Legal regulation

Legislative land tax is regulated by the Tax Code, as well as a number of federal laws and acts. Not long ago, there were big changes in tax legislation, which resulted in an increase in the tax on garden plots. This is due to the fact that until January 2020, the tax was calculated based on the inventory value of the site, and now on the cadastral value, which is quite close to the market price of the property. The inventory value is several times lower than the cadastral value since it is calculated more simply.

The taxation of objects that are included in Rosreestr and for which the cadastral value has been determined will be calculated in a new way. The law establishes a transition period until 2020.

Payment of land tax and property tax is made using receipts that a citizen receives at the tax office. These documents contain a detailed calculation scheme and you will no longer need to independently calculate the amount of tax.

How to check land tax debt? See here.

Who is entitled to benefits?

Benefits may be provided on the following grounds:

- the area established by law, which the site should not exceed;

- low-income citizens;

- persons under special social protection.

Tax relief can also be implemented by reducing the tax rate, reducing the amount of the taxable base, or complete exemption from paying tax. To clarify the current tax breaks in the region, you must contact the local branch of the Federal Tax Service.

This is important to know: How to register ownership of a summer cottage in 2020

Dacha taxation

It should be noted that a dacha is a kind of complex that includes a plot of land, a house and outbuildings. Therefore, not one tax is paid, but several. Moreover, it will not be calculated as a single amount, but separately for each part of the complex.

Ownership of any property must be registered in the manner prescribed by law. In the case of a dacha plot and the dacha itself, this is Rosreestr of the Russian Federation.

Many people treat country houses lightly and do not register ownership. Including in order to avoid paying taxes. Since 2020, the state has been systematically fighting against such owners.

The law allows registration in a house built on plots intended for gardening activities. As a result, many huge cottages have been built on dacha plots, and tax officials plan to bring them out of the shadows.

It is worth saying that the building still needs to be registered. Many people of retirement age are afraid to do this, fearing that they will have to pay unaffordable sums. However, there is more harm from such a refusal to register. For example, if land is confiscated for government needs. No one will reimburse the cost of an unregistered house.

How to register a house is explained in the video. See detailed instructions:

If the dacha has not been registered, it is better to do it quickly. Otherwise, you will have to pay a fine and the Federal Tax Service may have the right to collect tax payments for 3 years.

The dacha tax consists of:

- Land tax. Once the land is registered, there is an obligation to pay fees for it. Even if there are no buildings there and the owner does not use it in any way. The amount of tax collection on a garden plot is calculated based on the cadastral value of the plot;

- Property. The country house will be assessed by a specialized body and the amount will be calculated based on its cadastral value;

- Sales tax. You will have to pay a tax on profits (NDFL). For a citizen of the Russian Federation – 13%, for a citizen of another state – 30%. The calculation is made based on the amount specified in the contract.

It should be noted that starting from 2020, a program is underway to change the procedure for calculating tax payments. Until this time, the amount of the fee was calculated based on the inventory value of the dacha. Since 2015, the tax fee has been calculated based on the cadastral value of the property, which has led to an increase in taxes .

Payment calculation: cadastral value x interest rate. This rate is set by local authorities. The Federal Law only sets the upper ceiling. It will change annually. Payment is made on the basis of a notice, but for some time now the Federal Tax Service has not sent out such papers. It is better to visit the service office yourself and take a printout.

In the picture you can see the tax rates for residential premises in force in Russia:

Important: if the cadastral value of your house seems too high, you can appeal it in court. You will have to order your own assessment and present it in court. If the court takes the plaintiff’s side, then the Federal Tax Service of the Russian Federation will be obliged to calculate the tax payment differently.

Land tax on dacha plot

The amount of land tax on a dacha plot in 2020 largely depends on its price and location. Owners do not have the right to calculate the tax themselves. They make payments using receipts received from the tax office.

Tax department employees themselves determine what funds will need to be paid to the citizen in accordance with the cadastral value of the property. A notification with a requirement to pay the tax must be sent to the citizen by mail no later than October 1. In this case, there will be two months left to pay the state fee.

If a person knows the cadastral value of his land plot, as well as the tax rate in the constituent entity of the Russian Federation in which he lives, he can independently calculate the amount of money that he will have to spend on paying the tax.

In order to find the cadastral value, you need to look at the cadastral map or passport, or find an extract from the Unified State Register of Real Estate.

Depending on the subject of the Russian Federation, different rates are applied to the land plot, which can be set by the administrative bodies of municipalities. The Tax Code only specifies the upper limit of the rate. It is 0.3% for agricultural lands and personal subsidiary plots and 1.5% for lands of other categories. Land tax is calculated once a year.

For pensioners

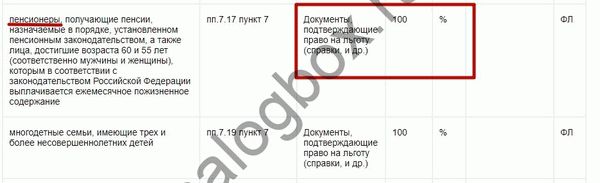

Calculation of land tax on a dacha plot for pensioners is carried out on a general basis. They do not qualify for tax breaks under federal law. However, local authorities have the right to establish benefits for people of retirement age independently.

Using this opportunity, regional authorities mainly formulate provisions on tax breaks for pensioners. The main benefit is the opportunity to pay half the tax.

If a citizen is one of the many owners of a land plot, the tax will be calculated according to his share.

For invalids

The legislation provides for the provision of benefits to people with disabilities, but not all groups. Tax breaks are provided to persons with disabilities of groups 1 and 2, as well as persons with disabilities from armed conflicts and the Great Patriotic War.

The latter receive slightly smaller benefits. Tax breaks for people with disabilities are provided at the federal level and decisions of local authorities do not play a special role here.

For labor veterans

Federal laws do not provide benefits for this category of citizens. However, the authorities of the constituent entities of Russia often establish laws that allow such categories of citizens to pay land tax in an incomplete amount.

The citizen will need to confirm his status with an official document. In this case, local authorities are obliged to include the person on the list for a reduction in tax payment.

Tax deduction for purchasing a summer house

According to the provisions of the law, when purchasing property, including a summer house, a tax deduction is provided. A tax deduction for the purchase of a summer house can also be provided at the request of the buyer. Its size is thirteen percent of the cost, but not more than 260,000 rubles. This deduction is an income tax refund. You can only use this opportunity once.

To receive a deduction, you need to contact your local tax office with a declaration, agreement, and payment documents.

What conclusions will we draw?! Tax on garden plots and country houses is mandatory. However, benefits are established by law for certain persons. You can find out more about the availability of benefits and tax rates at the tax office of your city.

How to pay?

To pay the tax, a citizen will need to personally contact the tax office or send his authorized representative there. Payment can also be made electronically using Sberbank online, the State Services portal or directly on the website of the Federal Tax Service.

To transfer funds to pay off tax payments, you can also use a mobile application or which will automatically transfer funds from your mobile phone account or bank card each time.

Are there any personal tax benefits for individuals? Information here.

How to calculate land tax? Details in this article.

Video about land tax

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

This is important to know: Fine for an unregistered house on a summer cottage

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Fixed tax deduction from January 1, 2019 for pensioners

Based on the adopted Federal Law No. 436-FZ of December 28, 2017, a new land tax benefit for pensioners has been introduced. They are entitled to a tax deduction. Its size is determined as the cadastral value of 6 acres. This means that if an elderly person’s summer cottage is less than 6 square meters. m, then he should not pay for it. Previously, only federal beneficiaries enjoyed this prerogative:

- Heroes of Russia (USSR);

- full holders of the Order of Glory;

- citizens who have been assigned disability group 1 or 2;

- veterans and disabled combat veterans;

- citizens directly involved in nuclear weapons testing and liquidation of nuclear accidents;

- citizens who became disabled as a result of nuclear tests.

- disabled since childhood;

- persons exposed to radiation;

- persons who received or suffered radiation sickness;

Please note that the tax deduction is provided only for one plot of land. It does not matter the purpose of its use, the amount of income of the owner or the location of the land. Regional legislation may stipulate additional benefits for other categories of older people, for example:

- recipients of survivor's pensions;

- working pensioners;

- upon early retirement due to length of service.

What to do if the tax payment notice did not arrive by mail

Payment receipts may not arrive by mail for two reasons:

- A personal taxpayer account was created. In this case, invoices for payment will be sent to your personal account, and not by mail.

- The payment was lost at the post office or arrived at the address of registration, and not the actual place of residence.

The only right decision in this situation is to notify the tax office as soon as possible about the lack of payment in order to avoid the accrual of penalties.

Everyone has the right to dispose of their own property as they see fit, but the mandatory land tax will have to be paid in any case.

Procedure and rules for calculating land tax on a dacha plot

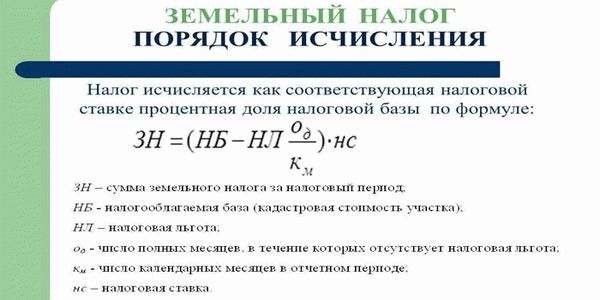

The amount payable can be calculated using the following formula:

ZN = NB × NS × KPV × DPS – L, where:

- ZN – the amount of land tax, expressed in rubles;

- NB – tax base, defined as the cadastral value of the plot as of January 1 of the billing period. The value is determined by the tax authorities from the data of the state real estate cadastre (Rosreestr).

- NS – tax rate. Determined by the regulatory legal acts of the region.

- CPV – coefficient of the period of ownership of a plot, determined in shares depending on the number of months (maximum value – 1).

- DPS – share in ownership. If the pensioner is the sole owner, the value is taken as 1. If the plot is owned by several persons, the tax is calculated for each person individually depending on the share of ownership.

- L – land tax benefits for pensioners, determined by regional legislation.

Tax Rate Limits

Please note that the interest rate is determined by local authorities. However, it cannot exceed the maximum values established by Art. 394 Tax Code of the Russian Federation:

Sales income tax

If a pensioner buys a dacha, then he does not have an obligation to pay the fee, since as a result of such a transaction he does not receive income. If a transaction took place between the parties to alienate the dacha through a gift agreement and the parties are not close relatives, then the donee will have to pay a tax of 13%.

In this case, there are no benefits for pensioners.

Should pensioners pay tax on the sale of their dacha? Yes, they should. The exceptions are the following cases:

- The country house and plot of six acres have been owned by the pensioner for more than five years;

- If the dacha was received by inheritance or through the conclusion of a gift agreement, then this period of ownership is reduced to three years.

Important: all these conditions apply to property that was acquired after January 1, 2020.

Watch the report where they talk about changes in 2020 regarding the dacha tax for pensioners:

Benefits for summer cottages for pensioners in Moscow and the Moscow region

Land tax for pensioners in the capital and region is charged to all owners of plots. Only some Moscow residents are exempt from paying land tax on an amount not exceeding 1 million rubles:

- disabled since childhood;

- persons with disability group 1 or 2;

- disabled people and combat veterans (including the Great Patriotic War);

- parents with many children (adoptive parents);

- persons injured as a result of the accident at the Chernobyl nuclear power plant.

For pensioners - owners of summer cottages living in the Moscow region, certain benefits are also provided. The size of the preference and categories of recipients are determined at the municipal level, for example:

This is important to know: New law on summer cottages and building a house on a garden plot in 2020

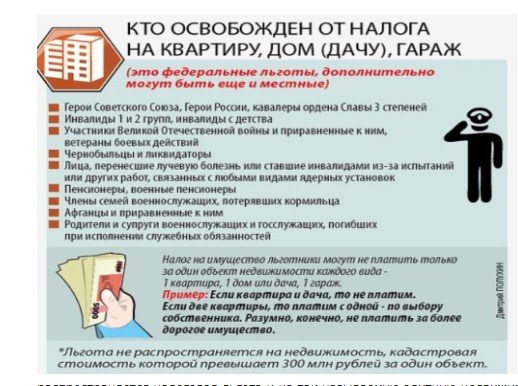

Who is entitled to tax benefits?

Beneficiaries include the following individuals:

- Heroes of the Russian Federation and the USSR.

- Disabled people of groups I and II.

- Liquidators of the Chernobyl accident.

- Women over 55 years of age.

- Men over 60 years of age.

- Persons who retired early.

Who is exempt from house (dacha) tax?

Is land tax charged to pensioners for their summer cottage plot?

About which objects the accrual is made and who must pay is written in Chapter 31 of the Tax Code. Let's look at the main provisions regarding land tax for retired summer residents:

- A garden or dacha plot in itself is an object of taxation if a person possesses it with the following rights:

- property;

- permanent use;

- lifelong inheritable ownership.

In other words, if there are no title documents issued to you for the site (extracts from the Unified State Register, decisions of the administration, etc.), no accruals are made. Also, land is not a taxable object in cases of lease and gratuitous use.

- Pensioners do not have to pay land tax for a 600 sq.m. dacha plot. m (clause 8, clause 5, article 391 of the Tax Code). For larger areas, only the remaining acres are taken into account. If there are two or more plots, the benefit applies to only one of them. The deduction is valid starting from the 2020 period.

Example 1

To receive the benefit, a pensioner must contact the Federal Tax Service with an application and supporting documents (see Letter of the Federal Tax Service dated September 10, 2018 No. BS-2-21/ [email protected] ). If a person has previously enjoyed benefits and the Federal Tax Service knows about his pensioner status, there is no need to provide anything.

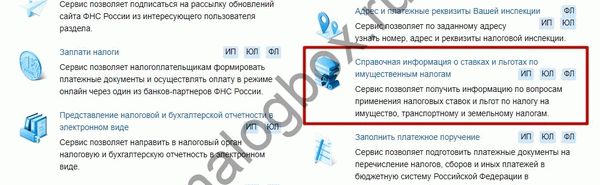

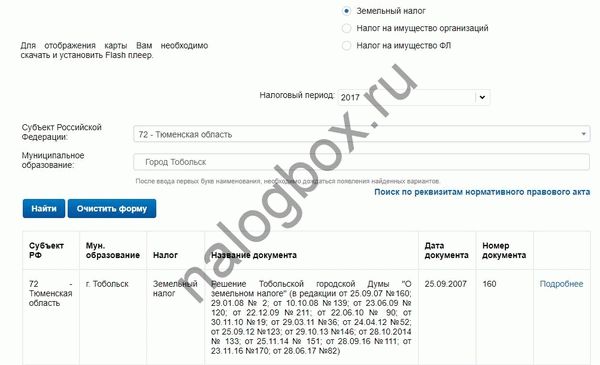

You can see what benefits are valid in the territory of the municipality where your site is located in the service on the Federal Tax Service website.

Example 2

According to the information presented on the Federal Tax Service website, pensioners here are exempt from the obligation to pay tax.

Should a pensioner pay tax on a country house?

If a house is built on a garden plot and outbuildings are located, they are no longer subject to land tax, but to property tax. It is regulated by Ch. 32 NK. Let's look at the main provisions regarding dacha property tax for pensioners:

- According to Article 401 of the Tax Code, houses and residential buildings on dacha and garden plots are considered residential buildings and are subject to taxation. In this case, only those citizens who own a house by right of ownership are recognized as payers.

Example 3

- Article 407 of the Tax Code states that pensioners are exempt from paying tax for each of the objects:

- House;

- household structure;

- garage.

Thus, pensioners do not need to pay tax on a dacha (house) if they own only one such object.

Example 4

Important!

If the tax amount is calculated based on the cadastral value, a deduction in the amount of 50 square meters is applied to country houses. m. (Clause 5 of Article 403 of the Tax Code).

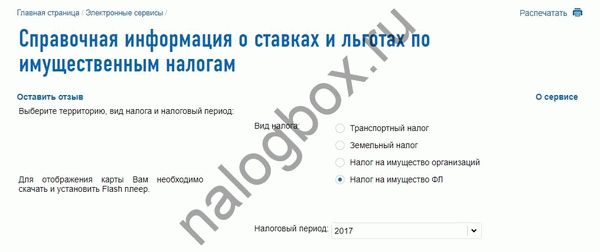

- As in the case of land, with regard to property tax, local authorities have the right to expand the number and scope of benefits provided. The information is compiled into a single directory on the Federal Tax Service website, where you can select the municipality and year of interest.

How to pay taxes on a dacha in SNT?

Documents are proof that real estate belongs to someone. To receive them, you need to register this very right. After registration, a document is issued. This right is formalized somewhat differently if the house is located in a non-profit partnership. What to do in this case, should pensioners pay dacha tax?

Houses located on the territory of SNT are not officially registered. They are simply part of a large dacha cooperative. There is no information about them in the tax office; demands for payment of taxes do not come to them.

All contributions are collected by the Board of the dacha partnership. Such organizations pay land tax for the entire piece of land on which the SNT is located. Payments received from summer residents are transferred to organizations to which the partnership is obliged to pay certain amounts.