How is a pension calculated for an individual entrepreneur?

Individual entrepreneurs also pay interest to the Tax Inspectorate (until 2020, contributions were made to the Pension Fund). The method for calculating an individual entrepreneur's pension will be different, depending on the taxation system used.

Individual entrepreneur

Individual entrepreneur: pension recalculation

If a pensioner continues to work after reaching retirement age, he can recalculate.

Two types of individual entrepreneur contributions:

- Pension;

- Health insurance.

The legislation establishes a single minimum contribution, which is the same for each individual entrepreneur and is paid regardless of how much profit the entrepreneur received or whether he received it at all. This amount is 36,238 rubles per year (for 2020). Of these funds, 29,354 rubles are allocated for pensions, and 6,884 rubles for medical insurance.

Individual entrepreneurs have the right not to pay fixed fees in exceptional cases. For example, lack of profit while the entrepreneur was in prison, and the individual entrepreneur has no employees.

The contribution amount is calculated in 2 ways:

- Income did not exceed 300,000 rubles = divide the fixed contribution by 12 months and multiply by X (the number of months in the period for which the contribution is planned to be made)

Reference! Contributions can be paid for a period: month, quarter, half year, year.

- If income exceeds 300,000 rubles = Mandatory contribution + ((income for the year – 300,000) * 1%).

In general, all formulas for calculating pensions for individual entrepreneurs are identical, but the basis for calculating contributions depends on the taxation system.

On the simplified tax system (simplified)

On the simplified tax system there can be 2 bases for calculation. If the system is “STS Income”, then the base will be all income received by the individual entrepreneur for the year. Under the “STS” system of income minus expenses, an entrepreneur has the right to reduce the tax base by the amount of expenses.

For example, an entrepreneur made a profit of 200,000 rubles and incurred expenses of 50,000 rubles. In the first case, the taxable base will be 200,000 rubles, and in the second - only 150,000 rubles (200,000 - 50,000).

Reference! The simplified tax system can be combined with other taxation systems. In this case, the simplified tax system will be the main, primary system, and the PSN or UTII will be an additional one. In this case, the calculation of the taxable base will be based on the rules of the additional taxation system.

On UTII

The same rules and a fixed contribution to the tax office apply to UTII. But UTII has one significant difference - the tax and additional contribution are calculated not from total income, but from imputed income. Tax authorities check how much an entrepreneur must pay.

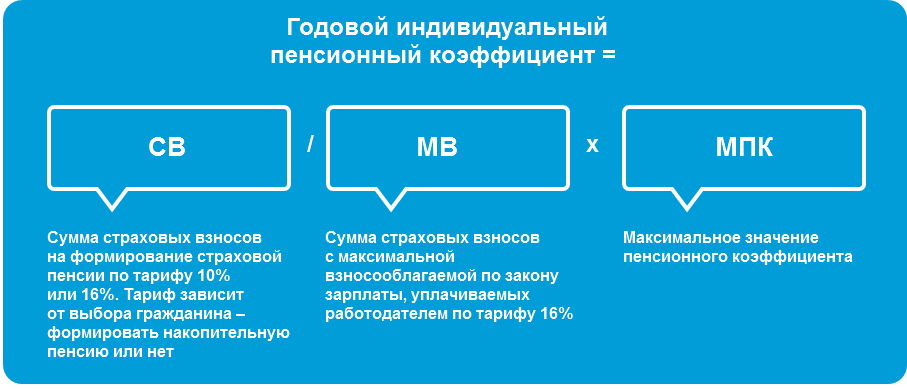

IPC calculation

On OSNO

All of the above rules apply to the general taxation system. But the basis for calculating contributions is income minus business deductions. Expenses are not deductible if an entrepreneur deducts expenses from income - the tax office sues. If OSNO is valid for an individual entrepreneur simultaneously with PSN or UTII, the calculation rule will apply as for PSN/UTII.

On PSN

PSN is a patent taxation system. It's a little more complicated. Here the pension amount will be calculated based on payments based on the amount of potential income. Potential income is specified in the Tax Code for each type of activity. However, the truth is simple: the more contributions, the higher the individual entrepreneur's pension will be.

Note ! In 2020, the fixed contribution will be 40,874. A gradual increase is planned every year.

What pension will the individual entrepreneur receive?

You can find out how an individual entrepreneur’s pension is calculated from Article 15 of the Federal Law of December 28, 2013 N 400-FZ. However, the calculation formulas are quite complex, so the Pension Fund provides detailed explanations on its website.

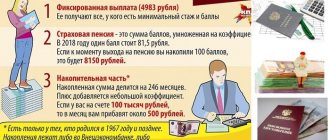

In short, to receive an insurance pension (and not a social old-age pension), an entrepreneur must fulfill the following conditions:

- have a minimum insurance period - in 2020 it is 11 years, and starting from 2024 - 15 years;

- ensure a minimum amount of individual pension coefficients: upon retirement in 2020 it is 18.6 points, and starting from 2025 and later - 30;

- reach retirement age: 60 years for women and 65 years for men.

In addition, it matters when a person applies for payment of a pension after fulfilling all these conditions. If this is later than the established retirement age, payments are multiplied by a multiplying factor. If there is a slight shortage of points, you can buy them by transferring a certain amount to the Pension Fund.

The most opaque place in this methodology is the individual pension coefficient, the calculation of which is recognized as difficult even by the auditors of the Accounts Chamber. And if the person himself does not understand how his pension is calculated, then there is guaranteed to be a violation of his pension rights. This is exactly what the Accounts Chamber stated in August 2020, finding that mandatory additional payments from the date of pensions were not made in 53.3% of cases.

Of course, the pension system in Russia will continue to be improved and supplemented. It is possible that the calculation of pensions will be transferred to the Federal Tax Service, as proposed by the leader of the A Just Russia party, Sergei Mironov. And the procedure for assigning points will be abolished, which Tatyana Golikova insisted on when she was the head of the Accounts Chamber.

But while the established calculation procedure is in effect, you can understand what the individual entrepreneur’s pension will be using the Pension Fund calculator.

What is an individual pension coefficient

Is the length of service required for an individual entrepreneur’s pension and how to calculate it

Each entrepreneur, in the course of his business activities, earns his own pension coefficient. The individual pension coefficient, abbreviated as IPC, is fixed on the date from which payment officially begins.

2 types of IPC:

- IPKs – for periods up to 2020;

- IPKn – for periods after 2020.

The IPK will be equal to the sum of the IPKn and IPKs multiplied by the KvSP. It stands for the coefficient of increase in the IPC for a deferred assignment of a pension. For example, if an entrepreneur continues to work upon reaching retirement age, the period of “overtime” will be additionally taken into account. If this does not happen, then KvSP will not influence. The IPC depends on the total amount of contributions paid during the entire existence of the individual entrepreneur and on the length of service. The longer the length of service and the volume of contributions, the higher the accumulated points and coefficients, therefore, the higher the pension accruals will be.

Pension points for entrepreneurs

Citizens engaged in individual entrepreneurial activities, as well as employees, are included in the pension insurance system. Every year, individual entrepreneurs make mandatory payments for pension insurance in a fixed amount - in 2019 they amount to 29,354 rubles (with an income of up to 300 thousand rubles). In fact, these contributions serve as a guarantee that after reaching retirement age the entrepreneur will receive a labor pension. In addition, an individual entrepreneur must pay to the Pension Fund one percent of the excess of his income in the amount of 300 thousand rubles, but not more than 234,832 rubles for one reporting year.

Based on these contribution amounts, you can calculate how many pension points an individual entrepreneur receives per year. With a minimum deduction of a fixed amount, the number of points will be 1.06, and with a maximum - 9.13. These pension points for individual entrepreneurs 2020 constitute the individual individual pension coefficient of the individual entrepreneur. This year, 1 pension point is 87.24 rubles, so in a year an entrepreneur can earn from 92.47 to 796.50 rubles of a future pension.

Additional odds

Do self-employed citizens have length of service and how does this affect their pension?

The basic calculation formula for 2020 takes into account only 4 indicators. One of them = MPC.

Note ! To apply for a pension, you must reach the minimum pension coefficient (MPC). In 2019, it is set at 13.2 points, and annually this figure will increase by 2.4 points until the MPC reaches 30. The cost of one such point for 2020 is 87 rubles.

Preferential coefficients:

- Military service – 1.8 points;

- Parental leave – 1.8 points per year minimum. For each child, the number of points increases, and the maximum vacation period in total is 6 years.

- Years spent caring for close relatives with disabilities or incapacitated relatives over 80 years of age, caring for a child with 1 degree of disability over 18 years of age - 1.8 points per year.

How an entrepreneur can apply for a pension: step-by-step instructions

To retire in old age, an individual entrepreneur must take several steps:

- Reach the established age and count how many IPCs he has. You can obtain information about the number of IPK through “Government Services” if you have a verified account. It is enough to order a certificate from the Pension Fund.

- Submit an application for a pension along with other documents to the Pension Fund at the place of registration.

- Wait for a decision. Typically, citizens' appeals are considered within 10 days.

If the answer is yes, the pension will be granted from the moment you reach the specified age. If a citizen applies later, from the date of filing the application.

Documentation

The following package of documents must be submitted to the Pension Fund:

| Name | Where to get | Validity |

| Statement | To be filled on site | Not installed |

| Passport | Department of Internal Affairs of the Ministry of Internal Affairs | Before personal data changes |

| Employment history | Employer at the last place of employment, if the citizen worked under a contract | Not determined |

| Employment contracts | Concluded with employers throughout their entire career | |

| Certificate of paid insurance premiums | Inspectorate of the Federal Tax Service | 3 months |

| Certificate of absence of tax debt | 1 month |

Rules for registering an old-age pension for individual industrial complexes

Registration number in the Pension Fund of the Russian Federation for individual entrepreneurs - how to find out and why it is needed

Reaching the minimum retirement age when an individual entrepreneur can receive an old-age pension is not enough. It is necessary to accumulate a minimum amount of IPC. A pleasant moment: when calculating the IPC, the time of service in the army, the time of caring for a child of no more than 6 years in total, the time of caring for sick incapacitated relatives and the time when the individual entrepreneur was officially listed as unemployed will be taken into account.

Insurance pension

In practice, the retirement age will be raised gradually.

Entrepreneurial experience in 2020 is at least 10 years. That is, upon the onset of old age, at least 10 years of life, an individual must work as an individual entrepreneur. If an individual entrepreneur is disabled, then the right to a pension or disability benefit is retained. If physical a person opens his own individual entrepreneur less than 10 years before the retirement age - he will be entitled to a pension calculated from his work experience without the status of an entrepreneur.

Note ! These benchmark figures may be reduced for representatives of small nationalities and residents of the far north.

To receive a pension, an entrepreneur must appear at the Pension Fund and present:

- birth documents of children;

- personal passport;

- work book;

- insurance certificate;

- certificate of payment of the single tax on imputed income;

- certificates of payment of mandatory insurance contributions and taxes. A sample of certificates is available on the official website of the Pension Fund.

Pension contributions for individual entrepreneurs for themselves

An entrepreneur pays contributions to his pension insurance according to special rules. Contributions to the Pension Fund consist of a fixed part (determined on the basis of the minimum wage established by the Federal Government at the beginning of the year). Tariffs for calculating contributions for individual entrepreneurs are set higher. They make up 26% of the minimum wage (and not 20-22% as for hired employees).

According to the new rules, the formation of a pension involves not only the minimum wage amount paid by individual entrepreneurs, but also their deductions from revenue over 300,000 rubles. at the rate of 1%. The additional contribution is paid based on actual income for individual entrepreneurs on the simplified tax system or OSNO (without reduction for expenses incurred), imputed income on UTII or potential income for PSN.

Let's give an example of calculating pension insurance contributions for an individual entrepreneur with a revenue of 2 million rubles. The following must be transferred to the pension fund in 2017:

- 23400 rub. according to the minimum wage at the beginning of 2020 (RUB 7,500*26%*12);

- additional payment in the amount of 17,000 rubles. from an amount over 300,000 rubles. (2000000-300000)*1%.

Also, an individual entrepreneur must pay contributions to the Federal Compulsory Medical Insurance Fund for health insurance, but they do not participate in the formation of his pension rights.