Legal issues regarding survivor's pensions are always very important to discuss, since the share of single-parent families in Russia is constantly growing.

Such pension contributions cannot be paid forever, so you need to know what is the basis for their termination. Reaching the age of majority and getting a job is the main condition for the abolition of pension payments, but are exceptions possible? Everyone's life situations are different, so the law takes into account many cases.

Survivor's pension: basic concepts

A survivor's pension is a type of monthly cash provision for children , as well as disabled citizens upon the death of a person who was financially dependent on them. This pension comes in several types:

- social;

- insurance;

- state;

- military

All these types of pensions differ from each other primarily by the former social status of the “breadwinner” (disabled person, military man, astronaut, working citizen, Chernobyl NPP victim, etc.), which greatly influences the amount of cash contributions.

You can receive cash payments only by applying to the territorial Pension Fund of the Russian Federation (PFR).

To do this, you need to write an application and also submit a certain package of documents. According to Article 10 of Federal Law No. 400, pensions are given to the following categories of citizens:

- minor close relatives of the deceased (children, brothers/sisters, grandchildren);

- parents, as well as grandparents of the deceased, who have reached retirement age or are disabled;

- the deceased's spouse, brothers/sisters, adult child, who may not be financially dependent on the former breadwinner, but they care for his close relatives who have not reached the age of 14 years. At the same time, pension recipients must not work.

- spouse of a breadwinner of retirement age;

- close relatives of the breadwinner who received disability before the age of 18.

It is worth noting that pension legal relations require an individual approach, so it is worth carefully familiarizing yourself with the legislative framework in order to be able to defend your rights and deal with the facts.

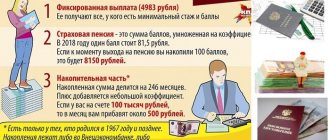

Size

The full amount payable to dependents includes both insurance coverage and a fixed additional payment to the indicator:

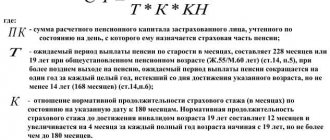

- insurance coverage is calculated only on the basis of an individual indicator - a score. The cost of one individual point in the year presented is set at around 78.28 rubles;

- a fixed surcharge is established in accordance with current legislation in each region.

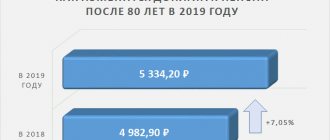

At the moment, the fixed payment is 2402.56 rubles. This is a fixed payment that does not depend on any indicators. There is also indexation on an annual basis.

Until what age do they pay?

The survivor's pension has its own legislative framework, which consists of a number of laws. These traditionally include:

- Federal Law No. 400;

- Federal Law No. 166;

- Federal Law No. 4468-1 (military personnel);

- Federal Law No. 173 (in certain cases);

- Order of the Ministry of Labor and Social Protection of the Russian Federation No. 885n;

- Order of the Ministry of Labor and Social Protection of the Russian Federation No. 958n;

- regional acts.

Based on the provisions of Art. 24 Federal Law No. 400, as well as Art. 11 Federal Law No. 166, we can say that cash payments are suspended upon reaching the age of 18 . The law contains the word “suspension” for a reason, since pension contributions can be resumed if the person provides the Pension Fund with a certificate of full-time study at the university.

If a person is studying part-time/evening at a university or has gotten a job, then no monetary payments are provided in this case . You need to contact the Pension Fund of Russia with an application to renew your pension, if there are legal grounds for this, as soon as possible, since no one will compensate for lost time with money.

A full-time university student receives a pension until the age of 23, provided that he does not officially work and has not been expelled from the university.

If university studies are completed before the age of 23, then the pension will no longer be paid .

It often happens that a pension recipient enters into a legal marriage while studying or before turning 18 years old. In this case, the question immediately arises: will cash payments continue and for how many years? In this case, pension contributions will continue, since no law prohibits this.

Among the grounds for termination of pension payments there is no clause “legal marriage” . It does not matter what specific pension the interested person receives.

Other situations may occur during training. For example, a student needs to take a leave of absence to resolve family problems.

By general definition, academic leave is a temporary suspension of studies at a university, institute, or college as a result of the occurrence of legally significant events for the student (marriage, birth, children, illness, caring for a sick relative, etc.). The procedure for granting such leave is established by local documents of the university, as well as by Order of the Ministry of Education and Science No. 455.

According to the law, a student who has taken an academic leave for a while is not expelled, so pension contributions for the loss of a breadwinner will not stop.

However, in order to continue payments, it is necessary that such a student was previously a full-time student and did not get a job at the same time. In other cases, academic leave is not an obstacle to further pension payments.

In legal practice there are many situations when a person is drafted into the army. Things get more complicated when it turns out that he is a survivor pensioner. In this case, the pension will no longer be paid .

The logic of the legislator here is that pension recipients in accordance with Art. 10 Federal Law No. 400 can only be disabled members of the breadwinner’s family . Military service requires full state registration. provision, which contradicts the concept of “disability”, since all expenses are borne by the state. It turns out that if you are drafted into the army, all pension contributions stop.

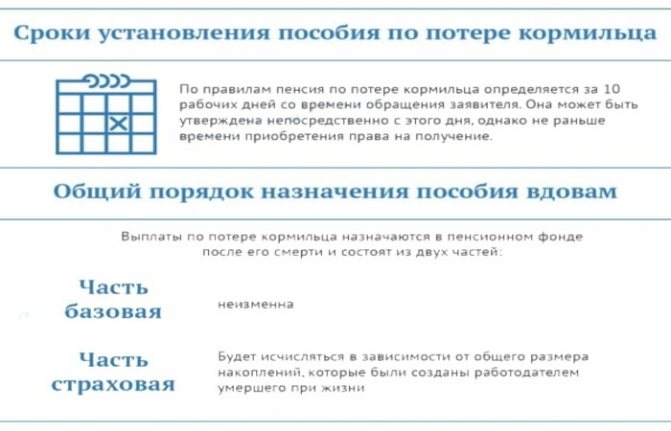

Where to apply and deadlines

In order to apply for a survivor's pension, file a petition on your own behalf or on behalf of an incapacitated family member (if you are considered his official representative). You can submit an application in one of the following ways:

- personal visit to a division of the Pension Fund of the Russian Federation;

- sending an application through the post office to the Pension Fund;

- visiting the MFC;

- submitting an application through a profile on the website of the Russian Pension Fund. To do this, you need to register on the Internet portal of government services.

Review of the application by Pension Fund employees takes 10 days from the date of acceptance of the documents. The assignment of pension payments is made from the date of filing the application, but not earlier than the date the right to them becomes available.

Before the date of application, the pension is issued only when the dependent submits an application within a year from the date of death of the breadwinner. In such a situation, pension benefits are assigned from the date of death. Pension payments are assigned for the period during which the dependent is unable to work, including indefinitely.

The death of a loved one is a sad event for any Russian. However, if this does happen, you need to take care of registering pension benefits, the right to which is guaranteed by the state.

Are there exceptional cases?

As a general rule, the pension should be suspended when its recipient turns 18 years old, but clause 1, part 2, art. 10 Federal Law No. 400 states that it is possible to renew cash payments until the age of 23 inclusive , if a person is studying full-time at a university/college. To extend the pension, the student must meet several criteria:

- studied at a university that has state accreditation, which is confirmed by a copy of the university license;

- studied only full-time at a university/college (certificate of training);

- was not expelled from the educational institution at his own request or for poor academic performance;

- did not get a job at the same time under an employment contract.

To resume monetary contributions, you need to come to the territorial Pension Fund with an application. A certain package of documents is attached to the written application, which includes a copy of the university license, a certificate of study with an official seal and completion dates.

Upon reaching the age of 23, pension contributions cease immediately. It does not matter whether the pensioner continues to study or not. The only exceptions are close relatives of the deceased who received disability before the age of 18 .

These categories of persons can still count on retirement after 23 years. There are no further exceptions. The maximum age for receiving cash contributions is 23 years.

Orphans and children without parental care have a special legal status, who are fully provided for by the state during full-time studies at a university, even if they are 23 years old in accordance with Article 6 of Federal Law No. 159. However, this is not a pension, but payments of a completely different order.

Procedure for terminating pension contributions

The survivor's pension stops being paid when legally significant events occur in accordance with Article 10, 24 of Federal Law No. 400:

- coming of age if the pensioner has not entered the university full-time;

- reaching the age of 23 years, despite continuing studies at a university;

- official employment;

- expulsion from the university;

- transfer to another form of education;

- death of the pension recipient;

- self-rejection;

- failure to provide a certificate of training to the territorial Pension Fund;

- expiration of the residence permit;

- conscription.

In this case, all monetary contributions cease automatically , and this is especially true when the pensioner reaches the age of majority or the age of 23. In other cases, it is necessary to notify the Pension Fund of all legally significant facts that may lead to the termination of the pension relationship.

This is done by contacting the Pension Fund, where you need to write an application and also provide certain documents. Otherwise, the former pensioner will have to pay illegally or excessively transferred funds, which may accumulate as a result of prolonged concealment of facts.

However, if the recipient of the pension is studying at a university, then he must regularly provide a certificate of study to the territorial Pension Fund, where it should be written in black and white that the person continues to study full-time at a particular university (clause 8 of the Order of the Ministry of Labor and Social Affairs. protection of the Russian Federation No. 958n).

The certificate must be signed by an official , have an official seal and the deadline for completing the training. It is prohibited to provide a false document, since the Pension Fund sends requests to educational institutions and checks all the information provided (clause 9 of Order of the Ministry of Labor and Social Protection No. 885n).