to reach 100% in the future.

Working at any enterprise, an American, as a rule, in addition to contributions to the state pension fund, has the opportunity to accumulate savings for a future pension in an additional pension fund, which is available in most large companies and corporations.

The amount of contributions to the state fund is about 15% of the salary, half of which is paid by the employee himself, and the other half by the enterprise. After reaching retirement age, about 30% of American citizens continue to work.

Return to contents

World pension policy

The governments of many developing European countries are interested in ensuring that older people receive a pension amount sufficient to meet their needs. The main direction of many European pension reforms is to increase the retirement age.

There is a rational grain in this, because many old people, despite their age, have jobs, and, consequently, a constant source of income.

Many employers prefer to keep pensioners on their staff rather than young employees, as they have extensive work experience and work skills honed over the years. Return to contents

Great Britain

Experts believe that the UK pension system is close to perfection. As in most other countries, pensions in the kingdom can be public, private or based on length of service. Men retire at age 65, women at age 60–65. If a British pensioner continues to work after reaching this age, a pension supplement is added to the pension for each year worked.

The average UK citizen earns £125 per week.

To qualify for a basic pension, a citizen of the kingdom must work in the country for at least 10 years: each year worked increases the amount of the future pension by 4.44 pounds sterling per week. The minimum basic pension would therefore be £44.4 per week.

If a Briton has chosen to accumulate a pension amount in one of the private financial institutions, he can independently determine the amount of payments; no restrictions are set.

As a rule, employees contribute 5-8% of their earnings to such savings funds: in accordance with recent changes in legislation, now, if necessary, you can withdraw a quarter of the amount accumulated in this way without paying taxes.

Some English people take this step, for example, to improve their living conditions.

More than significant pension supplements are provided in the UK for veterans of the Second World War: depending on the military rank or the severity of the injuries received, such a pensioner can receive in Russian currency from 150 to 650 thousand rubles per month.

Of course, with such passive income, a British pensioner may well devote the autumn of his life to travel, all kinds of hobbies, and the implementation of projects for which he did not have enough time in his youth.

Return to contents

Pension reform in the UK

In 2020, another reform of the UK pension system was carried out. Many key provisions have been adjusted. How the retirement age and its size have changed will be discussed in more detail below, but now let’s focus on one interesting point.

According to the innovations, persons who have reached 55 years of age have the right to fully withdraw the pension savings in their account by carrying out just one banking transaction. Moreover:

- no tax is paid on the first 25% of withdrawals;

- the remaining amount is subject to income tax.

Before the reform, most pensioners could have a constant source of funds until the end of their days. However, some of them decided not to prolong the pleasure.

In particular, there was a case when a person, having retired, immediately spent 120 thousand dollars on cars, alcohol and a casino. This story served as one of the arguments in the debate between members of the UK Parliament about the relevance of making changes to the country's pension system.

China

Perhaps the main feature of China's pension system is the lack of payments to agricultural workers. This situation is familiar to Soviet citizens: until the 60s of the last century, collective farmers in the USSR were not officially paid a pension; a small allowance was paid by the collective farm or state farm. Managers, civil servants and employees of industrial enterprises can count on pension payments in China.

For Chinese men, retirement age is 60 years old, for female managers - at 55 years old, for the rest of the fairer sex - at 50 years old.

In general, despite the unprecedented economic growth that China has demonstrated over the past three decades, most of the issues related to the pension provision of its citizens continue to remain unresolved. Today, it is clear to the naked eye how China’s positions in most world rankings, which reflect the general state of the economy and the size of the pensions of citizens of the Middle Kingdom, do not align.

The average pension in China today is about 150-200 USD.

During his working life, a Chinese worker contributes 11% of his salary to the state pension fund: 4% is collected automatically when payroll is calculated, and 7% is paid by the employer. The pension amount is about 20% of the average salary. To earn the right to receive a so-called basic pension, you must work for a state-owned enterprise for 15 years or more.

One of the explanations for such a low level of pensions in China can be considered the presence of a large number of citizens whose age has exceeded 65 years.

This situation was the result of birth restrictions that existed until recently. The Chinese nation today is recognized as aging: the number of pensioners in the country exceeds the total population in Russia. Economists say that about 40% of the country's budget is spent on pension payments.

Return to contents