The algorithm for interaction between citizens of retirement age and the Pension Fund is regulated by current legislative acts. In particular, they set out the procedure for informing the Pension Fund about the termination of work by the insured person.

What is the essence of the procedure for informing the Pension Fund about the termination of work by a pensioner? Who is obliged to inform the Pension Fund about the dismissal of a pensioner: the employee himself or the employer? What are the required documents? We will answer these questions in this article.

Indexation of pension after dismissal of a working pensioner: news for 2020

True, many of them have already forgotten that the authorities also considered the possibility of canceling their pensions altogether in 2020, but, fortunately, it did not come to that.

This means that the working pensioner will still continue to receive payments, but they will not increase by the amount of inflation until he is dismissed from work. In this situation, indexation will be calculated in the next month after visiting the Pension Fund. It is also important to attach a blueprint of the employment record to this application - this will confirm the fact of dismissal from work. In some cases, Pension Fund employees may require a number of additional documents, but, as a rule, this does not happen.

New rules for indexing pensions

Since 2016, the recalculation rules have undergone some changes. At the moment, only those who have stopped working and subsist only on social benefits from the state can receive an annual supplement to their assigned insurance-type pension.

Moreover, those who have the status of individual entrepreneurs and, for example, lawyers, were also left without indexation.

According to the authors of this legislative act, persons who continue to work in retirement:

- have additional income;

- suffer less from inflation.

According to the relevant regulatory framework of Russia, annual payments are designed to protect the income of pensioners from depreciation and in size must correspond to the level of growth in consumer prices (that is, inflation itself).

At the same time, this new approach to the problem allowed the state budget to save approximately 450 billion by not paying indexation to pensioners who continue to work.

According to statistics, there are currently more than 14 million of them in the country.

From that moment on, working citizens receive only:

- insurance pension;

- other allowances provided upon reaching a certain age.

Annual indexations are not taken into account in these charges.

However, this innovation did not apply to social plan pensions.

However, the state indicates that as soon as a citizen finally stops working, all required indexations for the period of his work in retirement are transferred to him. In addition, already 2 months after the date of retirement, social payments increase to standard values.

This period of time is required for employees of the Pension Fund in order to, upon receiving a message confirming the dismissal, process the data and recalculate.

Documents to the Pension Fund upon Dismissal of a Pensioner in 2020

I have been a working pensioner since 1977. On June 28, 2020, I submitted an application of my own free will and received compensation for the past year. From September 1st I want to work again in the same organization. Will my pension be indexed from the moment the state stopped indexing pensions for working pensioners?

I have been a working pensioner for 2 years. For me, the organization transfers insurance contributions to the Pension Fund, which are almost equal to my pension. The state has not yet transferred to me a single ruble from the insurance premiums previously transferred for me. Why do we, working pensioners, not have the right to compensation and indexation as non-working pensioners? We not only work, but also benefit the state with our work.

Recalculation of pension after dismissal of a working pensioner

It is the employer’s responsibility to inform the Pension Fund about dismissed employees, so there is no need to contact the Pension Fund with an application. The employer will transmit information to the Pension Fund the next month after termination of the contract with the employee, within a month the Pension Fund will make a decision on indexation, and starting from the next month, pension payments will be recalculated. Provided the employer submits reports on time, the process takes just over three months.

This is interesting: After How Many Years Can You Sell a Purchased Room Without Paying Tax

Federal Law No. 385-FZ of December 29, 2020 canceled the increase in pensions for working pensioners from 2020. The increase in payments that took place in August at the expense of insurance contributions paid by the employer, from 2020 is limited to three pension points, which is just over 200 rubles.

MILITARY PENSIONERS FOR RUSSIA AND ITS ARMED FORCES

Many working pensioners are interested in the question of whether they need to visit the Pension Fund after leaving work to notify them that they are no longer working. It is up to the employer to inform the Pension Fund about the dismissal of a pensioner from work, reports www.piterburger.ru. It is he who must inform the date from which the pensioner no longer works.

The employer does not transmit information about the dismissal of a pensioner immediately, but only for the next month. The Pension Fund of Russia needs a month to decide on indexation and the amount of payments, and only after that pension payments will be transferred. It takes three months from leaving a job to receiving a pension.

What documents does the employer submit for a dismissed pensioner to the Pension Fund?

The decision to pay a pension, taking into account indexation, in this case is made by the Pension Fund of Russia in the month following the month the employer submits reports, and payment of the pension, taking into account indexation, will be made from the month following the month in which the decision was made, i.e. 2 months after the employer provides information.

Starting from April 1, 2020, the procedure for paying insurance pensions, taking into account indexation, has changed. Now, if a pensioner is dismissed on April 1 or later, the indexation of the insurance pension will be carried out on the basis of data submitted by the employer to the Pension Fund of Russia. Information about work will be provided by the employer every month no later than the 10th day of the month following the reporting month.

Recalculation of pension after dismissal of a working pensioner

Pension benefits are indexed twice during a calendar year. The first is provided for the recalculation of insurance payments and was previously carried out in February. But back in 2020, as in 2020, the President of the Russian Federation decided to postpone the indexation of old-age insurance accruals to January.

IMPORTANT! In August last year, representatives of the Pension Fund of the Russian Federation carried out an undeclared adjustment of payments to retired elderly people. The reform standard is determined by clause 3, part 2, part 4 of art. 18 of Law No. 400-FZ; clause 56 of the Rules, approved. By Order of the Ministry of Labor of Russia dated November 17, 2014 No. 884n. This means that a similar recalculation of pensions will be carried out in August 2020. Moreover, there is no need to submit any applications for increased payments to the Pension Fund.

Complete list of documents when dismissing an employee in 2020

Dismissal of an employee at his own request is the most common way to terminate an employment relationship. The employee needs to write an application addressed to the manager no later than two weeks before the date of the proposed dismissal (Article 80 of the Labor Code of the Russian Federation). However, if the manager resigns, the period is a month. But an employee who is on a probationary period can submit an application for his dismissal three days in advance (Article 71 of the Labor Code of the Russian Federation). Also, persons with whom an employment contract was concluded for a period of less than two months (Article 292 of the Labor Code of the Russian Federation), as well as those who are employed in seasonal work (Article 296 of the Labor Code of the Russian Federation), can complete an application within three days.

Based on the employee’s application, which is signed by the head of the organization, an employee of the human resources department or an accountant, if he is entrusted with personnel records, issues a dismissal order in Form No. T-8. The form was approved by Decree of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

This is interesting: Compensation for Kurgan Kindergarten 2020

What documents need to be submitted to the Pension Fund?

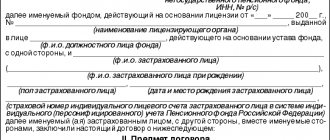

On a monthly basis, the employer is required to submit to the Pension Fund the SZV-M form, approved by PFR Resolution No. 83p, February 1, 2020. It contains information about all employees, including those dismissed during the reporting period.

SZV-M contains information of insured subordinates, their full name, INN, SNILS. According to the information provided in the reports, the Pension Fund sees with which employees the director of the company has terminated employment relations, and which pensioners continue to work for the benefit of the country.

When dismissing a subordinate, the employer is obliged to provide the Pension Fund with a package of documents, which includes the following papers:

- a copy of the pensioner’s passport;

- an extract from the employee’s dismissal record book or a copy of the order to terminate the employment relationship;

- individual personal account insurance number (SNILS);

- notification from the employee about termination of employment (executed in the form of an application).

You can send them electronically or order delivery by Russian Post or courier. It is acceptable to submit a package of documents through the Multifunctional Center.

Expert opinion

Irina Vasilyeva

Civil law expert

The employer must submit the documents to the Pension Fund in the month following the dismissal of the pensioner.

Recalculation of pension after dismissal

Recalculation of a pension upon dismissal of a working pensioner is a procedure regulated by law. The monetary support of a citizen who continues to work after retirement and then quits his job is subject to mandatory indexation. In this case, when recalculating, the amount of payments increases significantly. The final pension amount is influenced by a number of certain factors, which, as well as the procedure, should be known to every working pensioner.

If the pensioner was engaged in private practice, information about him will be provided by the tax service, or you will still need to visit the MFC or a branch of the Pension Fund and fill out an application form. However, here the procedure is no different in complexity. Additionally, documents may be required, the list of which depends on the applicant’s area of activity.

How to correctly fill out an application for termination of work?

The Pension Fund of Russia is notified of dismissal through an application in the prescribed form, which can be downloaded from the link. Let's figure out how to fill it out correctly:

- in the top line you must enter the name of the territorial body of the Pension Fund of the Russian Federation - the branch of the Pension Fund at the place of registration;

- in part 1, you must enter the citizen’s personal information: full name, insurance account number, identification card details, telephone numbers, etc. The name of the territorial branch of the Pension Fund of the Russian Federation, which accrues the pension to the applicant, is also indicated;

- in the 2nd part you should write the date of dismissal;

- In Part 3, you must list the documents attached to the application. To do this, fill out the attached table. The first column is the document number for the item; the second column is the title. The territorial body is required to provide: a work book,

- identification,

- SNILS;

Pension for working pensioners from January 1, 2020

The issue of canceling pensions for working pensioners has already been raised several times , and in connection with the start of the pension reform proposed by the Government in 2020, it began to be discussed even more actively. However, at a meeting of the Council under the President of the Russian Federation for the Development of Civil Society and Human Rights, which took place on July 11, 2020, Deputy Minister of Labor and Social Protection Andrei Pudov said that they do not intend to cancel . “No, such a plot is not being considered,” said A. Pudov.

For working pensioners, the value of the pension point and the amount of the fixed payment are “frozen” at the level that was established on the date of retirement or before January 1, 2020. This means that the annual indexation of these values carried out by the Government does not in any way affect the pension provision of working citizens - while they are working, their pensions remain at the same level .

Certificate for the Pension Fund regarding the dismissal of a pensioner

And when pensioners resign, pension indexation begins. However, I know of many cases when a retired pensioner goes on his own initiative to the pension fund for “greater reliability” in order to report that he is no longer working). The Pension Fund is interested in information about whether a pensioner is working, because during the period while he is employed, pension indexation is frozen.

Now you can easily answer the question if a pensioner quits his job: does he need to report this personally to the Russian Pension Fund. Today there is no need for this, since this responsibility lies with the employer who employed the pensioner.

This is interesting: How to Register a Built House on a Plot as Ownership 2020

What's new

If the year before last the indexation amount was 11 percent, then this year it is only 4. However, the authorities are reassuring pensioners, pointing out that another indexation will probably be carried out in mid-autumn.

Such actions of the government are largely due to the fact that in recent years, revenues to the state budget have decreased noticeably and a rather serious deficit of funds has developed there.

And thus, this year the average size of pension payments was:

- social – 8.82 thousand;

- insurance – 13.7.

It is also worth pointing out that this year the government does not intend to completely stop paying pensions to working senior citizens. This optimization measure was rejected in the past, when the economic situation was very unstable. Now, due to the fact that there are all the prerequisites for an increase in indicators, it is even more useless.

There is one more nuance that you should be aware of. If a pensioner, having resigned, begins to receive recalculated payments, but then gets a new job again, then their amount will be fixed at the last level.

Attention! As part of our website, you have a unique opportunity to receive free advice from a professional lawyer. All you need to do is write your question in the form below.

Indexation of pensions for working pensioners after dismissal in 2020

The new payment amount is determined taking into account the cost of consumer goods during the previous period. That is, when calculating the increase for pensioners in 2020, prices in 2020 should be taken into account. And the size of a person’s pension itself depends on the amount of insurance premiums paid by the organizations where he worked. And, although in 2020, instead of indexation, pensioners were paid an amount of 5,000 rubles, now the recalculation will be carried out according to all the rules.

As an example of how indexation occurs, we can consider the situation with information about dismissal incorrectly submitted by the employer within 2 months. In the fourth month, he continues to be paid the same pension as before. After a person applies to the Pension Fund or receives the correct information from the employer, a recalculation is carried out, and already from the fifth month the amount of pension payments is brought into line with the indexation coefficient. Although there will be no additional payment for the fourth month, the law does not provide for such compensation.

A working pensioner quit his job: will his pension increase, is it necessary to make a recalculation to the Pension Fund of the Russian Federation

After updating the amount, you can start working again. If you don’t want to lose money from the state, then you can try to negotiate with your employer about informal employment. However, such a scheme also entails various risks for both parties.

Important! The law provides for the recalculation of payments after the dismissal of a citizen. To do this, you must personally contact the Pension Fund employees with an application for recalculation. If this is not done, the same amount will be paid. Today the form of law in the country is indicative. That is, if citizens do not demand certain actions from government agencies, then they do not need it. Based on this, in the absence of an application, a citizen does not need to recalculate; he is completely satisfied with his existing income.

Dismissal of pensioners in 2020 at their own request or due to staff reduction

- at one's own request - Art. 80 Labor Code of the Russian Federation;

- by mutual agreement of the parties - Art. 78 Labor Code of the Russian Federation;

- in connection with the liquidation of the enterprise - Art. 180 Labor Code of the Russian Federation;

- according to Art. 81 of the Labor Code of the Russian Federation under the following circumstances:

- violation of official duties;

- low qualifications;

- staff reduction;

- absenteeism;

- serious complaints from the company management: embezzlement, theft, being under the influence of alcohol/drugs at work, negligent/criminal actions.

The procedure for dismissing an employee due to retirement differs from the procedure for terminating an employment contract at will only in documentary language. The first important nuance is the entry in the resignation letter, precisely indicating the reason. It gives the right to dismiss a pensioner without working off. Application example:

Documents upon dismissal from an employer in 2020

There are more documents when leaving an employer. For example, a new form SZV-STAZH has been added. In addition, legislators updated the form of the earnings certificate and replaced the RSV-1 report with a calculation of contributions. We will help you not to get confused in these documents and tell you what documents an employee receives from an employer in 2020 upon dismissal.

Laws require that employees be given various certificates and extracts from reports and other documents upon dismissal. The employer is required to issue some documents by law, and some at the request of the employee. Detailed information about what must be given to an employee upon dismissal is in the article “SZV-STAZH and six other mandatory documents for dismissed employees.”