Assistance to citizens from the state is provided not only in case of complete or temporary loss of the main source of income, but also to persons who have lost their main breadwinner due to the sudden death of the latter. A survivor's pension (for military personnel and others) is assigned to his close relatives, as well as other people who are financially dependent on him (dependents). Read more about the specifics of assigning this pension in our article.

Military survivor pension: size and latest changes

Who can receive a survivor's pension?

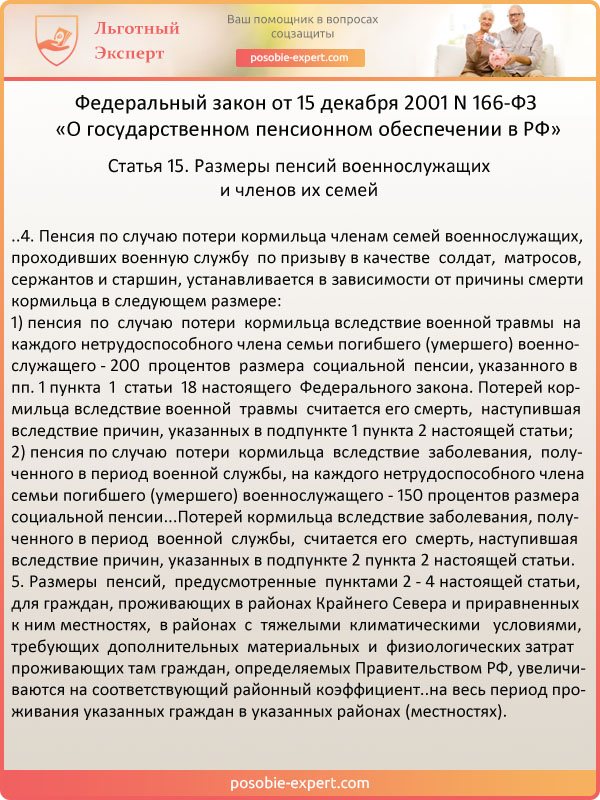

The basis for assigning a pension is the Law “On Pensions” - N400-FZ. Latest revision – March 2020. You should also take into account N166-FZ, which specifically refers to former employees of the RF Ministry of Defense. This type of financial assistance is considered insurance.

Clause 4 of Article 15. Amounts of pensions for military personnel (Federal Law No. 166)

List of persons who may qualify for monthly payments:

- children of the deceased under 18 years of age. If they study full-time at universities, lyceums and colleges, the period for obtaining it increases to 23 years. The accrual will continue, but in the case where the child received disability before adulthood;

- widows, if they are at least 55 years old and have not entered into a new marriage;

- parents (and grandparents), if they are at least 60 (55 for females) years old. The content will also be designed for people with disabilities;

- other persons who took up the responsibility of raising the deceased’s minor children.

Survivor's pension: who can count on it and under what conditions

Conditions for receiving an insurance pension:

- A person who relies on social benefits must confirm his disability.

- The deceased breadwinner did not commit crimes established in court.

- The soldier died either while performing his duty or within three months or less after the end of his service.

- The former law enforcement officer received serious injuries that caused his death; the pension is issued without time restrictions if there is a conclusion from a medical commission.

- The breadwinner has gone missing.

Important: both relatives of contract soldiers and relatives of conscripts have the right to count on state support. Payments will differ only in their size.

Where to apply for registration

In order for parents to become recipients of a survivor's pension, they must contact the pension fund at the place of registration or the MFC, providing a package of documents.

- This can be done at any time from the date of death of the serviceman

You can submit documents either in person or through communication channels, for example by mail, having previously certified all documents. If you want a trusted representative to do this, then you need to issue a power of attorney for him.

You can receive benefits in several ways, namely:

- through Russian Post (in a branch or at home);

- at a bank branch (to an account or bank card);

- through a delivery organization (to your home or at the box office).

The choice of the method that is convenient for you lies solely with the recipient and you can change it at any time by submitting an application to the Pension Fund.

Why do they stop paying survivor's pensions?

A pension will not be assigned if the death of the breadwinner was caused by the actions of his relatives-applicants, and in some cases payments will be stopped, even if the registration took place according to the law:

- the recipient of the benefit became able to work - found a job, lost his disabled status;

- the widow got married;

- children have lost the right to a pension due to age;

- in the event of the death of a dependent (pension recipient);

- the breadwinner, who had gone missing, was suddenly found;

- Forged documents used by applicants during registration were discovered.

Information: in the latter case, it is possible to initiate a criminal case for fraud with the perpetrators held accountable.

Types of pensions for military personnel and members of their families

Pension legislation for military personnel provides for the establishment of types of pensions:

- for length of service;

- upon the onset of disability;

- members of their families in case of loss of a breadwinner.

Each type is established depending on the availability of grounds and compliance with the conditions, which, as the procedure for their appointment and payments, are provided for by the Law of the Russian Federation of February 12, 1993 N 4468-1. There are some nuances:

- A military pensioner is allowed to re-enter military service or other services equivalent to it. But in this case, the pension payment for the duration of service is terminated and resumed upon his application upon his next dismissal.

- The recipient of a military pension can get a job under an employment contract or start a business. The income received in this way does not affect the payment of a military pension, with the exception of allowances for non-working pensioners.

Assignment of a long-service pension

The right to a long-service pension in accordance with the law arises for military personnel under the following conditions:

- After his dismissal from service.

- Having at the time of dismissal at least 20 years of service (military experience).

If a military pensioner re-enters service after he has been granted a pension, the amount of his pension benefit upon his next dismissal will be calculated based on the length of service and total length of service at the time of his last dismissal.

For persons dismissed upon reaching the age limit for service, for health reasons or as a result of organizational and staffing changes, the condition for granting a pension is:

- Be 45 years of age on the day of dismissal, with a total work experience of 25 years (calendar).

- In this case, at least 12 and a half years of the total length of service must consist of military service and (or) service in other bodies and institutions provided for by law.

Disability pension for military personnel

The law provides for the establishment of pension benefits for military personnel in the event of their becoming disabled. This type of pension is granted under the following circumstances:

- if it occurred during military service or within three months after dismissal from it;

- if the disability was established later, but it arose as a result of illness or as a result of an injury received during the period of service.

Disability is determined based on the results of a medical and social examination (MSE). The size of pension payments depends on the reason for which the disability occurred. In this regard, military disabled people are divided into categories:

- persons whose disability is related to military trauma;

- citizens who have become disabled as a result of a disease that occurred during military service.

Pension benefits for disabled people are assigned for the period for which they are diagnosed with disability, and in some cases for life, with the possibility of re-examination only upon their application.

The latter include disabled people: men over 60 years of age and women over 55 years of age.

Payment to family members in the event of the loss of a breadwinner

Family members of a military serviceman are provided with financial support in the form of pensions, subject to:

- if a serviceman died or was killed during service or no later than 3 months after dismissal from it, or later, but due to an injury or illness received during service.

- passed away while receiving a military pension;

- his death occurred no later than 5 years after his pension payments ceased.

- died in captivity (if he did not enter it voluntarily and, while there, did not commit criminal acts against the Motherland);

- disappeared without a trace during the hostilities.

Disabled family members have the right to establish a survivor's pension, while the pension benefit is calculated and paid for each disabled relative of the deceased breadwinner. Recipients of pension payments are:

- children (up to 18 years old or up to 23 years old, in case of full-time study);

- parents, spouse, if after the death of the breadwinner they have lost their source of income, have reached the age of 60 years for a man, 55 years for a woman, or have a disability;

- parents, spouse of a deceased military person disabled as a result of a military injury;

- spouse, mother or father, other family member, if they do not work and care for the children, brothers, sisters, grandchildren of the breadwinner until they reach the age of 14 years.

- grandmother or grandfather, if there are no other persons who are required by law to support them.

Spouses and parents of military personnel who died in the line of duty have the right to receive a pension on preferential terms.

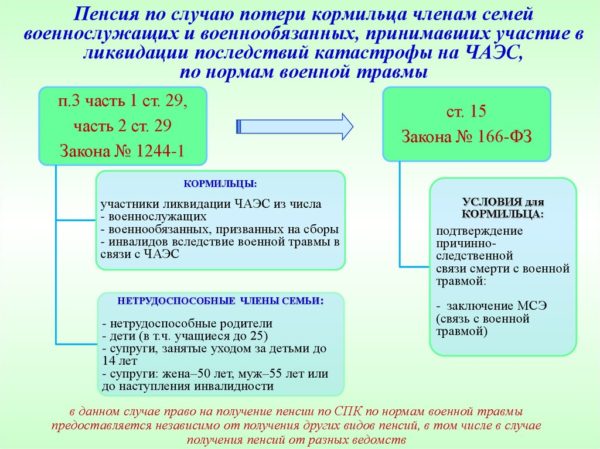

The right to two pensions (in case of loss of a breadwinner)

A number of persons have the right to receive not one, but two types of social benefits.

- Parents of conscripts who died in service or due to wounds received during service.

- Wives of deceased military personnel who did not remarry if their breadwinners died due to injuries.

This right arises after the death of the breadwinner and/or upon reaching retirement age. Disabled beneficiaries receive a second pension in addition to their main pension. The first pension benefit may be:

- old age/disability insurance;

- social benefits for old age/disability;

- long service payment.

Example: a mother’s son died while serving in the Russian Armed Forces. She will receive a survivor's pension immediately - if there are other reasons, and after she turns 56-60 years old, she will also be able to apply for an old-age pension .

Help: the list of papers for receiving a second pension should be found at the military registration and enlistment office and the Pension Fund of the Russian Federation.

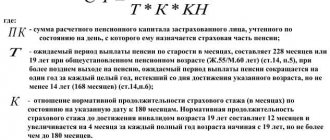

Conditions for calculating support for the loss of a breadwinner

A pension in connection with the loss of a breadwinner is paid to relatives:

- sergeants;

- sailors;

- soldier;

- foremen

Relatives of deceased military personnel can count on a certain amount of support from the state if the death of the breadwinner occurred during the period:

- during conscription military service;

- no later than three months after its completion;

- later than 3 months, but due to a wound, concussion, injury or illness received during military service;

- no later than five years after completion of receiving a military pension.

The type of service itself (contract or conscription) does not affect the eligibility for payments. Only the size of the benefit depends on it.

Important: if the deceased committed a crime, which is established by the court, then the dependents are assigned a social pension.

Who is assigned this type of state benefit?

There are a number of conditions that apply to the recipient of a bereavement pension. Able-bodied citizens cannot apply for it. They need to take care of their own maintenance. Important: the main condition for receiving state support related to the loss of a breadwinner is the applicant’s incapacity for work.

According to the current regulatory framework, such benefits are accrued to the following persons:

- military children:

- minors;

- until the age of 23, subject to full-time education;

- other persons under the age of 18 or 23 who are grandchildren, brothers or sisters of the deceased, under the same conditions;

- spouses;

- parents;

- grandparents of a military man, if they have no other income (including another pension);

- unemployed relatives raising young (under 14 years old) children (grandchildren, brothers, sisters) of the deceased.

Special rights to military pension

The law defines situations when support is provided to relatives regardless of the fact of previous dependency. These include:

- minor children of the deceased;

- his father or mother, wife, provided that these persons have no other income;

- parents and spouses of the deceased conscript.

Attention: military personnel who went missing during hostilities are considered dead. Their relatives are also provided with appropriate maintenance.

Preferential conditions for assigning maintenance to certain categories of citizens

Article 30 of Law No. 4468-1 of February 12, 1993 defines preferential rights to maintenance from the state for the parents and spouses of deceased defenders of the Fatherland. They apply if the death of the latter occurs:

- due to injury received during combat operations at the front;

- during the period of captivity by enemies of the Motherland;

- during the performance of military duty abroad;

- in the direct performance of the duties of a military personnel.

The preferential condition is to reduce the age of the applicant by five years:

- the wife and mother of the deceased receive maintenance after the 50th birthday;

- husband and father - 55th anniversary.

In addition, the law provides for the assignment of this payment to each of the applicants who meet preferential conditions. Whether these people were his dependents before the death of the defender of the Motherland is not taken into account.

Attention: the same preferential procedure for assigning pension benefits applies to the spouse of the deceased who is raising a common child under the 8th birthday. In this case, such circumstances characterizing the applicant as:

- age;

- ability to work;

- presence or absence of a place of duty.

Download for viewing and printing:

Law of the Russian Federation dated 02/12/1993 N 4468-1 (as amended on 05/01/2017) “On pension provision for persons who served in military service, service in internal affairs bodies, the State fire-fighting system...”

Registration of a survivor's pension

To receive a pension, you will either have to contact the Pension Fund department or submit papers to the nearest MFC. Online registration through the Pension Fund portal is also allowed.

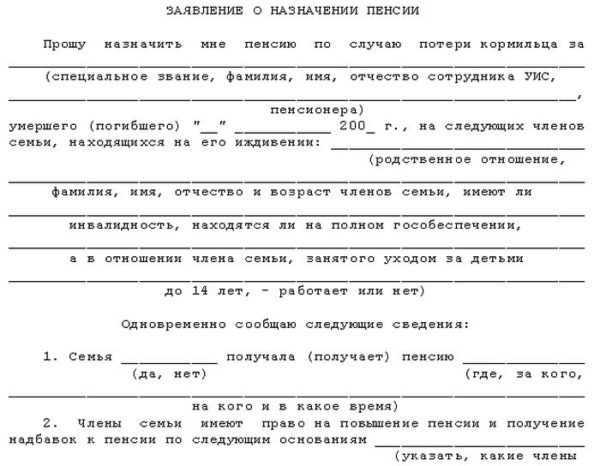

Pension application form

To begin the procedure for obtaining a pension, the applicant will have to prepare a minimum set of documents:

- identity cards of applicants for social payments - passports, military IDs, birth certificates;

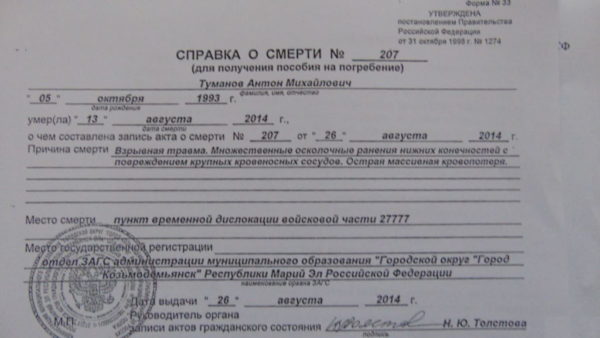

- a paper that records the death of the breadwinner. If a person is missing, a supporting document will be required - with a judge's visa;

- proof of relationship, such as adoption papers;

- additional certificates that pension department consultants may require: from school/university, about income, disability, and others.

The package of documents may vary in composition depending on the situation. When receiving benefits for a military man who served under a contract, you will have to contact the Ministry of Defense of the Russian Federation. The same applies to other law enforcement agencies: the Ministry of Internal Affairs, the Federal Penitentiary Service, the FSB. There it will be possible to collect evidence of the breadwinner’s service, data on his salary, and other documents necessary for the situation. You should arrive at the Pension Fund of the Russian Federation with a complete package of papers. Government officials will accept the application in the form, review the package of papers and make a decision. In case of refusal, the reason must be indicated. In controversial cases, it is recommended to go to court.

Death certificate

Important: according to the law, officials are given 10 days to consider the case and make a decision.

Social benefits will be transferred to the dependent’s personal bank account, received by mail or delivered directly to their home. The accrual must be made from the first day of the month in which the applicant submitted an application to the officials, that is, initiated the registration.

Possible problems during registration

Most often, problems arise with documents. The applicant is often unable to collect the entire required package. Cases of sudden death of a breadwinner who did not have time to adopt a child are not considered rare. In such cases, paternity must be established through the court. There is no other way to apply for a pension. In order to be able to recognize the deceased as the father at the meeting, photos or videos must be provided confirming the life together with the deceased. It is even more appropriate to invite witnesses who admit that the deceased called the child son/daughter. After a positive verdict from the judge, the applicant will be able to continue applying for a pension as usual.

If the breadwinner disappeared while serving, then it is necessary to initiate the procedure for declaring him missing. This can be done six months after the person went missing. To do this, you need to contact the Ministry of Internal Affairs and file a missing person report. If after 6 months the breadwinner does not show up, then he should be declared missing in court, and then a pension should be issued.

Pension of the mother of a deceased contract soldier

III. Payment for funeral services, as well as the production and installation of gravestones 30. When burying the persons specified in paragraph 2 of this Procedure, military units, at the expense of funds allocated to the Ministry of Defense from the federal budget for these purposes, pay for the following funeral services: registration of documents necessary for the burial of the deceased; transportation of the deceased (deceased) to the morgue, morgue services; provision and delivery of a coffin, urn, wreath; transportation of the body (remains) of the deceased (deceased) to the place of burial (cremation); burial (cremation).

At the same time, for military personnel undergoing conscription military service, the amount of insurance amounts is determined based on the minimum monthly salary for the position held and the monthly salary for the military rank established for military personnel undergoing military service under a contract.

Amount of pension and bonus

The amount of funds received by a dependent depends on the characteristics of the breadwinner’s service (including the amount of his salary), the causes of death and the region of residence of the applicant relatives. Taking into account the fact that the amount of social pension is 5180.24, the approximate amounts of payments to dependents can be given in the table.

Table. Survivor's pensions

| Type of breadwinner's service/cause of death | Pension amount, % of salary | Examples of calculations |

| Contractor/due to wounds or injuries | 50 | If a serviceman’s salary was 44 thousand rubles, then his relatives will be able to count on at least 22 thousand rubles |

| Contractor/from diseases acquired during service | 40 | If a contract soldier's salary is 60 thousand rubles, dependents will be paid 24 thousand rubles each |

| Conscript/injury or mutilation in service | 200 | 10360.48 rubles |

| Conscript/due to illness | 150 | 7770.36 rubles |

The place of residence of the military personnel’s families should also be taken into account. Those living in the Far North or equivalent will receive bonuses in accordance with certain coefficients. The following will also receive increased payments:

- disabled people I gr. - 100%;

- dependents who are 80 years old – 100%;

- disabled children (including from childhood I-II groups), orphans - 32%.

Example: contract serviceman Semenov A.S. received a salary of 64 thousand rubles. His wife did not work and cared for their common disabled daughter, class I. The family lives in the city of Norilsk - the regional coefficient is 1.8. Semyonov died in the line of duty. Rules for calculating pensions for both family members: for a daughter - 64,000/2 = 32,000 rubles - the main pension. Plus disability allowance: 32000*2= 64 thousand rubles. Taking into account the “northern” coefficient 64000*1.8 = 115200 rubles. The mother will receive the following amount: 32,000 * 1.8 = 57,600 rubles.

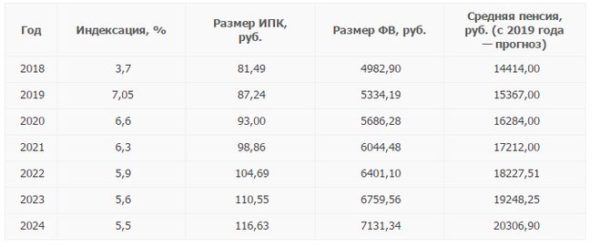

Please note that in 2020 it is planned to increase social payments and benefits from April 1, 2020. This is necessary to compensate for rising inflation. The size of pensions will increase by a little over 2%. Also, employees of a number of law enforcement agencies may have their salaries increased, which will also affect recipients of survivor’s pensions. A bill to change the salaries of employees of the Russian Guard, the Federal Penitentiary Service and other institutions is being considered in the State Duma.

Pension indexation plan until 2024

Pension amount for parents

The monthly payment amount depends on:

- monetary allowance of a serviceman during his lifetime;

- from the cause of death, as a result of which it occurred.

| Type of military service | The reason why the death of a military man occurred | Pension amount |

| Conscription service | The cause was military trauma | Two hundred percent of d/d |

| From diseases acquired during service | One hundred fifty percent | |

| Under contract, depending on salary | In case of injury | 50% |

| In case of illness or disability | 40% |

It is worth noting that for citizens living in the Far North and nearby microdistricts, a coefficient is provided for calculating benefits

Thanks to which its amount increases significantly, but for this you need to live there; in case of leaving for another territory, the allowances are removed.

Additional benefits for military family members

Some citizens receiving survivor pensions are also entitled to receive:

- medicines or special products to improve the quality of life;

- vouchers to sanatoriums for treatment;

- travel compensation for arriving at places for health improvement.

Applicants for benefits are children who have serious problems with the body (disability). If a deceased serviceman served for at least 20 years, then his family members have the right to receive compensation when paying:

- housing and communal services;

- telephone, radio and TV antenna;

- fuel if the house where the family lives does not have central heating.

Information: the family of a deceased serviceman cannot be evicted from a service apartment until similar housing is provided to them.

Members of such families may also have additional benefits at the regional level. For information, please contact your local social security office.

Answers to frequently asked questions

Are there additional benefits for the parents of a deceased military man?

Answer: Yes, a number of benefits are provided for family members of a military personnel:

- if the deceased was on a waiting list for housing, the family will be able to get it

- They are also entitled to compensation for housing and communal services.

- If parents live in a house without central heating, then they are entitled to the purchase and delivery of fuel within normal limits.

- Have the right to medical treatment and trips to a sanatorium

2.Question:

What is the amount of survivor's pension provided in 2020?

Answer: If a military man died specifically while on duty, then the pension will be 9919.70, if he died from injuries received, then 7439.78, and its assignment also depends on local coefficients and the rank of the deceased, contract soldier or conscript.

Rate the quality of the article. Your opinion is important to us:

- About

- Latest Posts

Belova Alina Sergeevna

Chief expert. Main Directorate of the Pension Fund No. 7 for Moscow and the Moscow region

Survivor's pension for military personnel: problematic situations

Question No. 1. I am a military pensioner, and so is my husband, who died six months ago. I will soon turn 55. I wanted to replace my pension with the pension of my late husband. The military registration and enlistment office told me that this can only be done through the court. Is it so?

Answer: yes, you will have to file a claim because you did not have time to resolve the issue within 6 months from the date of death. If your husband had died later than six months ago, the problem would have been resolved in the branch of the Pension Fund of the Russian Federation upon application. Now an additional court decision will be required to resume the review of the pension issue. In most cases, the outcome of the case is positive. After receiving a survivor's pension, you should refuse your own social benefits. The same situation will arise if the wife was a dependent (Article 10 of Federal Law N400) and has a disability or is recognized as an old-age pensioner.

Question No. 2. My husband, who served as an officer, was not officially married. He died recently while on duty. Before that, he supported me completely for more than 5 years. His relatives demand that I hand over all documents. Do I have any rights? Will they issue a pension?

Answer: you will have to prove the fact of dependency. According to Part 2 of Art. 1148 of the Civil Code of the Russian Federation, the breadwinner may not be a blood relative of the breadwinner. If you can convince the court, then, according to paragraph 1 of Article 1149 of the Civil Code of the Russian Federation, you have the right to an inheritance, but not to a pension. If you have a common child, then it is possible to receive social benefits in his name. Proof of dependency can be:

- medical certificates of disability;

- testimony of neighbors and relatives about the fact of cohabitation;

- information about financial dependence (recommended).

They cannot issue a pension because the marriage has not been officially registered. This is how Article 10 of the Law “On Insurance Pensions” works: if a marriage relationship is not registered in the registry office, then it is not possible to recognize it as official.

How can a widow receive pension payments?

To receive a pension, the widow must perform the following algorithm of actions:

- Visit the military commissariat

to register. The applicant must have a passport, a prescription, a personal file of the deceased, and a military ID. - Contact the Pension Fund

(Pension Fund). The widow is required to submit an application of the established form to the Fund’s branch, as well as submit the following package of documents (it is worth providing copies and originals):- passport details;

- a certificate confirming the death of the spouse;

- birth certificate of minor children;

- a document confirming relationship with the deceased;

- documentation on the assignment of the deceased’s pension;

- a certificate confirming the fact of caring for the child;

- service record of a military man.

- Receive pension payments.

The documentation review period is

10 days.

The pension is paid during the period of incapacity for work of a particular person. After the widow retires, contributions are made for the rest of her life.

Military pensioner died

A military pensioner has died. His wife (widow) receives an old-age pension. Does his widow have the right to transfer from her civilian pension to the military pension of her deceased husband? What percentage of the husband's pension will his widow receive?

Wives of military personnel whose husbands have died have the right to receive various types of material support: - pension (their own or the husband's, at your choice), - additional payment due to the loss of a breadwinner, - compensation for utility bills, - child benefit dependent. When choosing a pension payment, the widow is free to choose the one whose size is higher. The size of a military pension depends on military rank, official salary and bonus for length of service, and therefore usually exceeds the pension payments of the woman herself. In accordance with the law, the wife of a deceased serviceman can decide which pension to receive; this does not in any way affect the procedure for providing other benefits. The main condition is the absence of re-registration of marriage. Thus, each woman whose deceased husband was a military serviceman has her own specific list of benefits, which depends on various factors. This is influenced by the nature of her husband’s service, the circumstances under which he died, etc. There is also a law providing for the payment of social subsidies if the pensioner’s income does not reach the subsistence level. A widow can count on it if she is unemployed. If a woman enters into a new marriage, she loses the right to all the listed benefits or regular payments, because becomes a member of a new family that is not related to the deceased serviceman.

You might be interested

- Taking into account periods of child care when assigning and recalculating pensions

- Assignment of disability and old age pensions at the same time

- Retirement from service, for workers in the Far North and when working in hazardous working conditions

- State management company – Vnesheconombank

Important information

A pension can be called a regular, most often, monthly income that a citizen who has reached a certain retirement age, who has lost a breadwinner or has a disability receives from the state. In the case of military personnel, security may also be assigned based on length of service, that is, after a certain period of work in one of the military structures or upon receipt of disability while performing one’s duty.

The most popular and socially significant type of social security for citizens discharged from military service and their families is a pension, which means a monthly long-term payment assigned from federal budget money.

Since the government of the Russian Federation supports military affairs in its country, pensioners who were officers receive fairly good financial support.

The very concept of a military man is very broad, and this category includes such categories of workers as the Ministry of Emergency Situations, criminal, executive, intelligence services and the Ministry of Emergency Situations, and even engineers and builders serving in the military forces.

Registration of regular payments for citizens who are not former military personnel differs in procedure from registration of pensions for the second category of citizens.

Even despite this, there are also 2 more cases in which a former employee of any of the military structures of the Russian Federation may be assigned maintenance, which is financed from the state budget of the country. This may happen if a soldier receives a disability while performing his duties in the service or due to length of service, in accordance with the present legislation of the Russian Federation.

There are three types of pension payments for the military:

- For years of service.

- Due to disability.

- For the loss of a breadwinner.

Payments are assigned to military personnel within the time limits specified by law, namely, from the day of dismissal from service. For employees who are in prison, pension benefits can only be accrued from the time of their release.

Members of military families are also provided for by the state, and receive benefits for the loss of a breadwinner of an employee for any reason:

- Deaths during the performance of duty.

- Death from old age or disease.