Regulatory framework for the appointment of early pensions

Old age insurance pensions are assigned to those citizens who have worked for a certain number of years. After old age no longer allows you to work effectively, the state begins to pay a monthly allowance, which is intended to replace previously available earnings. If a certain list of conditions is met, an old-age pension can be granted much earlier than the age criteria.

The right of any citizen of our country to an early retirement pension is enshrined in Federal Law No. 400. Article No. 30 of this law includes a complete list of professions that give the right to retire much earlier than prescribed under normal working conditions.

According to the changes of 2013, the employer must make additional insurance contributions for all employees of harmful and dangerous industries. At the same time, all workplaces of this type must be assigned to some hazard class, according to the compiled lists:

- List of 1 harmful professions for early retirement.

- List 2 for going on vacation early.

Let us note the benefits for people employed in such industries:

- Retiring from work early.

- The right to regular additional leave once a year, which is regulated by Article 117 of the Labor Code of the Russian Federation.

- Increased wage level, according to Article 147 of the Labor Code of the Russian Federation.

- Citizens are issued vacation and recreation vouchers without a queue, in most cases free of charge, but sometimes with a small compensation payment.

List No. 1 of preferential hazardous occupations for early retirement was approved by Decree of the supreme executive body of the USSR dated January 26, 1991 No. 10 (used as amended on October 2, 1991).

When considering the right to early pay for periods of work before 1992, the lists put into effect by Decree of the Supreme Government of the Soviet Union No. 1173 of August 22, 1956 are taken into account.

The procedure for calculating length of service for assigning an early pension is established by Decree of the Government of the Russian Federation No. 665 of July 16, 2014.

The pension law reform announced in 2020 did not consider new actions on preferential pensions. Federal Law No. 350-FZ of October 3, 2020 “On Amendments to Certain Legislative Acts of the Russian Federation on the Appointment and Payment of Pensions” retained the methodology for accounting for periods of work experience in hazardous conditions.

What is work experience and how to find it out in the pension fund

General experience - at least 25 years, special - 12.5;

- women 50 years old, having a total time of 20 years, preferential time - 10.

There is one more requirement - Pension Fund points. They need to be dialed 30. This is stated in the Federal Law “On Insurance Pensions”.

How to calculate a pension based on harmful service The current pension legislation provides for calculation using a special formula. It is also used to determine the amount of almost all other types of payments, including the standard insurance pension.

SB x TSB = PB The first multiplier is the sum of points accumulated in the pensioner’s account. The second is the price of one pension bonus. This simple mathematical operation results in the size of the payout.

Industry affiliation of the most harmful impacts

The list consists of more than 500 items. These include blue-collar professions and positions of engineering and technical personnel: foremen, heads of departments, technologists and others.

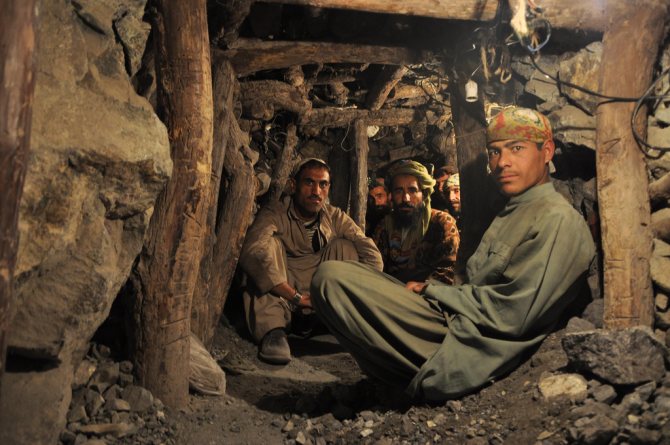

Most of the beneficiaries are in underground work, in the nuclear industry, metallurgical and foundry production, and in the chemical industry. List 1 contains common professions for all industries. As an example, a blacksmith using hammers and presses working at a machine-building enterprise. He forges metal in a hot furnace and can expect to work for a shorter period of time.

When considering the issue of taking a vacation on benefits, the pension fund will request information from the company:

- management structure, by workshops and sections;

- process maps;

- time standards for operations.

The task of the state institution regulating pensions is to prevent unjustified inclusion in the contingent of “early workers”. All their actions are justified by law.

Harmful experience for retirement

Harmful work experience is taken into account by pension fund employees to determine the amount of monthly pension payments, bonuses and benefits for pensioners, and also allows a person working in harmful and dangerous industries to retire early.

Despite this, people go to work in dangerous fields of activity, because in addition to early retirement, they are attracted by significant additional pension payments in the amount of 2 to 9 percent of basic accruals.

In Russia, this type of experience is regulated by the following legislative acts:

- Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ.

- Law “On Labor Pensions...” dated December 17, 2001 No. 173-FZ.

- Lists No. 1 and No. 2, which include a list of professions with hazardous conditions, working in which people can receive early retirement and additional payments.

- Decree of the Government of the Russian Federation “On lists...” dated July 16, 2014 No. 665.

In addition to the above documents, there are also additional lists of activities in specific professional industries, which also provide the opportunity to retire early.

Retirement due to harmfulness: list of professions

All professions and positions that are included in the first list have one common feature - they clearly indicate the harmfulness and even extreme danger of carrying out work activities. This list includes the following categories of work:

- Persons working in mining and mining operations, miners, subway construction workers and everyone else whose work is carried out below the surface of the earth for most of their working time.

- Employees of the metallurgical industry, that is, those employed in the production of non-ferrous and ferrous metals.

- Workers in gas and oil production of any position.

- Workers producing construction, chemical, medical and glass materials.

- People employed in the printing and healthcare industries, geological exploration and transport workers.

- Employees of the production of radio equipment and radio equipment using mercury and other harmful and dangerous substances.

This is only a small fraction of those professions that are included in the lists of hazardous professions for early retirement.

Conditions for assigning a pension according to the 1st list of harmfulness

Working in harmful and/or dangerous production does not give the right to early access to state support. Yes, and preferential professions for retirement, which are included in List 1, also imply compliance with a number of conditions:

- The position and place of work must be included in the list of preferential professions for early retirement.

- A person must reach a certain age, which for men is 50, and for women only 45 years.

- By retirement age, the required number of IPC coefficients (pension points) must be accumulated for the insurance period of 20 years for men, and 15 years for women.

- The duration of special “dangerous” experience for men is 10, and for women 7.5 years.

Provided that the employee worked in hazardous positions not the full required time, but slightly more than half of the required length of service, then the pension will be issued with a gradual decrease in the retirement age. According to list 1, for every full year of harmful work, the age for going on vacation will also be reduced by a year.

Additional contributions to the Pension Fund of the Russian Federation

Registration of a disability pension ahead of time becomes possible only when special (increased) insurance contributions are regularly paid for the employee by the employer. This fact is stated in Article 30 of the Federal Law No. 400 of the Labor Code of the Russian Federation, paragraphs 1, 2. Payments consist of:

- Insurance-type contributions for compulsory pension insurance, in accordance with Article 33.2 of the Federal Law number 167.

- Payments corresponding to the conclusion of the SOUT commission, according to the class of harmfulness and danger.

Due to changes in legislation in 2020, the amount of insurance payments increased. Now the employer must pay at least nine percent of the employee’s salary, otherwise the length of service will not be counted as harmful. If employers act fraudulently, extremely serious consequences for the entire enterprise can follow, including complete confiscation and freezing of assets.

How to find out how much harmful work experience I have

Sometimes such additional contributions become the only opportunity to receive a pension before reaching retirement age. The calculation of disability pensions is based on both the length of service (general and special) and the period of payment of mandatory payments to the pension fund.

Therefore, a very important point is the employer’s payment of insurance premiums for the first and second lists of harmful working conditions. In addition, on a quarterly basis, the employer must provide individual information about his employees to this fund, and he must issue a copy certifying that the data has been transferred directly to the employees.

Preferential length of service in various professions and hazards is understood as a time period during which a citizen carried out work under special conditions. These include work in hazardous and hazardous industries in the northern regions.

Applying for a disability pension

In order for a pension under List 1 for disability to be assigned, calculated and paid in full, you will have to arrange it yourself, since this type of security is an applicant’s. A package of documentation must be submitted to the Pension Fund of the Russian Federation at the place of your own registration or registration of actual residence.

List of documents

- Identity document: passport of a citizen of the Russian Federation or residence permit for foreigners.

- Papers confirming the right to early retirement on a preferential pension. These can be certificates-extracts from the employment record, from the employer, from the account card, etc.

- Application for early pension due to work in hazardous work from list 1. Fill out the sample application at home and bring it ready.

The pension fund may also require additional papers, for example, from housing and communal services, about the availability of bank accounts and the like, which can be submitted for a full three calendar months.

Submission and accrual procedure

The ways to declare the need to pay a preferential pension are as follows:

- Send all papers by mail. The letter must be recommended and have a list of all attachments.

- Register your personal account on the official Pension Fund portal and upload copies (scans) of all documents directly to the server.

- Contact MFC consultants.

- Personally take the papers to the nearest PF branch. This way you will know for sure that the papers have been accepted and there are no errors in them.

After the final acceptance of the documentation, ten days later you can already receive an answer on how, when and how much money you can receive from the pension benefits list for hazardous professions.

Is it possible to find out your work experience through government services?

These periods can be taken into account in your work experience, but only if you were previously officially employed and constantly contributed fees to the pension fund.

- Initially, you should register on the official website of government services.

- Then you need to go to your personal account and select “Service Catalog” from the menu. Then you will need to select the “Pension, benefits, benefits” tab.

- You must select the “Notification of personal account status” section. Then the “service information” window will open. This section describes in detail the procedure on how to find out your work experience on the government services website.

Video about those who are eligible for early retirement

If there are any unclear points about who has the right to early retirement, you should read the video below.

List No. 1 reflects production by industrial sectors, the technological process of which involves the presence of harmful and dangerous factors. Workers performing job duties in workplaces where the level of dust, toxic and carcinogenic gases, and radioactive substances exceed the permissible norm receive pension benefits earlier than other people. Subsections of List No. 1 for 24 industries list professions and positions where working poses a risk.

Harmful length of service for pension provision

Work experience is calculated by employees of pension authorities to determine the amount of benefits. This indicator is taken into account when establishing additional payments and benefits for a particular citizen. Output is considered one of the main indicators for early retirement.

Statistics show that more than 40% of the country's population works in hazardous or hazardous work. When determining rights to a preferential pension, it is also taken into account that they perform work that threatens their health. Sometimes there is a danger to life .

Despite such working conditions, citizens go to work in enterprises. The reason for this is not only the possibility of premature retirement, but also the receipt of additional payments to the pension benefit. The bonuses for the category in question range from 2 to 9% of the payment amount.

Legislative regulation of harmful work experience

There are several legal acts in force on harmful work experience in Russia.

Including:

- Federal Law No. 400 of 2013 “On Insurance Pensions”;

- Federal Law No. 173 of 2001 “On Labor Pensions”.

In addition, the Government of the Russian Federation issued Resolution No. 665 of 2014 “On lists...”. This act reflects 2 lists that define professions employed in hazardous conditions. Persons working in these positions may retire earlier than other categories.

Local regulations also apply. They are developed at the level of specific enterprises.

Features of length of service for retirement according to List No. 1

A woman must work under appropriate conditions for 7.5 years to become a pensioner at 45 years old.

Retirement under the first hazard grid under preferential list 1, according to the law, is due to men at 50 years of age. The candidate for pensioner confirms that he worked for 10 years in a profession from List No. 1.

Pension legislation allows old-age retirement on preferential terms if 50% or more of the established time has been worked under unfavorable conditions. So, for example, a man who has worked in underground work for five full years has the right to apply to the Pension Fund office for a pension at age 55.

In other cases, a pension is granted to male employees at the age of 54, if 6 years of service are taken into account. You can stop working at 53 after working for 7 years in poor conditions. Accordingly, at 52 and 51 years of age, well-deserved rest is prescribed for 8 and 9 years spent at risk to health.

A similar scheme applies to women. Half the term is 3 years and 8 months. Having received such a dose of “bad” influence, the lady goes on vacation at the age of 52. Carrying out work duties under fear of falling ill for 4,5,6 or 7 years, the employee expects to leave work: in the first case at 51 years old, in the second at 50 years old, in the third at 49 years old, in the fourth at 48 years old.

| Women | Men | ||

| Special preferential length of service in years | Retirement age in years | Special preferential length of service in years | Retirement age in years |

| 3,75 | 52 | 5 | 55 |

| 4 | 51 | 6 | 54 |

| 5 | 50 | 7 | 53 |

| 6 | 49 | 8 | 52 |

| 7 | 48 | 9 | 51 |

| 7,5 | 45 | 10 | 50 |

A pension will not be given if the required total length of service is not enough.

How harmful work experience affects the amount of early pension

When an employee’s functions are performed under heavy gas pollution, in conditions of abnormal atmospheric pressure and in the presence of other unauthorized environmental indicators, labor is paid at an increased rate. This norm is in most cases implemented under the control of the prosecutor's office and the state labor inspectorate.

When entering a well-deserved retirement with benefits, the pension amount is calculated in accordance with the general procedure. There is no point in hoping that the pension will be higher than that of an employee who worked under normal conditions.

For beneficiaries, the total amount of years worked at the time of retirement is less due to early departure. Labor was paid taking into account 1 hazard grid at work. The pension calculation formula compensates for fewer years worked with higher wages. The difference is not felt. It is assumed that compensation for harm is the early assignment of payments.

A pensioner receives additional insurance payments in the following cases:

- injury;

- identified occupational disease;

- other health problems related to job responsibilities.

Where are the days of service lost?

The technique does not contain a simple calculation. Upon detailed analysis, it becomes clear that the following will be deleted from the period recorded in the work book:

- absence from work at the request of the employee;

- days when the time sheet shows a shift lasting 4 hours or less;

- periods of suspension due to late payment of wages;

- maternity leave,

- distractions for off-site training,

- downtime.

If the enterprise is not operating stably and downtime is periodically announced, the calendar mode of accounting by day is activated. Sick days, weekends, and vacations are excluded. It happens that in a whole year only a month of work is accumulated, which will be included in the period of employment according to List 1.

Pension for hazardous working conditions

It should be remembered that when contacting the Pension Fund of Russia in order to receive payments for harmful work experience, you must have with you a package of documents (original and copy of passport, work book and other documentation that can confirm activity in hazardous production or industry, military ID if available ). In order to reduce the time required for assigning such pensions, the Pension Fund of Russia bodies begin to check in advance the documents of those people who are going to retire and create a model of the pension file.

What is not included in harmful experience? When preparing to retire, many people who have worked a sufficient amount of time in hazardous areas of activity begin to think about what may not be included in this length of service, for example, sick leave or vacation, as well as maternity leave and parental leave. A detailed answer to an exciting question can be obtained by reading in detail Art.

Informing about the state of working conditions

Registration of a preferential pension according to the 1st list of harmful conditions in Russia is possible if work in special conditions is documented.

When applying for a job, the employer is obliged to familiarize the employee with all the risks in the new place. The Russian Labor Code included information about the presence or absence of harm among the mandatory conditions of an employment contract. When reading the contract, the candidate must understand that he will perform the assigned work according to List 1.

The plant's personnel service must draw up lists of staffing units for which labor is subject to preferential treatment. The document is sent to the Pension Fund. At the same time, a clarifying certificate is being prepared confirming the workload of workers throughout the day under the influence of factors.

Having protected the list, the employer is obliged to pay insurance premiums in an increased amount. The transfer of contributions for the “harmfulness” of employees is a prerequisite for a decision on early retirement.

The pension fund will not take into account the list of professions if the enterprise has not carried out a special assessment of working conditions (SOUT). A special assessment is an independent examination. Conducted by an organization that has permits. The result of the SOUT is an act and maps describing the work areas, in each specific case. The map shows:

- class of harmfulness and danger;

- coefficients of hazardous environmental indicators;

- mandatory compensation measures;

- recommendations for improving changes.

The list that affects the date of retirement includes places with a hazardousness rating coefficient of 3 and 4. A person working under an employment contract has the right to know the truth about the microclimate and gas pollution in the area. He can independently obtain information about the hazard class from an expert.

What is included in harmful experience?

In Russia, this type of experience is regulated by the following legislative acts:

- Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ.

- Law “On Labor Pensions...” dated December 17, 2001 No. 173-FZ.

- Lists No. 1 and No. 2, which include a list of professions with hazardous conditions, working in which people can receive early retirement and additional payments.

- Decree of the Government of the Russian Federation “On lists...” dated July 16, 2014 No. 665.

In addition to the above documents, there are also additional lists of activities in specific professional industries, which also provide the opportunity to retire early.

Guarantees of a bona fide employer

Harm to the employee’s body, in addition to going on a well-deserved rest on preferential terms, also provides for other measures to ensure a reduction in the effect of harmful influence. The employer is obliged:

- constantly develop and implement measures to reduce harmful effects on workers;

- provide additional paid vacation days, 7 or more days, in terms of periods of time under special conditions;

- provide, at their own expense, protective equipment, special suits and footwear;

- pay for work in hazardous conditions at higher rates, from 4 to 28%;

- in particularly dangerous and harmful working conditions, according to the results of the special labor assessment, stipulate in employment agreements a week of 36 hours or less;

- for preventive purposes, provide dairy products or milk replacement products daily;

- organize annual medical examinations of specialists appointed taking into account hazardous factors in the working environment.

To feel care that compensates for the damage caused by working in conditions that deviate from normal conditions is the legal right of the worker. A conscientious employer enshrines its obligation to provide benefits and guarantees in the organization’s regulations.

How much harmful experience is needed?

The concept of preferential service is often used by employees of pension authorities. It is used to provide decent pensions to citizens for having worked in harmful conditions for a long time .

For 1 list

Male representatives have the possibility of early retirement, provided that they have worked in the professions reflected in 1 list for at least 10 years. The total labor output is also taken into account.

It must be at least 20 years old . In addition, these citizens are entitled to additional payments.

A woman whose profession is reflected in List 1 can receive early retirement status if she has 7.5 years of special work experience .

The total duration of employment must be 15 years.

In addition, you will need to reach a certain age category. For men this figure is 50 years. Female representatives must be 45 years of age.

Underground experience for retirement in Russia requires citizens to comply with the conditions assigned to List 1.

According to list 2

The second list determines that males retire for a well-deserved rest upon reaching 55 years of age. In this case, they will need to work for 12.5 years. The total output at the time of registration of benefits is 25 years .

Women will be able to retire earlier than the established period if they work in hazardous work for 10 years. The duration of their total production is set at 20 years . In addition, age category is taken into account. It is equal to 55 years.

Speaking about whether the preferential length of service for different professions is summed up, it should be noted that only those periods that provide for similar working conditions will be added up. If the level of danger in the second profession is lower, then there will be no summation.

Checking the contents of documents

The employee is a party to the labor relationship. You should not rely on the director to check the documents and punish the person in charge for inaccuracies in their execution.

Before signing an employment contract, read each line carefully. Ask for a SOUT card. Show interest in whether all recommended compensations are included. If the assessment has not been carried out, be aware that most likely social tax will not be charged

Important! Check whether the contract stipulates that the work is carried out during an 8-hour day. If it is noted in the contract that employment in a preferential profession is less than 80%, it gives the employer the right not to make the corresponding tax deductions. This prevents the employee from benefiting from the benefit in the future.

All legal entities maintain personalized accounting and reporting. Request your reporting data. The responsible executor has no right to refuse information.

Keep pay slips and keep your time sheet. This will not take much time, but may be useful when calculating occupancy.

What is not included in harmful experience?

When preparing to retire, many people who have worked a sufficient amount of time in hazardous areas of activity begin to think about what may not be included in this length of service, for example, sick leave or vacation, as well as maternity leave and parental leave.

A detailed answer to an exciting question can be obtained by reading in detail Art. 121 of the Labor Code of the Russian Federation and Decree of the Government of the Russian Federation No. 516 of July 11, 2002.

Having studied the above legislative acts, we can come to the conclusion that the insurance period, which gives the right to early retirement, includes periods such as temporary inability to work while receiving state social security benefits.

This length of service does not include periods of unpaid leave (administrative or “at your own expense”), or educational leave. It also does not include the probationary period, downtime (due to the fault of the employer or the fault of the employee), the time during which the employee was not allowed to work due to such circumstances as:

- any type of intoxication;

- a medical report identifying the reasons for inadmissibility to perform work;

- failed knowledge test in the field of labor protection.

In addition to the above, there are other reasons why an employee may not be allowed to carry out activities. These periods are also not counted towards the length of service of this type.

How is the degree of harmfulness of work activity determined?

The decision on the hazard class of working conditions at a particular workplace is made by experts, based on the methodology proposed in the order of the Ministry of Labor of Russia “On approval of the methodology...” dated January 24, 2014 No. 33n. In this case, the order contains 4 annexes:

- Methodology for special assessment of working conditions.

- Classifier of unfavorable factors.

- Form of a report on the special assessment.

- Recommendations for filling out the report.

Unfavorable ones include:

- production factors, including negative physical, chemical or biological effects on the employee;

- factors of the labor process, which are measured by the severity and intensity of work activity.

The technique assumes:

- identification of potentially negative factors accompanying production;

- research and measurement of the actual values of identified unfavorable factors at a specific place of work;

- assignment of working conditions in accordance with the degree of negativity to the classes listed above based on the results of the research.

Since Law No. 426-FZ came into force on January 1, 2014, the previously conducted certification of employees’ jobs according to the rules of the legislation in force before 2014 is recognized as valid for 5 years when resolving issues of providing labor guarantees to employees, including additional remuneration for unfavorable working conditions (Part 4, Article 27 of Law No. 426-FZ).

Note: a special assessment of working conditions is not carried out in relation to homeworkers, remote employees and those working for citizens who are not individual entrepreneurs.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

How to calculate the amount of additional payment for work in a hazardous environment?

The law does not establish any universal method for all enterprises for calculating the exact amount of compensation “for harmfulness.” But in order to make the appropriate calculations correctly, you can use the provisions of the Decree of the State Committee for Labor of the USSR and the Secretariat of the All-Union Central Council of Trade Unions dated October 3, 1986 No. 387/22-78, which propose regulating the amount of additional payment according to the points assigned to each of the approved classes of working conditions.

Thus, calculating the amount of “harmful” reward involves:

- Determination of the exact hazard class for specific working conditions.

- Converting the degree of adverse impact into points.

- Establishing the duration of the influence of negative factors.

- And the actual calculation of payments for work in hazardous conditions.

The use of a point system requires a specially developed internal document of the enterprise, which describes in detail the features of a specific algorithm for calculating compensation for work activities in hazardous conditions.

Calculation of preferential length of service for early retirement

- pulp and paper production;

- production of medicines, medical and biological preparations and materials;

- certain types of work in healthcare institutions (for example, the work of radiologists, as well as doctors constantly employed in X-ray and angiography rooms, etc.);

- printing production;

- transport (certain types of work);

- work with radioactive substances, sources of ionizing radiation, beryllium and rare earth elements;

- general professions (for example, divers and other workers engaged in work under water, including in conditions of high atmospheric pressure, at least 275 hours per year (25 hours per month); gas cutters engaged in work inside tanks, tanks, tanks and compartments

- ships, etc.);

- nuclear energy and industry.

This is important to know: The minimum pension for a military personnel with 20 years of service

Conditions for assigning a pension

In order for early insurance payments for pensions to be established at the legislative level, it is necessary:

- reach the age established by current legislation;

- have a full insurance record;

- have a sufficient length of preferential service.

| Assignment condition | Men | Women |

| According to List No. 1 | ||

| Retirement age | 50 years | 45 years |

| General insurance experience | at least 20 years | at least 15 years |

| Special experience* | 10 years | 7.5 years |

| According to List No. 2 | ||

| Retirement age | 55 years | 50 years |

| General insurance experience | at least 25 years | at least 20 years |

| Special experience * | 12.5 years | 10 years |

| * If these persons have worked in dangerous and harmful jobs (according to List No. 1) or hard work (according to List No. 2) for at least half of the period established above and have the required length of insurance (total) length of service, they will be granted an early pension with a reduction in retirement age : | ||

| Reducing the age according to List No. 1 | for one year for each full year of benefit work | |

| Reducing the age according to List No. 2 | for one year for every 2.5 years of benefit work | for one year for every 2 years of preferential work |