Despite all the efforts of the state to simplify the receipt of public services, many people still face bureaucracy when applying for a pension. Moreover, many citizens have a very vague understanding of their rights. In this text, we will look at assistance in obtaining a pension, assistance from a lawyer in Moscow on pension issues, and in what cases you can act independently.

- Help options

- Where to go for help

- Practical assistance from a lawyer

Who is entitled to receive a pension?

There are several types of insurance pension payments (Federal Law No. 400 dated 12/28/2013):

- by old age;

- due to acquired disability;

- for the loss of a breadwinner.

Exactly the same types are available when assigning a social pension.

Each type of pension has its own procedure and conditions for its registration. The main factors that influence the receipt of a pension are:

- age limit;

- experience;

- health conditions;

- place of work;

- various life circumstances: death of the sole breadwinner, living in the Far North.

To receive social pension payments, the insurance period must be at least 10 years in 2020

For example, starting from 2024, receiving an old-age insurance pension is due at the age of 60 for the female population of the country and 65 for the male population. To receive social pension payments, the insurance period must be at least 10 years in 2019, and from 2024 it will be equal to 15 years. At the same time, the age limit for receiving such a pension compared to the insurance pension has increased by 5 years and is 70 years for men and 65 for women. Also, for a pension in 2024 you will need to have a minimum coefficient of 30 points. In 2020 it is 16.2 points.

| Year of retirement age on December 31, 2020 | Age at which a pension is issued | ||

| Increase | Men | Women | |

| 2019 | + 6 months | 60,5 | 55,5 |

| 2020 | + 12 months | 61,5 | 56,5 |

| 2021 | + 36 months | 63 | 58 |

| 2022 | + 48 months | 64 | 59 |

| 2023 and beyond | + 60 months | 65 | 60 |

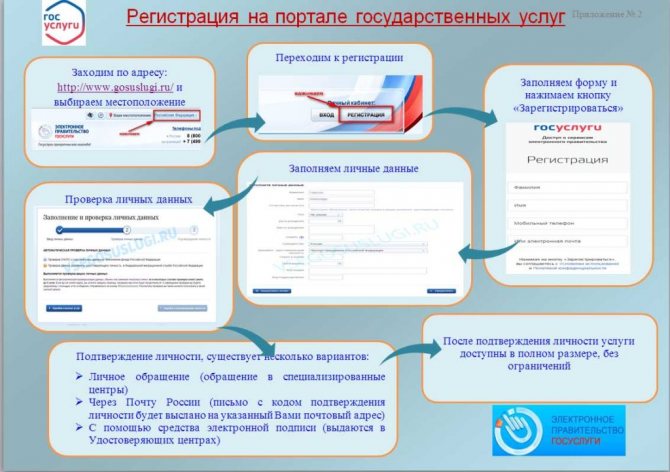

Registration on "State Services"

You can apply for a pension directly to the Pension Fund. The disadvantage of this is the loss of time, and the opening hours of this institution are very inconvenient for working citizens. The most acceptable method of submitting documents is via the Internet, namely the State Services website.

You can apply for a pension at the Pension Fund

In order for the data transfer procedure to be easy, you must first register on this portal. To do this, the system will ask you to enter some personal data:

- FULL NAME;

- passport;

- SNILS;

- TIN;

- address;

- email.

After entering your personal data, you will be sent for verification, which can take three days. Upon successful registration, the citizen will be assigned a standard status, which will allow him to use a minimum set of services. For example, find out if there is a fine, make an appointment with a doctor. If the check fails, the user will have a simplified . Access to services will be closed.

To be able to use all services of the portal, you will need account confirmation

To be able to use all services of the portal, account confirmation will be required. You can do this in one of the following ways:

- if the registered person has an electronic signature, identification is confirmed using it;

- You can change your account level using an application sent by mail to the Pension Fund. You will receive a code back, which should be entered in the field specified during registration. This will be confirmation. This procedure will take about 10 days;

- When visiting one of the Pension Fund branches, a specialist from this fund, based on your passport and SNILS, will check your personal data and assign the account status as confirmed.

Document collection procedure

The responsibility for collecting the required papers for assigning a pension falls entirely on the shoulders of the applicant. It is he who must, before contacting a government agency, independently collect all the documents required by law.

The responsibility for collecting the required papers for assigning a pension falls entirely on the shoulders of the applicant.

Passport of a citizen of the Russian Federation.

SNILS. An important document for processing pension payments, it has a unique number and is assigned to the citizen for life. Even if you replace or receive a duplicate in case of loss, the number remains the same. The presence of SNILS confirms that the applicant is registered in the pension system of the Russian Federation and has his own individual account. During the course of his work, employers make contributions to him that form the future pension of the SNILS owner.

Employment history. It is an equally important document, since it is used to confirm the insurance record. If an entry in the work book is lost, inaccurate or blurry, official papers listed in Order No. 91 of the Ministry of Health and Social Development of the Russian Federation dated 06/02/2007 are used for confirmation:

- labor agreement (contract);

- financial documents and certificates from the archive about making payments for pension insurance;

- extracts from the enterprise's orders on admission, transfer and dismissal.

The insurance record is confirmed using the work book.

Certificate of income for 60 consecutive months. The paper is issued at the enterprise where the citizen worked until 2002. In case of liquidation of a place of work, a request should be submitted to the archive.

Military ID. The document is required for the entire male population, as well as women liable for military service.

In addition to this list, depending on the various circumstances and type of pension, the following documents are attached:

- certificate of change of name, surname. In the case of marriage, this is a document confirming its registration;

- certificate of disability. Will be required when making payments in connection with an existing group;

- document on the death of the breadwinner. Required when calculating payments from the Pension Fund to citizens who were dependent on the deceased;

- certificates of dependents. For each dependent, there will be a set amount of supplement to the pension;

- birth documents of children. Necessary for those women who were on maternity leave for up to 1.5 years. Such leave should not exceed 6 years in total with all children;

- certificate of work in the Far North. It will be required for earlier provision of an old-age pension upon completion of a certain length of service: for women upon reaching 55 years of age and having 20 years of experience, of which 15 years were worked in the Far North; for men - 60 years with a total experience of 25 years and in the Far North 20 years.

Registration procedure on the public services portal

Important! The size of the pension depends on the length of service. Moreover, until 2002, the length of service was used for calculation; since 2002, the concept of insurance length of service was introduced, which may differ from the length of service. The insurance company is determined based on the time when transfers were made to the individual account in the Pension Fund. Labor is calculated according to the time of labor activity that was recorded in the work book.

Where to go for help

Theoretical assistance differs from other types of assistance in its accessibility. In most cases, such help can be obtained without contacting anyone, but there are two important nuances.

- Relevance – it is not always possible to find up-to-date information on the date of application. This is due to numerous changes in pension legislation.

- Honesty - many sites do not disclose the topic, but lead to the need to pay a fee to a lawyer to resolve the issue, even if the issue is simple and is related, for example, to the accrual of length of service and pension points for non-insurance periods.

To verify the information received, you can either refer to the law or simply ask a lawyer. For example, on our website there is always a free consultation with a lawyer in Moscow on legal issues, available both by telephone and online.

During the consultation, you can gain theoretical knowledge to resolve a specific situation. In particular, the lawyer will answer questions about a citizen’s pension rights and help in determining them.

Konstantin U turned to a lawyer for assistance. The man moved to live in Moscow from Pskov and was interested in where he needed to apply for a pension and what documents would be required for this. The lawyer found out that the man was officially registered in the capital, had more than 37 years of work experience and 2 years of non-insurance period in the form of service in the Soviet army. The lawyer advised to contact the Pension Fund Client Service or the MFC at your place of residence, taking with you your internship documents, passport, and military ID.

Consulting assistance is provided not only by lawyers, but also by specialists from the Pension Fund. But it should be borne in mind that the Pension Fund of the Russian Federation will not be able to determine all pension rights, but not because they “don’t want to pay,” but because their work involves a slightly different application of knowledge. But in most typical situations, the employees of the Pension Fund Client Services are well versed.

In both cases, the future pensioner will not have to pay for the consultation. Fees are charged only for the provision of practical assistance and legal assistance.

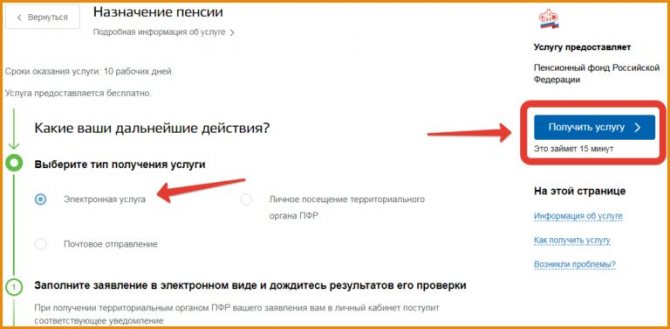

Applying for a pension through Gosuslugi

Follow the link to the website to apply for a pension: https://www.gosuslugi.ru.

After you have been assigned a confirmed status on the State Services portal and collected all the necessary documents, you should submit an electronic application to receive a pension.

Select “Receipt type” and click “Get service”

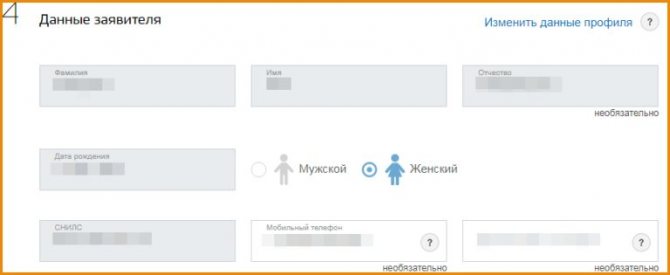

To do this, in the “State Services”, in the applicant’s personal account, select, which is provided by the Pension Fund. When you click the “Get service” button, an application in the form of a questionnaire will appear on the screen. Basic data (full name, passport, date of birth, SNILS, address, citizenship) will already be indicated. It is necessary to check their correctness.

We check the correctness of the applicant’s completed data

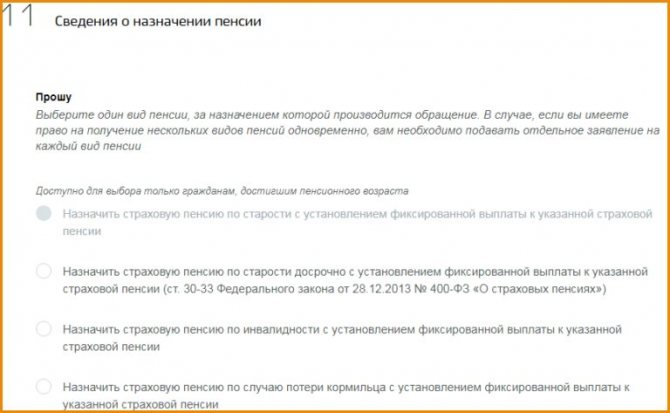

Next, the type of pension accruals for which the applicant is applying is selected. If there are several, then each will need to fill out a separate application.

Choosing the type of pension accruals

The presence or absence of current work is indicated. Information is entered, if any, on the availability of a pension already received, established by Law of the Russian Federation No. 4468-I of 02/12/1993. Such citizens have the right to receive both a long-service pension and an old-age insurance pension.

If there are dependents, they should also be indicated: full name and status (wife, children, parents).

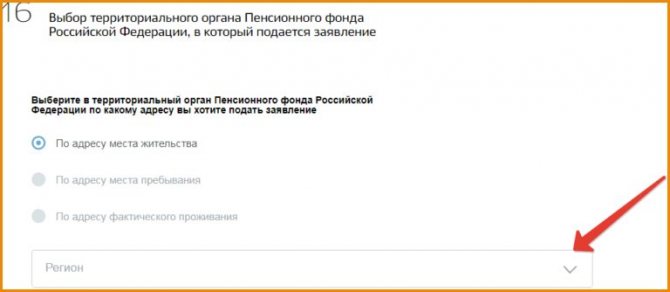

It is imperative to indicate the PFR branch to which the application is sent. The territorial authority at your place of residence will be automatically installed.

We indicate the PFR branch where the application is sent

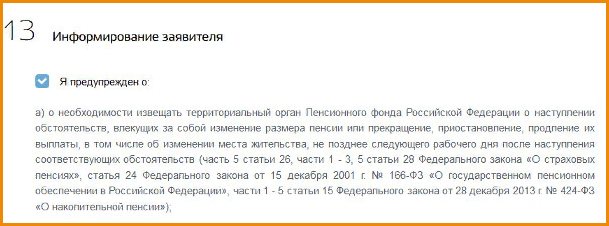

At the end of the application, a tick is placed stating that if any circumstances change, the applicant must notify the Pension Fund about this. The applicant is also responsible for the accuracy of the information provided.

Check the box and click “Submit”

After clicking the “Send” button, the document will be assigned on the “State” portal. The review procedure takes no more than 10 days. An invitation with the necessary list of documents, the originals of which will be required by the Pension Fund of Russia, will be located in the notification section of the State Services portal. Reception hours are also indicated there.

After a positive answer, the future pensioner will be able to decide on the method of delivery of pension money on the same portal:

- Russian Post. It is possible to receive money yourself at one of the post offices or have it delivered to your home on a specified date of the month;

- at a branch of Sberbank or any other bank. For convenience, it is recommended to issue a plastic pensioner card. Since 01/07/2017, such cards belong to the MIR payment system and no money is charged for services from its owners.

For the convenience of receiving a pension, you can apply for a plastic pensioner card

Important! The delivery method can be changed at any time if desired.

Duration of the service and its cost

The cost of the government service is zero rubles, and the execution time is ten working days. However, due to additional documentation, the processing time will increase.

After all, employers have been providing information to the fund only since 2002. Until this moment, there are no entries in the Pension Fund register.

The future pensioner provides such information during a personal visit to the pension. Non-insurance periods of life without work are also taken into account:

- Army.

- Childcare for children up to one and a half years old.

- Caring for the elderly or disabled people over 80 years of age.

- This also includes the overseas life of a consular officer and the spouse of a military personnel.

Changes in the regulations for the provision of services are announced by notice in your personal account and via e-mail. Non-insurance periods may not appear in the consideration of the application. But the applicant has a greater interest in them.

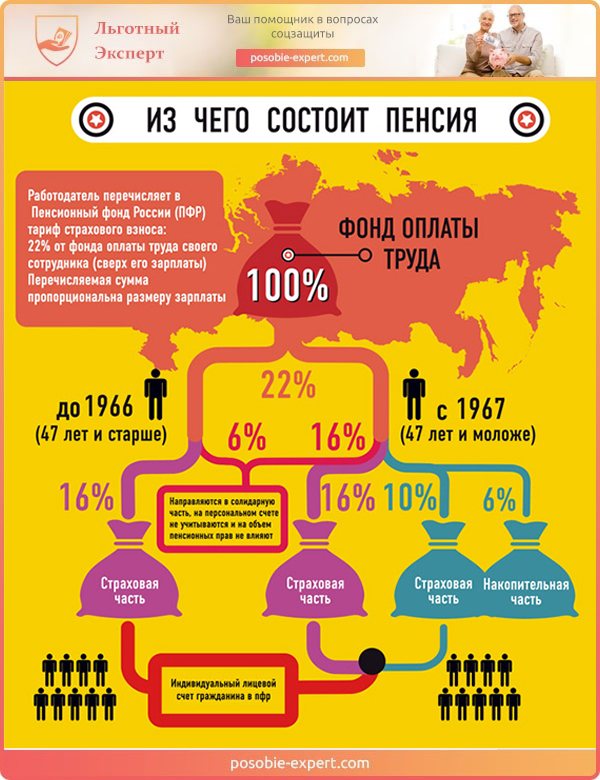

Cumulative part of pension

For citizens born after 1966, a funded part of the pension is formed. Those born before this year can independently make additional contributions to supplement their payments in old age. Maternity capital funds can be used for the same purposes.

Find out detailed conditions and options for directing maternity (family) capital funds from the article - “Rules for directing maternity capital funds, latest edition.”

The following options for receiving pension savings are available:

- One time. The entire amount accumulated before retirement age is transferred to the citizen’s account. Not everyone is entitled to such a payment. You can apply for it if the amount of monthly payments calculated from the funded part of the pension is no more than 5% of the amount of the required insurance part of the pension. Mothers who used maternity capital for this purpose can also apply for a lump sum pension. Another category that will be able to receive all the savings at once are the relatives of the deceased citizen in whose account these funds remain. Payments are made six months after the date of death.

- Urgent transfers. Monthly payments are made from the date of retirement age. The recipient must independently fill out an application, indicating the period during which the transfers will be made. The period should not be less than 10 years. Only those citizens who independently chose the location of their funds can take advantage of this.

- Unlimited transfers. By default, the funded part, if its value exceeds the 5% insurance barrier, will be distributed for the entire period of pension payments for life.

Scheme of how pension is determined

Additional Information

Even if your pension is not coming soon, you can find out about all the deductions on the State Services website. To do this, you need to select the “Notification of account status in the Pension Fund” section, which will receive information in almost a minute. The document will indicate the length of service calculated as of the date of the request, the amount of transfers and the name of the organizations that made them, and the future pensioner will also be able to find out his accumulated points.

You can also determine the size of your expected pension on the Internet by going to the “Pension calculator” section. This may be interesting for young citizens. You will need to enter:

- current salary amount;

- floor;

- expected duration of military service;

- planned number of children;

- expected experience.

So, a month before the date of assignment of an old-age pension, you should send an application to the Pension Fund. The easiest way is to submit it through State Services. A response will be provided within 10 days. Here you can choose the method of delivering money and the possible option of receiving the savings portion.

Documents required for granting a pension

The list of documentation presented below is considered the same for all subjects of the Russian Federation:

- Identification. Most often this is a passport. If a question arises about a representative, then his identity card and document on the right of authority are attached.

- A certificate from the last workplace confirming the length of work (this is the last five years in a row and until 01/01/2002 for the entire period of work) and the average monthly salary. This point contains the most nuances, considered individually.

- Employment history.

Other documentation includes:

- Certificate of change of surname.

- About the disability group.

- About the death of the breadwinner.

- Certificate of disabled family members.

- About registration and place of actual residence.

Pension rights are also confirmed by SNILS. The PRF considers only originals.