An early pension can be issued by agreement with the citizen or if the employment service makes an appropriate proposal. Early pensions are issued to unemployed citizens no earlier than 2 years before the opportunity to apply for an insurance pension.

This type of state support can be assigned during staff reductions or during the liquidation of the company in which the future retiree worked. At the same time, early retirement when an employee is laid off ensures that the person receives a pension before he reaches his social retirement age.

USEFUL : the country's legislative framework clearly regulates the lifelong provision of citizens after they complete their working career, read about how to apply for an old-age pension and go through the procedure without the use of early stages

Retiring before retirement age

Retraining a senior citizen is difficult and often impractical, so the Employment Center tries to find him a job in his main specialty or issues a referral for early receipt of old-age payments.

Requirements for retiring before the legal age:

- The Employment Center (PEC) does not have a suitable vacancy for a specialist of pre-retirement age.

- The unemployed person signed an agreement for the early assignment of pension benefits.

- The law provides for early pensions in the event of staff reduction, liquidation or bankruptcy of an enterprise. If the basis for dismissal was the employee’s misconduct or desire, the citizen will only be able to apply for standard unemployment benefits.

What payments are due to an employee upon early dismissal?

Early dismissal of an employee when staffing is reduced is an attractive opportunity for the laid-off employee. The use of this mechanism allows you not to perform work duties for two months, which are legally established as the period for warning an employee about his upcoming layoff. The employer is obliged to pay the average salary for the specified period, although the dismissed employee himself during this period may be looking for a new job. At the same time, the implementation of the early dismissal procedure does not in any way affect the amount of other payments and compensations. So, in addition to paying for two months of failed work, the company is obliged to pay such an employee severance pay, and the employee himself has the right to retain his salary for the period of employment (as a general rule, no more than two months).

Sources:

- Labor Code of the Russian Federation

The legislation of the Russian Federation provides for the possibility of assigning pension benefits upon reaching a certain age (male and female ages should be 60 and 55 years, respectively), as well as its early assignment due to special working conditions. To apply for a pension, a minimum of five years of work experience with hazardous labor factors is required.

Legal regulation

Russian legislation provides for the receipt of a labor pension by all citizens after reaching the generally established retirement age. For women in 2020 it is 55 years old, and for men it is 60 years old. Retirement at pre-retirement age is regulated by the following federal laws:

- No. 400-FZ dated December 28, 2013;

- No. 173-FZ dated December 17, 2001;

- No. 1032-FZ dated April 19, 1991;

- No. 166-FZ dated December 15, 2001

- 10 Common Habits That Can Harm Your Kidneys

- Hypoallergenic diet for children and adults - list of allowed and prohibited foods, menu for the week

- How to put a password on a folder using special programs or archivers

How to confirm special work experience

Special length of service must be confirmed by documents issued by enterprises in the prescribed manner. The clarifying certificate contains detailed necessary information about the characteristic factors and working conditions, links to archival documents confirming the amount of time for the specified type of activity. You also need to know that special work factors under which early registration is possible cannot be confirmed by witness testimony; confirmation must only be documentary.

As people get older, they begin to think about their future retirement. If a regular labor pension is issued quickly enough, then for those who worked in the Far North, they will also have to confirm their northern work experience. In this regard, it is necessary to begin preparing all the necessary documents in advance.

You will need

- - passport;

- - employment history;

- — a certificate from the employer confirming northern work experience;

- — certificate of presence of disabled family members;

- — certificate of dependents;

- - a certificate from the registry office confirming a change in last name, first name or patronymic;

- - certificate of residence.

Instructions

Determine if you are eligible to receive a Nordic pension. This category includes citizens who have worked in the Far North for at least 15 years, with a total experience of at least 25 years for men and 20 years for women. In this case, the pension is issued to men from the age of 55, and to women from the age of 50. If you live in the Far North on a permanent basis, then the northern pension is issued to men from the age of 50, and to women from the age of 45.

Check your work records. In them, opposite the relevant length of service, it must be indicated that the enterprise is located in a certain region of the Far North. This is relevant for those who worked in a large company with branches in many cities of the country. If there is no such record, then contact the organization and ask for a certificate that will confirm your northern experience. It is also necessary to check with the employer whether he has submitted the relevant information about you to the Pension Fund of the Russian Federation.

Collect the package of documents required to apply for a pension. You will need: passport; employment history; a certificate from the employer confirming northern work experience; certificate of presence of disabled family members; certificate of dependents; a certificate from the registry office confirming a change in last name, first name or patronymic; certificate of residence; other documents, the list of which is specified in the branch of the Pension Fund of the Russian Federation.

Contact the branch of the Pension Fund of the Russian Federation at your place of residence, write an application for a northern pension and provide all the necessary documents. Within a month you will be informed about the decision made, the amount of pension payments and will be issued a pension card.

You determine the method of receiving funds yourself and indicate when filling out the application. To do this, you can familiarize yourself with the conditions of pension cards of various banks. For example, some charge monthly interest, while others provide bonuses when paying for goods.

Video on the topic

Sources:

- What documents are needed to apply for a pension in Ukraine?

According to the Russian Federation Law “On Pensions”, every citizen upon reaching a certain age can apply for a pension

for old age in the pension

fund

. Age indicators for labor pensions have been established: for women – 55 years, for men – 60 years. If you have already reached the required age, you need to collect and submit a package of documents to the Pension Fund. Based on the submitted data, you will be awarded a labor pension.

You will need

- - passport;

- — pension insurance certificate;

- — certificates of experience for the period prior to registration with the insurance organization and salary for any 60 consecutive months;

- - employment history;

- — information about disabled members of your family.

Instructions

You have not yet heard about all the intricacies of registering a labor pension and going to the pension fund

, get ready for a long process of collecting all the necessary documents. You can only console yourself with the fact that every person goes through this.

Provide the first package of documents: - passport and copies of all its pages; - insurance certificate and its copy; - work book and its copy; - military ID with copies of 1, 3 and 8 pages.

You must obtain a salary certificate 60 months before January 1, 2000 or before December 31, 2001. If you worked during this period, then the years 2000-2001 will be used to calculate your pension.

If you worked before the work book was opened, bring a certified certificate from this organization. All copies of the documents that you provide do not need to be certified: you bring them along with the originals.

Early retirement pension

Current Russian legislation provides various categories of citizens with the right to early retirement.

The conditions and procedure for processing its payments were determined, adopted in December 2013.

This law

granted the right to

early retirement

to citizens who have worked in hazardous industries, as well as teachers, doctors and some other categories.

The list of professions

for which early old-age pension is provided is defined in

Articles 30, 31, 32 of Federal Law No. 400.

Dear visitors of the “Pension Expert” portal!

When studying the information on the pages of our project on pensions and maternity capital registration, remember that in the articles we try to describe the basic aspects that are based on the legislative framework.

Each situation and problem in matters of pension provision is individual and requires legal support and advice.

- For Moscow and the Moscow region telephone:

Conditions for early assignment of pensions to the unemployed

You can submit documents to receive a payment if you meet 6 requirements:

- Confirmation of unemployed status by employment service authorities. The certificate can be issued at the Central Tax Office.

- Impossibility of employment. An unemployed person can submit refusals from potential employers to the Employment Center to confirm his position, but this is often not required.

- Availability of the required number of IPC (pension points). In 2019, their minimum number is 11.4.

- Availability of the required work experience. For men it is 25 years old, and for women it is 20 years old.

- Direction from the Employment Center. The document serves as confirmation that a citizen can retire early.

- A person has less than two years left before reaching retirement age. In 2020, women 53 years old and men 58 years old will be able to apply for early old-age payments. By law, preferential cash benefits are not paid for longer than 24 months.

Conditions for early retirement

1. The basis for premature registration of a pension is the presence of special work experience. This work experience differs from the general work experience in that it is determined by the time spent working in areas unfavorable for living or working under special working conditions established by special lists of work, for example, hazardous work. These lists contain a list of production areas, specialties and positions that give the right to early, that is, premature pension provision (hereinafter referred to as the Lists).

2. There must be an insurance period or the total duration of all periods of work during which insurance contributions were made to the pension fund.

3. Pension provision at a reduced age for obtaining a pension is assigned to persons working constantly full-time, whose working conditions relate to the Lists of relevant jobs with special labor factors.

When applying for early retirement benefits, it is advisable to consult with specialists about the possibility of including periods of military service and receiving initial vocational education in the length of service.

For everyone who performed work that is classified as hazardous by the legislation of our state, the following right to early retirement is established: for the male population, special work experience should be 10 years with twenty years of insurance experience, for the female population - 7.5 years with fifteen years of insurance seniority

In the event that half of the special work experience has been completed, pension benefits can also be issued, but from a later age.

For example, a woman working as a radiologist had a special work experience of 7.5 years and she can apply for a pension upon reaching the age of 45, and in the case of four years of special work experience, she can apply for a pension at 51 years of age, provided that the total experience will be at least 15 years.

How to apply for a pension ahead of schedule

The unemployed will have to apply to the Pension Fund (PFR) at their place of residence. Algorithm for the procedure for registering an early pension:

- The unemployed person receives a referral from the Employment Center and completes all the documents necessary to receive early payment.

- Visit to the Pension Fund. The unemployed person fills out an application and submits it along with a package of documents to a civil servant.

- Consideration of the application. The Pension Fund can study documents submitted by the unemployed within 30 days. At the end of this period, the Pension Fund will send a notification with a decision.

- Assignment of early pension. The source of financing for early payments is the Pension Fund budget. The amount of early pension provision is determined by the same standards as insurance.

Recognizing a citizen as officially unemployed by the Employment Center does not always guarantee that he will be able to retire early. When studying documents, the Pension Fund requests information about refusals to the specialist regarding employers’ proposals. If an individual does not want to work in his specialty, then the Pension Fund may make a negative decision on the application.

- How to save on maintaining a country house

- Caesar salad with shrimp

- Who develops lasting immunity to coronavirus?

Direction of the employment center

A citizen has the right to early retirement if he has received written confirmation from the Central Employment Service. The direction from the Employment Center must indicate that the institution cannot find a job for the specialist. The document is valid for 1 month. The central control center often refuses to issue referrals to citizens for unlawful reasons. Algorithm of actions in such situations:

- Contact a lawyer and file a claim.

- Submit the statement of claim to the court at your place of residence. To consider the case, you must pay a state fee.

- The claim will be considered by a judge within 3 months from the date of filing the application. If the decision is positive, the central control center will be required to issue a referral.

It is better to immediately transfer the referral to the Pension Fund after receiving it, rather than wait a whole month, otherwise the preferential retirement will be delayed by its re-registration. A valid circumstance that allows you to extend the validity of a document is a certificate of temporary incapacity for work.

List of required documents

To apply for early retirement benefits, you must submit to the Pension Fund:

- direction from the central control center;

- application from an unemployed person;

- passport;

- a certificate indicating the average monthly earnings until 01/01/2002 for any 60 months of continuous work;

- SNILS;

- work book.

You will have to confirm with separate certificates:

- disability of some family members;

- presence of disabled dependents;

- change of personal information (last name, first name, etc.);

- place of actual residence or registration in Russia.

An application from an unemployed person must contain:

- full name of the body to which the citizen applies;

- surname, name, patronymic of the applicant;

- a request for early pension payments;

- list of grounds for registration;

- list of attached documents;

- date and signature of the applicant.

Unemployed citizens: features of pension provision

As of: 01/11/2011 Magazine: Personnel Directory Year: 2011 Author: Chirkov S. A., Polokhov O. M. Topic: At the initiative of the employee Category: Pensions and benefits

- Regulations

- Law of the Russian Federation dated April 19, 1991 No. 1032-1 “On employment in the Russian Federation” (extract) Federal Law dated December 15, 2001 No. 166-FZ “On state pension provision in the Russian Federation” (extract) Federal Law dated December 17, 2001 No. 173-FZ “On labor pensions in the Russian Federation” (extract)

Articles

Early pension for test pilots Pension for laboratory workers Work in Russia - pension abroad Disability pension: analyzing the new order Labor pension: fixed basic amount Early pension for geologists Early pension for employees of enterprises producing artificial and synthetic fibers Old-age pension for employees of electrical production Pension for employees power plants, power trains, steam power facilities Early pension for workers employed in pulp, paper and woodworking industries Long service pension: indexation Long service pension: calculating the amount Long service pension: determining length of service

Reference materials

- The amount of the fixed basic amount of old-age labor pension from April 1, 2010.

Many people are undoubtedly aware that if a citizen is declared unemployed, he will be able to receive the required benefits for a certain time. However, not everyone knows that unemployed people approaching retirement age have the right to early retirement. We will touch on the main aspects of the implementation of this right in our article.

It would seem that just recently such a phenomenon as unemployment was unknown to domestic legislation. However, in the post-Soviet years, this concept has firmly and, it seems, entered our lives for a long time. It turned out that the market economy and the focus on profit and profitability, inextricably linked with it, or rather being its essence, can lead not only to an increase in the well-being of citizens, but also to completely different consequences, for example, to the liquidation of enterprises or a reduction in the number of employees. Unfortunately, in the context of the global financial crisis that broke out in 2008, the topic of unemployment has acquired particular relevance.

Loss of a job is a generally recognized and significant social risk, upon the occurrence of which the state is obliged to take measures not only to promote employment of the population, but also to provide social support to the unemployed and provide them with a means of subsistence. And here it is not so important what form the state chooses for these purposes: insurance or budgetary.

RIGHT TO A PENSION AND CONDITIONS FOR ASSIGNING A “UNWORKLESS” PENSION

Currently, the grounds for the emergence of rights to labor pensions and state pensions and the procedure for their implementation are regulated by Federal Laws dated December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation” (hereinafter referred to as the Law on Labor Pensions) and dated December 15. 2001 No. 166-FZ “On State Pension Security in the Russian Federation” (hereinafter referred to as the Law on State Pension Security), unless otherwise provided by law or an international treaty (agreement) of the Russian Federation.

In accordance with Art. 3 of the Law on Labor Pensions, citizens of the Russian Federation have the right to a labor pension regardless of their place of residence, and foreign citizens and stateless persons - subject to permanent residence in the territory of the Russian Federation.

Note!

The right to an old-age labor pension on a general basis is granted to men who have reached the age of 60 years, and women who have reached the age of 55 years, with at least five years of insurance experience. ZY

The provisions of Art. 27 and 28 of the Law on Labor Pensions for certain categories of persons who worked in special professions, positions or lived in difficult climatic conditions (regions of the Far North and equivalent areas), as well as taking into account the corresponding social status or state of health, it is possible to assign a labor pension by old age before reaching the specified age.

For example, an old-age labor pension is assigned to men upon reaching the age of 55 years and women upon reaching 50 years of age, if they have worked for at least 15 calendar years in the Far North or at least 20 calendar years in equivalent areas, and also have an insurance period, respectively. at least 25 and 20 years (part 1, subparagraph 6, paragraph 1, article 28 of the Law on Labor Pensions).

If a citizen worked both in the regions of the Far North and in equivalent areas, then a labor pension is established for him for 15 calendar years of work in the Far North. Moreover, each calendar year of work in areas equated to the regions of the Far North is counted as 9 months of work in the regions of the Far North.

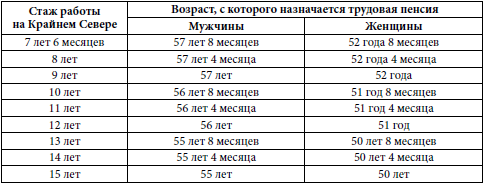

In the event that the duration of the period of work in the Far North does not reach 15 calendar years, but is at least 7 years 6 months, a labor pension is assigned with a decrease in the age established by Art. 7 of the Law on Labor Pensions, for 4 months for each full calendar year of work in these areas.

Retirement age depending on northern length of service

However, the Law on Labor Pensions does not say anything about special conditions for retirement for unemployed citizens. The rules on the procedure for pension provision for the named persons (before they acquire the right to an old-age labor pension) are enshrined in the Law of the Russian Federation of April 19, 1991 No. 1032-1 “On Employment of the Population in the Russian Federation” (hereinafter referred to as the Employment Law).

Article 32 of the Employment Law provides: at the proposal of the employment service authorities, in the absence of employment opportunities, unemployed citizens under the age of 60 years (for men) and 55 years (for women) and having an insurance period of at least 25 and 20 years for men and women accordingly, as well as the necessary length of service in the relevant types of work, giving them the right to early assignment of an old-age labor pension provided for in Art. 27 and 28 of the Law on Labor Pensions, who were dismissed due to the liquidation of an organization or termination of activities by an individual entrepreneur, reduction in the number or staff of employees of an organization, an individual entrepreneur, with their consent, a pension may be assigned for the period until the age entitling them to a labor pension under old age, including an early retirement pension for old age, but not earlier than two years before the appropriate age.

Thus, in order to assign such a pension—let’s call it conditionally “unemployed”—a complex legal structure is required, namely the presence of the following conditions.

Condition 1.

There is a proposal from the employment service authorities, formalized in the prescribed manner.

Condition 2.

There is the consent of the unemployed person to the assignment of a pension, expressed in the application form.

Condition 3.

The applicant has insurance experience of at least 25 and 20 years for men and women, respectively, and, if necessary, experience in the relevant types of work (or, as it was previously called, special experience) of the duration established by law.

As we see, here the requirements for the length of the insurance period are much more stringent than when establishing an old-age labor pension (only five years), which can be explained not so much by the influence of the previously in force (before January 1, 2002) legal regulation, but by the fact that The “unemployed” pension is a benefit for citizens.

Condition 4.

The applicant’s loss of work and, accordingly, his receipt of unemployed status solely in connection with the liquidation of an organization or termination of activities by an individual entrepreneur, a reduction in the number or staff of employees of an organization, an individual entrepreneur, i.e. on the initiative of the employer.

If a citizen quit of his own free will, or the termination of the employment contract was due to his guilty actions, or the employment contract was terminated on other grounds provided for by the Labor Code of the Russian Federation, an “unemployment” pension cannot be assigned.

Condition 5.

The applicant has reached the age at which he lacks two or less years to receive an old-age labor pension or any type of early labor pension. In other words, in the most common case, it is 58 years for men and 53 years for women, and if we talk, for example, about the “northern” pension, then 53 years for men and 48 years for women.

Please note: if at least one of the above conditions is not met, the pension will not be assigned early.

EXPERIENCE ACCOUNTING

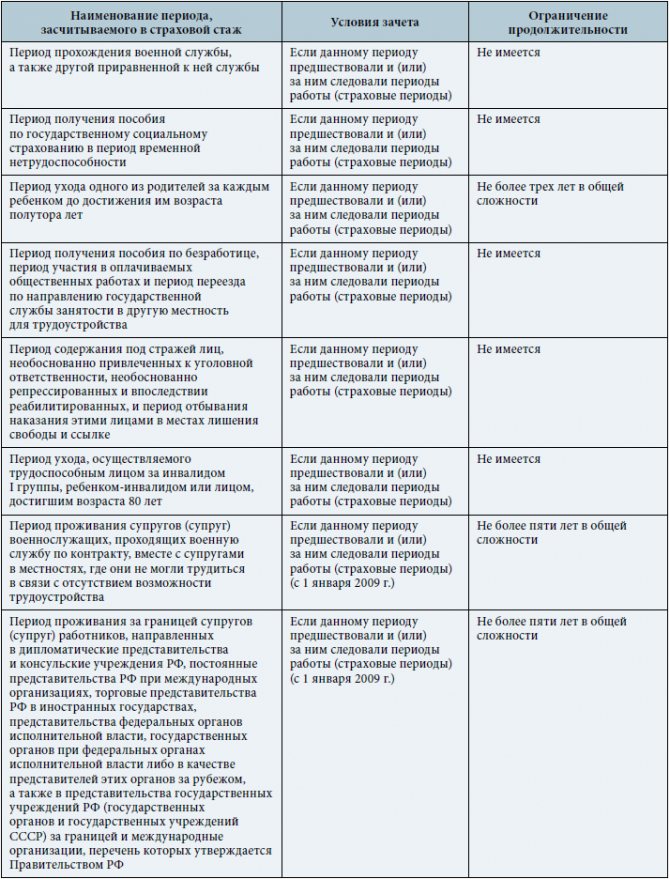

When determining the right to an “unemployed” pension, as well as when establishing a labor pension, the insurance period includes periods of work and other activities for which insurance contributions were paid to the Pension Fund. At the same time, the payment of contributions to state social insurance before January 1, 1991, the unified social tax (contribution) and the unified tax on imputed income for certain types of activities that took place before the Law on Labor Pensions came into force is equivalent to the payment of insurance contributions to the Pension Fund of the Russian Federation . Other periods listed in Art. are also included in this length of service. 11 of the Law on Labor Pensions ( Table 1

).

SOME FEATURES OF “UNEMPLOYMENT” PENSIONS

For federal civil servants, in addition to the pension assigned under the Employment Law, a long-service pension may be established in accordance with Art. 7 of the Law on State Pensions.

Costs associated with the appointment of a pension provided for by the Employment Law are carried out at the expense of the Pension Fund of the Russian Federation with subsequent reimbursement of costs from the federal budget. In fact, the source of financing for “unemployed” pensions is the state budget, and not insurance contributions for compulsory pension insurance. This circumstance, as well as the fact that the said pension is established not in connection with an insured event characteristic of the pension system (reaching retirement age, disability, loss of a breadwinner), but due to the loss of a person’s job, indicate that the “unemployed” the pension cannot be classified as labor pensions.

By the way

| It is interesting that the Employment Law previously - in the version that was in force before the entry into force of Federal Law No. 367-FZ of December 27, 2009 “On Amendments to the Law of the Russian Federation “On Employment in the Russian Federation”” - did not provide for the possibility of assigning a pension for the period until the age that gives the right to an old-age labor pension, including an early-assigned old-age labor pension, but not earlier than two years before the corresponding age, for persons dismissed due to termination of activity by an individual entrepreneur, reduction number or staff of employees of an individual entrepreneur. Corresponding changes were made to the Employment Law in connection with the release of the resolution of the Constitutional Court of the Russian Federation dated October 22, 2009 No. 15-P “In the case of | checking the constitutionality of the provisions of paragraph 1 of Article 30, paragraph 2 of Article 32, paragraph 1 of Article 33 and paragraph 1 of Article 34 of the Law of the Russian Federation “On Employment in the Russian Federation.” This resolution lists interrelated provisions to the extent that they do not ensure the accrual of unemployment benefits and the possibility of assigning a pension before reaching the statutory retirement age on an equal basis for citizens who, before dismissal, worked under an employment contract with an individual entrepreneur, and citizens dismissed from organizations , despite the fact that other conditions determined by law are equally met, are recognized as not complying with the Constitution of the Russian Federation. They have become invalid since the entry into force of the new legislative regulation. |

Table 1

Other periods counted in the insurance period (non-insurance periods)

“Unemployed” pension is a special phenomenon in the Russian pension system. In fact, in social security law it can be considered both a pension sub-institution and a social security sub-institution in case of unemployment.

Apparently, the legislator reasoned in a similar way if, despite the provision of paragraph 1 of Art. 1 of the Law on Labor Pensions (changes in the conditions and standards for establishing, as well as the procedure for paying labor pensions are carried out only by introducing amendments and additions to this Federal Law), do not provide for rules on the specifics of pension provision for the unemployed.

By the way, in this regard it is worth noting: the persons specified in paragraph 3 of Art. 3 of the Law on State Pension Provision, having the right to simultaneously receive two pensions (labor pension and state pension provision pension) and already receiving one pension according to the norms of this Federal Law, the establishment of another pension at the proposal of the employment service authorities in accordance with paragraph 2 of Art. . 32 of the Employment Law is not implemented.

The right to simultaneously receive two pensions in full is available to a limited circle of persons whom the legislator has recognized as needing special social protection. For example, disabled people due to military trauma, participants in the Great Patriotic War.

It should also be borne in mind that the current legislation and international treaties (agreements) of the Russian Federation do not provide for the possibility of establishing a pension at the proposal of the employment service authorities of foreign countries.

DETERMINING THE AMOUNT OF EARLY PENSION

The size of the “unemployment” pension is determined according to the norms of the insurance part of the old-age labor pension established by the Law on Labor Pensions.

Thus, the size of the insurance part of the old-age labor pension is calculated using the formula: SC = PC/T + B

, where SCH is the insurance part of the old-age labor pension;

PC

- the amount of the estimated pension capital of the insured person (determined based on the amount of pension rights - the duration of the total length of service as of January 1, 2002 and the average monthly earnings of the person for any five consecutive years before this date or for 2000-2001, - and also the amount of insurance contributions paid to finance the specified part of the labor pension for the period after January 1, 2002), taken into account as of the day from which the specified person is assigned the insurance part of the old-age labor pension;

T

- the number of months of the expected period of payment of the old-age labor pension, used to calculate the insurance part of the specified pension and amounting to 19 years (228 months).

This indicator is based on average statistical data, it is conditional and is used for calculations.

Note!

The amounts of the fixed basic amount of old-age labor pension (from April 1, 2010) can be found on the HR-Portal website

The Law on Labor Pensions provides for a gradual increase to the specified duration of the value T used when calculating the size of the pension: in 2002 it was 12 years (144 months), in 2010 - 16 years (192 months).

B

— fixed base amount of the insurance part of the old-age labor pension. Note that B is a differentiated value and is established taking into account the age of the person (reaching 80 years), the presence of dependents (but not more than three), residence and work in the regions of the Far North and localities equivalent to them (at least 15 and 20 calendar years, respectively ), and from 2020, the total duration of the person’s insurance experience on the day the pension was assigned will also be important.

RECORDING UNEMPLOYED CITIZENS AND THEIR DIRECTION TO PENSION

Citizens dismissed due to the liquidation of an organization or termination of activities by an individual entrepreneur, reduction in the number or staff of employees of an organization, individual entrepreneur, are registered as unemployed at their place of residence. Employment service institutions register them in accordance with the Procedure for registering unemployed citizens, approved. Decree of the Government of the Russian Federation dated April 22, 1997 No. 458.

The procedure for sending unemployed citizens to retire with early assignment of an old-age pension is as follows.

Stage 1.

A citizen submits to the employment service authority at the place of registration as unemployed an application in the form established by Appendix No. 1 to the Procedure for the work of territorial bodies of the Ministry of Labor and Social Development of the Russian Federation on employment issues for registration of citizens recognized as unemployed in the prescribed manner as pensions. old age (by age), including pension on preferential terms, early, approved. Resolution of the Ministry of Labor of Russia dated June 14, 2001 No. 48 (hereinafter referred to as the Procedure).

Note!

Law No. 340-1 of November 20, 1990 became invalid on January 1, 2002. The relevant norms, including those on periods included in the insurance (general work) length of service, are contained in the Law on Labor Pensions, which came into force on the same day. dates

Stage 2.

The employment service authority, on the basis of an application from an unemployed citizen, issues to him, against receipt, a proposal for early retirement on an old-age pension in two copies (in the form established by Appendix No. 2 to the Procedure), as well as a certificate of the periods included in accordance with the Law of the Russian Federation dated November 20. 1990 No. 340-1 “On state pensions in the Russian Federation” in the total length of service, taking into account which pension provision is provided, for subsequent application to the body providing pension provision at the place of residence.

The issuance of the proposal is recorded in the personal registration card of the unemployed citizen by making an entry: “A proposal has been issued to send an unemployed citizen to an old-age pension (age), including a pension on preferential terms, ahead of schedule. Date, signature."

Simultaneously with the issuance of these documents, the employment service body informs the unemployed citizen of information about the location of the body providing pensions, its mode of operation, and also informs about the procedure for re-registration as an unemployed person and the conditions for paying unemployment benefits during the period of registration of an old-age pension (by age ), including early retirement pension in old age.

Stage 3.

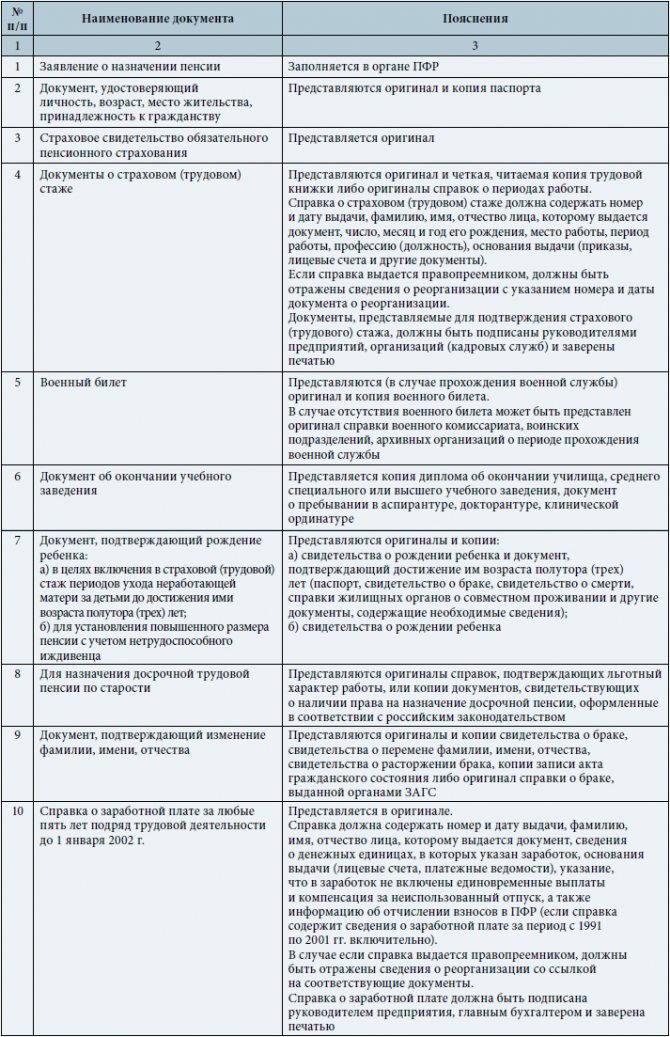

The citizen submits to the territorial body of the Pension Fund of the Russian Federation a proposal issued to him by the employment service for early retirement on an old-age pension, a certificate of the periods included in the length of service, together with an application for the assignment of a pension and the documents necessary for this, provided for in the List of documents required to establish a labor pension and pensions for state pensions in accordance with the Federal Laws “On Labor Pensions in the Russian Federation” and “On State Pensions in the Russian Federation”, approved.

Resolution of the Ministry of Labor of Russia and the Pension Fund of the Russian Federation dated February 27, 2002 No. 16/19pa ( Table 2

).

Stage 4.

The territorial body of the Pension Fund of the Russian Federation makes a decision to assign or refuse to assign an “unemployed” pension in accordance with the law, and also notifies the employment service body that issued the employee an offer for early retirement to an old-age pension about the corresponding decision.

table 2

Approximate list of documents required for assigning an old-age labor pension

Payment of unemployment benefits during the period when an unemployed citizen receives the pension in question is made in the manner and under the conditions established by the Employment Law.

According to paragraph 2 of Art. 35 of the Employment Law, the appointment of a pension provided for in paragraph 2 of Art. 32 of this Law, either the assignment of an old-age labor pension, including early (or early assignment of part of an old-age labor pension), or the assignment of an old-age pension or long-service pension under state pension provision are grounds for termination of unemployment benefits .

Thus, the employment service body, upon receipt from the body providing pensions, notification of the assignment of an “unemployed” pension, starting from the date of assignment of the old-age pension (age), including early retirement pension, stops paying unemployment benefits with the simultaneous withdrawal of the citizen registered as unemployed.

If the body providing pension provision receives a notification of refusal to assign such a pension, the employment service body resumes work to assist the unemployed citizen in finding employment.

The employment service body carries out personal registration of recipients of an early old-age pension (age), including a pension on preferential terms, during the entire period of its payment - until the right to assign an old-age pension (age), including an early labor pension, arises in accordance with the legislation of the Russian Federation old age pension.

TRANSITION TO PENSION ON A GENERAL BASIS

Upon reaching the age that gives the right to establish an old-age labor pension, including one assigned ahead of schedule (Articles 27 and 28 of the Law on Labor Pensions), the recipient of the pension assigned under the Employment Law has the right to make the transition to an old-age labor pension. Such a transition is carried out in accordance with clause 7 of Art. 19 of the Law on Labor Pensions, i.e. from the 1st day of the month following the month in which the pensioner submitted an application for transfer to a labor pension with all the necessary documents (if they are not in his pension file), but not earlier than the day acquiring the right to a labor pension.

Note!

When transferring to an old-age labor pension or in case of its appointment, the amount of the specified pension is determined as for a new appointment

At the request of the applicant in this situation, the issue of assigning an old-age pension can also be considered. In this case, the appointment is made from the deadlines provided for in paragraphs. 1 and 4 tbsp. 19 of the Law on Labor Pensions, namely from the date of application for the specified pension, with the exception of the cases provided for in paragraph 4 of this article (a labor disability pension is assigned from the day the person is recognized as disabled, if the application for the specified pension followed no later than 12 months from of this day, labor pension in case of loss of a breadwinner - from the date of death of the breadwinner, if the application for the specified pension followed no later than 12 months from the date of his death, and if this period is exceeded - 12 months earlier than the day when the application for the specified pension followed pension), but in all cases not earlier than from the date the right to the specified pension arises.

For example, a citizen who is a recipient of a pension assigned under the Employment Law reaches retirement age on October 3, 2010. He can be transferred to an old-age pension from November 1, 2010 (Clause 7, Article 19 of the Labor Pensions Law).

At the same time, if the amount of the old-age labor pension exceeds the previously established pension, then the citizen, since it is more beneficial for him, can exercise the right to reassign it from the period established by paragraph 1 of Art. 19 of the Law on Labor Pensions. To do this, he submits a corresponding application - and the old-age labor pension will be assigned to him from the date of application (for example, from October 3, 2010).

RESPONSIBILITY, GROUNDS FOR TERMINATION AND RESTORATION OF PAYMENT OF “UNEMPLOYMENT” PENSION

Upon entering a job or resuming other paid activity, the payment of the pension established for an unemployed citizen on the basis of the Employment Law is terminated in accordance with subsection. 3 p. 1 art. 22 of the Law on Labor Pensions (from the 1st day of the month following the month in which the above circumstances were discovered).

It must be taken into account that, according to paragraph 4 of Art. 23 and art. 25 of the Law on Labor Pensions, a pensioner is obliged to immediately notify the body providing pensions of the occurrence of circumstances entailing a change in the size of the labor pension or termination of its payment.

Individuals and legal entities are responsible for the accuracy of the information contained in the documents they submit for the establishment and payment of a labor pension, and employers, in addition, are responsible for the accuracy of the information provided for maintaining individual (personalized) records in the compulsory pension insurance system.

If the submission of false information or late submission of information has resulted in an overspending of funds for the payment of labor pensions, the guilty persons shall compensate the Pension Fund for the damage caused in the manner prescribed by law.

After the citizen stops working, the payment of the pension in question is resumed in accordance with subparagraph. 2 clause 3 and clause 5 art. 22 of the Law on Labor Pensions from the 1st day of the month following the month in which the body providing pensions received an application for the restoration of pension payment and all the necessary documents.

The right to a pension is not revised, but its size is determined anew in the manner prescribed by the Law on Labor Pensions. If, when the pension payment is resumed, its amount does not reach the value established on the day the payment was terminated, then the pensioner is restored to the previous, higher amount.

Termination of pension payment

The citizen will not receive this type of benefit for the rest of his life. Early pensions for the unemployed will cease to be paid if:

- Resumption of work. The pensioner must notify the Pension Fund office about going back to work. If a citizen neglects this duty, then he will then have to reimburse all funds overpaid by the state along with penalties. After termination of employment, payments can be resumed by re-receiving a referral from the Employment Center and submitting an application to the Pension Fund.

- Reaching the retirement age established by law. After turning 56 or 61 years old (requirements for women and men in 2020), an unemployed person must apply to the Pension Fund for a regular old-age insurance pension. If you do not submit documents in advance, the citizen will be left without payments during the re-registration of pension benefits.

Social pension: concept and conditions of assignment

A labor pension is assigned to citizens who have a certain salary. But what about those who have no work experience? Among such citizens there are a lot of women who have been involved in housekeeping and raising children all their lives, but have not worked in any area related to professional activities. In accordance with the right to an old-age pension

have men who have reached the age of 60 years, and women who have reached the age of 55 years. At the same time, an old-age labor pension is assigned if there are at least five years of insurance experience.

In the same case, if citizens do not have work experience, that is, they have never worked, they have the right to receive a social pension

. However, this right arises for them later than the right to receive a labor pension for employed persons. In accordance with , the right to a social old-age pension arises upon reaching the age of 60 years for women and 65 years for men.

So, if everything is more or less clear with the assignment of pensions to a non-working category of citizens, then quite a lot of questions arise regarding those people who have significant income, but in connection with the liquidation of an organization or the cessation of activities of an individual entrepreneur, a reduction in the number or staff of employees of an organization, an individual entrepreneur , were fired. Moreover, these people have not yet reached retirement age and are registered with the employment center. What rights do they have in the area of pensions?

Under what conditions is an early pension issued to an unemployed person in 2020?

If there are 2 years left before retirement, there are no opportunities for work, early retirement of unemployed pre-retirees is possible. A corresponding proposal for this must come from the employment service. The specialist has the right to accept or refuse it. Early pensions for citizens recognized as unemployed are granted subject to the following mandatory conditions:

- The citizen is registered with the Center for Significance.

- The duration of the insurance period is from 25/20 years - for men/women.

- The basis for dismissal is liquidation of the organization or layoff.

- There are enough pension points to process the payment - in 2020 you need to accumulate at least 18.6 IPC.

- There are no opportunities for further work.

- Regular retirement is 2 years away.

Then the CZN invites the citizen to issue a pension early. After reaching the normal retirement age, at which it is possible to assign an old-age benefit, the recipient has the right to switch to an insurance payment. In case of refusal, the person will continue to be registered with the employment service and receive benefits as an unemployed person.

For example, economist Lidiya Sergeevna Khorosheva was laid off from her job. According to the new procedure, she will be able to retire only after 2 years, that is, in 2022. Lidiya Sergeevna is registered with the Labor Center, but she cannot find a job. Therefore, the employment service suggested that she apply for the benefit now, since the amount is higher than that of the benefit for the unemployed.

How to retire early through the employment center

In case of dismissal due to downsizing or liquidation of an enterprise, a person of pre-retirement age (2 years before retirement or less) must register with the employment center . At the same time, he receives the status of unemployed and the corresponding benefit. He can remain in this status and receive benefits intermittently for 24 months (Part 1 of Article 32 of Law No. 1032-1 of April 19, 1991), that is, until he reaches retirement age. At this time, the CZN offers employment options to the unemployed.

For your information

But if a person of pre-retirement age cannot find a job at the labor exchange, there is another option. The center makes a proposal to send the unemployed person to early, well-deserved rest . The citizen must submit this proposal in the form of a paper document to the Pension Fund. The pension fund will issue payments.

In some cases, it will not be possible to become a pensioner early through the labor exchange. For example, if:

- A pre-retirement worker quit of his own free will, was fired due to violation of labor regulations or for other reasons. Dismissal is allowed only due to reduction or liquidation.

- The dismissed person retains his monthly salary from his previous place of work.

- The age does not reach the pre-retirement age, the required years of experience or pension points are not enough.

- The applicant rejected 3 or more job offers from the Employment Center within 1 year.

Documents for early retirement for an unemployed person

Technically, there is nothing complicated about applying for an early pension. A citizen receives 2 documents at the employment center: an offer and a certificate of periods of work experience. With them, he goes to the territorial branch of the Pension Fund at his place of residence and fills out a standard application for a pension.

You need to take these two documents with you, as well as the following:

- passport (or, instead, other identity card and documents confirming citizenship and place of residence);

- SNILS;

- a certificate of average monthly salary for any 60 months of work before 2002;

- work book or certificate of experience;

- other documents if necessary (about change of surname, presence of disability, etc.).

Transfer to an insurance pension upon reaching retirement age

Early pension is issued from the month of application until the month of reaching retirement age . It does not automatically transfer to an old-age insurance pension issued on a general basis. Therefore, unemployed people who received early pension payments and reached 65/60 years for men and women, respectively, will have to apply for a regular old-age pension. To do this, submit the application and the necessary documents to the Pension Fund again.

It should be remembered that upon reaching retirement age, payment of early pensions stops . Insurance old-age pension and early retirement pension are two different payments. A regular insurance pension will not be issued on its own. In order not to be left without money for some period of time, it is better to contact the Pension Fund for re-registration in advance - a couple of months before reaching retirement age.