( 10 ratings, average: 5.00 out of 5)

Tax benefits for military pensioners provide for discounts or complete exemption from paying certain types of payments to the state treasury. The introduction of new rules for calculating taxes affected the change in the volume of preferences. We will discuss further who can apply for them and what types of taxation they apply to.

- Conditions for providing tax benefits

- Tax benefits for military pensioners

- Property tax benefits

- Transport tax benefits

- Land tax benefits

- Tax breaks for military retirees

- Tax privileges of close relatives of a military pensioner

- When to apply for tax benefits

- Conclusion

Conditions for providing tax benefits

Any military retiree can take advantage of the tax benefits. The exercise of this right is permitted after assignment of the appropriate status. Its assignment is subject to availability:

- Total service experience of at least 25 years.

- Continuous work experience in a specific military department for at least 20 years.

When providing benefits, it does not matter whether the military pensioner retired early or due to old age. The main thing is to have the necessary experience.

Tax benefits are provided to pensioners working in the following structures:

- National Guard;

- Ministry of Internal Affairs;

- Executive authorities;

- Fire Service;

- Other law enforcement agencies.

Registration of the status of a military pensioner is carried out in a subordinate structure. One of the regulations governing its provision is Federal Law No. 76-FZ dated May 27, 1998 (as amended on December 30, 2012) “On the status of military personnel.” It is pointless for a former employee to contact the Pension Fund. The exception is receiving insurance payments or old-age pensions. However, as a rule, they are rarely combined with a military pension.

Types of government assistance

Since the pension of military personnel is formed differently than that of other citizens, it is quite logical that they have different advantages.

There are a large number of benefits for retired military personnel . Benefits include:

- transport;

- property;

- to the ground;

- to obtain housing;

- for close relatives;

- for treatment;

- utilities.

Transport taxes and benefits , oddly enough, do not apply to all subjects of the Russian Federation. It is worth noting that beneficiaries in Moscow and the region are disabled people of groups 1 and 2, veterans of the Great Patriotic War, heroes of Russia and the USSR. The amount of tax discount varies in different regions, as it is set by local administrations.

Land tax belongs to the category of payments that can be regulated by local governments of various regions of Russia. In most cases, this tax must be paid by military pensioners according to a special procedure. Only indigenous residents of the Far North are completely exempt from paying this tax in order to maintain their traditions and culture.

The housing benefit is perhaps one of the most important. Article 15 of Federal Law No. 76 of May 27, 1998 implies free provision of housing to military pensioners registered as in need of housing or its improvement. A citizen has the right to choose a allocated apartment or a subsidy for its purchase.

Close relatives also have benefits. Military children are admitted to school and preschool educational institutions without a waiting list. Regarding wives, there is a law that counts the length of service of the time when they could not get a job at their place of residence (in other cities).

The healthcare sector is not left behind. As you know, there are separate clinics, hospitals and sanatoriums for military personnel, where they undergo examination and treatment free of charge. Pensioners over 60 years of age are provided with free medicines and vaccinations against various types of diseases (the list of diseases for which prevention and treatment is carried out is quite wide). Naturally, special conditions also apply to treatment in sanatorium-resort areas.

Tax benefits for military pensioners

A military pensioner has the right to count on benefits for all available tax payments, including:

- Tax on real estate and land plots.

- Transport tax.

In addition, a pensioner has the right to request a refund of previously paid personal income tax by filing a tax deduction. Provided that for the last three years he regularly paid income tax to the state treasury. It does not matter whether it was paid from official wages or profits from additional sources (for example, rental property).

The indicated tax benefits are provided throughout the Russian Federation, regardless of place of residence. However, regional authorities have the right to make their own adjustments to their provision, as well as expand the list of privileges.

Property tax benefits

A military pensioner has the right to apply for a property tax benefit. The regional government may provide a discount of 50-100%. Often, a complete exemption from paying annual property contributions is applied.

The conditions for providing benefits may include the age of the pensioner. Many regions require a man to be 60 years old and a woman to be 55 years old. To clarify these issues, a pensioner can contact the Federal Tax Service department located at the place of registration.

Benefits apply to paying tax for:

- Apartment;

- A private house;

- Dacha;

- Garage.

If a pensioner owns several properties of the same type (for example, two apartments or garages), the tax benefit will be provided for only one. The right to choose belongs to the owner.

A pensioner may be denied benefits if his property:

- Costs more than 300 million rubles

- Used for commercial purposes.

By renting out an apartment or private house, a military pensioner will lose the right to receive benefits. At the same time, he will be obliged to annually submit an income declaration to the Federal Tax Service and pay personal income tax.

Filing an application for a tax benefit is carried out in accordance with Art. 407 of the Tax Code of the Russian Federation. A military pensioner will need to visit the Federal Tax Service by submitting:

- Written statement;

- Passport;

- TIN;

- Pensioner's ID;

- Title documentation for real estate;

- Extract from the Unified State Register of Real Estate;

If it is impossible to complete the application in person, it is possible to send documents by registered mail via Russian Post, the Federal Tax Service website or State Services.

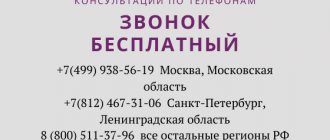

Registration procedure

Tax benefits for military pensioners can be provided by contacting the Federal Tax Service. In this case, the inspection must refer to the address where the pensioner is registered. It is the tax office that will carry out registration of the benefit, its implementation and control over the procedure. The basis for consideration of the issue is an application for relief in the payment of property taxes, which is made by the directly interested subject - a military pensioner.

An application for the benefit must be submitted before November 1 of the year in which the citizen intends to use the assistance provided.

Although the deadlines for completing the procedure have restrictions, missing them does not entail the cancellation of the opportunity to receive benefits. The only thing you have to do is recalculate your taxes. In addition, it is possible to contact the tax office for past periods with a further return of funds. However, here it is important to remember about the limitation period; such a privilege is valid within its limits, namely for 3 years.

Submission of the application and additional documents is carried out directly through the tax authority by personal visit to the structure, execution of a power of attorney for an authorized person or by mail. The latter option requires all copies of documents to be certified by a notary. There is also a special resource - “Government Services”. It allows you to submit an application, but this requires an electronic signature confirming the authenticity of the documents.

If a subject, as of December 31, 2014, had the opportunity to use a tax break, then in the future the legislator exempts him from the need to re-submit documents to confirm his right to a relief.

Transport tax benefits

The amount of the transport tax benefit depends on the region of residence. As a rule, military retirees are given a 100% discount on one car. At the same time, the regional government has the right to put forward an age requirement for applying for benefits (for example, 60 years for men). You can find out the exact conditions by contacting the territorial branch of the Federal Tax Service or from the information on the website of the regional tax service.

When providing benefits, the power of the car plays an important role. Most regions set the conversion limit at 100-150 horsepower. In case of owning several vehicles, the owner will be given a benefit for only one. Which one, the pensioner has the right to choose independently, taking into account the size of the benefit received.

Example. Vlasov Yuri Petrovich is the owner of two cars. The annual transport tax for the first is 500 rubles, for the second – 188 rubles. The citizen took advantage of his right to a 100% benefit by choosing the first car, since the cost of payments for it is more expensive.

The Federal Tax Service is in charge of issuing benefits. The pensioner will need to visit the organization in person, providing:

- Completed preference application form.

- Passport.

- Military pensioner certificate.

- TIN.

- Technical passport for the vehicle.

Federal Tax Service employees will check the documents for authenticity. After which, the application will be sent for consideration. If the answer is positive, tax accrual will stop from the date of application. However, you will still have to pay for the previous period.

Required documents

The application for a benefit must include information about the pensioner. You should indicate your name, address, contacts, passport details, TIN, as well as details. Based on the information provided, the tax office will identify the taxpayer. However, for this you will need to submit additional papers as an attachment to the application:

- identification document;

- TIN;

- certificate from the Pension Fund;

- a certificate confirming the fact of complete disposal of the property;

- documentation reflecting the status of the person (certificate from the military registration and enlistment office, registration certificate);

- power of attorney with the participation of an authorized person.

The tax inspector may request additional data, including to confirm the reason for termination of service. In addition, it is recommended to draw up an inventory of the documents being transferred to control the registration procedure.

If you have had experience applying for property tax benefits, share it, or ask questions in the “comment” section.

Land tax benefits

Military pensioners are not completely exempt from paying land tax. However, they have the right to reduce the tax base. As a standard, the tax is calculated based on the total square footage of the land plot and the regional coefficient. Providing benefits allows you to reduce the area of the site by 6 acres. If it is less, the tax will not be calculated.

Registration of benefits takes place at the Federal Tax Service. As in the case of transport and property taxes, a military pensioner will need to write an application in advance and prepare documents for the land.

Tax breaks for military retirees

Many regions practice providing property deductions. The purpose of their implementation is to reduce the total amount of tax payments. So, when calculating the tax for a military pensioner, the following will be deducted from the total square footage of real estate:

- 20 sq.m. – for apartments;

- 50 sq. m. - for private houses;

- 10 sq. m. – for dorm rooms.

The benefit is provided to a pensioner on an application basis. To receive it, a citizen will need to visit the Federal Tax Service and submit a standard package of documents.

If the land is leased, the right to receive benefits is abolished. If there are two plots, to apply for a discount, the pensioner will need to choose one of them.

Support for families of fallen soldiers

Family members of a deceased soldier or officer:

- wives;

- minor children;

- children recognized as disabled;

- persons who were dependent.

Family members of a deceased serviceman who have lost or have not yet acquired the ability to work receive financial support from the state. These persons continue to enjoy a 50% discount on housing and communal services.

The law provides for full payment for the funeral of a deceased soldier or officer. A monument is erected free of charge. A prerequisite is that the death must occur as a result of the performance of official functions.

Wives of deceased military personnel are entitled to a number of benefits:

- the state assigns maintenance to children;

- provision is made for issuing a referral to a health resort once a year;

- the cost of travel to the husband’s grave is fully compensated;

- has the right to receive a children's voucher to a dispensary;

- Children can go to kindergarten without waiting in line.

Travel to the burial of a deceased serviceman is paid not only for his wife, but also for two other family members.

Wives of deceased military personnel have the right to one-time financial assistance. Housing privileges for widows:

- It is prohibited by law to evict wives and other dependents from their homes. If the apartment becomes vacant, they must be provided with suitable housing.

- All housing benefits that were assigned to the husband are preserved.

- The right to demand free home repairs.

- If the spouse did not manage to receive his square meters, then they are allocated to the spouse without a queue.

These benefits remain with the widow only until a new marriage.

When to apply for tax benefits

It is recommended to submit documents for tax benefits before November 1 of the current year. At this time, amounts are calculated and receipts are sent to taxpayers. Violation of deadlines is not critical. The citizen will be able to exercise his right in subsequent years. The statute of limitations is three years.

In case of overpayment of tax payments in previous periods, the pensioner will be able to demand their refund. To do this, you must make a written application and provide bank account details.